Marcus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marcus Bundle

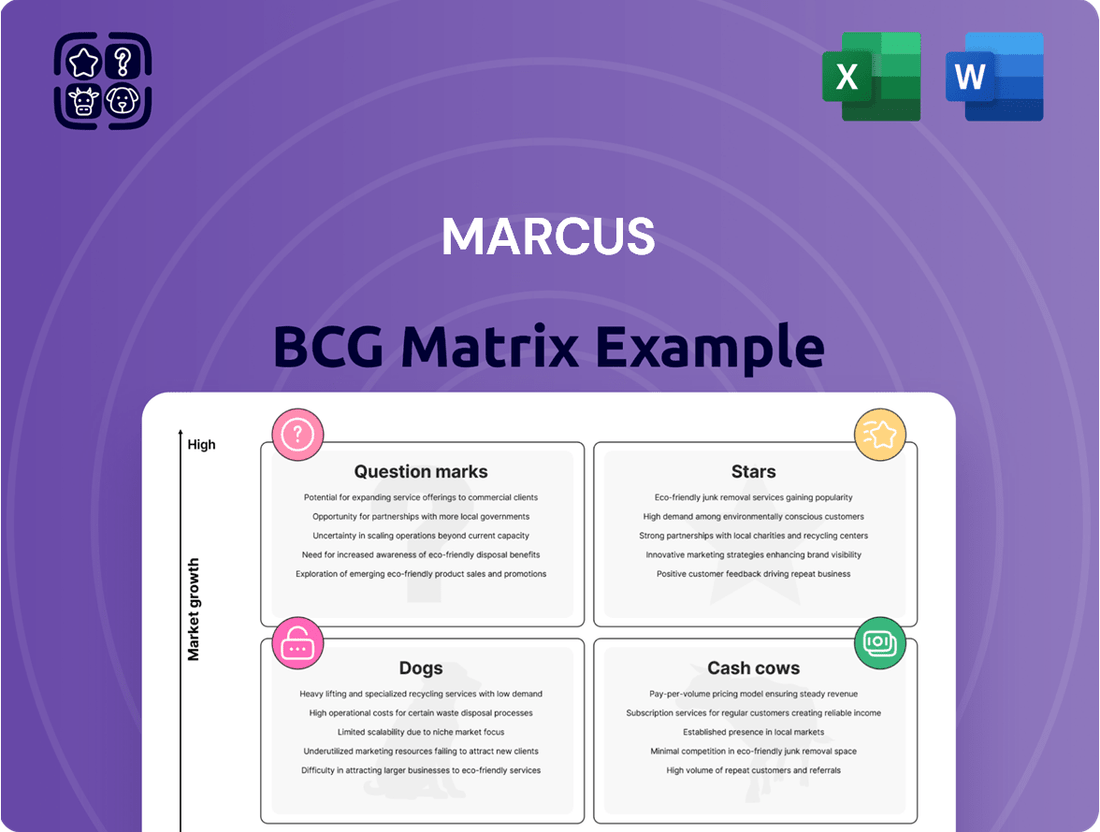

Curious about which of this company's products are poised for growth and which might be holding them back? The BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a powerful visual framework for strategic decision-making. Understanding this placement is crucial for optimizing resource allocation and driving future success.

This preview offers a glimpse into the strategic positioning of their product portfolio. To truly unlock actionable insights and develop a robust plan for market dominance, dive deeper with the full BCG Matrix report. It's your essential guide to making informed investment and product decisions.

Stars

Marcus Theatres' premium large format (PLF) screens, including SuperScreen DLX and UltraScreen DLX, are proving to be a major attraction, drawing audiences looking for a superior movie-watching experience. These premium offerings typically generate higher ticket revenue and appeal to a broader customer base, suggesting a strong position in the expanding premium cinema market segment.

These enhanced auditoriums are key to Marcus Theatres' strategy. For instance, in fiscal 2024, the company reported that its PLF screens, such as UltraScreen DLX, often achieved higher attendance rates and average ticket prices compared to standard screens. This performance highlights their ability to capture a significant share of the premium segment.

