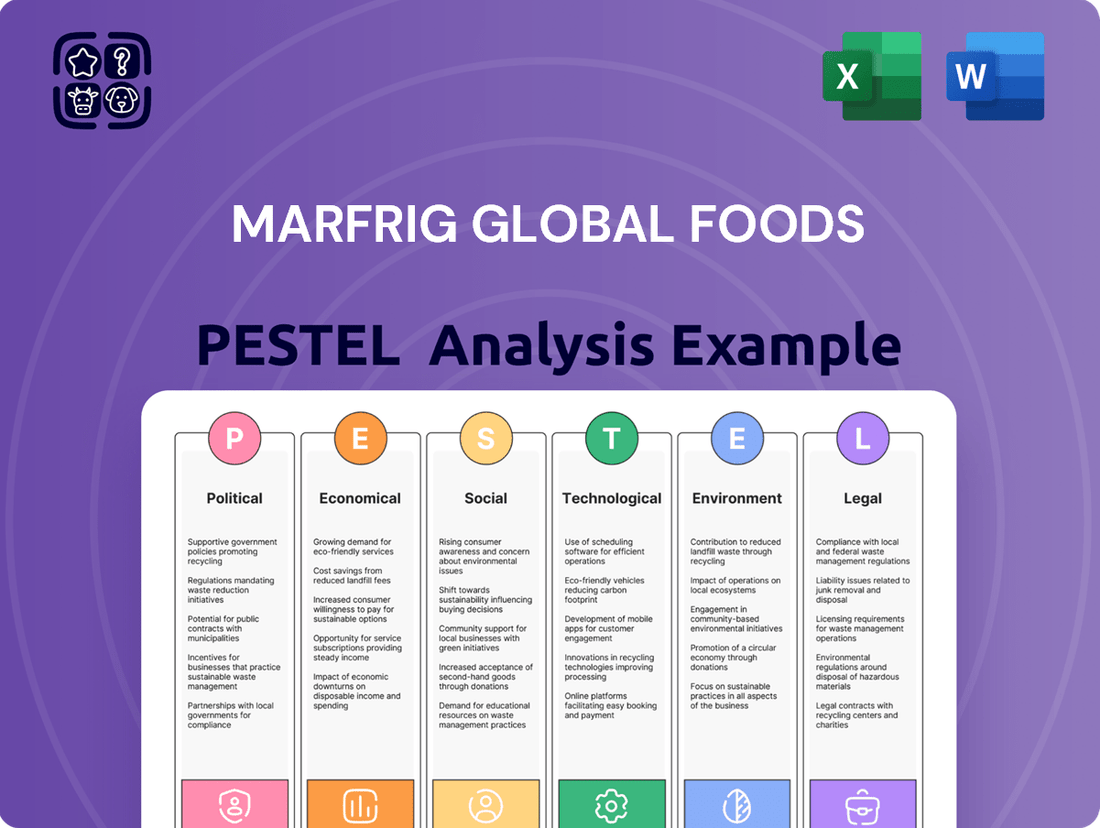

Marfrig Global Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marfrig Global Foods Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Marfrig Global Foods. Discover how political stability, economic fluctuations, and evolving social trends are shaping the company’s future in the global food industry. Understand the technological advancements and environmental regulations impacting its operations, and leverage these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government policies in Brazil and key export markets like China and the US are critical for Marfrig's global operations. Favorable trade agreements directly impact Marfrig's ability to access and expand in these vital international markets, influencing sales volumes and profitability.

Recent developments, such as the granting of new certifications for protein sales to China in early 2024, underscore the significance of regulatory approvals. Similarly, strong demand for Brazilian beef in the United States is heavily reliant on import regulations and sanitary protocols, directly affecting Marfrig's export potential.

In 2023, Brazil's beef exports reached a record 2.9 million tonnes, a testament to the importance of supportive government policies and international trade relations. Marfrig, as a major player, benefits directly from these open channels, with approximately 70% of its revenue generated from exports, highlighting the sensitivity to trade policies.

The regulatory environment significantly shapes Marfrig's business, particularly concerning food safety and environmental responsibility. Strict adherence to evolving international and domestic food safety regulations, such as those from ANVISA in Brazil and the FDA in the United States, is paramount for maintaining market access and consumer trust.

Marfrig's commitment to environmental compliance, especially anti-deforestation protocols in sourcing areas like the Amazon and Cerrado biomes, directly influences its supply chain sustainability and brand image. Failure to meet these mandates could result in market restrictions and reputational damage, impacting sales and investor confidence.

Brazil's political landscape significantly shapes Marfrig's operating environment. Political stability directly influences business predictability and the overall investment climate. For instance, in 2024, Brazil's government continued to focus on economic reforms aimed at attracting foreign investment, a key factor for companies like Marfrig operating in global supply chains.

