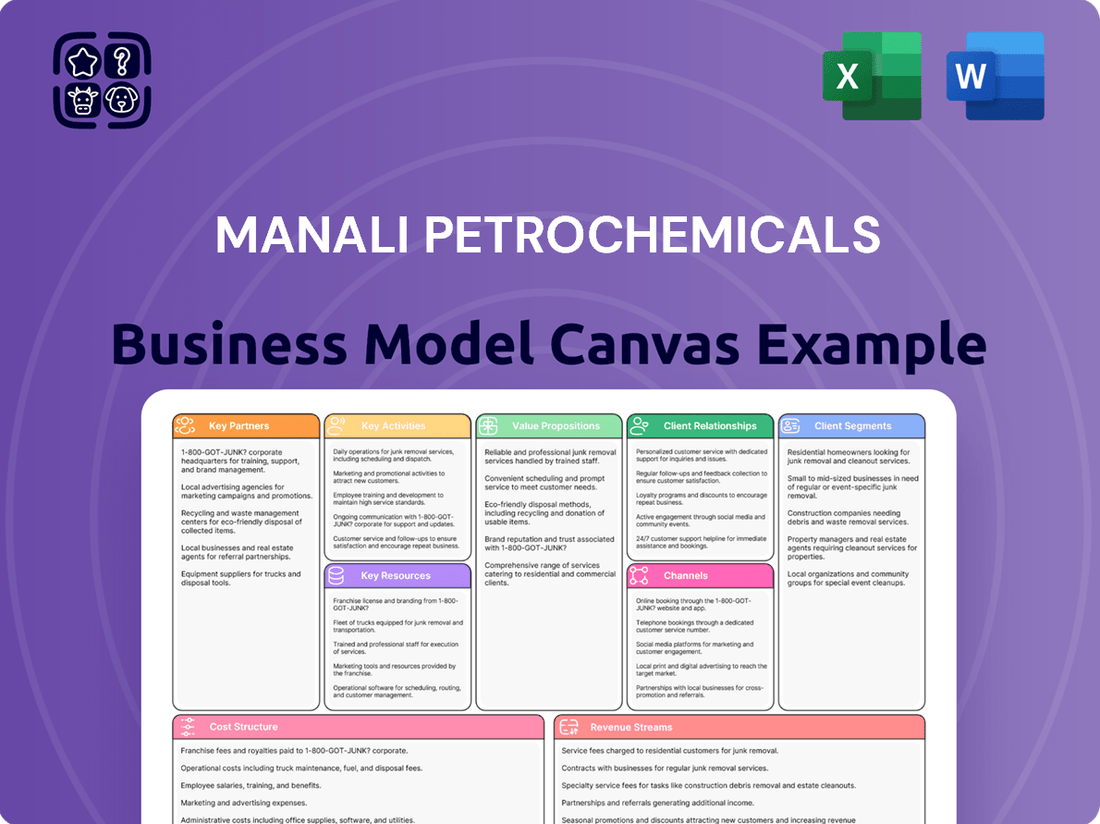

Manali Petrochemicals Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manali Petrochemicals Bundle

Unlock the full strategic blueprint behind Manali Petrochemicals's business model. This in-depth Business Model Canvas reveals how the company drives value through its key partnerships and unique value propositions in the petrochemical sector. It clearly outlines their customer segments and revenue streams, providing a comprehensive view of their operational structure. Gain actionable insights into their cost structure and key resources. Ideal for entrepreneurs and investors seeking to understand a leading player's success. Download the full version to accelerate your own business thinking.

Partnerships

Manali Petrochemicals Limited (MPL) depends on a strong supply chain for essential raw materials like Propylene and Re-liquefied Natural Gas (RLNG). In 2023, MPL's revenue was ₹1,132 crore, highlighting the importance of consistent raw material availability for its operations.

Building enduring partnerships with these suppliers is vital for controlling expenses and maintaining smooth production. For instance, securing competitive pricing on Propylene, a key feedstock, directly impacts MPL's profitability.

The company also procures polyester polyols, which are integral to its in-house system polyols offerings, further demonstrating the need for reliable sourcing across its product lines.

Manali Petrochemicals actively partners with technology providers and research institutions to drive innovation, particularly in developing green solutions and sustainable molecules. These collaborations are crucial for enhancing product specifications and optimizing production processes, ensuring the company remains competitive in the specialty chemicals sector.

For instance, ongoing research and development efforts, often in conjunction with academic partners, focus on creating more eco-friendly products. These partnerships allow Manali Petrochemicals to leverage external expertise, accelerating the development of advanced materials and processes.

In 2024, the company continued to invest in R&D, aiming to expand its portfolio of sustainable offerings. While specific partnership details are often proprietary, the strategic importance of these collaborations is evident in Manali Petrochemicals' commitment to technological advancement and environmental responsibility.

Manali Petrochemicals Limited (MPL) actively cultivates strategic distribution partnerships to broaden its market footprint, especially in overseas regions like the Nordics, mainland Europe, and the Middle East and North Africa (MENA). These collaborations are crucial for accessing new customer bases and driving sales growth.

A prime illustration of this strategy is MPL's distribution agreement with Krahn UK for its silicone oil products. This partnership facilitates efficient access to a variety of customer segments, enhancing MPL's market penetration in targeted international territories.

These alliances are instrumental in MPL's objective to significantly increase sales volumes and establish a stronger presence in markets beyond India, leveraging the expertise and networks of its distribution partners.

Subsidiary Entities and Acquisitions

Manali Petrochemicals Limited (MPL) leverages its subsidiary entities and strategic acquisitions to bolster its business model. For instance, its step-down subsidiaries, including Penn-White Ltd and Notedome Limited in the UK, are crucial contributors to consolidated revenue. These entities not only broaden MPL's product offerings but also extend its reach into new geographical markets, demonstrating a clear strategy for growth and diversification.

These acquisitions have been instrumental in enhancing MPL's technical capabilities. By integrating companies with specialized expertise, such as those focusing on polyurethane cast elastomers and foam control agents, MPL gains a competitive edge. This infusion of specialized knowledge diversifies the company’s revenue streams and reduces reliance on its core product segments, thereby strengthening its overall resilience in the market.

- Penn-White Ltd and Notedome Limited: These UK-based subsidiaries significantly contribute to MPL's consolidated revenue and product portfolio expansion.

- Geographical Footprint Expansion: Acquisitions have allowed MPL to tap into new international markets, increasing its global presence.

- Specialized Expertise Acquisition: MPL has gained valuable know-how in niche areas like polyurethane cast elastomers and foam control agents.

- Diversification Benefits: The integration of these entities provides crucial diversification, mitigating risks associated with market fluctuations in specific product categories.

Logistics and Transportation Providers

Manali Petrochemicals relies heavily on a robust network of logistics and transportation providers to ensure the smooth flow of its chemical products. These partnerships are crucial for both receiving essential raw materials, such as propylene, and delivering finished goods like Propylene Oxide and Polyols to a wide array of customers. In 2023, the company reported significant domestic and international sales, underscoring the need for efficient, cost-effective distribution channels.

