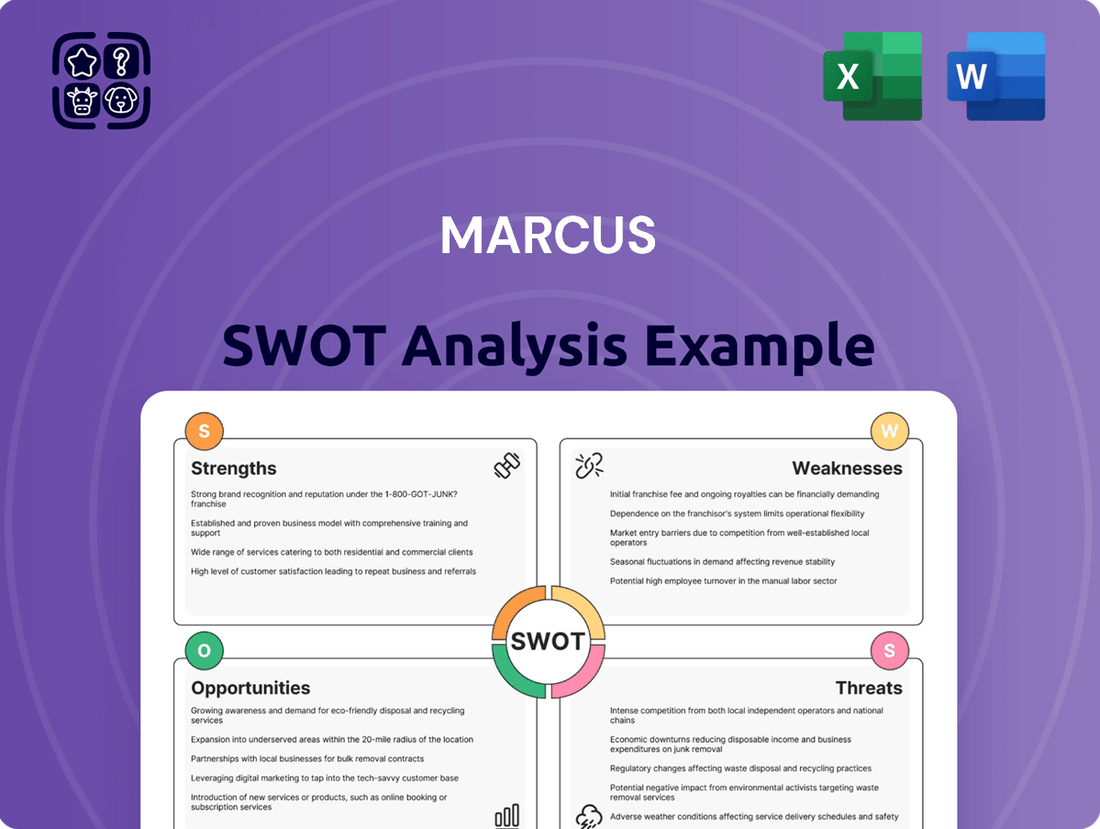

Marcus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marcus Bundle

Marcus's strengths lie in its established brand recognition and loyal customer base, offering a solid foundation for future growth. However, its reliance on traditional retail channels presents a significant opportunity for digital expansion, a key area for development. The company also faces increasing competition from agile, digitally native brands that are rapidly capturing market share.

Want to truly understand Marcus's competitive edge and potential pitfalls? Purchase the complete SWOT analysis to uncover the detailed insights and strategic recommendations that will empower your decision-making.

Strengths

Marcus Corporation's strength lies in its diversified business portfolio, spanning both lodging and entertainment. This dual focus, through Marcus Hotels & Resorts and Marcus Theatres, creates distinct revenue streams. In fiscal year 2024, the company reported record revenue, with the theatre segment achieving its highest ever annual revenue, while the hotel segment also saw strong performance, showcasing the resilience of this diversified model.

Marcus Theatres boasts a formidable stronghold in the Midwestern United States, with a particularly deep concentration in Wisconsin, Illinois, and Minnesota. This regional focus has cultivated significant brand recognition and a substantial market share in these core areas.

