Manhattan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manhattan Bundle

The Manhattan's iconic brand recognition is a significant strength, allowing it to command premium pricing and customer loyalty. However, its reliance on a specific geographic market presents a notable weakness, limiting scalability. Opportunities abound in expanding its digital presence and exploring new product lines. Yet, the threat of increasing competition and changing consumer tastes demands careful consideration.

Want the full story behind The Manhattan's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Manhattan Associates' primary strength lies in its comprehensive and unified cloud platform, the Manhattan Active Platform. This integrated suite covers the full spectrum of supply chain needs, from initial planning and execution to in-store operations.

The platform's cloud-native, API-microservices design is a significant advantage, enabling rapid innovation and delivering top-tier functionality across the entire supply chain commerce landscape. This architecture is key to their competitive edge.

A testament to their commitment to innovation is the continuous delivery of updates. Manhattan Associates releases approximately 40-45 new features every quarter, ensuring clients benefit from the most current advancements in supply chain technology.

This regular influx of new capabilities, delivered through quarterly updates, means clients are consistently equipped with cutting-edge tools, fostering operational efficiency and adaptability in a dynamic market.

Manhattan Associates' consistent recognition as a leader by industry analysts is a significant strength. For instance, they were named a Gartner Magic Quadrant Leader for Warehouse Management Systems (WMS) for 17 consecutive years, and for Transportation Management Systems (TMS) for seven consecutive years as of 2025. This long-standing dominance highlights their advanced technology and strategic prowess in the supply chain software sector.

Manhattan Associates is showing impressive financial health, largely thanks to its focus on cloud services. In the first quarter of 2025, their cloud revenue saw a significant jump of 21% compared to the previous year. This strong performance is a clear indicator of how well their cloud solutions are being received by businesses.

The company's commitment to its cloud strategy is paying off, with enterprise clients increasingly adopting Manhattan Active solutions. This widespread adoption fuels the robust revenue growth observed in their cloud segment.

Further bolstering this positive outlook, Manhattan Associates' Remaining Performance Obligation (RPO) experienced a substantial increase of 25%, reaching $1.9 billion by the end of Q1 2025. This surge in RPO signifies a strong and reliable future revenue stream, reflecting sustained customer demand for their innovative offerings.

Commitment to Innovation and AI Integration

Manhattan Associates demonstrates a robust commitment to innovation, particularly through its strategic integration of artificial intelligence and machine learning across its supply chain solutions. This focus is evident in their ongoing investment in research and development, which fuels the continuous enhancement of their platform. For instance, the company has been actively rolling out advanced AI capabilities, including Agentic AI, designed to automate complex tasks and optimize operational workflows for their clients.

Key recent advancements underscore this dedication. The introduction of Manhattan Active Supply Chain Planning and the latest iteration of their point-of-sale system, Iris, highlight their drive to push technological boundaries. Furthermore, the integration of Agentic AI within their Manhattan Active suite, leveraging large language models, allows for dynamic adaptation to market changes and improved efficiency, directly impacting client productivity and operational effectiveness.

The company's forward-thinking approach positions them strongly in a competitive landscape. By embedding AI and automation, Manhattan Associates aims to provide clients with more intelligent, responsive, and efficient supply chain management tools, anticipating future market demands and client needs.

- AI Integration: Manhattan Associates actively incorporates AI, machine learning, and automation into its platform.

- Key Innovations: Recent launches include Manhattan Active Supply Chain Planning and Iris (next-gen POS).

- Agentic AI: Their solutions feature AI agents powered by LLMs for task automation and workflow optimization.

- Client Benefits: These advancements aim to enhance client efficiency, productivity, and adaptability.

Deep Industry Expertise and Diverse Customer Success

Manhattan Associates boasts profound expertise in supply chain and omnichannel commerce, cultivated over decades of operation. This deep understanding translates into solutions that demonstrably enhance customer success, evidenced by their extensive global clientele, which includes many prominent enterprise-level organizations. Their proven track record highlights their ability to drive significant top-line growth and bottom-line profitability for businesses across diverse sectors such as retail, distribution, and manufacturing.