Looking ahead, Marcus Theatres is committed to growing its presence in high-demand formats. The company's plans include converting more existing auditoriums to ScreenX, an immersive 270-degree viewing experience, during fiscal 2025, further solidifying its investment in this lucrative and rapidly evolving area of the cinema industry.

Renovated luxury hotels, such as the recently upgraded Hilton Milwaukee and Grand Geneva Resort & Spa under Marcus Hotels & Resorts, represent the Stars in the BCG Matrix. These properties are experiencing significant growth and hold a substantial market share, fueled by substantial investments.

The extensive renovations, costing tens of millions of dollars and slated for completion in 2025, are strategically designed to capture increasing demand in the luxury hospitality sector. This investment is projected to boost occupancy rates and average daily rates significantly.

The enhanced appeal of these properties is expected to attract more group bookings and leisure travelers, solidifying their position as market leaders. This strategic repositioning aims to maximize revenue and profitability in a competitive market.

Marcus Theatres' Movie Tavern by Marcus and BistroPlex are strong contenders in the evolving cinema landscape. These dine-in concepts cater to consumers seeking an elevated, multi-sensory entertainment experience beyond just watching a film.

The premiumization trend in the movie theater industry, marked by gourmet food, craft beverages, and enhanced seating, is a significant tailwind for these brands. This strategy aligns with broader consumer preferences for experiential consumption.

While precise market share figures for these specific Marcus brands are not publicly disclosed, the overall growth in the dine-in cinema sector indicates strong potential. Industry reports suggest the premium cinema segment is outperforming traditional theaters. For example, in 2023, the U.S. box office saw a notable increase in revenue driven by premium formats and enhanced offerings, supporting the viability of concepts like Movie Tavern and BistroPlex.

Strategic Joint Venture Hotel Acquisitions

Marcus Hotels & Resorts is strategically leveraging joint ventures for hotel acquisitions, a move that aligns with a high-growth, lower-equity investment model. This approach allows them to expand their footprint by partnering with entities like Hempel Real Estate and Robinson Park, as seen in the acquisition of The Lofton Hotel. This strategy is designed to unlock new markets and properties with substantial growth potential, while Marcus Hotels & Resorts benefits from management fees.

This joint venture strategy positions Marcus Hotels & Resorts’ hotel acquisitions within the Stars quadrant of the BCG Matrix, signifying high market share in a high-growth industry. The company anticipates further expansion through similar partnerships in fiscal year 2025, aiming to capitalize on favorable market conditions and attractive property opportunities.

- Strategic Growth: Joint ventures allow for portfolio expansion with a reduced equity outlay.

- Revenue Streams: Management fees generated from these partnerships provide a stable income source.

- Market Penetration: This model facilitates entry into new geographic markets and property types.

- Future Outlook: Marcus Hotels & Resorts plans to continue this strategy in fiscal 2025 and beyond.

Loyalty Programs and Membership Clubs

Loyalty programs, like the Marcus Movie Club at $9.99 per month, are a key strategy to foster customer retention and recurring revenue. This initiative, offering benefits such as a 2D movie credit and a 20% discount on food and beverages, directly addresses the growing consumer demand for value-added memberships.

The focus on encouraging early membership sales highlights a proactive approach to capturing market share in an increasingly competitive entertainment landscape. Such programs are designed to transform casual customers into loyal patrons, thereby increasing lifetime value.

Industry data from 2024 shows a significant uptick in loyalty program subscriptions across various sectors, with many companies reporting increased customer engagement and sales driven by these initiatives. For example, a significant percentage of consumers actively participate in at least one loyalty program, demonstrating their perceived value.

- Customer Retention: Loyalty programs are proven to increase customer retention rates by as much as 20% or more.

- Recurring Revenue: Membership fees provide a predictable stream of recurring revenue, crucial for financial stability.

- Increased Spending: Members tend to spend more, often by 10-15%, compared to non-members.

- Data Collection: These programs offer valuable insights into customer behavior, enabling more targeted marketing efforts.

Marcus Theatres' premium large format (PLF) screens, like SuperScreen DLX and UltraScreen DLX, are performing strongly, drawing in audiences for a better movie experience. These premium offerings are generating more ticket revenue and attracting a wider audience, indicating a solid position in the growing premium cinema market.

