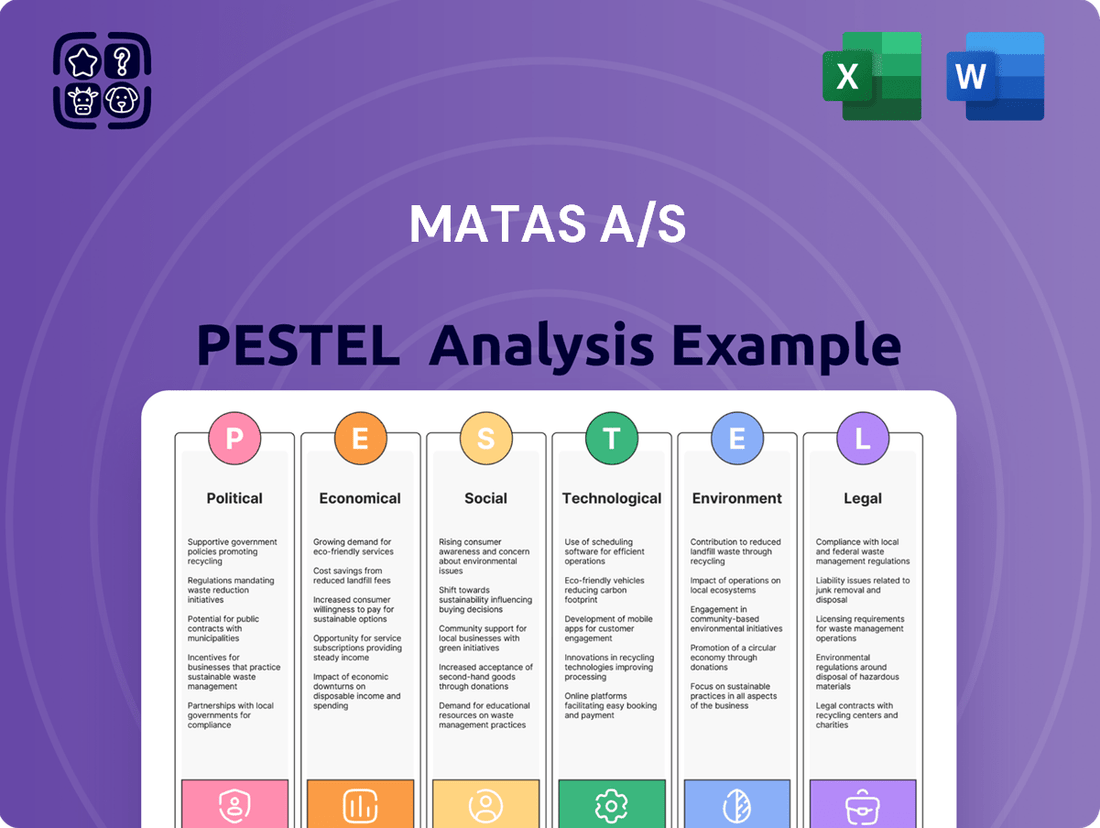

Matas A/S PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Matas A/S Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Matas A/S's path to success. Our PESTLE analysis dives deep into the external forces influencing the Danish health and beauty market, providing you with the strategic foresight needed to navigate complex challenges and capitalize on emerging opportunities. Understand how regulatory shifts, consumer trends, and technological advancements are impacting Matas's operations and competitive landscape. This comprehensive report is your essential guide to making informed business decisions and staying ahead of the curve. Don't miss out on these crucial insights – download the full Matas A/S PESTLE Analysis now and gain a significant competitive advantage.

Political factors

The stability of the Danish government and its policies on retail and consumer goods directly impact Matas. Denmark's political landscape, characterized by coalition governments, typically fosters a predictable economic environment beneficial for business planning, as seen with consistent consumer protection laws. Any significant shifts in government composition or regulatory focus, such as potential changes to VAT rates or environmental taxes for products, could introduce uncertainty for the retail sector. Matas’s 2024 financial outlook relies on this stable regulatory framework, supporting its projected revenue growth for the fiscal year ending March 2025.

