Marfrig Global Foods Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marfrig Global Foods Bundle

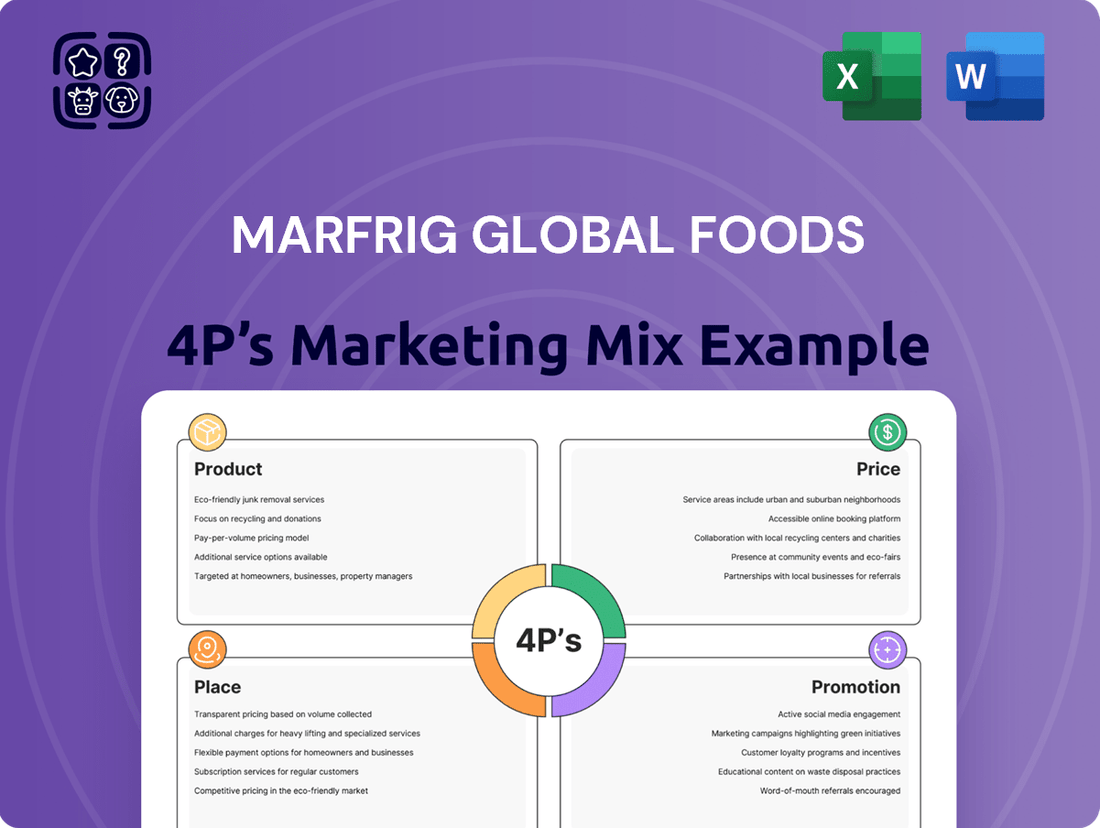

Marfrig Global Foods masterfully leverages its 4Ps to dominate the global food market. Their diverse product portfolio, from premium beef to convenient processed foods, caters to a wide array of consumer needs. Strategic pricing ensures competitiveness across various segments, while their extensive distribution network guarantees widespread availability.

Discover how Marfrig's product innovation, pricing architecture, expansive distribution channels, and targeted promotional campaigns create a powerful market presence. This detailed analysis offers actionable insights into their success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Marfrig Global Foods' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Marfrig Global Foods' diverse beef portfolio is a cornerstone of its market strategy, offering fresh, chilled, and frozen beef cuts to meet a wide array of global consumer needs. This comprehensive product range ensures Marfrig can serve different culinary traditions and market segments, from foodservice to retail, consistently delivering high-quality animal protein.

The company's vertically integrated operations are key to maintaining the quality and integrity of its beef products. By controlling everything from sourcing and slaughtering to processing and distribution, Marfrig ensures a reliable supply chain. This integration is particularly important in the beef market, where traceability and quality control are paramount for consumer trust and regulatory compliance.

