Matas A/S Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Matas A/S Bundle

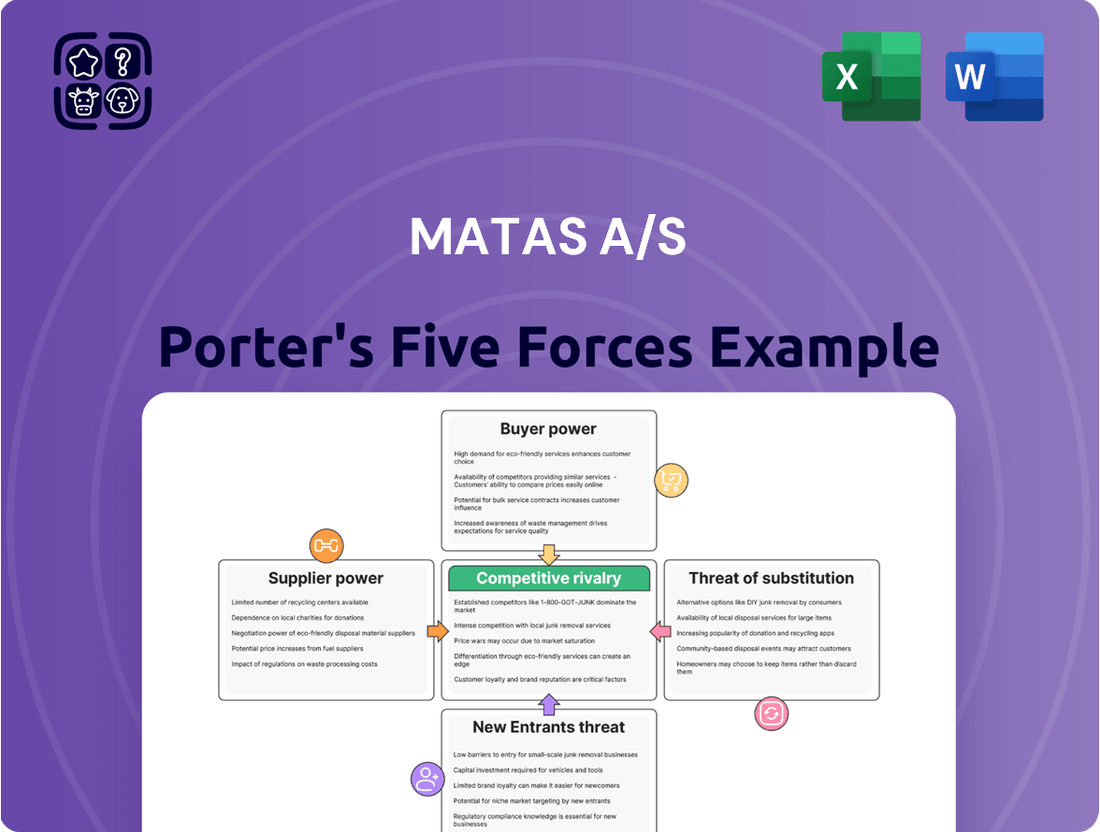

Matas A/S navigates a competitive landscape shaped by several key forces. Understanding these dynamics is crucial for any stakeholder. The bargaining power of buyers, for instance, can influence pricing and product offerings.

Similarly, the threat of new entrants and the intensity of rivalry among existing players significantly impact market profitability. Suppliers also wield influence, affecting the cost of raw materials and operational inputs.

The availability of substitute products presents another challenge, potentially diverting customers from Matas' core offerings. These forces collectively define the attractiveness and competitive intensity of the beauty and health retail sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Matas A/S’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The health and beauty retail sector often sees a concentrated market with powerful international brands. Matas A/S, despite being a leading Nordic retailer, relies heavily on a limited number of these key suppliers for a significant portion of its product range, including popular beauty brands. This dependence grants these suppliers considerable leverage in negotiations. For instance, in 2024, suppliers could demand specific pricing, product exclusivity, or extensive promotional support, impacting Matas's margins and inventory. This dynamic highlights a notable bargaining power for these crucial brand partners.

Many customers exhibit strong loyalty to prominent beauty and personal care brands, driving demand for these specific products. This brand allegiance compels Matas A/S to consistently stock popular items to attract and retain its customer base. For instance, in 2024, maintaining a diverse portfolio of sought-after brands remains crucial for retailers. An inability to offer these key brands could easily steer customers towards competing retailers, thereby enhancing the bargaining power of these major brand suppliers over Matas.