These enhanced auditoriums are central to Marcus Theatres' strategy. In fiscal 2024, the company noted that its PLF screens, such as UltraScreen DLX, frequently saw higher attendance and average ticket prices than standard screens. This performance underscores their success in capturing a significant portion of the premium market segment.

Marcus Theatres is focused on expanding its presence in high-demand formats. The company plans to convert more existing auditoriums to ScreenX, an immersive 270-degree viewing experience, during fiscal 2025, reinforcing its investment in this dynamic area of the cinema industry.

Renovated luxury hotels, such as the recently upgraded Hilton Milwaukee and Grand Geneva Resort & Spa under Marcus Hotels & Resorts, represent the Stars in the BCG Matrix. These properties are experiencing significant growth and hold a substantial market share, fueled by substantial investments.

The extensive renovations, costing tens of millions of dollars and slated for completion in 2025, are strategically designed to capture increasing demand in the luxury hospitality sector. This investment is projected to boost occupancy rates and average daily rates significantly.

The enhanced appeal of these properties is expected to attract more group bookings and leisure travelers, solidifying their position as market leaders. This strategic repositioning aims to maximize revenue and profitability in a competitive market.

Marcus Theatres' Movie Tavern by Marcus and BistroPlex are strong contenders in the evolving cinema landscape. These dine-in concepts cater to consumers seeking an elevated, multi-sensory entertainment experience beyond just watching a film.

The premiumization trend in the movie theater industry, marked by gourmet food, craft beverages, and enhanced seating, is a significant tailwind for these brands. This strategy aligns with broader consumer preferences for experiential consumption.

While precise market share figures for these specific Marcus brands are not publicly disclosed, the overall growth in the dine-in cinema sector indicates strong potential. Industry reports suggest the premium cinema segment is outperforming traditional theaters. For example, in 2023, the U.S. box office saw a notable increase in revenue driven by premium formats and enhanced offerings, supporting the viability of concepts like Movie Tavern and BistroPlex.

Marcus Hotels & Resorts is strategically leveraging joint ventures for hotel acquisitions, a move that aligns with a high-growth, lower-equity investment model. This approach allows them to expand their footprint by partnering with entities like Hempel Real Estate and Robinson Park, as seen in the acquisition of The Lofton Hotel. This strategy is designed to unlock new markets and properties with substantial growth potential, while Marcus Hotels & Resorts benefits from management fees.

This joint venture strategy positions Marcus Hotels & Resorts’ hotel acquisitions within the Stars quadrant of the BCG Matrix, signifying high market share in a high-growth industry. The company anticipates further expansion through similar partnerships in fiscal year 2025, aiming to capitalize on favorable market conditions and attractive property opportunities.

- Strategic Growth: Joint ventures allow for portfolio expansion with a reduced equity outlay.

- Revenue Streams: Management fees generated from these partnerships provide a stable income source.

- Market Penetration: This model facilitates entry into new geographic markets and property types.

- Future Outlook: Marcus Hotels & Resorts plans to continue this strategy in fiscal 2025 and beyond.

Loyalty programs, like the Marcus Movie Club at $9.99 per month, are a key strategy to foster customer retention and recurring revenue. This initiative, offering benefits such as a 2D movie credit and a 20% discount on food and beverages, directly addresses the growing consumer demand for value-added memberships.

The focus on encouraging early membership sales highlights a proactive approach to capturing market share in an increasingly competitive entertainment landscape. Such programs are designed to transform casual customers into loyal patrons, thereby increasing lifetime value.

Industry data from 2024 shows a significant uptick in loyalty program subscriptions across various sectors, with many companies reporting increased customer engagement and sales driven by these initiatives. For example, a significant percentage of consumers actively participate in at least one loyalty program, demonstrating their perceived value.

- Customer Retention: Loyalty programs are proven to increase customer retention rates by as much as 20% or more.

- Recurring Revenue: Membership fees provide a predictable stream of recurring revenue, crucial for financial stability.

- Increased Spending: Members tend to spend more, often by 10-15%, compared to non-members.