The company's strategic focus on bolstering supply chain resilience and agility is particularly relevant in today's volatile global landscape. Manhattan's solutions are designed to help businesses navigate disruptions effectively, positioning them as an indispensable partner for companies aiming to optimize their operational frameworks.

- Proven Growth Driver: Manhattan's solutions have been instrumental in achieving revenue increases and cost reductions for clients. For instance, in the first quarter of 2024, the company reported a 12% increase in revenue year-over-year, reaching $255.8 million, reflecting strong demand for their integrated solutions.

- Global Enterprise Adoption: Their customer base features a significant number of Fortune 500 and global retail leaders, underscoring the scalability and effectiveness of their offerings in complex, large-scale environments.

- Resilience Enablement: Manhattan's platform is recognized for its role in building more agile and robust supply chains, a critical factor for businesses adapting to geopolitical and economic uncertainties.

Manhattan Associates' leadership in the supply chain software market is a core strength, consistently recognized by industry analysts. Their sustained position as a Gartner Magic Quadrant Leader for Warehouse Management Systems for 17 consecutive years and for Transportation Management Systems for seven consecutive years as of 2025 underscores their technological superiority and market foresight.

| Analyst Recognition | Category | Consecutive Years as Leader (as of 2025) |

|---|---|---|

| Gartner Magic Quadrant | Warehouse Management Systems (WMS) | 17 |

| Gartner Magic Quadrant | Transportation Management Systems (TMS) | 7 |

What is included in the product

Delivers a strategic overview of Manhattan’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Manhattan Associates' reliance on services revenue presents a notable weakness, as evidenced by an 8% decline in this segment during Q1 2025 compared to the previous year. This downturn was largely attributed to customer budget constraints and delayed professional services work, highlighting the company's vulnerability to macroeconomic shifts affecting client spending on implementation and customization.

Manhattan Associates' powerful supply chain solutions, while robust, present a significant hurdle for many potential clients due to their high implementation costs and inherent complexity. These solutions often demand substantial upfront investment and intricate integration processes, which can deter smaller or mid-sized businesses from adopting them. For instance, a typical large-scale WMS (Warehouse Management System) implementation can range from hundreds of thousands to millions of dollars, depending on the scope and required customizations.

This complexity can also translate into lengthy project timelines and challenges during future system upgrades. Clients may find that extensive customization, a key selling point, paradoxically increases the difficulty and expense of maintaining and updating their systems over time. This might lead to a concentration of their customer base among larger enterprises with the resources to manage such undertakings, potentially capping their addressable market.

Manhattan Associates operates in a fiercely competitive supply chain software arena, facing both established giants and nimble specialists. While Manhattan's solutions are highly regarded, often securing wins against major rivals, the company frequently encounters situations where pricing becomes a decisive factor in deal closures.

This persistent pricing pressure indicates a market dynamic where cost sensitivity is high, forcing Manhattan Associates to constantly innovate and clearly articulate the value proposition of its premium offerings. Failing to effectively communicate its unique advantages could lead to erosion of market share, despite its strong product capabilities.

For example, in the first quarter of 2024, while Manhattan Associates reported a 10% increase in total revenue to $257 million, the need to justify higher price points remains a critical strategic consideration amidst competitor strategies focused on aggressive discounting.

Negative Impact of Macroeconomic Uncertainty on Outlook

Manhattan Associates acknowledges the significant impact of macroeconomic uncertainty on its business outlook. Global economic headwinds can directly affect IT spending, consequently dampening demand for their solutions and services.

This caution was evident in their financial reporting. For Q4 2024, the company’s performance and subsequent 2025 guidance highlighted these concerns.

- Projected Modest Total Revenue Growth: For fiscal year 2025, Manhattan Associates anticipates a total revenue growth rate of only 2% to 3%.

