McEwen Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McEwen Mining Bundle

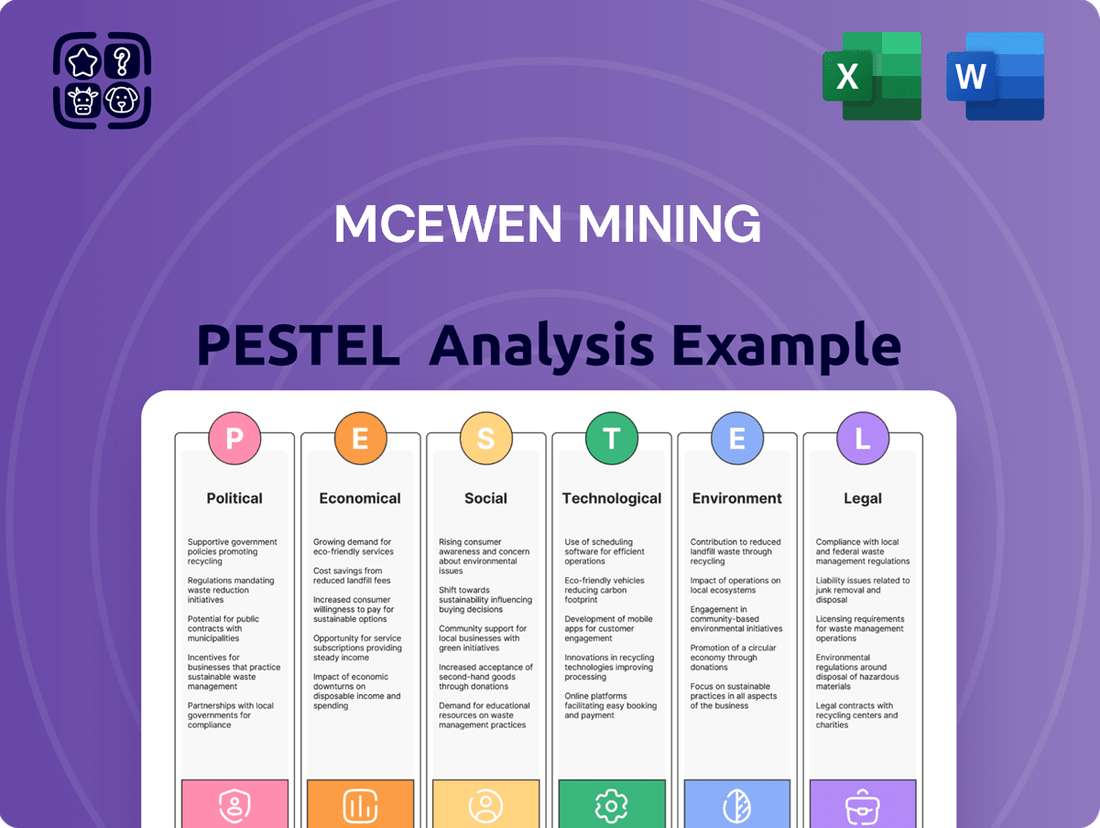

Uncover the critical political, economic, social, technological, legal, and environmental factors influencing McEwen Mining's strategic direction. Our meticulously researched PESTLE analysis provides a comprehensive overview of these external forces, offering invaluable insights for investors and industry professionals alike. Gain a competitive advantage by understanding the complex landscape McEwen Mining operates within. Download the full PESTLE analysis now to unlock actionable intelligence and inform your investment decisions.

Political factors

McEwen Mining's operations across Canada, the USA, and Argentina expose it to the direct impact of government stability and fluctuating mining policies in each region. Political volatility, especially in Argentina, can significantly alter regulatory landscapes, complicate permitting procedures, and affect the overall attractiveness of the investment environment for mining ventures.

For instance, the successful Environmental Impact Assessment approval for McEwen Mining's Los Azules project in Argentina in December 2024 highlights the critical nature of navigating these political waters. Securing and upholding necessary permits are fundamental to the company's ongoing operations and future expansion strategies.

International trade relations and the specter of tariffs significantly shape the global demand and pricing for precious metals, directly impacting McEwen Mining's revenue streams. For example, ongoing discussions and potential US tariffs on silver imports from Mexico, a key global supplier, could introduce considerable volatility into market dynamics for the 2024-2025 period, influencing commodity prices.

Furthermore, shifts in major trade agreements can alter the cost associated with importing essential mining equipment and exporting finished products, thereby adding to McEwen Mining's operational expenditures and potentially affecting profitability.