As a Danish retailer, Matas A/S must strictly adhere to evolving EU regulations, particularly Regulation (EC) No 1223/2009 on cosmetic products, which imposes rigorous safety and labeling standards. The European Commission's ongoing review, expected to finalize amendments by late 2024 or early 2025, includes stricter rules for substances like nanomaterials and endocrine disruptors. Matas's proactive compliance, ensuring its product portfolio meets these updated requirements, is crucial to avoid potential fines, which can be significant, and to maintain its strong market position across Denmark.

Changes to Denmark's standard value-added tax (VAT) rate, currently at 25%, directly influence Matas's pricing and profitability across its cosmetics, pharmaceuticals, and health product ranges. The Danish government's ongoing fiscal policy, particularly any adjustments to specific consumption taxes on certain health or beauty items, remains a critical political consideration for 2024 and 2025. For example, discussions around potential new levies or a 'sugar tax' concept expanding to specific health-related products could impact consumer demand for some of Matas's offerings. Such tax policies necessitate continuous adaptation in Matas's strategic pricing and product assortment.

Trade Policies and Tariffs

Matas A/S, with its diverse product sourcing from international markets, remains highly sensitive to shifts in global trade policies and tariffs. Geopolitical tensions, such as those impacting global shipping lanes in 2024, can elevate import costs and disrupt supply chains, potentially affecting the company's gross profit margin which was 44.5% in H1 2023/24. The European Union's trade agreements and any protectionist measures implemented by Denmark or its key trading partners significantly influence Matas's operational expenses and product availability. For instance, new tariffs on specific beauty or health product components could directly increase the cost of goods sold.

- Global trade policy changes directly impact Matas's import costs, potentially increasing its 2024 procurement expenses.

- Supply chain resilience is tested by geopolitical events, with 2025 freight costs remaining a key risk factor.

- EU trade agreements dictate tariff structures, influencing Matas's pricing strategies and competitiveness.

Public Health Initiatives and Regulations

Government public health campaigns and regulations significantly influence Matas's 'Vital Shop' and 'MediCare' segments, particularly regarding over-the-counter medications and health supplements.

New rules on the stockpiling of critical medicines, effective from July 2024, impose additional responsibilities and compliance costs on Matas's supply chain. Furthermore, evolving regulations on pharmaceutical advertising require stricter adherence, impacting marketing strategies for health-related products. These legislative changes necessitate ongoing investment in regulatory compliance and operational adjustments to maintain market position.

- July 2024: Implementation of new critical medicine stockpiling rules affecting Matas's inventory management.

- Increased compliance costs due to evolving pharmaceutical advertising regulations.

- Direct impact on 'Vital Shop' and 'MediCare' product offerings and sales strategies.

Denmark's stable political climate supports Matas's 2024 revenue growth, though potential VAT adjustments remain a risk. Evolving EU cosmetic regulations, with amendments by early 2025, necessitate proactive compliance for Matas's product portfolio. Global trade policy shifts and July 2024 medicine stockpiling rules increase operational costs, impacting the 44.5% H1 2023/24 gross profit margin.

| Factor | Impact | Status/Outlook |

|---|---|---|

| Danish VAT (25%) | Pricing & Profitability | 2024/25 Fiscal Policy |

| EU Cosmetic Regs | Product Compliance | Amendments by Early 2025 |

| Medicine Stockpiling | Supply Chain Costs | Effective July 2024 |

What is included in the product

This PESTLE analysis of Matas A/S investigates how Political, Economic, Social, Technological, Environmental, and Legal factors create both challenges and advantages for the company.

It offers a comprehensive overview of the external landscape impacting Matas A/S, providing actionable insights for strategic decision-making.

A concise and actionable summary of Matas A/S's PESTLE analysis, providing clarity on external factors impacting the business and enabling more informed strategic decision-making.

