McEwen Mining Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McEwen Mining Bundle

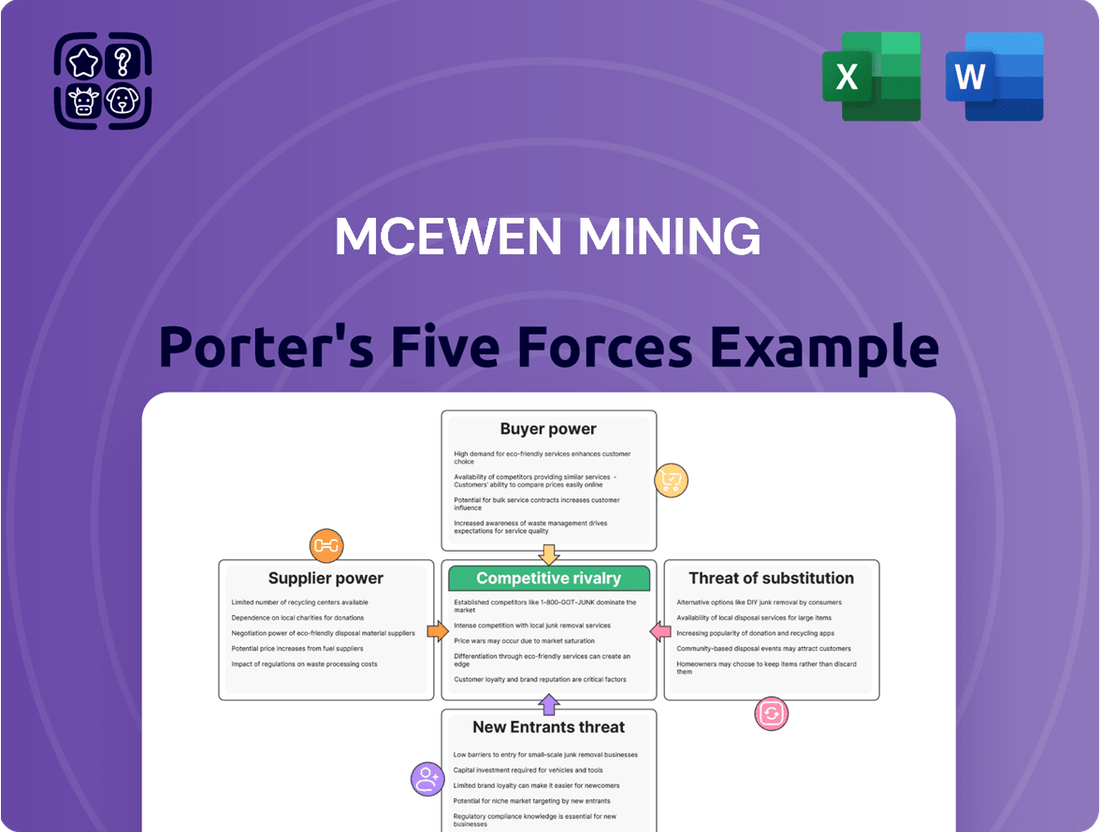

McEwen Mining operates within a dynamic industry shaped by significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of both buyers and suppliers, and the threats posed by new entrants and substitutes is crucial for strategic success.

Our analysis reveals how these forces directly impact McEwen Mining's profitability and market position. We delve into the specifics of each force, providing a clear picture of the competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore McEwen Mining’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The mining sector, including companies like McEwen Mining, is heavily dependent on a select group of global suppliers for specialized equipment, cutting-edge technology, and essential services. This limited supplier base inherently concentrates bargaining power, particularly for critical components such as advanced drilling rigs, sophisticated processing machinery, and specialized geological software.

For instance, in 2024, the market for large-scale underground mining haul trucks remained dominated by a few major manufacturers, leading to extended lead times and higher capital expenditures for mining firms. This reliance means suppliers can often dictate terms, impacting project timelines and overall operational costs for companies like McEwen Mining.

McEwen Mining must therefore cultivate strong, strategic relationships with these key suppliers. Effective negotiation and long-term partnerships are crucial for securing consistent access to necessary resources and maintaining cost competitiveness in a demanding industry.

Switching between suppliers for core mining equipment or specialized services can involve substantial costs for McEwen Mining. These costs can include retooling machinery, extensive employee training on new systems, and the inherent risk of operational disruptions during the transition. For instance, changing a primary drilling equipment supplier might necessitate significant capital investment in new rigs and the associated training for mechanics and operators, potentially delaying production schedules.