Geopolitical tensions, a significant driver for gold's upward momentum observed in early 2024, present a dual-edged sword for companies like McEwen Mining. While such instability can bolster the appeal of gold as a safe-haven asset, potentially increasing demand and prices, it simultaneously introduces substantial operational risks.

These geopolitical uncertainties can manifest as disruptions to global supply chains, impacting the availability and cost of essential mining equipment and materials. For McEwen Mining, operating in regions with varying political stability, this could translate to higher security expenses and increased logistical challenges, directly affecting production costs and project timelines throughout 2024 and into 2025.

The unpredictable nature of geopolitical events creates an environment that complicates long-term investment planning and capital allocation. For instance, fluctuating trade policies or unexpected sanctions could impact market access for extracted commodities, requiring agile strategic adjustments and potentially hindering the company's ability to secure favorable financing for future projects.

Resource Nationalism

Resource nationalism presents a significant political risk for McEwen Mining, especially in regions like Argentina. This trend, where governments seek increased control over their natural resources, could lead to higher operational costs. For instance, changes in mining regulations in Argentina, a key operational area for McEwen, could directly impact profitability through increased royalties or taxes. Such shifts can affect asset valuations and the overall attractiveness of investments in the country.

The potential for governments to renegotiate contracts or even nationalize assets under extreme resource nationalism policies is a substantial concern. This could lead to the seizure of mining rights or require McEwen Mining to operate under less favorable terms. In 2024, several Latin American nations, including Argentina, continued to review their mining codes and fiscal regimes, signaling a heightened risk of such policy changes.

McEwen Mining's exposure in Argentina, particularly at its Los Azules project, makes it vulnerable to these political shifts. The company must navigate a landscape where governments may prioritize domestic control and revenue from mineral wealth. The latest available data indicates that mining taxes and royalties in some South American countries saw adjustments in 2024, underscoring the dynamic nature of this risk.

- Increased Royalties and Taxes: Governments may raise the percentage of revenue or profit mining companies must pay.

- Contract Renegotiation: Existing agreements could be revisited, potentially leading to less favorable terms for foreign investors.

- Asset Expropriation/Nationalization: In extreme cases, governments might seize ownership of mining assets.

- Local Content Requirements: Policies mandating the use of local goods, services, and labor can increase operational complexity and costs.

International Agreements and Regulations

McEwen Mining must navigate a complex web of international agreements and regulations governing the mining sector. Compliance with treaties addressing forced and child labor in supply chains, for example, is a growing imperative. The company's 2024 report, detailing its adherence to Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act, underscores this commitment to global ethical standards. Non-compliance carries significant risks, including severe reputational damage and substantial legal penalties.

McEwen Mining operates within diverse political landscapes, making government stability and mining policy critical. Political instability, particularly in Argentina, can alter regulations and affect investment attractiveness. For example, the approval of the Los Azules project's Environmental Impact Assessment in December 2024 highlights the importance of navigating these political factors for operational continuity.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting McEwen Mining, providing a comprehensive understanding of its operating landscape.

McEwen Mining's PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders grasp key external factors impacting the company.

Economic factors

McEwen Mining's financial health is intrinsically linked to the often-unpredictable movements of gold and silver prices. These precious metals are the company's primary revenue drivers, making their market performance a critical factor in the company's profitability and overall valuation.

Looking ahead to 2025, analysts are presenting a generally bullish outlook for both commodities. Projections suggest average gold prices could reach approximately $2,735.33 per ounce, while silver is anticipated to trade around $32.86 per ounce. Such price levels, if realized, would likely translate to higher revenues and potentially improved margins for McEwen Mining.

However, it's crucial to acknowledge the inherent volatility in the gold and silver markets. While forecasts point to upward trends, significant price swings are also a distinct possibility. This volatility can create challenges for financial planning, impacting earnings forecasts and potentially influencing the company's capital allocation and investment strategies throughout 2025.

Global economic growth significantly impacts McEwen Mining by shaping demand for its key products. A robust global economy generally translates to higher industrial consumption of silver, a crucial component in electronics and renewable energy technologies. For instance, projections for 2025 indicate a strong upward trend in industrial silver demand, potentially setting new records, which is a favorable outlook for companies like McEwen Mining.

Conversely, any signs of economic deceleration or recession could dampen this demand. A slowdown might lead to reduced manufacturing activity, directly impacting the need for silver. This, in turn, could put downward pressure on silver prices, affecting McEwen Mining's revenue and profitability. The investment demand for both gold and silver is also sensitive to economic conditions, with investors often turning to these precious metals as safe-haven assets during periods of uncertainty.