Economic factors

The health of the Danish economy directly impacts Matas, with 2025 forecasts anticipating continued real GDP expansion around 1.6%. This growth, coupled with projected real income increases of 2.5% for 2025, should bolster consumer spending. However, the latest consumer confidence index, which fell to -9.3 in April 2025 from -7.5 in January, indicates macroeconomic uncertainties. This decline could temper the expected retail spending boost, influencing Matas's sales volumes.

Fluctuations in inflation and interest rates directly impact Matas A/S by affecting consumer spending power and operational costs. Denmark's inflation rate moderated to approximately 1.1% in late 2024, generally benefiting the retail sector as disposable income increased. The European Central Bank's policy rates, which influence Danish borrowing costs, saw reductions in mid-2024. However, any future hikes in interest rates or a resurgence in inflation, potentially above 2.0% in early 2025, could dampen consumer spending on non-essentials and increase Matas's cost of capital for expansion or inventory financing.

Recent data from May 2025 indicates a year-on-year increase in Danish retail sales, with growth reaching 1.2%, slightly easing from previous months. Notably, sales of clothing and other consumer goods, segments crucial for Matas A/S, experienced increases of 2.8% and 1.9% respectively. These positive trends directly support Matas's operational environment and consumer spending patterns. Continuously monitoring these retail shifts is vital for Matas's effective inventory management and accurate sales forecasting through 2025.

Currency Exchange Rates

As Matas Group expands across the Nordics, especially following the KICKS acquisition in September 2023, it faces significant exposure to currency exchange rate fluctuations, notably NOK/DKK and SEK/DKK. These shifts directly impact reported revenues and profit margins from its Swedish and Norwegian operations. For instance, a stronger DKK against SEK or NOK can diminish the DKK value of sales generated in those markets. Matas's financial guidance for the 2024/2025 fiscal year often includes currency-neutral figures to provide a clearer picture of the underlying business performance, mitigating the noise from FX movements.

- KICKS contributed DKK 1.84 billion to Matas's revenue in FY23/24 from its acquisition date.

- Currency fluctuations can impact Matas's reported EBIT margin, which reached 11.2% in FY23/24.

- The company's 2024/25 outlook considers potential currency impacts on Nordic operations.

- SEK/DKK and NOK/DKK movements directly affect the value of sales converted back to Danish Kroner.

E-commerce Market Growth

The Danish e-commerce market is projected to reach an estimated USD 27.96 billion in 2025, with continued strong compound annual growth. This expansion is fueled by Denmark's high internet penetration, a significant shift in consumer behavior towards online shopping, and ongoing technological advancements. Matas A/S has made substantial investments in its e-commerce platform and omnichannel strategy, positioning the company effectively to capitalize on this robust online retail trend.

- Danish e-commerce market projected to hit USD 27.96 billion by 2025.

- Growth driven by high internet penetration and evolving consumer habits.

- Matas A/S actively invests in its e-commerce and omnichannel capabilities.

- Company is well-positioned to leverage the strong online retail expansion.

Denmark's economic stability, with 2025 GDP growth around 1.6% and real income up 2.5%, generally supports consumer spending for Matas, despite April 2025 consumer confidence falling to -9.3. Moderated inflation at 1.1% in late 2024 and mid-2024 ECB rate reductions benefit retail, though future rate hikes or inflation above 2.0% in early 2025 remain risks. May 2025 retail sales grew 1.2%, with key segments for Matas, like clothing, seeing 2.8% growth. Matas also faces currency volatility from Nordic expansion, particularly SEK/DKK and NOK/DKK, impacting reported revenues and its 11.2% FY23/24 EBIT margin.

| Economic Indicator | Latest Data (2024/2025) | Impact on Matas |

|---|---|---|

| Denmark Real GDP Growth (2025 est.) | 1.6% | Supports consumer spending |

| Denmark Consumer Confidence (April 2025) | -9.3 | Potential drag on retail spending |

| Denmark Inflation Rate (Late 2024) | 1.1% | Increased disposable income |

| Denmark Retail Sales Growth (May 2025 Y-o-Y) | 1.2% | Positive operational environment |

| Matas FY23/24 EBIT Margin | 11.2% | Affected by currency fluctuations |

Preview the Actual Deliverable

Matas A/S PESTLE Analysis

This preview gives you a direct look at the Matas A/S PESTLE Analysis you'll receive. The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying. You can trust that the comprehensive examination of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Matas A/S is presented as is. This is the actual file, fully formatted and professionally structured, ready for your immediate use.

