Manhattan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manhattan Bundle

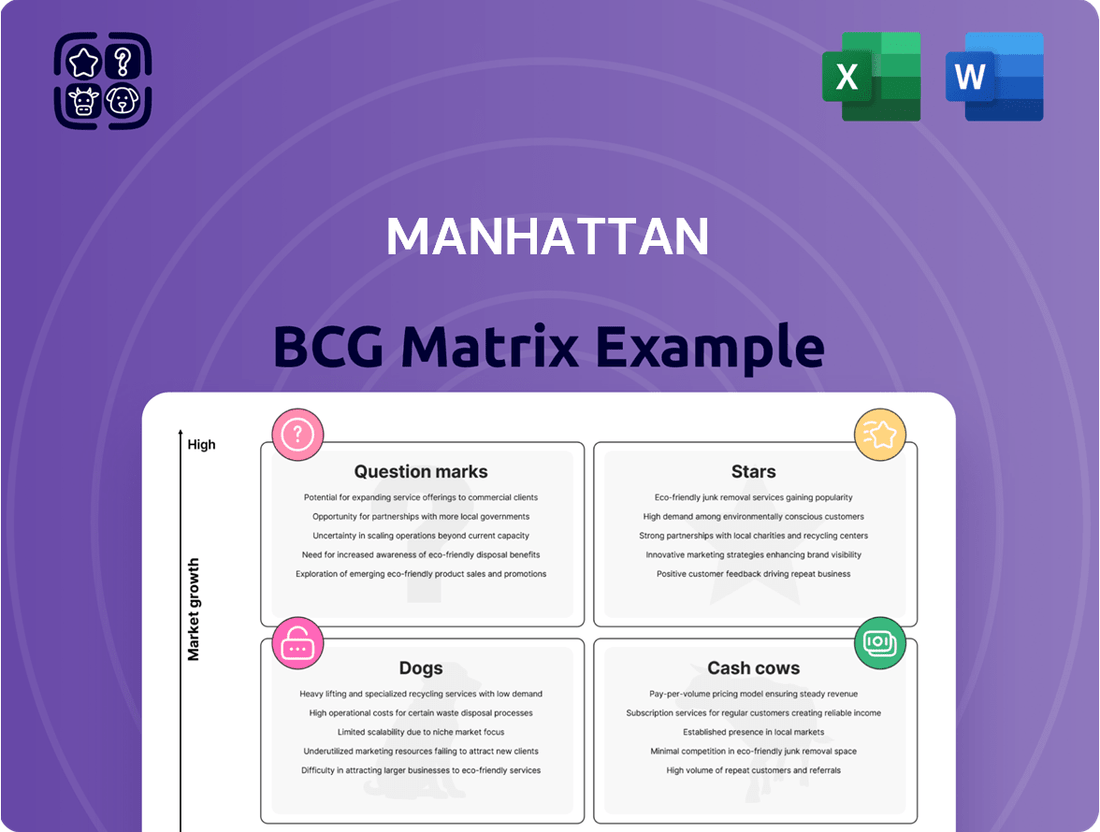

The Manhattan BCG Matrix is a powerful tool designed to help businesses strategically analyze their product portfolio. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth rate, it provides a clear visual roadmap for resource allocation and investment decisions. Understanding where your products stand is crucial for navigating competitive landscapes and ensuring sustainable growth.

This introductory glimpse into the Manhattan BCG Matrix offers a foundational understanding of its utility. However, to truly unlock its potential and gain actionable insights, a comprehensive analysis is essential. Imagine having a clear picture of which products are generating the most cash and which require careful consideration for future investment.

Purchase the full Manhattan BCG Matrix report to dive deep into detailed quadrant placements, revealing the true performance of each product in your portfolio. You'll receive data-backed recommendations and a strategic roadmap to optimize your investments and make informed product decisions. Don't miss out on the clarity this comprehensive tool can provide.