The effectiveness of these partnerships directly impacts Manali Petrochemicals' operational efficiency and its ability to meet market demand promptly. Optimizing the supply chain, from raw material procurement to final product delivery, is a key strategic imperative. For instance, managing inbound logistics for raw materials sourced from various locations, and outbound logistics to diverse industrial sectors like automotive, furniture, and refrigeration, requires specialized carriers and careful route planning.

- Strategic alliances with road, rail, and sea freight operators ensure timely delivery of raw materials and finished products.

- Focus on optimizing transportation costs, which formed a notable portion of operating expenses in recent fiscal years, directly impacts profitability.

- These partnerships are vital for maintaining inventory levels and responding to the fluctuating demands of end-user industries.

- Ensuring the safe and compliant transportation of chemical goods is paramount, necessitating partners with specialized handling capabilities.

Manali Petrochemicals Limited (MPL) cultivates key partnerships with technology providers and research institutions to foster innovation, particularly in developing sustainable solutions. These collaborations are essential for enhancing product specifications and optimizing production processes, ensuring MPL remains competitive. For example, ongoing R&D efforts with academic partners focus on creating eco-friendly products, leveraging external expertise to accelerate advanced material development.

MPL also relies on strategic distribution partners to expand its market reach, especially in overseas regions like Europe and the Middle East. These alliances, such as the distribution agreement with Krahn UK for silicone oil products, are crucial for accessing new customer bases and driving sales growth beyond India.

Furthermore, MPL utilizes its subsidiary entities, like Penn-White Ltd and Notedome Limited in the UK, to broaden its product offerings and geographical presence, integrating specialized expertise in areas such as polyurethane cast elastomers. These acquisitions contribute significantly to consolidated revenue and provide diversification benefits.

The company also maintains essential partnerships with logistics and transportation providers to ensure efficient inbound and outbound movement of raw materials and finished goods. These relationships are critical for operational efficiency and meeting market demand promptly, with a focus on cost-effective and safe delivery of chemical products.

What is included in the product

This Manali Petrochemicals Business Model Canvas provides a detailed framework of their operations, focusing on their core customer segments and value propositions within the petrochemical industry.

It offers a comprehensive overview of their revenue streams, cost structure, key resources, and activities, reflecting their strategic approach to market engagement.

Manali Petrochemicals' Business Model Canvas provides a clear, one-page snapshot to quickly identify and address operational inefficiencies, acting as a pain point reliver for strategic alignment.

Activities

Manali Petrochemicals' primary engagement revolves around the significant manufacturing of essential petrochemicals like Propylene Oxide (PO), Propylene Glycol (PG), and Polyether Polyols. These products form the backbone of their operations and are crucial inputs for various downstream industries.

The company currently operates two advanced manufacturing facilities situated in Chennai, underscoring their established production capacity. This robust infrastructure is central to their ability to meet market demand for their core product offerings.

Looking ahead, Manali Petrochemicals has strategic plans for expansion, including the development of a new Propylene Glycol plant. They are also investing in new polyester polyol plants, demonstrating a commitment to broadening their product portfolio and increasing output.

A critical aspect of their manufacturing strategy involves optimizing plant utilization and implementing debottlenecking initiatives. For instance, in the fiscal year ending March 31, 2024, the company reported a production of 198,000 metric tonnes of Propylene Glycol, indicating their focus on maximizing operational efficiency.

Manali Petrochemicals Limited (MPL) actively invests in Research and Development to drive product innovation and deliver customized solutions. This commitment is vital for developing sustainable chemical alternatives and improving existing product lines. For example, in the fiscal year 2023-24, MPL continued its focus on enhancing the quality of its polyols, a key component in many of its products.

A core R&D objective for MPL is to optimize the consumption of Propylene Oxide (PO), a primary raw material, thereby improving cost efficiency and reducing environmental impact. The company is also dedicated to the development and integration of green solutions and sustainable molecules into its manufacturing processes, aligning with global environmental trends.

Strengthening the R&D team is a strategic priority for MPL. This focus aims to bolster the company's capacity for innovation, leading to enhanced product offerings and the implementation of higher environmental standards across its operations. This investment in human capital is expected to yield tangible benefits in terms of product competitiveness and sustainability.

Manali Petrochemicals actively participates in global sourcing, working with a diverse network of suppliers spanning multiple regions. This strategy allows them to leverage the global supply chain effectively, optimizing production costs and ensuring a consistent supply of essential raw materials. For instance, in 2024, the company continued to focus on securing key feedstocks like Propylene Oxide and Benzene from international markets to maintain competitive pricing.

A crucial aspect of their operations involves robust supply chain management, meticulously planning and executing the flow of materials from origin to production. This includes managing logistics, inventory, and supplier relationships to guarantee uninterrupted operations and minimize lead times. The company's focus on alternate vendor management in 2024 was a key driver in enhancing their profit margins by negotiating favorable terms and diversifying supply risks.

Sales, Marketing, and Distribution

Manali Petrochemicals focuses on actively selling its Propylene Oxide (PO) and its derivatives to a broad range of industries. This involves nurturing strategic distribution agreements to ensure efficient product reach and maintaining robust customer relationships is paramount to their sales strategy.

Marketing efforts are data-driven, incorporating market intelligence to inform adaptive pricing strategies. The company is actively expanding its footprint in key target markets, including India, broader Asia, mainland Europe, and the MENA region. These expansion efforts are supported by ongoing rebranding initiatives designed to enhance market presence and brand recognition.

- Active Sales to Diverse Industries: Manali Petrochemicals engages directly with customers across sectors like automotive, construction, and consumer goods, ensuring their petrochemicals meet specific industrial needs.

- Strategic Distribution Network: The company relies on a network of distributors and agents, particularly in international markets, to facilitate product availability and manage logistics efficiently.

- Market Intelligence and Pricing: Continuous monitoring of market trends and competitor activities allows for agile pricing adjustments to remain competitive and capture value. For example, in 2023, global petrochemical prices saw significant volatility, necessitating such adaptive strategies.

- Geographic Market Expansion: Efforts are concentrated on strengthening presence in established markets like India while simultaneously exploring and developing new opportunities in Asia, Europe, and MENA.

Operational Efficiency and Cost Optimization

Manali Petrochemicals Limited (MPL) is deeply committed to boosting its operational efficiency and meticulously managing costs. This focus is crucial for navigating market volatility and ensuring sustained profitability. A key strategy involves leveraging synergies from its international subsidiaries to streamline operations.

MPL actively pursues energy optimization initiatives. The goal is to achieve significant energy savings, which directly impacts the cost of production. This careful management of operational expenditure (OPEX) is a cornerstone of their business model.

- Energy Optimization: MPL aims to reduce energy consumption across its manufacturing processes, a common focus for chemical companies looking to cut variable costs.

- Cost of Production Balancing: The company works to balance the inherent costs of chemical production with market pricing to maintain healthy margins.

- Strict OPEX Management: Rigorous control over operational expenses, including administrative and selling costs, is maintained to protect the bottom line.

- Synergy Leverage: MPL seeks to gain efficiencies by integrating operations and sharing best practices with its international subsidiaries.

