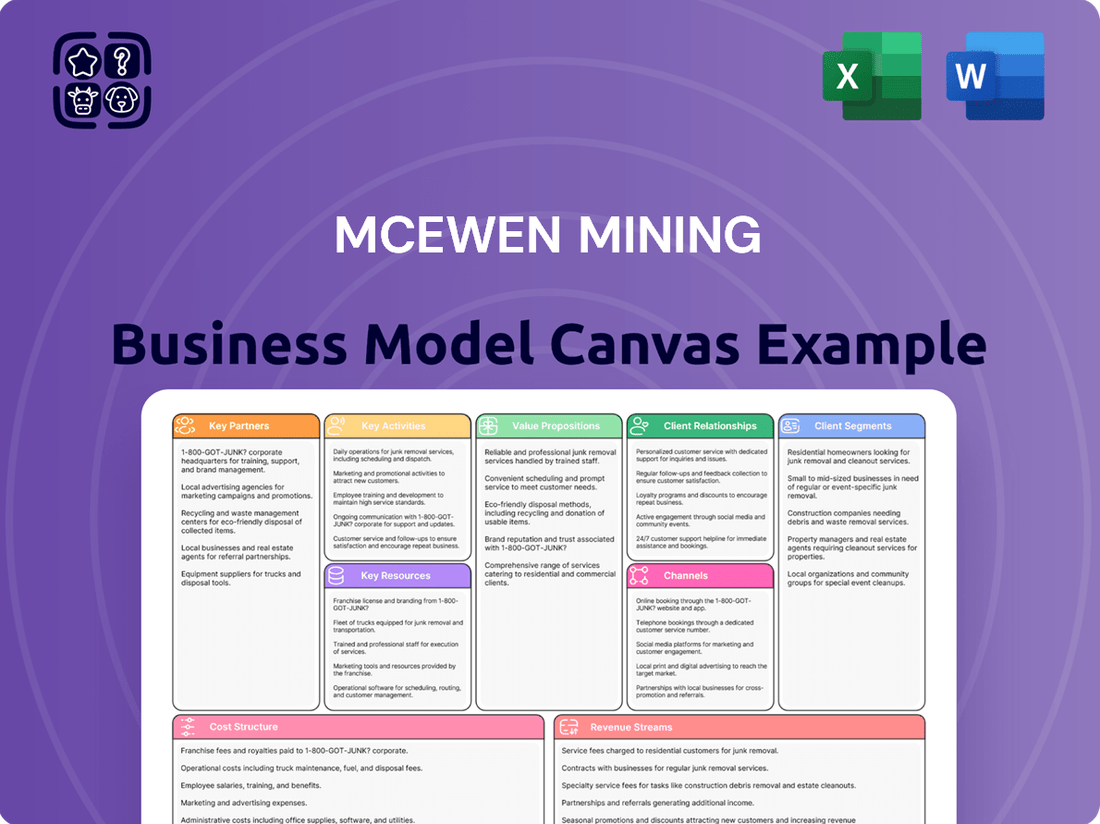

McEwen Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McEwen Mining Bundle

Unlock the strategic blueprint behind McEwen Mining's operations with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and key revenue streams, offering a clear picture of their success. Discover how they build partnerships and manage costs to maintain their competitive edge. This is an essential tool for anyone looking to understand or replicate their approach.

Ready to dive deeper? Get the full Business Model Canvas for McEwen Mining and gain a complete strategic overview, including their cost structure and key activities. Download it now to accelerate your own business planning and gain actionable insights from a proven industry leader.

Partnerships

McEwen Mining's strategic partnership with Hochschild Mining plc for the San José mine in Argentina is a cornerstone of its operations. McEwen Mining holds a significant 49% stake in this venture, highlighting the importance of this collaboration.

Hochschild Mining plc, as the operator, manages the San José mine's daily activities and reports all operational results. This division of labor allows McEwen Mining to leverage Hochschild's expertise while maintaining a substantial interest in a key asset.

This joint venture structure ensures that both partners share in the risks and rewards associated with the San José mine. For instance, in 2023, the San José mine produced 3.2 million ounces of silver and 30,000 ounces of gold, demonstrating the tangible outcomes of such partnerships.

McEwen Mining depends on a diverse group of suppliers for critical equipment, specialized materials, and essential services that keep its mining operations running smoothly. This includes everything from the drills that break ground to the processing equipment that refines ore and the maintenance services that ensure machinery stays in top shape.

The company also strategically utilizes contractors for specific, often labor-intensive, tasks. For instance, contractors are brought in for pre-stripping activities at the Gold Bar project and for crucial ramp development work at the Fox Complex, both key to unlocking resource potential.

These supplier and contractor relationships are fundamental to McEwen Mining's operational success and the timely advancement of its projects. For example, in 2023, the company reported that its Gold Bar Phase 1 expansion was progressing, relying on these external partners for specialized earthmoving and construction services.

McEwen Mining's partnerships with government and regulatory bodies are foundational for its operational success. These relationships are crucial for securing and retaining the permits and licenses necessary to initiate and continue exploration, development, and active mining. For instance, adherence to environmental standards set by agencies like the Bureau of Land Management (BLM) in Nevada is paramount for legal and sustainable operations.

Achieving regulatory milestones, such as the final Closure Plan Permit for the Stock mine, demonstrates the company's commitment to responsible mining and facilitates project advancement. These collaborations ensure that McEwen Mining operates within the legal framework, mitigating risks associated with non-compliance and fostering long-term viability.

Local Communities and Indigenous Groups

McEwen Mining places significant emphasis on fostering strong connections with local communities and Indigenous groups situated near its operational sites. This commitment is foundational to securing and maintaining its social license to operate, ensuring long-term stability and promoting sustainable development.

Transparent communication and active engagement are cornerstones of these relationships. The company actively addresses local concerns, which is crucial for smooth operations. For instance, in 2023, McEwen Mining continued its focus on community investment programs, though specific figures for 2024 partnerships are still being finalized as reporting cycles progress. These initiatives often include:

- Supporting local employment and training opportunities.

