Manhattan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manhattan Bundle

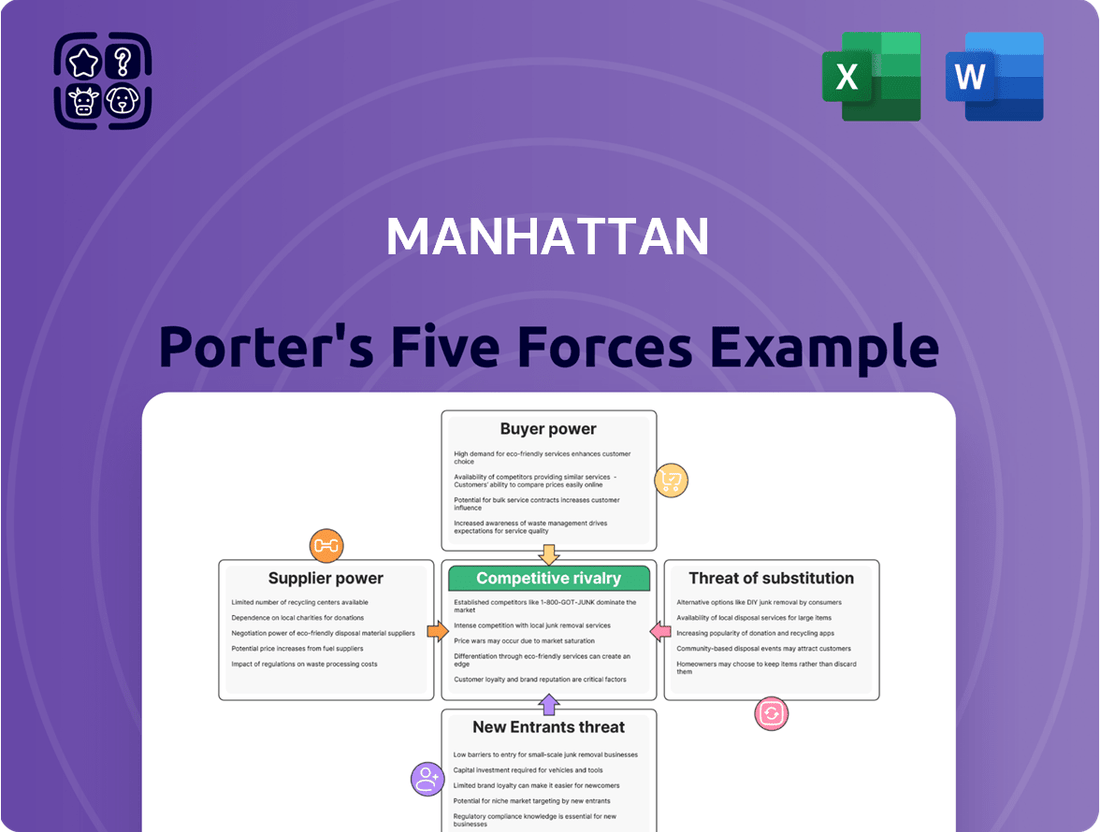

Porter's Five Forces analysis offers a powerful lens to understand the competitive landscape impacting Manhattan's industry. It reveals the intricate balance of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the impact of substitutes. Understanding these forces is crucial for navigating market dynamics and identifying strategic opportunities.

The complete report reveals the real forces shaping Manhattan’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Manhattan Associates' reliance on generic software and hardware suppliers carries limited influence due to the commoditized nature of these inputs. The company primarily utilizes its own proprietary software and cloud services, meaning its core operations are less dependent on external software vendors. This reduces the bargaining power of those who might otherwise dictate terms.

For essential cloud infrastructure, Manhattan Associates leverages providers like AWS, Azure, and Google Cloud. The significant competition among these major players ensures that no single provider can exert excessive pressure on pricing or service terms. This competitive landscape benefits Manhattan Associates by providing stability and cost-effectiveness for its infrastructure needs.

Similarly, general hardware suppliers are numerous and offer standardized products. The availability of multiple vendors for necessary hardware components means Manhattan Associates can source components competitively. This broad availability prevents any single hardware supplier from holding significant sway over the company's supply chain or overall cost structure.