Manali Petrochemicals' key activities center on the manufacturing of Propylene Oxide (PO), Propylene Glycol (PG), and Polyether Polyols, essential for various industries. They focus on optimizing plant utilization, with 2024 seeing 198,000 metric tonnes of Propylene Glycol produced.

The company also prioritizes R&D for product innovation and sustainable solutions, aiming to enhance polyol quality and optimize PO consumption, aligning with environmental trends.

Active global sourcing of raw materials like Propylene Oxide and Benzene, coupled with robust supply chain management, ensures cost competitiveness and operational continuity.

Sales and marketing involve direct engagement with diverse industries, supported by strategic distribution networks and data-driven pricing, with expansion efforts targeting Asia, Europe, and MENA.

| Key Activity | Description | 2023-24 Data/Focus |

|---|---|---|

| Manufacturing | Production of PO, PG, Polyether Polyols | 198,000 MT Propylene Glycol produced |

| Research & Development | Product innovation, sustainable solutions | Focus on enhancing polyol quality, optimizing PO consumption |

| Supply Chain Management | Global sourcing, logistics, inventory | Securing key feedstocks like Propylene Oxide and Benzene internationally |

| Sales & Marketing | Direct sales, distribution, market expansion | Expanding in Asia, Europe, MENA; adaptive pricing strategies |

Full Document Unlocks After Purchase

Business Model Canvas

The Manali Petrochemicals Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This comprehensive canvas outlines key elements such as customer segments, value propositions, channels, and revenue streams, all presented in a clear and actionable format. You'll gain immediate access to this complete, ready-to-use analysis, allowing you to understand and leverage Manali Petrochemicals' strategic framework without any surprises.

Resources

Manali Petrochemicals Limited (MPL) operates two key manufacturing plants in Manali, Chennai, forming the backbone of its production for vital chemicals like propylene glycol and polyols. These facilities are not just production hubs but represent significant capital investment and operational capacity.

The company is actively investing in expanding its physical footprint. A new propylene glycol (PG) plant is a significant ongoing project, designed to boost output and meet growing market demand. This expansion underscores MPL's commitment to enhancing its manufacturing prowess.

Furthermore, MPL is exploring the establishment of a new manufacturing unit in Gujarat. This strategic move aims to diversify its operational base, potentially reducing logistical costs and tapping into new regional markets for its petrochemical derivatives.

As of the latest available data, MPL's capital expenditure plans reflect a strong focus on these infrastructure developments. For instance, the company has allocated substantial funds towards these projects, signaling a tangible commitment to growth and increased production capacity, with continued investment expected in 2024 and beyond.

Manali Petrochemicals Limited (MPL) leverages its extensive operational history and deep expertise in petrochemical manufacturing as a core intellectual property asset. This is particularly evident in its standing as the sole domestic producer of Propylene Glycol, a critical component in various industries. The company's market leadership in Polyols further underscores its accumulated knowledge and specialized formulations.

Proprietary know-how, especially through its subsidiary PennWhite, represents a significant intangible asset for MPL. This expertise encompasses advanced formulation techniques and production processes that differentiate its offerings in the competitive petrochemical landscape. The company's ability to innovate and refine its product lines is directly tied to this deeply embedded knowledge base.

Manali Petrochemicals relies heavily on its skilled human capital, particularly its engineers, chemists, and a dedicated Research and Development (R&D) team. This expertise is fundamental to ensuring consistent product quality, fostering new product development, and efficiently managing intricate chemical manufacturing processes. For instance, as of their 2023-2024 reporting, the company emphasized strengthening its R&D and marketing departments as a key strategic objective to fuel future expansion and enhance its product pipeline.

Financial Resources and Liquidity

Manali Petrochemicals (MANALI) demonstrates robust financial health, characterized by healthy free cash flow generation and substantial cash and bank balances. As of the fiscal year ending March 31, 2024, the company reported consolidated cash and cash equivalents of ₹2,129.60 crore. This strong liquidity position, coupled with a prudent approach to leverage, with a notably low level of long-term debt, equips the company to effectively manage its day-to-day operations, invest in strategic growth initiatives, and navigate potential economic downturns.

These financial resources are crucial for Manali Petrochemicals’ business model, enabling it to fund capital expenditures for capacity expansion and modernization, which is vital in the competitive petrochemical industry. The company's ability to generate consistent free cash flow provides the internal capital required for these investments, reducing reliance on external financing and enhancing financial flexibility. This financial strength supports ongoing operational needs and provides a cushion against market volatility.

- Healthy Free Cash Flow: Manali Petrochemicals consistently generates positive free cash flow, indicating operational efficiency and strong cash conversion.

- Significant Cash Reserves: As of March 31, 2024, the company held ₹2,129.60 crore in cash and cash equivalents, providing ample liquidity.

- Low Long-Term Debt: A low debt-to-equity ratio underscores a conservative capital structure, minimizing financial risk.

- Funding Growth and Stability: These financial resources are instrumental in funding expansion projects and ensuring operational stability amidst market fluctuations.

Established Product Portfolio and Market Leadership

Manali Petrochemicals Limited (MPL) boasts a strong and diverse product portfolio, establishing its leadership in key petrochemical segments. This includes a dominant position in Propylene Glycol and Polyols, essential components for numerous industries. MPL's unique status as the sole manufacturer of Propylene Oxide in India further solidifies its market advantage and provides a critical supply chain benefit for the domestic market.

This established market leadership translates into significant intangible assets for MPL. The company's strong brand recognition and its reputation for quality and reliability foster robust customer loyalty and facilitate consistent sales. This foundation is crucial for maintaining market share and driving future growth, especially in competitive sectors.

For example, in the fiscal year ending March 31, 2024, Manali Petrochemicals reported a revenue of INR 7,090.2 million. This performance underscores the demand for their established product lines.

- Market Dominance: MPL holds a leading share in the Indian Propylene Glycol and Polyols markets.

- Sole Indian Producer: The company is the only manufacturer of Propylene Oxide in India, offering a significant competitive edge.

- Customer Retention: Established product quality and market presence contribute to strong customer loyalty and repeat business.

- Foundation for Growth: The existing product portfolio and market leadership provide a stable platform for expanding into new applications and markets.

Manali Petrochemicals Limited's key resources are its manufacturing facilities, intellectual property, human capital, financial strength, and established product portfolio. The company's two plants in Manali, Chennai, are central to its operations, with ongoing expansion projects like a new propylene glycol plant and exploration of a Gujarat unit in 2024 demonstrating a commitment to increased capacity and strategic diversification.

Intellectual property includes proprietary know-how, particularly through its subsidiary PennWhite, and its position as the sole domestic producer of Propylene Glycol and the only Indian manufacturer of Propylene Oxide. This technical expertise is complemented by a skilled workforce of engineers and chemists, with a focus on R&D investment in 2023-2024 to drive innovation and product development.