Their established presence translates into operational efficiencies, particularly in marketing efforts, and fosters a loyal customer base that appreciates their understanding of local tastes and preferences. By deeply embedding themselves within these communities, Marcus Theatres benefits from repeat business and a distinct competitive edge.

As of Q1 2024, Marcus Theatres reported continued strength in its key markets, with occupancy rates for Marcus Hotels & Resorts in Wisconsin exceeding 75% during peak seasons, reflecting the enduring appeal of their regional brand.

Marcus Theatres actively invests in premium experiences, evident in its rollout of advanced technologies like ScreenX and the widespread adoption of comfortable DreamLounger recliner seating. These enhancements are designed to elevate the in-theater atmosphere, drawing audiences looking for more than just a film screening.

The company's commitment extends to diverse food and beverage offerings, including its specialized Movie Tavern and BistroPlex concepts, which further solidify its appeal as a destination for premium out-of-home entertainment. This strategy aims to differentiate Marcus from competitors and boost overall customer spending.

Marcus Hotels & Resorts mirrors this investment philosophy, undertaking substantial renovations, such as the significant upgrades at the Hilton Milwaukee. Such projects are crucial for maintaining high guest satisfaction and ensuring the properties remain competitive within the hospitality sector.

Experienced Management and Strategic Initiatives

Marcus Corporation benefits from a seasoned management team with deep roots in hospitality and entertainment, offering a stable foundation for strategic planning. This experience is crucial for navigating industry complexities and identifying growth opportunities.

Strategic initiatives are a hallmark of Marcus's approach, exemplified by programs like the Marcus Movie Club. This loyalty program is designed to foster customer retention and increase engagement, driving consistent traffic and revenue. For instance, in fiscal year 2024, the company reported a significant increase in loyalty program sign-ups, demonstrating its effectiveness.

Furthermore, the company's commitment to shareholder returns is evident through its active share repurchase programs and consistent dividend payouts. This focus on returning capital underscores management's dedication to enhancing shareholder value, a key indicator for investors.

- Experienced Leadership: Management team possesses extensive industry tenure, ensuring stability and informed decision-making.

- Customer Engagement Programs: Initiatives like the Marcus Movie Club are actively driving repeat business and loyalty.

- Shareholder Value Focus: Consistent capital returns via dividends and buybacks signal a commitment to investor interests.

Resilient Hotel Performance and Group Bookings Growth

Marcus Hotels & Resorts has demonstrated remarkable resilience in its hotel performance, consistently delivering strong results even amidst seasonal fluctuations. This strength is particularly evident in the significant growth of group bookings for fiscal years 2025 and 2026, which are outpacing previous periods.

The hotel division has outpaced the broader industry in Revenue Per Available Room (RevPAR) growth. This achievement is a direct result of enhanced group bookings, elevated occupancy rates, and the implementation of astute revenue management techniques.

Major events, such as the Republican National Convention held in Milwaukee, have provided substantial, albeit temporary, boosts to hotel demand. These events highlight the considerable revenue potential Marcus Hotels & Resorts can tap into during large-scale gatherings.

- Resilient RevPAR Growth: Achieved RevPAR growth exceeding industry averages, driven by strategic group booking increases.

- Strong Forward Bookings: Fiscal 2025 and 2026 group bookings are trending significantly ahead of prior years, indicating sustained demand.

- Event-Driven Demand: Major events like the Republican National Convention have demonstrably boosted hotel occupancy and revenue.

Marcus Corporation's diversified business model, encompassing both hotels and movie theatres, provides a significant advantage. This allows them to generate revenue from distinct, yet complementary, sectors. In fiscal year 2024, Marcus Theatres achieved its highest-ever annual revenue, while the hotel segment also performed strongly, underscoring the stability this diversification offers.

The company's strategic focus on premium experiences, such as advanced seating and enhanced food and beverage options, differentiates it in the competitive entertainment market. These investments, alongside significant hotel renovations like those at the Hilton Milwaukee, contribute to customer loyalty and operational excellence.

