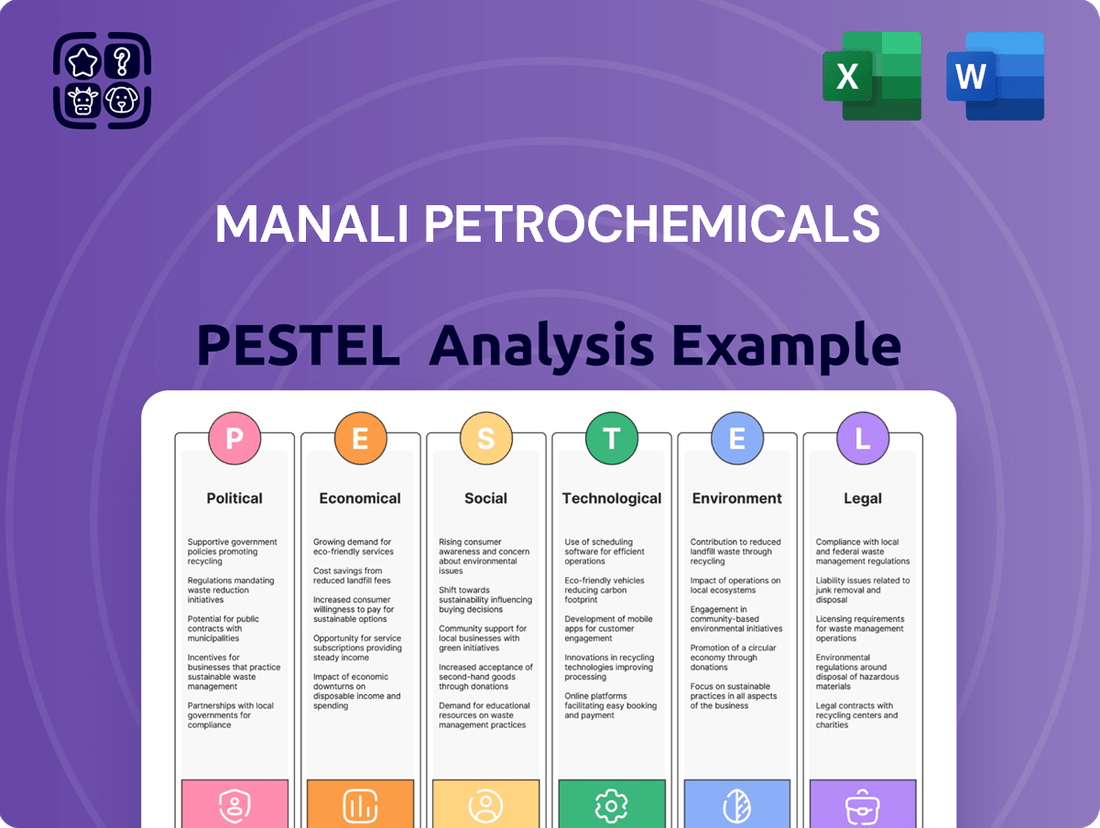

Manali Petrochemicals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manali Petrochemicals Bundle

Uncover the intricate web of external forces shaping Manali Petrochemicals's trajectory. Our PESTLE analysis delves into the political stability, economic fluctuations, and technological advancements impacting the petrochemical industry. Understand the social shifts and environmental regulations that present both challenges and opportunities.

Gain a competitive advantage by leveraging our comprehensive PESTLE analysis of Manali Petrochemicals. This report offers actionable intelligence to navigate the evolving market landscape and inform your strategic decisions. Don't miss out on critical insights that can drive your business forward.

Ready to make informed investment decisions or refine your business strategy? Our meticulously researched PESTLE analysis provides a deep dive into the factors influencing Manali Petrochemicals's performance, from legal frameworks to global economic trends.

Empower your strategic planning with our detailed PESTLE analysis of Manali Petrochemicals. Explore how socio-cultural trends and evolving environmental policies could impact your stakeholders and operations. Download the full version now to unlock a wealth of expert-backed intelligence.

Navigate the complexities of the petrochemical sector with confidence. Our PESTLE analysis for Manali Petrochemicals offers a clear view of the external environment, enabling you to anticipate risks and capitalize on emerging opportunities. Get your copy today for a strategic edge.

Political factors

The Indian government is a strong proponent of the petrochemical industry, evidenced by its 'Make in India' and 'Atmanirbhar Bharat' campaigns. These initiatives are designed to lessen reliance on imported petrochemicals and bolster domestic manufacturing capabilities.

Policies like the Petroleum, Chemicals, and Petrochemical Investment Regions (PCPIRs) are crucial, aiming to draw substantial investment into the sector. The target is to attract ₹10 lakh crore (roughly USD 142 billion) by 2025, fostering an environment ripe for growth.

This supportive policy framework directly benefits companies such as Manali Petrochemicals Limited (MPL). It encourages expansion and aligns their operations with the national objective of achieving greater self-sufficiency in petrochemical production.

India's policy allowing 100% Foreign Direct Investment (FDI) in petrochemicals via automatic routes significantly simplifies entry for global companies. This open door policy is designed to attract substantial foreign capital and cutting-edge technologies into the sector.