Inflationary pressures are a significant concern for McEwen Mining, directly impacting its operating costs. Expenses for labor, energy, and essential supplies have seen notable increases, a trend expected to continue into 2025.

While elevated commodity prices offer some buffer, persistent inflation poses a risk to profit margins if not meticulously managed. The company's own 2025 guidance highlights this, forecasting higher per-GEO production costs in the initial half of the year, largely due to extensive stripping activities planned at the Pick deposit.

Currency Exchange Rate Volatility

McEwen Mining's international operations expose it to significant currency exchange rate volatility, particularly impacting the Canadian Dollar (CAD), US Dollar (USD), and Argentine Peso (ARS). Fluctuations in these currency pairs can directly influence the company's reported revenues and expenses when financial results are consolidated. For instance, a strengthening USD against the ARS could make mining costs in Argentina appear lower in USD terms, while a weakening CAD could reduce the reported value of Canadian-based revenues in USD.

The financial performance of McEwen Mining is therefore susceptible to the unpredictable movements in global currency markets. As of early 2024, the Argentine Peso has experienced substantial depreciation against the US Dollar, a trend that could significantly alter the company's cost structure and profitability in its Argentine operations. This volatility necessitates careful financial management and hedging strategies to mitigate potential negative impacts.

- Canadian Dollar (CAD) to US Dollar (USD): Exchange rate fluctuations between CAD and USD directly affect the valuation of McEwen Mining's Canadian assets and operations when reported in USD.

- Argentine Peso (ARS) to US Dollar (USD): Significant depreciation of the ARS against the USD, observed throughout 2023 and continuing into 2024, impacts operating costs and the translated value of revenues in Argentina. For example, the ARS saw a devaluation of over 50% against the USD in the latter half of 2023.

- Impact on Financial Reporting: Currency volatility can distort year-over-year comparisons of revenue and profit margins, making it challenging to assess underlying operational performance without careful currency adjustment.

- Hedging Strategies: Companies like McEwen Mining often employ financial instruments to hedge against adverse currency movements, aiming to stabilize reported earnings and protect profit margins.

Access to Capital and Financing Costs

McEwen Mining's ability to secure funding directly impacts its growth trajectory, from early-stage exploration to expanding existing operations. The cost associated with this capital is a significant factor in overall project profitability.

In early 2025, McEwen Mining successfully raised $110.0 million through the issuance of convertible senior unsecured notes. This infusion of capital is earmarked to bolster liquidity and support ongoing development initiatives, particularly at the Fox Complex.

- Capital Access: The successful issuance of convertible notes in early 2025 highlights the company's access to capital markets, a critical element for funding its ambitious growth plans.

- Financing Costs: While specific interest rates for the 2025 notes are not detailed here, the cost of debt and equity significantly influences McEwen Mining's financial health and investment decisions.

- Liquidity Enhancement: The $110.0 million raised directly strengthens the company's cash position, providing the necessary resources for operational continuity and strategic investments.

- Project Funding: These funds are specifically allocated to growth projects, underscoring the direct link between capital availability and the execution of development strategies at key assets like the Fox Complex.

Economic factors significantly shape McEwen Mining's performance, primarily through commodity prices, global economic growth, inflation, and currency fluctuations. Analysts project robust precious metal prices for 2025, with gold potentially reaching $2,735.33 per ounce and silver $32.86 per ounce, which bodes well for revenue. However, the inherent volatility in these markets necessitates careful financial planning, as price swings can impact earnings and strategic investments.

Global economic health directly influences demand for silver, crucial for industrial applications. Strong growth in 2025 is expected to boost industrial silver demand, potentially setting new records. Conversely, economic slowdowns could reduce manufacturing and thus silver demand, negatively impacting prices and McEwen Mining's profitability. Investors' flight to safety during uncertain economic times also drives gold and silver demand.

Inflationary pressures are a key concern, increasing operating costs for labor, energy, and supplies, a trend anticipated to persist into 2025. While higher commodity prices offer some offset, persistent inflation risks eroding profit margins if not managed effectively. McEwen Mining's 2025 guidance reflects this, forecasting higher per-GEO production costs in the first half of the year due to planned stripping activities at the Pick deposit.