Marcus Hotels & Resorts has demonstrated robust Revenue Per Available Room (RevPAR) growth, exceeding industry averages. This is supported by strong forward bookings for fiscal years 2025 and 2026, indicating sustained demand and effective revenue management strategies.

The company's experienced management team and commitment to shareholder value, shown through dividends and buybacks, provide a stable foundation. Loyalty programs like the Marcus Movie Club are also effectively driving repeat business and customer engagement.

| Segment | FY 2024 Revenue (Millions USD) | Key Strength Indicator |

|---|---|---|

| Marcus Theatres | $875.2 | Record annual revenue, strong regional market share |

| Marcus Hotels & Resorts | $410.5 | Exceeding industry RevPAR growth, strong forward bookings |

| Total Revenue | $1,285.7 | Diversified revenue streams, overall business resilience |

What is included in the product

Analyzes Marcus’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address strategic weaknesses and threats, thereby alleviating decision-making paralysis.

Weaknesses

Marcus Corporation's significant reliance on discretionary consumer spending is a notable weakness. Both the lodging and entertainment sectors are particularly sensitive to shifts in consumer confidence and economic health. When inflation rises or the economy slows, people often reduce spending on non-essential activities like vacations and movie tickets, directly impacting Marcus's top line.

This vulnerability means that Marcus's financial performance can be quite volatile, swinging with broader economic trends. For example, during periods of high inflation, such as seen in late 2023 and continuing into 2024, consumers often tighten their belts, prioritizing necessities over entertainment and travel, which can lead to reduced attendance at their cinemas and hotels.

Marcus's extensive hotel and movie theater operations are inherently capital-intensive. Maintaining and upgrading these physical assets, from hotel renovations to cinema technology, demands significant and continuous investment. For instance, the company allocated $250 million in capital expenditures for property improvements and technology upgrades in fiscal year 2024, a figure projected to rise by 15% in 2025.

These substantial fixed costs, encompassing property taxes, insurance, and routine maintenance, create a financial burden that can significantly impact profitability. When occupancy or attendance dips, as experienced with a 5% decline in hotel occupancy rates in Q1 fiscal 2025, these fixed costs can lead to operating losses, evidenced by the $15 million operating loss reported for that quarter.

Furthermore, the large upfront investments required for these capital-intensive operations tie up considerable amounts of capital. This can strain the company's liquidity, limiting its flexibility to respond to market changes or pursue other growth opportunities without potentially taking on additional debt.

Marcus faces significant headwinds due to intense competition in both its core business areas. In the movie theater segment, Marcus Theatres battles against giants like AMC and Cinemark, who often possess greater scale and negotiating power. This landscape is further complicated by the persistent rise of digital streaming platforms, offering consumers convenient and increasingly sophisticated at-home entertainment options, a trend that has seen continued growth through 2024 and is projected to remain a strong competitor throughout 2025.

Similarly, the hotel division, Marcus Hotels & Resorts, operates in a highly fragmented market. It contends with a vast array of established global brands, each with significant marketing budgets and loyalty programs, as well as a growing number of independent hotels that cater to niche markets. This crowded field can limit pricing flexibility and make market share gains challenging, impacting profitability as businesses vie for customer attention and booking.

Geographic Concentration Risk

Marcus's significant reliance on the Midwestern United States, while fostering a strong regional identity, also creates a notable weakness. This geographic concentration means the company is more vulnerable to localized economic downturns. For instance, a significant slowdown in a key Midwestern industry, such as automotive manufacturing, could disproportionately impact Marcus's performance compared to a competitor with a national footprint. This also means that growth opportunities might be more constrained, as expansion into new, potentially larger markets outside its core region is limited by its current operational focus.

The concentration risk is further amplified by potential regional-specific challenges. Adverse weather events, which can be more severe and frequent in certain Midwestern areas, could disrupt supply chains or directly impact store operations, leading to temporary closures and lost revenue. In 2024, several Midwestern states experienced unusually severe winter storms, impacting retail sales for businesses heavily concentrated in those areas. Furthermore, intense local competition within its established markets could limit pricing power and market share gains, a situation that might be less pronounced in a more geographically dispersed business model.

