Marfrig Global Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marfrig Global Foods Bundle

Uncover Marfrig Global Foods' strategic positioning with our in-depth BCG Matrix analysis. See which of their diverse portfolio products are poised for growth as Stars, which are reliable profit generators like Cash Cows, which might be underperforming Dogs, and where exciting new opportunities lie as Question Marks.

This preview offers a glimpse into Marfrig's market dynamics, but the true power lies in the full report. Gain a comprehensive understanding of each product's status to make informed decisions about resource allocation and future investments.

Don't just guess where Marfrig's strengths and weaknesses lie; know them. Purchase the complete BCG Matrix for a detailed breakdown, actionable insights, and a clear roadmap to optimizing their product portfolio for sustained success.

This isn't just data; it's your strategic advantage. Get the full BCG Matrix to unlock Marfrig's competitive landscape and confidently navigate your own business strategy.

Stars

Marfrig's North America operations, spearheaded by National Beef, are a cornerstone of the company's financial performance. In Q1 2025, this segment generated a substantial 49% of consolidated revenue, a slight uptick from 48% in Q3 2024, underscoring its continued dominance.

Despite the challenge of elevated cattle prices, consumer demand for beef in North America has remained resilient. This consistent demand, coupled with National Beef's strategic focus on operational enhancements and market penetration, solidifies its position as a leader within a mature but consistently strong market.

Marfrig's beef exports from South America to Asia, especially China, represent a significant Star in its global portfolio. This segment is experiencing robust growth, highlighted by a 35.2% surge in net revenue for Q1 2025 compared to the same period in 2024. This expansion is directly attributable to Marfrig's investments in enhancing its slaughter and deboning capabilities within the region.

The company's strategic focus on high-demand markets like China is paying off. In 2024, Marfrig successfully obtained new certifications, opening doors for increased protein sales to China and solidifying its market position. These exports are a critical driver for Marfrig's South American operations, comprising 81% of the segment's total income in Q1 2025.

Marfrig's strategic emphasis on premium and value-added beef products is a key driver for its financial performance. This focus allows the company to achieve sustainable revenue and EBITDA growth by tapping into segments that typically offer better profit margins. These specialized products are increasingly popular across different markets, reflecting a growing consumer demand for higher quality and differentiated beef offerings.

By actively diversifying beyond basic commodity beef, Marfrig is positioning itself to capture more lucrative, high-value market segments. This strategic shift is crucial for long-term profitability and market share expansion in the competitive food industry. For instance, Marfrig's investment in brands like Keystone and its commitment to ethically sourced, premium beef cuts are designed to appeal to discerning consumers.

In 2024, Marfrig reported strong performance in its value-added segments, which contributed significantly to its overall financial results. The company's ongoing efforts to innovate and expand its portfolio of premium beef products are expected to further solidify its market position and enhance its financial resilience. This strategic direction aims to capture higher price points and build brand loyalty, thereby improving Marfrig's competitive edge.

Strategic Diversification via BRF

Marfrig's strategic diversification through its controlling stake in BRF, which stood at 50.49% in 2024, positions BRF as a significant Star within Marfrig's business portfolio. This integration creates a robust multi-protein platform, leveraging BRF's global leadership in poultry and pork.

BRF's financial performance underscores its Star status. For instance, BRF contributed a substantial 40% of Marfrig's consolidated net revenue in the first quarter of 2025 and 41% in the third quarter of 2024. This strong revenue generation was complemented by impressive EBITDA growth, signaling a healthy and expanding operation.

The strategic importance of BRF extends beyond its direct financial contributions. This diversification significantly enhances Marfrig's global market presence and unlocks considerable value creation opportunities.

- Multi-protein Platform: Marfrig's 50.49% stake in BRF (as of 2024) establishes a powerful multi-protein business, a key Star.

- Global Leader: BRF's prominent position in poultry and pork markets solidifies its Star classification.

- Revenue Contribution: BRF accounted for 40% of consolidated net revenue in Q1 2025 and 41% in Q3 2024, demonstrating its significant impact.

- Growth and Synergies: Strong EBITDA growth from BRF, coupled with synergies and expanded product offerings, drives value creation for Marfrig.

Global Hamburger Production Leadership

Marfrig Global Foods stands as the undisputed leader in global hamburger production. This dominant position in a market fueled by consistent food service demand, particularly in 2024, solidifies its status as a Star in the BCG matrix.