In 2024, Marfrig continued to leverage its strong position in the global beef market. For instance, the company's operations in Brazil, a leading beef exporter, are crucial. Brazil's beef exports reached a record 2.1 million tonnes in 2023, and Marfrig, as a major player, is well-positioned to benefit from this trend in 2024 and beyond. The company’s focus on sustainability in its beef production, including efforts to reduce deforestation, also aligns with growing international demand for responsibly sourced products.

Marfrig Global Foods actively expands its presence in the value-added and processed foods sector, moving beyond its core raw beef business. This strategic pivot includes a strong focus on products like hamburgers, sausages, cold cuts, and convenient ready-to-eat meals. This diversification not only broadens their product portfolio but also taps into higher profit margins by catering to the increasing demand for convenience from both individual consumers and the food service industry.

In 2023, Marfrig saw significant growth in its value-added segment. For instance, its processed beef products, including its well-known brands, contributed substantially to its overall revenue, reflecting a growing consumer preference for convenience and prepared meal solutions. This focus is a critical driver for the company's forward-looking growth strategy, aiming to capture a larger share of the evolving food market.

Marfrig is strategically expanding its product offerings to become a comprehensive multi-protein food company. This evolution is significantly driven by its strategic partnership and upcoming merger with BRF, which will integrate poultry and pork products alongside Marfrig's existing beef portfolio. This consolidation positions Marfrig to cater to a broader consumer base and leverage synergies across different protein sources.

Recognizing the growing consumer demand for alternative protein sources, Marfrig is actively investing in plant-based meat alternatives. The company has launched its Revolution brand and is collaborating with ADM, a global leader in nutrition and agriculture. This dual approach of expanding traditional protein sources while embracing innovative plant-based options demonstrates Marfrig's commitment to adapting to evolving dietary trends and offering diversified food solutions for the future.

Strong Brand Portfolio

Marfrig Global Foods boasts a robust brand portfolio, featuring well-established names like Montana, Pampeano, Hamby, Secco, GJ, Tacuarembó, and Quickfood. These brands have carved out recognition across diverse markets, reflecting Marfrig's broad reach and consumer engagement.

The company is strategically deploying Sadia, a flagship brand, for its global expansion initiatives. This move is particularly focused on premium beef hamburgers and cuts, aiming to leverage Sadia's established international reputation and consumer trust to drive growth in new territories.

Here's a look at some key aspects of Marfrig's brand strategy:

- Diverse Brand Presence: Marfrig's portfolio includes brands recognized in various markets, such as Montana and Pampeano in beef, and Quickfood for convenience items.

- Sadia's Global Push: The company is making a significant investment in Sadia for international markets, targeting the premium beef segment.

- Brand Equity Leverage: By utilizing Sadia's existing global recognition, Marfrig seeks to accelerate market penetration and build consumer loyalty for its beef products worldwide.

Quality and Sustainability Focus

Marfrig's commitment to quality and sustainability is a cornerstone of its marketing strategy. The company actively invests in developing products that meet stringent safety standards while prioritizing environmentally responsible production. This focus is evident in their innovative projects aimed at environmental preservation and ensuring full traceability throughout their supply chain.

The company has established aggressive goals for achieving deforestation-free supply chains, demonstrating a clear dedication to protecting vital forest ecosystems. This commitment not only safeguards natural resources but also significantly bolsters the integrity of Marfrig's products, making them more attractive to consumers and business partners who value environmental stewardship.

By late 2023, Marfrig reported that 98% of its cattle suppliers in Brazil were already compliant with its deforestation-free policy, a significant step towards its 100% target by 2025. This proactive approach to sustainability is increasingly crucial in the global food market.

Marfrig's sustainability initiatives directly contribute to its product quality by ensuring responsible sourcing and production methods. This dual focus addresses growing consumer demand for ethically produced goods and aligns with the evolving regulatory landscape.

- Environmental Preservation: Marfrig's pioneering projects focus on protecting forests and promoting biodiversity.

- Supply Chain Traceability: The company ensures transparency from farm to fork, enhancing product safety and integrity.

- Deforestation-Free Goals: Marfrig aims for 100% deforestation-free supply chains by 2025, with 98% compliance achieved by late 2023 in Brazil.