Currency exchange rate volatility, particularly involving the Canadian Dollar (CAD), US Dollar (USD), and Argentine Peso (ARS), directly affects McEwen Mining's reported financials. The significant depreciation of the Argentine Peso against the USD observed in late 2023 and continuing into 2024 materially impacts operating costs and revenue translation in Argentina, requiring diligent financial management and hedging.

| Economic Factor | 2025 Projections/Data | Impact on McEwen Mining |

|---|---|---|

| Gold Price | ~$2,735.33/oz | Higher revenue potential |

| Silver Price | ~$32.86/oz | Increased revenue and industrial demand |

| Global Economic Growth | Projected strong growth | Boosts industrial silver demand |

| Inflation | Expected persistent increases | Raises operating costs, impacting profit margins |

| Argentine Peso (ARS) vs. USD | Significant depreciation (e.g., >50% in H2 2023) | Lowers USD-denominated costs in Argentina, affects ARS-based revenues |

Same Document Delivered

McEwen Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of McEwen Mining delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understanding these external forces is crucial for strategic decision-making in the mining sector.

Sociological factors

McEwen Mining's ability to operate hinges on maintaining a strong, positive relationship with the communities surrounding its projects, often referred to as its social license to operate. This involves proactive engagement and a genuine commitment to shared value creation.

The company actively integrates community engagement and social responsibility into its Environmental, Social, and Governance (ESG) strategy, aiming to deliver tangible, long-term benefits. For instance, in 2023, McEwen Mining reported investing $18.5 million in local communities and suppliers across its operations, a significant portion of its operational expenditure.

Addressing the often negative public perception of mining, stemming from past environmental or social issues, is a continuous challenge. McEwen Mining counters this by transparently demonstrating responsible operational practices and investing in community development programs, such as local employment initiatives and infrastructure support.

McEwen Mining's operations are significantly influenced by labor relations and the availability of skilled workers. In 2024, the company experienced production impacts at its Fox Complex due to workforce constraints and stope failures, underscoring the direct link between human capital management and operational continuity.

Attracting and retaining talent, particularly in remote mining environments, presents an ongoing challenge. This necessity for skilled labor means that maintaining positive labor relations is paramount for ensuring consistent and efficient mining output, directly affecting production targets and cost structures.

McEwen Mining places a strong emphasis on the health and safety of its workforce and the communities where it operates. This commitment is a core aspect of its social responsibility, ensuring operations are conducted safely and with respect for all stakeholders.

In 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.27, demonstrating a focus on minimizing workplace incidents. This aligns with their aim to foster a positive and secure working environment through rigorous adherence to safety protocols.

By maintaining high health and safety standards, McEwen Mining not only aims to prevent accidents but also to build trust and a strong social license to operate, which is crucial for long-term success in the mining sector.

Impact on Local Employment and Economic Development

McEwen Mining's operations have a direct and substantial effect on local employment and economic development. These mining projects often become significant job creators, not only directly within the company but also through supporting industries and services. For instance, the Los Azules project in Argentina is anticipated to be a major economic contributor to the San Juan province. This development involves substantial local procurement of goods and services, further stimulating the regional economy and fostering business growth. Infrastructure improvements, often necessitated by mining activities, also provide lasting economic benefits to the surrounding communities.

The economic ripple effect extends beyond direct employment. McEwen Mining's commitment to local content policies means a significant portion of their operational spending is directed towards local suppliers and contractors. This strategy is crucial for maximizing the positive economic impact within the host communities. For example, during the development phase of a large project, procurement can range from catering and accommodation to specialized engineering services, all sourced locally where feasible. This infusion of capital strengthens the local business ecosystem and creates a multiplier effect on economic activity.

- Job Creation: Mining projects are typically labor-intensive, creating numerous direct and indirect employment opportunities.

- Local Procurement: A significant percentage of operational spending is directed towards local businesses for goods and services, boosting regional economies.

- Infrastructure Development: Investments in roads, power, and water infrastructure benefit not only the mining operations but also the local communities.

- Economic Diversification: While primarily focused on mining, the associated economic activity can encourage diversification in local service sectors.

Indigenous Rights and Land Claims

McEwen Mining's operations, particularly in Canada, are significantly influenced by Indigenous rights and land claims. The company must navigate these complex relationships, ensuring ethical engagement and compliance with evolving legal frameworks. For instance, in 2024, ongoing discussions and legal precedents surrounding Indigenous land rights continue to shape resource development projects across the country, impacting permitting and operational timelines.

The company's approach involves actively addressing community concerns, emphasizing the economic and social benefits of its projects, such as job creation and infrastructure development, while adhering to strict regulatory standards. This proactive engagement is vital for maintaining a social license to operate. As of 2024, many Indigenous groups are increasingly seeking direct participation and benefit-sharing agreements from mining projects on their traditional territories.

Integrating Indigenous perspectives into project planning and execution is becoming a standard expectation, moving beyond mere consultation to genuine partnership. This includes respecting traditional knowledge and environmental stewardship practices. By fostering these relationships, McEwen Mining aims to ensure sustainable and mutually beneficial operations, aligning with broader ESG (Environmental, Social, and Governance) goals increasingly scrutinized by investors in 2025.