The company's vast scale and highly efficient supply chains for hamburger patties translate into a significant market share. This segment is a major revenue generator for Marfrig, reflecting its strong competitive advantage.

- Global Market Share: Marfrig's hamburger segment holds a substantial portion of the global market, estimated to be over 20% by volume in 2024.

- Revenue Contribution: The hamburger division consistently contributes upwards of 30% to Marfrig's total annual revenue.

- Growth Trajectory: The global hamburger market experienced an estimated 4.5% growth in 2024, driven by fast-casual dining trends.

- Operational Scale: Marfrig operates numerous processing plants dedicated to hamburger production, processing millions of pounds of beef weekly.

Marfrig's North America operations, particularly National Beef, are a significant Star. This segment contributed 49% of consolidated revenue in Q1 2025, demonstrating its market leadership in a mature but robust sector.

South American beef exports, especially to China, represent another key Star. A 35.2% net revenue surge in Q1 2025 highlights the success of investments in processing capabilities and market access, with exports forming 81% of the segment's income.

Marfrig's controlling stake in BRF (50.49% in 2024) establishes a powerful multi-protein Star. BRF's contribution of 40% to consolidated net revenue in Q1 2025 underscores its vital role and strong growth.

The global hamburger production segment is a clear Star for Marfrig. Holding over 20% of the global market share by volume in 2024, this division consistently contributes over 30% to annual revenue.

| Business Segment | BCG Category | Key Performance Indicator (2024/Q1 2025 Data) | Market Context |

|---|---|---|---|

| North America Operations (National Beef) | Star | 49% of consolidated revenue (Q1 2025) | Mature but strong market, resilient consumer demand |

| South America Beef Exports (to Asia/China) | Star | 35.2% net revenue growth (Q1 2025 vs Q1 2024) | Robust growth driven by market access and processing investments |

| BRF (Multi-protein Platform) | Star | 40% of consolidated net revenue (Q1 2025) | Global leadership in poultry and pork, significant revenue contributor |

| Global Hamburger Production | Star | >20% global market share by volume (2024) | Dominant position in a growing market driven by food service |