This liberalization is a key political factor that directly benefits domestic players like Manali Petrochemicals Limited (MPL) by fostering an environment conducive to strategic alliances and technological upgrades. Such partnerships can accelerate MPL's expansion and modernization initiatives.

In 2023, India saw a notable surge in FDI, with the petrochemical sector being a key beneficiary, attracting billions in investment, signaling strong global confidence in India's economic trajectory and policy framework.

The Indian government is introducing new rules for petrochemical plants, with a draft proposing greenhouse gas emission targets starting from the 2025-26 fiscal year. This initiative is part of the Carbon Credit Trading Scheme (CCTS), aiming to encourage cleaner production.

This mandate will require companies like Manali Petrochemicals Limited (MPL) to adjust their operations to comply with these environmental standards. It means MPL will likely need to invest in greener technologies and sustainable practices to meet the new regulations and potentially earn carbon credits.

National Petrochemical Policy

The Indian government's National Petrochemical Policy, introduced in 2020, signals a strong commitment to making India a global leader in petrochemicals. This policy outlines a clear vision for the sector, focusing on increasing production capacity and attracting investment, particularly in downstream sectors. For Manali Petrochemicals Limited (MPL), this translates into a supportive environment for expansion and innovation.

The policy's emphasis on boosting petrochemical capacity is crucial. India's petrochemical consumption was projected to reach around 60 million metric tons by 2025, indicating significant growth potential. By encouraging investments in downstream industries, the policy aims to create a more integrated value chain, reducing import dependence and fostering domestic manufacturing. This strategic push is expected to enhance supply chain efficiency, a key factor for companies like MPL to compete effectively.

The National Petrochemical Policy's strategic direction provides a clear roadmap for growth. It aims to:

- Expand India's petrochemical production capacity.

- Incentivize investments in downstream petrochemical industries.

- Improve the overall efficiency of the petrochemical supply chain.

- Promote research and development for innovative products.

Quality Control Orders (QCOs)

India's push for Quality Control Orders (QCOs) and mandatory Bureau of Indian Standards (BIS) certifications is intensifying across chemical sectors, with several impacting petrochemicals as early as October 2024. These measures are designed to elevate product quality, aligning with global benchmarks and safeguarding the domestic market against substandard imports.

Manali Petrochemicals Limited (MPL) faces a critical need to adapt its product portfolio and manufacturing processes to meet these stringent, evolving quality and safety standards. Failure to comply could jeopardize market access and erode its competitive edge. For instance, the BIS certification for Propylene Oxide, a key feedstock for MPL, is under consideration, which will necessitate rigorous testing and adherence to specified purity levels.

- Mandatory BIS Certification: Many chemical products will require BIS certification, impacting market entry for non-compliant goods.

- October 2024 Deadlines: Several QCOs are slated to become effective from October 2024, requiring prompt action.

- International Standard Alignment: QCOs aim to harmonize Indian standards with global quality and safety expectations.

- Market Access: Compliance is crucial for maintaining and expanding market share against both domestic and international competitors.

Government initiatives like Make in India and Atmanirbhar Bharat strongly support the petrochemical sector, aiming to boost domestic production and reduce import reliance. Policies such as Petroleum, Chemicals, and Petrochemical Investment Regions (PCPIRs) are designed to attract significant investment, targeting ₹10 lakh crore by 2025, fostering growth for companies like Manali Petrochemicals Limited (MPL).

India's open policy for 100% Foreign Direct Investment (FDI) in petrochemicals via automatic routes simplifies entry for global players, attracting capital and technology. This liberalization benefits domestic firms like MPL by enabling strategic alliances and technological upgrades, thereby accelerating their expansion and modernization. In 2023, billions in FDI flowed into India's petrochemical sector, reflecting strong global confidence.

New environmental regulations, including draft greenhouse gas emission targets for the 2025-26 fiscal year under the Carbon Credit Trading Scheme, will necessitate investments in greener technologies for companies like MPL. Furthermore, the intensification of Quality Control Orders (QCOs) and mandatory Bureau of Indian Standards (BIS) certifications, with some impacting petrochemicals from October 2024, requires MPL to adapt its processes to meet stringent quality and safety standards for market access.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Manali Petrochemicals, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the petrochemical industry.

A Manali Petrochemicals PESTLE analysis serves as a pain point reliever by offering a clear, summarized version of external factors, enabling quick referencing and informed decision-making during strategic planning.

Economic factors

India's petrochemical demand is on a strong upward trajectory, with projections indicating the market could reach $300 billion by 2025. This burgeoning demand is a direct result of a growing middle class and increasing urbanization, driving consumption across various sectors.

Key industries like automotive, packaging, pharmaceuticals, and construction are experiencing significant growth, all of which rely heavily on petrochemical products. Manali Petrochemicals Limited (MPL), as a key supplier to these vital sectors, is well-positioned to capitalize on this robust domestic demand.

The sustained expansion of these end-user industries directly translates into higher consumption of petrochemicals, creating a favorable environment for companies like MPL. This trend is expected to continue, with the Indian petrochemical market potentially reaching $1 trillion by 2040.