These high switching costs effectively bolster the bargaining power of existing suppliers. McEwen Mining may find it challenging to shift to alternative providers, even if more favorable pricing or terms are offered, because the upfront investment and operational risks of a change outweigh the immediate benefits. This is particularly true for critical inputs like large-scale excavators, specialized assaying equipment, or unique chemical reagents essential for mineral processing.

The uniqueness of inputs significantly impacts the bargaining power of McEwen Mining's suppliers. Proprietary geological survey technologies or highly specialized processing chemicals, for instance, can give suppliers considerable leverage. If McEwen Mining relies heavily on these unique inputs for its gold and silver operations, the suppliers of these critical components can dictate terms and pricing, potentially increasing operational costs.

Threat of Forward Integration by Suppliers

The threat of suppliers forward integrating into mining operations, while theoretically possible, remains a minimal concern for McEwen Mining. This is largely due to the immense capital requirements and the intricate regulatory landscape inherent in the mining industry, which act as substantial barriers to entry for even well-funded suppliers. For instance, establishing a new mine can easily cost hundreds of millions, if not billions, of dollars, a scale of investment typically beyond the scope of equipment or service providers.

Should a supplier, perhaps a major manufacturer of specialized mining equipment, decide to pursue forward integration, it would present a direct competitive challenge. This would mean they are not just selling equipment but actively extracting and processing ore, competing head-to-head with companies like McEwen Mining. The complexity of securing exploration rights, managing environmental impact, and navigating diverse governmental regulations makes this a highly unattractive proposition for most suppliers.

The capital intensity of mining is a critical factor. In 2024, the average capital expenditure for a new mid-tier gold mine development project often exceeds $500 million.

- High Capital Investment: Developing a new mine requires significant upfront capital, often hundreds of millions of dollars, deterring suppliers focused on equipment or services.

- Regulatory Hurdles: Navigating permits, environmental assessments, and labor laws in mining jurisdictions is complex and costly, posing a substantial barrier to entry.

- Operational Expertise: Successful mining demands specialized geological, engineering, and operational knowledge that many suppliers may not possess.

- Market Dynamics: Suppliers often thrive by serving multiple mining companies, and direct competition could alienate their existing customer base.

Labor Union Strength

The bargaining power of suppliers, specifically labor unions, can significantly impact McEwen Mining's operational costs. In regions where McEwen operates, strong labor unions can negotiate for higher wages, improved benefits, and more stringent working conditions for skilled mining personnel. For instance, in 2024, the average hourly wage for mining machine operators in certain key mining jurisdictions saw an upward trend, partly due to union influence.

This supplier power translates directly into increased labor expenses for McEwen Mining. Unionized workforces often have collective bargaining agreements that set wage scales and benefit packages, limiting the company's flexibility in managing labor costs. When unions are well-organized and represent a substantial portion of the workforce, their ability to withhold labor through strikes can compel companies to meet their demands.

- Unionized Labor Costs: In 2024, reports indicated that unionized mining operations in North America experienced labor cost increases of approximately 3-5% year-over-year, driven by new contract negotiations and cost-of-living adjustments.

- Skilled Labor Shortages: Certain specialized mining roles, such as experienced geologists or specialized equipment technicians, face a tighter labor market, further amplifying the bargaining power of skilled workers, whether unionized or not.

- Impact on Profitability: Higher labor costs directly reduce a mining company's profit margins, especially in a sector with volatile commodity prices. McEwen Mining, like its peers, must factor these potential cost increases into its financial planning and project viability assessments.

McEwen Mining faces significant supplier bargaining power due to the concentrated nature of specialized equipment and technology providers. In 2024, the limited number of manufacturers for essential mining machinery, like large haul trucks, meant higher prices and longer delivery times. This reliance allows these suppliers to dictate terms, impacting McEwen Mining's project timelines and operational budgets.

High switching costs for critical inputs, such as specialized assaying equipment or proprietary processing chemicals, further strengthen supplier leverage. The substantial investment in retraining, retooling, and potential production disruptions discourages McEwen Mining from changing providers, even for better pricing. This situation is particularly acute for unique technologies crucial to gold and silver extraction.