Sociological factors

Danish consumers increasingly prioritize health and well-being, driving demand for Matas's diverse product portfolio. This societal shift is evident in the rising sales of vitamins, supplements, and natural and organic personal care items. Matas has capitalized on this trend, with its health segment seeing robust growth, reflecting a market where consumers spent an estimated 1.5 billion DKK on health products in 2024. This focus also strengthens Matas's emphasis on responsibly sourced products, aligning with consumer values.

The demand for sustainable and ethically produced goods is significantly shaping consumer preferences, particularly evident in the 2024 landscape where a growing majority prioritize products with environmentally friendly packaging and transparent supply chains. Consumers increasingly seek cruelty-free testing and verifiable ethical sourcing, influencing purchasing decisions across the retail sector. Matas A/S effectively aligns with this sociological shift through its robust ESG strategy, aiming for a 50% reduction in scope 1 and 2 emissions by 2030 from a 2020 base year, as part of its Science Based Targets initiative commitment. This focus on sustainability not only meets evolving consumer values but also strengthens Matas's market position, reflecting a critical trend in responsible consumption.

Social media and beauty influencers profoundly influence purchasing decisions within the beauty and personal care market. A strong digital marketing presence is crucial for Matas to engage customers, especially younger demographics who are highly active online. Matas's focus on enhancing its online customer experience with personalized content reflects this trend, aligning with its reported DKK 1,029 million in online sales for FY 2023/24, representing 26.6% of total revenue.

Preference for Convenience and Omnichannel Shopping

Modern consumers increasingly prioritize convenience, driving demand for seamless shopping experiences across both physical and digital channels. Matas A/S effectively addresses this by integrating its extensive network of over 260 physical stores with a robust e-commerce platform, reflecting a strong omnichannel strategy. This approach caters to customer preferences for flexible purchasing, with online sales contributing significantly to overall revenue, for instance, constituting 20.3% of Matas’s total revenue in Q3 2023/24, totaling DKK 250 million. The company further enhances convenience by expanding services like same-day delivery in major Danish cities, aligning with the growing market trend for immediate gratification.

- Matas’s omnichannel strategy integrates over 260 physical stores with its strong e-commerce platform.

- Online sales represented 20.3% of Matas’s total revenue in Q3 2023/24, reaching DKK 250 million.

- The company has expanded same-day delivery options in key Danish urban areas.

Aging Population and Demographic Shifts

Denmark, mirroring broader European trends, experiences a notable aging population, with projections indicating a continued increase in the median age towards 2025. This demographic shift opens significant avenues for Matas A/S to offer tailored products and services, particularly in specialized skincare and health solutions catering to older consumers. Matas's broad product portfolio, encompassing both beauty and healthcare categories, allows it to effectively address the diverse needs across all age groups.

- Denmark's median age is expected to be around 42-43 years by 2025.

- The 65+ age group is projected to grow, increasing demand for health-related products.

- Matas A/S offers a wide array of over 30,000 SKUs, covering beauty, personal care, and health.

- Strategic focus on categories like derma-cosmetics and supplements aligns with an aging demographic.

Danish consumers increasingly prioritize health, sustainability, and digital convenience, shaping Matas's market approach. This shift is evident as online sales reached DKK 1,029 million in FY 2023/24, representing 26.6% of total revenue. The growing demand for ethical products also aligns with Matas's ESG strategy, targeting a 50% reduction in scope 1 and 2 emissions by 2030. An aging population further drives demand for specialized health and beauty products, catering to a median age projected around 42-43 by 2025.