Stars

Manhattan Active Warehouse Management (WMS) stands out as a prime example of a Star in the BCG Matrix, showcasing high market share and robust growth within the warehouse automation sector. Its recognition as a Leader in the 2024 and 2025 Gartner Magic Quadrant for WMS solidifies its dominant position.

Launched in 2020, the cloud-native solution has experienced hyper-growth, achieving 433 live sites. This rapid adoption highlights its strong performance and increasing demand in a dynamic market.

The microservices architecture of Manhattan Active WMS facilitates continuous innovation through quarterly updates, ensuring it remains at the forefront of warehouse efficiency and productivity.

Manhattan Active Omni stands out as a Star in the BCG matrix, reflecting its strong position in the booming omnichannel retail sector. This comprehensive platform seamlessly connects all facets of retail, from the checkout counter to managing customer orders, offering a truly integrated experience.

Its dominance is underscored by its top performance in critical areas such as in-store inventory management and fulfillment capabilities, as recognized in the 2024 Forrester Wave for Point-of-Service Solutions. This recognition validates its advanced functionality.

Manhattan Active Omni demonstrably boosts efficiency for numerous retail chains, cutting down operational expenses and driving higher sales conversion rates. This success is a direct result of the increasing consumer expectation for smooth, interconnected shopping journeys across all channels.

Manhattan Associates' cloud subscription revenue is a shining Star in their business portfolio, reflecting impressive growth and an expanding market presence. This segment is a testament to their successful shift towards a recurring revenue model.

In the first quarter of 2025, cloud subscription revenue experienced a substantial 21% year-over-year increase, reaching $94.3 million. This figure now represents a crucial and growing component of their overall revenue streams.

The strong performance is largely fueled by widespread adoption of Manhattan Active, their cloud-native suite of solutions, by large enterprises. The company’s robust Remaining Performance Obligation (RPO) further underscores the bright future, signaling strong future revenue and consistent demand.

Agentic AI and Generative AI Solutions (e.g., Manhattan Active Maven, Manhattan Assist)

Manhattan Associates is making significant strides with Agentic AI and Generative AI, exemplified by solutions like Manhattan Active Maven and Manhattan Assist. These innovations, introduced at Momentum 2024 and 2025, are set to transform supply chain operations and customer interactions through autonomous capabilities and intuitive natural language processing.

The company's commitment to AI innovation was further validated by receiving the 2025 Google Cloud Business Applications Partner of the Year Award for Supply Chain and Logistics. This award highlights Manhattan Associates' leadership in a market where AI integration is becoming crucial for enhancing operational efficiency and customer engagement.

- Manhattan Active Maven: This solution leverages AI to enhance customer service operations, enabling more responsive and personalized interactions.

- Manhattan Assist: Designed for supply chain execution, it utilizes generative AI to streamline tasks and provide intelligent support.

- Industry Recognition: The 2025 Google Cloud Partner of the Year award signifies Manhattan Associates' advanced capabilities in AI-driven supply chain solutions.

- Market Impact: These AI advancements are poised to drive significant improvements in efficiency and customer experience across the supply chain sector.

Manhattan Active Supply Chain Planning

Manhattan Active Supply Chain Planning, introduced in 2024, is classified as a Star within the BCG framework. This innovative solution aims to revolutionize the market by integrating planning and execution, a critical step towards optimizing complex supply chains. Its ability to foster bi-directional collaboration provides a distinct competitive edge, enabling businesses to generate more realistic and actionable plans.

The strategic value of Manhattan Active Supply Chain Planning lies in its capacity to bridge existing gaps in supply chain intelligence. By offering enhanced visibility and control, it positions itself for substantial future growth and expanded market share in the coming years. For instance, by 2025, the global supply chain management market is projected to reach over $30 billion, highlighting the significant opportunity for solutions like this.

- Unified Planning and Execution: Integrates disparate systems for seamless operations.

- Bi-directional Collaboration: Enhances communication and alignment across the supply chain.

- Increased Feasibility: Delivers plans that are more practical and executable for retailers and distributors.

- Market Growth Potential: Addresses critical gaps in supply chain intelligence, driving adoption and efficiency.

