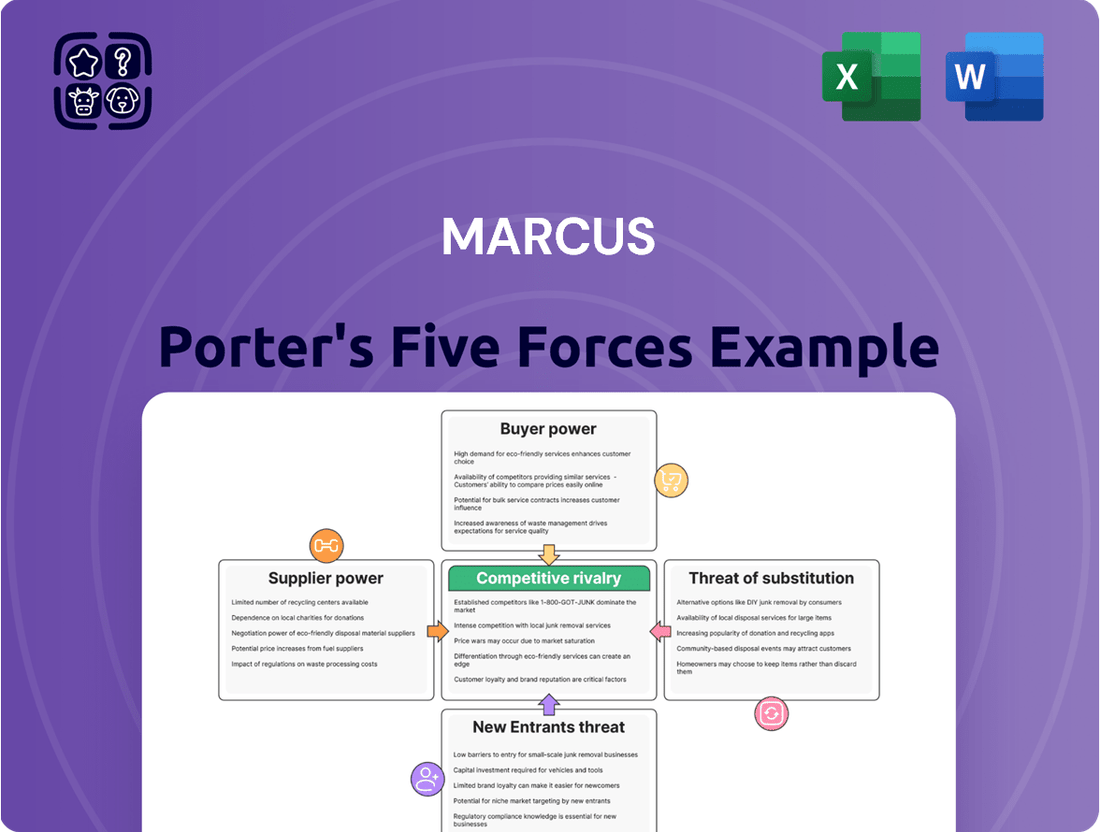

Marcus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marcus Bundle

Marcus's Five Forces Analysis reveals the intricate web of competitive pressures shaping his market. Understanding the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the allure of substitutes is crucial for strategic success. This foundational understanding highlights the dynamic forces at play, influencing profitability and market positioning.

The complete report reveals the real forces shaping Marcus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Film distributors, especially major studios, wield considerable bargaining power over exhibitors like Marcus Theatres. This is primarily because these distributors control the supply of highly anticipated and popular movie content, which is the lifeblood of the theatrical exhibition business. Without access to these films, theaters cannot draw audiences.

The reliance on a consistent stream of blockbusters is starkly evident; for instance, the performance of Marcus Theatres in late 2024 and early 2025 was significantly influenced by the release schedule of major studio productions. This dependence allows distributors to dictate terms, including revenue sharing and exhibition windows, as there are a limited number of dominant players in the distribution landscape.

Suppliers of specialized technology, such as premium large format (PLF) screen systems, advanced projection, and sophisticated sound equipment, hold a moderate level of bargaining power. While the market may feature several vendors, the significant expense and technical complexity involved in switching these systems, coupled with the necessity for cutting-edge features to elevate the audience experience, grant these suppliers considerable leverage.