- Investing in community infrastructure and social programs.

- Engaging in respectful dialogue and consultation processes.

- Collaborating on environmental stewardship initiatives.

These partnerships are not just about compliance; they are integral to McEwen Mining's strategy for responsible resource development and contribute to shared value creation.

Financial Institutions and Investors

McEwen Mining cultivates vital relationships with financial institutions like banks to secure credit facilities, essential for funding exploration and operational needs. These partnerships are crucial for accessing the capital required to advance their mining projects. In 2023, the company raised approximately $40 million through a bought deal offering of common shares, illustrating their reliance on equity financing.

Investors are key partners, providing both equity and debt financing to fuel McEwen Mining's growth. The company actively engages with capital markets, as evidenced by its issuance of convertible notes, which offers an avenue for debt financing that can convert to equity. This strategic approach helps fund ongoing exploration and development activities.

Flow-through financings are another important partnership avenue, allowing the company to raise funds specifically for Canadian exploration expenses. This mechanism attracts investors seeking tax benefits, directly supporting the company's grassroots exploration efforts. For example, in 2024, McEwen Mining continued to utilize this financing tool to advance its projects in Canada.

- Banks: Provide essential credit facilities for operational capital.

- Equity Investors: Supply capital through share offerings and private placements.

- Debt Holders: Offer financing via convertible notes and other debt instruments.

- Flow-Through Investors: Fund Canadian exploration activities through specialized tax-advantaged financings.

McEwen Mining's key partnerships extend to its joint venture with Hochschild Mining at the San José mine, where McEwen holds a 49% stake. Hochschild acts as the operator, managing daily activities and reporting results, a structure that shares risks and rewards. In 2023, San José produced 3.2 million ounces of silver and 30,000 ounces of gold, demonstrating the productive output of this collaboration.

What is included in the product

This Business Model Canvas provides a strategic blueprint for McEwen Mining, detailing its value proposition of producing precious metals through efficient operations and exploring growth opportunities in its mining portfolio.

It maps out customer segments (investors, commodity markets), key resources (mines, geological expertise), and revenue streams (metal sales) to guide sustainable business development.

McEwen Mining's Business Model Canvas offers a pain point reliever by providing a clear, one-page snapshot of their strategy, simplifying complex operations for better understanding and decision-making.

Activities

McEwen Mining's core activities revolve around identifying new mineral deposits and expanding resources at its key properties. For instance, at the Grey Fox project, extensive drilling programs are underway to define the potential of future mining areas. This systematic approach to exploration is crucial for extending the operational life of its mines and boosting overall reserves.

The company places significant emphasis on geological studies to better understand the ore bodies and their economic viability. In 2024, McEwen Mining continued these efforts, aiming to convert inferred resources into measured and indicated categories. This focus on resource definition is paramount for long-term sustainability and future production planning.

McEwen Mining's mine development and construction activities are pivotal for future production. This includes preparing new mining areas, much like the ongoing underground access ramp development at the Stock mine within their Fox Complex. These projects require substantial capital outlay and intricate engineering to build the necessary infrastructure for effective resource extraction.

Crucial to this phase are the permitting processes and pre-construction planning. For instance, in 2023, the company continued to advance its development projects, with a focus on de-risking and preparing for future operational phases. These efforts are foundational for unlocking the economic potential of their mineral assets.

McEwen Mining's core activities revolve around extracting gold and silver from its key mining sites. This involves the entire process from initial drilling and blasting to hauling the ore and then processing it through mills to create doré or concentrate. Think of it as the fundamental work of getting the valuable metals out of the ground and ready for the next stage.

The company actively operates and manages several mines, including the Black Fox Complex, Gold Bar, and San José. These locations are where the actual mining and initial processing take place, forming the backbone of their production capabilities. Each mine has its unique geological characteristics and operational requirements, which the company must skillfully manage.

A significant ongoing effort is placed on making these mining operations as efficient and cost-effective as possible. This means constantly looking for ways to improve productivity, reduce waste, and control expenses throughout the extraction and processing chain. For instance, in 2023, McEwen Mining reported total gold equivalent production of 147,094 ounces, with a focus on optimizing operational throughput and recovery rates at their active sites.

Sales and Marketing of Precious Metals

McEwen Mining’s sales and marketing of precious metals are core to its revenue generation. The company primarily sells gold and silver, often as doré or concentrate, to specialized refiners and other participants in the global precious metals market. This involves careful management of sales agreements, ensuring efficient logistics for metal delivery, and continuous monitoring of fluctuating international metal prices to secure the best possible returns.

The company's financial performance is directly influenced by the quantity of gold and silver it successfully sells and the prevailing market prices for these commodities. For instance, in the first quarter of 2024, McEwen Mining reported selling approximately 7,500 gold equivalent ounces (GEOs), a figure that directly reflects the volume aspect of this key activity.

- Primary Sales Channels: Doré bars and concentrate sold to refiners and industrial buyers.

- Revenue Drivers: Sales volume of gold and silver, and prevailing market prices.

- Key Operational Focus: Contract management, logistics, and price monitoring.

- 2024 Performance Indicator: Q1 2024 sales of approximately 7,500 gold equivalent ounces (GEOs).

Environmental, Social, and Governance (ESG) Management

McEwen Mining's key activities include robust Environmental, Social, and Governance (ESG) management. This involves implementing and adhering to strong practices, such as responsible waste management and water recycling, to minimize environmental impact. Ensuring safe working conditions for all employees is also a core focus, reflecting a commitment to social responsibility.

The company actively tracks sustainability-related risks and strives for continuous improvement in its ESG performance. This proactive approach demonstrates a dedication to responsible mining operations. For example, as of early 2024, McEwen Mining reported a reduction in reportable incidents, underscoring their focus on safety.

- Responsible Waste Management: Implementing advanced techniques to handle mining byproducts safely and efficiently.