- Consumer Appeal: This commitment resonates with environmentally conscious consumers and industrial clients seeking sustainable partners.

Marfrig's product strategy extends beyond raw beef to encompass value-added items like burgers and ready-to-eat meals, aiming for higher profit margins. The company is also diversifying into a multi-protein business, integrating poultry and pork through its partnership with BRF. Furthermore, Marfrig is investing in plant-based alternatives, launching its Revolution brand to cater to evolving dietary preferences.

Marfrig's brand portfolio includes established names like Montana, Pampeano, and Quickfood, with Sadia being leveraged for global expansion in premium beef. This brand strategy aims to enhance market penetration and build consumer loyalty worldwide.

The company's commitment to sustainability is central to its product offering, with a focus on deforestation-free supply chains and traceability. By late 2023, 98% of Marfrig's cattle suppliers in Brazil were compliant with its deforestation-free policy, moving towards its 2025 target.

| Product Focus | Key Brands | Strategic Initiatives |

| Value-added & Processed Foods (Burgers, Sausages, Ready-to-eat meals) | Montana, Pampeano, Hamby, Secco, GJ, Tacuarembó, Quickfood | Expanding into higher-margin convenience foods. |

| Multi-protein Expansion (Beef, Poultry, Pork) | Sadia (leveraged for premium beef) | Integration with BRF to broaden market appeal. |

| Plant-based Alternatives | Revolution | Investing in innovative food solutions to meet diverse consumer demands. |

What is included in the product

This analysis provides a comprehensive overview of Marfrig Global Foods' marketing strategies, examining its Product, Price, Place, and Promotion tactics to understand its market positioning and competitive advantages.

Simplifies Marfrig's complex 4Ps strategy, offering a clear roadmap to address market challenges and boost consumer engagement.

Provides actionable insights into how Marfrig's product, price, place, and promotion strategies alleviate common industry pain points for stakeholders.

Place

Marfrig boasts an extensive global distribution network, reaching over 100 countries spanning North America, Europe, Asia, and the Middle East. This impressive reach is facilitated by 33 production units and 10 dedicated distribution and commercial hubs strategically positioned worldwide. By 2024, this infrastructure allowed Marfrig to efficiently deliver its diverse product portfolio to a vast international customer base, particularly in high-demand regions like China.

Marfrig Global Foods employs a multifaceted approach to market channels, ensuring its diverse product portfolio reaches various customer segments effectively. This strategy is crucial for a company serving everyone from individual shoppers to large-scale industrial buyers.

The company supplies its products through extensive supermarket chains, making them accessible to everyday consumers. Simultaneously, Marfrig is a key supplier to the food service industry, providing ingredients and готовые блюда to restaurants and catering businesses, which is a significant driver of sales volume. For instance, in 2023, the company reported that its food service and retail segments were key contributors to its revenue, with retail growth particularly strong in Brazil and Argentina.

This dual approach allows Marfrig to maximize product availability and penetration across different market tiers. By catering to both direct consumer sales and business-to-business relationships, Marfrig builds resilience and broad market coverage.

Marfrig's strategic geographic diversification is a cornerstone of its market approach, with substantial operations across South America, including Brazil, Argentina, and Uruguay, alongside a significant presence in North America through National Beef. This broad footprint, further extended by its stake in BRF, allows Marfrig to mitigate risks tied to any single economic or political environment.

This global spread is not just about market access; it's a deliberate strategy to build resilience. By not being overly dependent on one region, Marfrig can better absorb the impact of localized downturns, such as potential supply chain disruptions or shifts in consumer demand in a particular country. For instance, strong performance in North America can offset challenges faced in South American markets, thereby stabilizing overall financial results.

Looking at 2024 and projections into 2025, the company's diverse geographic revenue streams are critical. National Beef, for example, has consistently shown strong performance in the U.S. market, contributing significantly to Marfrig’s consolidated earnings. This regional strength is vital for maintaining market share and profitability amidst global economic uncertainties.