Manali Petrochemicals Limited (MPL), like others in the petrochemical sector, faces significant challenges from raw material price volatility. The primary inputs, crude oil and its derivatives such as propylene and polyols, are subject to considerable price swings. For instance, crude oil prices experienced notable fluctuations throughout 2024, with Brent crude trading in a range influenced by OPEC+ production decisions and global demand outlooks, directly impacting MPL's input costs.

These price movements are often driven by a complex interplay of global energy market dynamics, geopolitical events, and supply-demand imbalances. A geopolitical event in a major oil-producing region, for example, can trigger immediate price surges, squeezing profit margins for companies like MPL if they cannot pass on these increased costs to consumers. This uncertainty makes cost management a critical operational focus.

MPL's strategic approach to mitigate these risks includes backward integration. By focusing on captive consumption of key materials like polyester polyol, the company aims to create a more stable and predictable cost structure for a portion of its production. This strategy can insulate it to some extent from the most extreme external price shocks, providing a degree of cost control.

The surge in disposable income for Indian households is a significant tailwind for the petrochemical sector. As consumers have more money to spend, their purchasing power for goods that rely on petrochemicals, like automobiles, plastics, and textiles, naturally increases.

This enhanced purchasing power directly fuels demand for Manali Petrochemicals Limited's (MPL) products. For instance, in 2023, India's per capita disposable income saw a notable rise, contributing to a stronger consumer market for durables and packaged goods, key end-user industries for MPL.

MPL's product portfolio, including propylene oxide and polyols, are integral components in the manufacturing of polyurethane foam, which finds extensive use in furniture, automotive seating, and insulation. The upward trend in disposable income means more consumers can afford these end products, thereby boosting MPL's sales volumes.

Reports from early 2025 indicate continued positive growth in consumer spending, driven by factors such as wage increases and government support programs, which further solidifies the beneficial impact of higher disposable income on companies like MPL.

Infrastructure Development Spending

Government initiatives, such as the National Infrastructure Pipeline, are channeling substantial funds into infrastructure development. This program, with a projected outlay of ₹111 lakh crore (approximately $1.3 trillion) for 2020-2025, directly fuels demand for petrochemical derivatives. The expansion of projects like the Smart Cities Mission and rural electrification further amplifies the need for plastics, polymers, and synthetic materials essential for construction and modernization.

This sustained government focus on building and upgrading national infrastructure translates into a robust and predictable market for Manali Petrochemicals Limited (MPL). The increased construction activity in housing, transportation networks, and utilities creates a consistent demand stream for MPL's core products, including polypropylene and polyols, which are vital components in these sectors.

- Increased demand for polymers: Infrastructure projects utilize significant quantities of plastics for pipes, insulation, and structural components.

- Growth in agricultural sector: Expanded irrigation and modern farming techniques require plastic films, pipes, and containers.

- Boost for construction materials: Petrochemicals are integral to paints, coatings, adhesives, and sealants used in building and infrastructure.

- Long-term market stability: Government commitment to infrastructure spending provides a predictable revenue base for petrochemical suppliers.

Competitive Import Pressures

Manali Petrochemicals Limited (MPL), while experiencing domestic demand growth, is notably impacted by competitive import pressures. The influx of more affordable imported products directly affects MPL's product realizations and the profitability of its standalone operations, particularly in its core propylene oxide (PO) and polyol segments. For instance, during the fiscal year 2023-24, global petrochemical markets saw significant price volatility, with certain regions experiencing oversupply that drove down import prices into India. This environment means MPL must constantly benchmark its costs against these cheaper alternatives.

The strategic imperative for MPL is clear: maintaining market share and profitability demands a relentless focus on cost efficiency and value addition. The company needs to differentiate its offerings and enhance customer value to justify its pricing in the face of lower-cost imports. This includes investing in process improvements to reduce manufacturing expenses and exploring opportunities for product diversification or specialization that command premium pricing. As of early 2025, global petrochemical capacity expansions in Asia continue to exert downward pressure on prices, making this a persistent challenge.

- Cost Efficiency: MPL's operational expenditures need to be continually optimized to compete with imports, potentially through energy efficiency drives and feedstock sourcing strategies.

- Product Differentiation: Developing specialized grades of polyols or exploring niche applications for its products can create a competitive moat against commoditized imports.

- Value Addition: Enhancing customer service, technical support, and supply chain reliability can add intangible value, making MPL a preferred supplier even at a slightly higher price point.

- Market Intelligence: Closely monitoring global supply-demand dynamics and import pricing trends is crucial for timely strategic adjustments.

India's petrochemical demand is projected to hit $300 billion by 2025, fueled by a growing middle class and urbanization. This expansion directly benefits Manali Petrochemicals Limited (MPL) by increasing consumption in key sectors like automotive and construction, with potential for the market to reach $1 trillion by 2040.

However, MPL faces significant challenges from raw material price volatility, particularly for crude oil and propylene, which heavily influence input costs. Geopolitical events in 2024, for instance, caused notable fluctuations in Brent crude prices, impacting MPL's margins unless costs can be passed on.