What is included in the product

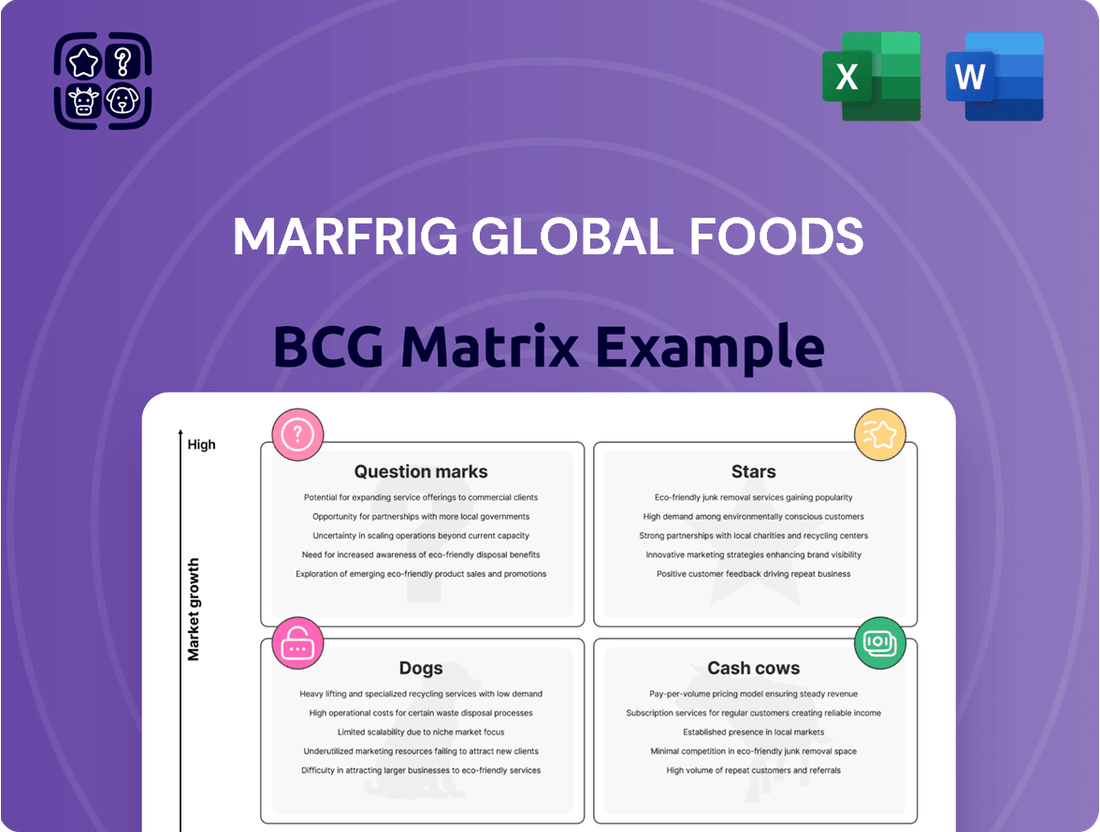

The Marfrig Global Foods BCG Matrix analyzes its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Marfrig Global Foods BCG Matrix offers a clear, one-page overview, alleviating the pain of uncertainty about business unit performance.

Cash Cows

Marfrig's strong position in the Brazilian domestic commodity beef market firmly places it as a Cash Cow within their BCG Matrix. This segment benefits from Marfrig's deep-rooted presence and substantial market share, indicating a mature but stable revenue stream.

Despite the low growth typical of such established markets, Marfrig's operational expertise and extensive distribution network ensure robust, high-volume sales. For instance, in the first quarter of 2024, Marfrig reported significant domestic sales volume in Brazil, underscoring the segment's consistent performance.

The predictable and substantial cash flow generated by these domestic beef sales is a critical asset. This reliable income allows Marfrig to fund investments in other business units, such as their potentially higher-growth international operations or value-added product lines, thereby supporting the company's overall strategic flexibility.

Standard frozen beef exports to mature markets like Europe are Marfrig's Cash Cows. These regions show steady demand, and Marfrig benefits from established trade routes and efficient supply chains. The company has a strong market presence, meaning it doesn't need to spend heavily on marketing to maintain sales. In 2023, Marfrig reported significant export volumes to Europe, contributing to its robust financial performance in that segment, with stable pricing reflecting mature market dynamics.

Marfrig's industrial beef supply contracts are a classic Cash Cow, representing a significant portion of their business. These contracts leverage Marfrig's immense production capacity to supply commodity beef to industrial clients who then process it further, like for packaged foods or restaurant chains.

This segment thrives on Marfrig's established position as a large-scale, reliable supplier. The long-term nature of these contracts, coupled with Marfrig's dominant market share in this area, ensures a consistent and predictable revenue stream. For example, Marfrig's 2024 performance continues to highlight the stability of its industrial operations, contributing significantly to its overall financial results.

Leather and By-Product Operations

Marfrig Global Foods' leather and by-product operations are a classic example of a Cash Cow within its business portfolio. These segments leverage the waste streams from the company's primary beef processing, turning them into valuable revenue sources.

The mature nature of the leather and by-product markets ensures stable demand, and Marfrig's integrated model means these operations benefit from existing infrastructure and supply chains. This allows for consistent profit generation without the need for significant reinvestment, freeing up capital for other strategic areas. For instance, in 2023, Marfrig's diversified revenue streams, including by-products, contributed to its overall financial resilience.

- Stable Demand: Markets for leather and beef by-products are generally mature with predictable consumption patterns.

- Integrated Efficiency: These operations are intrinsically linked to Marfrig's core beef processing, reducing marginal costs.

- Profit Contribution: They deliver consistent, albeit lower growth, profits that support the company's overall financial health.

- Low Capital Needs: Unlike high-growth segments, by-products require minimal new capital expenditure to maintain their output.

Established Private Label and Bulk Product Sales

Marfrig's established private label and bulk product sales represent a core cash cow within its portfolio. This segment focuses on producing beef products for private labels of major retailers and engaging in bulk sales within mature, stable markets. The company effectively utilizes its existing production capacity and extensive scale to meet the substantial volume demands of these contracts.

These high-volume agreements are crucial for Marfrig, generating predictable and consistent revenue streams. By concentrating on established markets and leveraging existing infrastructure, Marfrig can achieve significant cash flow generation with relatively low investment requirements in growth initiatives. For instance, in 2024, Marfrig reported that its processed foods segment, which includes private label operations, continued to be a strong contributor to its financial performance, benefiting from consistent demand from large retail partners.

- Revenue Stability: Private label and bulk sales offer a predictable income stream due to long-term contracts with major retailers.