- Expected Decline in Earnings Per Share: The company forecasts a GAAP EPS decline ranging from 10% to 13% for FY 2025.

- External Economic Factors as a Challenge: These macroeconomic uncertainties represent a notable impediment to achieving more robust growth targets.

Legal Challenges and Shareholder Lawsuits

Manhattan Associates faced significant legal headwinds in late 2024 and early 2025, including securities fraud investigations and a shareholder class action lawsuit. These legal troubles were primarily ignited by allegations that the company had been misleading about the performance and future outlook of its Services segment, coupled with providing overly optimistic revenue forecasts. The fallout from these claims resulted in a notable decline in Manhattan Associates' market capitalization, sparking investor apprehension regarding the company's commitment to transparency and its overall corporate governance practices.

The core of these legal challenges revolved around accusations of misrepresentation concerning the Services segment's financial health and growth trajectory. Investors alleged that the company's public statements did not accurately reflect the underlying realities of this business unit. This discrepancy between reported information and actual performance is a common trigger for shareholder lawsuits and regulatory scrutiny.

The consequence of these legal battles was a tangible impact on Manhattan Associates' stock performance. The erosion of market capitalization, estimated to be in the hundreds of millions by early 2025, directly reflects investor confidence being shaken. This situation underscores the critical importance of accurate financial disclosures and consistent communication with the investment community.

- Securities Fraud Investigations: Multiple investigations were launched against Manhattan Associates in late 2024/early 2025.

- Shareholder Class Action Lawsuit: A significant lawsuit was filed alleging misrepresentation of financial performance.

- Services Segment Concerns: Allegations focused on the company's portrayal of its Services segment's health and growth.

- Overly Optimistic Guidance: Accusations included providing inflated revenue forecasts to investors.

- Market Capitalization Decline: Legal issues led to a substantial drop in the company's market value.

Manhattan Associates' high implementation costs and complexity can be a barrier for many businesses, particularly smaller ones. This complexity also extends to system upgrades, making ongoing maintenance more challenging and potentially limiting the company's appeal to a broader market beyond large enterprises.

The competitive landscape forces Manhattan Associates to contend with pricing pressures. While its solutions are strong, the need to justify premium pricing against competitors who may offer more aggressive discounts is a constant challenge, impacting market share potential.

Macroeconomic uncertainty remains a significant weakness, directly influencing IT spending and, consequently, demand for Manhattan Associates' software and services. This was reflected in their cautious growth projections for 2025, with only a 2-3% total revenue growth anticipated.

Legal issues, including securities fraud investigations and shareholder lawsuits stemming from allegations of misrepresenting the Services segment's performance and providing overly optimistic forecasts, have eroded investor confidence and negatively impacted market capitalization in late 2024 and early 2025.

| Weakness Category | Description | Impact/Example |

|---|---|---|

| Implementation Costs & Complexity | High upfront investment and intricate integration processes for supply chain solutions. | Deters smaller/mid-sized businesses; lengthy project timelines; upgrade challenges. |

| Competitive Pricing Pressure | Need to justify premium pricing against aggressive competitor discounts. | Potential erosion of market share despite strong product capabilities. |

| Macroeconomic Sensitivity | Direct impact of global economic headwinds on IT spending and demand. | Projected modest total revenue growth of 2-3% for FY 2025. |

| Legal and Reputational Issues | Securities fraud investigations and shareholder lawsuits alleging misrepresentation. | Erosion of investor confidence and market capitalization decline in late 2024/early 2025. |