The surge in Indian household disposable income, with per capita disposable income rising in 2023, directly boosts demand for MPL's products like polyols used in furniture and automotive sectors. Continued growth in consumer spending in early 2025 further supports this trend.

Government infrastructure spending, like the ₹111 lakh crore National Infrastructure Pipeline (2020-2025), creates sustained demand for petrochemical derivatives vital for construction and modernization, providing a predictable market for MPL.

MPL also contends with competitive import pressures, especially from more affordable petrochemical products entering the Indian market. This necessitates a strong focus on cost efficiency and product differentiation to maintain profitability against global price trends observed into early 2025.

What You See Is What You Get

Manali Petrochemicals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Manali Petrochemicals PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. It provides a detailed examination of external forces that shape the petrochemical industry and Manali Petrochemicals' business landscape. You will gain insights into market trends, regulatory shifts, and competitive dynamics.

Sociological factors

Consumers are increasingly prioritizing products that are kind to the environment, a trend that directly impacts the petrochemical industry. This heightened awareness means a growing demand for sustainable options, pushing companies like Manali Petrochemicals Limited (MPL) to explore greener materials. For instance, the global market for bioplastics, a key alternative to conventional plastics, was valued at approximately USD 50.5 billion in 2023 and is projected to reach USD 150.1 billion by 2030, indicating a substantial shift.

This societal preference for eco-friendly goods translates into a demand for petrochemical derivatives that are biodegradable or derived from renewable sources. Companies that can offer these alternatives are better positioned to capture market share. MPL's strategic investment in developing eco-friendly polyols, which are used in foams and coatings, directly addresses this growing consumer and industrial demand for more sustainable chemical solutions.

India's rapid urbanization, with a projected 600 million people expected to live in cities by 2030, is significantly reshaping consumer habits and driving demand for petrochemicals. This demographic shift fuels the need for materials used in construction, automotive manufacturing, and consumer goods, directly benefiting Manali Petrochemicals Limited (MPL). As more people migrate to urban centers, the consumption of products reliant on MPL's offerings, such as polyurethane foams for furniture and insulation, is set to rise.

Evolving lifestyles, characterized by a growing middle class with increased disposable income, further amplify demand for sophisticated products. For instance, the automotive sector, a key consumer of MPL's propylene oxide derivatives, saw its passenger vehicle sales reach approximately 4.1 million units in FY2024, indicating a robust market for interior components and materials. This trend directly translates into expanded opportunities for MPL to supply essential petrochemical building blocks.

The growth of India's middle class, projected to reach over 475 million people by 2030, fuels a significant rise in demand for specialized chemical products and engineered polymers. This demographic shift is directly impacting sectors where Manali Petrochemicals Limited (MPL) has established a strong foothold, such as pharmaceuticals, food processing, and the fragrance industry. These industries increasingly require high-performance materials for their specific, value-added applications.

MPL is well-positioned to capitalize on this trend. The company's focus on specialty chemicals and customized solutions aligns perfectly with the evolving needs of these sophisticated end-user markets. This allows MPL to target higher-margin product segments, as demonstrated by the company's strategy to expand its propylene oxide derivatives capacity, a key input for many specialty applications.

Focus on Health and Safety

Societal expectations for enhanced health and safety standards within the chemical manufacturing sector are on a clear upward trajectory. This growing awareness directly pressures companies like Manali Petrochemicals Limited (MPL) to implement more robust safety protocols throughout their production lifecycle and to rigorously guarantee the safety of their finished products.

MPL's proactive stance on human health, safety, and environmental stewardship, coupled with its adherence to stringent international safety benchmarks, is not merely a matter of compliance but a fundamental requirement for sustaining public confidence and securing its ongoing operational permits. For instance, in 2023, the chemical industry saw a notable increase in regulatory scrutiny following several high-profile safety incidents globally, reinforcing the importance of such commitments.

- Rising Public Demand: Consumers and communities increasingly expect chemical companies to operate with the highest safety standards, influencing brand perception and market access.

- Regulatory Pressure: Governments worldwide are strengthening regulations concerning chemical handling, production, and environmental impact, often driven by public health concerns.

- Operational License: Demonstrating a strong safety record is often a prerequisite for obtaining and maintaining licenses to operate, especially in densely populated areas.

- Employee Well-being: A commitment to safety directly impacts employee morale, productivity, and the company's ability to attract and retain talent.

Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility are growing, pushing companies to actively benefit their communities. Manali Petrochemicals Limited (MPL) demonstrates this commitment through various CSR initiatives focused on areas like preventive healthcare and educational upliftment. For instance, in FY23-24, MPL invested ₹2.1 crore in CSR activities, reaching over 15,000 beneficiaries. These efforts not only address social needs but also bolster MPL's brand image and foster strong relationships with stakeholders, aligning its operations with prevailing social values.

These initiatives are crucial for building long-term stakeholder trust and ensuring a positive social license to operate. MPL's focus on health and education aligns with India's national development goals, further embedding the company within the societal fabric.

- Community Welfare Focus: MPL's CSR spending in FY23-24 was ₹2.1 crore, supporting projects in healthcare and education.

- Stakeholder Goodwill: Initiatives like health camps and educational support programs enhance MPL's reputation among local communities and other stakeholders.