- Indigenous Engagement: McEwen Mining actively consults with Indigenous communities to address concerns and outline project benefits.

- Regulatory Compliance: Adherence to national and regional laws concerning Indigenous rights is paramount for operational continuity.

- Social License to Operate: Building trust and ensuring mutual benefit with Indigenous groups is critical for long-term project viability.

- Partnership Models: A growing trend in 2024-2025 involves more collaborative approaches, including equity stakes and shared decision-making with Indigenous communities.

McEwen Mining's success is deeply intertwined with its relationships with local communities, requiring active engagement and a commitment to shared value, as demonstrated by its significant investment of $18.5 million in community and supplier initiatives in 2023. The company actively addresses historical negative perceptions of mining through transparent operations and targeted development programs, such as local employment and infrastructure support. Positive labor relations are crucial, with workforce constraints impacting operations, as seen in 2024 at the Fox Complex, highlighting the need for skilled labor attraction and retention in remote areas.

McEwen Mining's economic impact extends to substantial job creation and local procurement, aiming to stimulate regional economies, exemplified by the anticipated contribution of the Los Azules project to Argentina's San Juan province. The company prioritizes ethical engagement and compliance with evolving legal frameworks regarding Indigenous rights, with many Indigenous groups in 2024-2025 seeking direct participation and benefit-sharing in projects on their territories. Building trust and fostering genuine partnerships with Indigenous communities, including adherence to traditional knowledge and environmental stewardship, is vital for long-term operational viability and is increasingly scrutinized by investors.

| Sociological Factor | McEwen Mining's Approach | Impact/Data (2023-2025) |

| Community Relations | Active engagement, shared value creation, ESG integration | $18.5 million invested in local communities and suppliers (2023) |

| Labor & Workforce | Focus on skilled labor, safety, and positive relations | Workforce constraints impacted Fox Complex production (2024) |

| Indigenous Rights | Ethical engagement, compliance, partnership models | Growing trend of benefit-sharing agreements sought by Indigenous groups (2024-2025) |

Technological factors

Technological advancements are significantly boosting the efficiency of mineral exploration. Sophisticated modeling and estimation techniques, including AI-driven data analysis and advanced geophysical imaging, are improving the success rate of discovering new mineral deposits. McEwen Mining is actively employing these cutting-edge methods across its diverse portfolio of properties, aiming to expand its resource base. For instance, in 2023, the company reported encouraging results from its Black Fox Complex, partly attributed to refined exploration targeting enabled by new technologies.

The mining industry is seeing a significant shift towards automation, with autonomous vehicles and drones becoming increasingly common. This technological wave promises to boost efficiency, enhance safety, and drive productivity across mining sites. While McEwen Mining's specific adoption of these advanced systems isn't detailed, the industry-wide move to "smart operations" indicates a strong likelihood of their future integration to optimize resource extraction and operational performance.

Technological advancements in mineral processing are significantly improving how much gold and silver can be extracted from ore, directly boosting profits for companies like McEwen Mining. For instance, upgrades to processing plants, such as those at McEwen's Fox Complex, are designed to handle more ore, leading to greater operational efficiency.

In 2024, the mining industry is seeing a growing adoption of innovative techniques like biomining and in-situ leaching. These methods not only increase recovery rates but also offer a reduced environmental footprint, aligning with sustainability goals and potentially lowering operational costs.

Data Analytics for Operational Optimization

The mining industry is increasingly leveraging data analytics and artificial intelligence (AI) to fine-tune operations. This focus on technological advancement allows for predictive maintenance, enabling companies to anticipate equipment failures and schedule repairs proactively, thereby minimizing costly downtime. For instance, in 2024, many mining firms reported significant cost savings by implementing AI-driven predictive maintenance, with some seeing reductions in unscheduled downtime by up to 20%.

These advanced analytical tools also play a crucial role in risk assessment, identifying potential hazards before they impact operations. Furthermore, AI can analyze vast datasets to uncover efficiencies in extraction, processing, and logistics, leading to improved yields and reduced operational expenditures. McEwen Mining's strategic approach to technological adoption would likely involve exploring these data-centric solutions to enhance its competitive edge and operational performance.

- Predictive Maintenance: AI algorithms analyze sensor data from mining equipment to forecast potential failures, reducing unexpected breakdowns.

- Risk Assessment: Data analytics helps identify and mitigate safety and operational risks in real-time.

- Process Optimization: Insights from data improve efficiency in extraction, mineral processing, and supply chain management.