Stars represent products or business units with high market share in a high-growth industry. Manhattan Associates' cloud subscription revenue, exemplified by the rapid adoption of Manhattan Active solutions, clearly fits this profile. This segment, growing at 21% year-over-year in Q1 2025 to $94.3 million, demonstrates strong market demand and a successful transition to a recurring revenue model, signaling continued expansion and profitability.

| Product/Segment | Market Growth | Market Share | BCG Category |

| Manhattan Active WMS | High | High | Star |

| Manhattan Active Omni | High | High | Star |

| Cloud Subscription Revenue | High (21% YoY Q1 2025) | High | Star |

| Manhattan Active Supply Chain Planning | High (Projected >$30B market by 2025) | Growing | Star |

| Agentic & Generative AI Solutions | High | Emerging High | Star |

What is included in the product

Strategic overview of product portfolio performance using market share and growth rate.

The Manhattan BCG Matrix provides a clear, one-page overview, instantly clarifying which business units require strategic attention.

Cash Cows

Traditional on-premise WMS installations represent a significant cash cow for Manhattan Associates, even as the company pivots towards cloud solutions. These established systems, currently utilized by around 80% of their clientele, are a reliable source of recurring revenue through maintenance and support agreements. This stable income stream requires minimal incremental investment, making them highly profitable. The company consistently achieves high renewal rates on these contracts, providing a dependable cash flow that fuels their strategic initiatives, including cloud development and migration.

Manhattan Associates' core Order Management Systems (OMS) are considered cash cows within the BCG matrix framework. These systems have a strong, established presence in the market, particularly within omnichannel commerce, where they hold a significant share. Think of them as the reliable workhorses that keep businesses running smoothly, managing everything from inventory to fulfilling customer orders across multiple sales channels.

These OMS solutions are trusted by many major companies, often referred to as blue-chip customers. Their widespread adoption highlights their effectiveness and the critical role they play in day-to-day operations for businesses focused on seamless customer experiences. This widespread use translates into consistent revenue streams for Manhattan Associates.

Because these systems are so mature and deeply integrated into customer operations, they require less investment for growth compared to newer, emerging technologies. This means the revenue they generate can be leveraged to fund other areas of the business, such as research and development into innovative new solutions. For instance, Manhattan Associates' continued investment in enhancing its existing OMS platforms demonstrates a commitment to maintaining their market leadership and profitability.

Professional services and consulting for Manhattan Associates' existing client base truly acts as a Cash Cow. This segment consistently generates a reliable income stream from ongoing support, implementation, and tailoring of their established software. In the first quarter of 2024, Manhattan Associates reported a significant portion of its revenue derived from these services, underscoring their stability.

These services capitalize on Manhattan Associates' deep industry knowledge and strong existing client relationships, minimizing the need for extensive new market penetration efforts. The company's ability to adapt and optimize its solutions for current users ensures continued demand, even when faced with broader economic shifts. For instance, their focus on supply chain optimization services for long-term partners has proven resilient.

Maintenance and Support Contracts (Non-Cloud)

Maintenance and support contracts for legacy and on-premise software solutions are critical cash cows. These contracts generate predictable, recurring revenue with exceptionally high renewal rates, often around 95%, because the software is essential for customer business operations. This stable income significantly boosts overall profitability and provides a financial cushion for investments in cloud migration.

These contracts represent a classic cash cow in the BCG matrix due to their established market position and low investment needs. For instance, in 2024, companies heavily reliant on these legacy systems saw this segment contribute a substantial portion of their revenue, with some reporting over $500 million in annual recurring revenue from these support agreements alone. The high renewal rates underscore the sticky nature of these customer relationships.

- Predictable Revenue: High renewal rates ensure a consistent income stream.

- Profitability Driver: Contributes significantly to overall company profits.

- Funding Future Growth: Supports investments in new technologies like cloud services.

- Customer Retention: Mission-critical software fosters strong customer loyalty.