While suppliers are unlikely to forward integrate into mining due to the extreme capital and regulatory barriers, labor unions present a notable source of supplier power. In 2024, strong unions in key mining regions pushed for higher wages and benefits, increasing labor costs for companies like McEwen Mining by an estimated 3-5% in unionized operations. Skilled labor shortages also amplify the bargaining power of individual workers.

What is included in the product

This Porter's Five Forces analysis provides a strategic overview of McEwen Mining's competitive environment, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the mining industry.

McEwen Mining's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making and identifying key competitive pressures.

Customers Bargaining Power

The end customers for gold and silver are incredibly diverse, spanning individual investors, jewelry manufacturers, industrial applications, and even central banks. This wide distribution means no single buyer holds significant sway over the prices McEwen Mining can command for its precious metals. For instance, in 2024, the global jewelry sector, a major consumer of gold, continued to show varied demand across different regions, preventing any one segment from dictating terms.

The commodity nature of gold and silver significantly amplifies the bargaining power of customers for McEwen Mining. Because these precious metals are largely undifferentiated, buyers can easily switch between suppliers based on price alone, making them highly price-sensitive. This interchangeability means that McEwen Mining faces intense competition, as its products are essentially the same as those offered by numerous other mining companies globally.

In 2024, the global gold market, valued in the trillions, exemplifies this commodity dynamic. With many producers, a single mine’s output has little impact on overall market price, forcing McEwen Mining to accept prevailing market rates. This lack of product uniqueness erodes customer loyalty, as purchasing decisions are driven by cost rather than brand or specific product features.

McEwen Mining, like most gold and silver producers, acts as a price taker in the global commodities market. This means the company has very little control over the prices it receives for its products. The world price of gold and silver is influenced by a vast array of factors, including international supply and demand, currency fluctuations, geopolitical events, and investor sentiment, none of which a single mining company can significantly alter.

Consequently, customers, which are essentially the global buyers of gold and silver, possess substantial bargaining power over price. This collective power stems from the sheer volume of buyers and the standardized nature of the commodity. For instance, in 2023, the average price of gold hovered around $1,979 per ounce, and silver averaged about $23.70 per ounce. These figures are set by global markets, not by individual producers like McEwen Mining, highlighting the limited pricing leverage the company has.

Customer Sensitivity to Price

Customer sensitivity to the price of gold and silver can significantly impact McEwen Mining. For example, in 2023, while gold prices showed resilience, reaching averages around $1,970 per ounce, elevated prices can still deter some consumers, particularly in the jewelry market. This can lead to reduced sales volumes for jewelry manufacturers, indirectly affecting the demand McEwen Mining faces.

This price sensitivity creates a bargaining power for customers. When prices for precious metals rise substantially, consumers may postpone purchases or seek less expensive alternatives. This dynamic can force mining companies to consider pricing strategies that balance profitability with maintaining market share.

- Gold Price Impact: Historically, significant increases in gold prices have led to a noticeable slowdown in consumer demand for gold jewelry.

- Demand Elasticity: The demand for gold and silver, especially from end-consumers, can be elastic, meaning changes in price lead to proportionally larger changes in quantity demanded.

- Indirect Revenue Effect: Fluctuations in consumer spending on gold and silver products directly influence the volume of metals that manufacturers purchase, thus indirectly impacting McEwen Mining's revenue potential.

Alternative Investment Options for Customers

Customers possess considerable bargaining power due to the wide array of alternative investment options available beyond physical gold and silver. These include other precious metals such as platinum and palladium, which offer similar inflation-hedging properties. For instance, in 2024, platinum prices fluctuated, presenting a viable alternative for investors seeking precious metal exposure.

Financial instruments like Exchange Traded Funds (ETFs) tracking precious metals provide liquidity and ease of trading, further empowering customers. In late 2023, gold ETFs saw net inflows, indicating investor preference for these accessible vehicles over direct bullion ownership.

- Diversified Precious Metals: Platinum and palladium offer alternative hedges against inflation and currency devaluation.

- Financial Instruments: ETFs and other derivatives provide accessible, liquid exposure to precious metals without physical storage needs.

- Broader Asset Classes: Equities, bonds, real estate, and cryptocurrencies present a vast universe of investment choices, diminishing the unique draw of gold and silver for many customers.

- Information Accessibility: Online platforms and financial news readily provide comparative data on various investment performance, enabling informed decisions and increasing customer leverage.