Preview the Actual Deliverable

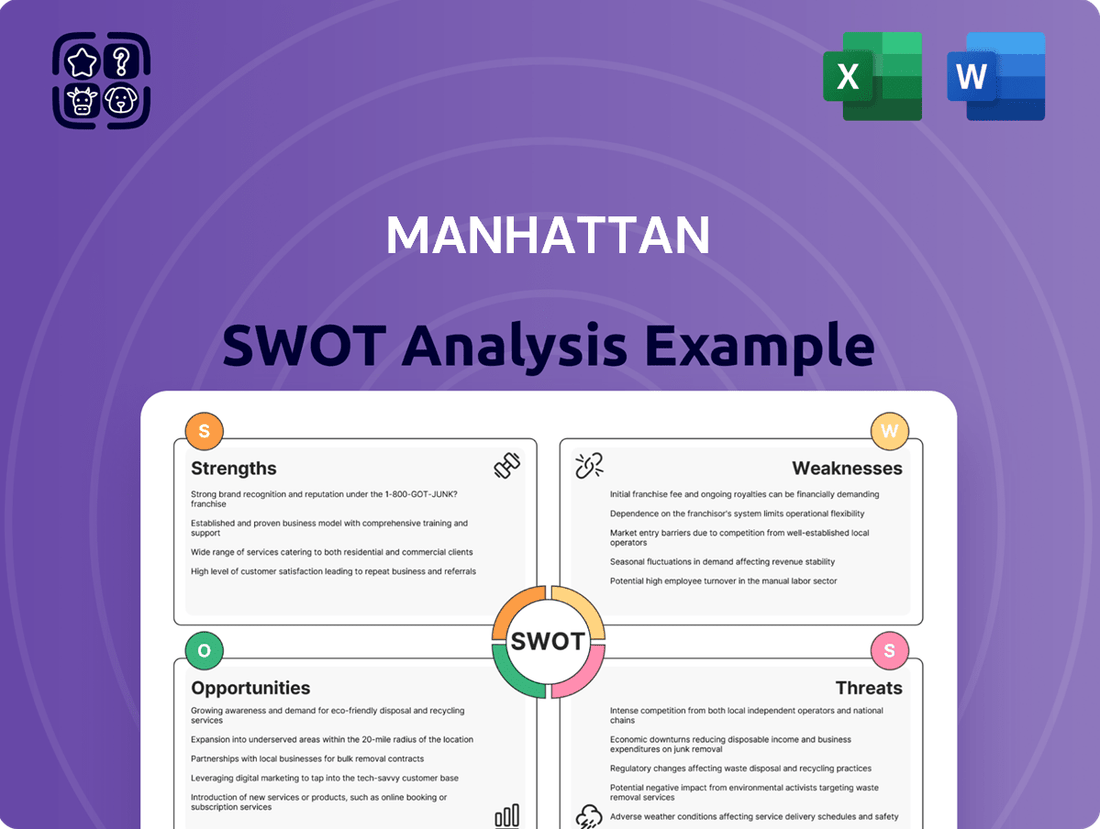

Manhattan SWOT Analysis

The file shown below is not a sample—it’s the real Manhattan SWOT analysis you'll download post-purchase, in full detail. This comprehensive document is meticulously crafted to provide actionable insights for strategic planning. You'll receive the complete, professionally formatted analysis immediately after completing your purchase, ensuring you have all the information you need to leverage Manhattan's unique position.

Opportunities

The global business landscape in 2024 and 2025 is increasingly shaped by the imperative for robust supply chains. Events from the past few years have underscored the vulnerability of traditional models, leading to a significant uptick in demand for solutions that enhance resilience and efficiency. Businesses are actively seeking advanced technologies to navigate disruptions, from geopolitical tensions to climate-related events, and to optimize their operations for greater adaptability.

Manhattan Associates is strategically positioned to capitalize on this trend. Their integrated suite of solutions, encompassing warehouse management, transportation management, and planning capabilities, directly addresses the growing need for end-to-end supply chain visibility and control. This comprehensive offering allows companies to not only mitigate risks but also to improve their overall operational agility and cost-effectiveness in a volatile market.

The market for supply chain technology is experiencing substantial growth. Projections for 2025 indicate continued strong investment, with the global supply chain management market expected to reach over $40 billion. This expansion is fueled by businesses recognizing that optimized and resilient supply chains are no longer a competitive advantage but a fundamental requirement for survival and growth.