Supply Chain Integration and Efficiency

Marfrig's commitment to supply chain integration is a cornerstone of its operational strategy. As a vertically integrated beef producer, the company manages processes from farm to table, including cattle sourcing, slaughtering, processing, and distribution. This end-to-end control allows for significant optimization in logistics and inventory management, directly contributing to product availability and quality assurance. For instance, Marfrig's ability to track and manage its livestock ensures consistent supply and adherence to strict quality standards throughout the production cycle.

The strategic merger with BRF in 2023, though now Marfrig has divested its stake in the company, initially aimed to unlock substantial supply chain synergies. These synergies were expected to enhance logistics networks and streamline operations, leading to improved overall efficiency and cost savings. By integrating operations, Marfrig can leverage economies of scale and reduce inefficiencies that often plague fragmented supply chains. The company's focus on these integrations is crucial for maintaining competitiveness in the global food market.

Marfrig's supply chain efficiency is further bolstered by its strategic investments in technology and infrastructure. For example, the company utilizes advanced tracking systems to monitor product flow from origin to consumer, ensuring traceability and minimizing spoilage. This meticulous approach to managing its supply chain directly impacts its ability to meet demand and maintain consistent product quality, which is paramount for consumer trust and brand reputation. The company's operational efficiency in 2024 is expected to benefit from these ongoing improvements.

- Vertical Integration: Marfrig controls cattle raising, slaughtering, processing, and distribution, optimizing the entire value chain.

- Logistics Optimization: Integrated operations allow for efficient transportation and warehousing, reducing costs and delivery times.

- Inventory Management: Direct oversight of production and distribution enables precise inventory control, minimizing waste and ensuring product availability.

- Synergies from BRF Merger (Initial Phase): The integration with BRF was designed to create further efficiencies in logistics and operations.

Commitment to Supply Chain Traceability

Marfrig Global Foods places significant emphasis on a traceable and deforestation-free supply chain, especially within Brazil. This commitment directly impacts its distribution channels and market access. In 2023, Marfrig reported that 100% of its direct suppliers in the Amazon and Cerrado biomes were already compliant with its zero-deforestation policy, a testament to its rigorous monitoring systems.

This focus on sustainability is not merely an ethical stance but a strategic imperative for Marfrig's place in global markets. By ensuring that its beef supply chain is free from deforestation, the company meets the increasingly stringent import requirements of key international markets, including the European Union and Asia. This adherence to sustainability criteria is vital for maintaining and expanding Marfrig's presence in these regions.

The company's place strategy is further reinforced by its proactive approach to monitoring both direct and indirect suppliers. This comprehensive oversight allows Marfrig to guarantee that its products align with global sustainability benchmarks. For instance, Marfrig's investments in technology for supply chain monitoring have been substantial, enabling real-time tracking and verification of compliance.

- Traceability Initiatives: Marfrig's system monitors over 10,000 direct and indirect suppliers in Brazil, ensuring compliance with deforestation-free policies.

- Market Access: Compliance with sustainability standards is a prerequisite for accessing lucrative markets like the EU, which has implemented new deforestation regulations.

- Consumer Trust: A transparent and verifiable supply chain builds consumer confidence, particularly among environmentally conscious shoppers in developed economies.

- Risk Mitigation: Proactive supply chain management reduces the risk of disruptions and reputational damage associated with non-compliance.

Marfrig's place strategy is defined by its extensive global distribution network, reaching over 100 countries, supported by 33 production units and 10 distribution hubs. This infrastructure ensures efficient delivery to a broad international customer base, with a notable focus on high-demand regions like China. By 2024, this robust network allowed Marfrig to effectively serve diverse markets and maintain a strong global presence.

Same Document Delivered

Marfrig Global Foods 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Marfrig Global Foods 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can confidently purchase knowing you're getting the exact, high-quality content you see. This comprehensive breakdown will provide deep insights into Marfrig's strategic approach to Product, Price, Place, and Promotion.

Promotion

Marfrig is enhancing its promotional impact by fostering brand synergies, notably through deeper integration with BRF. This collaboration allows for more cohesive and amplified marketing campaigns across their portfolios.

The strategic decision to position Sadia as a global flagship brand is a key promotional lever. By leveraging Sadia's established international reputation for diverse protein products, Marfrig aims to transfer consumer trust and familiarity to its beef products in overseas markets.