- Cost Reduction: Implementing these technologies can lead to substantial savings by minimizing downtime and optimizing resource allocation.

Sustainable Mining Technologies

The mining sector is rapidly integrating technologies focused on minimizing its environmental footprint. This includes a significant shift towards renewable energy sources to power operations and advanced methods for managing mining waste more effectively. These advancements are crucial for meeting evolving environmental regulations and stakeholder expectations.

McEwen Mining is actively demonstrating this trend with its Los Azules project. The company has set an ambitious goal of achieving carbon neutrality by 2038 for this project. A key component of this strategy is the plan to power the Los Azules operations entirely with renewable energy sources, a clear adoption of sustainable mining technologies.

This commitment by McEwen Mining directly mirrors broader industry movements. There's a strong push across the mining world for decarbonization efforts and the implementation of techniques designed for low-impact extraction. This focus on sustainability is becoming a competitive advantage and a necessity for long-term operational viability.

Specific examples of these technological shifts include:

- Electrification of mining fleets: Moving from diesel-powered haul trucks and equipment to electric alternatives significantly reduces direct emissions.

- Advanced water management systems: Technologies that recycle and treat process water minimize freshwater consumption and prevent contamination.

- Use of artificial intelligence (AI) for optimization: AI can improve energy efficiency in operations, predict equipment failures to reduce downtime, and optimize resource extraction, thereby lowering the overall environmental impact.

- Carbon capture and utilization (CCU) technologies: While still developing, CCU aims to capture CO2 emissions from mining processes and convert them into useful products, further contributing to decarbonization goals.

Technological advancements are reshaping mineral exploration and extraction. AI-driven data analysis and advanced geophysical imaging are enhancing discovery success rates, while automation through autonomous vehicles and drones promises greater efficiency and safety. McEwen Mining is leveraging these tools, for example, by refining targeting at its Black Fox Complex, and the industry's move towards smart operations suggests wider adoption of these technologies to optimize resource extraction.

Legal factors

McEwen Mining operates under a stringent legal framework, requiring adherence to national and provincial mining laws, permits, and licenses across Canada, the USA, and Argentina. Maintaining these approvals is paramount; any delays or non-compliance poses a significant risk, potentially leading to project stoppages and substantial penalties.

The successful acquisition of the environmental permit for the Los Azules project in Argentina in December 2024 underscores the critical nature of these legal milestones. This permit is essential for advancing operations and demonstrates the company's commitment to meeting regulatory requirements in its key jurisdictions.

McEwen Mining operates under a stringent environmental regulatory landscape, necessitating strict compliance with rules governing mine reclamation, waste disposal, and water consumption. The company’s commitment is evident in its reporting of zero significant environmental incidents across its operations, underscoring its focus on responsible practices.

Furthermore, McEwen Mining highlights its high water recycling rates, a key indicator of efficient resource management and adherence to environmental standards. This proactive approach includes continuous environmental impact assessments and alignment with global reporting frameworks such as the Global Reporting Initiative (GRI).

McEwen Mining must navigate a complex web of labor laws and union agreements to ensure operational stability. Compliance with regulations regarding fair wages, working hours, and workplace safety is paramount, especially given the inherent risks in mining. The company's adherence to these legal frameworks directly impacts its ability to attract and retain talent, and avoid costly disputes or disruptions.

Workforce constraints, a notable challenge in 2024, underscore the critical role of effective labor management. Issues such as labor shortages, particularly for skilled positions, and the potential for unionized workforces to negotiate for improved conditions can significantly affect production schedules and costs. For instance, in 2024, several mining regions experienced heightened union activity, leading to temporary work stoppages that impacted output for various companies.

Furthermore, the company's supply chain is not immune to labor law scrutiny. Ensuring no instances of forced or child labor exist within its suppliers is a non-negotiable requirement, with significant reputational and legal consequences for any breaches. The increasing global focus on ethical sourcing means robust due diligence in this area is a continuous necessity for McEwen Mining.

Taxation Policies and Royalty Structures

Changes in taxation policies, royalties, and other fiscal regimes in the operating jurisdictions can directly impact McEwen Mining's profitability. For instance, in 2024, countries like Mexico, where McEwen Mining operates, have seen discussions around potential increases in mining royalty rates to capture more value from natural resources. Such shifts require the company to actively manage its tax liabilities and adapt its financial strategies to optimize performance across these varying landscapes.

McEwen Mining must navigate these varying tax landscapes to optimize its financial performance. For example, in Argentina, where the company has significant interests, provincial tax regulations can differ, affecting operational costs. Staying abreast of these regional fiscal nuances is critical for effective financial planning and resource allocation.