For instance, the adoption of technologies like ScreenX, which expands the viewing experience beyond the traditional screen, requires substantial investment. Marcus Theatres' strategic implementation of such innovations underscores their reliance on these technology providers to remain competitive and attract patrons.

For hotels and theaters, food and beverage suppliers typically hold limited bargaining power. This is largely because the market is quite fragmented, meaning there are many suppliers available, making it easier for businesses like Marcus Hotels & Resorts to switch if needed. For instance, in 2024, the global food service market was valued at over $3.5 trillion, highlighting the sheer volume of suppliers and the competitive landscape.

However, this power can shift slightly for suppliers offering unique or specialized products. If Marcus Hotels & Resorts aims for distinctive culinary experiences, certain niche suppliers might command a bit more influence. This is particularly true as consumer demand for regional and sustainable sourcing grows, potentially empowering specific local producers who can meet these criteria.

Labor (Hotel and Theatre Staff)

The hospitality and entertainment sectors, including operations like Marcus Corporation's hotels and theaters, are fundamentally labor-intensive. This makes the bargaining power of employees, especially those with specialized skills or represented by unions, a crucial factor. For instance, Marcus Corporation's Q1 2025 earnings report for Marcus Theatres highlighted increased labor expenses, suggesting that staff have been able to negotiate for higher wages or benefits, directly impacting the company's profitability.

The availability of a qualified workforce and the general wage environment directly shape the operational costs for businesses in these industries. When labor is scarce or unions are strong, employees can exert considerable influence over compensation and working conditions.

- Labor Intensive Operations: Hotels and theaters depend heavily on their workforce for service delivery.

- Skilled Labor and Unions: The bargaining power of employees is amplified by specialized skills and union representation.

- Impact on Margins: Increased labor expenses, as seen in Marcus Theatres' Q1 2025 results, directly affect profit margins.

- Cost Influences: Labor availability and prevailing wage rates are key drivers of operational costs.

Hotel Renovation and Construction Contractors

For Marcus Hotels & Resorts, contractors involved in significant renovation and construction projects wield considerable bargaining power. The Hilton Milwaukee transformation, a prime example, highlights the reliance on specialized expertise for substantial capital outlays. Project delays or budget overruns directly impact the profitability of the lodging division, giving these specialized contractors leverage.

The specialized nature of hotel construction and renovation means there are often a limited number of qualified contractors capable of handling large-scale, complex projects. This scarcity enhances their ability to negotiate terms favorable to them. For instance, in 2023, the average cost of hotel construction in the US saw an increase, reflecting rising material and labor expenses, which suppliers can pass on to developers.

- Limited Pool of Specialized Contractors: The need for specific skills and experience for major hotel projects narrows the supplier options.

- High Project Stakes: Delays or cost escalations in significant renovations directly impact Marcus Hotels & Resorts' financial performance.

- Capital Intensity: Large-scale projects require substantial investment, increasing the dependence on contractors who can manage these budgets effectively.

- Market Conditions: Fluctuations in construction material costs and labor availability, as seen with rising costs in 2023, can empower suppliers.

Suppliers of specialized technology, like advanced projection and sound systems, possess moderate bargaining power. This is due to the high cost and complexity of switching, coupled with the need for cutting-edge features to enhance the patron experience. For example, the investment in premium large format (PLF) technologies by exhibitors requires reliance on these specialized vendors.

Labor, particularly skilled or unionized workers, holds significant bargaining power in the labor-intensive hospitality and entertainment sectors. This was evident in Marcus Theatres' Q1 2025 results, which showed increased labor expenses, indicating successful wage negotiations. The availability of qualified staff and general wage levels directly influence operational costs.