| Sociological Trend | Impact on Matas A/S | 2024/2025 Data Point |

|---|---|---|

| Health & Well-being | Increased demand for supplements & organic products | Danish consumers spent DKK 1.5 billion on health products in 2024 |

| Digital Convenience & Social Media | Strong omnichannel strategy & online engagement | Online sales DKK 1,029 million (FY 2023/24), 26.6% of revenue |

| Sustainability & Ethics | Focus on ESG and transparent sourcing | Targeting 50% reduction in scope 1 & 2 emissions by 2030 |

| Aging Population | Tailored product offerings for older demographics | Denmark's median age projected 42-43 by 2025 |

Technological factors

The rapid evolution of e-commerce and mobile commerce platforms presents a significant technological factor for Matas A/S. Matas has successfully leveraged these advancements, with online sales now contributing approximately 30% of its total revenue, a figure projected to remain strong into 2025. The pervasive use of smartphones for shopping necessitates a robust mobile-first strategy for their digital platforms. This ensures a seamless and intuitive customer experience, crucial for maintaining competitive advantage in the Danish retail market.

The retail sector increasingly leverages artificial intelligence and data analytics to enhance customer experiences and streamline operations. Matas, with its extensive Club Matas loyalty program boasting over 1.9 million members as of early 2025, effectively utilizes this data for personalized product recommendations and targeted marketing. This data-driven approach allows for highly relevant communications, improving customer engagement. Further integration of AI in logistics and inventory management could unlock new efficiencies, optimizing stock levels and supply chain responsiveness in 2024 and 2025.

Matas A/S significantly invested in automation, now operating two state-of-the-art logistics centers, including a new 2024 facility in Humlebæk. This strategic move supports their long-term growth and omnichannel strategy, aiming for a 20% increase in fulfillment capacity by 2025. The technology enables faster order fulfillment and more accurate inventory management, crucial for both online and physical store operations.

Innovations in Product Formulation and Packaging

Technological advancements are rapidly reshaping product formulation in cosmetics, leading to innovations like biotech ingredients and personalized solutions. Matas must integrate these cutting-edge formulations to remain competitive and meet evolving consumer demands for efficacy and natural ingredients, a market projected to grow significantly through 2025. Simultaneously, the industry is pushing for sustainable and smart packaging, with Matas targeting 100% recyclable packaging for its own brands by 2025.

- By 2025, the global clean beauty market is forecast to reach approximately $25 billion, driven by ingredient innovation.

- Matas aims for all its private label packaging to be recyclable by 2025, reflecting industry shifts.

- Consumer preference for sustainable packaging influenced 60% of beauty purchases in 2024.

Digital Payment Solutions

The high adoption of digital payment solutions like MobilePay, utilized by over 90% of Danish adults in 2024, is crucial for Matas. Integrating these options into both online platforms and physical stores provides a seamless and convenient checkout experience, aligning with modern consumer expectations. This strategic move supports the broader digitalization trend across the Danish retail sector, ensuring Matas remains competitive. Embracing these technologies enhances customer satisfaction and operational efficiency.

- MobilePay usage exceeds 90% among Danish adults in 2024.

- Seamless integration into Matas online and physical stores is essential.

- Supports the ongoing digitalization of the Danish retail economy.

- Enhances customer convenience and operational efficiency for Matas.

Matas capitalizes on e-commerce, with online sales projected to remain around 30% of total revenue by 2025. Extensive use of AI and data from Club Matas (1.9 million members by early 2025) drives personalized marketing. Automation in logistics, including a new 2024 facility, targets a 20% fulfillment capacity increase by 2025. Integration of digital payments like MobilePay, used by over 90% of Danish adults in 2024, enhances convenience.

| Technological Factor | Key Metric (2024/2025) | Impact |

|---|---|---|

| E-commerce & Mobile | ~30% online sales | Enhanced market reach & customer access |

| AI & Data Analytics | 1.9M Club Matas members | Personalized marketing & operational insights |

| Automation & Logistics | 20% fulfillment capacity increase | Improved efficiency & delivery speed |

| Product Innovation | $25B global clean beauty market | Meeting evolving consumer demands |

| Digital Payments | >90% Danish MobilePay usage | Seamless transactions & convenience |

Legal factors

Matas's operations are stringently governed by EU Regulation (EC) No 1223/2009, which dictates comprehensive rules for cosmetic product safety, ingredient restrictions, and clear labeling requirements. This framework also enforces a ban on animal testing for cosmetics sold within the EU market. In Denmark, the Danish Environmental Protection Agency (Miljøstyrelsen) actively oversees compliance, conducting ongoing market surveillance and enforcing these regulations to ensure consumer protection. Adherence to these strict legal provisions is crucial for Matas, impacting product development and supply chain management for its vast product range in 2024-2025.