The bargaining power of customers for McEwen Mining is substantial due to the commoditized nature of gold and silver. Buyers face a global market with numerous suppliers, making it easy to switch based on price. In 2024, with gold prices fluctuating around $2,300 per ounce for much of the year, customers could easily shop around for the best available rates.

The wide distribution of end-users, from jewelry makers to industrial clients, means no single buyer can dictate terms. This lack of buyer concentration, coupled with the standardization of precious metals, grants customers significant leverage. For example, while demand from India's jewelry sector remained a key driver in 2024, the overall market's vastness prevented any one segment from exerting undue pressure.

Customers also benefit from a plethora of alternative investment and hedging options beyond physical gold and silver. Financial instruments like ETFs, as well as other precious metals such as platinum, offer comparable benefits. In 2023, gold ETFs saw significant inflows, demonstrating a preference for accessible, liquid investment vehicles, which further empowers customer choice and limits McEwen Mining's pricing power.

Same Document Delivered

McEwen Mining Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for McEwen Mining. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, allowing you to immediately assess the competitive landscape and strategic positioning of McEwen Mining.

Rivalry Among Competitors

The gold and silver mining sector is a dynamic landscape populated by a spectrum of companies, from global giants to smaller, emerging players like McEwen Mining. While a few major corporations often command significant market share and resources, the industry is also characterized by a substantial number of junior and intermediate mining firms actively seeking and developing new deposits.

This diverse competitive structure means that while established players may have advantages in scale and capital, smaller companies can still compete effectively, particularly in the exploration and early-stage development phases. For instance, as of early 2024, the market capitalization of major gold producers can reach tens of billions of dollars, whereas junior miners like McEwen Mining operate with significantly smaller valuations, highlighting the varied scale of operations and competitive intensity.

The gold mining industry is experiencing a mature growth phase, with global mine production showing a plateau. Despite robust demand, new discoveries have become increasingly scarce, limiting organic expansion opportunities. This maturity intensifies competition among existing players, as companies vie for market share and control over a finite supply of accessible gold reserves.

Mining companies like McEwen Mining face intense competition partly due to high fixed costs. Building and maintaining mines, including heavy machinery, processing plants, and skilled workforces, requires massive upfront capital. For example, a new mine development can easily cost hundreds of millions, if not billions, of dollars.

These substantial investments, combined with long project timelines and specialized equipment that's difficult to repurpose, create formidable exit barriers. Companies often find it more economically viable to continue operating, even at reduced capacity during market slumps, rather than abandoning their significant investments. This dynamic keeps more players in the market, fueling ongoing rivalry.

This situation means that even when metal prices fall, mining firms are often compelled to keep production going to cover their fixed operational expenses. In 2023, the average operating cost for gold mining globally hovered around $1,300 per ounce, while prices fluctuated significantly, highlighting the pressure to maintain output to remain competitive and cover these ongoing costs.

Product Homogeneity

Product homogeneity in the mining sector, particularly for precious metals like gold and silver, intensifies competitive rivalry. Since these commodities are largely undifferentiated, McEwen Mining and its competitors find themselves in a constant battle centered on cost efficiency and production volume. This lack of product differentiation means that companies cannot easily command premium prices based on unique product features, forcing a direct reliance on operational prowess to gain an edge.

The competition thus becomes a race to the bottom on costs, where even minor improvements in extraction efficiency or operational streamlining can significantly impact profitability. For instance, during periods of price volatility in 2024, miners with lower all-in sustaining costs (ASCs) were better positioned to weather downturns and maintain healthier margins. McEwen Mining's focus on optimizing its operations at its Los Azules project, aiming for cost reductions, directly addresses this intense rivalry driven by product sameness.

- Cost Efficiency Dominance: With gold and silver being commodities, price is the primary differentiator, making low-cost production a critical competitive advantage.

- Operational Excellence is Key: Companies that excel in mining, processing, and management can outperform rivals even when selling the same raw material.

- Limited Pricing Power: Homogeneity restricts the ability of any single producer to influence market prices, leading to price-taking behavior.

- Focus on Volume and Scale: Larger operations and higher production volumes can often lead to economies of scale, further reducing per-unit costs and enhancing competitiveness.

Acquisition and Consolidation Activity

Acquisition and consolidation activity is reshaping the mining sector, particularly for gold and silver producers. Companies are actively merging and acquiring to achieve greater scale and build resilience against market volatility and operational challenges. This trend, evident throughout 2024, sees larger, more integrated entities emerging, which can intensify the competitive pressures faced by smaller players like McEwen Mining.