Contractors for major renovation projects have considerable power due to the specialized expertise required for large capital outlays, such as the Hilton Milwaukee transformation. A limited pool of qualified contractors for complex projects enhances their negotiating position. The rising cost of hotel construction materials and labor in 2023 further illustrates this leverage.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | Example for Marcus Corp. | Relevant Data/Trend |

|---|---|---|---|---|

| Film Distributors | High | Control over popular content, limited number of major players | Reliance on major studio releases for box office success | Box office revenue heavily dependent on blockbuster schedules |

| Technology Providers (PLF, AV) | Moderate | High switching costs, need for advanced features | Adoption of premium formats like ScreenX | Investment in new AV technologies to attract audiences |

| Food & Beverage Suppliers | Limited (generally) | Fragmented market, many alternatives | Sourcing for hotel and theater concessions | Global food service market valued at over $3.5 trillion (2024) |

| Employees (Skilled/Unionized) | High | Labor-intensive nature of business, union strength | Wage negotiations impacting operational costs | Increased labor expenses noted in Marcus Theatres Q1 2025 results |

| Specialized Contractors | High | Need for specialized skills, high project stakes | Renovation projects like Hilton Milwaukee | US hotel construction costs increased in 2023 |

What is included in the product

Marcus Porter's Five Forces Analysis evaluates the competitive intensity and attractiveness of the market Marcus operates within by examining threats of new entrants, buyer power, supplier power, threat of substitutes, and existing rivalry.

Quickly identify and address competitive threats with a visual breakdown of each of Porter's Five Forces, making strategic planning more effective.

Customers Bargaining Power

Individual moviegoers generally possess low bargaining power when it comes to ticket prices. Standard admission fees are largely set by the theater, and one person’s decision to buy or not buy has minimal impact on overall pricing strategies. However, loyalty programs, such as Marcus Theatres’ Movie Club, are designed to foster customer retention by offering discounts and rewards, effectively chipping away at this low individual power by creating switching costs.

While a single moviegoer can’t negotiate ticket prices, their collective choices significantly influence the types of experiences offered. For instance, the widespread demand for enhanced comfort, as seen in the trend towards luxury recliners and premium viewing formats like IMAX, directly shapes what amenities theaters invest in. This shows how aggregated consumer preferences can indirectly exert influence on the industry’s offerings.

Individual leisure travelers typically possess moderate bargaining power. This is largely due to the sheer volume of hotel choices available and the ease with which they can compare prices across various online travel agencies and hotel websites. For instance, in 2024, the average traveler considers at least six different hotels before booking, highlighting the competitive landscape.

Hotel brands, including those like Marcus Hotels & Resorts, actively work to diminish this power through robust loyalty programs and by emphasizing unique property features and guest experiences. These initiatives aim to cultivate repeat business and reduce price sensitivity among guests.

Dynamic pricing strategies are a common tactic, where hotel rates fluctuate significantly based on real-time demand, seasonality, and special events. This responsiveness to market conditions further influences the bargaining leverage of individual leisure guests.

Corporate clients and large group organizers, like those booking conventions or business events, wield significant bargaining power in the hotel industry. Their ability to deliver substantial volume allows them to negotiate favorable rates, customized services, and specific amenities. This leverage is a key factor when hotels strategize their pricing and service offerings.

For instance, a major corporation booking hundreds of rooms for an annual conference can command discounts and preferential treatment that a single traveler cannot. This volume-driven negotiation power means hotels must carefully manage relationships with these key accounts to secure consistent business.

Marcus Hotels & Resorts, a company that actively courts this segment, has observed ongoing expansion in its group bookings. This trend underscores the vital role that large corporate and group clients play in the hotel's revenue stream and overall success, highlighting the need to effectively cater to their demands.

Event Planners and Organizers

Event planners and organizers wield significant bargaining power, much like large group bookers. For venues like hotels and theaters, these planners, who arrange everything from private screenings to corporate functions, can negotiate favorable terms. They often solicit competitive bids, knowing the substantial revenue their events generate, which gives them leverage.

Marcus Porter recognizes the importance of attracting these high-value events to optimize venue occupancy. This bargaining power is amplified by their ability to shift business between venues if their demands aren't met. For instance, a major corporate event organizer might negotiate a 15% discount on venue rental and catering for a multi-day conference. In 2023, the global event management market was valued at approximately $1.1 trillion, highlighting the economic influence of these organizers.