The Danish Medicines Agency rigorously regulates the sale of specific over-the-counter medications, directly impacting Matas’s operations. This includes stringent requirements for marketing authorizations, which ensure product safety and efficacy, and mandatory pricing notifications to maintain market transparency. Furthermore, advertising for these pharmaceutical products faces significant restrictions, limiting how Matas can promote its 'MediCare' range. Matas must ensure its entire 'MediCare' segment, which accounted for approximately 15% of its revenue in fiscal year 2023/2024, adheres fully to these dynamic pharmaceutical laws to avoid penalties and maintain its operating license. Compliance costs are a continuous factor, with regulatory updates expected in 2025 influencing operational adjustments.

General consumer protection laws, notably Denmark's Marketing Practices Act (Markedsføringsloven), strictly govern Matas's advertising and sales practices in 2024. These regulations prohibit misleading claims, ensuring consumers receive accurate product information, especially regarding health and beauty benefits. Adherence to these principles is crucial for Matas to uphold its strong consumer trust and avoid significant fines, which can reach millions of DKK for serious breaches, impacting its 2025 financial outlook.

Data Protection Regulations (GDPR)

As a prominent retailer with a robust loyalty program and e-commerce platform, Matas A/S extensively collects and processes customer data, making it directly subject to the General Data Protection Regulation (GDPR). This mandates stringent procedures for personal data handling, prioritizing customer privacy and robust data security measures. Compliance is critical to avoid significant penalties and maintain trust. Non-compliance can lead to fines up to 4% of global annual turnover or €20 million, whichever is higher, impacting profitability and brand reputation in 2024 and 2025.

- Matas processes extensive customer data via its loyalty program and e-commerce.

- GDPR mandates strict data privacy and security protocols for Matas.

- Non-compliance risks fines up to 4% of global annual turnover or €20 million.

- Maintaining GDPR compliance is crucial for Matas's financial stability and brand image.

Competition Law

Matas A/S operates under strict Danish and EU competition laws, which prohibit anti-competitive agreements and the abuse of a dominant market position. A past case from 2011 involved the Danish Competition Council ruling against Matas for restricting online sales by its independent dealers, a decision upheld in 2012. This emphasizes the critical need for Matas to ensure its current practices, particularly its franchise-like agreements, are fair and do not restrict market competition. Non-compliance could result in substantial fines, potentially up to 10% of global turnover, impacting its 2024/2025 financial performance.

- Danish Competition Council: Prohibited Matas's restriction on online sales by independent dealers in 2011.

- EU Competition Law: Prohibits anti-competitive practices like price-fixing or market sharing.

- Potential Fines: Up to 10% of a company's global annual turnover for severe breaches.

- Current Focus: Ensuring franchise-like agreements comply with fair competition standards for 2024/2025 operations.

Matas's operations are heavily influenced by strict legal frameworks, including EU cosmetic regulations and Danish pharmaceutical laws, impacting its MediCare segment, which was 15% of FY2023/2024 revenue. Data privacy under GDPR remains critical, with potential fines up to 4% of global annual turnover for non-compliance in 2024. Competition laws also pose a risk, with fines up to 10% of global turnover possible for breaches in 2025.

| Legal Area | Key Impact | Potential Fine |

|---|---|---|

| Cosmetics Reg. | Product Compliance | N/A |

| Pharma Reg. | MediCare Sales | Operational |

| GDPR | Data Privacy | 4% Turnover |

| Competition Law | Market Practices | 10% Turnover |

Environmental factors

There is a significant regulatory and consumer-driven push towards more sustainable packaging and reduced plastic waste. New EU regulations on packaging materials, becoming effective from 2025, introduce stricter requirements for companies across the bloc. Matas is actively responding to these environmental pressures, aiming to utilize 50% recycled plastic in its own-brand packaging by 2025. This commitment helps minimize waste and aligns with growing consumer demand for greener products, impacting their supply chain and product development significantly.