The global beauty industry has seen significant consolidation, with large conglomerates like L'Oréal and Estée Lauder owning a vast portfolio of major brands. This concentration means Matas has fewer alternative suppliers for many key product categories. For instance, in 2024, a few dominant players control a substantial share of the cosmetics and personal care market. This gives these remaining large suppliers increased bargaining power over pricing, delivery terms, and product availability for retailers like Matas A/S.

Potential for direct-to-consumer sales by suppliers

Many beauty and cosmetic brands are increasingly establishing their own direct-to-consumer (D2C) sales channels, both online and through brand-owned physical stores. This growing trend significantly reduces their reliance on traditional retailers such as Matas, thereby enhancing their bargaining leverage. Suppliers can credibly threaten to bypass retailers or offer exclusive product lines solely through their own D2C platforms. For instance, the global D2C beauty market continues its robust expansion, with projections indicating strong growth through 2024 and beyond.

- Global D2C e-commerce sales are expected to exceed $200 billion in 2024.

- Major beauty brands report over 20% of their sales coming from D2C channels in 2024.

- Exclusive D2C product launches can divert significant customer traffic from retailers.

- Suppliers gain greater control over pricing and customer data through D2C models.

Matas's own brands as a counter-balance

Matas significantly mitigates supplier power by actively developing and promoting its robust portfolio of own private-label brands, including the well-known Matas Striber and Matas Natur series. These in-house brands provide customers with compelling alternatives to national brands, enhancing loyalty directly to Matas. For instance, Matas's own brands accounted for 30.6% of total sales in Q1 2024, demonstrating their significant market presence. This strategic focus reduces the negotiating leverage of external suppliers, granting Matas greater control over its product mix and pricing strategies, ultimately strengthening its market position.

- Matas own brands represented 30.6% of sales in Q1 2024.

- Private labels like Matas Striber increase customer loyalty.

- These brands reduce reliance on external suppliers' pricing.

- Matas gains enhanced control over its product assortment.

Suppliers hold notable power over Matas due to brand loyalty and market consolidation, compelling Matas to stock popular items. Many major beauty brands also bolster their leverage via growing direct-to-consumer (D2C) channels, reducing reliance on retailers. Matas counters this by significantly expanding its own private-label brands, which represented 30.6% of sales in Q1 2024. This strategy enhances Matas's control over pricing and product mix, reducing external supplier influence.

| Supplier Power Driver | Impact on Matas | 2024 Data/Trend |

|---|---|---|

| Brand Loyalty | Must stock key brands | Maintains customer base |

| Market Consolidation | Fewer alternative suppliers | Dominant players control market share |

| D2C Channels | Reduced supplier reliance on Matas | Global D2C sales over $200B |

| Matas Private Labels | Mitigates supplier power | 30.6% of sales in Q1 2024 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks for Matas A/S, highlighting the intensity of rivalry and the bargaining power of both suppliers and buyers within the beauty and health sector.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Matas A/S.

Customers Bargaining Power

Customers in the Danish health and beauty market possess significant bargaining power due to the high availability of alternatives. Matas faces robust competition from various channels, including specialized beauty retailers like Normal and Sephora, alongside supermarkets such as Salling Group's Føtex and Coop's SuperBrugsen, which have expanded their beauty offerings. The rapidly growing online segment further intensifies this pressure, with e-commerce accounting for a substantial share of retail sales in Denmark, projected to continue its upward trend into 2024. This extensive choice allows consumers to easily switch if Matas' prices, product range, or service do not meet their expectations.

Danish consumers, despite periods of lower inflation and rising real incomes, remain notably price-sensitive, particularly for everyday personal care items. With Denmark's CPI inflation at 0.8% in May 2024, consumers are empowered to seek value. The ease of comparing prices online further amplifies this power, as 87% of Danish households used e-commerce in 2023, readily finding better deals. This strong consumer awareness of pricing compels Matas to maintain highly competitive pricing strategies across its product range.

For most beauty and health products sold by Matas, customers face minimal costs or inconveniences when choosing a different retailer. This ease of transition significantly strengthens the bargaining power of customers, as they can readily opt for competitors. While programs like Club Matas, which boasted over 1.8 million members as of early 2024, aim to foster retention, the core cost of switching remains inherently low. This low barrier means Matas must continuously compete on price, selection, and service to prevent customer churn, enhancing buyer influence.

Access to information and product reviews

The internet empowers Matas A/S customers with vast information, including product reviews, ingredient analyses, and real-time price comparisons. This transparency, critical in 2024, enables more informed purchasing decisions and reduces reliance on in-store recommendations. With this power, customers demand higher quality and better value across beauty and health products.

- Online reviews influence over 70% of Danish consumers' purchasing decisions.