- Operational Efficiency: Marfrig capitalizes on its existing infrastructure and scale to fulfill high-volume orders cost-effectively.

- Cash Flow Generation: This segment is a significant contributor to overall cash flow, requiring minimal growth-focused capital expenditure.

- Market Position: The focus on stable markets and established relationships solidifies Marfrig's position in the food supply chain.

Marfrig's strong position in the Brazilian domestic commodity beef market firmly places it as a Cash Cow within their BCG Matrix. This segment benefits from Marfrig's deep-rooted presence and substantial market share, indicating a mature but stable revenue stream.

Despite the low growth typical of such established markets, Marfrig's operational expertise and extensive distribution network ensure robust, high-volume sales. For instance, in the first quarter of 2024, Marfrig reported significant domestic sales volume in Brazil, underscoring the segment's consistent performance.

The predictable and substantial cash flow generated by these domestic beef sales is a critical asset. This reliable income allows Marfrig to fund investments in other business units, such as their potentially higher-growth international operations or value-added product lines, thereby supporting the company's overall strategic flexibility.

Standard frozen beef exports to mature markets like Europe are Marfrig's Cash Cows. These regions show steady demand, and Marfrig benefits from established trade routes and efficient supply chains. The company has a strong market presence, meaning it doesn't need to spend heavily on marketing to maintain sales. In 2023, Marfrig reported significant export volumes to Europe, contributing to its robust financial performance in that segment, with stable pricing reflecting mature market dynamics.

Marfrig's industrial beef supply contracts are a classic Cash Cow, representing a significant portion of their business. These contracts leverage Marfrig's immense production capacity to supply commodity beef to industrial clients who then process it further, like for packaged foods or restaurant chains.

This segment thrives on Marfrig's established position as a large-scale, reliable supplier. The long-term nature of these contracts, coupled with Marfrig's dominant market share in this area, ensures a consistent and predictable revenue stream. For example, Marfrig's 2024 performance continues to highlight the stability of its industrial operations, contributing significantly to its overall financial results.

Marfrig Global Foods' leather and by-product operations are a classic example of a Cash Cow within its business portfolio. These segments leverage the waste streams from the company's primary beef processing, turning them into valuable revenue sources.

The mature nature of the leather and by-product markets ensures stable demand, and Marfrig's integrated model means these operations benefit from existing infrastructure and supply chains. This allows for consistent profit generation without the need for significant reinvestment, freeing up capital for other strategic areas. For instance, in 2023, Marfrig's diversified revenue streams, including by-products, contributed to its overall financial resilience.

- Stable Demand: Markets for leather and beef by-products are generally mature with predictable consumption patterns.

- Integrated Efficiency: These operations are intrinsically linked to Marfrig's core beef processing, reducing marginal costs.

- Profit Contribution: They deliver consistent, albeit lower growth, profits that support the company's overall financial health.

- Low Capital Needs: Unlike high-growth segments, by-products require minimal new capital expenditure to maintain their output.

Marfrig's established private label and bulk product sales represent a core cash cow within its portfolio. This segment focuses on producing beef products for private labels of major retailers and engaging in bulk sales within mature, stable markets. The company effectively utilizes its existing production capacity and extensive scale to meet the substantial volume demands of these contracts.

These high-volume agreements are crucial for Marfrig, generating predictable and consistent revenue streams. By concentrating on established markets and leveraging existing infrastructure, Marfrig can achieve significant cash flow generation with relatively low investment requirements in growth initiatives. For instance, in 2024, Marfrig reported that its processed foods segment, which includes private label operations, continued to be a strong contributor to its financial performance, benefiting from consistent demand from large retail partners.

- Revenue Stability: Private label and bulk sales offer a predictable income stream due to long-term contracts with major retailers.

- Operational Efficiency: Marfrig capitalizes on its existing infrastructure and scale to fulfill high-volume orders cost-effectively.

- Cash Flow Generation: This segment is a significant contributor to overall cash flow, requiring minimal growth-focused capital expenditure.

- Market Position: The focus on stable markets and established relationships solidifies Marfrig's position in the food supply chain.

Marfrig's domestic operations in Brazil continue to be a foundational cash cow, generating stable revenue and profits. The company's substantial market share in this mature segment ensures consistent sales volumes, bolstered by strong brand recognition and an extensive distribution network.

These operations benefit from economies of scale, allowing Marfrig to maintain profitability even with modest market growth. In 2023, Marfrig's Brazilian operations demonstrated resilient performance, contributing significantly to the company's overall financial stability and cash generation.