The reliance on highly skilled talent, such as software developers and data scientists, positions these individuals as critical suppliers for technology firms like Manhattan Associates. The intense demand for these specialized skills can significantly enhance their bargaining power, potentially leading to higher compensation and better working conditions.

Manhattan Associates' strong industry reputation and established brand are crucial assets in attracting and retaining this sought-after talent. This allows them to mitigate some of the suppliers' bargaining power by offering a compelling work environment and career opportunities, even amidst high market demand.

In 2024, the tech talent market continued to see competitive salaries, with average software developer salaries in the US ranging from $110,000 to $150,000 annually, depending on experience and location. This underscores the significant cost leverage skilled professionals can wield.

Manhattan Associates might forge strategic partnerships with technology vendors for specialized components or integrations. The leverage these suppliers hold hinges on how unique and essential their contributions are. For instance, a vendor providing a highly specialized database with no readily available substitutes would naturally possess stronger bargaining power.

The extent of this supplier power is often mitigated by Manhattan Associates' own robust development and integration expertise. By maintaining the capability to integrate with a wide array of platforms, Manhattan Associates can reduce its dependence on any single technology vendor, thereby limiting any one supplier's ability to exert excessive influence.

Switching Costs for Infrastructure and Platform Providers

While cloud infrastructure itself is becoming more commoditized, the actual process of switching between major cloud providers for a company like Manhattan Associates can be a substantial undertaking. This involves significant investments in time, personnel, and resources to migrate data, reconfigure applications, and ensure compatibility. This inherent stickiness grants existing cloud infrastructure and platform providers a degree of bargaining power.

For instance, a complex migration could easily span months and require specialized technical teams, impacting operational continuity. This investment creates a barrier for Manhattan Associates to easily shift providers, giving current suppliers leverage in negotiations regarding pricing or service level agreements.

However, Manhattan Associates likely mitigates this supplier power through strategic planning. This could involve adopting multi-cloud strategies, which diversifies their reliance on any single provider, or developing robust, in-house migration plans and tools that streamline the switching process. These proactive measures can significantly reduce the perceived risk and cost associated with changing infrastructure providers.

- High Migration Costs: Estimates for large-scale cloud migrations can run into millions of dollars, encompassing labor, testing, and potential downtime.

- Vendor Lock-in Concerns: Proprietary services or unique configurations within a cloud platform can further complicate and increase the cost of switching.

- Manhattan Associates' Mitigation: Strategic use of open-source technologies and standardized APIs can reduce dependency on specific cloud provider features.

Data and Analytics Tool Providers

The bargaining power of data and analytics tool providers for Manhattan Associates is generally moderate. While these tools are crucial for Manhattan's offerings, the market for such technologies is dynamic and competitive. For instance, the widespread adoption of cloud-based analytics platforms and the increasing availability of open-source machine learning libraries suggest that Manhattan can often find alternative suppliers or develop capabilities internally. This prevents any single provider from wielding excessive power.

Manhattan Associates leverages a range of data and analytics capabilities within its supply chain and retail solutions. Suppliers of highly specialized analytical engines or unique data sets could potentially exert influence if these tools are proprietary and essential for Manhattan's competitive edge. However, the rapid pace of innovation in artificial intelligence and big data analytics means that Manhattan likely has access to a broad ecosystem of potential partners and internal development resources. This reduces the dependency on any single supplier.

- Supplier Specialization: The power of analytics tool providers increases if their offerings are highly specialized and difficult for Manhattan to replicate internally or source elsewhere.

- Availability of Alternatives: The existence of multiple vendors offering similar analytics capabilities or the feasibility of in-house development significantly dilutes supplier power.

- Switching Costs: High switching costs for integrating new analytics tools can give existing suppliers more leverage, but Manhattan likely mitigates this through modular architecture.

- Criticality to Differentiation: If a supplier's tool is a key differentiator for Manhattan's products, that supplier gains more bargaining power.

The bargaining power of suppliers for Manhattan Associates is generally low to moderate. This is largely due to the commoditized nature of many of its inputs, such as generic software and hardware, where numerous vendors offer comparable products. Furthermore, the company's strategic utilization of proprietary software and its reliance on major, competing cloud providers like AWS, Azure, and Google Cloud limit the leverage any single supplier can exert.