- Data Collection: These programs offer valuable insights into customer behavior, enabling more targeted marketing efforts.

Marcus Theatres' Stars, such as their premium large format screens and dine-in concepts, are performing exceptionally well. These offerings are experiencing high growth and command a significant market share within the cinema industry.

The ongoing investment in luxury hotel renovations, like those at Hilton Milwaukee and Grand Geneva, positions them as Stars. These properties are benefiting from substantial capital infusions and are projected to see significant increases in occupancy and average daily rates by 2025.

Furthermore, the joint venture strategy for hotel acquisitions allows Marcus Hotels & Resorts to expand rapidly in high-growth markets. This approach secures a strong market position for these ventures, treating them as Stars in the portfolio.

The loyalty program, Marcus Movie Club, also falls under the Stars category due to its role in driving recurring revenue and customer retention. By offering compelling benefits, it captures a loyal customer base and fosters increased spending, contributing to its star status.

| Category | Examples within Marcus | Market Growth | Market Share | Key Driver |

| Stars | PLF Screens (SuperScreen DLX, UltraScreen DLX) | High | High | Superior experience, premium pricing |

| Stars | Dine-in Concepts (Movie Tavern, BistroPlex) | High | Growing (estimated) | Experiential consumption trend |

| Stars | Joint Venture Hotel Acquisitions | High | High (in target markets) | Strategic partnerships, market expansion |

| Stars | Loyalty Programs (Marcus Movie Club) | High (for digital subscriptions) | Increasing | Customer retention, recurring revenue |

What is included in the product

The Marcus BCG Matrix provides strategic guidance by categorizing business units based on market growth and relative market share, highlighting which units to invest in, hold, or divest.

A clear visual of your portfolio, instantly showing which units need investment and which can fund others.

Cash Cows

Marcus Theatres' established multiplex cinema operations are firmly positioned as cash cows within their business portfolio. These core operations, encompassing a substantial portion of their 78 locations and 985 screens, represent a mature segment with a dominant market share in traditional movie exhibition.

Despite industry volatility, these cinemas consistently deliver robust revenue streams, underpinning the company's financial stability. Notably, the theatre segment spearheaded the company's financial performance, generating an impressive $87.36 million in revenue during the first quarter of 2025.

Well-established, company-owned hotels, such as The Pfister Hotel in Milwaukee, exemplify cash cows within the BCG matrix. These properties benefit from decades of brand building and a deeply ingrained loyal customer base. For instance, The Pfister, a historic hotel, has consistently drawn guests, even as the hospitality sector evolves, demonstrating its resilience and mature market status.

Their mature market positioning means consistent, albeit slower, growth, but with significant, predictable cash flow. Unlike hotels needing extensive market penetration strategies, these established brands require less aggressive marketing spend. The Pfister's ongoing significant renovations, like the $30 million project completed in 2020, illustrate how reinvestment maintains their competitive advantage and cash-generating ability, ensuring continued profitability without the high risk of new ventures.

In-lobby concession stands and other food and beverage offerings are a significant profit driver for Marcus Theatres, generating substantial cash flow. These sales are crucial, often compensating for lower ticket prices and unpredictable attendance.

Theaters heavily rely on these high-margin items to bolster overall revenue. For instance, average concession revenues per person saw a healthy increase of 2.9% during the first quarter of fiscal 2025, highlighting their importance as a cash cow.

Group and Convention Business at Key Hotel Properties

The group and convention business at key Marcus Hotels & Resorts properties, such as the Hilton Milwaukee, functions as a cash cow. This segment offers a stable and predictable revenue stream due to large, pre-booked events that ensure high occupancy and significant banquet revenue, solidifying its role as a reliable generator in the mature hospitality market.

For fiscal 2025, group bookings are outpacing the same period in fiscal 2024. This positive trend indicates continued strength and demand for these large-scale events, reinforcing the cash cow status of this business segment.

- Stable Revenue: Pre-booked group and convention business provides a predictable income flow.

- High Occupancy: Large events translate to consistent high occupancy rates.

- Robust Banquet Sales: These events typically include substantial food and beverage revenue.

- Fiscal 2025 Growth: Bookings are ahead of fiscal 2024 figures, showing continued demand.