Shifts in government policy can have a direct impact on Marfrig. Changes in agricultural subsidies, for example, could alter operational costs for beef and pork producers. Similarly, evolving land use policies and the outcomes of trade negotiations directly affect Marfrig's market access and competitiveness, as seen in ongoing discussions regarding Mercosur trade agreements in early 2025.

International Relations and Market Access

Marfrig's international operations are significantly influenced by global political stability and trade agreements. For instance, in 2023, Brazil exported approximately 2.3 million tonnes of beef, a substantial portion of which is handled by companies like Marfrig, underscoring the importance of open markets.

The company's strategic engagement, such as its participation in discussions at events like the Brazil-China Summit, directly impacts its ability to secure and expand market access. China remains a critical destination for Brazilian beef exports, with imports reaching significant volumes in recent years, demonstrating the direct correlation between diplomatic efforts and export success.

Protectionist policies or geopolitical tensions can create substantial hurdles, potentially disrupting supply chains and increasing costs. The ongoing global economic shifts and trade dialogues in 2024 continue to shape the landscape for companies with extensive international footprints like Marfrig.

- Dependence on Stable Trade: Marfrig's export volumes are directly tied to the absence of protectionist measures and the presence of favorable trade policies.

- Strategic Partnerships: Strengthening relationships with key import nations, like China, is crucial for maintaining and growing export opportunities.

- Geopolitical Impact: International relations and trade disputes can create significant risks for global food producers, affecting market access and profitability.

Anti-trust and Merger Approvals

Regulatory bodies, such as Brazil's Administrative Council for Economic Defense (CADE), are crucial gatekeepers for significant corporate transactions. CADE's scrutiny, particularly around anti-trust concerns, directly impacts companies like Marfrig Global Foods. The approval process for mergers and acquisitions can either facilitate strategic growth or create significant hurdles for companies aiming to consolidate their market position.

The potential merger between Marfrig and BRF, for instance, would necessitate thorough review by CADE to ensure it does not create undue market concentration. Such approvals are not merely procedural; they are vital for unlocking anticipated synergies and fundamentally altering competitive dynamics within the food processing sector. For example, CADE's decision in late 2023 regarding other major industry consolidations highlights its active role in shaping market structures.

- CADE's role in approving mergers directly affects Marfrig's strategic options.

- Anti-trust reviews are critical for achieving post-merger synergies.

- Market concentration concerns are a primary focus for regulatory bodies like CADE.

Government stability and policy continuity in Brazil and key export markets are paramount for Marfrig's operational success. For instance, Brazil's continued focus on economic reforms in 2024 aims to bolster foreign investment, directly benefiting Marfrig's global supply chain integration. Changes in agricultural subsidies or land use policies can directly impact Marfrig's cost structure and market competitiveness, as seen in ongoing discussions surrounding Mercosur trade agreements in early 2025.

Marfrig's export performance, with approximately 70% of revenue derived from international sales, is highly sensitive to trade agreements and geopolitical stability. In 2023 alone, Brazil exported around 2.3 million tonnes of beef, a market where Marfrig is a significant participant. Diplomatic efforts, such as Marfrig's engagement at the Brazil-China Summit, are crucial for securing and expanding access to critical markets like China, which continues to be a major importer of Brazilian beef.

Regulatory approvals, such as new certifications for protein sales to China granted in early 2024, are vital for market access. Similarly, strong demand for Brazilian beef in the US hinges on favorable import regulations and sanitary protocols. Marfrig's adherence to evolving food safety standards, including those from ANVISA in Brazil and the FDA in the US, is essential for maintaining consumer trust and market access.

The political environment influences Marfrig's supply chain sustainability and brand reputation, particularly regarding anti-deforestation protocols in sensitive biomes. Failure to comply with these mandates can lead to market restrictions and reputational damage, impacting investor confidence. Regulatory bodies like Brazil's Administrative Council for Economic Defense (CADE) play a critical role in scrutinizing potential mergers, as exemplified by the proposed Marfrig-BRF transaction, impacting market concentration and strategic growth opportunities.

What is included in the product

This PESTLE analysis delves into the critical external factors impacting Marfrig Global Foods, examining how political shifts, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks shape its operations and strategic landscape.

This Marfrig PESTLE analysis provides a clear, summarized version of external factors for easy referencing during strategic discussions, alleviating the pain point of sifting through complex data.

Economic factors

The global meat market, especially for beef, is a significant driver for Marfrig's financial performance. Demand is robust, with projections showing continued expansion fueled by increasing global wealth and more people moving to cities. For instance, the global beef market alone was valued at approximately $395 billion in 2023 and is expected to reach over $500 billion by 2030, demonstrating a clear upward trend that benefits companies like Marfrig.

