Manali Petrochemicals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manali Petrochemicals Bundle

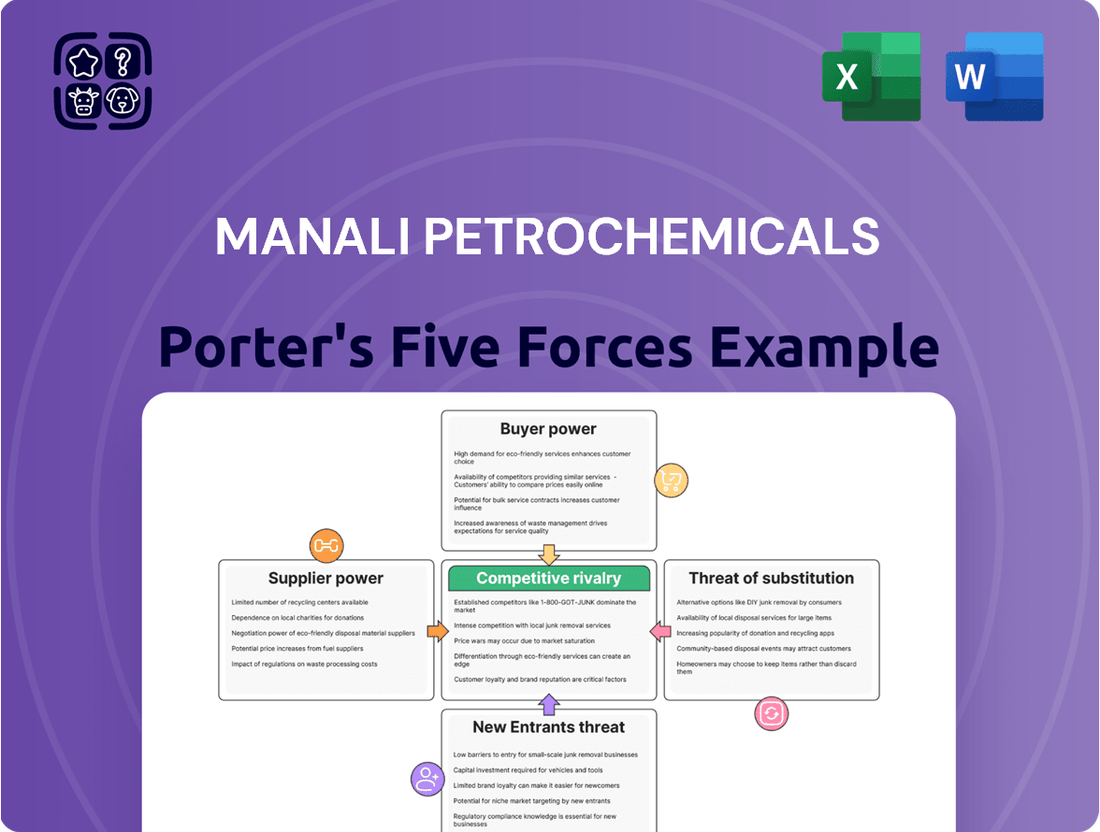

Manali Petrochemicals operates in a dynamic petrochemical landscape, where intense rivalry among existing players significantly shapes its market. Understanding the bargaining power of both suppliers and buyers is crucial, as these forces can directly impact pricing and profitability. Furthermore, the threat of substitute products looms large, demanding continuous innovation and cost-efficiency.

The full analysis reveals the strength and intensity of each market force affecting Manali Petrochemicals, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Manali Petrochemicals' reliance on key raw materials like propylene oxide directly impacts its bargaining power. Propylene oxide is essential for producing its core products, propylene glycol and polyether polyols.

The availability and pricing of these feedstocks are closely tied to global crude oil markets. This linkage means that fluctuations in crude oil prices can significantly alter Manali Petrochemicals' cost structure and procurement budgets.

For instance, if crude oil prices surge, the cost of propylene oxide increases, directly impacting Manali Petrochemicals' production expenses. In the first half of 2024, crude oil prices experienced volatility, with Brent crude averaging around $83 per barrel, presenting ongoing cost pressures for petrochemical producers reliant on oil derivatives.

This dependency on a few critical, oil-linked raw materials can give suppliers considerable leverage, especially when global supply chains face disruptions or when demand for these feedstocks is high.

If Manali Petrochemicals relies on a limited number of suppliers for crucial raw materials, those suppliers gain significant leverage. This concentration can force Manali Petrochemicals to accept higher prices or less favorable contract terms, impacting profitability. For instance, in 2024, the global petrochemical industry experienced supply chain disruptions, particularly for key feedstocks, which amplified supplier power in many regions.

Conversely, having a broad and competitive supplier base mitigates this risk. A diverse supplier network allows Manali Petrochemicals to switch providers if terms become unfavorable, fostering a more balanced negotiation dynamic. The Indian chemical sector, however, has noted an ongoing challenge of overdependence on established feedstocks and production methods, which can inadvertently strengthen the position of existing suppliers.