- Water Recycling Initiatives: Focusing on reducing water consumption through recycling and reuse programs, a critical aspect for mining operations in arid regions.

- Workplace Safety Programs: Prioritizing the health and well-being of employees through comprehensive safety protocols and training.

- ESG Risk Monitoring: Continuously assessing and mitigating environmental, social, and governance risks across all operations.

McEwen Mining's key activities encompass the entire lifecycle of mineral extraction, from initial exploration and resource definition to the actual mining and processing of precious metals. This includes extensive drilling programs, geological studies to delineate ore bodies, and the development of underground infrastructure like ramps at projects such as Grey Fox and Stock mine. The company focuses on operational efficiency, aiming to optimize throughput and recovery rates, as evidenced by their 2023 gold equivalent production of 147,094 ounces.

Sales and marketing of gold and silver, primarily as doré or concentrate, are crucial for revenue generation, with sales volume and market prices being key drivers. The company actively manages sales agreements and logistics, keeping a close eye on global commodity prices. For instance, in Q1 2024, McEwen Mining sold approximately 7,500 gold equivalent ounces (GEOs), directly reflecting their sales output.

Furthermore, robust Environmental, Social, and Governance (ESG) management is a core activity. This involves implementing responsible waste management, water recycling, and prioritizing workplace safety, with a focus on continuous improvement and risk mitigation. As of early 2024, the company reported a reduction in reportable incidents, highlighting their commitment to safety.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Exploration & Resource Definition | Identifying and delineating mineral deposits. | Ongoing drilling at Grey Fox project. |

| Mine Development & Operations | Extracting and processing gold and silver. | 2023 production: 147,094 GEOs. Underground ramp development at Stock mine. |

| Sales & Marketing | Selling precious metals to refiners and buyers. | Q1 2024 sales: ~7,500 GEOs. |

| ESG Management | Ensuring responsible and safe mining practices. | Reduced reportable incidents (early 2024). |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for McEwen Mining you are previewing is the exact document you will receive upon purchase. This comprehensive overview, including all key components of their strategic approach, is not a sample but a direct representation of the final deliverable. You'll gain full access to this same, detailed analysis, ready for your immediate use and understanding of McEwen Mining's operational framework.

Resources

McEwen Mining's most crucial asset is its extensive collection of gold and silver mineral reserves and resources. These valuable deposits are spread across its mining sites in Canada, the United States, and Argentina, forming the core of the company's operations and future expansion plans.

The company's financial health and long-term viability are directly linked to the sheer volume and grade of these mineral reserves. For instance, as of December 31, 2023, McEwen Mining reported Proven and Probable Mineral Reserves of 1.1 million gold equivalent ounces (GEO), with Measured and Indicated Mineral Resources of 1.3 million GEO and Inferred Mineral Resources of 0.9 million GEO.

These geological assets are the bedrock upon which all mining activities and strategic growth are built. The successful extraction and sale of these minerals are what drive revenue and profitability for McEwen Mining.

The ongoing exploration and development efforts are vital for replenishing and expanding these reserves, ensuring the continued operation and potential for increased value for shareholders.

McEwen Mining's business model relies heavily on its mining infrastructure and equipment, encompassing everything from the heavy machinery that extracts ore to the sophisticated processing mills that refine it. This includes their significant investment in fleets for hauling and drilling, as well as critical processing facilities like the Stock Mill.

The company is actively upgrading and expanding these assets. For instance, the construction of a new vertical mill at their San José operation is a key development, designed to boost processing capacity and improve overall operational efficiency, which is crucial for cost-effective production.

In 2024, McEwen Mining continued to focus on optimizing its existing infrastructure. Investments in maintaining and upgrading their mining fleets are essential to ensure reliable operations and minimize downtime. Efficient power and water systems are also fundamental to the sustainability and cost-effectiveness of their mining activities.

These physical assets are not just operational necessities; they represent substantial capital investments that directly impact the company's ability to extract and process valuable minerals. The strategic development of new or enhanced facilities, like the San José mill, is a testament to their commitment to leveraging infrastructure for competitive advantage.

McEwen Mining relies heavily on its highly skilled workforce, comprising geologists, engineers, mine operators, and processing technicians. These professionals are vital for the efficient exploration, development, and ongoing operation of its mining assets, ensuring optimal extraction and processing of valuable minerals.

Experienced management provides the crucial strategic direction and operational oversight necessary to navigate the inherently complex and volatile mining industry. Their expertise is key to making sound decisions regarding resource allocation, risk management, and long-term growth strategies for the company.

In 2023, McEwen Mining reported a total workforce of approximately 320 employees and contractors, highlighting the significant human capital investment required for its operations. The company's management team includes seasoned professionals with decades of experience in mining, geology, and finance.

Capital and Financial Strength

McEwen Mining’s ability to access capital is a cornerstone of its business model, enabling everything from initial exploration to maintaining existing operations. This access is crucial for funding growth initiatives and navigating the capital-intensive nature of the mining industry.

The company has actively utilized various financing avenues to bolster its financial strength. For instance, in 2024, McEwen Mining completed several strategic financial transactions to support its development pipeline.

- Access to Capital: McEwen Mining relies on equity, debt, and operational cash flow to fund exploration, project development, and ongoing operations.

- 2024 Financing Activities: Recent convertible note issuances and flow-through financings in 2024 demonstrate the company's proactive approach to securing capital for growth.

- Financial Flexibility: These financing strategies provide the necessary liquidity to advance key projects and maintain operational momentum.

- Investor Confidence: Successful capital raises are indicative of investor confidence in the company's strategic direction and asset portfolio.

Permits, Licenses, and Intellectual Property

McEwen Mining’s ability to operate hinges on securing essential legal and regulatory permissions. This includes comprehensive environmental impact assessments and the specific mining permits required for each jurisdiction where it operates. For instance, in 2024, the company continued to navigate the permitting processes for its key projects. These governmental approvals are not just procedural; they are the bedrock that allows McEwen Mining to legally access and begin the exploitation of its valuable mineral assets.