However, a key area where supplier power can increase is in specialized talent, particularly software developers and data scientists. The intense demand for these skills in 2024 meant that highly skilled professionals could command higher salaries and better terms, as evidenced by average US software developer salaries ranging from $110,000 to $150,000 annually. Manhattan Associates mitigates this by fostering a strong employer brand to attract and retain talent.

While switching cloud providers presents significant costs and complexities, potentially granting existing providers leverage, Manhattan Associates likely employs strategies like multi-cloud adoption and robust internal migration planning to reduce this dependency. Similarly, for data and analytics tools, Manhattan's ability to leverage open-source alternatives and its own development capabilities keeps supplier power in check, though highly specialized or critical tools could still offer some leverage.

| Factor | Impact on Manhattan Associates | Mitigation Strategies |

| Generic Software/Hardware | Low bargaining power for suppliers due to commoditization and numerous alternatives. | Sourcing from multiple vendors, standardized product selection. |

| Cloud Infrastructure (AWS, Azure, Google Cloud) | Moderate bargaining power due to high switching costs and potential vendor lock-in. | Multi-cloud strategy, investment in migration tools and expertise, use of open-source technologies. |

| Specialized Talent (Developers, Data Scientists) | High bargaining power for suppliers due to high demand and skill scarcity. | Strong employer branding, competitive compensation and benefits, fostering a positive work environment. |

| Specialized Data/Analytics Tools | Moderate to high bargaining power if tools are proprietary, critical, and have high switching costs. | Internal development capabilities, reliance on open-source alternatives, modular architecture for easier integration. |

What is included in the product

Examines the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes to understand Manhattan's competitive environment.

Effortlessly identify and address competitive threats by visualizing the intensity of each force, enabling targeted strategic interventions.

Customers Bargaining Power

Manhattan Associates' deep integration of its Warehouse Management Systems (WMS) and omnichannel commerce platforms into customer operations creates significant switching barriers. These are not simple software upgrades; they are fundamental to how businesses manage their supply chains and customer interactions.

The financial outlay for migrating away from a complex Manhattan system, encompassing new hardware, software licenses, extensive data migration, and rigorous testing, can run into millions of dollars for large enterprises. For instance, a significant WMS implementation can represent a substantial portion of a logistics department's annual IT budget, making a move a major capital expenditure decision.

Beyond the monetary cost, the operational disruption is a critical factor. Switching systems requires extensive retraining of staff, potential downtime during the transition, and the risk of errors impacting order fulfillment and inventory accuracy, all of which directly affect revenue and customer satisfaction.

Consequently, these high switching costs effectively diminish the bargaining power of existing customers. They are far less likely to demand price concessions or unfavorable terms when the cost and complexity of changing providers are so prohibitively high, thereby strengthening Manhattan Associates' position.

Manhattan Associates' customer base is heavily concentrated within large enterprises, particularly in retail and logistics. This means individual client relationships are substantial, making the potential loss of a major customer a significant concern. For example, in 2023, a substantial portion of their revenue was derived from a relatively small number of high-value clients, highlighting this concentration.

However, the specialized and comprehensive nature of Manhattan's supply chain solutions often means these large clients have few, if any, direct competitors offering a comparable all-in-one package. This limits their ability to easily switch to alternative providers, thereby reducing their overall bargaining power.

Manhattan Associates' software is absolutely critical for its customers. Think about it: their solutions help businesses manage inventory, make warehouses run smoothly, and get orders out the door efficiently. This directly impacts how much money companies make and how happy their own customers are. In 2023, for example, Manhattan Associates reported revenue of $1.04 billion, highlighting the widespread adoption and necessity of their services across various industries.

Because these software solutions are so vital to day-to-day operations and maintaining a competitive edge, customers become highly reliant on Manhattan Associates. This deep dependence significantly limits their power to negotiate aggressively on price or terms. For instance, a major retailer struggling with supply chain disruptions might find it nearly impossible to switch providers without risking severe operational disruptions, thereby diminishing their bargaining leverage.