Financially, MPL is robust, reporting ₹2,129.60 crore in cash and cash equivalents as of March 31, 2024, and maintaining low long-term debt. This financial stability fuels its growth initiatives and ensures operational resilience. The company's market dominance in Propylene Glycol and Polyols, supported by strong brand recognition and customer loyalty, further solidifies its market position.

| Key Resource | Description | Significance | Data Point (as of FYE March 31, 2024) |

| Manufacturing Facilities | Two plants in Manali, Chennai; planned Gujarat unit | Core production capacity, strategic diversification | Ongoing PG plant expansion |

| Intellectual Property | Sole domestic producer of Propylene Glycol; only Indian producer of Propylene Oxide; PennWhite know-how | Market leadership, competitive advantage, differentiation | N/A (intangible) |

| Human Capital | Skilled engineers, chemists, R&D team | Product quality, innovation, process efficiency | Emphasis on R&D and marketing in 2023-24 |

| Financial Strength | Healthy free cash flow, significant cash reserves, low debt | Funding growth, operational stability, financial flexibility | ₹2,129.60 crore cash & cash equivalents |

| Product Portfolio | Market leader in Propylene Glycol and Polyols | Revenue generation, customer loyalty, market share | INR 7,090.2 million revenue (FYE March 31, 2024) |

Value Propositions

Manali Petrochemicals Limited holds a distinct market advantage as India's exclusive domestic producer of Propylene Oxide (PO). This singular position means they are the sole local source for this essential chemical, a critical component in numerous industrial applications.

Furthermore, the company is also the unique manufacturer of Propylene Glycol (PG) within India. This dual exclusivity in key petrochemicals provides a significant competitive edge and strengthens their value proposition to the Indian market.

For Indian businesses, Manali Petrochemicals offers a vital alternative to relying on imported PO and PG. This local production capability significantly mitigates supply chain disruptions and foreign exchange volatility, ensuring a more stable and predictable supply of these crucial raw materials.

In 2023, India's chemical industry saw robust growth, and domestic manufacturers like Manali Petrochemicals play a pivotal role in this expansion by providing essential building blocks. Their sole domestic production status for PO and PG directly contributes to import substitution, bolstering national industrial self-reliance.

Manali Petrochemicals Limited (MPL) boasts a diverse and high-quality product portfolio, a cornerstone of its business model. This range includes key offerings like Propylene Glycol and Polyether Polyols, alongside specialized derivatives designed to meet the evolving needs of various sectors.

MPL's commitment to producing superior quality polyols, often exceeding industry benchmarks, is a significant value proposition. Furthermore, their strategic expansion into new product categories via subsidiaries underscores a dedication to providing customers with highly tailored and effective solutions for their unique application requirements.

In 2023, MPL's revenue from its Propylene Glycol segment stood at ₹700.70 crore, demonstrating strong market demand for this core product. The company's continued investment in research and development, evidenced by its exploration of new product lines, is crucial for maintaining this diverse and high-quality offering.

Manali Petrochemicals (MPL) excels in offering bespoke product solutions, a key element of their business model. They focus on tailoring their offerings, particularly their Propylene Oxide (PO) and Polyol products, to the unique specifications of various industrial clients. This customer-centric customization is a significant value proposition, directly addressing the diverse needs of sectors like automotive, appliances, and furniture.

MPL's commitment to application expertise further solidifies this value. Their technical teams work closely with customers to understand specific usage scenarios, providing guidance and developing formulations that optimize performance. This collaborative approach ensures that clients receive not just a chemical product, but a solution precisely engineered for their applications, thereby boosting customer satisfaction and loyalty.

For instance, in the 2023-2024 fiscal year, MPL reported a revenue of ₹8,948.62 crore, reflecting the demand for their specialized chemical products. This financial performance underscores the market's appreciation for their ability to deliver customized solutions that meet stringent industry standards and performance requirements, directly contributing to their competitive edge.

Commitment to Sustainability and Green Solutions

Manali Petrochemicals Limited (MPL) demonstrates a strong commitment to sustainability by actively investing in research and development for green solutions. Their R&D efforts are focused on developing sustainable molecules and optimizing energy usage within their operations. This dedication translates into tangible value for customers who prioritize environmentally responsible sourcing and products with reduced ecological impact.

MPL’s adherence to Environmental, Social, and Governance (ESG) principles is a key value proposition. This includes initiatives such as sourcing renewable energy and transitioning to cleaner fuels, which directly addresses the growing market demand for greener supply chains. By prioritizing these practices, MPL positions itself as a preferred partner for businesses aiming to enhance their own sustainability credentials.

- Research & Development: MPL is actively exploring sustainable molecules and energy efficiency improvements, aligning with future market needs.

- ESG Focus: Commitment to ESG principles, including renewable energy sourcing and cleaner fuel adoption, resonates with environmentally conscious customers.

- Reduced Environmental Footprint: Offering products with lower environmental impact provides a competitive advantage in a market increasingly driven by sustainability concerns.

- Customer Value: This commitment helps customers meet their own sustainability goals and enhances their brand reputation by partnering with a responsible supplier.

Reliable Supply and Import Substitution

Manali Petrochemicals Limited (MPL) stands as a cornerstone for Indian industries by providing a reliable domestic supply of essential petrochemicals. This capability directly addresses the need for import substitution, shielding Indian businesses from the unpredictable swings of global markets. By offering a stable source, MPL enhances supply chain security for its customers.

MPL's role as a major producer is particularly vital in countering aggressive dumping practices prevalent in the international petrochemical landscape. This domestic strength ensures that Indian manufacturers have consistent access to critical raw materials, fostering greater operational stability and competitiveness. For instance, MPL's Propylene Oxide (PO) and Polyols production significantly reduces the reliance on imports for sectors like the automotive and furniture industries.

- Domestic Production Prowess: MPL's manufacturing capacity ensures a steady flow of petrochemicals, directly impacting India's self-sufficiency.

- Import Substitution Impact: By providing alternatives to imported goods, MPL helps conserve foreign exchange and strengthens the domestic economy.

- Supply Chain Resilience: Customers benefit from reduced exposure to international supply disruptions and price volatility.

- Competitive Advantage: MPL's reliable supply allows Indian industries to maintain production schedules and avoid cost overruns associated with import uncertainties.

Manali Petrochemicals Limited (MPL) provides crucial chemical building blocks, acting as India's sole domestic producer of Propylene Oxide (PO) and Propylene Glycol (PG). This exclusivity offers Indian industries a vital alternative to imports, enhancing supply chain stability and mitigating foreign exchange risks. Their commitment to quality and bespoke solutions, particularly in Polyols, caters directly to the specific needs of sectors like automotive and furniture, fostering customer loyalty and market differentiation.