Beyond operational permits, McEwen Mining also leverages intellectual property as a key resource. This often encompasses proprietary mining techniques or unique geological data painstakingly gathered from extensive exploration activities. Such intellectual property provides a competitive edge, potentially leading to more efficient extraction methods or the identification of previously uneconomical ore bodies. This strategic asset underpins the company's capacity to unlock the full value of its mineral reserves.

- Environmental Impact Assessments: Crucial for obtaining permits and ensuring responsible mining practices.

- Mining Permits: Legally authorize the extraction of minerals in specific locations.

- Proprietary Mining Techniques: Offer efficiency and cost advantages in extraction.

- Geological Data: Insights from exploration enhance resource identification and valuation.

McEwen Mining’s key resources are its substantial mineral reserves, robust mining infrastructure, a skilled workforce, and access to capital. These elements are fundamental to its operations and strategic growth.

The company's mineral reserves, particularly gold and silver, are its primary asset, with 1.1 million gold equivalent ounces (GEO) in Proven and Probable Reserves as of December 31, 2023. Its infrastructure includes processing facilities like the Stock Mill, with ongoing upgrades such as the new vertical mill at San José enhancing efficiency.

A workforce of approximately 320 employees and contractors in 2023, coupled with experienced management, ensures operational expertise. Furthermore, McEwen Mining actively secures capital through various financing activities, including 2024 convertible note issuances, to fund development and operations.

Securing necessary permits and leveraging proprietary mining techniques and geological data are also critical resources, enabling legal operations and providing a competitive advantage.

| Key Resource | Description | As of December 31, 2023 / 2024 Data |

|---|---|---|

| Mineral Reserves | Gold and Silver deposits | 1.1 million GEO (Proven & Probable Reserves) |

| Infrastructure | Processing facilities, mining equipment | Ongoing upgrades at San José (vertical mill) |

| Human Capital | Skilled workforce, experienced management | Approx. 320 employees and contractors (2023) |

| Access to Capital | Equity, debt, operational cash flow | 2024 convertible note issuances, flow-through financings |

| Licenses & IP | Mining permits, proprietary techniques | Continued navigation of permitting processes (2024) |

Value Propositions

McEwen Mining is committed to the consistent output of gold and silver from its active mining sites, ensuring a dependable flow of these precious metals into the global market. This reliability is a cornerstone of their market presence and revenue streams, offering customers a stable supply.

For 2024, the company has been working towards its production targets, demonstrating a focus on meeting operational goals. For instance, their Los Azules project, while in development, represents a significant future source of copper and gold, underscoring their long-term production strategy.

McEwen Mining provides investors with substantial leverage to potential increases in gold, silver, and copper prices. Its portfolio, notably including the large-scale Los Azules copper project, is structured to capitalize on upward movements in these key commodity markets. The company’s revenue and profitability are directly correlated with the fluctuating prices of these metals, meaning a rise in metal prices can significantly boost shareholder value.

For example, a sustained 10% increase in gold prices could have a disproportionately positive impact on McEwen Mining's earnings, given its significant gold reserves. Similarly, advancements and eventual production at Los Azules are anticipated to amplify the company's exposure to copper price appreciation. In 2024, the company's strategic focus remains on advancing these key assets, directly linking its operational progress to commodity market trends.

McEwen Mining's growth potential is anchored in its development and exploration pipeline. The company is actively advancing the Stock mine at its Fox Complex, a key project expected to bolster future production. This strategic development, alongside advanced exploration at Grey Fox and Windfall, aims to significantly extend mine life and increase overall output.

These initiatives are designed to unlock new economic potential and create long-term value for shareholders. For instance, exploration at Windfall is a significant focus, with ongoing efforts to define and expand the resource base. The company's commitment to reinvesting in exploration underscores its strategy to discover and develop new mineral assets.

As of early 2024, McEwen Mining continues to prioritize these growth drivers. The company's capital allocation reflects a clear strategy to advance its development projects and expand its exploration footprint, positioning it for sustained growth in the coming years.

Responsible and Sustainable Mining Practices

McEwen Mining prioritizes responsible and sustainable mining practices, demonstrating a strong commitment to environmental stewardship and social performance across its operations. This focus is a key value proposition for investors and stakeholders who increasingly value Environmental, Social, and Governance (ESG) factors.

The company actively showcases its dedication through transparent reporting, including publishing detailed sustainability reports. These reports highlight tangible achievements, such as maintaining zero significant environmental incidents at its wholly-owned operations and achieving high water recycling rates. For example, in 2023, their operations achieved impressive water recycling metrics, underscoring their commitment to resource efficiency.

- Environmental Stewardship: McEwen Mining aims for minimal environmental impact, evidenced by a commitment to zero significant environmental incidents at its 100%-owned properties.

- Social Performance: The company emphasizes positive social contributions and community engagement as part of its operational philosophy.

- Water Recycling: High water recycling rates are a testament to their efficient resource management, a critical aspect of sustainable mining.

- ESG Appeal: This responsible approach directly appeals to a growing segment of investors and stakeholders who prioritize ESG criteria in their investment decisions.

Experienced Leadership and Aligned Ownership

McEwen Mining's leadership team, notably Chairman and Chief Owner Rob McEwen, brings extensive industry experience. His substantial ownership stake, coupled with a symbolic $1 annual salary, underscores a powerful alignment of personal and shareholder interests.

This significant insider ownership directly links management's financial success to the company's performance, cultivating trust and encouraging robust strategic planning.

- Deep Industry Expertise: Rob McEwen's decades of experience in mining operations and investment are a core asset.

- Strong Insider Ownership: As the largest shareholder, McEwen's personal wealth is directly tied to McEwen Mining's success.

- Aligned Incentives: The $1 annual salary highlights a focus on long-term value creation rather than short-term executive compensation.