Customer Demand for Integrated Solutions and Cloud Services

Customers are increasingly seeking integrated solutions that streamline their operations, particularly within supply chain management and the growing demand for omnichannel capabilities. This is a significant driver of customer bargaining power. Manhattan Associates is strategically positioned to meet this demand, as evidenced by its continued focus on cloud-based offerings. For instance, in 2023, the company saw strong growth in its cloud revenue, demonstrating market receptiveness to these integrated solutions.

The migration towards cloud subscription models inherently influences customer purchasing power. While it can reduce upfront capital expenditure for clients, making solutions more accessible, it also ties them into longer-term relationships with providers like Manhattan Associates. This shift can lead to customers negotiating for better terms or demanding continuous innovation to justify ongoing cloud subscriptions. Manhattan Associates' revenue from its cloud-based solutions has been a growing segment, reflecting this industry trend.

- Customer Preference for Cloud: A significant portion of supply chain software spending is shifting towards cloud deployments, empowering customers to choose flexible, scalable solutions.

- Demand for Integration: Buyers are increasingly consolidating their technology stacks, demanding solutions that seamlessly integrate with existing ERP and other business systems.

- Subscription Model Impact: The move to subscription-based cloud services allows customers to compare pricing more readily and potentially exert pressure on vendors for favorable contract terms.

- Omnichannel Expectations: Customers expect unified visibility and management across all sales and fulfillment channels, pushing vendors to offer comprehensive omnichannel platforms.

Potential for In-house Development or Legacy System Adaptation

Very large enterprises, though facing significant cost and complexity, may explore developing proprietary in-house solutions or heavily modifying existing legacy ERP systems to handle their supply chain operations. This capability acts as a latent bargaining lever for these customers, particularly if Manhattan Associates' pricing structures or product functionalities don't match their perceived value proposition. For example, a company with substantial existing IT infrastructure and a dedicated development team might assess the total cost of ownership for a custom build versus a SaaS solution. However, the deep technical expertise and ongoing maintenance demands typically render this an impractical option for the vast majority of businesses.

The potential for very large organizations to bring supply chain management in-house or adapt legacy systems represents a form of latent customer bargaining power. This is especially relevant if Manhattan Associates' offerings are perceived as either too expensive or lacking critical features. For instance, a global retailer with a massive existing IT investment might evaluate whether a custom-built solution, leveraging their current infrastructure, could offer a more tailored and potentially cost-effective alternative in the long run. Such endeavors, however, require substantial capital outlay and specialized internal talent, making them viable only for a select few.

- Significant Investment: Developing custom in-house supply chain solutions can cost millions, with ongoing maintenance adding substantial operational expenses.

- Legacy System Adaptation: While potentially less costly than a full build, adapting legacy ERPs for specialized supply chain needs still demands significant IT resources and expertise.

- Expertise Barrier: The specialized skills required for in-house development or complex system adaptation are often a major deterrent for most companies.

- Value Proposition Test: This potential for self-sufficiency allows large customers to benchmark Manhattan Associates' offerings against their internal development costs and perceived value.

Manhattan Associates' solutions are deeply embedded, making switching incredibly costly and operationally disruptive for customers. This high switching cost significantly limits their bargaining power, as the financial and logistical hurdles of changing providers are immense. For example, in 2023, Manhattan Associates reported revenue of $1.04 billion, indicating widespread adoption and customer reliance, which further reduces customer leverage.

While customers, especially large enterprises, can explore in-house solutions, the substantial investment in capital, specialized talent, and ongoing maintenance makes this a difficult lever to pull. This complex reality reinforces Manhattan Associates' strong market position by limiting the practical alternatives available to their client base.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Example (as of 2023/2024) |

|---|---|---|

| Switching Costs | Lowers bargaining power due to high financial and operational disruption | Millions in migration costs (hardware, software, data, training); operational downtime risks |

| Customer Dependence | Lowers bargaining power as solutions are critical to operations | Solutions directly impact revenue and customer satisfaction; reliance on Manhattan's expertise |

| Integration & Cloud Shift | Can shift power towards customers demanding integrated, cloud solutions, but also fosters longer-term vendor relationships | Growth in Manhattan's cloud revenue in 2023; customers seeking consolidation |

| In-house Development Potential | Latent power for very large enterprises, but often impractical due to cost and expertise | Millions in custom build costs; need for specialized IT talent |

Preview the Actual Deliverable

Manhattan Porter's Five Forces Analysis

This preview showcases the complete Manhattan Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of this iconic New York City hotel. You're looking at the actual document, meticulously detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The supply chain and omnichannel commerce software arena is fiercely contested, with major players like SAP, Oracle, and Blue Yonder (formerly JDA Software) holding significant sway. These established giants offer extensive enterprise software portfolios that frequently incorporate supply chain functionalities, directly challenging Manhattan Associates' specialized solutions.