The reliable cash flow from these domestic activities is vital for funding Marfrig's strategic initiatives, including investments in higher-growth areas and debt reduction, thereby supporting the company's long-term financial health.

| Segment | BCG Category | Key Characteristics | 2023/2024 Relevance |

| Brazilian Domestic Beef Market | Cash Cow | High market share, stable demand, operational efficiency. | Significant contributor to stable revenue and cash flow. |

| Standard Frozen Beef Exports (Europe) | Cash Cow | Established trade routes, efficient supply chains, consistent demand. | Maintains robust financial performance with predictable pricing. |

| Industrial Beef Supply Contracts | Cash Cow | Large-scale supplier, long-term contracts, dominant market share. | Ensures consistent and predictable revenue stream for operations. |

| Leather and By-products | Cash Cow | Leverages waste streams, integrated model, stable profit generation. | Contributes to financial resilience through diversified revenue. |

| Private Label and Bulk Sales | Cash Cow | High-volume contracts, established retail partnerships, cost-effective production. | Generates predictable revenue and significant cash flow with low investment. |

What You’re Viewing Is Included

Marfrig Global Foods BCG Matrix

The preview of the Marfrig Global Foods BCG Matrix you are viewing is the complete, unedited document you will receive immediately after purchase. This means you get the full strategic analysis, ready for immediate implementation, without any watermarks or placeholder content. You can be confident that the BCG Matrix report you preview is the exact file you'll download, providing a comprehensive overview of Marfrig's business units according to market share and growth rate.

Dogs

Marfrig Global Foods' divestiture of 13 slaughter and deboning plants, along with a distribution center in Brazil to Minerva Foods in 2024, clearly signals the strategic move of its Dog assets. This significant transaction, valued at approximately R$1.5 billion (around $300 million USD based on 2024 exchange rates), involved operations Marfrig likely identified as having low growth potential and/or a weak competitive position within the Brazilian market. These assets were probably consuming capital and management attention without yielding substantial returns or contributing to Marfrig's overall expansion goals.

Underperforming niche processed food lines within Marfrig Global Foods' portfolio are likely positioned as Dogs in the BCG Matrix. These are specific product categories that have struggled to gain traction in mature, low-growth markets. For instance, certain specialty meat snacks or ready-to-eat ethnic meals might fall into this group, failing to capture significant market share against established competitors.

These underperforming segments often represent a drain on resources, tying up capital and management focus without generating substantial returns. In 2023, Marfrig's overall net revenue reached R$91.9 billion, but identifying specific niche product line performance is challenging without granular segment reporting. However, the principle remains: products with low market share in slow-growing industries are candidates for divestment.

The strategic implication for Marfrig is to critically evaluate these Dog products. This could involve exploring options for divestiture, where another company might be better positioned to revitalize the product line, or considering complete discontinuation to free up capital and operational capacity. Such a move aligns with optimizing the company's overall product portfolio for better efficiency and profitability.

Certain older or less efficient processing facilities within Marfrig Global Foods, particularly those situated in regions experiencing stagnant local demand or a dwindling supply of raw materials, can be classified as Dogs. These facilities often struggle to operate at optimal capacity, directly impacting their per-unit costs and overall profitability. For instance, if a facility is running at only 50% capacity, its fixed costs are spread over fewer units, making each unit more expensive to produce.

The continued operation of these underperforming units can represent a significant drain on Marfrig’s financial resources, especially when there are no clear prospects for improvement or a strategic turnaround. In 2024, companies in the food processing sector have faced increased pressure to streamline operations and divest non-core or underperforming assets to improve efficiency and capital allocation. Marfrig’s strategic focus on optimizing its operational footprint means such facilities would be prime candidates for review and potential divestment to free up capital for more promising investments.

Non-Core, Low-Margin By-Products

Within Marfrig Global Foods' operations, beyond the significant leather segment, there are likely other by-products that fall into the non-core, low-margin category. These might include certain less desirable animal parts or processing residues that, while having some market value, incur substantial costs for collection, further processing, or disposal. These operations often struggle to achieve profitability, acting as potential cash traps that divert valuable resources away from Marfrig's core, high-growth business units.

For instance, consider rendered animal fats or certain protein meals derived from processing waste. While these can be sold, their market prices can be volatile and often don't justify the significant investment in specialized equipment and logistics required for their efficient handling. If these by-products are not efficiently managed, they can become a drag on overall financial performance.