- Industry Consolidation: The mining industry, driven by the need for economies of scale and access to new reserves, is witnessing a significant uptick in M&A.

- Drivers of M&A: Declining ore grades, increasing exploration costs, and the desire for operational synergies are key motivators for consolidation in 2024.

- Impact on Competition: The emergence of larger, consolidated mining entities can lead to increased pricing power and a more challenging competitive environment for companies that do not participate in this trend.

Competitive rivalry within the gold and silver mining sector is fierce, driven by the commodity nature of the products and the high fixed costs inherent in the industry. McEwen Mining, like its peers, must constantly focus on cost efficiency and operational excellence to gain an edge, as differentiation is minimal. This intense competition is further amplified by industry consolidation trends observed throughout 2024.

The lack of product differentiation means that price and cost become the primary battlegrounds. Companies with lower all-in sustaining costs (ASCs) are better positioned to navigate market downturns and maintain profitability. For example, in early 2024, the average ASC for gold producers varied significantly, with top-tier producers often operating below $1,000 per ounce, while others struggled to stay below $1,500.

| Metric | 2023 Average (USD/oz) | 2024 Trend | Impact on Rivalry |

|---|---|---|---|

| All-in Sustaining Costs (Gold) | $1,300 - $1,500 | Slight increase due to inflation, but focus on reduction | Lower costs provide a significant competitive advantage. |

| Production Volume | Varies greatly by company size | Stable to slightly declining global output | Drives focus on efficiency and reserve acquisition. |

| Market Capitalization of Major Producers | $20 Billion - $100 Billion+ | Fluctuating with gold prices | Larger players benefit from economies of scale. |

SSubstitutes Threaten

Other precious metals like platinum and palladium pose a threat as substitutes for gold and silver. In jewelry, platinum often replaces white gold, especially when gold prices surge, impacting demand. For example, in 2023, platinum prices averaged around $1,000 per ounce, making it a competitive alternative to white gold, which is an alloy of gold and other metals.

Investors have a wide array of alternatives to precious metals for wealth preservation and growth. Real estate, for instance, has historically served as a tangible asset, with U.S. home prices appreciating by approximately 4.2% year-over-year as of Q1 2024, according to the Federal Housing Finance Agency.

Government bonds also present a stable investment option, particularly U.S. Treasury bonds. The yield on the 10-year U.S. Treasury note hovered around 4.3% in early May 2024, offering a predictable income stream and capital preservation, which can draw funds away from non-yielding metals.

Equities, despite their volatility, provide significant growth potential. The S&P 500 index saw a substantial increase of over 10% in the first quarter of 2024, demonstrating the allure of stock market returns for investors looking for higher gains than typically offered by gold or silver.

Furthermore, other commodities like oil or agricultural products can also act as investment substitutes, offering diversification and potential hedges against inflation, depending on market conditions and investor objectives, thus diluting investment interest in precious metals.

While gold and silver find use in industries like electronics and solar panels, rapid technological progress could introduce substitute materials or enhance the efficiency of existing ones, potentially dampening demand for these precious metals in specific applications.

For instance, advancements in battery technology or material science might offer alternatives to silver's conductivity in certain electronic components. Conversely, the burgeoning field of artificial intelligence is actually fueling increased demand for gold due to its exceptional conductivity and resistance to corrosion, crucial for high-performance computing infrastructure.

McEwen Mining, like others in the sector, must monitor these evolving industrial demands. The global demand for silver in electronics, a significant industrial application, was estimated to be around 283 million ounces in 2023, highlighting the potential impact of substitutions.

Recycled Metals

The threat of recycled gold and silver is a crucial factor for McEwen Mining. These secondary sources can significantly impact the overall supply, acting as a direct substitute for newly mined metals. When prices for precious metals rise, the economic incentive to recover gold and silver from existing sources, like electronics or jewelry, also increases.

This dynamic can put downward pressure on the prices of newly mined metals. For instance, in 2023, the World Gold Council reported that recycled gold supply reached approximately 1,200 tonnes. Higher prices can make these recycled supplies more competitive, potentially reducing demand for primary production. This is particularly relevant as McEwen Mining seeks to develop its new projects.