McEwen Mining's value proposition centers on its ability to deliver consistent gold and silver production from established mines. This reliability provides a stable revenue base, while its development pipeline, including the Los Azules copper project, offers significant leverage to rising metal prices. The company's strategic focus on advancing these assets and exploration efforts positions it for substantial future growth and increased shareholder value.

Customer Relationships

McEwen Mining actively engages its investor base through a robust investor relations program. This includes the consistent release of quarterly and annual financial reports, participation in earnings calls, and delivery of corporate presentations, ensuring shareholders and the broader financial community are kept abreast of the company's operational and financial status.

Transparency is a cornerstone of McEwen Mining's approach, fostering trust and enabling informed decision-making for investors. For instance, in the first quarter of 2024, the company reported a net loss of $12.9 million, a figure readily available and discussed with stakeholders, illustrating their commitment to open communication regarding performance metrics.

McEwen Mining actively cultivates strong ties with communities surrounding its mining sites. They prioritize open communication and proactively address social and environmental considerations, which is crucial for securing and maintaining their social license to operate.

These relationships are strengthened through various engagement initiatives. For instance, fostering local employment opportunities directly benefits the community, demonstrating a commitment beyond just resource extraction. In 2024, the company continued to focus on these local economic contributions.

Furthermore, community development programs play a significant role. These might include investments in local infrastructure, education, or healthcare, directly improving the quality of life for residents. This approach ensures that mining operations are seen as a positive force within the local context.

McEwen Mining cultivates essential business-to-business relationships with metal refineries and prominent bullion dealers. These partnerships are fundamentally transactional, serving as the direct sales channel for the company's gold and silver doré and concentrates. This focus on efficient sales and seamless logistics is paramount for revenue generation.

The company's financial performance is directly tied to the successful execution of these buyer relationships. For instance, in the first quarter of 2024, McEwen Mining reported total revenues of $27.6 million, largely driven by the sale of its metal output through these established channels.

Employee Relations and Talent Development

McEwen Mining prioritizes cultivating strong employee relations by implementing fair labor practices and offering competitive compensation packages. This approach is designed to attract and retain a skilled workforce, which is fundamental to achieving operational excellence in the demanding mining sector.

Investing in professional development and providing opportunities for career advancement are key components of McEwen Mining's talent management strategy. A highly motivated and well-trained workforce directly translates into increased productivity and operational efficiency.

- Employee Engagement: McEwen Mining focuses on creating a positive work environment to foster loyalty and commitment among its staff.

- Skill Development: The company provides training programs aimed at enhancing the technical and soft skills of its employees, ensuring a capable team.

- Performance Incentives: Competitive remuneration and performance-based incentives are utilized to motivate employees and drive high output.

Government and Regulatory Dialogue

McEwen Mining actively engages in ongoing dialogue and collaboration with government agencies and regulatory bodies. This is crucial for navigating complex permitting processes and ensuring strict compliance with all applicable laws and regulations.

These relationships are absolutely critical for McEwen Mining to secure the necessary approvals for both its ongoing operations and the development of new projects.

- Permitting Efficiency: Building strong relationships can streamline the often lengthy permitting process, potentially reducing project timelines.

- Regulatory Compliance: Proactive dialogue ensures the company stays ahead of evolving regulations, minimizing the risk of non-compliance penalties.

- Social License to Operate: Collaboration fosters trust and transparency with governmental stakeholders, reinforcing the company's social license to operate.

- Policy Influence: Engaging with regulators allows for input on policy development that could impact the mining sector.

McEwen Mining's customer relationships are primarily with metal refineries and bullion dealers, forming the critical sales channels for its gold and silver output. These B2B interactions are transactional, focusing on efficient sales and logistics to generate revenue.

The company's financial results directly reflect the strength of these buyer relationships. For instance, in Q1 2024, McEwen Mining reported revenues of $27.6 million, underscoring the importance of these established sales channels.

In addition to these core sales relationships, McEwen Mining places significant emphasis on building trust and maintaining open communication with its investor base and the communities surrounding its operations. This multifaceted approach to stakeholder engagement is vital for sustained success and social license to operate.

| Relationship Type | Key Focus | 2024 Relevance |

|---|---|---|

| Metal Refineries & Bullion Dealers | Sales channels for gold & silver; Transactional efficiency | Drove $27.6M revenue in Q1 2024 |

| Investors | Transparency; Financial reporting; Earnings calls | Ongoing communication on operational and financial status |

| Local Communities | Social license; Local employment; Community development | Continued focus on local economic contributions |

Channels

McEwen Mining's primary revenue stream flows from the direct sale of its gold and silver. These metals, typically in the form of doré bars or concentrates, are sold directly to reputable metal refineries and established bullion dealers.

This direct sales approach is crucial for efficiently converting the company's mined output into cash. For example, in the first quarter of 2024, McEwen Mining reported total gold sales of 10,338 ounces and silver sales of 376,915 ounces.

McEwen Mining's official website and dedicated investor relations portal are crucial touchpoints for engaging with stakeholders. These platforms provide a direct conduit for sharing vital corporate updates, including recent financial reports, investor presentations, and comprehensive sustainability initiatives, ensuring transparency and accessibility for a global audience.

These digital channels offer a centralized repository for up-to-date company data, empowering investors with the information needed for informed decision-making. As of the first quarter of 2024, the company reported total assets of approximately $345 million, with cash and cash equivalents around $40 million, underscoring the importance of these platforms for tracking financial performance.

McEwen Mining leverages financial news outlets and industry publications as a critical channel for disseminating information. This includes distributing press releases, earnings announcements, and corporate updates through financial news wires. For example, in 2024, the company continued to utilize these channels to communicate its operational progress and financial performance.

These publications are essential for reaching a broad audience. This includes individual and institutional investors, financial analysts, and other industry professionals. This wide dissemination ensures that key stakeholders are kept informed about McEwen Mining's activities and strategic direction.

By publishing in industry-specific media, McEwen Mining enhances its visibility within the mining sector. This targeted approach helps to build credibility and attract the attention of those most interested in the company's operations and investment potential.

