Matas A/S SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Matas A/S Bundle

Matas A/S, a leading health and beauty retailer, demonstrates significant strengths in its established brand recognition and strong customer loyalty within the Danish market. Its robust online presence and omnichannel strategy are key advantages, allowing for seamless customer experiences.

However, understanding the full scope of their competitive landscape, potential threats from emerging online players, and internal weaknesses in supply chain resilience is crucial for strategic planning. This brief overview only scratches the surface of Matas's market position.

Want the full story behind Matas A/S's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The acquisition of KICKS has established Matas Group as the leading beauty and wellbeing retailer across the Nordics. This expands their reach to approximately 500 stores and over 6 million club members in Denmark, Sweden, Norway, and Finland. The group demonstrated robust financial performance in 2024/25, with proforma currency-neutral revenue growth of 7.0% to DKK 8.4 billion. This was coupled with an increased EBITDA margin, providing a solid foundation for future expansion and profitability.

Matas demonstrates a highly successful omnichannel strategy, seamlessly blending its physical retail presence with a robust e-commerce platform. Online sales contributed approximately 30% to total revenue in the 2024/25 fiscal year, highlighting digital channel strength. The company experienced significant e-commerce expansion, with Matas' online sales increasing by 18.5% and KICKS' by 30.1% (excluding Skincity) during this period. This integrated approach effectively caters to varying customer preferences, ensuring sustained growth across both in-store and online channels.

Matas A/S boasts a significant competitive advantage through its robust loyalty program, encompassing over 6 million members across the Nordic region as of 2024. This extensive and highly engaged customer base, supported by a strong Net Promoter Score, reflects exceptional customer satisfaction and enduring loyalty. The loyalty program is crucial for enabling personalized marketing efforts, which directly drives repeat business. Furthermore, it facilitates the collection of valuable consumer data, strengthening Matas's market position.

Strategic Brand Portfolio and Assortment Expansion

Matas A/S leverages a robust brand portfolio, encompassing exclusive third-party distribution rights alongside popular own brands such as Matas Striber and Matas Natur. The company significantly expanded its product range in fiscal year 2024/25, introducing hundreds of new brands across both Matas and KICKS platforms. This continuous assortment expansion directly addresses evolving consumer demands for novel and diverse offerings, particularly a rising interest in natural and sustainable beauty products. This strategic approach enhances market appeal and strengthens customer loyalty.

- Hundreds of new brands launched across Matas and KICKS in FY 2024/25.

- Proprietary brands like Matas Striber and Matas Natur contribute to brand equity.

- Exclusive distribution rights for third-party brands secure unique market positioning.

- Assortment caters to growing consumer demand for natural and sustainable products.

Significant Investments in Logistics and Efficiency

Matas is significantly bolstering its operational infrastructure with two new state-of-the-art automated logistics centers. The Matas Logistics Center, which became operational in April 2025, represents a substantial capital outlay designed for long-term growth and enhanced efficiency across its supply chain. These strategic investments are projected to drive positive margin improvements and strengthen the company's competitiveness and profitability well into the future.

- Two new state-of-the-art automated logistics centers enhance operational capacity.

- The Matas Logistics Center opened in April 2025, a key capital investment.

- Expected positive margin effects from improved efficiency.

- Supports Matas's long-term competitiveness and profitability.

Matas A/S dominates the Nordic beauty market following the KICKS acquisition, achieving DKK 8.4 billion in proforma revenue for 2024/25 with 7.0% growth. Its robust omnichannel strategy saw online sales contribute 30% to total revenue, with Matas and KICKS e-commerce growing by 18.5% and 30.1% respectively. A strong loyalty program with over 6 million members drives repeat business, complemented by a diverse brand portfolio and new automated logistics centers, like the Matas Logistics Center operational in April 2025, boosting efficiency.