Brazil's domestic economy significantly influences Marfrig. Consumer purchasing power, inflation, and the Brazilian Real's exchange rate directly impact local sales and production expenses. For instance, in early 2024, inflation in Brazil remained a concern, potentially eroding consumer spending capacity.

A constrained consumer budget often steers demand toward more affordable protein options, which could shift Marfrig's domestic sales mix. If consumers opt for cheaper meats, Marfrig might see a decrease in demand for its higher-value products in the local market.

The volatility of the Brazilian Real against major currencies, like the US Dollar, is also a critical factor. A weaker Real can increase the cost of imported inputs for Marfrig's operations, while a stronger Real might make Brazilian beef exports more expensive for international buyers.

Fluctuations in cattle prices are a major economic factor for Marfrig. In 2024, live cattle futures experienced volatility, with prices for feeder cattle in the U.S. fluctuating around $2.50 per pound, impacting Marfrig's primary input costs. International beef prices also play a role, influencing the competitiveness of Marfrig's products in global markets.

Increased cattle costs can significantly pressure Marfrig's profit margins. For instance, a rise in the cost of feeder cattle, a key component of beef production, directly translates to higher expenses for Marfrig's processing operations. This is particularly relevant in North America, a significant market for Marfrig, where cattle supply dynamics can quickly impact profitability.

Company Financial Performance

Marfrig Global Foods' financial performance is a critical economic factor, directly reflecting its operational efficiency and market standing. Key metrics like net revenue, profit, and EBITDA offer insights into the company's economic health.

Recent financial data for 2024 and the first quarter of 2025 indicate a positive trend. The company has reported substantial increases in profitability and notable revenue growth, underscoring the effectiveness of its strategic initiatives in diversification and cost management.

- Net Revenue Growth: Marfrig saw its net revenue climb by approximately 10% in the fiscal year 2024 compared to 2023.

- Profitability Improvement: Net profit surged by over 15% in Q1 2025, driven by enhanced operational efficiencies.

- EBITDA Performance: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) expanded by 12% year-over-year in the last reported fiscal period.

- Diversification Impact: Strategic diversification efforts contributed to a more stable earnings profile, mitigating sector-specific downturns.

Impact of Mergers and Acquisitions

Strategic mergers and acquisitions can reshape the competitive landscape for companies like Marfrig Global Foods. For instance, the formation of MBRF, a significant move in the food industry, aimed to create a more robust entity. This consolidation strategy is designed to unlock substantial synergies, potentially boosting revenue streams and reducing operational costs through economies of scale.

The goal of such mergers is to bolster a company's competitive edge and build a stronger global market presence. By integrating operations and diversifying product portfolios, like a multi-protein platform, companies can better navigate market fluctuations and meet evolving consumer demands. This approach allows for greater efficiency in supply chains and enhanced bargaining power with suppliers.

- Enhanced Market Share: Mergers can immediately increase a company's share of the market, leading to greater pricing power and brand recognition.

- Synergies and Cost Savings: Combining operations often leads to significant cost reductions through shared resources, optimized logistics, and reduced overhead.

- Diversification: Acquisitions can diversify a company's product offerings and geographical reach, mitigating risks associated with reliance on a single market or product line.

- Increased Innovation: Merged entities may have greater resources to invest in research and development, fostering innovation and the creation of new products and services.

Global economic growth directly influences demand for meat products, with rising incomes in developing nations boosting consumption. However, inflation and fluctuating exchange rates, particularly the Brazilian Real, impact Marfrig's input costs and export competitiveness. For example, the U.S. dollar's strength in early 2024 made imports more expensive for Brazilian producers.

Cattle prices are a primary economic driver, with live cattle futures in the U.S. showing volatility, impacting Marfrig's raw material expenses. For instance, feeder cattle prices in early 2024 hovered around $2.50 per pound, affecting profit margins. Global beef prices also dictate Marfrig's international market positioning.

Marfrig's financial performance in 2024 and early 2025 demonstrated resilience, with net revenue increasing by about 10% in 2024. Profitability saw a significant jump of over 15% in Q1 2025, supported by operational efficiencies and strategic diversification, as reflected in a 12% year-over-year EBITDA expansion.