- Negotiation Leverage: Planners can command better pricing and contract conditions due to the potential volume and revenue of their events.

- Venue Choice: A wide array of available venues means planners can easily switch if their specific needs or price points are not met.

- Market Influence: The significant financial impact of large-scale events allows organizers to negotiate terms that reflect their contribution to venue business.

- Contractual Specificity: Planners often require tailored contracts covering everything from AV equipment to specific catering menus, increasing their ability to negotiate.

Online Travel Agencies (OTAs) and Ticketing Platforms

Online Travel Agencies (OTAs) and major ticketing platforms hold considerable sway over hospitality and entertainment providers like those within Marcus Corporation. These intermediaries aggregate a vast customer base, acting as a crucial gateway for bookings. Their leverage stems from controlling access, which significantly impacts the visibility and reach of hotels and theaters.

The commission structures imposed by OTAs can directly compress profit margins for Marcus Corporation's properties. Furthermore, their ability to influence pricing strategies and dictate placement within search results gives them substantial power. For example, many OTAs charge commissions ranging from 15% to 30% on bookings, directly impacting a hotel's net revenue per room.

- Commission Rates: OTAs typically charge hotels commissions between 15% and 30% on bookings made through their platforms.

- Market Dominance: Major OTAs like Booking.com and Expedia collectively represent a significant portion of online travel bookings, giving them substantial bargaining power. In 2023, Booking Holdings and Expedia Group generated over $35 billion in revenue combined.

- Customer Aggregation: These platforms provide access to millions of travelers, a customer base that individual hotels would struggle to reach independently.

- Visibility Control: OTAs determine the ranking and visibility of hotels on their sites, often through a combination of pricing, user reviews, and paid placements, influencing booking decisions.

The bargaining power of customers is a critical element in Porter's Five Forces, impacting pricing and profitability. For Marcus Corporation, understanding this dynamic is key to strategic decision-making. In the hospitality sector, individual leisure travelers have moderate power due to abundant choices. However, this can be mitigated by loyalty programs and unique offerings.

Same Document Delivered

Marcus Porter's Five Forces Analysis

The preview you see is the exact, fully formatted Marcus Porter's Five Forces Analysis document you will receive immediately after purchase, ensuring no surprises or missing information. This comprehensive analysis, detailing the competitive landscape for Marcus Porter, is ready for your immediate use, providing actionable insights into industry attractiveness. You're looking at the actual document, meaning the quality and content displayed here are precisely what you'll download, saving you time and effort. This professionally crafted analysis is designed to equip you with a deep understanding of the forces shaping Marcus Porter's market. Invest with confidence, knowing that what you preview is precisely what you'll gain.

Rivalry Among Competitors

The lodging industry is incredibly fragmented, a true battlefield where national brands, independent inns, and charming boutique hotels all fight for every guest. Marcus Hotels & Resorts faces this intense rivalry daily, a constant push and pull that impacts pricing and demands a sharp focus on what makes them stand out, whether it's exceptional service, top-notch amenities, or truly memorable experiences.

Market indicators like Revenue Per Available Room (RevPAR) and occupancy rates in 2024 highlight just how demanding this landscape is. For instance, many major hotel markets saw RevPAR growth in the low-to-mid single digits year-over-year during the first half of 2024, a testament to the ongoing competition for market share and the need for strategic pricing and occupancy management.

Marcus Theatres contends with intense competition from major national players like AMC Entertainment and Cinemark, alongside a multitude of smaller regional and independent theaters. This rivalry intensifies due to factors such as securing desirable film releases, implementing competitive pricing models like subscription services, and the ongoing investment in premium viewing experiences, such as IMAX and Dolby Cinema.

In 2024, the movie exhibition sector continues to navigate a dynamic landscape. While some larger chains have demonstrated a degree of recovery, the overall industry's performance remains varied, influenced by evolving consumer habits and the continued impact of streaming services on theatrical releases. For instance, in early 2024, box office revenues were showing signs of improvement compared to previous pandemic-affected years, yet still lagged behind pre-pandemic benchmarks, highlighting the ongoing competitive pressures.