| Metric | 2024/25 Data | Impact |

|---|---|---|

| Proforma Revenue | DKK 8.4 Billion | Nordic Market Leadership |

| Online Sales Contribution | 30% | Strong Omnichannel Growth |

| Loyalty Members | >6 Million | High Customer Retention |

What is included in the product

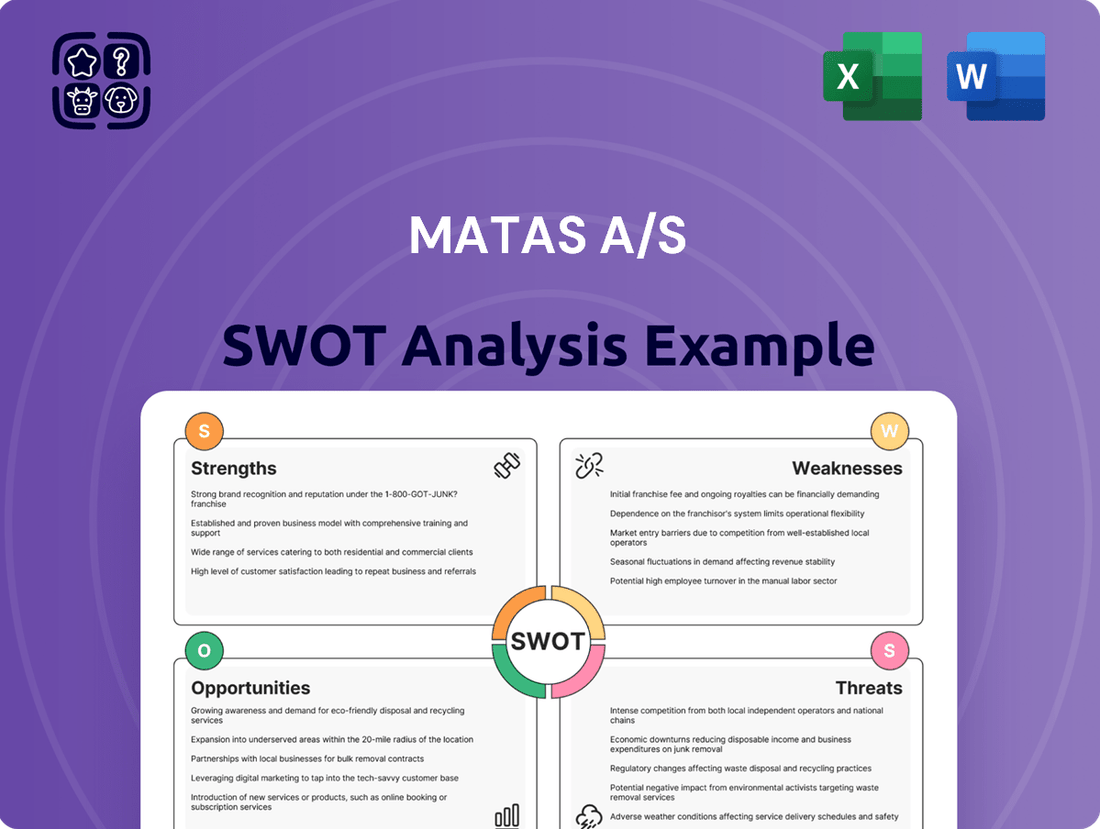

Delivers a strategic overview of Matas A/S’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, visual representation of Matas A/S's strategic landscape, simplifying complex internal and external factors for better decision-making.

Weaknesses

Matas faces a significant challenge with its high debt. As of early 2025, total liabilities stood at DKK 5.30 billion, exceeding its cash and near-term receivables, and notably, this deficit is larger than its DKK 4.70 billion market capitalization. The company's debt-to-EBITDA ratio of 3.0 indicates considerable financial leverage. While currently managed, this high debt level could restrict future strategic investments and operational flexibility.

The integration of KICKS presents notable challenges for Matas A/S. The first full year of integration incurred special costs of DKK 27 million. Looking ahead, an additional DKK 40 million in integration costs are projected for 2025/26. Merging diverse operations, systems, and company cultures inherently carries significant execution risks. Successfully navigating this complex process is critical to realizing the acquisition's anticipated value and maximizing returns.

Matas A/S's expansion into a Nordic-wide operation significantly increases the complexity of its supply chain, particularly with the integration of two new automated distribution centers. Managing logistics and inventory across Denmark, Sweden, and Norway introduces potential vulnerabilities that could disrupt operations. For instance, any unforeseen challenges in 2024-2025 within this expanded network, such as customs delays or labor shortages, could directly impact product availability. This heightened complexity demands robust oversight to prevent efficiency declines and ensure consistent delivery across all markets.

Significant Carbon Footprint from Value Chain

Matas A/S faces a significant weakness from its substantial carbon footprint, particularly within its value chain. In 2024, the company reported Scope 3 emissions, primarily from its upstream activities, at 116,164,000 kg CO2e. These extensive indirect emissions pose both a reputational and regulatory risk despite Matas's high industry benchmark sustainability scores. Tackling these value chain emissions represents a considerable challenge for achieving its environmental sustainability targets.

- 2024 Scope 3 emissions: 116,164,000 kg CO2e.

- Majority of footprint from upstream value chain.

- Presents significant reputational and regulatory risks.

- Major hurdle for environmental goal attainment.