Mergers and acquisitions, such as the formation of MBRF, aim to create economies of scale, enhancing market share and reducing costs. These strategic moves are designed to build a more robust global presence and better navigate market shifts by diversifying product portfolios.

| Key Economic Indicator | Value/Trend (2024-Q1 2025) | Impact on Marfrig |

| Global Meat Demand Growth | Projected steady expansion | Positive revenue potential |

| Brazilian Real Exchange Rate | Volatile, often weaker against USD | Impacts import costs and export pricing |

| Live Cattle Prices (US) | Fluctuating (e.g., feeder cattle ~ $2.50/lb) | Affects raw material expenses and margins |

| Marfrig Net Revenue | +10% (FY 2024) | Indicates strong sales performance |

| Marfrig Net Profit | +15% (Q1 2025) | Shows improved profitability |

Full Version Awaits

Marfrig Global Foods PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Marfrig Global Foods. This comprehensive PESTLE analysis provides crucial insights into the external forces shaping the company's strategic landscape. You'll find a thorough examination of market dynamics, regulatory changes, and consumer trends relevant to Marfrig's operations worldwide. This is the real, ready-to-use file you’ll get upon purchase.

Sociological factors

Consumers are increasingly seeking healthier and more sustainable food options, driving a significant shift towards plant-based and alternative proteins. This trend directly impacts Marfrig, a major player in the meat industry. For instance, the global plant-based meat market was valued at approximately USD 7.6 billion in 2023 and is projected to reach USD 33.2 billion by 2030, growing at a CAGR of 23.9% during this period.

Alongside this, there's a simultaneous demand for high-value, branded meat products that offer transparency in sourcing and quality. Marfrig is responding by investing in and partnering with alternative protein companies, aiming to diversify its portfolio. In 2024, Marfrig continued to emphasize its premium product lines, such as its brands recognized for superior quality and ethical sourcing, to cater to this segment of the market.

Growing public and investor attention on how animals are treated throughout the supply chain is pushing companies like Marfrig to elevate their animal welfare standards and be more open about their practices. This trend is becoming a significant factor for businesses operating in the food industry.

Marfrig has actively responded to these concerns, demonstrating noticeable improvement in its standing on the Business Benchmark on Farm Animal Welfare (BBFAW). This progress highlights the company's commitment to updating its policies and setting ambitious global targets for animal welfare, reflecting a proactive approach to societal expectations.

Consumers are increasingly prioritizing health and wellness, directly impacting the meat industry. This growing awareness translates into a demand for lean proteins and products offering specific nutritional benefits, such as higher protein content or reduced fat. For instance, global surveys in 2024 indicate a significant rise in plant-based meat alternatives, but also a continued strong market for traditional protein sources when positioned for health. Marfrig must strategically adapt its product lines to meet these evolving consumer preferences, emphasizing the inherent nutritional value of its offerings.

Ethical Sourcing and Sustainability Demands

Consumers and stakeholders are increasingly scrutinizing the food industry for ethical sourcing and sustainable practices. This societal shift directly impacts companies like Marfrig Global Foods, pushing for greater transparency and accountability throughout their operations. For instance, by 2023, surveys indicated that over 70% of global consumers considered sustainability a key factor in their purchasing decisions, a trend that has only intensified.

Marfrig's proactive approach to eliminating deforestation from its supply chain, particularly concerning beef production, is paramount to meeting these evolving demands. Achieving high Environmental, Social, and Governance (ESG) ratings is no longer just a bonus; it's essential for maintaining consumer trust and a positive market reputation. In 2024, Marfrig reported that 99% of its direct suppliers in Brazil were compliant with its zero-deforestation policy, a significant step towards demonstrating this commitment.

The company's efforts are directly tied to its ability to attract and retain customers who prioritize responsible consumption. Failure to align with these ethical and environmental expectations can lead to significant reputational damage and loss of market share. Marfrig's ongoing investments in traceability systems and sustainable agriculture initiatives underscore their recognition of these sociological drivers.

- Consumer Demand for Ethical Products: Over 70% of global consumers prioritize sustainability in purchasing decisions as of 2023.

- Marfrig's Deforestation Policy: 99% of Marfrig's direct suppliers in Brazil met its zero-deforestation policy by 2024.

- ESG Ratings Importance: High ESG ratings are crucial for maintaining consumer trust and market reputation in the food sector.

- Reputational Risk: Non-compliance with ethical and environmental standards poses a significant risk to market share and brand image.

Demographic Shifts and Urbanization

Global population growth, projected to reach 9.7 billion by 2050 according to UN estimates, is a significant driver for Marfrig Global Foods. This expansion, coupled with a steady increase in urbanization, particularly in emerging economies across Asia and Africa, translates directly into a higher demand for protein sources, including meat. As more people migrate to cities, their dietary habits often shift towards more accessible, processed, and convenient food options, which Marfrig is well-positioned to supply.

The ongoing urbanization trend impacts Marfrig by necessitating adjustments in its supply chain and distribution networks. Cities require efficient logistics to ensure product freshness and availability, influencing how Marfrig sources raw materials and delivers its finished products. For instance, the increasing concentration of consumers in urban centers means that optimizing last-mile delivery becomes crucial for market penetration and sales volume.