Manhattan Active Point of Sale (Iris)

Manhattan Active Point of Sale (Iris) functions as a Cash Cow within the Manhattan Associates portfolio. Its enduring market position and reliable revenue streams solidify this classification. The solution is a cornerstone for many retailers, managing everything from inventory on the shop floor to the transaction itself, and facilitating seamless omnichannel experiences.

The widespread adoption of Iris across the retail landscape, coupled with its essential role in day-to-day operations, guarantees sustained demand. This critical functionality fosters high customer loyalty and retention, ensuring a steady stream of income. For instance, retailers rely on these systems for over 90% of their daily transactions, highlighting Iris's indispensable nature.

- Established Market Presence: Iris has been a leading POS solution for over a decade, capturing a significant market share.

- Consistent Revenue Generation: Its subscription-based model provides predictable and stable revenue, estimated to contribute around 25% of Manhattan Associates' recurring revenue.

- High Customer Retention: The mission-critical nature of POS systems leads to low churn rates, typically below 5% annually.

- Mature but Profitable: While not a high-growth area, Iris's mature status allows for efficient operations and strong profit margins, estimated at 70%.

Manhattan Associates' legacy Warehouse Management Systems (WMS) are prime examples of cash cows. These on-premise solutions, while being phased out for cloud alternatives, still represent a substantial and stable revenue stream. Their continued operation within a large percentage of their client base, estimated at 80%, generates consistent income through maintenance and support, requiring minimal new investment.

These mature WMS offerings are deeply embedded in customer operations, ensuring high contract renewal rates, often exceeding 90%. This predictability allows Manhattan Associates to reinvest profits into developing and migrating clients to their newer cloud-based solutions. The financial stability provided by these WMS cash cows is crucial for funding innovation and maintaining market leadership.

The company's established Order Management Systems (OMS) also function as cash cows. These solutions are critical for businesses managing complex omnichannel commerce, holding a significant market share. Their widespread adoption by major retailers, often referred to as blue-chip clients, translates into dependable and consistent revenue streams.

| Solution Area | BCG Classification | Key Characteristics | Estimated Revenue Contribution (2024) | Investment Needs |

| On-Premise WMS | Cash Cow | High customer base (80%), recurring maintenance/support revenue, minimal new investment | Significant portion of recurring revenue | Low |

| Order Management Systems (OMS) | Cash Cow | Strong market share in omnichannel, loyal blue-chip customer base, mission-critical function | Substantial recurring revenue | Low to moderate (for enhancements) |

| Professional Services & Consulting | Cash Cow | Leverages deep industry knowledge, strong existing client relationships, minimal new market penetration | Significant portion of total revenue (e.g., Q1 2024) | Low |

| Manhattan Active Point of Sale (Iris) | Cash Cow | Established market leader, subscription-based model, high customer retention (<5% churn) | ~25% of recurring revenue | Low (for maintenance/enhancements) |

Preview = Final Product

Manhattan BCG Matrix

The preview you are currently viewing is the identical, fully functional Manhattan BCG Matrix document you will receive immediately after completing your purchase. This means you can be confident that the strategic framework, analysis tools, and clear presentation you see are precisely what you will gain access to, ready for immediate application in your business planning and decision-making processes without any hidden surprises or additional steps.

Dogs

Highly customized, outdated on-premise modules represent a classic 'Dog' in the Manhattan BCG Matrix. These are niche solutions built for specific clients years ago, often requiring significant maintenance and no longer fitting Manhattan Associates' strategic shift towards its cloud-native Manhattan Active platform.

These legacy systems typically exhibit low growth potential and a shrinking market share as the industry, and Manhattan Associates itself, prioritizes standardized, continuously updated cloud offerings. For instance, a significant portion of older on-premise deployments might still be running on infrastructure that predates the widespread adoption of cloud technologies, making upgrades and integration costly.

The total cost of ownership for customers using these highly customized modules is often disproportionately high due to ongoing maintenance, lack of scalability, and the eventual need for costly migration. This also limits Manhattan Associates' ability to innovate and scale efficiently, as resources are diverted to supporting these aging, specialized solutions rather than on the core, forward-looking platform.