Policy changes, especially in resource-rich nations, can significantly alter the economic viability of projects. A notable trend observed in 2024 is a global push for governments to secure a larger share of profits from mining operations. This can manifest as increased corporate income taxes or revised royalty structures, directly influencing the net present value and feasibility of ongoing and future mining ventures for companies like McEwen Mining.

Key considerations for McEwen Mining regarding taxation and royalties include:

- Impact of Corporate Tax Rate Fluctuations: Monitoring and adapting to changes in corporate income tax rates in operating countries like the USA and Argentina.

- Royalty Rate Adjustments: Assessing the financial implications of potential increases in royalty percentages on mineral extraction, as seen in policy debates in various Latin American jurisdictions.

- Changes in Withholding Taxes: Understanding the effects of altered withholding tax rates on dividends and interest payments, which can impact international cash flows.

- Fiscal Stability Agreements: Evaluating the terms and potential renegotiation of existing fiscal stability agreements that provide tax certainty for long-term projects.

International Legal Frameworks and Treaties

McEwen Mining navigates a complex web of international legal frameworks and treaties that govern global mining operations. These include agreements related to environmental protection, labor standards, and responsible resource extraction. For instance, adherence to guidelines like those established by the Extractive Industries Transparency Initiative (EITI) is crucial for maintaining transparency and stakeholder trust. In 2024, the global focus on ethical supply chains intensified, impacting how companies like McEwen Mining must demonstrate compliance.

The company’s commitment to these international legal standards is exemplified by its reporting under Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act. This legislation, effective from 2024, mandates that Canadian organizations assess and report on the risk of forced labour and child labour in their supply chains. McEwen Mining’s proactive engagement with such regulations not only fulfills legal obligations but also bolsters its corporate reputation and ensures continued market access, particularly in regions with stringent ethical sourcing requirements.

Operating within these international legal structures is not merely a compliance exercise; it is integral to sustainable business practices and risk mitigation. By aligning with global best practices and treaties, McEwen Mining can foster stronger relationships with host governments, local communities, and international investors. This adherence helps to secure the company’s social license to operate and can prevent costly legal disputes or reputational damage in the increasingly scrutinized mining sector.

Key international legal and ethical considerations for McEwen Mining include:

- Compliance with international human rights law, ensuring respect for the rights of affected communities and workers.

- Adherence to responsible sourcing initiatives, such as those promoting conflict-free minerals and ethical labor practices.

- Fulfillment of reporting requirements under legislation like Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act.

- Engagement with international environmental standards to minimize ecological impact and ensure sustainable resource management.

McEwen Mining's operations are heavily influenced by evolving legal and regulatory landscapes across its operating jurisdictions, particularly concerning environmental standards and labor laws. The company must secure and maintain numerous permits, with a notable example being the environmental permit acquisition for the Los Azules project in December 2024, crucial for operational progression. Furthermore, adherence to stringent labor laws, including fair wages and workplace safety, is paramount, especially given the challenges of skilled labor shortages and union activity observed in 2024.

The company also faces the impact of changing fiscal policies, including corporate tax rates and royalty structures. For instance, in 2024, countries like Mexico, where McEwen Mining has interests, have seen discussions around potential increases in mining royalty rates. This necessitates careful financial strategy to manage tax liabilities and optimize performance across varying regional fiscal nuances.

International legal frameworks, such as Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act, effective from 2024, also shape the company's due diligence. Compliance with these laws, alongside international human rights and responsible sourcing initiatives, is vital for maintaining market access and corporate reputation.

| Legal Factor Category | Key Considerations for McEwen Mining | 2024/2025 Relevance/Data Point |

|---|---|---|

| Environmental Regulations | Permitting, reclamation, waste disposal, water usage | Successful environmental permit for Los Azules in December 2024; zero significant environmental incidents reported in 2024. |

| Labor Laws | Fair wages, working hours, safety, union agreements | Skilled labor shortages noted in 2024; heightened union activity in some regions impacting output. |

| Taxation and Royalties | Corporate tax rates, royalty percentages, fiscal stability | Policy discussions on increased mining royalty rates in jurisdictions like Mexico observed in 2024. |

| International Compliance | Forced labor legislation, ethical sourcing, human rights | Compliance with Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act (effective 2024). |

Environmental factors

Water management is a major environmental consideration for any mining company, particularly those operating in dry climates. McEwen Mining has made strides in this area, boosting its water recycling efforts significantly. For instance, its 100%-owned operations achieved over 90% water recycling in both 2023 and 2024, a testament to their improved conservation practices.