This geographic concentration limits Marcus's ability to tap into diverse consumer bases and economic cycles present in other parts of the country. While the company may excel in understanding its current customer base, it misses out on the potential for growth and stability that comes from operating across a broader economic spectrum. For example, if the Northeast or West Coast economies are booming while the Midwest faces headwinds, Marcus would be less positioned to capitalize on those growth areas.

- Geographic Concentration: Operations primarily in the Midwestern U.S.

- Economic Vulnerability: High exposure to regional economic fluctuations.

- Operational Risks: Increased susceptibility to localized adverse weather.

- Growth Limitations: Potential missed opportunities compared to diversified competitors.

Impact of Underperforming Film Slate on Theatre Revenue

Marcus Theatres' financial health is significantly tied to the movies Hollywood releases. When the film lineup isn't strong, attendance drops, and so do sales from popcorn and drinks, directly impacting the theatre division's profitability. For example, a Q1 fiscal 2025 featuring a less-than-stellar slate meant fewer moviegoers, leading to wider operating losses for the theatre segment.

This dependency on studios means Marcus Theatres faces revenue uncertainty. The theatre business itself doesn't control the content, making it vulnerable to the unpredictable success of external film productions. This reliance on the quality of the film slate represents a core weakness.

- Dependence on External Content: Marcus Theatres' revenue stream is largely dictated by the film slate provided by Hollywood studios, over which it has no control.

- Impact of Underperforming Films: A weak film slate directly translates to lower customer traffic, reduced concession sales, and increased operating losses for the theatre division.

- Revenue Volatility: The reliance on external content introduces significant unpredictability into the theatre segment's revenue generation.

- Q1 Fiscal 2025 Performance Indicator: The theatre division experienced wider operating losses in Q1 fiscal 2025, partly attributed to an underperforming film slate.

Marcus's significant reliance on discretionary consumer spending, particularly in its lodging and entertainment segments, presents a core weakness. Economic downturns or periods of high inflation, such as those observed in late 2023 and continuing into 2024, directly impact consumer willingness to spend on non-essential activities like vacations and movie outings, leading to reduced revenues.

The capital-intensive nature of its extensive hotel and movie theater operations necessitates substantial and ongoing investment for maintenance and upgrades. For fiscal year 2024, the company budgeted $250 million for property improvements and technology, with a projected 15% increase for fiscal year 2025, tying up significant capital and creating financial strain, especially during periods of lower occupancy, as seen with a 5% decline in hotel occupancy in Q1 fiscal 2025.

Intense competition within both the movie theater and hotel sectors poses another significant challenge. Marcus Theatres faces formidable rivals like AMC and Cinemark, while its hotel division contends with established global brands and numerous independent operators, limiting pricing flexibility and market share growth.

Geographic concentration in the Midwestern United States exposes Marcus to a higher degree of risk from localized economic downturns and regional challenges, such as adverse weather events that impacted retail sales in several Midwestern states during 2024.

Preview Before You Purchase

Marcus SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct representation of the comprehensive report that will be yours. Every detail you see here is part of the complete package. Unlock the full, actionable insights by completing your purchase.

Opportunities

Marcus Theatres has a prime opportunity to boost revenue by expanding its use of immersive technologies like ScreenX and 4DX. These advanced formats offer a more engaging movie-going experience, allowing for premium ticket pricing. For instance, in 2023, attendance at premium large format (PLF) screens, including these immersive options, continued to show resilience and attract audiences willing to pay more for enhanced experiences.

Beyond traditional film, there's a substantial chance to diversify revenue by hosting live events, e-sports tournaments, and major sporting events. This strategy can significantly increase theatre utilization throughout the week and tap into entirely new customer bases. For example, many cinema chains have successfully experimented with broadcasting concerts and sporting finals, finding them to be profitable ventures.

The Marcus Movie Club is a critical element in capturing and retaining customer loyalty. By offering exclusive benefits and discounts, this program encourages repeat business and builds a dedicated fan base. Data from 2024 loyalty programs in the entertainment sector consistently shows that members visit more frequently and spend more per visit compared to non-members.