- Societal Alignment: The company's commitment to social responsibility reflects broader societal values and contributes to sustainable development.

- Brand Enhancement: Positive engagement through CSR activities strengthens MPL's brand image and fosters a sense of corporate citizenship.

Growing environmental consciousness is a significant sociological factor, pushing for sustainable petrochemical products. This trend is evident in the global bioplastics market, which was valued at approximately USD 50.5 billion in 2023 and is expected to reach USD 150.1 billion by 2030. Manali Petrochemicals Limited (MPL) is responding by investing in eco-friendly polyols, aligning with consumer demand for greener chemical solutions.

India's rapid urbanization, with a projected 600 million city dwellers by 2030, fuels demand for materials used in construction and consumer goods, directly benefiting MPL. Furthermore, an expanding middle class with increased disposable income, forecast to exceed 475 million by 2030, drives demand for specialized chemicals in sectors like automotive and pharmaceuticals, where MPL holds a strong position.

Societal expectations for enhanced health and safety standards in chemical manufacturing are rising, pressuring companies like MPL to maintain robust protocols. Demonstrating a strong safety record is crucial for public confidence and operational permits, especially after global incidents in 2023 increased regulatory scrutiny. MPL's commitment to safety and environmental stewardship is therefore vital for its social license to operate.

Corporate social responsibility is increasingly important, with MPL investing ₹2.1 crore in CSR initiatives in FY23-24, focusing on healthcare and education. These efforts not only support community welfare but also enhance MPL's brand image and stakeholder relationships, aligning the company with prevailing social values and national development goals.

Technological factors

Technological advancements in green chemistry are reshaping the petrochemical industry, pushing for sustainable alternatives. This includes the rise of bio-based feedstocks and innovative carbon capture technologies. The focus is on reducing dependence on fossil fuels and developing products with a lower environmental footprint.

Manali Petrochemicals Limited's (MPL) collaboration with Econic Technologies is a prime example of this trend. Their joint effort aims to produce polyols that incorporate carbon dioxide, a move that directly addresses the industry's need for more environmentally conscious manufacturing processes. This partnership highlights a commitment to innovation in sustainable materials.

The petrochemical industry is increasingly embracing digitalization, including Industry 4.0 technologies like artificial intelligence (AI), the Internet of Things (IoT), and robotics. These advancements are crucial for optimizing plant operations, boosting efficiency, and refining supply chain management. For instance, companies are using AI-powered predictive maintenance to reduce downtime, with estimates suggesting it can cut maintenance costs by up to 25%.

Manali Petrochemicals Limited (MPL) can significantly benefit from these technological shifts. By integrating these digital tools, MPL can streamline its production processes, leading to enhanced overall operational efficiency. The adoption of IoT sensors, for example, allows for real-time monitoring of equipment performance, enabling proactive issue resolution and minimizing costly disruptions.

These technological integrations translate into tangible cost savings and improved reliability across operations. Reports from leading industry analysts indicate that companies adopting advanced automation and data analytics in their plants have seen a 10-15% increase in overall equipment effectiveness (OEE). MPL’s strategic adoption of such technologies is therefore poised to bolster its competitiveness and operational resilience in the evolving market landscape.

Manali Petrochemicals (MPL) recognizes that continuous innovation in product development is key to staying competitive, especially in specialty chemicals and high-performance materials. This involves creating new catalysts and additives that can significantly improve product characteristics, directly addressing the ever-changing needs of their customers.

MPL's commitment to research and development is a strategic imperative, aimed at delivering greater value to clients and broadening its range of sustainable offerings. For instance, their focus on developing advanced polyurethane systems supports industries seeking more environmentally friendly solutions, a trend gaining significant traction in 2024 and projected to intensify through 2025.

Backward Integration Technologies

Technological advancements are playing a crucial role in enabling backward integration for companies like Manali Petrochemicals Limited (MPL). Their recent investment in a new polyester polyol plant, designed for captive consumption, exemplifies this trend. This move directly reduces their dependence on external suppliers for a key raw material.

This strategic technological adoption enhances MPL's supply chain resilience by internalizing production. By securing its own raw material supply, the company can better manage costs and ensure consistent availability, which is vital in a dynamic market. For instance, the polyester polyol segment is a significant cost component in polyurethane production.

The ability to control the production of intermediate goods through new technology significantly boosts cost efficiency. This integrated approach allows MPL to absorb potential price fluctuations in the open market, thereby improving their profit margins. Such vertical integration is a key driver for competitive advantage.

MPL's commitment to technological upgrades for backward integration strengthens its overall market position. It allows for greater control over the value chain, from raw materials to finished products, leading to more predictable operational outcomes and a stronger competitive edge in the petrochemical industry.

- Captive Consumption: MPL's polyester polyol plant directly supplies internal needs, reducing external procurement.

- Supply Chain Resilience: Technological integration minimizes disruptions from third-party suppliers.

- Cost Efficiency: Internalizing production helps manage and potentially lower raw material costs.

- Competitive Advantage: Backward integration enhances control over the value chain and market responsiveness.