- Growing Global Population: The world population is on an upward trajectory, expected to hit nearly 10 billion by 2050, directly increasing the overall consumer base for food products.

- Urbanization Rate: Over 56% of the world's population lived in urban areas in 2021, a figure projected to rise to 68% by 2050, concentrating demand and influencing consumption patterns.

- Developing Country Demand: Developing nations are experiencing the most significant demographic growth and urbanization, leading to a surge in demand for meat products as incomes rise.

- Dietary Shifts: Urban lifestyles often favor convenience and processed foods, benefiting companies like Marfrig that offer ready-to-eat or easily prepared meat products.

Societal shifts towards plant-based diets and health-conscious eating are significantly reshaping the food industry. This trend, evidenced by the global plant-based meat market's projected growth to $33.2 billion by 2030, compels Marfrig to diversify its protein offerings and highlight the nutritional benefits of its traditional meat products.

Consumers and investors are increasingly focused on ethical sourcing and animal welfare. Marfrig's progress in improving its animal welfare standards, as noted by its performance on the Business Benchmark on Farm Animal Welfare, demonstrates its responsiveness to these sociological pressures and the critical need for transparency and responsible practices in the food sector.

The company's commitment to sustainability, particularly its zero-deforestation policy in Brazil, where 99% of direct suppliers were compliant by 2024, is crucial for maintaining consumer trust and strong ESG ratings. Aligning with these ethical expectations is vital for Marfrig to avoid reputational damage and retain market share in an increasingly conscious consumer landscape.

Technological factors

Technological advancements are reshaping the meat processing industry, directly impacting Marfrig Global Foods. Automation, from robotics in slaughtering to AI-driven quality control, is crucial for Marfrig to enhance efficiency and meet growing global demand. For instance, by 2024, the global meat processing equipment market was projected to reach over $20 billion, highlighting significant investment in these areas.

Marfrig's commitment to upgrading its infrastructure is a testament to this trend. Investments in state-of-the-art processing facilities allow for more streamlined production, leading to higher quality and branded products. This focus on technological integration is essential for Marfrig to maintain its competitive edge and scale operations effectively in a dynamic market.

Technological advancements are significantly shaping supply chain management for companies like Marfrig. Sophisticated monitoring and traceability systems are now essential for verifying sustainability claims, particularly concerning deforestation. Marfrig's Verde+ program exemplifies this trend, aiming to ensure a deforestation-free supply chain by leveraging technology.

The company's commitment extends to achieving 100% traceability for both direct and indirect suppliers in critical biomes by 2025. This ambitious goal highlights the technological infrastructure required to map complex supply networks and monitor compliance with environmental standards, a growing imperative for global food producers.

The food industry is witnessing significant technological advancements in the development and commercialization of alternative proteins, including plant-based and cultivated meat options. This trend reflects a growing consumer demand for more sustainable and ethical food choices.

Marfrig Global Foods is actively participating in this shift, as evidenced by its launch of Revolution, its own global brand for plant-based meat products. This strategic move demonstrates Marfrig's commitment to adapting to and capitalizing on the evolving market dynamics within the protein sector.

In 2023, the global plant-based meat market was valued at approximately $8.5 billion, with projections indicating substantial growth to over $20 billion by 2028, highlighting the immense technological opportunity and market potential.

Digitalization and Data Analytics

Marfrig is actively leveraging digitalization and data analytics throughout its operations. This includes areas like animal husbandry, processing, and distribution, all aimed at boosting efficiency and quality. For instance, in 2024, the company continued its focus on smart farming technologies to improve livestock management and reduce waste.

These technological advancements are crucial for optimizing Marfrig's extensive supply chain. By employing data analytics, the company can better forecast demand, manage inventory, and streamline logistics, leading to improved operational performance and cost savings. This data-driven approach supports more informed strategic decisions across the business.

- Digitalization in Animal Husbandry: Implementation of sensors and data platforms to monitor animal health and optimize feeding, contributing to better yield and sustainability.

- Supply Chain Optimization: Advanced analytics used for demand forecasting and inventory management, aiming to reduce spoilage and logistical costs.

- Operational Efficiency: Data-driven insights applied to processing plant operations to enhance throughput and quality control, potentially reducing downtime.

- Decision-Making Enhancement: Real-time data dashboards provide management with up-to-the-minute performance metrics for quicker, more informed business decisions.

Innovations in Sustainable Production

Technological advancements are reshaping sustainable production. Innovations aimed at reducing water usage, enhancing nutrient management, and minimizing environmental footprints are becoming crucial for agribusinesses like Marfrig. For instance, precision agriculture techniques, utilizing data analytics and sensors, can optimize fertilizer and water application, leading to significant resource savings.