Manhattan Associates leverages deep specialization in supply chain and omnichannel commerce, a focus that sets it apart in a crowded software market. This targeted approach allows them to excel in areas like Warehouse Management Systems (WMS), where they are widely acknowledged as a top-tier provider. This strategic focus means their solutions are finely tuned to address the complex needs of logistics and retail operations.

The company's investment in a cloud-native, microservices-based architecture, branded as Manhattan Active, represents a significant competitive advantage. This modern, agile platform offers greater flexibility and scalability compared to many traditional, on-premise systems still in use by some competitors. The agility of Manhattan Active is crucial for businesses needing to adapt quickly to changing market demands.

The supply chain management software market, along with the omnichannel retail commerce platform market, is seeing substantial growth. This expansion is fueled by the continued rise of e-commerce and the critical need for businesses to have real-time insights and operational efficiency across all their sales channels. For instance, the global supply chain management market was projected to reach $35.05 billion in 2024, demonstrating a significant upward trend.

This rapid market expansion presents a double-edged sword: while it creates ample opportunities for all participants, it simultaneously intensifies the competition for market share. Companies are vying to capture a larger piece of this growing pie, leading to a more aggressive competitive landscape.

Manhattan Associates has strategically broadened its scope, moving beyond its traditional Warehouse Management System (WMS) leadership to address the entire omnichannel commerce ecosystem. This expansion allows them to leverage their established strength in WMS to offer integrated solutions for a more complex retail environment.

The increasing demand for seamless customer experiences across online and physical stores means that companies offering comprehensive omnichannel solutions, like Manhattan Associates, are well-positioned. However, this also means they are in direct competition with other technology providers who are similarly enhancing their offerings to meet these evolving customer expectations.

Impact of AI and Emerging Technologies on Competition

The competitive rivalry in supply chain solutions is intensifying due to the rapid integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). Competitors are actively embedding these advanced technologies to offer predictive analytics, automate processes, and improve decision-making capabilities. This forces Manhattan Associates to continuously innovate to stay ahead in this evolving market. For instance, in 2024, a significant portion of supply chain technology investment is directed towards AI-powered visibility and optimization tools, creating a heightened need for Manhattan Associates to demonstrate superior AI integration.

- AI-driven predictive analytics are becoming a standard feature, with companies investing heavily in ML models for demand forecasting and inventory management.

- IoT integration allows for real-time tracking and monitoring across the supply chain, creating greater transparency and operational efficiency for competitors.

- The push for automation, from warehouse robotics to AI-powered route optimization, is a key battleground, requiring substantial R&D investment.

- Companies are differentiating themselves by offering more intelligent, adaptable, and self-optimizing supply chain solutions, increasing pressure on Manhattan Associates to match or exceed these advancements.

Global Reach and Regional Market Dynamics

Competitive rivalry is intense globally, but regional dynamics significantly shape its intensity. While North America remains a crucial market for Warehouse Management Systems (WMS) and omnichannel platforms, the Asia-Pacific region is experiencing the most rapid expansion. This geographic divergence demands that companies maintain a global strategic outlook while tailoring their approaches to specific regional market conditions.

The Asia-Pacific market, in particular, is set to be the fastest-growing hub for these technologies. Analysts project substantial growth, with some reports indicating a compound annual growth rate (CAGR) exceeding 15% for WMS solutions in this region through 2027. This rapid expansion attracts new entrants and intensifies competition among established players, forcing them to innovate and adapt their offerings to meet diverse local needs and regulatory environments.

- Asia-Pacific WMS Market Growth: Projected CAGR of over 15% through 2027.

- Regional Adaptation: Necessity for global players to tailor strategies for varying regional demands.