Manhattan Associates is capitalizing on the enduring trend of omnichannel retail by expanding its Point of Sale (POS) software and introducing new B2B sales and fulfillment solutions. This strategic move directly addresses the growing need for unified commerce platforms that bridge online, mobile, and physical store interactions.

The company's focus on enhancing visibility and inventory accuracy across multiple channels is crucial for retailers aiming to meet evolving consumer expectations. For instance, by mid-2024, e-commerce sales were projected to reach over $2.7 trillion globally, highlighting the critical importance of seamless digital and physical integration.

This push into B2B commerce, alongside their established omnichannel capabilities, opens significant avenues for growth. Manhattan Associates is well-positioned to help businesses streamline complex sales and fulfillment processes, thereby improving customer experiences and operational efficiency in a highly competitive market.

Manhattan Associates can tap into new client segments beyond its retail and consumer goods stronghold, reaching distributors and manufacturers who are also keen on modernizing their supply chains. This diversification leverages their established expertise in Warehouse Management Systems (WMS) and Transportation Management Systems (TMS), attracting a broader industry base. By offering cloud-native solutions, they are well-positioned to capture clients across various sectors looking for efficiency gains.

Significant growth potential lies in expanding into international markets, where Manhattan Associates currently derives only about 20% of its revenue. This presents a substantial opportunity to increase global market share, particularly in regions with less developed supply chain technology adoption. The company’s market leadership in key software areas can be a strong selling point for these underserved regions.

Leveraging Advanced AI and Automation Technologies

Manhattan Associates can significantly enhance its market position by further integrating advanced AI and automation. This includes deeper application of machine learning for more predictive and secure supply chain operations. For instance, their Manhattan Active Assist tools already provide real-time guidance and automate tasks, improving efficiency. The company's commitment is further evidenced by the increasing client demand for generative AI solutions, highlighting a clear market opportunity.

The strategic advantage lies in transforming complex supply chain data into actionable insights through AI. This allows for more proactive problem-solving and optimized resource allocation. By continuing to invest in these technologies, Manhattan Associates can offer clients a distinct competitive edge. This focus aligns with the growing industry trend towards intelligent automation, promising substantial operational improvements for users.

- Enhanced Predictive Capabilities: AI can forecast demand with greater accuracy, reducing stockouts and overstock situations.

- Automated Task Execution: Routine tasks like inventory checks and order processing can be automated, freeing up human resources.

- Real-time Decision Support: Tools like Manhattan Active Assist provide instant guidance, improving the speed and quality of operational decisions.

- Improved Security: AI can detect anomalies and potential security threats within supply chain networks more effectively.

Strategic Partnerships and Cloud Marketplace Expansion

Manhattan Associates' strategic partnerships are a significant growth avenue. Their collaboration with Google Cloud, for instance, aims to enhance cloud-native supply chain solutions, potentially tapping into Google's extensive customer base. Similarly, their integration with Shopify is designed to streamline commerce fulfillment for Shopify merchants, opening up a vast e-commerce market. These alliances are crucial for expanding their reach and diversifying their product and service portfolio.

Launching solutions on cloud marketplaces, like AWS Marketplace and Google Cloud Marketplace, is another key opportunity. This approach simplifies the procurement and deployment process for customers, accelerating their digital transformation initiatives. For example, by making their solutions readily available on these platforms, Manhattan Associates can gain visibility and attract new clients who prefer a streamlined cloud procurement experience. This strategy is vital for staying competitive in the rapidly evolving cloud landscape.

Manhattan Associates' robust partner ecosystem further amplifies these opportunities. By nurturing relationships with system integrators and technology partners, they can extend their market penetration and enhance the delivery of their solutions. This collaborative approach allows them to serve a broader range of customer needs and industries, thereby strengthening their overall market position. As of early 2024, the company continues to emphasize these strategic integrations to drive growth.

- Expanded Market Reach: Partnerships with giants like Google Cloud and Shopify provide access to millions of potential new customers.