- Matas's e-commerce sales reached DKK 1,326 million in the first nine months of the 2023/24 financial year, reflecting digital customer engagement.

- Price comparison sites are increasingly utilized for health and beauty products, intensifying competitive pressure.

- Social media platforms amplify customer voices, making product satisfaction and dissatisfaction widely visible.

Importance of customer loyalty programs

Matas A/S effectively mitigates the bargaining power of customers through its robust loyalty program, Club Matas. As of 2024, this program boasts over 6 million members across the Nordics, representing a significant portion of its customer base. Club Matas delivers personalized offers and rewards, creating a tailored shopping experience that enhances customer satisfaction and retention. This strong relationship building increases loyalty, reducing the propensity for customers to switch to competing beauty and health retailers.

- Club Matas has over 6 million members in the Nordics as of 2024.

- Personalized deals and rewards reduce customer price sensitivity.

- Increased loyalty minimizes customer churn to competitors.

Matas customers wield significant bargaining power due to abundant alternatives and low switching costs in 2024's competitive market. Danish consumers, highly price-sensitive with May 2024 CPI inflation at 0.8%, leverage digital tools for price comparisons. While online reviews influence over 70% of Danish purchasing decisions, Matas mitigates this with Club Matas, boasting over 6 million Nordic members in 2024, fostering loyalty.

| Factor | Metric | 2024 Data |

|---|---|---|

| Alternatives | Online Retail Growth | Upward Trend |

| Price Sensitivity | Danish CPI Inflation | 0.8% (May 2024) |

| Loyalty Mitigation | Club Matas Members | 6M+ (Nordics) |

Preview the Actual Deliverable

Matas A/S Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It meticulously details Matas A/S's Porter's Five Forces Analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive report provides actionable insights into the competitive landscape affecting Matas A/S's strategic positioning.

Rivalry Among Competitors

Matas faces significant competitive pressure from specialized beauty retailers like Sephora and Rituals in Denmark, alongside Nordic online players such as Nicehair.dk and Luxplus.dk. These rivals target similar customer segments with comparable product ranges. Matas's acquisition of KICKS in 2024 expanded its Nordic footprint, placing it in direct competition with KICKS' existing rivals across Sweden, Norway, and Finland. This intensified rivalry demands continuous innovation and market adaptation.

Supermarkets and hypermarkets are increasingly expanding their beauty and personal care sections, often offering lower prices on everyday items; for instance, major chains continue to invest heavily in these categories in 2024. Pharmacies also represent a significant channel for dermo-cosmetic and healthcare-related products, leveraging consumer trust. This creates a broad competitive landscape where Matas must differentiate itself. Matas counters this by emphasizing its specialized product range, certified expertise, and loyalty programs, which had over 1.7 million members in early 2024.

The e-commerce market for beauty and personal care in Denmark presents intense competitive rivalry, with both domestic and international online retailers actively vying for market share. Pure-play online retailers often benefit from lower overhead costs, enabling them to pursue very aggressive pricing strategies. For instance, the Danish online beauty market saw continued growth into 2024, intensifying this pressure. Matas has responded by investing significantly in its own robust e-commerce platform to effectively compete in this dynamic digital landscape.

Expansion of international players

The expansion of international retail giants and online marketplaces significantly intensifies competitive rivalry for Matas A/S. Companies like Amazon and Zalando are actively growing their beauty and personal care offerings within the Nordic markets, directly challenging Matas's established position. Their substantial resources, global brand recognition, and sophisticated logistical networks, including rapid delivery options, pose a formidable threat. This competitive pressure is particularly acute as these players can leverage economies of scale and broader product assortments.

- Amazon's 2024 market penetration in Nordic e-commerce continues to grow, impacting local retailers.

- Zalando, with its strong fashion and beauty presence, reported a 2023 revenue of €10.1 billion, indicating vast resources for market expansion.

- International online players offer a wider product range, often at competitive prices, challenging Matas's pricing strategy.

- Matas A/S reported a net revenue of DKK 4,606 million for the financial year 2023/24, reflecting its current market standing against larger international rivals.

Private label and exclusive brands as a differentiator

To mitigate intense competitive rivalry, Matas strategically emphasizes its private label offerings and secures exclusive rights for specific third-party brands. This approach creates a distinct product portfolio that competitors find difficult to replicate, fostering significant customer loyalty as Matas becomes the sole provider of these desired items. By the first half of the 2023/24 financial year, Matas's own brands and exclusive products contributed significantly to their sales.

- Matas's private label and exclusive brands accounted for 30.0% of total revenue in the first half of the 2023/24 financial year.

- This segment saw a revenue increase of 9.2% in H1 2023/24 compared to the previous year.