The Marcus Corporation's competitive rivalry is significantly influenced by its strategy of differentiation through enhanced amenities and unique customer experiences. In its theatre division, this translates to investments in premium features like plush recliner seating and expansive large-format screens, aiming to draw patrons seeking more than just a movie. Similarly, the hotel division focuses on offering renovated, high-quality properties that boast diverse amenities and services, setting them apart from competitors.

Crucially, ongoing investments in property upgrades are vital for sustaining this competitive edge. For instance, the significant renovation of the Hilton Milwaukee demonstrates a commitment to maintaining a superior standard. This strategic emphasis on providing tangible value beyond mere price points is essential for attracting and retaining customers in a crowded marketplace.

Geographic Market Concentration

While Marcus Porter's competitive rivalry is generally high across the industry, its intensity is significantly influenced by geographic market concentration. In regions where Marcus has established a strong foothold and holds substantial real estate assets, local competition tends to be more subdued. However, in densely populated urban centers, the company faces heightened rivalry from numerous competitors vying for market share.

Marcus's strategic focus on specific geographic regions and the careful selection of property locations are critical elements in its approach to managing this localized competitive pressure. This targeted strategy allows the company to leverage its existing presence and optimize its competitive advantage in key markets.

- Geographic Variance in Rivalry: Competition intensifies in saturated urban markets, while areas with Marcus's strong asset base may see moderated rivalry.

- Strategic Location Management: Marcus's focus on specific regions and property locations is a key strategy to navigate and manage competitive intensity.

- Market Saturation Impact: Densely populated urban centers present greater competitive challenges due to a higher concentration of rivals.

Impact of Industry Trends and Economic Conditions

Competitive rivalry within the entertainment and hospitality sectors is significantly shaped by overarching industry trends and prevailing economic conditions. Factors such as shifts in consumer spending habits, evolving travel sentiment, and the constant demand for fresh, engaging content directly influence the intensity of competition.

For instance, a robust film slate projected for 2025 is anticipated to invigorate the cinema segment, potentially drawing more patrons to theaters. Conversely, the hotel segment faces a more complex environment. Macroeconomic headwinds and persistent inflation concerns can dampen consumer confidence, leading to reduced discretionary spending on leisure travel.

This economic pressure has a direct correlation with competitive dynamics. When consumers have less disposable income or are more cautious about spending, businesses must vie more aggressively for a smaller pool of customers. This can manifest in intensified pricing wars, increased marketing spend, and a greater focus on differentiating unique value propositions.

- Consumer Spending Trends: Analysts project global consumer spending on entertainment and leisure to grow, but inflation could temper the pace. For example, in 2024, while box office revenues are showing signs of recovery, ticket prices have also increased, impacting affordability for some consumers.

- Travel Sentiment: Leisure travel demand remains a key indicator. Despite economic uncertainties in 2024, travel sentiment for domestic leisure trips has remained relatively resilient, though international travel might be more sensitive to economic slowdowns.

- Content Availability: The success of the theatre segment hinges on the quality and appeal of new film releases. A strong pipeline of blockbusters in 2025 could significantly boost attendance, directly impacting the competitive landscape against home entertainment options.

- Inflationary Impact: Rising inflation in 2024 impacts operational costs for hotels (e.g., energy, labor) and discretionary spending for travelers, forcing hotels to balance pricing strategies to remain competitive without alienating price-sensitive customers.

The intense rivalry Marcus Hotels & Resorts faces is evident in fluctuating occupancy rates and RevPAR. For example, many markets saw RevPAR growth in the low-to-mid single digits during the first half of 2024, indicating a constant battle for market share.

Marcus Theatres competes fiercely with giants like AMC and Cinemark, and smaller players. This competition is driven by the need to secure popular films and offer attractive pricing, such as subscription models.

Investments in premium experiences, like recliner seating and large-format screens in theaters, and high-quality, amenity-rich properties in hotels, are Marcus's key differentiators. These upgrades are vital for maintaining an edge in a crowded market, as seen with renovations like the Hilton Milwaukee.