Parking and Ancillary Revenue Streams

Ancillary revenue streams, like parking fees at busy cinemas or hotels, often exhibit low growth potential but command high profit margins. These established income sources bolster a company's overall cash flow, requiring minimal additional investment to maintain. For instance, in 2024, many large entertainment venues continued to rely on parking revenue as a significant contributor to their bottom line, even as attendance patterns shifted.

These types of services are classic examples of "cash cows" within the BCG matrix framework. They generate steady profits that can be reinvested in other areas of the business, such as funding new ventures or research and development. The stability of these income streams is particularly valuable in dynamic market environments.

- Low Growth, High Profit: Services like parking often have mature markets, limiting expansion but offering substantial profit margins.

- Cash Flow Generation: These streams provide consistent, reliable cash to support other business activities.

- Minimal Investment: Once established, ancillary services typically require little ongoing capital expenditure.

- Industry Example: Many hospitality and entertainment businesses in 2024 continued to leverage parking and on-site retail as key profit centers.

Concession sales represent a prime example of a cash cow for Marcus Theatres. These high-margin items, such as popcorn and beverages, generate substantial and consistent profits, offsetting lower ticket revenues. For instance, in the first quarter of fiscal 2025, average concession revenues per person saw a healthy 2.9% increase, underscoring their vital role in fueling the company’s financial stability and providing ample cash for reinvestment.

Preview = Final Product

Marcus BCG Matrix

The BCG Matrix document you are currently previewing is precisely the final, unwatermarked, and fully formatted report you will receive immediately after purchase. This comprehensive analysis tool is designed for immediate strategic application, offering clear insights into your business portfolio without any demo content or hidden alterations.

Dogs

Certain older multiplex cinemas within the Marcus Theatres portfolio, especially those lacking recent upgrades to premium formats or enhanced dining experiences, could be classified as Dogs. These locations often face declining attendance and a shrinking market share within a slower-growing segment of the cinema industry.

These underperforming sites may operate at break-even or even incur small losses. For context, Marcus Theatres' theatre division reported an operating loss of $6.3 million in the first quarter of 2025, highlighting the challenges faced by some of its locations.

Outdated hotel properties needing renovation or sale often fall into the Dogs category of the BCG Matrix. These are assets that aren't performing well, struggling to attract customers in today's competitive travel landscape. They typically experience low occupancy and contribute little to profitability, essentially locking up valuable capital without a good return.

Consider the case of the Hilton Milwaukee's west tower, where 175 rooms were removed from inventory. This move likely signals a strategy to divest or repurpose underperforming sections of the hotel, a common tactic for assets categorized as Dogs. Such properties require significant capital infusion for renovations or are candidates for sale to unlock trapped value.

Traditional ticket sales for standard 2D movies, without any premium add-ons like luxury seating or enhanced sound systems, can be categorized as a Dog in the BCG Matrix. This segment faces challenges in a market that increasingly favors immersive experiences and additional value. For instance, in early 2025, the film industry reported a generally disappointing first quarter performance, indicating a potential slowdown in demand for basic movie tickets alone, even with some later blockbusters providing a boost.

The reliance on just the base ticket price for conventional movie showings may lead to low growth prospects and a shrinking market share as consumers seek more engaging entertainment options. This approach struggles to compete with premium formats, dine-in services, or loyalty programs that enhance the overall customer value proposition.

Non-core, Low-Utilization Real Estate Assets

Non-core, Low-Utilization Real Estate Assets within Marcus Corporation's portfolio are those properties not directly tied to their core lodging and entertainment businesses. These could include vacant land parcels or underused office spaces that require ongoing expenses like property taxes and maintenance without contributing significantly to the company's revenue stream. For instance, if Marcus Corporation owns a commercial building in a declining market that has a high vacancy rate, it would fit this description. These assets might represent a drain on resources, potentially hindering investment in more productive areas of the business.

The strategic implication for Marcus Corporation is to evaluate these underperforming assets. The company's 2023 annual report might detail property disposals or strategies for repurposing such real estate. Companies often look to divest these holdings to free up capital or to convert them into more profitable ventures. For example, a company might sell off unused land to a developer or redevelop an underutilized building to attract new tenants.