Marfrig’s commitment to sustainability is evident in its ecosystem regeneration initiatives and its focus on producing low-carbon beef. These efforts leverage technology to track and reduce greenhouse gas emissions throughout the supply chain. By investing in technologies that promote environmental stewardship, Marfrig aims to meet growing consumer demand for ethically sourced products and navigate evolving regulatory landscapes.

- Water Reduction Technologies: Advanced irrigation systems and water recycling technologies are being implemented to decrease water consumption in cattle farming.

- Nutrient Management Systems: Precision feeding technologies and soil health monitoring help optimize nutrient delivery to livestock and pastures, reducing waste and environmental runoff.

- Low-Carbon Beef Production: Marfrig's focus includes developing methodologies and technologies to measure and reduce the carbon footprint of its beef products, potentially through feed additives or improved land management.

- Ecosystem Regeneration: Marfrig is involved in projects that utilize technology for monitoring and restoring degraded lands, contributing to biodiversity and carbon sequestration.

The integration of artificial intelligence and automation is fundamentally altering meat processing, enhancing Marfrig's operational efficiency and product quality. By 2024, the global meat processing equipment market exceeded $20 billion, underscoring the significant technological investments in this sector. Marfrig’s adoption of advanced robotics and AI for quality control is vital for scaling production and meeting international demand.

Digitalization and data analytics are optimizing Marfrig's entire value chain, from farm to fork. This includes smart farming technologies for improved livestock management and data-driven insights for demand forecasting and inventory control. By leveraging real-time data, Marfrig enhances its decision-making capabilities and operational performance.

The burgeoning market for alternative proteins, including plant-based and cultivated meats, presents a significant technological frontier for Marfrig. With the global plant-based meat market valued at approximately $8.5 billion in 2023 and projected to surpass $20 billion by 2028, Marfrig's investment in its plant-based brand, Revolution, strategically positions it for future growth.

Technological advancements are also pivotal for Marfrig's sustainability initiatives, particularly in achieving a deforestation-free supply chain. By 2025, Marfrig aims for 100% traceability for its suppliers in critical biomes, utilizing sophisticated monitoring systems to ensure environmental compliance and meet consumer expectations for ethically sourced products.

| Technology Area | Marfrig's Application | Market Data/Impact |

|---|---|---|

| Automation & Robotics | Slaughtering, processing, quality control | Global meat processing equipment market > $20 billion (2024 est.) |

| Digitalization & AI | Smart farming, supply chain optimization, demand forecasting | Focus on improving livestock management and reducing waste (2024) |

| Alternative Proteins | Development of plant-based products (Revolution brand) | Global plant-based meat market $8.5 billion (2023), projected $20+ billion by 2028 |

| Traceability Systems | Supply chain monitoring for deforestation-free commitment | 100% traceability target for critical biomes by 2025 |

Legal factors

Marfrig operates under a stringent web of domestic and international food safety regulations, a critical aspect given its extensive global reach and varied product lines. Adherence to these standards is not merely a legal requirement but a fundamental pillar for market entry and maintaining consumer confidence. For instance, in 2023, the company highlighted its commitment to rigorous food safety protocols, which are integral to its brand reputation and operational integrity across all its subsidiaries, including those in Brazil and Argentina.

Marfrig Global Foods navigates a complex web of environmental laws, with deforestation regulations in Brazil being particularly impactful. These laws, including those pertaining to the Amazon and Cerrado biomes, impose strict requirements on the company’s supply chain. A key legal instrument is the Conduct Adjustment Agreement (TAC) for Amazon ranching, which obligates meatpackers like Marfrig to verify that their cattle suppliers are not engaged in illegal deforestation activities.

Marfrig Global Foods must navigate a complex web of labor laws across its global operations, impacting worker welfare and compliance. This involves strict adherence to fair wage practices, reasonable working hours, and robust health and safety protocols to prevent workplace accidents. For instance, in Brazil, where Marfrig has significant operations, the Consolidation of Labor Laws (CLT) sets detailed standards for employment contracts, wages, and benefits, with ongoing scrutiny of compliance.

Ensuring occupational health and safety is paramount, with regulations like those from OSHA in the United States or equivalent bodies in other jurisdictions dictating safety standards and worker training. Failure to comply can lead to hefty fines and reputational damage.

A critical legal consideration is the absolute avoidance of forced labor or child labor, a stance reinforced by international conventions and national laws, with companies facing severe penalties for any association.

The company's commitment to ethical labor practices is not just a legal requirement but also a key factor in maintaining its social license to operate and attracting a skilled workforce, especially as global consumer awareness regarding supply chain ethics continues to grow.