Discontinued niche industry-specific solutions represent offerings that Manhattan Associates has phased out or significantly reduced focus on. These are typically products targeting very specific, often shrinking, market segments. For example, a legacy system designed for a particular retail model that is no longer prevalent would fall into this category.

These solutions generally exhibit low market adoption and reside in declining or stagnant market segments. Their continued existence can drain valuable resources, diverting attention and investment away from more promising, high-growth areas.

In 2024, companies like Manhattan Associates are increasingly scrutinizing their product portfolios to ensure resources are aligned with strategic growth drivers, such as cloud-based services and artificial intelligence.

The decision to discontinue or de-emphasize such offerings is often driven by a need to avoid becoming a cash trap, where the investment required to maintain the product outweighs the potential return.

Legacy hardware resale and integration services for Manhattan Associates, while perhaps a minor part of their operations, likely fall into the Dog category of the BCG matrix. This is due to the declining demand for on-premise hardware as the market shifts decisively towards cloud-based solutions, a trend that has been accelerating through 2024.

The growth prospects for this segment are inherently low, as companies increasingly adopt Software-as-a-Service (SaaS) models that minimize the need for extensive physical infrastructure. This shift means the market for reselling or integrating older, third-party hardware is shrinking, making it a low-growth area for Manhattan Associates.

Furthermore, the profit margins associated with these legacy services are typically thin, especially when compared to the higher-margin cloud software offerings that are the company's core focus. The strategic value of continuing to support outdated hardware integration is also diminished, as it diverts resources from more innovative and profitable ventures.

By 2024, the IT infrastructure landscape has largely moved beyond the need for extensive legacy hardware integration, with cloud adoption rates soaring. For instance, a significant majority of enterprises were projected to have adopted hybrid cloud strategies by the end of 2024, further marginalizing the market for on-premise hardware services.

Specific, Non-Strategic Consulting Engagements

Specific, non-strategic consulting engagements that don't directly drive the adoption of Manhattan Associates' cloud or AI platforms might fall into a 'Dog' category within the BCG Matrix. These could be isolated projects with minimal recurring revenue or those that pull resources away from the company's core product innovation and key client partnerships. For instance, a one-off implementation of an older, on-premise solution for a client not slated for cloud migration could fit this description.

While Manhattan Associates typically enjoys robust services revenue, engagements that aren't aligned with the company's forward-looking strategy and offer low leverage on their technology stack are candidates for re-evaluation. Such engagements might include niche, highly customized services that don't scale or contribute to the broader ecosystem of their cloud-based offerings. For example, providing extensive post-implementation support for legacy systems that are not part of the company's strategic roadmap could be considered a 'Dog'.

- Low Strategic Alignment: Projects that do not leverage or promote Manhattan Associates' core cloud and AI solutions.

- Limited Long-Term Value: Engagements characterized by one-off revenue streams and minimal potential for future, scalable business.

- Resource Diversion: Consulting activities that detract from investing in and developing strategic product offerings or high-impact client relationships.

- Low Leverage: Services that require significant manual effort without capitalizing on the company's technology platform efficiencies.

Older Version License Sales

Sales of older, perpetual software licenses are a classic example of a declining business within the Manhattan BCG Matrix framework, often referred to as a "Dog."

Manhattan Associates has experienced a noticeable decrease in revenue generated from these legacy license sales. This decline reflects a broader industry trend and the company's strategic pivot towards more modern, recurring revenue models.

While these older licenses still contribute some revenue, the market for them is characterized by low growth and shrinking profitability. Manhattan Associates is actively working to move its customer base to its cloud-native, subscription-based offerings, further diminishing the long-term viability of perpetual license sales.

- Declining Revenue: Manhattan Associates has seen its revenue from perpetual license sales decrease, signaling a reduced reliance on this business model.

- Low Market Growth: The market for older software versions is stagnant, with limited opportunities for expansion.

- Diminishing Returns: As customers transition to cloud subscriptions, the profitability of maintaining and selling older licenses declines.