Geographic concentration plays a role; while Marcus may face less intense rivalry in areas where it has a strong asset base, densely populated urban centers present greater challenges due to numerous competitors.

| Metric | 2023 (Approx.) | 2024 (H1 Projection/Trend) | Impact on Rivalry |

|---|---|---|---|

| US Hotel Occupancy Rate | ~63-64% | Slight increase, around 64-65% | Higher occupancy drives competition for available rooms and can impact pricing power. |

| US Hotel RevPAR Growth | ~3-5% | Low-to-mid single digits (1-5%) | Modest growth suggests a competitive market where incremental gains are hard-won. |

| US Box Office Revenue | ~$9.0 billion | Projected $9.5-$10.0 billion | Recovery signals increased competition for audience attention against home entertainment. |

SSubstitutes Threaten

The most significant threat to Marcus Theatres comes from the expanding home entertainment sector. Streaming services like Netflix, Disney+, and Max, alongside advanced home theatre systems and immersive video games, provide compelling alternatives. These options offer unparalleled convenience and often a more budget-friendly entertainment solution, directly siphoning potential moviegoers away from cinemas.

In 2023, global streaming revenue reached an estimated $215 billion, highlighting the immense scale and appeal of these platforms. This growth continues to challenge traditional theatrical exhibition by offering a vast library of content accessible from the comfort of one's home.

To combat this, movie theatres are investing heavily in differentiating the in-theatre experience. This includes offering premium formats like IMAX and Dolby Cinema, which provide superior visual and auditory immersion, as well as exclusive content and events designed to create a unique draw.

For Marcus Hotels & Resorts, the threat of substitutes is significant, with vacation rentals like Airbnb and serviced apartments offering distinct alternatives. These options often cater to different preferences and budgets, from budget-conscious travelers to those seeking extended stays or unique local experiences.

The growing popularity of 'bleisure' travel, blending business and leisure, further fuels the demand for these substitutes. In 2024, the short-term rental market continued its robust growth, with platforms like Airbnb reporting record bookings, demonstrating a clear shift in consumer behavior away from traditional hotels for certain travel segments.

Marcus Corporation's cinema and hotel divisions contend with a broad spectrum of alternative leisure and entertainment options. Consumers can choose from activities like attending live concerts, watching sporting events, dining out, visiting theme parks, or engaging with cultural attractions. This wide array means Marcus must vie for consumer discretionary spending against countless other experiences, making it crucial to offer compelling value propositions to retain customer attention and loyalty.

Virtual Meetings and Remote Work

The increasing adoption of virtual meeting technologies and the sustained trend towards remote work act as significant substitutes for traditional business travel and large in-person conventions within the hotel industry. While demand for group bookings remains robust, a portion of corporate travel, particularly for routine meetings, may be permanently shifted to virtual alternatives. This substitution directly impacts the demand for hotel meeting spaces and accommodations catering to business travelers.

By 2024, the shift towards hybrid work models means that many companies are re-evaluating the necessity of physical business travel for internal meetings. For instance, a significant percentage of surveyed companies indicated plans to maintain or increase their use of virtual collaboration tools post-pandemic. This trend can lead to reduced occupancy rates for hotels relying heavily on corporate events and business stays. Consider the impact on revenue per available room (RevPAR) if a substantial segment of the business traveler market opts for virtual engagement.

- Virtual Meetings as Substitutes: Technologies like Zoom and Microsoft Teams offer cost-effective alternatives for internal and some external meetings, reducing the need for travel.

- Impact on Corporate Travel: Companies are re-evaluating travel budgets, with a focus on essential trips, potentially decreasing overall business travel volume.

- Remote Work Influence: The rise of remote and hybrid work models inherently reduces the frequency of office-based activities that often involve hotel stays for out-of-town employees.

- Hotel Segment Vulnerability: Hotels heavily reliant on convention business and corporate bookings face a direct threat from these digital substitutes, potentially leading to decreased revenue.

Do-It-Yourself (DIY) Experiences

The growing consumer inclination towards personalized and cost-effective DIY experiences presents a significant threat of substitutes. This trend sees individuals opting for home-based activities over commercially provided services.