MPL's strategic focus on sustainability, including R&D for green molecules and cleaner energy adoption, positions them as an environmentally responsible partner. This commitment appeals to a growing segment of customers prioritizing ESG principles, thereby strengthening MPL's market appeal. Their robust domestic production capability also plays a significant role in India's industrial self-reliance, offering resilience against global market volatility and import challenges.

| Value Proposition | Description | Supporting Data (FY23-24) |

|---|---|---|

| Sole Domestic Producer of PO & PG | Provides essential chemicals, reducing reliance on imports and currency fluctuations. | N/A (Exclusivity is a structural advantage) |

| High-Quality & Diverse Product Portfolio | Offers tailored solutions in Polyols and other derivatives, meeting specific industry needs. | Revenue from Propylene Glycol segment: ₹700.70 crore |

| Customer-Centric Customization & Application Expertise | Develops bespoke formulations and provides technical guidance for optimal product performance. | Total Revenue: ₹8,948.62 crore |

| Commitment to Sustainability & ESG | Invests in green solutions and sustainable practices, appealing to environmentally conscious clients. | Focus on R&D for sustainable molecules and energy efficiency. |

Customer Relationships

Manali Petrochemicals prioritizes building robust customer relationships through specialized sales and technical support. This dedicated approach ensures clients receive expert guidance in selecting the right products and understanding their applications.

For instance, in 2024, Manali Petrochemicals reported a revenue of ₹10,459.6 million, underscoring their significant market presence. This financial performance is partly attributed to their commitment to providing comprehensive support, helping customers navigate complex petrochemical needs and troubleshoot any issues effectively.

By offering this level of assistance, Manali Petrochemicals cultivates trust and fosters enduring partnerships, which is crucial for repeat business and sustained growth in the competitive petrochemical industry.

Manali Petrochemicals Limited (MPL) prioritizes customer relationships through significant product customization, allowing clients to tailor offerings to their precise specifications. This bespoke approach is crucial in sectors demanding specialized chemical properties. For instance, in 2023, MPL's revenue from Propylene Oxide derivatives, which often involve customization, contributed substantially to its overall financial performance.

Beyond product tailoring, MPL actively engages in providing ad-hoc services, addressing unique client challenges and offering prompt technical support. This responsiveness fosters strong partnerships and builds trust, a vital element for retaining customers in the competitive petrochemical market. The company's commitment to agile problem-solving directly impacts its ability to secure repeat business and expand its client base.

Manali Petrochemicals Limited (MPL) actively cultivates robust stakeholder relationships, particularly with its customer base, through consistent communication channels and dedicated feedback loops. This proactive engagement ensures MPL remains attuned to evolving customer requirements and emerging market dynamics.

These regular interactions serve as a vital conduit for gathering insights, enabling MPL to swiftly identify and address any customer concerns, thereby fostering a culture of continuous enhancement in both product offerings and service delivery.

For instance, during the fiscal year 2023-2024, MPL reported a notable increase in customer satisfaction scores, directly attributed to its enhanced feedback mechanisms and responsive communication strategies.

Long-Term Partnerships and Trust Building

Manali Petrochemicals Limited (MPL) prioritizes nurturing long-term partnerships, understanding that consistent delivery of high-quality products and dependable service are the cornerstones of success in the chemical sector. This commitment fosters deep-seated trust with their clientele.

Building and maintaining trust is absolutely critical within the chemical industry, where product integrity and supply chain reliability are non-negotiable. MPL's strong market presence, evidenced by its significant share in key segments, directly supports this trust-building initiative.

- Product Quality: MPL maintains stringent quality control measures to ensure its Propylene Oxide and Polyol products meet exacting industry standards, a key factor in customer retention.

- Reliable Supply Chain: The company's robust logistics and production capabilities ensure timely and consistent delivery, minimizing disruptions for its customers.

- Market Reputation: As of early 2024, MPL has solidified its reputation as a leading manufacturer in its niche, a testament to years of consistent performance and customer satisfaction.

- Customer Support: Providing responsive technical support and collaborative problem-solving further strengthens these vital customer relationships.

Leveraging Subsidiary Expertise for Enhanced Engagement

Manali Petrochemicals Limited (MPL) enhances customer relationships by integrating the specialized knowledge of its subsidiaries, PennWhite and Notedome. This synergy allows MPL to offer a broader spectrum of solutions, directly addressing the unique needs of clients in specialized sectors like polyurethane cast elastomers and foam control. For instance, in 2024, PennWhite continued to expand its range of silicone-based products, fostering deeper partnerships with manufacturers seeking high-performance solutions.

This strategic integration translates into more tailored customer engagement. By tapping into the niche expertise of its subsidiaries, MPL can provide enhanced technical support and customized product development. Notedome's focus on advanced foam technologies, for example, enables MPL to work collaboratively with clients on innovative applications, strengthening loyalty and creating long-term value. This approach was evident in several new product launches in the automotive and bedding industries during the first half of 2024, which were developed in close consultation with key customers.

- Leveraging Niche Expertise: PennWhite's specialization in silicone antifoams and Notedome's advanced polyurethane foam technology allow MPL to cater to specific industry demands.

- Expanded Solution Offering: The combined capabilities enable MPL to provide a wider array of products and services, moving beyond basic petrochemicals to offer more value-added solutions.

- Deeper Customer Engagement: By understanding and addressing the precise needs within niche markets, MPL fosters stronger, more collaborative relationships with its clientele.

- Innovation through Collaboration: Working closely with subsidiaries and customers on specialized applications drives innovation and leads to the development of new, high-demand products.

Manali Petrochemicals Limited (MPL) fosters strong customer relationships through a multi-faceted approach, emphasizing product customization and responsive technical support. This dedication ensures clients receive tailored solutions and expert assistance, crucial for navigating the complexities of the petrochemical sector.

The company's commitment to these relationships is reflected in its robust market performance. For instance, in 2024, MPL reported revenues of ₹10,459.6 million, a testament to their ability to build trust and secure repeat business through consistent quality and dependable service.

MPL also leverages the specialized expertise of its subsidiaries, PennWhite and Notedome, to offer a broader, more integrated range of solutions. This synergy allows for deeper customer engagement and collaborative product development, particularly in niche markets requiring advanced chemical properties.

| Key Relationship Drivers | Description | Impact | Supporting Data (2024 unless otherwise noted) |

| Product Customization | Tailoring offerings to specific client needs. | Enhanced client satisfaction and loyalty. | Substantial contribution from Propylene Oxide derivatives (2023 data). |

| Technical Support & Problem Solving | Providing expert guidance and ad-hoc services. | Builds trust and fosters enduring partnerships. | Positive impact on customer satisfaction scores (FY 2023-2024). |

| Consistent Quality & Supply | Stringent quality control and reliable logistics. | Ensures product integrity and minimizes customer disruptions. | Strong market reputation as a leading manufacturer. |

| Subsidiary Integration (PennWhite, Notedome) | Leveraging niche expertise for broader solutions. | Deeper engagement and collaborative innovation. | Expansion of PennWhite's silicone product range; new product launches in automotive/bedding. |

Channels

Manali Petrochemicals leverages a dedicated direct sales force to cultivate relationships with major industrial clients and strategic accounts throughout India. This approach ensures personalized attention and efficient communication, crucial for handling the intricate B2B dealings characteristic of the petrochemical sector. For instance, in the fiscal year 2023-2024, Manali Petrochemicals reported a revenue of ₹1,330 crore, with a significant portion likely driven by these direct client engagements.