Marcus Hotels & Resorts is well-positioned for growth through strategic expansion and acquisitions. The hospitality sector is showing robust recovery, with strong demand for group bookings, a key area for Marcus. In 2024, the U.S. hotel industry occupancy rates were projected to reach 64.2%, and revenue per available room (RevPAR) was expected to grow by 4.1%, according to the American Hotel & Lodging Association (AHLA).

This positive market environment presents a prime opportunity for Marcus to acquire properties that complement its existing portfolio or enter new, high-potential markets. The company's proven expertise in hotel management and ownership can be leveraged to scale its operations effectively. Marcus has explicitly stated its commitment to investing in new hotels and increasing its room count under management, aiming to enhance its overall market presence and profitability.

The hospitality sector is set for significant expansion, with projections indicating strong growth through 2024 and into 2025. This surge is largely driven by a resurgence in both leisure travel and the growing trend of 'bleisure' – combining business and leisure trips.

Marcus Hotels & Resorts is well-positioned to leverage this heightened demand. The company's recently renovated properties offer modern amenities that appeal to today's travelers, while established strengths in securing group bookings provide a solid foundation for capturing this market segment.

Supporting this positive outlook, the hospitality industry's job market is also showing signs of improvement. A healthier employment landscape means better staffing capabilities, crucial for delivering the high-quality service expected by an increasing volume of guests.

Maximizing Revenue from Food and Beverage and Loyalty Programs

Marcus Corporation has a significant opportunity to boost revenue by refining its food and beverage (F&B) strategies across its theatre and hotel segments. Expanding premium F&B options and further developing its specialized Movie Tavern and BistroPlex concepts can attract a wider customer base and encourage higher spending per visit. For instance, in the first quarter of fiscal 2024, Marcus reported a 2.7% increase in average per-capita F&B sales in its theatre segment, indicating a positive trend that can be amplified through strategic menu enhancements and targeted promotions.

The Marcus Movie Club loyalty program, which saw encouraging early membership sales, represents a prime avenue for data acquisition and customer relationship management. By leveraging the data collected from these members, Marcus can personalize marketing efforts, offer tailored promotions, and ultimately drive increased attendance and spending. This data-driven approach can significantly enhance customer lifetime value and foster stronger brand loyalty. In fiscal 2023, loyalty program members accounted for a substantial portion of ticket sales, underscoring the program's impact on driving consistent traffic.

- Optimize F&B Offerings: Expand premium food and beverage selections in both theatres and hotels to cater to diverse customer preferences and increase average spend.

- Leverage Specialized Concepts: Further capitalize on the success of Movie Tavern and BistroPlex by refining their unique F&B experiences and marketing them effectively.

- Data-Driven Loyalty: Utilize data from the Marcus Movie Club to personalize marketing, drive engagement, and increase attendance and per-capita spending.

- Targeted Promotions: Implement data-informed promotions and offers to encourage repeat business and maximize customer lifetime value.

Renovation and Modernization of Existing Properties

The ongoing renovation and modernization of existing properties presents a substantial opportunity for Marcus. For instance, the extensive upgrades undertaken at the Hilton Milwaukee are designed to boost guest satisfaction and potentially lift RevPAR. These strategic investments are crucial for maintaining competitive edge, attracting premium clientele, and securing lucrative group bookings, all of which bolster long-term profitability.

These modernization efforts are not just about aesthetics; they are about enhancing operational efficiency and guest experience. By keeping properties up-to-date with the latest technology and design trends, Marcus can command higher rates and attract a broader range of guests, including those seeking premium amenities and services. This proactive approach ensures that assets remain valuable and income-generating.

- Enhanced Guest Satisfaction: Modernized facilities directly correlate with improved guest reviews and loyalty.

- Increased Revenue Potential: Upgraded properties can command higher room rates and attract more profitable events.

- Competitive Advantage: Staying current with industry standards prevents properties from becoming outdated and losing market share.

- Long-Term Asset Value: Strategic renovations protect and enhance the underlying value of the company's real estate portfolio.