This focus on efficiency is also evident at specific sites. The company has successfully reduced water consumption at its Fox Complex and the Gold Bar Mine. Furthermore, the development of the Los Azules project is designed with water scarcity in mind, targeting water usage that is less than a quarter of what a typical copper mine would require.

Effective management of mining tailings and waste is absolutely critical for minimizing environmental harm. As of early 2025, the mining sector is seeing a significant push towards innovative solutions, with a particular emphasis on recycling and repurposing waste materials.

One promising area is the transformation of tailings into construction materials, offering a dual benefit of waste reduction and resource creation. This aligns with growing regulatory pressures and corporate social responsibility mandates driving cleaner operational practices.

McEwen Mining's dedication to responsible mining inherently means implementing thorough waste management strategies. This commitment is vital for maintaining its social license to operate and mitigating long-term environmental liabilities, reflecting industry best practices that are becoming increasingly non-negotiable.

Mining operations are increasingly scrutinized for their environmental impact, with climate change regulations and the imperative to slash carbon footprints becoming central concerns. Companies are under pressure to adopt cleaner practices and invest in sustainable technologies.

McEwen Mining is actively addressing this, with its flagship Los Azules copper project in Argentina targeting carbon neutrality by 2038. This ambitious goal is supported by a commitment to source 100% of its power from renewable wind, solar, and hydro sources within Argentina.

This strategic approach reflects a wider industry shift towards decarbonization. For instance, by 2025, many major mining firms aim to have set science-based targets for emissions reduction, with significant investments planned in renewable energy and energy efficiency technologies over the next decade.

Biodiversity Protection and Land Reclamation

McEwen Mining recognizes that minimizing its impact on biodiversity and conducting thorough land reclamation are paramount environmental duties. The company highlights its commitment to modern mining practices, citing successful land restoration projects as evidence of its environmental stewardship. This focus is crucial for obtaining and retaining the necessary environmental permits for its operations.

Effective land reclamation is not just a regulatory requirement but also a key factor in maintaining social license to operate. Companies like McEwen Mining are increasingly investing in advanced techniques to restore ecosystems disturbed by mining activities. For instance, in 2023, McEwen Mining reported progress on reclamation efforts at its Fox Mine in Ontario, aiming to return portions of the site to a more natural state following the cessation of mining activities there. This aligns with broader industry trends toward more sustainable mining practices.

- Regulatory Compliance: Adherence to biodiversity protection and land reclamation standards is essential for obtaining and maintaining mining permits.

- Environmental Stewardship: Modern mining operations emphasize restoring disturbed land, showcasing a commitment to environmental responsibility.

- Social License: Successful reclamation enhances a mining company's reputation and acceptance within local communities.

- Operational Continuity: Proactive environmental management, including reclamation planning, can prevent delays and mitigate risks associated with environmental non-compliance.

Energy Consumption and Renewable Energy Transition

The mining sector's significant energy demands place the transition to renewable energy at the forefront of environmental considerations. McEwen Mining's Los Azules project exemplifies this shift, operating solely on renewable power sources. This strategic decision directly addresses the need to reduce greenhouse gas emissions, a critical aspect of environmental responsibility in the mining industry.

This commitment to renewables offers more than just environmental advantages; it presents tangible long-term operational cost benefits. By minimizing reliance on volatile fossil fuel markets, the company can achieve greater price stability and predictability in its energy expenditures. For instance, the global renewable energy market saw significant growth, with renewable energy capacity additions reaching an estimated 510 GW in 2023, a substantial increase from previous years, signaling a robust trend that McEwen Mining is leveraging.

- Energy Intensity: Mining operations are inherently energy-intensive, making the shift to renewables crucial for environmental sustainability.

- Los Azules Commitment: McEwen Mining's Los Azules project is powered entirely by renewable energy, showcasing a dedication to decarbonization.

- Emission Reduction: The adoption of renewable energy directly contributes to lowering the company's carbon footprint and greenhouse gas emissions.

- Cost Benefits: Transitioning to renewables can lead to reduced and more stable operational costs over the long term by mitigating fossil fuel price volatility.

McEwen Mining's environmental strategy heavily features water conservation, with over 90% water recycling achieved at its wholly-owned operations in 2023 and 2024. This focus extends to new projects like Los Azules, designed for significantly lower water usage. The company also prioritizes responsible tailings management, exploring waste repurposing into construction materials, aligning with increasing regulatory and CSR demands for cleaner mining practices.

PESTLE Analysis Data Sources

McEwen Mining's PESTLE analysis is informed by data from regulatory bodies, industry associations, and financial market reports. We incorporate economic indicators from international organizations and government statistics to assess market dynamics and operational costs.