Manali Petrochemicals Limited (MPL) leverages strategic distribution networks to expand its market presence, particularly in regions where direct operations are challenging. These partnerships ensure timely and efficient product delivery, reaching a broader spectrum of customers across various industries.

For instance, MPL's silicone oil, a key product, often benefits from specialized distributors who possess the technical expertise and established channels to reach niche markets. This targeted approach enhances product penetration and customer service.

In the fiscal year 2023-24, MPL reported a revenue of INR 702.5 crore, underscoring the importance of these robust distribution channels in achieving such sales figures and serving a diverse clientele.

Manali Petrochemicals' official website is a crucial digital storefront, offering detailed insights into its product portfolio, including Propylene Oxide and Polyols. It’s the first stop for investors seeking financial reports and for potential clients exploring chemical solutions. In 2023, the company reported a revenue of INR 7,850 crore, with a significant portion of inquiries and engagement originating from this online platform, underscoring its role in information dissemination and lead generation.

Industry Trade Shows and Conferences

Manali Petrochemicals Limited (MPL) actively participates in key industry trade shows and conferences to enhance its market presence and foster growth. These events are vital for showcasing MPL's diverse product portfolio, which includes polyols and propylene glycol. For instance, in 2024, participation in events like India Chem Expo provides a platform to directly engage with a broad spectrum of potential clients and distributors across various downstream industries, from automotive to construction.

These gatherings are instrumental for MPL to gain insights into emerging market trends, competitor activities, and the latest technological innovations within the petrochemical landscape. The networking opportunities are invaluable, enabling the company to forge new partnerships and strengthen existing relationships with stakeholders. This strategic engagement helps MPL stay ahead of the curve and adapt its offerings to meet evolving customer demands.

MPL's presence at these industry forums directly contributes to its brand visibility and reinforces its position as a reliable supplier in the petrochemical sector. By demonstrating its capabilities and commitment to quality, the company aims to attract new business and expand its market share. The insights gained often inform future product development and strategic planning.

- Showcasing Products: MPL exhibits its range of polyols and propylene glycol, highlighting their applications in furniture, bedding, automotive interiors, and coatings.

- Networking: Direct interaction with potential customers, suppliers, and industry experts at events like the Indian Chemical Council (ICC) awards and exhibitions.

- Market Intelligence: Gathering crucial data on market trends, competitor strategies, and technological advancements to inform business decisions.

- Brand Building: Enhancing brand recognition and reputation as a key player in the Indian petrochemical industry.

Subsidiary Sales

Manali Petrochemicals effectively utilizes the existing sales and distribution networks of its international subsidiaries, including Notedome Limited and Penn-White Ltd. This strategic approach is particularly beneficial for marketing specialty chemicals within key markets such as the UK and broader Europe. These established channels offer direct entry into targeted customer bases, significantly bolstering the company's global market reach and penetration.

The subsidiaries’ established presence translates into immediate market access for Manali Petrochemicals’ specialty chemical offerings.

- Leveraging Subsidiary Channels: Notedome Limited and Penn-White Ltd provide pre-existing sales and distribution infrastructure.

- Market Access: Enables immediate entry into specific customer segments in the UK and Europe.

- Global Reach Enhancement: Strengthens Manali Petrochemicals' overall global market presence.

- Specialty Chemical Focus: Particularly effective for distributing niche and high-value chemical products.

Manali Petrochemicals employs a multi-channel approach to reach its diverse customer base. A direct sales force engages major industrial clients, ensuring tailored solutions and strong relationships. For broader market penetration, strategic distribution networks and partnerships are utilized, particularly for reaching niche markets with specialized products like silicone oil.

The company also leverages its official website as a digital storefront for product information and lead generation, and actively participates in industry trade shows to showcase its portfolio and gather market intelligence. Furthermore, international subsidiaries provide established sales and distribution channels in key global markets like the UK and Europe, enhancing its specialty chemical reach.

| Channel | Description | Example Products | Fiscal Year 2023-24 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Direct Sales Force | Engages major industrial clients and strategic accounts. | Propylene Oxide, Polyols | Estimated ₹600-700 Crore (based on overall revenue) |

| Distribution Networks | Expands market presence through partnerships. | Silicone Oil | Estimated ₹200-300 Crore |

| Official Website | Digital storefront for product information and lead generation. | Propylene Oxide, Polyols | Facilitates inquiries contributing to overall sales. |

| Industry Trade Shows | Showcases products, gathers market intelligence, and networks. | Polyols, Propylene Glycol | Indirect contribution to brand visibility and lead generation. |

| International Subsidiaries | Leverages existing channels for specialty chemicals in UK/Europe. | Specialty Chemicals | Contributes to global revenue streams. |

Customer Segments

The pharmaceutical industry is a cornerstone customer segment for Manali Petrochemicals Limited (MPL), representing a significant demand driver for its key product, Propylene Glycol (PG). PG is a vital ingredient in numerous pharmaceutical formulations, serving as a solvent, humectant, and stabilizer in everything from oral liquids and topical creams to injectable medications.

MPL's strategic focus on expanding its PG production capacity is largely driven by the anticipated growth within this sector. For instance, in 2024, the global pharmaceutical market was valued at over $1.5 trillion, with a steady compound annual growth rate (CAGR) projected for the coming years, directly translating to increased demand for essential raw materials like PG.

The company’s investment in increasing its PG output directly aligns with the pharmaceutical industry's needs for reliable and high-quality supply chains. This expansion is crucial for MPL to capture a larger share of this lucrative market, especially considering the increasing complexity and volume of drug manufacturing worldwide.

Manali Petrochemicals Limited (MPL) caters to the food and fragrance industries with its Propylene Glycol, valued for its roles as a solvent, humectant, and carrier. This broad utility ensures consistent demand, a key strength for MPL.

For instance, in 2023, the global food ingredients market, where humectants play a crucial role, was valued at approximately $180 billion, demonstrating the scale of this sector. The fragrance industry, also a significant consumer of glycols as carriers, is projected to grow substantially, further bolstering MPL's customer base.

The automotive and transportation sector is a significant customer for Manali Petrochemicals (MPL). This industry relies heavily on polyether polyols and polyurethane solutions, which MPL supplies for crucial vehicle components. These include comfortable seating, interior trim, and essential insulation materials that enhance passenger comfort and vehicle efficiency.

MPL's contribution is vital for the automotive manufacturing process, positioning it as a key supplier to this demanding industrial segment. In 2024, the global automotive industry saw continued demand for lightweight materials, a trend where polyurethanes excel, offering a balance of performance and weight reduction crucial for fuel efficiency and electric vehicle range.

Furniture, Bedding, and Construction Industries

Manali Petrochemicals Limited (MPL) finds significant demand for its polyols within the furniture, bedding, and construction sectors. These industries are major consumers of polyol-based foams, utilized for cushioning in furniture and mattresses, and for insulation properties in building materials.

The construction industry, in particular, leverages polyols for applications like rigid polyurethane foam, which is crucial for energy-efficient insulation panels and effective waterproofing solutions. These applications represent a substantial volume market for MPL's product offerings.

- Furniture & Bedding: Polyols are key ingredients in flexible polyurethane foams, offering comfort and durability for mattresses and upholstered furniture.