- Definition: Real estate assets not directly supporting core lodging or entertainment operations, characterized by low usage or demand.

- Financial Impact: These properties incur maintenance and tax costs, often without generating commensurate revenue or appreciating in value.

- Strategic Consideration: Marcus Corporation would analyze these assets for potential divestiture or redevelopment to optimize resource allocation.

- Industry Practice: Diversified companies frequently hold such assets, requiring periodic review to improve overall portfolio efficiency.

Inefficient Legacy Operational Processes

Inefficient legacy operational processes can act as a 'Dog' within a company's strategic framework, draining resources without yielding proportional benefits. These can manifest as outdated manual systems or convoluted procedures that stifle both profitability and agility in a slow-growth, low-return environment.

The company's Q1 2025 operating loss of $20.4 million highlights potential areas where such inefficiencies are impacting financial performance.

- Resource Drain: Manual data entry and paper-based workflows consume significant labor hours and increase error rates, diverting funds from value-adding activities.

- Reduced Responsiveness: Slow approval chains and legacy IT systems hinder the ability to adapt to market shifts or customer demands quickly.

- Profitability Erosion: Redundant steps in production or service delivery lead to higher operating costs, directly impacting the bottom line, especially in mature or low-growth markets.

- Competitive Disadvantage: Companies with streamlined, automated processes can offer better pricing or faster delivery, leaving inefficient operations behind.

Dogs in the Marcus BCG Matrix represent underperforming assets or business segments with low market share in slow-growing industries. These require careful management, often involving divestment or revitalization efforts to avoid continued resource drain.

For Marcus Corporation, this could include older cinema locations with outdated amenities or specific hotel properties that are no longer competitive. These assets typically generate minimal profits, or even losses, tying up capital that could be better utilized elsewhere.

The company's Q1 2025 results, showing an operating loss in its theatre division, underscore the challenges faced by such 'Dog' assets. Strategic decisions are crucial, whether it's investing in upgrades to boost performance or exiting these segments to improve overall portfolio health.

Consider the following illustrative breakdown of potential 'Dog' assets within a portfolio like Marcus Corporation's:

| Asset Type | Description | Market Share | Market Growth | Potential Strategy |

| Older Multiplex Cinemas | Lacking premium formats, declining attendance | Low | Slow/Declining | Divestment or significant renovation |

| Underutilized Hotel Wings | Rooms removed from inventory, low occupancy | Low | Slow | Repurposing or sale |

| Non-Core Real Estate | Vacant land, unused office space | N/A | N/A | Sale or redevelopment |

| Legacy Operational Systems | Inefficient, manual processes | N/A | N/A | Automation or process re-engineering |

Question Marks

The expansion into new cinema technologies, such as adding more ScreenX auditoriums, places this initiative firmly in the Question Mark category for Marcus. While the demand for premium and immersive viewing experiences is on the rise, the specific market share and profitability Marcus can achieve with these newer, more niche technologies are still being determined.

Significant investment is necessary to build brand awareness and capture a substantial customer base, with the goal of eventually transitioning these formats from Question Marks to Stars. For example, in 2024, the global immersive entertainment market, which includes technologies like ScreenX, was valued at over $5 billion and is projected to grow significantly.

Niche hotel concepts or boutique acquisitions that are in nascent stages, targeting emerging segments like experiential or wellness tourism, fall into the question mark category of the BCG Matrix. These ventures, while holding significant growth potential, often require substantial investment to build brand recognition and operational efficiency. For example, consider the rapid expansion of eco-lodges or "digital nomad" friendly accommodations, which are carving out specific market share but are still developing their scalable models.

These properties are characterized by their unique offerings aimed at specific traveler preferences, yet their market penetration is limited. Many are in the process of proving their concept and demonstrating consistent profitability, making them prime candidates for further investment to capture potential market share. The travel industry in 2024 saw a continued surge in demand for personalized and unique experiences, with wellness tourism alone projected to reach $1 trillion globally by 2027, highlighting the growth runway for these niche players.