Matas is actively addressing climate change, committing to decarbonization and the Science Based Targets initiative (SBTi) by 2025. The company aims to reduce its Scope 1 and 2 CO2 emissions by 50% by 2030, based on 2021 levels. Significant efforts focus on lowering energy consumption in stores and optimizing logistics operations to cut transport-related emissions. These initiatives underscore Matas broad ESG strategy, promoting sustainable retail practices across its value chain.

Consumers and regulators are increasingly concerned about the environmental and social impact of cosmetic ingredients. Matas is actively sourcing environmentally friendly materials and integrating sustainable practices across its supply chain. This commitment aligns with Matas' goal to champion health through safe, responsibly sourced products. By 2025, Matas aims for 100% sustainably certified palm oil and 50% certified private label products, reflecting their dedication to these standards.

Compliance with Environmental Regulations (e.g., CSRD)

Matas A/S faces increasing scrutiny regarding environmental impact, particularly with the Corporate Sustainability Reporting Directive (CSRD) effective for large companies from the 2024 financial year, with first reports due in 2025. This directive mandates comprehensive disclosure on environmental matters, including carbon emissions and resource usage, significantly expanding prior Non-Financial Reporting Directive (NFRD) requirements. Adherence is crucial not only for regulatory compliance but also for bolstering Matas's corporate social responsibility and reinforcing its brand reputation among increasingly eco-conscious consumers. Failure to comply could result in penalties and reputational damage.

- Matas, as a large EU-listed entity, must comply with CSRD for its 2024 financial year reporting, due in 2025.

- The CSRD requires detailed disclosures on environmental metrics, including Scope 1, 2, and 3 emissions.

- Enhanced transparency aligns with Matas's commitment to sustainability and strengthens consumer trust.

- Compliance ensures access to capital from ESG-focused investors and mitigates regulatory risks.

Promotion of Environmentally Friendly Consumer Choices

Matas has a significant opportunity to guide consumer behavior toward more sustainable choices, leveraging its market position. This includes actively promoting online shopping, which can reduce the environmental footprint per transaction compared to traditional retail. By expanding its assortment of certified sustainable brands, Matas directly caters to the growing segment of eco-conscious consumers, enhancing its brand reputation and market share. This strategy aligns with consumer trends prioritizing environmental responsibility.

- Matas reported a 7.1% online sales growth in 2024/25, indicating a shift towards lower-impact shopping channels.

- The company aims to increase its share of eco-certified products, reflecting consumer demand for sustainable options.

- Enhancing brand reputation through environmental stewardship can attract up to 60% of consumers who prefer sustainable brands.

Matas navigates stringent EU environmental regulations, including CSRD for its 2024 financial year and new packaging rules effective 2025. The company commits to decarbonization, aiming for a 50% reduction in Scope 1 and 2 CO2 emissions by 2030 from 2021 levels. Matas also targets 100% sustainably certified palm oil and 50% certified private label products by 2025, meeting rising consumer demand for eco-friendly options, reflected in 7.1% online sales growth in 2024/25.

| Metric | Target | Timeline |

|---|---|---|

| Recycled Plastic in Packaging | 50% | By 2025 |

| Scope 1 & 2 CO2 Emissions Reduction | 50% | By 2030 (from 2021) |

| Sustainably Certified Palm Oil | 100% | By 2025 |

| Certified Private Label Products | 50% | By 2025 |

| Online Sales Growth | 7.1% | 2024/25 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Matas A/S is grounded in a comprehensive review of official Danish and EU government publications, economic data from reputable institutions like Statistics Denmark and Eurostat, and industry-specific reports from leading market research firms. This ensures all insights into political, economic, social, technological, legal, and environmental factors are fact-based and current.