- Recycled Gold and Silver as Substitutes: Recovered metals offer an alternative supply source to newly mined material.

- Price Sensitivity: Higher precious metal prices incentivize increased recycling efforts.

- Impact on New Production: Increased recycled supply can dampen price appreciation for primary gold and silver.

- 2023 Recycled Gold Supply: Approximately 1,200 tonnes of gold were recycled globally, according to the World Gold Council.

Shift in Consumer Preferences

Shifting consumer tastes represent a significant threat to McEwen Mining. For instance, a growing preference for lab-grown diamonds or other gemstones over traditional gold and silver jewelry directly impacts demand. This is particularly relevant as gold prices have seen volatility, with some reports in early 2024 indicating consumer pullback in certain markets due to affordability concerns, pushing them towards less expensive alternatives or entirely different luxury categories.

The jewelry sector, a primary consumer of gold and silver, is highly susceptible to fashion trends and economic conditions. When consumers pivot towards different aesthetic preferences or face economic pressures, the demand for precious metals can wane. This can lead to a decrease in sales volume for mining companies if they cannot adapt their product offerings or marketing strategies.

- Consumer Preference Shifts: Growing interest in alternative jewelry materials like platinum or ethically sourced gemstones can reduce demand for gold and silver.

- Price Sensitivity: High gold prices, observed in periods like early 2024, can deter consumers, leading them to seek more affordable luxury goods or fashion items.

- Economic Downturns: Recessions or economic uncertainty often lead consumers to reduce discretionary spending on items like high-end jewelry, impacting the demand for precious metals.

- Technological Advancements: Innovations in jewelry design or the emergence of new luxury materials could also present substitutes by capturing consumer interest and spending.

Beyond direct material substitutes, investment alternatives significantly dilute the appeal of precious metals for wealth preservation. Real estate, with U.S. home prices rising approximately 4.2% year-over-year in Q1 2024, offers tangible asset growth. Similarly, government bonds, like the 10-year U.S. Treasury note yielding around 4.3% in early May 2024, provide stable income. Equities, exemplified by the S&P 500's over 10% Q1 2024 gain, present higher growth potential, diverting capital from non-yielding precious metals.

| Asset Class | Approximate 2024 Performance/Yield (Early Year) | Nature of Substitute |

|---|---|---|

| Real Estate (US Homes) | +4.2% YoY (Q1 2024) | Tangible asset, inflation hedge |

| 10-Year US Treasury Note | ~4.3% Yield (Early May 2024) | Stable income, capital preservation |

| S&P 500 Index | >+10% (Q1 2024) | Growth potential, higher returns |

Entrants Threaten

High capital requirements act as a significant barrier to entry in the gold and silver mining sector. Companies like McEwen Mining need substantial upfront investment for exploration, mine development, processing facilities, and essential equipment. For instance, bringing a new gold mine into production can cost hundreds of millions, even billions, of dollars, making it difficult for smaller or less capitalized firms to compete.

The mining industry faces significant regulatory hurdles. For instance, in 2024, the average time for obtaining major mining permits in many jurisdictions can extend over several years, often exceeding 5 to 10 years. This lengthy process includes rigorous environmental impact assessments and adherence to strict compliance standards, making it a substantial barrier for new companies.

The threat of new entrants in the mining sector, particularly concerning access to quality reserves, is significant. Identifying and acquiring economically viable gold and silver deposits is becoming a tougher task. Many of the easily accessible, high-grade reserves have already been found and developed.

New companies entering the market face a substantial hurdle in securing prime mineral properties. This difficulty in obtaining quality reserves is a critical factor that can hinder sustainable and profitable mining operations for any new player.

For instance, in 2024, the global exploration budget for metals and mining was projected to be around $11.4 billion, a slight increase from previous years, reflecting the ongoing effort and competition to find new deposits. However, the average discovery cost per ounce of gold has been on an upward trend, indicating that finding new, high-quality reserves is becoming more expensive and challenging.

Need for Specialized Expertise and Technology

The mining industry demands a highly specialized workforce, encompassing geologists, mining engineers, and experienced equipment operators. For instance, in 2024, companies like Barrick Gold invested heavily in advanced training programs to ensure their teams possess the necessary skills for complex extraction processes.

Access to and mastery of cutting-edge mining technology, from sophisticated exploration software to automated heavy machinery, represents another substantial hurdle for potential new entrants. These technologies are critical for efficiency and safety, and their acquisition or development requires significant capital outlay and technical know-how.