Investor Conferences and Presentations

McEwen Mining actively participates in key investor conferences and industry summits to engage directly with stakeholders. These forums are crucial for sharing the company's strategic vision, providing detailed updates on ongoing projects, and addressing inquiries from investors, analysts, and financial advisors. For instance, in 2024, the company presented at notable events like the BMO Global Mining Conference, offering insights into their progress and future plans.

These presentations serve as a vital channel for transparency and building confidence in McEwen Mining's operations. Management uses these platforms to articulate their approach to exploration, development, and operational efficiency. The company's ability to clearly communicate its value proposition at these events directly influences investor perception and potential capital allocation.

The impact of these engagements is significant, facilitating direct dialogue and feedback. McEwen Mining leverages these opportunities to:

- Showcase strategic advancements and project milestones.

- Facilitate direct Q&A sessions with management.

- Network with potential investors and industry partners.

- Enhance market visibility and investor relations.

Regulatory Filings (SEC, TSX)

McEwen Mining's regulatory filings, such as those submitted to the U.S. Securities and Exchange Commission (SEC) and Canada's Toronto Stock Exchange (TSX), are crucial channels for transparency and compliance. These mandatory submissions, including annual 10-K reports and quarterly 10-Q reports, offer detailed financial statements, operational updates, and risk disclosures. For instance, in their 2023 10-K filing, McEwen Mining reported total revenues of $223.8 million and a net loss of $18.2 million, providing a clear financial snapshot. These documents are essential for investors and analysts to assess the company's performance and strategic direction.

These filings serve as a primary source of reliable data for a diverse audience, from individual investors to financial professionals and academic researchers. They ensure that all stakeholders have access to consistent and audited information, which is vital for making informed decisions. The level of detail provided allows for thorough valuation analyses, including Discounted Cash Flow (DCF) models, by offering insights into production costs, capital expenditures, and reserve estimates.

- SEC Filings: Provide comprehensive financial data, management discussions, and risk factors, supporting in-depth analysis.

- TSX Filings: Offer Canadian regulatory compliance and company-specific operational and financial updates.

- Transparency: These channels ensure adherence to disclosure requirements, fostering trust and informed decision-making.

- Data Accessibility: Publicly available filings empower stakeholders with the necessary information for strategic planning and investment evaluation.

McEwen Mining utilizes a multi-faceted approach to reach its customers and stakeholders. Direct sales of gold and silver to refineries and bullion dealers form the core transaction channel. Complementing this are robust digital platforms, including the company's website and investor relations portal, which serve as primary information hubs.

Furthermore, the company actively engages with the financial community through press releases distributed via financial news outlets and participation in industry conferences. Regulatory filings with bodies like the SEC and TSX are also critical for transparency and providing detailed financial and operational data, ensuring broad accessibility for analysis.

These channels collectively facilitate the sale of mined resources and the dissemination of crucial corporate information, enabling informed decision-making by investors and stakeholders.

| Channel Type | Key Activities | 2024 Data/Examples |

|---|---|---|

| Direct Sales | Selling gold and silver to refineries and bullion dealers. | Q1 2024: 10,338 oz gold sales, 376,915 oz silver sales. |

| Digital Platforms | Company website, investor relations portal for updates and reports. | Q1 2024 Total Assets: ~$345 million; Cash: ~$40 million. |

| Financial Media & News Wires | Press releases, earnings announcements, corporate updates. | Continued use in 2024 for operational and financial performance communication. |

| Investor Conferences | Presentations, networking with investors and analysts. | Participation in events like the BMO Global Mining Conference in 2024. |

| Regulatory Filings | SEC (10-K, 10-Q) and TSX filings for financial and operational transparency. | 2023 10-K: Revenue $223.8 million, Net Loss $18.2 million. |

Customer Segments

Institutional and individual investors represent a cornerstone customer segment for McEwen Mining. This diverse group, ranging from large pension funds and mutual funds to individual retail investors, seeks opportunities for capital appreciation and direct exposure to the precious metals market. They are driven by the potential for growth in McEwen Mining's stock, which is directly tied to the company's exploration success, production levels, and market conditions for gold and silver.

These investors rely heavily on readily accessible financial data and strategic insights to inform their decisions. They analyze company reports, production guidance, and exploration results, often utilizing valuation tools like discounted cash flow (DCF) analysis to assess the intrinsic value of McEwen Mining. For example, in early 2024, investors closely monitored the company's progress at its Los Azules copper-gold project in Argentina, a key driver of future valuation.

Metal refineries and industrial buyers represent a core customer segment for McEwen Mining. These entities directly purchase the company's refined gold and silver. Their primary interest lies in securing a reliable supply of high-quality precious metals for their manufacturing processes, investment portfolios, or the creation of jewelry and other products.

For instance, in 2023, the global gold jewelry demand reached approximately 2,086 tonnes, indicating a significant market for refined gold. Similarly, industrial applications for silver, such as in electronics and solar panels, continue to grow, with global silver demand for industrial uses tracking around 500 million ounces annually in recent years.

McEwen Mining's ability to meet these customers' needs hinges on consistent production volumes and adherence to stringent quality standards. Buyers in this segment often engage in long-term supply agreements, prioritizing predictability and the assurance of metal purity to ensure the integrity of their own end products.

McEwen Mining's employees and contractors are a crucial internal customer segment, directly impacting operational efficiency and safety. The company prioritizes providing stable employment, aiming for secure and consistent work for its mining personnel.

Ensuring safe working conditions is paramount, with the company investing in training and equipment to minimize risks in the demanding mining environment. In 2023, McEwen Mining reported a total workforce of approximately 800 individuals across its various operations.

Opportunities for professional growth and development are offered to foster employee engagement and skill enhancement, recognizing that a skilled and motivated workforce is essential for long-term success. This focus on human capital directly contributes to the company's ability to execute its exploration and production plans effectively.