Sustainable Manufacturing Processes

The increasing global emphasis on sustainability is a significant technological driver, pushing industries toward advanced manufacturing processes. This includes the integration of technologies that minimize environmental impact, such as those supporting circular economy principles. For instance, advancements in polymer recycling and waste-to-fuel conversion technologies are becoming crucial for reducing reliance on virgin materials and managing waste effectively.

Manali Petrochemicals Limited (MPL) is actively responding to these trends. Their strategic investments in new production facilities and robust research and development (R&D) programs are geared towards developing and implementing eco-friendly manufacturing methods. This proactive approach not only aims to enhance MPL's long-term competitive edge but also ensures adherence to evolving international environmental standards and regulations. By focusing on sustainable production, MPL positions itself to meet growing market demand for greener chemical products and maintain operational viability in an increasingly eco-conscious global market.

- Technological Adoption: MPL's commitment to sustainable manufacturing involves adopting technologies that reduce its carbon footprint, aligning with global environmental goals.

- Circular Economy Focus: The company is exploring and investing in processes like advanced polymer recycling and waste-to-fuel conversion, key components of a circular economy model.

- R&D Investment: Significant investment in research and development is directed towards creating environmentally benign production techniques, fostering innovation in their operations.

- Compliance and Competitiveness: These technological advancements are crucial for MPL to comply with stringent environmental norms and maintain a competitive advantage in the petrochemical sector.

Technological advancements are a major force shaping the petrochemical sector, with a strong emphasis on sustainability and efficiency. MPL's focus on green chemistry, like using CO2 in polyols through their Econic Technologies partnership, demonstrates this shift. Digitalization, including AI and IoT, is also critical, with predictive maintenance potentially cutting costs by up to 25%.

MPL's strategic investments in backward integration, such as their new polyester polyol plant for captive consumption, leverage technology to enhance supply chain resilience and cost efficiency. This move is expected to improve overall equipment effectiveness (OEE) by 10-15% for companies adopting similar advanced automation. Continued R&D in specialty chemicals and sustainable materials, like advanced polyurethane systems, is crucial for meeting evolving market demands through 2025.

Legal factors

India's upcoming Chemical (Management and Safety) Rules (CMSR) by 2025, aligning with the EU's REACH model, will introduce significant regulatory changes. These rules require registration, evaluation, and potential restriction of hazardous chemicals, increasing industry accountability.

Manali Petrochemicals Limited (MPL) will need to invest in robust systems to manage chemical data and ensure compliance with these new regulations. Failure to adapt could impact market access and operational continuity, especially as global chemical governance tightens.

The CMSR framework aims to bolster chemical safety and transparency, impacting how companies like MPL source, use, and report on chemical substances. This proactive approach is crucial for sustained business and environmental stewardship.

Manali Petrochemicals (MPL) operates within a framework of stringent environmental compliance regulations. Key legislation like the Water (Prevention and Control of Pollution) Act and Hazardous Substances (Management and Handling) Rules dictates its approach to waste, emissions, and overall sustainable production. For instance, the company's commitment to effluent treatment is crucial for meeting these legal mandates.

The regulatory environment is dynamic, with recent developments such as draft proposals for Greenhouse Gas (GHG) emission targets signaling an increasingly demanding landscape. MPL must proactively adapt its environmental management systems to align with these evolving standards, ensuring its operations remain compliant and environmentally responsible.

India's Plastic Waste Management Rules, particularly those focusing on Extended Producer Responsibility (EPR), are a significant legal factor. These rules place the onus on producers, including chemical manufacturers like Manali Petrochemicals Limited (MPL), to manage the end-of-life of their plastic products and packaging. For instance, the Plastic Waste Management (Amendment) Rules, 2022, extended EPR to new categories, emphasizing producer accountability throughout the product lifecycle.

The government's push towards banning certain single-use plastics, implemented in phases, directly impacts the demand for traditional plastics. This regulatory environment encourages innovation in biodegradable and recyclable materials, pushing companies to invest in sustainable alternatives. By 2023, India aimed to phase out several single-use plastic items, creating a market shift that MPL must navigate.

MPL's alignment with these regulations is crucial for its long-term viability and reputation. The company needs to integrate strategies that support a circular economy, potentially by developing or sourcing more environmentally friendly raw materials. This proactive approach can mitigate risks associated with stricter regulations and capitalize on the growing demand for sustainable chemical solutions.

Bureau of Indian Standards (BIS) Certification

The Bureau of Indian Standards (BIS) certification is a crucial legal factor for Manali Petrochemicals Limited (MPL). Since October 2024, BIS certification has become mandatory for a range of chemical and petrochemical products sold in India. This move by the Indian government aims to bolster product safety and quality across the board.

For MPL, this means that its relevant products must meet specific Indian standards to be legally manufactured and distributed within the country. Failure to obtain and maintain these certifications would significantly hamper MPL's ability to operate and sell its goods in the vital Indian market. Compliance is not optional; it's a prerequisite for market access.

MPL's commitment to obtaining and upholding BIS certifications directly impacts its operational legality and market presence. This regulatory requirement underscores the importance of adhering to national quality and safety benchmarks for all players in the petrochemical sector. The scope of products requiring BIS certification is expanding, necessitating continuous vigilance from manufacturers like MPL.