This approach capitalizes on existing brand equity. For instance, Sadia's strong presence in markets like the Middle East, where it is a leading brand, provides a ready-made platform to introduce and build consumer confidence in Marfrig's beef products, a significant promotional advantage.

Marfrig prominently features its sustainability leadership within its promotional efforts, emphasizing its dedication to tackling deforestation. This commitment is a cornerstone of their marketing, aiming to connect with a growing segment of consumers and investors who prioritize environmental responsibility.

The company's pursuit of a CDP Triple A rating underscores its advanced environmental management and transparency. This achievement is a key talking point, highlighting Marfrig's proactive approach to mitigating climate change and its impact on ecosystems.

By showcasing its environmental stewardship and responsible production practices, Marfrig leverages sustainability as a significant competitive advantage. This strategy aims to build brand loyalty and attract partnerships with like-minded organizations and consumers who value ethical business operations.

For instance, in 2023, Marfrig reported a 100% traceability for its cattle purchases in Brazil, a crucial step in its anti-deforestation efforts. This data-driven approach to promotion reinforces their claims and provides tangible evidence of their commitment.

Marfrig's communication strategy is designed to resonate with a wide array of stakeholders. For instance, in 2023, the company held several earnings calls, providing detailed financial updates and strategic outlooks directly to investors and financial analysts. These sessions are crucial for transparency and maintaining investor confidence.

Beyond investor relations, Marfrig actively participates in key industry events. Their presence at international summits, such as those focused on Brazil-China trade relations, highlights their commitment to fostering global partnerships and expanding market reach, crucial for a company with significant international operations.

The company also leverages digital platforms to disseminate corporate information and growth narratives. Marfrig's use of LinkedIn, for example, allows them to share news on market expansion, new product launches, and sustainability initiatives, effectively engaging with a professional audience and potential business partners.

This multi-channel approach ensures that Marfrig's messaging effectively reaches diverse groups, from individual consumers who engage with their brands to sophisticated financial professionals evaluating their performance. In the first quarter of 2024, Marfrig reported net revenue of R$30.4 billion, underscoring the scale of their operations and the importance of clear communication across all segments.

Emphasis on Product Quality and Value

Marfrig Global Foods consistently highlights the superior quality of its premium beef cuts and value-added products, effectively resonating with consumers who seek both excellence and affordability. This commitment to high-quality, safe, and innovative food items is a cornerstone of their marketing, fostering trust and driving demand across their extensive product portfolio.

For instance, in 2024, Marfrig's focus on product quality contributed to its strong market presence, with investments in technological advancements aimed at enhancing meat processing and safety standards. The company's dedication to delivering value ensures that consumers perceive a favorable balance between the premium nature of their offerings and the price point.

- Premium Cuts: Marfrig emphasizes the superior quality and taste of its premium beef cuts, appealing to a discerning customer base.

- Value Proposition: The company ensures its products offer excellent value, balancing high quality with competitive pricing.

- Innovation and Safety: Continuous investment in innovation and stringent safety protocols underpins Marfrig's reputation for reliable and high-quality food items.

- Consumer Confidence: These efforts build strong consumer confidence, leading to increased preference for Marfrig's diverse product range.

Public Relations and Industry Engagement

Marfrig Global Foods leverages public relations and industry engagement as key components of its marketing strategy. The company actively communicates its successes in operational efficiency, financial results, and sustainability initiatives to stakeholders. This proactive approach builds trust and reinforces Marfrig's position as a responsible industry leader.

Participation in significant industry events and receiving accolades for its practices are central to Marfrig's promotional efforts. For instance, being recognized as a top performer in ESG (Environmental, Social, and Governance) global rankings significantly enhances its corporate reputation. This engagement highlights Marfrig's dedication to superior performance and ethical operations within the global food sector.

- Industry Recognition: Marfrig's consistent high rankings in ESG benchmarks, such as those reported by Sustainalytics in late 2023 and early 2024, underscore its commitment to sustainable practices.

- Operational Excellence: The company frequently highlights improvements in its supply chain and production processes, often backed by data showing reduced waste and increased efficiency.

- Financial Transparency: Public relations efforts include communicating strong financial performance, with Marfrig reporting positive revenue growth in its 2024 fiscal year updates.