Negative Free Cash Flow in Recent Quarter

Matas A/S reported a negative free cash flow of DKK 206 million for the fourth quarter of 2024. This significant outflow was primarily driven by working capital adjustments linked to new logistics setups. Substantial capital expenditures, particularly for the new Matas Logistic Center, also contributed heavily to this figure. While these are strategic investments, a sustained period of negative cash flow could pressure the company's liquidity and operational flexibility.

- Q4 2024 FCF: DKK -206 million

- Impact: Working capital changes for new logistics

- Impact: Capital expenditures for Matas Logistic Center

- Risk: Potential liquidity pressure if sustained

Matas faces notable weaknesses including high debt, with DKK 5.30 billion in liabilities exceeding its DKK 4.70 billion market capitalization as of early 2025. The KICKS integration adds complexity, projecting DKK 40 million in costs for 2025/26. An expanded Nordic supply chain introduces new vulnerabilities in 2024-2025, while its 2024 Scope 3 emissions hit 116,164,000 kg CO2e. Furthermore, Q4 2024 saw a negative free cash flow of DKK 206 million.

| Weakness | Key Metric | 2024/2025 Data | ||

|---|---|---|---|---|

| High Debt | Total Liabilities | DKK 5.30 Billion | ||

| Integration Costs | KICKS 2025/26 | DKK 40 Million | ||

| Carbon Footprint | 2024 Scope 3 | 116,164,000 kg CO2e |

What You See Is What You Get

Matas A/S SWOT Analysis

This preview reflects the real Matas A/S SWOT analysis document you'll receive. It's professionally structured and ready to use, offering a clear overview of their strategic landscape. You'll gain comprehensive insights into their Strengths, Weaknesses, Opportunities, and Threats. This is the actual document, no sample or edited version, ensuring you get the full picture of Matas A/S's market position and future potential.

Opportunities

Matas A/S's 'Win the Nordics' strategy, significantly bolstered by the KICKS acquisition completed in Q1 2024, presents a clear path for substantial growth. This strategic move underpins the company's long-term ambition to exceed DKK 10 billion in revenue by the fiscal year 2027/28. There is considerable potential to increase market share across Sweden, Norway, and Finland. Leveraging the combined strength of both the Matas and KICKS brands allows for deeper penetration and market leadership throughout the Nordic region.

E-commerce remains the fastest-growing channel in the Danish premium beauty and personal care market. Matas reported online sales growth of 14.2% for the fiscal year 2023/24, reaching 26.5% of total revenue. By enhancing digital platforms and personalizing the online experience, Matas can further capitalize on this trend, integrating its strong omnichannel services. The continued rise of social commerce platforms also offers new avenues for customer engagement and sales growth for Matas in 2024/25.

Growing consumer demand for sustainable and natural beauty products presents a significant opportunity for Matas. The market for eco-friendly personal care is projected to expand, with Matas well-positioned to capitalize by expanding its portfolio of certified sustainable brands. The company can further develop its own successful Matas Natur line, which aligns directly with its ambitious ESG targets, aiming for a 50% reduction in CO2 emissions by 2030. This strategy attracts the increasing segment of environmentally conscious consumers, enhancing market share and brand loyalty. Matas's focus on sustainable offerings can drive revenue growth in the 2024-2025 fiscal year.

Leveraging Technology for Personalized Customer Experiences

Matas has a significant opportunity to enhance customer engagement by leveraging technology for personalized experiences, a trend increasingly valued by consumers in 2024. With over 6 million loyalty members, Matas can deploy advanced AI and analytics to provide highly tailored product recommendations and targeted promotions. This data-driven approach is expected to further strengthen brand loyalty and drive increased sales, building upon their robust customer base.

- Utilize AI for personalized product recommendations.

- Implement targeted promotions based on loyalty member data.

- Enhance the overall digital shopping journey.

- Strengthen customer loyalty and boost sales by 2025.

Synergy Realization and Margin Improvement

Matas A/S is positioned to significantly enhance its profitability. Beyond the initial synergies from the KICKS acquisition, Matas anticipates further annual cost synergies reaching DKK 50 million by 2026/27. This, combined with efficiency gains from new automated logistics centers, presents a clear opportunity for margin improvement. The company forecasts its EBITDA margin to be around 15% for the 2025/26 fiscal year.

- Annual cost synergies from KICKS acquisition expected to reach DKK 50 million by 2026/27.

- Efficiency gains are driven by new automated logistics centers.

- Forecasted EBITDA margin is approximately 15% for the 2025/26 fiscal year.