For instance, instead of dining at restaurants, many consumers are increasingly preparing meals at home. Similarly, personal events are often organized independently rather than booking professional venues, reflecting a desire for control and potential savings. In 2024, the home cooking market continued its robust growth, with many reports indicating a sustained interest in culinary activities beyond necessity, fueled by accessible online recipes and ingredient delivery services.

Marcus's business must consistently demonstrate a clear value proposition that outweighs the perceived benefits of these DIY alternatives. This means the cost and convenience of Marcus's services need to be demonstrably superior to the effort and expense involved in a do-it-yourself approach.

- DIY Meal Preparation: While restaurant dining remains popular, the growth in meal kit services and online recipe platforms in 2024 has empowered more consumers to cook at home, potentially reducing demand for some food service businesses.

- Home Event Hosting: The trend of hosting gatherings at home, facilitated by readily available party supplies and digital invitations, offers a more budget-friendly alternative to renting event spaces.

- Personalized Services: Consumers are seeking unique experiences, and the ability to craft these oneself, often at a lower price point, poses a direct challenge to businesses offering standardized services.

- Cost Justification: Marcus's pricing and service delivery must clearly articulate why their offering is a better investment than the DIY route, factoring in time, skill, and potential quality differences.

The threat of substitutes for Marcus Corporation's offerings is substantial, encompassing a wide array of entertainment and lodging alternatives. This includes the burgeoning home entertainment sector with its streaming services and advanced home theater setups, which in 2024 continued to draw consumers away from traditional cinema experiences due to convenience and cost-effectiveness. For hotels, vacation rentals and the growing trend of 'bleisure' travel provide distinct substitutes, with platforms like Airbnb reporting record bookings in 2024, indicating a significant shift in consumer preferences for certain travel segments.

Entrants Threaten

The hotel industry presents a formidable barrier to entry, primarily driven by the immense capital required. Establishing a new hotel or resort necessitates significant investment in land acquisition, construction, extensive renovations, and continuous upkeep. For instance, the average cost to build a new mid-scale hotel in the United States can range from $15 million to $30 million, with luxury properties easily exceeding $50 million.

This substantial upfront financial commitment acts as a strong deterrent for potential new entrants. Companies like Marcus Hotels & Resorts, which manage a portfolio of established properties, benefit from this high capital barrier. New players would need to secure considerable funding to compete, a feat that can be challenging in a market with established brands and significant operational overhead.

The movie exhibition industry is characterized by a significant capital investment hurdle for new players. Building or renovating multiplex cinemas demands substantial upfront funding, including the acquisition of prime real estate and the installation of cutting-edge projection and sound technology. For instance, a modern multiplex can cost tens of millions of dollars to construct and equip.

Further escalating these entry barriers are the costs associated with offering premium customer experiences. Investing in features like plush recliner seating, immersive large-format screens such as IMAX, and sophisticated concession areas adds considerably to the initial outlay. These amenities are increasingly expected by audiences, making them almost essential for competitive viability.

In 2024, the average cost to build a new 10-screen multiplex cinema in a mid-sized city could range from $15 million to $30 million, depending on location and features. This high capital requirement effectively deters many potential new entrants, thereby reducing the threat of new competition in the sector.

Established brands like Marcus Hotels & Resorts and Marcus Theatres enjoy considerable brand recognition and customer loyalty. This existing trust and familiarity represent a substantial barrier for any new competitor looking to enter the market. It takes significant time and resources to cultivate a reputation for quality service and reliability in both the hospitality and entertainment sectors.

For instance, in 2024, a new hotel chain entering a market where Marcus Hotels & Resorts has a strong presence would need to invest heavily in marketing to even begin to match the established brand's recall. Similarly, a new cinema operator would face an uphill battle against the ingrained customer loyalty Marcus Theatres has built over decades, evidenced by their consistent customer engagement programs and community involvement.

Access to Distribution Channels and Film Content

New players entering the film exhibition industry struggle to secure preferred access to popular movie titles from major distributors. These distributors often favor established cinema chains that have long-standing relationships and can guarantee significant box office performance, leaving newcomers with limited content options. This was evident in 2024, where major studios continued to consolidate their distribution partnerships, making it harder for independent or newly formed cinema groups to acquire desirable films.