- Stakeholder Communication: Marfrig actively engages with investors, consumers, and regulatory bodies through press releases and participation in forums, fostering a transparent and accountable image.

Marfrig's promotional strategy is multifaceted, focusing on brand synergy, premium product quality, and a strong emphasis on sustainability. By leveraging existing brand equity, such as Sadia's global recognition, and highlighting its commitment to environmental responsibility, Marfrig aims to build consumer trust and attract value-aligned stakeholders.

The company actively engages in public relations and industry participation, underscoring operational excellence and financial transparency. This proactive communication, often supported by data on traceability and ESG performance, reinforces Marfrig's image as a responsible industry leader.

Marfrig showcases its dedication to quality through continuous investment in advanced processing and safety standards, ensuring a favorable balance between premium offerings and competitive pricing. This focus on innovation and safety underpins consumer confidence across its diverse product portfolio.

In 2024, Marfrig reported net revenue of R$30.4 billion in Q1, reflecting significant operational scale and the importance of its communication strategies across all stakeholder segments.

| Promotional Focus Area | Key Strategy/Initiative | Supporting Data/Fact (2023-2024) |

|---|---|---|

| Brand Synergy | Integration with BRF, positioning Sadia globally | Sadia is a leading brand in markets like the Middle East. |

| Sustainability Leadership | Emphasis on anti-deforestation, CDP Triple A pursuit | 100% traceability for cattle purchases in Brazil (2023). |

| Product Quality & Value | Highlighting premium cuts, innovation, and safety | Investments in technological advancements for processing and safety in 2024. |

| Stakeholder Communication | Earnings calls, industry events, digital platforms | Reported net revenue of R$30.4 billion in Q1 2024. High ESG rankings from Sustainalytics (late 2023/early 2024). |

Price

Marfrig's pricing strategy for its premium product lines is firmly rooted in value-based pricing, aiming to capture higher profit margins by reflecting the superior quality, sustainable sourcing practices, and established brand reputation. This strategy allows Marfrig to differentiate its offerings in competitive domestic and international markets.

The company’s commitment to quality assurance and ethical supply chains, exemplified by its investments in traceability and certifications, underpins its ability to command premium pricing. For instance, in the first quarter of 2024, Marfrig reported a net revenue increase of 6.2% to R$29.2 billion, indicating market acceptance of its value proposition.

This premium pricing approach is particularly evident in Marfrig’s export markets, where consumer willingness to pay for ethically sourced and high-quality beef products is significant. The company’s strategic focus on value-added items, such as pre-portioned cuts and specialty beef products, further supports its ability to achieve higher average selling prices compared to commodity beef.

Marfrig's pricing strategy is highly dynamic, directly influenced by fluctuating market conditions. This includes responding to shifts in consumer demand for beef and pork, the pricing strategies of its key competitors, and the cost of essential raw materials, most notably cattle prices.

For instance, in 2024, volatile cattle futures in Brazil, a primary input for Marfrig, directly pressured its pricing decisions, forcing adjustments to maintain margins amidst rising procurement costs.

The company actively adapts its pricing to navigate inherent industry volatility, a crucial tactic for preserving profitability when faced with elevated input expenses or imbalances in supply and demand dynamics within the global protein market.

Marfrig Global Foods prioritizes rigorous cost control and operational efficiency throughout its entire value chain. This focus directly impacts its ability to maintain competitive pricing and healthy profit margins. For instance, in the first quarter of 2024, Marfrig reported a significant reduction in its net financial expenses, showcasing the impact of their cost management strategies.

The company actively pursues initiatives such as optimizing its industrial complexes and leveraging synergies stemming from the BRF merger. These efforts are designed to drive down overall costs. This cost optimization provides Marfrig with greater pricing flexibility in a competitive market, supporting its strategic objectives.

Leverage of Geographic and Protein Diversification

Marfrig's strategic advantage lies in its robust geographic and protein diversification. Operating in key markets like Brazil, Argentina, the United States, and Uruguay, the company can navigate regional economic shifts and demand variations. This spread across beef, pork, and poultry segments allows Marfrig to mitigate risks associated with any single market or product category, fostering more consistent revenue streams and potentially more stable profit margins.