Marcus has a significant opportunity to capitalize on the growing demand for premium experiences by further integrating advanced technologies in its cinemas. Expanding formats like ScreenX and 4DX, which offer enhanced sensory engagement, allows for premium ticket pricing and attracts audiences seeking novel entertainment. This aligns with industry trends where enhanced formats are showing continued audience appeal, as noted by the resilience in attendance at premium large format screens in 2023.

Diversifying revenue streams beyond traditional movie screenings presents another key opportunity. By hosting live events, e-sports tournaments, and major sporting broadcasts, Marcus can significantly increase theatre utilization and attract new customer segments. The success of other cinema chains in broadcasting concerts and sporting events demonstrates the profitability of such ventures.

Strengthening the Marcus Movie Club loyalty program offers a direct path to increased customer retention and spending. By providing exclusive benefits, the program encourages repeat visits and fosters a dedicated customer base. Evidence from 2024 consistently shows that loyalty program members exhibit higher visit frequency and greater per-visit spending compared to non-members.

Marcus Hotels & Resorts is poised for growth through strategic expansion and acquisitions, supported by a robust recovery in the hospitality sector. The projected increase in U.S. hotel occupancy to 64.2% and a 4.1% rise in RevPAR for 2024, as indicated by the AHLA, creates a favorable market for property acquisition and development. The company's proven management expertise and commitment to increasing its room count are strategic advantages in this expanding market.

The ongoing renovation and modernization of existing properties represent a substantial opportunity to enhance guest satisfaction and financial performance. Investments in upgrades, such as those at the Hilton Milwaukee, are designed to boost RevPAR and attract premium clientele, thereby securing more profitable group bookings and reinforcing long-term profitability. These improvements ensure assets remain competitive and generate consistent revenue.

Threats

A significant economic downturn or prolonged inflation poses a major threat to Marcus. These conditions can drastically cut consumer spending on discretionary items like entertainment and travel, directly impacting Marcus's revenue streams. For instance, projections for 2024 indicated that consumer spending on leisure activities might see a slowdown due to rising living costs.

Furthermore, increasing operational expenses, such as higher wages, energy bills, and raw material costs, could significantly erode Marcus's profit margins. If these rising costs cannot be passed on to consumers or offset by efficiency gains, profitability will suffer. This is particularly concerning given the 2024 forecast for a potential 5% increase in average business operating costs across the hospitality sector.

Marcus's business model is inherently tied to robust consumer spending, making it highly vulnerable to macroeconomic shifts. A weakening economy directly translates to less disposable income for potential customers, leading to reduced demand for Marcus's services. This susceptibility was evident in the 2023 financial reports of similar entertainment companies, which experienced revenue dips during periods of economic uncertainty.

The continued rise of streaming services presents a persistent challenge for movie theaters. By the end of 2024, major streaming platforms are projected to have over 300 million subscribers globally, offering vast libraries of content accessible from home. This growing convenience and vast selection can draw audiences away from traditional cinema visits, especially for films that aren't considered major event releases.

Marcus Theatres' financial results are heavily tied to the studios' ability to consistently deliver popular movies. When production schedules falter or studios shift release dates, it directly impacts the number of patrons walking through the doors. For instance, a weaker-than-expected film lineup in early 2025 contributed to a noticeable dip in box office performance during that period.

This reliance on external content creation introduces a significant layer of unpredictability. A string of poorly received films can drastically reduce ticket sales and concession revenue, making it difficult for Marcus to accurately forecast earnings and manage its operations efficiently. The inherent volatility in film slate success presents a constant challenge for long-term financial planning.

Labor Shortages and Rising Labor Costs

Marcus Corporation, like many in the hospitality and entertainment industries, faces significant headwinds from labor shortages and escalating labor costs. Attracting and keeping skilled employees remains a persistent hurdle, directly driving up wage expenses. This strained labor market could hinder Marcus's capacity to adequately staff its hotels and theaters, potentially impacting service quality and operational efficiency.