- The share of own brands and exclusive products in total sales is targeted to reach 35% by 2027.

Matas faces intense competitive rivalry from diverse players, including specialized beauty chains, mass-market retailers, and aggressive online pure-plays. The 2024 acquisition of KICKS significantly expanded its Nordic competition, while international giants like Amazon and Zalando continue their Nordic market penetration. Matas counters this by leveraging its 1.7 million loyalty members and its growing private label offerings, which contributed 30.0% of revenue in H1 2023/24.

| Rivalry Factor | Key Competitors | 2024/Recent Data |

|---|---|---|

| Specialized Retail | Sephora, Rituals | Matas's KICKS acquisition (2024) expands direct Nordic competition. |

| Mass Market | Supermarkets, Pharmacies | Major chains investing heavily in beauty categories (2024). |

| Online | Nicehair.dk, Luxplus.dk, Amazon, Zalando | Danish online beauty market growth (2024); Amazon's growing Nordic penetration. |

SSubstitutes Threaten

Customers can easily find lower-priced alternatives for many basic personal care items in supermarkets, discount stores, and online platforms. For instance, consumers can opt for private-label brands at stores like Rema 1000 or Netto, which offer significant savings compared to Matas's premium offerings. While these substitutes may differ in perceived quality or brand prestige, they fulfill the same fundamental personal care needs, making them a viable choice for many. This threat is particularly salient for price-sensitive consumer segments, influencing purchasing decisions and potentially impacting Matas's market share, especially as inflation impacts household budgets in 2024.

The growing trend towards DIY beauty treatments and natural, homemade remedies poses a subtle threat as consumers increasingly seek clean ingredients. While this remains a niche market, the shift towards natural alternatives can lead to substitution for some commercially produced products. Matas has proactively responded to this by launching its own Matas Natur product line. This strategic move aligns with market trends, as the global natural and organic beauty market is projected to reach approximately $27 billion in 2024, demonstrating significant consumer interest.

Customers often choose professional salon services for specialized needs like advanced skincare treatments or complex hair coloring, directly substituting Matas' at-home retail products. These services, such as a salon hair color costing DKK 900-1500, offer a different value proposition compared to a DKK 150-300 home dye kit from Matas. While salons compete by offering services, they also sell professional-grade products, potentially becoming a partner channel for Matas, especially as the professional beauty market continues to grow, with Danish salon revenues showing resilience in 2024.

Subscription box services

Beauty subscription box services pose a notable threat of substitution, offering consumers a curated selection of products delivered regularly, which directly competes with traditional retail. These discovery-oriented platforms appeal to individuals seeking new brands and personalized experiences, a trend Matas A/S has recognized. In response, Matas partnered with Reepay to launch its own subscription offerings, aiming to capture a share of this growing market segment. This strategic move, vital in 2024, helps Matas mitigate the risk from pure-play subscription competitors.

- The global beauty subscription box market was valued at approximately $4.3 billion in 2023.

- Matas's own subscription service, launched through Reepay, targets Danish consumers.

- Subscription models offer convenience and product discovery, key differentiators for consumers.

- Consumer spending on subscription services continues to show resilience in 2024, despite economic fluctuations.

Health and wellness services

The increasing consumer focus on health and wellness presents a significant substitute threat to Matas, as many now view internal well-being, like diet and exercise, as the primary path to beauty, rather than solely relying on topical cosmetics. This shift means consumers might opt for nutritional supplements or health foods over traditional beauty products. Matas strategically counters this by expanding its 'Vital Shop' segment, which in fiscal year 2023/24 saw strong performance, reflecting its commitment to offering a wide range of vitamins, supplements, and health-conscious products. This diversification helps Matas capture a broader share of the wellness market, directly addressing the substitute threat by becoming a holistic health and beauty destination.

- Matas's 'Vital Shop' segment offers vitamins, supplements, and health foods.

- The growing emphasis on internal health (diet, exercise) acts as a substitute for external beauty products.

- This consumer trend represents a shift in how beauty is perceived and achieved.

- Matas's strategic expansion into wellness products helps mitigate this substitute threat.