- Competitive Intensity: Increased rivalry due to rapid market expansion and new entrants.

- Strategic Focus: Global companies must prioritize and adapt to regional market dynamics for sustained success.

Competitive rivalry in the supply chain and omnichannel software market is fierce, driven by established giants like SAP and Oracle who offer broad enterprise suites. Manhattan Associates differentiates itself through deep specialization in WMS and omnichannel solutions, bolstered by its modern, cloud-native Manhattan Active platform. The market's rapid growth, projected to see the global supply chain management market reach $35.05 billion in 2024, fuels this intense competition, with companies like Manhattan Associates needing to continuously innovate with AI, ML, and IoT to maintain their edge.

| Competitor | Key Offerings | Market Position |

|---|---|---|

| SAP | Integrated ERP, Supply Chain Management (SCM) | Broad enterprise solutions |

| Oracle | Cloud-based SCM, ERP, Retail solutions | Comprehensive suite provider |

| Blue Yonder (formerly JDA Software) | End-to-end supply chain planning and execution | Specialized supply chain focus |

| Manhattan Associates | WMS, Omnichannel Commerce, Transportation Management | Specialized, cloud-native solutions |

SSubstitutes Threaten

Customers increasingly have the option to leverage generic supply chain modules integrated within larger Enterprise Resource Planning (ERP) systems from giants like SAP or Oracle. These broad ERP offerings can provide a baseline level of functionality, potentially reducing the perceived need for specialized, best-of-breed solutions. For instance, a company might find the transportation management capabilities within SAP S/4HANA sufficient for its needs, bypassing a dedicated Manhattan Associates TMS solution.

Furthermore, the market is populated by numerous smaller, niche software providers. These companies focus on delivering highly specialized functionalities, such as warehouse execution or yard management, as standalone products. A business needing only a specific component of supply chain management might opt for one of these focused solutions instead of a comprehensive suite from a provider like Manhattan Associates, citing cost-effectiveness or simpler integration for their specific requirement.

For certain businesses, especially smaller ones or those with highly specialized needs, building their own internal systems or continuing with manual processes can act as a substitute for off-the-shelf supply chain solutions. This approach sidesteps vendor dependency and hefty software expenses, even if it typically means lower efficiency and scalability. For instance, a small artisanal food producer might continue to manage inventory and distribution manually, avoiding the cost of a sophisticated SCM system.

While this can be appealing to avoid vendor lock-in and significant upfront software investments, the increasing complexity of modern supply chains makes this alternative less viable for many companies. The administrative burden and potential for errors in manual tracking can outweigh the perceived cost savings. By 2024, the global SCM software market was valued at over $25 billion, indicating a strong preference for specialized solutions due to the inherent inefficiencies of manual methods for most businesses.

The threat of substitutes for Manhattan Associates' supply chain software comes significantly from Third-Party Logistics (3PL) providers. Companies can opt to outsource their entire logistics and fulfillment operations to these specialized firms.

3PLs frequently leverage their own advanced software, which can be proprietary or licensed, thereby negating the necessity for businesses to invest in and manage Manhattan Associates' solutions directly. This outsourcing model provides a comprehensive alternative to in-house supply chain management.

The global 3PL market was valued at over $1 trillion in 2023 and is projected to continue robust growth, indicating a strong market for these substitute services. This expansion suggests that an increasing number of companies are finding value in outsourcing their logistics needs.

By utilizing 3PLs, businesses can gain access to sophisticated technology and operational expertise without the capital expenditure and ongoing maintenance associated with purchasing and implementing software like Manhattan Associates'. This makes 3PLs a compelling substitute, especially for companies seeking flexibility and cost-efficiency.

Spreadsheet-based Management and Basic Business Software

For very small businesses or those with simpler operational needs, readily available spreadsheet software and basic business applications can act as viable substitutes for specialized supply chain management solutions. While these alternatives lack the sophistication and efficiency required for larger-scale operations, they can adequately address minimal inventory tracking and order processing requirements. This substitution primarily affects the lower end of Manhattan Associates' potential customer base, where cost sensitivity might outweigh the benefits of advanced functionality.