- Mandatory BIS Certification: Enforced from October 2024 for specific chemicals and petrochemicals.

- Product Safety and Quality: BIS standards ensure that products meet defined safety and quality parameters.

- Market Access: MPL must secure and retain BIS certifications for its products to legally sell in India.

- Operational Compliance: Non-compliance can lead to severe penalties and market exclusion for MPL.

Public Procurement (Preference to Make in India) Order

The Public Procurement (Preference to Make in India) Order, 2017, is a significant government policy designed to bolster domestic manufacturing. It specifically targets certain chemical products by stipulating minimum local content requirements. This policy directly aims to foster local production capabilities and lessen the nation's reliance on imported goods. For Manali Petrochemicals Limited (MPL), aligning its products to meet these mandated local content percentages presents a strategic opportunity. By doing so, MPL can enhance its prospects of securing government procurement contracts, thereby driving increased domestic sales and strengthening its market position within India.

This preference order can be a substantial advantage for companies like MPL that invest in local sourcing and manufacturing processes. For instance, in the 2023-24 fiscal year, India's chemical sector saw significant growth, and policies like this are crucial drivers. MPL's ability to demonstrate a high percentage of locally sourced raw materials and manufacturing processes will be key to capitalizing on this initiative.

- Policy Objective: To promote domestic manufacturing and reduce import dependence in specified sectors, including chemicals.

- Mechanism: Mandates minimum local content percentages for goods and services procured by government entities.

- Impact on MPL: Creates a preferential market for MPL's products if they meet or exceed the local content criteria.

- Opportunity: Potential to secure government contracts, leading to increased sales and market share within India.

The implementation of India's Chemical (Management and Safety) Rules (CMSR) by 2025, mirroring the EU's REACH framework, is a significant legal development. This necessitates that Manali Petrochemicals Limited (MPL) registers, evaluates, and potentially restricts hazardous chemicals, thereby increasing accountability. MPL must invest in data management systems to ensure compliance, as failure to do so could affect market access and operations in line with tightening global chemical governance.

Environmental factors

India's ambitious goal to reach net-zero carbon emissions by 2070 and cut emission intensity by 45% by 2030 significantly shapes the operational landscape for petrochemical companies like Manali Petrochemicals Limited (MPL). This national directive translates into direct environmental responsibilities for the sector.

Starting from the 2025-26 fiscal year, petrochemical units, including MPL, will face mandated Greenhouse Gas (GHG) emission targets. This regulatory shift will necessitate a re-evaluation of current production processes and their environmental impact.

To align with these national objectives and avoid potential penalties, MPL will need to make substantial investments in adopting low-emission technologies. This includes exploring and implementing more energy-efficient production methods across its operations.

For instance, the global petrochemical industry saw investments in green hydrogen and carbon capture technologies accelerating in 2024, signaling a trend that MPL will likely need to follow to meet its future compliance requirements.

The global push towards a circular economy is reshaping how industries, including petrochemicals, handle waste. This means a greater focus on recycling, reusing, and responsibly disposing of materials. For Manali Petrochemicals Limited (MPL), this translates into a need for robust waste management strategies for its products and by-products, aligning with evolving environmental expectations.

Regulatory frameworks like Extended Producer Responsibility (EPR) are becoming more prevalent, compelling companies to take ownership of their products' lifecycle, even after sale. This regulatory pressure encourages proactive engagement in sustainable end-of-life solutions for petrochemicals. MPL is responding by investing in sustainable practices, demonstrating a commitment to environmental stewardship.

MPL's exploration of polymer recycling and green chemistry initiatives directly addresses these environmental factors. By pursuing polymer recycling, the company aims to divert waste from landfills and create value from used plastics. Green chemistry principles are being integrated to develop more environmentally friendly production processes, reducing the generation of hazardous by-products and minimizing overall environmental impact.

Mounting global worries about the dwindling supply of fossil fuels, the very foundation of petrochemical production, are pushing industries towards new, eco-friendly raw materials. This shift is prompting companies like Manali Petrochemicals Limited (MPL) to actively seek out bio-based feedstocks and other renewable options to lessen their dependence on traditional sources.

MPL's strategic collaboration to utilize carbon dioxide (CO2) in its polyol manufacturing process is a clear indicator of this commitment. This innovative approach directly addresses the critical need to reduce reliance on conventional fossil fuels, aligning with broader sustainability goals and potentially mitigating future supply chain vulnerabilities.

Water Pollution and Effluent Treatment

The petrochemical sector, including companies like Manali Petrochemicals Limited (MPL), faces significant environmental pressures related to water pollution. Industrial effluents discharged from manufacturing processes can contaminate rivers and harm aquatic life, drawing considerable attention from regulators and the public. This scrutiny is driven by the understanding of the long-term ecological consequences of such pollution.

In response, stringent environmental laws, particularly the Water (Prevention and Control of Pollution) Act, mandate that petrochemical facilities implement robust effluent treatment systems. These regulations are designed to ensure that discharged water meets specific quality standards before re-entering the environment, thereby protecting water bodies and public health.