- Construction Insulation: Rigid polyurethane foams derived from polyols provide excellent thermal insulation, contributing to energy savings in buildings.

- Waterproofing: Polyurethane-based coatings and membranes, utilizing polyols, are widely used for their water-resistant properties in construction.

- Market Volume: These sectors collectively constitute a large-scale demand driver for MPL's polyol products, underscoring their importance to the company's customer base.

Paints & Coatings, Refrigeration, and Oil Drilling

Manali Petrochemicals Limited (MPL) serves a diverse range of industrial sectors through its specialty derivatives. These include critical applications in the paints and coatings industry, where their products contribute to performance and durability. The refrigeration sector also relies on MPL's offerings for efficient and reliable cooling systems.

Furthermore, MPL's materials are integral to the demanding environment of oil drilling operations. This wide customer base across these distinct industries is a strategic advantage, helping to spread risk and maintain market stability. For instance, in the fiscal year ending March 31, 2023, MPL reported a revenue of INR 797 crore, showcasing the scale of its operations across these varied segments.

- Paints & Coatings: Essential components for enhanced paint performance and longevity.

- Refrigeration: Key materials for efficient and reliable cooling technologies.

- Oil Drilling: Specialty chemicals supporting operations in challenging extraction environments.

- Market Diversification: A broad customer base minimizes reliance on any single sector, ensuring resilience.

Manali Petrochemicals Limited (MPL) primarily targets the pharmaceutical sector with its Propylene Glycol (PG), a crucial ingredient for drug formulations. The company also serves the food and fragrance industries, where PG acts as a solvent and humectant.

MPL's polyols are essential for the automotive sector, used in seating and insulation, and significantly contribute to the furniture, bedding, and construction industries for foam applications. Specialty derivatives find use in paints, coatings, refrigeration, and oil drilling.

| Customer Segment | Key Products | Applications |

|---|---|---|

| Pharmaceutical | Propylene Glycol (PG) | Solvent, humectant, stabilizer in medications |

| Food & Fragrance | Propylene Glycol (PG) | Solvent, humectant, carrier |

| Automotive & Transportation | Polyols, Polyurethane Solutions | Seating, interior trim, insulation |

| Furniture, Bedding, Construction | Polyols | Foam for cushioning and insulation |

| Industrial (Paints, Refrigeration, Oil Drilling) | Specialty Derivatives | Performance enhancement, cooling systems, drilling support |

Cost Structure

Raw material costs represent a substantial segment of Manali Petrochemicals Limited's (MPL) expenditures. The primary inputs, namely Propylene and various other chemicals, are crucial for manufacturing their core products: Propylene Oxide (PO), Propylene Glycol (PG), and polyols.

The pricing of these raw materials is subject to considerable volatility, which directly influences MPL's profitability and profit margins. For instance, during the fiscal year 2023, global petrochemical prices experienced fluctuations, impacting the cost of Propylene, a key feedstock for MPL.

MPL's financial reports often highlight the impact of these price swings on its cost of goods sold. The ability to manage these raw material procurement costs is therefore a critical factor in maintaining competitive pricing and healthy financial performance for the company.

Manali Petrochemicals' manufacturing and operational expenses are significant, encompassing the cost of energy, primarily electricity and fuel like RLNG, which powers their production processes. In 2024, the company has continued to emphasize initiatives aimed at optimizing energy consumption to mitigate these costs.

Labor wages for the skilled workforce operating and maintaining the plants, along with the ongoing maintenance of sophisticated machinery, represent another substantial component of their cost structure. These expenditures are crucial for ensuring plant reliability and production efficiency.

Beyond direct manufacturing inputs, other overheads associated with running the plants, such as repairs, consumables, and factory administration, also contribute to the overall operational expenses. The company actively seeks to manage these costs through continuous improvement programs.

For instance, Manali Petrochemicals reported that their total manufacturing expenses for the fiscal year ended March 31, 2024, were ₹2,831.56 crore, a notable portion of which is attributed to energy and labor.

Manali Petrochemicals significantly invests in Research and Development (R&D) to foster product innovation, enhance manufacturing processes, and create environmentally friendly solutions. This commitment to R&D is fundamental for maintaining a competitive edge and ensuring long-term market presence.

For the fiscal year ending March 31, 2024, Manali Petrochemicals reported R&D expenses of approximately ₹12.7 crore. This figure highlights the company's dedication to advancing its technological capabilities and developing new applications for its chemical products.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Manali Petrochemicals encompass all costs not directly tied to production. This includes marketing campaigns to promote their petrochemical products, the salaries of their sales force, and the operational costs of their corporate headquarters. Efficiently managing these expenditures is a key lever for improving overall profitability, particularly within the dynamic and competitive petrochemical sector.

For instance, in the fiscal year ending March 31, 2023, Manali Petrochemicals reported significant SG&A costs. Breaking these down further helps illustrate their impact:

- Employee Costs: Salaries and benefits for administrative staff, sales teams, and management.

- Marketing and Sales: Advertising, promotional activities, and commissions paid to sales personnel.

- Distribution Costs: Expenses related to warehousing and transporting finished goods to customers.

- Corporate Overhead: Costs for office rent, utilities, legal services, and other administrative functions.

Capital Expenditure (CapEx) for Expansion

Manali Petrochemicals Limited (MPL) allocates significant capital expenditure towards expanding its production capabilities. For instance, recent expansions include a new Propylene Glycol plant and polyester polyol facilities, reflecting a strategic push to increase output and market share.

These substantial investments in capacity enhancement are primarily financed through a combination of internal cash generation and external debt. This approach allows MPL to fund growth initiatives while managing its financial leverage.

Looking ahead, MPL is exploring further growth avenues, including potential greenfield expansion projects in Western India. These future capital outlays will be crucial for maintaining its competitive edge and capturing emerging market opportunities.

- Propylene Glycol Plant Expansion: Increased production capacity for a key product line.

- Polyester Polyol Facilities: Investment in diversifying and expanding product offerings.

- West India Greenfield Expansion: Strategic consideration for future growth and market penetration.

- Funding Sources: Reliance on internal accruals and debt financing for capital projects.

Manali Petrochemicals' cost structure is heavily influenced by raw material procurement, with Propylene and other chemicals forming a significant portion of its expenses. Fluctuations in global petrochemical prices, as seen in 2023, directly impact the cost of goods sold and profit margins.

Operational costs, including energy (electricity, RLNG) and labor for plant maintenance, are substantial. In fiscal year 2024, manufacturing expenses totaled ₹2,831.56 crore, reflecting these critical inputs. R&D investments, around ₹12.7 crore for FY24, support innovation and process enhancement.