Local Communities and Indigenous Populations

Local communities and Indigenous populations are vital partners for McEwen Mining, directly experiencing the impacts and benefits of operations. Their cooperation is crucial for maintaining a social license to operate, enabling continued exploration and production. For example, in 2024, the company continued to focus on building strong relationships through employment and local purchasing.

These groups are not just recipients of company activities but active participants in the success of mining projects. McEwen Mining's commitment extends to fostering economic opportunities and supporting community development programs, recognizing the long-term sustainability of these relationships.

- Employment: McEwen Mining provides direct employment opportunities to members of surrounding communities.

- Local Procurement: The company prioritizes sourcing goods and services from local suppliers and businesses.

- Community Investment: Initiatives often include infrastructure improvements, education, and health programs tailored to community needs.

- Stakeholder Engagement: Regular dialogue and consultation with community leaders and members are fundamental to operations.

Government Entities and Regulatory Bodies

Government entities and regulatory bodies are crucial stakeholders for McEwen Mining, acting as essential gatekeepers and partners. These organizations, at federal, provincial, and local levels, dictate the operational landscape through the issuance of permits and licenses required for exploration and production activities. For instance, in 2024, securing and maintaining exploration permits in jurisdictions like Nevada or Argentina involves adherence to stringent environmental impact assessments and community consultation protocols.

Compliance with tax regulations and payment of royalties are fundamental obligations, contributing to national and regional economic development. McEwen Mining's financial reporting in 2024 would reflect these fiscal contributions. Furthermore, these bodies enforce environmental, health, and safety standards, ensuring responsible mining practices. Meeting these requirements is not just a legal necessity but also vital for maintaining social license to operate and avoiding potential operational disruptions.

- Permitting and Licensing: Essential for legal operation, requiring adherence to environmental and social impact assessments.

- Taxation and Royalties: Direct financial contributions to government revenue streams, impacting national and regional economies.

- Regulatory Compliance: Adherence to environmental, health, and safety standards to ensure responsible mining practices.

- Economic Contribution: Governments benefit from job creation, infrastructure development, and resource utilization driven by mining activities.

McEwen Mining serves institutional and individual investors seeking exposure to precious metals, who analyze financial data and company progress, such as developments at the Los Azules project in early 2024. Metal refineries and industrial buyers are key customers, prioritizing reliable supply of refined gold and silver, with global gold jewelry demand around 2,086 tonnes in 2023 and significant industrial silver demand.

Cost Structure

Mining operations costs are the backbone of production for companies like McEwen Mining. These are the direct expenses tied to getting valuable minerals out of the ground and ready for sale. Think about the people doing the hard work – the miners underground and the operators in the processing plants – their wages are a major component. In 2024, labor costs remain a significant driver across the mining sector, influenced by demand for skilled workers and regional wage trends.

Energy consumption is another massive piece of this cost puzzle. Extracting ore and then crushing and chemically treating it to separate the metals requires a lot of electricity and fuel. For instance, the price of diesel, a common fuel source for heavy machinery, directly impacts operational expenses. The global energy markets in 2024 continue to present volatility, making energy efficiency a critical focus for cost management.

Beyond labor and energy, there are the essential consumables that get used up in the process. This includes chemical reagents needed for processes like leaching, explosives to break up rock, and grinding media like steel balls or rods that pulverize the ore. These materials are vital for efficient extraction and processing, and their prices can fluctuate based on global supply and demand dynamics, impacting overall mining costs in 2024.

McEwen Mining's cost structure heavily relies on exploration and development expenses, representing significant capital outlays. These costs encompass geological surveys, extensive drilling campaigns to identify and delineate ore bodies, and the construction of essential mine infrastructure like ramps and underground accessways. For instance, in the first quarter of 2024, the company reported exploration and development expenditures of $3.5 million, underscoring the ongoing investment in future production capacity.

McEwen Mining's capital expenditures represent significant investments in the future of their operations. In 2024, a substantial portion of this CapEx is allocated to acquiring and upgrading heavy mining machinery, essential for efficient resource extraction. For instance, the company continues to invest in new haul trucks and excavators to support its growing production targets.

Expansion and modernization of processing facilities are also key components of their CapEx strategy. This includes ongoing upgrades to the mill at the San José mine, aiming to boost recovery rates and processing throughput. These improvements are critical for maximizing the value derived from extracted ore.

Furthermore, McEwen Mining dedicates capital to mine development projects, which are crucial for extending the operational life of their assets and unlocking new mineral reserves. These long-term investments are designed to ensure sustained production and profitability for years to come.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs for McEwen Mining include essential overhead not directly linked to the mining process itself. These are the expenses that keep the company running smoothly behind the scenes.

This category covers a range of operational expenditures such as executive compensation, salaries for administrative personnel, costs associated with office spaces, and crucial expenses for legal counsel and ensuring regulatory compliance. Efficient management of these G&A elements is vital for maintaining and enhancing the company's overall profitability and financial health.

For context, in their 2024 financial reporting, McEwen Mining's G&A expenses are a key component of their operational budget. For example, during the first quarter of 2024, the company reported specific figures for these overheads, highlighting the ongoing investment in corporate infrastructure and compliance necessary to operate within the mining sector.

- Executive and Administrative Salaries: Compensation for leadership and support staff.

- Office Expenses: Costs related to maintaining corporate offices and facilities.

- Legal and Professional Fees: Expenditures for legal services, accounting, and other professional support.

- Regulatory Compliance: Costs incurred to meet governmental and industry regulations.

Environmental and Social Compliance Costs

McEwen Mining incurs significant costs to meet environmental standards and foster positive community relations. These expenses are crucial for maintaining their social license to operate and ensuring long-term sustainability. In 2024, environmental compliance costs included ongoing monitoring of air and water quality, waste management, and the implementation of best practices for minimizing ecological impact at their operations, such as the El Gallo project.

Beyond regulatory adherence, the company invests in proactive sustainability initiatives. This encompasses expenditures related to rehabilitation of mined areas, aiming to restore landscapes post-extraction, and investing in energy efficiency to reduce their carbon footprint. These efforts are not just about compliance but also about responsible stewardship of the environment.