This diversified approach directly impacts Marfrig's pricing power. By balancing the unique market dynamics and demand cycles of different proteins and regions, the company can optimize its product mix and respond effectively to price fluctuations. For example, during periods of lower beef prices, strong performance in poultry or pork can help offset those downturns, contributing to an overall more resilient financial performance.

Looking at recent performance, Marfrig's commitment to this diversified strategy is evident. As of the first quarter of 2024, the company reported net revenue of R$31.9 billion, with its North America operations (Keystone) contributing significantly alongside its South American businesses. This broad operational footprint allows Marfrig to leverage economies of scale and achieve a more balanced profitability profile across its entire portfolio.

- Geographic Spread: Marfrig operates in Brazil, Argentina, Uruguay, and the United States, reducing reliance on any single market.

- Protein Variety: The company processes beef, pork, and poultry, offering a buffer against sector-specific downturns.

- Margin Stability: Diversification helps Marfrig achieve more consistent and stable profit margins by balancing market-specific demand and price fluctuations.

- Revenue Resilience: In Q1 2024, Marfrig's net revenue reached R$31.9 billion, showcasing the strength of its diversified business model.

Shareholder Value and Financial Discipline

Marfrig's pricing and financial strategies are intricately linked to maximizing shareholder value, demonstrated by its consistent approach to dividend payouts. This focus ensures that profitability translates directly into returns for investors, reinforcing confidence in the company's long-term financial health and strategic direction.

The company's commitment to robust financial discipline is a cornerstone of its operational philosophy. This includes actively managing leverage and prioritizing strong cash flow generation. For instance, Marfrig reported a significant reduction in its net debt to EBITDA ratio, falling to 2.37x as of the first quarter of 2024, a testament to its deleveraging efforts.

This financial prudence empowers Marfrig to pursue strategic investments while maintaining competitive pricing across its product portfolio. The ability to generate substantial cash flow, evidenced by a reported operating cash flow of R$4.7 billion in 2023, allows for reinvestment in growth opportunities and operational efficiencies without jeopardizing its financial stability or its capacity for shareholder returns.

- Shareholder Returns: Marfrig has a history of consistent dividend distributions, reflecting its commitment to returning value to shareholders.

- Leverage Management: The company actively works to reduce its debt burden, with its net debt to EBITDA ratio improving to 2.37x in Q1 2024.

- Cash Flow Generation: Strong operating cash flow, reaching R$4.7 billion in 2023, provides the financial flexibility for strategic investments and operational stability.

- Competitive Pricing: Financial discipline supports Marfrig's ability to offer competitive pricing without compromising its financial health or investment capacity.

Marfrig's pricing strategy is dynamic, influenced by market conditions like consumer demand and competitor actions. In 2024, volatile cattle prices in Brazil directly impacted its input costs, necessitating pricing adjustments to maintain profitability.

The company employs value-based pricing for premium products, highlighting quality and sustainability to command higher prices. This is supported by a 6.2% net revenue increase to R$29.2 billion in Q1 2024, demonstrating market acceptance.

Cost control and operational efficiencies are key to Marfrig's competitive pricing. Reduced net financial expenses in Q1 2024 and efforts to leverage synergies from the BRF merger contribute to greater pricing flexibility.

Marfrig's diversified geographic and protein portfolio (beef, pork, poultry) allows it to manage price fluctuations effectively. This strategy is reflected in its Q1 2024 net revenue of R$31.9 billion, with strong contributions from North American operations.

| Metric | Q1 2024 Data | 2023 Data | Significance for Pricing |

|---|---|---|---|

| Net Revenue | R$31.9 billion | N/A | Indicates market demand and price realization. |

| Net Debt to EBITDA Ratio | 2.37x | N/A | Financial health supports competitive pricing. |

| Operating Cash Flow | N/A | R$4.7 billion | Funds investments that enhance operational efficiency and pricing power. |

| Net Revenue Growth (YoY) | 6.2% | N/A | Shows market acceptance of value proposition and pricing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Marfrig Global Foods leverages a comprehensive dataset including company financial reports, investor relations materials, and official press releases. We also incorporate insights from industry publications, market research reports, and competitor benchmarking to ensure a holistic view of their marketing strategies.