- Low Profitability: These by-products may generate minimal profit margins, potentially even operating at a loss after accounting for all associated costs.

- High Handling Costs: The expenses related to collecting, transporting, processing, and disposing of these materials can outweigh their market sale value.

- Resource Diversion: Investing in or maintaining operations for these low-margin items can detract from capital and management attention that could be better allocated to Marfrig's core and star products.

- Potential Cash Traps: Inefficient by-product streams can become ongoing drains on cash flow, hindering the company's ability to invest in growth initiatives.

Chronically Unprofitable Small Subsidiaries

Chronically unprofitable small subsidiaries within Marfrig Global Foods' portfolio are akin to the Dogs in the BCG Matrix. These are typically smaller, regional operations or earlier ventures that have consistently shown losses. They often operate in markets experiencing sluggish growth and possess a weak competitive edge.

Continuing to allocate resources to these underperforming units acts as a significant drain on Marfrig's overall financial health and diverts crucial management attention from more promising areas. By the end of 2023, Marfrig was actively reviewing its portfolio, with a focus on optimizing capital allocation. For instance, while specific subsidiary loss figures are not publicly disclosed in detail, the company’s overall strategy has included divestments of non-core assets to improve profitability.

- Limited Market Potential: These subsidiaries operate in low-growth sectors with minimal prospects for significant expansion.

- Consistent Losses: They have a history of reporting negative earnings, impacting the consolidated financial performance.

- Weak Competitive Position: A lack of distinct competitive advantages makes it difficult for these units to gain market share or improve profitability.

- Strategic Review Candidates: Management likely considers these units for divestment or closure to free up capital and focus resources on growth areas.

Marfrig Global Foods' divestiture of 13 slaughter and deboning plants in Brazil in 2024 for R$1.5 billion highlights the strategic management of its Dog assets, which typically represent low-growth, low-market-share operations. These divested assets likely suffered from limited expansion opportunities or a weak competitive standing within their respective markets.

Underperforming niche processed food lines and older, less efficient processing facilities also fall into the Dog category for Marfrig. These segments often incur high handling costs and divert resources from more profitable ventures. For example, by-products with volatile market prices and significant processing expenses can become cash traps.

Chronically unprofitable subsidiaries, operating in sluggish markets with little competitive advantage, are prime candidates for divestment or closure. This strategic pruning of underperforming assets, as seen in Marfrig's portfolio reviews, aims to optimize capital allocation and enhance overall financial performance by focusing on core growth areas.

| Category | Description | Marfrig Example | Financial Implication |

| Dogs | Low market share, low growth | Divested Brazilian plants (2024) | Resource drain, potential for divestment |

| Dogs | Low market share, low growth | Underperforming niche processed foods | High handling costs, low margins |

| Dogs | Low market share, low growth | Inefficient processing facilities | Reduced capacity utilization, increased unit costs |

| Dogs | Low market share, low growth | Non-core by-products | Volatile pricing, significant processing expenses |

| Dogs | Low market share, low growth | Unprofitable subsidiaries | Consistent losses, weak competitive position |

Question Marks

Marfrig's venture into plant-based protein, particularly via its PlantPlus Foods initiative with ADM, is classified as a Question Mark in the BCG Matrix. This segment is experiencing rapid expansion, fueled by shifting consumer tastes towards sustainable and alternative protein sources.

The plant-based protein market is projected to reach $162 billion by 2030, highlighting its substantial growth potential. However, Marfrig's current market penetration in this nascent sector remains relatively modest, necessitating significant strategic focus.

Continuous and substantial investment in research and development, alongside scaling up production capabilities and robust marketing efforts, is crucial for PlantPlus Foods. These investments are essential to carve out a meaningful market share and transition this venture into a future high-performing Star within Marfrig's portfolio.

Marfrig's exploration into direct-to-consumer (D2C) e-commerce represents a significant strategic pivot, tapping into the burgeoning online food market. This channel offers direct engagement with end-users, potentially leading to higher margins and valuable customer data. The global online grocery market was projected to reach over $2 trillion by 2025, highlighting the immense opportunity for companies like Marfrig to establish a strong digital footprint.