Consider the case of underground mining operations; they often require specialized ventilation systems, ground support techniques, and remote monitoring capabilities. Developing or licensing these proprietary technologies can be prohibitively expensive for newcomers, creating a steep barrier to entry.

- Specialized Workforce Needs: Geologists, mining engineers, and skilled tradespeople are essential for successful operations.

- Advanced Technology Requirements: Sophisticated exploration, extraction, and processing technologies are vital.

- Capital Investment in Expertise: New entrants must invest significantly in training and development to build a competent team.

- Technological Acquisition Costs: Acquiring or developing proprietary mining technologies can be a major financial barrier.

Established Supply Chains and Infrastructure

McEwen Mining, like other established players in the mining sector, benefits significantly from deeply entrenched supply chains and infrastructure. Existing companies have cultivated long-standing relationships with key suppliers of equipment, explosives, and specialized services, often securing more favorable pricing and priority access. For instance, major mining equipment manufacturers like Caterpillar and Komatsu have established service networks that are readily available to incumbents, a resource that would take a new entrant years and considerable investment to replicate.

The logistical networks for transporting ore, equipment, and personnel are also a formidable barrier. These often involve specialized trucking companies, rail access, or even port facilities that are already contracted and optimized for existing operations. In 2024, the cost of establishing new, reliable transportation links for a remote mining site can run into tens of millions of dollars, not to mention the time required for permitting and construction. Building these capabilities from the ground up presents a substantial hurdle for any potential new competitor aiming to enter the market.

Furthermore, access to essential utilities like power and water is often secured through long-term agreements or existing infrastructure. New entrants would face the challenge of either constructing their own power generation facilities or negotiating for grid access, which can be costly and time-consuming. For example, a new mine requiring significant power might face tariffs that are less competitive than those enjoyed by older, established operations with pre-existing power purchase agreements. This disparity in operational costs directly impacts the profitability and viability of new ventures.

- Established Supplier Relationships: Mining companies like McEwen Mining have decades-old ties with critical equipment and consumables providers, leading to volume discounts and guaranteed service availability.

- Logistical Network Dominance: Existing players leverage well-developed road, rail, and sometimes port infrastructure, often with exclusive or preferential access, which new entrants must build or contract at higher costs.

- Infrastructure Access Costs: Securing reliable power and water for a new mine in 2024 can involve upfront capital expenditures in the tens of millions, a significant deterrent compared to leveraging existing utility networks.

- Time and Expertise Barriers: Developing the necessary operational expertise and navigating the complex permitting processes for infrastructure build-out requires substantial time and specialized knowledge, which new entrants lack.

The threat of new entrants for McEwen Mining is generally considered moderate to low, primarily due to the substantial barriers inherent in the gold and silver mining industry. High capital requirements, stringent regulatory environments, and the difficulty in securing prime mineral properties all deter new companies. For instance, the average cost to bring a new gold mine into production in 2024 can easily reach hundreds of millions of dollars, a sum many new players cannot readily access.

Furthermore, established players like McEwen Mining benefit from strong existing infrastructure and supply chain relationships that new entrants would find difficult and costly to replicate. Navigating the complex permitting processes, which can take over five years for major mining permits in 2024, also presents a significant hurdle for newcomers. The global exploration budget for metals and mining in 2024, projected at $11.4 billion, underscores the intense competition for new deposits.

| Barrier to Entry | Description | Impact on New Entrants | 2024 Data/Example |

|---|---|---|---|

| Capital Requirements | High upfront investment for exploration, development, and equipment. | Significant deterrent for smaller or less capitalized firms. | New gold mine production costs can exceed $100 million. |

| Regulatory Hurdles | Lengthy and complex permitting and compliance processes. | Extends time-to-market and increases project risk. | Permit acquisition can take 5-10+ years. |

| Access to Reserves | Difficulty in finding and acquiring economically viable deposits. | Limits growth potential and profitability for new ventures. | Rising average discovery cost per ounce of gold. |

| Infrastructure & Logistics | Need for established supply chains, transportation, and utilities. | Requires substantial investment and time to build or contract. | New transportation links can cost tens of millions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for McEwen Mining is built upon a foundation of publicly available information, including the company's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific data from reputable mining trade journals and market research reports to provide a comprehensive view of the competitive landscape.