Matas faces significant substitution threats from lower-priced general retailers and private labels, as consumers prioritize value. The shift towards natural beauty and internal wellness also encourages alternatives like DIY remedies and health supplements. Furthermore, specialized salon services and the rise of beauty subscription boxes offer distinct value propositions, compelling Matas to innovate and diversify its offerings in 2024.

| Substitute Type | Key Driver | Market Context (2024) |

|---|---|---|

| Discount Retailers | Price Sensitivity | Inflation impacts household budgets |

| Natural/DIY Beauty | Wellness Focus | Global market ~ $27 billion |

| Subscription Boxes | Convenience/Discovery | Global market ~ $4.3 billion (2023) |

Entrants Threaten

The Danish health and beauty retail market is significantly shaped by established players, with Matas A/S holding a dominant position and strong brand recognition. A new entrant would face substantial hurdles in building brand awareness and customer loyalty against these entrenched incumbents. For instance, Matas reported net revenue of DKK 4,775 million for the financial year 2023/24, highlighting its scale. This requires considerable investment in marketing and brand-building efforts, making market penetration very challenging for newcomers.

Established retailers like Matas A/S benefit significantly from economies of scale in purchasing, marketing, and distribution. Their substantial market presence, evidenced by Matas reporting net revenue of DKK 4,778.6 million in the first nine months of the 2023/24 financial year, allows them to negotiate superior terms with suppliers. This bulk buying power translates into lower per-unit costs, enabling them to offer competitive pricing to consumers, a crucial factor in the Danish health and beauty market. A new entrant would struggle to match these efficiencies, facing higher initial costs for inventory and logistics. Consequently, achieving profitability and market penetration becomes a much steeper challenge for any potential competitor.

Matas A/S significantly deters new entrants through its extensive retail footprint, boasting 260 physical stores across Denmark as of late 2023, coupled with a robust online platform and advanced logistics.

Establishing a comparable network of prime retail locations and constructing an efficient supply chain from scratch presents an immense capital and operational hurdle for any newcomer.

Matas's strategic investment in a new, state-of-the-art logistics center further solidifies this competitive advantage, making it exceedingly difficult for potential rivals to match their distribution capabilities.

Strong supplier relationships of incumbents

Matas A/S benefits significantly from its strong, established relationships with key suppliers, a formidable barrier for potential new entrants. These long-standing ties often result in preferential treatment for Matas, including exclusive access to popular beauty and health brands, crucial in a market valuing brand availability. For instance, Matas reported a 2.6% increase in like-for-like sales for Q3 2023/24, showcasing customer loyalty partly driven by its product range. A newcomer would struggle to secure similar favorable payment terms or inventory access, hindering their competitive edge in 2024.

- Matas's extensive supplier network, cultivated over decades, provides a significant competitive advantage.

- New entrants face challenges in securing popular or exclusive product lines due to incumbents' existing agreements.

- The Danish health and beauty market, valued at approximately DKK 17.5 billion in 2024, prioritizes brand access.

- Preferential terms, like extended payment cycles, further disadvantage new market participants.

Increasing importance of omnichannel capabilities

The increasing importance of omnichannel capabilities represents a significant barrier for new entrants in the retail beauty and health sector. Modern retail demands a seamless integration of physical stores with robust online platforms, a complex undertaking that Matas A/S has heavily invested in. Developing and managing a truly effective omnichannel strategy requires substantial capital expenditure in advanced technology, sophisticated logistics networks, and specialized digital expertise. This high cost of entry and operational complexity, evidenced by the rising investment in digital transformation across retail in 2024, significantly deters potential new competitors from easily challenging established players like Matas.

- Matas reported an online sales share of 28.5% in Q3 2023/24, highlighting their established digital presence.

- Their recent acquisition of Skincity in 2022 further solidified their online reach and expertise.

- Retailers globally are expected to invest over $300 billion in digital transformation by 2025, with omnichannel being a key driver.

- Building a competitive logistics infrastructure for same-day or next-day delivery, crucial for omnichannel, can cost millions.

New entrants face substantial barriers in the Danish health and beauty market, primarily due to Matas A/S's dominant brand, extensive retail footprint of 260 stores, and robust omnichannel capabilities. The high capital investment required for market penetration, coupled with Matas's economies of scale and strong supplier relationships, makes it exceedingly difficult for new players to compete effectively. Matching Matas's established infrastructure and market share, especially with the Danish health and beauty market valued at approximately DKK 17.5 billion in 2024, presents an immense challenge.

| Barrier Type | Matas's Advantage | New Entrant Challenge |

|---|---|---|

| Brand & Scale | DKK 4,775M net revenue (FY23/24) | High marketing investment |

| Distribution | 260 physical stores, advanced logistics | Building comparable network |

| Omnichannel | 28.5% online sales share (Q3 23/24) | Significant tech investment |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Matas A/S is built upon a robust foundation of data, drawing from the company's annual reports and investor presentations, alongside market research reports from firms like Statista and Euromonitor.

We also incorporate insights from industry publications, competitor websites, and relevant regulatory filings to provide a comprehensive understanding of the competitive landscape.