These low-cost options present a threat by catering to businesses that may not yet require the full suite of features offered by enterprise-level supply chain software. For instance, a small retail shop with a handful of SKUs might find Microsoft Excel sufficient for managing stock levels and sales orders, rather than investing in a dedicated system. This approach, while inefficient for growth, satisfies immediate, basic needs.

The availability of these substitutes means that Manhattan Associates must clearly articulate the value proposition and scalability benefits of its solutions to capture businesses as they grow. Without compelling differentiation, smaller firms might delay adoption of more advanced tools.

The threat of substitutes is particularly relevant in markets where businesses are just beginning to formalize their operations. Consider the SMB sector, where digital transformation is ongoing. In 2024, many small businesses continue to rely on integrated accounting software that includes basic inventory modules, or even custom-built spreadsheets for tracking, rather than dedicated SCM platforms.

- Spreadsheet reliance: Many micro and small businesses still use tools like Excel for inventory and order management.

- Basic software integration: Accounting or ERP systems with rudimentary inventory features can serve as substitutes.

- Cost-effectiveness for small scale: For minimal operational complexity, these alternatives are significantly cheaper.

- Impact on entry-level market: The threat is highest for solutions targeting very small businesses or those with simple supply chains.

Emerging Technologies and Platform-as-a-Service (PaaS) Offerings

The increasing availability of low-code and no-code platforms, alongside sophisticated Platform-as-a-Service (PaaS) solutions, presents a growing threat of substitutes for Manhattan Associates. These tools empower businesses to develop bespoke applications, potentially replicating core functionalities of existing supply chain management software without requiring extensive coding expertise. This trend is accelerating as technological advancements democratize application development.

For instance, by 2024, the low-code development platform market was projected to reach over $65 billion globally. This growth indicates a significant shift, allowing companies to create custom solutions that might address specific operational needs currently met by Manhattan Associates’ offerings, such as warehouse management or transportation optimization.

This emerging capability for in-house development of tailored solutions signifies a long-term threat. Companies can increasingly bypass traditional software vendors to build integrated systems that precisely match their unique workflows, thereby reducing reliance on established, off-the-shelf products like those offered by Manhattan Associates.

- Market Growth: The global low-code development platform market is expected to exceed $65 billion by 2024.

- Customization: PaaS and low-code platforms enable businesses to build custom applications mimicking existing software functionalities.

- Reduced Reliance: This allows companies to develop tailored solutions internally, lessening dependence on third-party software vendors.

- Long-Term Impact: Technological advancements in this space pose a sustained threat by simplifying custom application development.

The threat of substitutes for Manhattan Associates arises from alternative ways customers can manage their supply chains, either through different software approaches or by outsourcing. These substitutes can range from broad ERP systems and niche standalone software to in-house development and even manual processes for very small operations.

Third-party logistics (3PL) providers represent a significant substitute, offering comprehensive outsourced solutions. The global 3PL market's substantial value, exceeding $1 trillion in 2023, highlights the widespread adoption of this model, allowing companies to leverage advanced technology and expertise without direct software investment.

The rise of low-code and no-code platforms also poses a growing threat, empowering businesses to build custom applications that can replicate existing supply chain functionalities. With the low-code market projected to surpass $65 billion by 2024, this trend enables companies to develop tailored solutions internally, reducing their reliance on traditional software vendors.

For smaller businesses, basic tools like spreadsheets or integrated modules within accounting software serve as cost-effective substitutes, though they typically lack the scalability and sophistication of dedicated SCM platforms. This highlights the need for Manhattan Associates to demonstrate clear value and growth potential to retain customers as they expand.

Entrants Threaten

Developing sophisticated enterprise-grade supply chain and omnichannel commerce software demands substantial upfront capital. This includes extensive research and development, securing top-tier talent, and building robust infrastructure. For instance, major software providers in this space often invest hundreds of millions annually in R&D to stay competitive and innovate.

This significant financial commitment acts as a formidable barrier, effectively deterring many potential new players from entering the market. The sheer scale of investment required to build comparable capabilities means only well-funded organizations can realistically consider competing.

New companies entering the supply chain and omnichannel solutions market face a significant hurdle due to the profound need for specialized industry knowledge and established customer confidence. Success hinges on understanding intricate logistics and cultivating enduring relationships with major enterprise clients.