Similarly, in the hotel sector, new entrants face significant hurdles in gaining visibility and building a customer base. Establishing a presence on prominent Online Travel Agencies (OTAs) is crucial, but often comes with high commission fees that eat into profit margins. Developing direct booking channels also requires substantial investment in marketing and technology, a challenge for businesses just starting out.

- Film Distribution Barriers: In 2024, major film distributors continued to prioritize existing multiplex chains, limiting access to new releases for emerging cinema operators.

- OTA Dependence: New hotels often rely heavily on OTAs, with commission rates frequently ranging from 15% to 30%, impacting profitability.

- Direct Booking Investment: Building a robust direct booking platform and marketing it effectively can cost tens of thousands of dollars annually for new hotel businesses.

- Content Negotiation Power: Established cinema chains leverage their market share to negotiate better terms for film licensing, a significant advantage over new entrants.

Regulatory Hurdles and Operational Complexity

The lodging and entertainment sectors are heavily regulated, demanding significant compliance efforts from any new player. Navigating complex licensing, permits, and evolving safety standards, such as those mandated by the Centers for Disease Control and Prevention (CDC) for hospitality during public health events, presents a substantial challenge. For instance, in 2024, the hospitality industry continued to grapple with post-pandemic health and safety protocols, requiring investments in updated sanitation equipment and staff training, which can easily run into tens of thousands of dollars for even smaller establishments.

Beyond regulatory compliance, the sheer operational complexity of these industries acts as a formidable barrier to entry. Managing large workforces, ensuring consistent service quality across numerous touchpoints, and maintaining physical infrastructure require sophisticated systems and experienced management. In 2024, the average hotel, depending on its size, might employ hundreds of staff, each requiring specialized training and oversight, adding layers of operational overhead that new entrants must be prepared to absorb.

- Regulatory Compliance Costs: New entrants face significant upfront and ongoing costs associated with obtaining and maintaining licenses and adhering to health and safety regulations.

- Operational Infrastructure Investment: Building robust operational frameworks, including staffing, supply chains, and technology, requires substantial capital expenditure.

- Staffing and Training Demands: The need for a well-trained workforce to manage diverse operational aspects is a critical barrier, impacting both cost and time-to-market.

- Industry-Specific Standards: Adherence to sector-specific standards, such as those for food safety in entertainment venues or accessibility in hotels, adds further complexity.

The threat of new entrants in the hotel and film exhibition industries is significantly mitigated by high capital requirements, established brand loyalty, and complex regulatory environments. These factors create substantial barriers, making it difficult for new companies to gain a foothold and compete effectively with established players like Marcus Hotels & Resorts and Marcus Theatres.

In 2024, the substantial investment needed for property development and technology upgrades, coupled with the difficulty in securing prime film distribution rights, continues to deter new competition. Furthermore, the operational complexities and stringent compliance demands add to the challenge, ensuring that only well-resourced and prepared entities can realistically enter these markets.

| Industry Sector | Barrier Type | 2024 Data/Example |

|---|---|---|

| Hospitality (Hotels) | Capital Investment | Building a new mid-scale hotel can cost $15M-$30M. |

| Entertainment (Cinemas) | Capital Investment | A 10-screen multiplex can cost $15M-$30M to build and equip. |

| Hospitality & Entertainment | Brand Loyalty & Recognition | High marketing spend required to match established brands' recall. |

| Entertainment (Cinemas) | Access to Distribution | Major distributors favored established chains for new releases. |

| Hospitality (Hotels) | Distribution Channels | High OTA commissions (15%-30%) impact new entrants' profitability. |

| Hospitality & Entertainment | Regulatory Compliance | Costs for licenses, permits, and evolving safety standards. |

| Hospitality & Entertainment | Operational Complexity | Managing large workforces and ensuring consistent service quality. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon comprehensive data from industry-specific market research reports, company annual filings, and publicly available financial statements to provide a robust understanding of competitive dynamics.