Community engagement is another vital component of their cost structure. McEwen Mining allocates resources to development programs in the areas surrounding their mines, contributing to local infrastructure, education, and healthcare. For instance, at their San José mine in Argentina, community support programs are a significant outlay, fostering trust and mutual benefit. These outlays are essential for smooth operations and positive stakeholder relationships.

- Environmental Monitoring: Costs for continuous testing of water, air, and soil quality to ensure compliance with regulatory limits.

- Rehabilitation and Reclamation: Funds set aside for the restoration of land disturbed by mining activities, often a significant long-term expense.

- Community Development Programs: Investments in local infrastructure, social services, and economic opportunities for communities near mining sites.

- Sustainability Initiatives: Expenditures on renewable energy adoption, water conservation projects, and biodiversity protection efforts.

McEwen Mining's cost structure is dominated by direct operational expenses like labor and energy, alongside significant investments in exploration and capital expenditures. The company also manages general administrative costs and dedicates resources to environmental stewardship and community engagement. These varied expenses are critical for sustaining current operations and ensuring future growth.

Revenue Streams

McEwen Mining's core revenue generation is through the sale of gold, sourced from its wholly-owned properties, including the Black Fox Complex and the Gold Bar mine, as well as its share of production from the San José mine. This revenue is directly tied to how much gold is extracted and the fluctuating global gold market prices. For instance, in the first quarter of 2024, the company reported that gold sales contributed a significant portion of its overall revenue, demonstrating the critical role of this commodity.

Silver sales represent a crucial revenue stream for McEwen Mining, especially stemming from their San José mine in Argentina, where it's extracted alongside gold. This co-production model means silver's contribution to overall revenue is directly tied to both the volume of silver produced and the prevailing market price for the metal. For instance, in 2023, the San José mine produced approximately 3.2 million ounces of silver, contributing significantly to the company's financial performance.

McEwen Mining generates revenue through its equity stake in joint ventures, notably its 49% ownership of Minera Santa Cruz S.A., which operates the San José mine. This means the company books its share of the net income or loss generated by this venture, contributing to its overall financial picture rather than through direct sales of its own products.

For the first quarter of 2024, McEwen Mining reported equity earnings from its investment in Minera Santa Cruz S.A. as $0.9 million. This figure directly reflects the profitability of the San José mine and McEwen's proportional share in that success.

Royalties and Other Interests

McEwen Mining's revenue streams are enhanced by a portfolio of royalties, offering a diversified approach to income generation. A key example is the 1.25% Net Smelter Royalty (NSR) on McEwen Copper's Los Azules property. As this significant copper project progresses through development and into production, this royalty represents a substantial potential future revenue stream for McEwen Mining. This diversification mitigates risk by not solely relying on the company's direct mining operations.

This royalty structure provides McEwen Mining with exposure to the success of other mining ventures without direct operational involvement or capital expenditure. The Los Azules project, in particular, is a significant asset within the copper sector, and its advancement directly translates to potential upside for McEwen Mining through its NSR. This is a crucial element in their broader business model, ensuring multiple avenues for financial return.

- Diversified Income: Royalties provide a stream of income independent of direct operational output.

- Los Azules NSR: A 1.25% NSR on McEwen Copper's Los Azules project offers significant future revenue potential.

- Reduced Operational Risk: Royalty income is generated without the direct capital and operational burdens of mining.

- Strategic Asset Exposure: Allows participation in the success of high-potential projects like Los Azules.

Asset Sales and Financing Activities

While not the primary source of income, McEwen Mining can generate capital through selling off assets that are no longer central to their strategy or through specific financing arrangements. These financial maneuvers are crucial for injecting funds into ongoing operations or for advancing new development projects.

For instance, in 2023, McEwen Mining completed the sale of its Montana mining operations, which contributed to strengthening its financial position. These types of transactions are not routine but provide necessary liquidity.

- Asset Sales: Occasional divestiture of non-core mining properties or equipment.

- Financing Activities: Issuance of financial instruments like convertible debt or flow-through shares to raise capital.

- Capital Inflows: These activities provide significant, albeit periodic, infusions of cash.

- Purpose: Funds raised are primarily allocated to operational expenses and the advancement of growth initiatives.

McEwen Mining's revenue primarily stems from the sale of gold and silver, with significant contributions from its wholly-owned Black Fox Complex and Gold Bar mine, as well as its share of production from the San José mine. In Q1 2024, gold sales were a major revenue driver. Silver sales, particularly from the San José mine in Argentina, where approximately 3.2 million ounces were produced in 2023, also form a crucial part of their income, directly linked to market prices.

The company also generates revenue through its equity stake in joint ventures, such as its 49% ownership of Minera Santa Cruz S.A. operating the San José mine. In Q1 2024, equity earnings from this investment amounted to $0.9 million, reflecting the profitability of this partnership. Additionally, McEwen Mining benefits from a portfolio of royalties, including a 1.25% Net Smelter Royalty (NSR) on McEwen Copper's Los Azules property, providing potential future income without direct operational involvement.

| Revenue Stream | Key Assets/Sources | 2023/Q1 2024 Data Points |

|---|---|---|

| Gold Sales | Black Fox Complex, Gold Bar Mine, San José Mine (share) | Significant contributor in Q1 2024 |

| Silver Sales | San José Mine (Argentina) | 3.2 million ounces produced in 2023 |

| Equity Earnings | Minera Santa Cruz S.A. (San José mine 49% ownership) | $0.9 million equity earnings in Q1 2024 |

| Royalties | 1.25% NSR on Los Azules (McEwen Copper) | Potential future revenue stream |

Business Model Canvas Data Sources

The McEwen Mining Business Model Canvas is built upon a foundation of robust financial disclosures, detailed operational reports, and comprehensive market intelligence. These sources ensure each component, from revenue streams to cost structures, is informed by accurate and relevant industry data.