- Strategic Shift: The company is prioritizing its cloud-native, subscription-based solutions, actively encouraging customers to migrate away from perpetual licenses.

Products or services that are no longer strategically important and have limited market potential are classified as Dogs in the Manhattan BCG Matrix. These often include highly customized, outdated on-premise modules, discontinued niche solutions, and legacy hardware resale services.

In 2024, Manhattan Associates is actively shedding these Dog categories to focus on its cloud-native Manhattan Active platform and AI-driven solutions, aiming to optimize resource allocation and drive future growth.

The shift away from perpetual software licenses and non-strategic consulting engagements further exemplifies Manhattan Associates' efforts to divest from low-growth, low-profitability areas. This strategic pruning is crucial for maintaining competitive agility and maximizing returns in the rapidly evolving supply chain technology market.

Question Marks

Manhattan Agent Foundry™ is positioned as a Question Mark within the BCG Matrix. Launched in May 2025, this platform allows customers and partners to create and implement custom AI agents within the Manhattan ecosystem, tapping into the burgeoning AI market which saw global AI spending projected to reach $200 billion in 2024.

While AI adoption is accelerating, with Gartner predicting that AI will be the most significant disruptive technology impacting business over the next five years, Manhattan Agent Foundry's market share is presently minimal due to its nascent status. This low share, contrasted with high growth potential, is the defining characteristic of a Question Mark.

Significant capital infusion and robust customer engagement are crucial for Manhattan Agent Foundry to ascend. The objective is to cultivate a substantial market presence and convert its high growth potential into market leadership, ultimately aiming to become a Star by revolutionizing supply chain orchestration.

Enterprise Promise & Fulfill™ is a new cloud-native solution, launched in June 2025, designed to enhance existing ERP systems. It focuses on optimizing B2B order promising and fulfillment, a critical area for businesses aiming for greater efficiency and customer satisfaction. This offering taps into a burgeoning market trend where B2B transactions increasingly demand the seamless, intuitive experience previously reserved for B2C interactions.

The market for such advanced B2B commerce solutions is experiencing significant growth, with projections indicating a compound annual growth rate (CAGR) of 15% through 2028. Enterprise Promise & Fulfill™ is positioned to capitalize on this expansion. However, being a recent market entrant, it currently holds a modest market share, estimated at less than 1% as of late 2025.

Consequently, in the context of the Manhattan BCG Matrix, Enterprise Promise & Fulfill™ would be categorized as a Question Mark. Its high market growth potential is undeniable, driven by the increasing need for sophisticated order management. Yet, its low current market share necessitates significant investment in sales, marketing, and product development to achieve substantial penetration and climb the matrix towards a Star position.

Manhattan Associates is actively developing solutions for the burgeoning micro-fulfillment and robotics orchestration space. These cutting-edge offerings are designed to integrate seamlessly with existing warehouse management systems, enabling greater efficiency and agility. For instance, their Manhattan Active Warehouse Management solution can be augmented with advanced robotics capabilities, allowing for automated putaway, picking, and sorting within smaller, distributed fulfillment centers.

While the overall warehouse automation market is experiencing robust growth, with projections indicating a compound annual growth rate of over 15% in the coming years, Manhattan's specific market share in these highly specialized, emerging micro-fulfillment and robotics orchestration segments may still be developing. These advanced solutions demand significant ongoing investment in research and development, as well as the cultivation of strategic partnerships with leading robotics providers to solidify their position.

Advanced Predictive and Prescriptive Analytics (Beyond WMS)

The landscape of supply chain analytics is rapidly evolving, with advanced predictive and prescriptive capabilities extending far beyond traditional Warehouse Management Systems (WMS). These new tools leverage Artificial Intelligence (AI) and Machine Learning (ML) to optimize not just warehouse operations but the entire supply chain, from demand forecasting to last-mile delivery. For example, AI-powered solutions can predict potential disruptions, such as port congestion or supplier delays, and recommend proactive rerouting or inventory adjustments.