- Streamlined Deployment: Cloud marketplace listings simplify how clients acquire and implement Manhattan Associates' solutions, accelerating adoption.

- Enhanced Technological Capabilities: Collaborations often involve co-development, leading to more advanced and integrated offerings.

- Accelerated Digital Transformation: By making solutions readily available and integrated, Manhattan Associates helps businesses modernize their operations faster.

Manhattan Associates is well-positioned to benefit from the increasing demand for advanced supply chain technologies, with the global market projected to exceed $40 billion by 2025. Their comprehensive solutions address the critical need for resilience and efficiency in today's volatile business environment. Additionally, the company's expansion into B2B commerce and omnichannel retail, driven by the booming e-commerce sector (projected over $2.7 trillion globally by mid-2024), offers substantial growth potential.

Leveraging AI and automation presents a significant opportunity, with Manhattan Associates already offering tools like Manhattan Active Assist to provide real-time guidance and automate tasks. This aligns with the growing client demand for generative AI solutions, promising enhanced predictive capabilities and operational improvements. Strategic partnerships with major players like Google Cloud and Shopify, along with listings on cloud marketplaces, are also key avenues for expanding market reach and accelerating customer adoption.

Threats

Economic downturns pose a significant threat to Manhattan Associates. A substantial slowdown in the global economy, or persistent macroeconomic uncertainty, could prompt businesses to curb their IT expenditures. This is especially true for major investments like large-scale enterprise software deployments. Manhattan Associates itself acknowledged that customer budget constraints and delayed deals negatively affected its services revenue in late 2024 and early 2025, highlighting this vulnerability.

Such an economic climate might compel clients to postpone or downsize their planned services projects and new software purchases. This directly impedes Manhattan Associates' ability to achieve its projected revenue growth, as the demand for its solutions becomes more sensitive to economic fluctuations.

The supply chain software market remains a battleground, with established giants and nimble startups constantly pushing the innovation envelope. Manhattan Associates, while a recognized leader, faces the perpetual threat of being outpaced by rapid technological shifts and disruptive forces. For instance, the rise of AI-powered predictive analytics and blockchain for enhanced transparency presents significant opportunities for competitors to chip away at market share if Manhattan is not agile enough in its own adoption and integration.

Competitors are not standing still; many are actively investing in R&D to close any perceived gaps. New cloud-native startups, often unburdened by legacy systems, are capable of offering more flexible and cost-effective solutions, directly challenging Manhattan's established client base. This dynamic intensifies competitive pressure, demanding continuous investment in product development and a keen eye on emerging technological trends to maintain market leadership.

Manhattan Associates, a key player in enterprise software for supply chains and customer data, faces significant threats from escalating cyberattacks. A substantial data breach, similar to the one impacting a major logistics provider in late 2023 which exposed millions of customer records, could severely compromise Manhattan's sensitive information.

Furthermore, the company must navigate a complex and evolving landscape of data security and privacy regulations. Non-compliance with mandates like GDPR or CCPA, which carry potential fines reaching millions of dollars, poses a considerable risk, impacting financial performance and operational continuity.

The consequences of a security lapse extend beyond financial penalties. A failure to protect customer data could lead to a significant erosion of trust, damaging Manhattan's reputation and potentially driving customers to seek solutions from competitors. This was evident when a cybersecurity incident in the SaaS sector in early 2024 resulted in a 15% decline in customer retention for the affected vendor.

Customer Churn and Resistance to Vendor Lock-in

A significant threat for Manhattan Associates stems from customer churn, particularly due to concerns about vendor lock-in. The substantial investment required for implementing their comprehensive solutions can make it difficult for clients to switch providers, leading some to resist deeper integration. This resistance can manifest as a reluctance to adopt new Manhattan modules, especially if competitors offer more adaptable or modular solutions. For instance, in 2024, the supply chain software market saw increased demand for interoperability, putting pressure on deeply integrated systems.