The challenge for these "question mark" hotels lies in transitioning from a niche concept to a widely recognized and profitable brand. This often involves significant marketing spend, strategic partnerships, and operational refinement to ensure a consistent and high-quality guest experience. Without adequate support, these promising ventures risk remaining small-scale operations or failing to gain traction in competitive markets.

Marcus Theatres is actively experimenting with new revenue streams within its auditoriums. This includes testing concepts like sports bars for live sports viewing, sports gaming, and even interactive live bingo. These initiatives represent a strategic move to diversify income beyond traditional movie screenings.

These new offerings are positioned as potential high-growth areas for Marcus Theatres. The goal is to attract a broader audience and increase per-customer spending. For instance, AMC Theatres, a competitor, has seen success with its "Movies + Dining" concept, indicating a market appetite for enhanced in-theatre experiences.

However, the market adoption and profitability of these in-theatre gaming and live event offerings are still largely unproven for Marcus Theatres. While the concept of entertainment diversification is sound, the specific execution and customer reception of these particular ventures remain to be seen. Success will depend on factors like venue design, content selection, and pricing strategies.

International Expansion Initiatives (if any)

While Marcus Corporation's core operations are firmly rooted in the United States, any early-stage international expansion efforts would likely be categorized as Question Marks within the BCG Matrix. These initiatives, if they exist, would represent ventures into new geographic territories, aiming to tap into high-growth markets.

Such endeavors, however, typically begin with a low market share and necessitate significant investment of capital and strategic resources. This is due to the inherent complexities and risks associated with establishing a presence in unfamiliar business environments.

For instance, if Marcus were to consider expanding into emerging markets in Southeast Asia or Latin America, these regions often present substantial growth potential but also come with considerable regulatory hurdles, competitive landscapes, and currency fluctuations.

- High Growth Potential: Emerging economies often exhibit faster GDP growth rates than developed nations, offering a larger addressable market.

- Low Market Share: Initially, Marcus would have minimal brand recognition and a negligible share of the local market.

- Capital Intensive: Establishing operations, marketing, and distribution networks in a new country requires substantial upfront investment.

- High Risk: Political instability, economic volatility, and cultural differences pose significant risks to the success of international ventures.

Digital Content Distribution Partnerships

Digital content distribution partnerships, particularly those exploring direct-to-consumer streaming or exclusive digital releases, represent a potential high-growth area. Marcus's current standing in this nascent market is likely characterized by low market share and a need for substantial investment to build competitive advantage. The existing strategic alliance with AMC Theatres, which includes joint marketing efforts, could serve as a springboard for exploring these digital distribution avenues.

These ventures into digital content distribution are crucial for adapting to evolving consumer habits. For instance, in 2024, the global digital media distribution market was valued at over $300 billion, with streaming services alone experiencing significant year-over-year growth. Companies are increasingly prioritizing direct engagement with audiences, bypassing traditional intermediaries.

- Emerging Digital Channels: Exploration of direct-to-consumer streaming platforms and exclusive digital content releases.

- Market Position: Likely low current market share and competitive advantage in digital distribution.

- Investment Needs: Significant capital investment required to scale operations and gain traction in this high-growth sector.

- Strategic Synergies: Leveraging existing partnerships, like the one with AMC Theatres, to explore new distribution models.

Question Marks within Marcus's portfolio represent initiatives with high growth potential but currently low market share. These ventures require significant investment to develop and capture market position.

The success of these Question Marks hinges on strategic execution and market reception, with the aim of transforming them into Stars or Cash Cows. For example, Marcus's exploration of niche hotel concepts in the wellness tourism sector, a market projected to reach $1 trillion globally by 2027, exemplifies this.

These new ventures, while promising, demand careful nurturing and substantial capital to overcome initial market penetration challenges and achieve profitability.

Marcus Theatres' foray into in-auditorium entertainment diversification, such as sports bars and gaming, also falls under Question Marks. While the broader entertainment market shows strong demand for varied experiences, the specific success of these new revenue streams for Marcus is yet to be determined, requiring investment to build customer adoption.

BCG Matrix Data Sources

Our BCG Matrix leverages robust data, including financial disclosures, market growth statistics, and competitor analysis, to provide strategic clarity.