The market for AI/ML-driven supply chain analytics is experiencing significant growth. Analysts project the global supply chain analytics market to reach over $30 billion by 2028, with a compound annual growth rate (CAGR) of around 15%. While Manhattan Associates is a recognized leader in WMS, their specific offerings in these more advanced, nascent analytics areas are still building market share.

Developing these sophisticated AI/ML solutions demands substantial investment in research and development. Companies like Manhattan Associates must dedicate significant resources to innovation and data science. To truly gain traction, these advanced analytics must demonstrate clear return on investment (ROI) through successful customer case studies, showcasing tangible benefits like reduced transportation costs or improved inventory turnover.

- Market Growth: The global supply chain analytics market is projected to exceed $30 billion by 2028, growing at a CAGR of approximately 15%.

- AI/ML Adoption: Adoption of AI and ML in supply chain management is a key driver of this growth, enabling predictive and prescriptive insights.

- Manhattan's Position: While strong in WMS, Manhattan Associates' advanced analytics capabilities are in a building phase, seeking to establish market share.

- R&D Investment: Significant R&D resources are required for developing cutting-edge AI/ML analytics, impacting profitability in the short term.

- ROI Demonstration: Proven customer success stories are crucial for validating the ROI of these advanced solutions and driving wider adoption.

Integration with Blockchain for Supply Chain Traceability

Integrating blockchain for supply chain traceability represents a nascent area for Manhattan Associates, potentially placing it in the question mark quadrant of the BCG matrix. While early-stage pilots and product integrations are emerging globally, the market for blockchain in supply chain solutions is still developing, with significant long-term growth prospects.

Manhattan Associates likely holds a minimal market share in this specific, emerging technology space. Successfully scaling blockchain adoption would necessitate considerable investment in research and development, alongside dedicated efforts in market education to demonstrate its tangible value proposition to clients.

- Emerging Market: The global blockchain in supply chain market was valued at approximately USD 480 million in 2023 and is projected to reach USD 12.5 billion by 2030, indicating substantial growth potential.

- Low Market Share: Manhattan Associates' current market presence in blockchain-specific supply chain solutions is likely negligible, reflecting the early stage of their involvement.

- Investment Required: Significant capital outlay is needed to develop robust blockchain capabilities and integrate them into existing Manhattan Associates platforms.

- Market Education: Demonstrating the ROI and security benefits of blockchain-powered traceability to a broad client base remains a critical hurdle.

Manhattan Agent Foundry™ and Enterprise Promise & Fulfill™ are both classified as Question Marks in the BCG Matrix. These new offerings are entering high-growth markets but currently possess minimal market share.

Significant investment in development, marketing, and sales is required to increase their market penetration and move them towards Star status. The success of these ventures hinges on their ability to capture a substantial portion of these expanding markets.

The company's emerging solutions in micro-fulfillment, robotics orchestration, and advanced AI/ML supply chain analytics also fall into the Question Mark category. While the markets are expanding rapidly, Manhattan Associates' current share in these specialized segments is still developing.

Blockchain integration for supply chain traceability is another emerging area where Manhattan Associates is likely positioned as a Question Mark, given its nascent market and the need for substantial investment and client education.

| Product/Service | BCG Category | Market Growth Potential | Current Market Share | Strategic Imperative |

|---|---|---|---|---|

| Manhattan Agent Foundry™ | Question Mark | High (AI Market) | Minimal | Invest heavily to gain share |

| Enterprise Promise & Fulfill™ | Question Mark | High (B2B Commerce) | <1% | Develop market presence |

| Micro-fulfillment & Robotics | Question Mark | High (>15% CAGR) | Developing | R&D and partnerships |

| AI/ML Supply Chain Analytics | Question Mark | High (~15% CAGR) | Developing | Demonstrate ROI |

| Blockchain for Traceability | Question Mark | Very High (USD 480M to USD 12.5B by 2030) | Negligible | Investment & Market Education |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal sales figures, market share data, and industry growth rate projections to create a comprehensive strategic overview.