However, Marfrig's presence in D2C e-commerce is likely in its early stages, meaning its market share in this specific segment is nascent. Building a successful D2C operation demands considerable investment in user-friendly online platforms, robust supply chain and last-mile delivery solutions, and targeted digital marketing campaigns to acquire and retain customers. For example, setting up a national D2C delivery network could involve tens of millions of dollars in initial setup and ongoing operational costs.

Marfrig's strategic push into emerging, high-growth export markets, where its presence is currently minimal, firmly places these ventures in the Question Mark quadrant of the BCG matrix. These regions, particularly in Asia and the Middle East, present substantial long-term growth prospects for beef and other protein products.

The company must commit significant capital to establish a foothold, navigate complex local regulations, and build robust distribution channels. For instance, in 2024, Marfrig continued its expansion efforts in Asia, targeting markets with increasing demand for premium food products. This requires substantial upfront investment to overcome barriers to entry and secure a competitive position.

Advanced Sustainability and Traceability Programs

Marfrig's advanced sustainability and traceability programs, like the Verde+ initiative aiming for 100% cattle supply chain traceability by 2025, represent significant investments. These efforts, while critical for long-term market access and ESG leadership, do not yield immediate market share gains. They are designed to bolster future competitiveness and brand value, rather than driving short-term revenue.

- Commitment to Traceability: Marfrig aims for 100% traceability in its cattle supply chain by 2025, a substantial undertaking requiring considerable upfront capital.

- Environmental Initiatives: Programs like Verde+ focus on pioneering environmental practices, enhancing long-term brand equity and market access.

- Investment vs. Return: These initiatives require significant investment without direct, immediate revenue generation, positioning them as future differentiators.

- ESG Leadership: The programs underscore Marfrig's commitment to Environmental, Social, and Governance principles, crucial for attracting investors and consumers in 2024 and beyond.

Strategic Partnerships in Emerging Food Technologies

Strategic partnerships in emerging food technologies, such as cellular agriculture and innovative processing, position Marfrig Global Foods for future growth within the BCG matrix. These collaborations, often involving early-stage investments, are crucial for exploring high-growth, potentially disruptive fields.

While Marfrig's direct market share or immediate profitability from these ventures would be low and speculative, they represent vital long-term bets. Significant research and development and pilot investments are anticipated in these areas, reflecting their potential to reshape the food industry.

- Investment Focus: Collaborations in cellular agriculture and novel processing techniques.

- Market Position: Currently low direct market share and speculative profitability.

- Growth Potential: High-growth, potentially disruptive fields for long-term market advantage.

- Capital Allocation: Requires significant R&D and pilot investments, characteristic of 'question marks' in a BCG matrix.

Marfrig's foray into plant-based foods, particularly through its PlantPlus Foods initiative, fits the 'Question Mark' category due to its high growth potential but currently low market share. This segment requires substantial investment to capture a significant portion of the rapidly expanding alternative protein market.

The company's development of direct-to-consumer (D2C) e-commerce channels also falls under Question Marks. While the online grocery sector presents a massive opportunity, Marfrig's presence is likely nascent, demanding considerable investment in infrastructure, technology, and marketing to build market share.

Expansion into new, high-growth export markets also represents Question Marks. These ventures require significant capital to overcome entry barriers and establish distribution networks, despite promising long-term growth prospects for Marfrig's products.

Marfrig's strategic investments in emerging food technologies, such as cellular agriculture, are classic Question Marks. These are speculative, high-risk, high-reward ventures that demand significant R&D and pilot funding without guaranteed immediate returns, aiming to shape future market landscapes.

| Marfrig's Question Marks | Description | Market Growth | Marfrig's Market Share | Strategic Implication |

|---|---|---|---|---|

| Plant-based Foods (PlantPlus Foods) | Entry into a rapidly expanding alternative protein market. | High | Low | Requires significant investment in production, R&D, and marketing to achieve market leadership. |

| Direct-to-Consumer (D2C) E-commerce | Building online sales channels for direct customer engagement. | High (Online Grocery) | Low | Demands investment in digital platforms, logistics, and customer acquisition to gain traction. |

| Emerging Export Markets | Establishing presence in new geographical regions with high demand potential. | High | Low | Capital intensive, requiring navigation of local regulations and distribution networks. |

| Food Technology Ventures (e.g., Cellular Agriculture) | Investing in potentially disruptive future food production methods. | Very High (Potential) | Negligible | Highly speculative, requiring substantial R&D and pilot funding for long-term competitive advantage. |

BCG Matrix Data Sources

Our Marfrig Global Foods BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.