Customers may actively seek to diversify their software portfolios to mitigate the risks associated with relying on a single vendor. This trend is driven by a desire for greater flexibility and the potential to cherry-pick best-of-breed solutions from various providers. As of early 2025, industry reports indicate a growing preference for cloud-native, API-first platforms that facilitate easier integration and avoid proprietary ecosystems.

Competitors offering more modular and flexible solutions pose a direct threat. These alternatives can attract clients who prioritize agility and the ability to scale specific functionalities without committing to an entire suite. The perceived value proposition of modularity can lead to slower adoption rates for Manhattan's broader offerings if clients feel constrained by the integrated model.

- High Implementation Costs: Significant upfront investment can deter potential customers or lead to scrutiny of long-term value.

- Vendor Lock-in Concerns: Clients may prioritize solutions that offer greater flexibility and easier switching options.

- Competitive Modularity: Competitors offering piecemeal or highly configurable solutions can siphon market share.

- Customer Retention Challenges: The risk of churn increases if customers perceive a lack of flexibility or better alternatives elsewhere.

Impact of Legal and Regulatory Investigations

Manhattan Associates faces a serious threat from ongoing securities fraud investigations and shareholder class action lawsuits. These legal battles, initiated due to allegations of misrepresenting its Services segment's financial health, could significantly impact the company. For instance, the market's reaction in early 2024 saw considerable stock price volatility, highlighting investor concern.

These legal challenges are not just abstract worries; they can actively drain crucial resources. Management's attention and the company's financial reserves might be diverted from strategic growth initiatives to navigate these complex proceedings. Such distractions can hinder innovation and operational efficiency.

Beyond financial drain, the reputational damage from these investigations poses a substantial risk. A tarnished image can erode customer trust and deter potential business partners, making it harder to secure new contracts and maintain existing relationships. The potential for significant financial penalties or settlements further amplifies this threat, impacting the company's bottom line.

- Securities Fraud Allegations: Investigations focus on claims of misrepresentation regarding the Services segment's performance.

- Shareholder Lawsuits: Class action suits add legal pressure and potential financial liability.

- Market Volatility: Investor uncertainty has already led to significant fluctuations in Manhattan Associates' stock price in 2024.

- Resource Diversion: Management focus and company funds may be redirected from core operations to legal defense.

- Reputational Risk: Damage to the company's standing can affect customer and partner relationships.

The competitive landscape for supply chain software is intensely dynamic, with both established players and emerging startups vying for market share. Manhattan Associates must contend with competitors who are rapidly innovating, particularly in areas like artificial intelligence and blockchain, which enhance data visibility and predictive capabilities. For example, several cloud-native competitors launched enhanced AI-driven forecasting tools in 2024, directly challenging Manhattan's traditional analytics offerings.

These rivals, often unburdened by legacy infrastructure, can provide more agile and cost-effective solutions. This forces Manhattan to continuously invest in research and development to maintain its technological edge and prevent market erosion. The pressure to integrate new technologies quickly is immense, as falling behind can quickly translate to lost customers and revenue opportunities.

Manhattan Associates is susceptible to economic downturns, which can impact client IT spending. A slowdown in the global economy, as seen with persistent inflation concerns in late 2024, could lead businesses to defer or reduce investments in large-scale enterprise software. This sensitivity to economic cycles directly affects revenue projections, as demand for complex solutions often correlates with business confidence and available capital.

The company also faces significant threats from cybersecurity risks and evolving data privacy regulations. A major data breach, similar to incidents impacting other enterprise software providers in 2023 and 2024, could compromise sensitive client data, leading to substantial financial penalties and reputational damage. Adhering to regulations like GDPR and CCPA, with potential fines reaching millions, adds another layer of operational complexity and risk, impacting financial performance and client trust.

SWOT Analysis Data Sources

This Manhattan SWOT analysis is built upon a robust foundation of data, including official economic reports, real estate market trend analyses, and demographic studies to provide a comprehensive overview.