Matas A/S is set to expand significantly across the Nordics, aiming for DKK 10 billion in revenue by 2027/28, leveraging the KICKS acquisition. Enhanced e-commerce, which grew 14.2% in FY2023/24, presents further growth, alongside increasing demand for sustainable products. Utilizing AI for personalized experiences with 6 million loyalty members will boost sales by 2025. Profitability will improve with DKK 50 million in KICKS synergies by 2026/27, targeting a 15% EBITDA margin for FY2025/26.

| Opportunity | Target/Metric | Timeline |

|---|---|---|

| Nordic Expansion | DKK 10B Revenue | FY2027/28 |

| E-commerce Growth | 14.2% online sales growth (FY23/24) | 2024-2025 |

| Profitability | 15% EBITDA Margin | FY2025/26 |

Threats

The Nordic beauty and personal care market is highly fragmented and competitive, with threats from numerous specialty retailers, online players, and discounters. The rise of online retailers, such as Lyko and Pureness, expanding into physical stores directly challenges Matas’ omnichannel strategy. Persistent pressure from value retailers, including grocery chains, also impacts pricing and market share. Maintaining its leading position, which was approximately 35% of the Danish beauty and health market in 2024, requires continuous innovation, competitive pricing, and a superior customer experience.

The macroeconomic outlook remains uncertain, with declining consumer confidence potentially impacting consumer spending on non-essential items, a key segment for Matas. This risk is reflected in Matas A/S wider revenue guidance for the 2025/26 fiscal year. A slowdown in the economy, particularly in crucial markets like Sweden, could negatively affect sales and growth projections. Consumer hesitancy to spend on beauty and wellness products during economic downturns poses a significant threat to profitability.

Despite strategic expansion into the Nordics, Matas A/S maintains a substantial dependence on its Danish operations, which generated a significant portion of its DKK 2.13 billion revenue in Q3 2023/24. This concentration means that any adverse economic shifts or regulatory changes specifically within Denmark could disproportionately impact the company's overall financial performance and profitability. For instance, a downturn in Danish consumer spending in 2024 could directly affect its core revenue streams. Geographic diversification of revenue, especially post-KICKS acquisition, remains critical to mitigate this inherent market risk in 2025.

Regulatory Changes

Operating in the health, beauty, and over-the-counter medication sectors exposes Matas A/S to evolving regulations, particularly concerning product safety and marketing claims. The implementation of the Corporate Sustainability Reporting Directive (CSRD) for large companies, effective from fiscal year 2024, significantly increases reporting burdens related to environmental and social standards. Adapting to these new legal requirements, which include detailed disclosures on sustainability metrics, can lead to substantial compliance costs and necessary operational adjustments. Matas must continuously invest in robust compliance frameworks to mitigate risks from potential fines or reputational damage, ensuring all products meet stringent EU standards.

- Increased compliance costs due to new EU regulations like CSRD, impacting large companies from 2024.

- Potential fines for non-compliance with product safety and marketing laws.

- Operational adjustments required for updated environmental and social reporting standards.

- Continuous need for investment in regulatory monitoring and adaptation.

Technological Disruption and Shifting Consumer Behavior

The retail landscape is rapidly reshaped by technological disruption and evolving consumer habits, notably the increasing influence of social commerce platforms where purchasing decisions are often made directly within social media feeds. Matas must continually invest in its digital capabilities, such as enhancing its mobile app and e-commerce functionalities, to remain competitive and appeal to younger demographics. Failure to keep pace with these technological shifts could result in a significant loss of market share, particularly as online beauty and health sales are projected to grow significantly through 2025.

- Matas's Q1 2024/25 online sales growth will be crucial to monitor against broader e-commerce trends.

- The company's digital investment strategy, including AI-driven personalization, must accelerate beyond 2023/24 levels.

- Customer acquisition costs on social platforms are rising, impacting marketing efficiency for 2025.

- Competitors leveraging livestream shopping and influencer marketing pose an increasing threat to traditional retail models.

Matas faces intense competition from online and discount retailers, challenging its 35% Danish market share in 2024. Economic uncertainty and declining consumer confidence, reflected in its 2025/26 revenue guidance, threaten non-essential spending. High dependence on Danish operations and new EU regulations like CSRD from fiscal year 2024 also pose significant financial and compliance risks.

| Metric | 2024/25 Data | Impact |

|---|---|---|

| Danish Market Share | ~35% (2024) | Competitive pressure |

| CSRD Implementation | FY 2024 onwards | Increased compliance costs |

| Revenue Guidance | FY 2025/26 (wider range) | Economic uncertainty |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Matas A/S's official financial statements, comprehensive market research reports, and expert industry analysis to provide a thorough and insightful evaluation.