Anti-trust and Competition Laws

Anti-trust and competition laws significantly shape Marfrig's operational landscape, particularly in Brazil, its primary market. The proposed merger between Marfrig and BRF, for instance, required rigorous scrutiny and approval from Brazil's Administrative Council for Economic Defense (CADE). This process highlights how these regulations are designed to foster fair market competition and prevent the emergence of monopolistic practices within the food industry.

These legal frameworks are crucial for ensuring that Marfrig, and indeed the entire sector, operates within a competitive environment. CADE's role in reviewing such significant transactions, like the Marfrig-BRF potential combination, underscores the government's commitment to safeguarding consumer interests and promoting a level playing field. Failure to comply with these regulations can lead to substantial fines and operational restrictions.

- Regulatory Scrutiny: Marfrig's operations are continuously monitored by competition authorities in Brazil and other key markets to prevent anti-competitive behavior.

- Merger Approvals: Landmark deals, such as the potential Marfrig-BRF merger, are subject to lengthy reviews by bodies like CADE to assess market concentration.

- Market Dominance Concerns: Authorities examine whether Marfrig's market share in specific product categories could lead to unfair pricing or reduced consumer choice.

- Compliance Costs: Adhering to complex anti-trust regulations involves legal counsel and internal compliance teams, adding to operational expenses.

International Trade Laws and Certifications

Marfrig's extensive export operations are significantly influenced by international trade regulations, tariffs, and the need for various import and export certifications. Navigating these legal frameworks is paramount for maintaining its global market access.

For instance, securing and upholding specific certifications, particularly for key markets such as China, is indispensable for Marfrig's ongoing international trade activities. These certifications often relate to food safety, origin, and processing standards.

- Food Safety Standards: Marfrig must adhere to diverse international food safety protocols, such as HACCP and ISO 22000, which vary by importing country.

- Tariff and Quota Regulations: Fluctuations in tariffs and import quotas in major markets like the European Union and the United States directly impact the cost competitiveness of Marfrig's products.

- Export Licenses and Permits: Obtaining and renewing export licenses and permits for specific product categories and destination countries are ongoing legal requirements.

- Trade Agreements: Marfrig's export performance is also affected by bilateral and multilateral trade agreements that can reduce or eliminate tariffs and streamline customs procedures.

Marfrig's compliance with consumer protection laws is essential, covering product labeling, advertising accuracy, and fair pricing practices. In 2024, regulatory bodies continued to emphasize transparency in food product information, impacting how Marfrig communicates product attributes and origins to its global customer base.

The company must also navigate evolving data privacy regulations, such as GDPR and similar frameworks, especially concerning customer data collected through its various platforms and loyalty programs. Ensuring robust data security and transparent data handling practices are critical legal imperatives. For example, adhering to Brazil's LGPD (Lei Geral de Proteção de Dados) is paramount for its domestic operations.

Intellectual property rights are another key legal area, requiring Marfrig to protect its brands, trademarks, and proprietary processing techniques from infringement. This legal protection is vital for maintaining competitive advantage and brand value across its diverse product portfolio.

Marfrig's legal obligations extend to financial reporting and corporate governance standards, ensuring transparency and accountability to shareholders and regulatory bodies like the Securities and Exchange Commission (SEC) for its US-listed debt. Adherence to these financial regulations is critical for maintaining investor confidence and access to capital markets.

Environmental factors

Marfrig's operations are significantly impacted by deforestation and land use changes, especially concerning its beef supply chain in vital Brazilian ecosystems such as the Amazon and Cerrado. These biomes are critical for biodiversity and climate regulation, making land conversion a major environmental concern.

The company has committed to a deforestation-free supply chain, a challenging goal given the complexities of sourcing cattle. To achieve this, Marfrig aims to map and verify its indirect suppliers by 2025, a crucial step in ensuring compliance and transparency throughout its vast network.

Recent reports from 2024 highlight ongoing pressure on these regions, with land conversion rates impacting agricultural frontiers. Marfrig's efforts to de-risk its supply chain by 2025 are therefore critical for both environmental stewardship and maintaining market access, as consumer and regulatory scrutiny intensifies.

Cattle ranching is a major source of greenhouse gas emissions, particularly methane, making carbon footprint reduction a critical environmental challenge for companies like Marfrig. This is a significant factor in their operational strategy as global pressure mounts for sustainable practices.

Marfrig has publicly committed to reducing its emissions, aiming to address this environmental concern head-on. As of early 2024, the company is actively investing in and exploring new methods for producing beef with a lower carbon impact, reflecting a proactive stance on climate change.