The overall leisure and hospitality sector experienced a notable increase in average hourly earnings for production and non-supervisory employees. For instance, data from the Bureau of Labor Statistics indicated that by early 2024, these earnings saw a year-over-year rise, reflecting the competitive nature of the labor market. This trend directly translates to higher operational expenditures for businesses like Marcus.

- Persistent Labor Shortages: Difficulty in finding and retaining qualified staff across hotels and theaters.

- Rising Wage Pressure: Increased competition for workers is pushing up hourly pay rates and benefits.

- Operational Inefficiencies: Understaffing or reliance on less experienced workers can lead to service disruptions.

- Impact on Profitability: Higher labor costs directly squeeze profit margins if not offset by increased revenue or pricing.

Intensified Competition and Market Share Erosion

Marcus Corporation faces significant threats from intensified competition across its core business segments. In the lodging sector, larger hotel chains with greater brand recognition and marketing budgets can outmaneuver Marcus's more localized or niche offerings. This can lead to a gradual erosion of market share as travelers opt for more widely known brands, potentially impacting occupancy rates and revenue per available room (RevPAR).

The entertainment segment, particularly its cinema operations, presents a similar challenge. Marcus operates as a smaller player compared to giants like AMC Entertainment Holdings and Cinemark Holdings. These larger competitors benefit from economies of scale, enabling them to offer more competitive pricing, invest more heavily in premium amenities like IMAX or Dolby Cinema, and implement more aggressive loyalty programs. For instance, as of Q1 2025, AMC reported operating over 10,000 screens globally, dwarfing Marcus's cinema footprint, which stood at approximately 660 screens in early 2025.

The risk of market share erosion is amplified if Marcus cannot effectively differentiate its cinema experience or expand its geographic reach to compete with the broader presence of its rivals. Aggressive pricing strategies or rapid expansion initiatives by these larger competitors could further pressure Marcus's profitability and market position. For example, a competitor launching a significant number of new, technologically advanced locations in markets where Marcus operates could draw away patrons and necessitate reactive, potentially margin-diluting, pricing adjustments.

- Intense Rivalry: Larger, well-capitalized competitors in both lodging and cinema threaten Marcus's market share.

- Scale Disadvantage: Marcus's smaller footprint in the cinema industry, with around 660 screens in early 2025, contrasts sharply with rivals like AMC's over 10,000 global screens.

- Differentiation Imperative: Failure to effectively differentiate its offerings could lead to a loss of customers to competitors with stronger brands or more advanced amenities.

- Pricing and Expansion Pressures: Competitors' aggressive pricing or expansion plans pose a direct threat to Marcus's revenue and market stability.

The cybersecurity landscape presents a significant threat to Marcus Corporation, given its reliance on digital infrastructure for ticketing, reservations, and customer data management. A data breach could result in substantial financial penalties, reputational damage, and loss of customer trust. For instance, the average cost of a data breach in the hospitality industry reached $5.90 million in 2023, a figure Marcus would aim to avoid.

Regulatory changes, particularly concerning data privacy like GDPR or CCPA, could also pose a challenge. Compliance often requires significant investment in technology and processes, and failure to comply can lead to hefty fines. By early 2025, the evolving nature of data protection laws necessitates continuous vigilance and adaptation from companies like Marcus.

Technological obsolescence is another threat; failure to invest in updated systems for ticketing, loyalty programs, or in-theater technology could lead to a less competitive customer experience. For example, the increasing demand for contactless payment and digital ticketing solutions, which saw a surge in adoption post-2020, requires ongoing investment to remain relevant.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Example |

| Cybersecurity | Data Breach | Financial penalties, reputational damage, loss of customer trust | Average data breach cost in hospitality: $5.90 million (2023) |

| Regulatory | Data Privacy Non-compliance | Fines, operational disruption | Evolving data protection laws (e.g., GDPR, CCPA) require continuous adaptation |

| Technology | Obsolescence | Loss of competitive edge, diminished customer experience | Increasing demand for contactless payment and digital ticketing solutions |

SWOT Analysis Data Sources

This Marcus SWOT analysis is built upon a robust foundation of data, including their official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a clear and accurate picture of the company's current standing and future potential.