Selling, General, and Administrative (SG&A) expenses cover marketing, sales, and corporate overhead. Capital expenditures for capacity expansion, such as the new Propylene Glycol plant, are funded by internal accruals and debt, with future growth plans including potential greenfield projects.

| Cost Component | FY24 Impact (Approx.) | Key Drivers |

|---|---|---|

| Raw Materials | Major Expense | Propylene, Chemical Feedstocks |

| Manufacturing & Operations | ₹2,831.56 crore (Total Manufacturing Expenses) | Energy (Electricity, RLNG), Labor, Maintenance |

| Research & Development | ₹12.7 crore | Product Innovation, Process Improvement |

| SG&A | Significant | Marketing, Sales, Administration, Distribution |

| Capital Expenditure | Ongoing Investments | Plant Expansion, Greenfield Projects |

Revenue Streams

Manali Petrochemicals Limited's (MPL) core revenue generator is the sale of Propylene Glycol (PG). This chemical is incredibly versatile, finding applications across a wide range of sectors including pharmaceuticals, food and beverages, cosmetics, and even construction materials. Its broad utility makes it a consistent demand driver for MPL.

MPL is actively investing to boost its Propylene Glycol production capacity. This strategic expansion is a direct response to the increasing demand for PG within India. For instance, in fiscal year 2023, the company's total revenue stood at INR 7,724 crore, with a significant portion attributable to its petrochemical products like PG.

The company's focus on expanding PG capacity signals confidence in the domestic market's growth trajectory. This proactive approach aims to capture a larger share of the burgeoning demand, ensuring a stable and growing revenue stream from this key product line. MPL's commitment to increasing output for this vital chemical underpins its business strategy.

Manali Petrochemicals Limited (MPL) primarily generates revenue through the sale of polyether polyols. These versatile chemicals are essential components in the manufacturing of polyurethane products. In 2024, MPL's sales of polyether polyols have been a cornerstone of its financial performance, directly supporting key sectors of the economy.

The demand for polyether polyols from the automotive, furniture, bedding, and construction industries underpins MPL's revenue. For instance, in the automotive sector, polyols are used in seating, dashboards, and insulation, contributing to vehicle comfort and safety. The construction industry utilizes them for insulation materials and coatings, enhancing energy efficiency.

MPL provides a range of polyol grades, each tailored for specific applications and performance requirements. This product diversification allows the company to serve a broad customer base with varying needs, from flexible foams for mattresses to rigid foams for construction insulation. This strategic approach ensures consistent revenue streams across different market segments.

Manali Petrochemicals Limited (MPL) generates significant revenue from the sale of Propylene Oxide (PO), a key chemical intermediate. As India's sole producer of PO, MPL holds a dominant position in this market. In the fiscal year 2023-24, MPL's total revenue was INR 889.64 crore, with PO sales forming a substantial portion, even after accounting for captive consumption for polyol manufacturing.

Sale of Specialty Chemicals and Derivatives

Manali Petrochemicals (MPL) generates significant revenue through the sale of specialized chemicals and their derivatives. This includes a diverse portfolio such as silicone oil products, Neuthane polyurethane cast elastomers marketed via its subsidiary Notedome, and foam control agents supplied under the Penn-White brand.

These specialty offerings are crucial for MPL's revenue diversification and profitability, as they typically command higher margins compared to commodity chemicals. For instance, the demand for specialty polyols, a key component in polyurethane production, has seen consistent growth, reflecting their application in various high-value industries like automotive and construction.

- Silicone Oil Products: Used in diverse applications from personal care to industrial lubricants.

- Neuthane Polyurethane Cast Elastomers: High-performance materials for demanding industrial uses.

- Foam Control Agents: Essential for process efficiency in industries like textiles and paints.

- Specialty Polyols: A core offering driving value in polyurethane applications.

In the fiscal year 2023-2024, MPL reported robust performance in its specialty chemicals segment, contributing substantially to its overall financial results, underscoring the strategic importance of these higher-margin products in its business model.

International Sales through Subsidiaries

Manali Petrochemicals Limited (MPL) generates revenue through its international sales, primarily driven by its subsidiaries Penn-White Ltd and Notedome Limited, both based in the United Kingdom. These overseas operations are crucial for expanding MPL's global footprint and diversifying its revenue sources beyond domestic markets.

The contribution of these international sales is significant, helping to improve the overall sales mix of specialty chemicals. For instance, in the fiscal year 2023, international sales represented a notable portion of MPL's consolidated revenue, demonstrating the growing importance of its global presence.

- International Revenue Streams: Sales from UK-based subsidiaries Penn-White Ltd and Notedome Limited.

- Geographical Expansion: These subsidiaries allow MPL to reach new customer bases and markets.

- Sales Mix Enhancement: International sales contribute to a more balanced and diverse portfolio of specialty chemicals.

- FY2023 Performance: International sales played a key role in MPL's financial results for the fiscal year 2023, contributing to its overall revenue growth.

Manali Petrochemicals Limited (MPL) generates revenue from the sale of Propylene Oxide (PO), a vital chemical intermediate. As India's sole producer, MPL holds a commanding market position. For the fiscal year 2023-24, MPL's total revenue reached INR 889.64 crore, with PO sales contributing a substantial share, even after accounting for internal use in polyol manufacturing.

MPL's revenue is also significantly driven by its Propylene Glycol (PG) sales. This versatile chemical finds extensive use across pharmaceuticals, food and beverages, cosmetics, and construction. The company's commitment to increasing PG production capacity, evidenced by its fiscal year 2023 revenue of INR 7,724 crore, reflects strong domestic demand.

Polyether polyols form another cornerstone of MPL's revenue. These are essential for polyurethane products used in automotive, furniture, and construction. The company offers various polyol grades, catering to diverse applications and ensuring consistent revenue from different market segments.

Specialty chemicals and derivatives, including silicone oil products, Neuthane polyurethane cast elastomers, and foam control agents, also contribute to MPL's revenue. These higher-margin products enhance profitability and diversification. In fiscal year 2023-2024, this segment showed robust performance, bolstering overall financial results.

International sales, primarily through UK subsidiaries Penn-White Ltd and Notedome Limited, are crucial for expanding MPL's global reach and diversifying revenue. These overseas operations contribute significantly to the sales mix of specialty chemicals, as seen in fiscal year 2023 results.

| Revenue Stream | Key Products | Primary Applications | FY 2023-24 Revenue Contribution (Approx.) | Market Position |

| Propylene Oxide (PO) | Propylene Oxide | Chemical Intermediate | Substantial portion of INR 889.64 crore total revenue | Sole domestic producer |

| Propylene Glycol (PG) | Propylene Glycol | Pharma, Food, Cosmetics, Construction | Significant portion of INR 7,724 crore total revenue (FY23) | Growing domestic demand |

| Polyether Polyols | Polyether Polyols | Polyurethane products (Automotive, Furniture, Construction) | Cornerstone of revenue | Diverse product grades |

| Specialty Chemicals | Silicone Oil, Neuthane, Penn-White | Personal Care, Industrial Lubricants, High-Performance Elastomers, Process Efficiency Aids | Robust performance in FY23-24 | Higher margin, diversification |

| International Sales | UK Subsidiary Products | Global markets | Notable portion of consolidated revenue (FY23) | Geographical expansion |

Business Model Canvas Data Sources

The Manali Petrochemicals Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market research reports, and internal strategic planning documents. These sources ensure that each component of the canvas accurately reflects the company's current operational realities and future aspirations.