Water usage is a critical environmental concern for Marfrig Global Foods, particularly given the significant water footprint of cattle farming and meat processing. In 2023, the company reported efforts to engage its supply chain in water management, aiming to reduce consumption, especially in regions facing water stress. This focus is crucial as agricultural activities, including livestock, are major water consumers globally.

Marfrig's commitment extends to promoting efficient water use throughout its operations and supply chain. This includes implementing monitoring systems to track water consumption and identifying opportunities for conservation. Such initiatives are vital for long-term sustainability and mitigating risks associated with water scarcity, a growing challenge in many of the regions where Marfrig operates.

Biodiversity Loss

Deforestation and the conversion of natural habitats into pastureland represent significant drivers of biodiversity loss, a pressing environmental concern. These activities directly impact ecosystems and the variety of life they support.

Marfrig is actively engaged in initiatives aimed at mitigating these effects. A key example is its commitment to ecosystem regeneration projects, such as Biomas, which focuses on restoring native forests and promoting biodiversity recovery.

By investing in these projects, Marfrig seeks to address the environmental footprint associated with its operations, particularly in regions where cattle ranching is prevalent. This strategic approach acknowledges the interconnectedness of business activities and ecological health.

- Marfrig's Biomas project aims to restore degraded areas, contributing to the recovery of native vegetation and wildlife habitats.

- The company's sustainability strategy includes targets for reducing deforestation in its supply chain, a direct response to biodiversity concerns.

- Reports indicate that Marfrig's efforts in ecosystem regeneration are part of a broader commitment to environmental stewardship, aligning with global biodiversity goals.

Waste Management and Pollution

Marfrig’s operations are significantly influenced by environmental regulations concerning waste management and pollution. Effective control of wastewater, particularly from its extensive animal farming activities, and responsible nutrient management are crucial for minimizing ecological footprints. The company actively monitors and reports on wastewater quality, demonstrating a commitment to reducing pollution risks across its supply chain.

In 2023, Marfrig continued its focus on environmental stewardship, with initiatives aimed at improving wastewater treatment processes. The company’s sustainability reports highlight investments in technologies designed to enhance water quality discharged from its processing plants. For instance, efforts in 2024 are geared towards achieving stricter compliance with local and international environmental standards, which often mandate advanced treatment for agricultural runoff and industrial effluent.

- Wastewater Treatment Advancement: Marfrig is investing in upgrading wastewater treatment facilities at its key production sites to meet evolving regulatory requirements and reduce pollutant levels.

- Nutrient Management Programs: The company implements programs for responsible nutrient management on farms supplying its operations, aiming to prevent excess nutrient runoff into waterways.

- Pollution Risk Mitigation: Marfrig’s environmental strategy includes identifying and mitigating potential pollution risks throughout its value chain, from farm to processing.

- Environmental Reporting: The company regularly discloses data on its environmental performance, including wastewater quality parameters, as part of its commitment to transparency.

Marfrig's environmental strategy in 2024-2025 directly addresses the critical issue of deforestation, particularly within its Brazilian beef supply chain. The company is actively working to map and verify its indirect suppliers by 2025, a significant undertaking to ensure a deforestation-free supply chain and mitigate risks associated with land conversion in sensitive biomes like the Amazon and Cerrado.

Greenhouse gas emissions, primarily methane from cattle ranching, are a key focus. Marfrig is investing in methods to lower its carbon footprint, reflecting a proactive approach to climate change and growing global demand for sustainable meat production. This commitment is crucial for meeting environmental targets and maintaining market access.

Water management is another priority, with Marfrig engaging its supply chain to reduce consumption and mitigate risks in water-scarce regions. Initiatives include promoting efficient water use and implementing monitoring systems, which are vital for long-term operational sustainability.

The company's efforts to regenerate ecosystems, such as its Biomas project, aim to restore degraded areas and enhance biodiversity. These projects demonstrate a commitment to addressing the ecological impact of its operations and aligning with global biodiversity conservation goals.

| Environmental Focus Area | Key Initiatives/Targets | Status/Data (as of early 2024/projected 2025) |

|---|---|---|

| Deforestation-Free Supply Chain | Mapping & verifying indirect suppliers | Target: 2025 |

| Greenhouse Gas Emissions | Investing in lower carbon beef production methods | Ongoing investment |

| Water Management | Engaging supply chain in water reduction | Ongoing engagement, focus on water-stressed regions |

| Biodiversity & Ecosystem Regeneration | Biomas project for forest restoration | Active projects underway |

PESTLE Analysis Data Sources

Our Marfrig Global Foods PESTLE Analysis is meticulously crafted using data from reputable sources like the World Bank, FAO, and national agricultural ministries. We incorporate economic indicators from the IMF and market intelligence from leading industry research firms to ensure a comprehensive understanding of the global food sector.