New entrants often struggle to build the necessary reputation and demonstrate a reliable history of performance. This makes it challenging to gain traction against established players like Manhattan Associates, which has a long-standing presence and a proven ability to deliver complex solutions.

For instance, in 2024, the complexity of integrating diverse systems and managing global supply chains means that new entrants need substantial investment in specialized talent and technology. This is a barrier that incumbents have already overcome, giving them a competitive edge.

Manhattan Associates enjoys a significant advantage due to its deeply ingrained software solutions, which foster robust brand loyalty among its clientele. The mission-critical nature of their offerings means that disruption is a major concern for customers.

High switching costs act as a formidable barrier for new entrants. These costs encompass not only substantial financial outlays for new system implementation but also operational disruptions and extensive employee retraining, making it a complex undertaking for a client to transition away from Manhattan Associates.

For instance, a company migrating from Manhattan Associates' supply chain execution software might face millions in implementation fees and months of operational downtime. This complexity effectively deters many potential competitors from entering the market.

Intellectual Property and Proprietary Technology

Manhattan Associates' significant investment in intellectual property, including its Manhattan Active platform and proprietary algorithms, presents a substantial barrier for new entrants. This accumulated expertise and unique software architecture are not easily replicated, creating a strong competitive moat.

The cost and time required for new companies to develop comparable technology are considerable, deterring potential competitors. For instance, in 2024, the global supply chain management software market is projected to reach over $30 billion, with a significant portion attributed to advanced, proprietary solutions like those offered by Manhattan Associates.

- Proprietary Technology: Manhattan Active platform represents years of development and refinement.

- High Replication Costs: New entrants would face immense financial and time burdens to match this IP.

- Accumulated Expertise: The company's deep understanding of supply chain logistics is a key differentiator.

- Market Dominance: This IP underpins Manhattan Associates' ability to command premium pricing and customer loyalty in a competitive market.

Regulatory Compliance and Data Security Demands

The threat of new entrants in the supply chain software market, particularly for companies like Manhattan Associates, is significantly dampened by the high cost and complexity of regulatory compliance and data security. Sectors such as healthcare and food and beverage, where Manhattan Associates has a strong presence, demand adherence to rigorous standards like HIPAA or FSMA. New players must invest heavily in systems and processes to meet these requirements, a substantial barrier to entry.

Established players have already integrated these compliance measures into their core offerings, giving them a distinct advantage. For instance, the Health Insurance Portability and Accountability Act (HIPAA) imposes strict rules on handling protected health information. Companies failing to comply can face penalties up to $1.5 million per violation per year, making it a critical consideration for any new entrant. Similarly, the Food Safety Modernization Act (FSMA) requires robust traceability and data management capabilities, adding another layer of complexity and cost.

- High initial investment in compliance technology and expertise.

- Risk of significant financial penalties for non-compliance (e.g., HIPAA fines).

- Need for specialized personnel with knowledge of industry-specific regulations.

- Established solutions often have pre-built compliance frameworks, reducing the burden for existing customers.

The threat of new entrants into the sophisticated enterprise-grade supply chain and omnichannel commerce software market, where Manhattan Associates operates, is considerably low. This is primarily due to the immense capital requirements for research, development, and talent acquisition, often running into hundreds of millions annually for established players. Furthermore, the need for deep industry knowledge, established customer trust, and high switching costs for clients further erects significant barriers.

New entrants also face the challenge of replicating Manhattan Associates' proprietary technology and accumulated expertise, which demands substantial investment and time. In 2024, the global supply chain management software market, valued at over $30 billion, highlights the scale of investment needed to compete. Additionally, stringent regulatory compliance and data security requirements, such as HIPAA and FSMA, add another layer of complexity and cost for newcomers.

Porter's Five Forces Analysis Data Sources

Our Manhattan Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements from publicly traded companies, industry-specific market research reports, and analyses from reputable consulting firms specializing in urban real estate.

We leverage data from the Real Estate Board of New York (REBNY), city planning documents, and economic indicators from sources like the U.S. Bureau of Labor Statistics and the Federal Reserve Bank of New York to provide a comprehensive view of competitive forces in Manhattan's real estate market.