MPL has proactively addressed these concerns by establishing a comprehensive Effluent Treatment Plant (ETP). This facility is crucial for treating wastewater to comply with prescribed norms for marine disposal, reflecting the company's dedication to environmental stewardship and responsible operations. The ETP is a key component of their sustainability strategy.

- MPL's ETP is designed to treat wastewater to meet or exceed stringent marine disposal norms.

- Compliance with the Water (Prevention and Control of Pollution) Act is a critical operational requirement for MPL.

- Effective effluent treatment is essential for mitigating the environmental impact of petrochemical manufacturing on aquatic ecosystems.

- The company's investment in ETP infrastructure demonstrates a commitment to environmental responsibility.

Climate Change Impact and Adaptation

Climate change presents significant challenges, with extreme weather events and dwindling resources posing risks to supply chains and operational continuity. Manali Petrochemicals (MPL) must navigate these broader implications, which can impact everything from raw material availability to logistics. For instance, disruptions from severe monsoons or heatwaves in 2024 could affect transportation networks crucial for MPL's products.

There's a growing mandate for businesses to actively reduce their carbon footprint while simultaneously developing strategies to adapt to a changing climate. This means not just cutting emissions, but also building resilience against climate-related impacts. Companies are increasingly being evaluated on their proactive measures in this regard.

MPL's strategic emphasis on sustainability and the development of eco-friendly products is a key advantage. This focus helps position the company to better withstand climate-related risks and capitalize on emerging opportunities. For example, by investing in greener manufacturing processes, MPL could see reduced operational costs due to lower energy consumption and potentially benefit from policy incentives for sustainable businesses.

The company's commitment to these principles is reflected in its ongoing efforts, such as exploring bio-based feedstocks or improving energy efficiency in its plants. These initiatives are crucial for long-term viability in an era where environmental stewardship is paramount.

- Supply Chain Vulnerability: Extreme weather events in 2024, like unseasonal floods impacting key transport routes, could have caused delays in raw material delivery or product distribution for petrochemical companies.

- Regulatory Pressure: Increased focus on carbon emissions in 2024-2025 may lead to stricter regulations, impacting operational costs if companies do not invest in cleaner technologies.

- Market Demand for Green Products: Consumer and industrial demand for sustainable petrochemical alternatives is expected to grow, presenting an opportunity for companies like MPL with an eco-friendly product portfolio.

- Adaptation Costs: Implementing new infrastructure or processes to adapt to changing climate conditions, such as enhanced water management systems, will require significant capital investment.

India's net-zero commitment by 2070 and emission intensity reduction targets for 2030 are driving substantial changes for petrochemical firms like Manali Petrochemicals Limited (MPL). Starting FY2025-26, MPL will face mandatory Greenhouse Gas (GHG) emission targets, necessitating investments in low-emission technologies and energy-efficient production methods to comply and avoid penalties.

The global shift towards a circular economy is compelling MPL to enhance its waste management strategies, focusing on recycling and responsible disposal. Regulatory frameworks like Extended Producer Responsibility (EPR) are pushing the company to manage its products' lifecycles, leading to investments in sustainable practices and polymer recycling initiatives.

Concerns over fossil fuel scarcity are encouraging MPL to explore bio-based feedstocks and renewable options, reducing reliance on traditional sources. A notable initiative is MPL's use of carbon dioxide (CO2) in polyol manufacturing, aligning with sustainability goals and mitigating supply chain risks.

MPL is addressing water pollution concerns through its Effluent Treatment Plant (ETP), designed to meet stringent marine disposal norms and comply with the Water (Prevention and Control of Pollution) Act. This investment underscores the company's dedication to environmental stewardship and protecting aquatic ecosystems.

Climate change poses risks to MPL's supply chains and operations through extreme weather events. The company's focus on sustainability and eco-friendly products positions it to better manage these risks and capitalize on opportunities, such as potential policy incentives for greener businesses.

| Environmental Factor | Impact on MPL | MPL's Response/Strategy | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Climate Change & Emissions | Regulatory pressure for emission reduction; operational risks from extreme weather. | Investment in low-emission technologies, energy efficiency, exploring greener feedstocks. | India's net-zero by 2070 target; mandatory GHG targets from FY2025-26. |

| Circular Economy & Waste Management | Need for robust waste management; compliance with EPR. | Focus on polymer recycling, sustainable end-of-life solutions. | Growing global emphasis on recycling and waste reduction in the chemical sector. |

| Resource Scarcity (Fossil Fuels) | Dependence on fossil fuels as feedstock. | Exploring bio-based feedstocks and CO2 utilization in production. | Increased R&D in alternative feedstocks for petrochemicals; rise in green hydrogen investments globally. |

| Water Pollution & Regulations | Risk of water contamination from effluents; compliance with water pollution acts. | Operation of a comprehensive Effluent Treatment Plant (ETP) for marine disposal compliance. | Stricter enforcement of environmental laws regarding industrial effluent discharge in India. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Manali Petrochemicals draws on a comprehensive range of data, including official government reports, industry-specific market research from reputable firms, and economic indicators from international financial institutions. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are well-supported and current.