Switching costs significantly influence the bargaining power of suppliers for Manali Petrochemicals. The financial and operational hurdles involved in changing suppliers, such as re-tooling manufacturing equipment or obtaining new certifications for materials, can be substantial. For instance, if Manali Petrochemicals needs specialized chemicals and the process to qualify a new supplier involves extensive testing and regulatory approval, the existing supplier gains leverage.

High switching costs directly limit Manali Petrochemicals' ability to negotiate better terms or explore alternative sourcing options. This can include the cost of retraining staff, integrating new systems, or potential disruptions to production schedules. In 2023, the chemical industry, which Manali Petrochemicals operates within, saw global supply chain disruptions impacting lead times and raw material availability, underscoring the importance of supplier relationships and the costs associated with changing them.

Uniqueness of Inputs

Suppliers providing unique or proprietary inputs to Manali Petrochemicals hold considerable bargaining power. If Manali Petrochemicals relies on specific chemicals or technologies that are not readily available from multiple sources, these suppliers can dictate terms, potentially impacting Manali Petrochemicals' profitability and operational flexibility. For instance, a supplier of a specialized catalyst crucial for the petrochemical production process, with no close substitutes, would have a strong hand in negotiations regarding price and delivery schedules.

Manali Petrochemicals can counter this supplier power by actively exploring and developing alternative feedstock sources. Investing in research and development for bio-based or recycled feedstocks, for example, would reduce its dependence on traditional, potentially concentrated supplier bases. By diversifying its input streams, Manali Petrochemicals can create a more competitive supplier landscape, thereby lessening the leverage of any single supplier.

- Reduced Dependence: Diversifying feedstock reduces reliance on single, powerful suppliers.

- Cost Mitigation: Alternative sources can offer more competitive pricing.

- Innovation Drive: Pursuing bio-based or recycled materials fosters R&D and sustainability.

- Supplier Competition: A wider supplier base naturally intensifies competition, benefiting Manali Petrochemicals.

Threat of Forward Integration

If suppliers of raw materials to Manali Petrochemicals could integrate forward into the production of petrochemicals themselves, they would gain significant leverage and potentially become direct competitors. This threat, however, is generally considered low for basic chemical suppliers.

The sheer capital investment required to establish and operate a petrochemical manufacturing facility presents a substantial barrier to entry. For instance, building a new ethylene cracker, a foundational petrochemical unit, can cost billions of dollars, making it economically unfeasible for most raw material suppliers to undertake such a venture.

This high capital intensity effectively limits the likelihood of suppliers integrating forward. They typically focus on their core competencies, which are usually in upstream resource extraction or basic chemical production, rather than venturing into the complex and capital-intensive downstream petrochemical processes.

Therefore, while the theoretical possibility of forward integration exists, its practical application as a significant threat to Manali Petrochemicals is minimal due to the economics of the industry.

Manali Petrochemicals faces moderate bargaining power from its suppliers, primarily due to its reliance on a few key petrochemical feedstocks like propylene oxide. The global volatility in crude oil prices, which directly influences feedstock costs, means suppliers can exert pressure on pricing. In the first half of 2024, Brent crude averaged around $83 per barrel, highlighting these ongoing cost pressures for producers like Manali Petrochemicals.

The limited number of suppliers for certain specialized chemicals and the high switching costs involved in changing providers further bolster supplier leverage. For example, qualifying new chemical suppliers can involve extensive testing and regulatory approvals, making it difficult for Manali Petrochemicals to negotiate better terms or switch easily. The Indian chemical sector's ongoing overdependence on established feedstocks also strengthens the position of existing suppliers.

Suppliers of unique or proprietary inputs, such as specialized catalysts with no close substitutes, hold considerable power. This can impact Manali Petrochemicals' profitability and operational flexibility by allowing suppliers to dictate terms. However, the threat of suppliers integrating forward into petrochemical production is generally low due to the substantial capital investment required, making them unlikely direct competitors.

| Factor | Impact on Manali Petrochemicals | 2024 Data/Context |

|---|---|---|

| Feedstock Dependence (Propylene Oxide) | Moderate to High Supplier Power | Linked to crude oil prices; Brent crude averaged ~$83/barrel H1 2024. |

| Supplier Concentration | Moderate to High Supplier Power | Limited suppliers for specialized chemicals; supply chain disruptions in 2024 amplified this. |

| Switching Costs | Moderate to High Supplier Power | High costs for re-tooling, certifications, and potential production disruptions. |

| Proprietary Inputs | High Supplier Power | Suppliers of unique catalysts or specialized chemicals have strong negotiation leverage. |

| Threat of Forward Integration | Low Supplier Power | High capital costs for petrochemical manufacturing create significant barriers. |

What is included in the product

This analysis delves into the competitive forces impacting Manali Petrochemicals, examining supplier and buyer power, new entrant threats, substitute product risks, and the intensity of rivalry within the petrochemical industry.

Manali Petrochemicals Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making and identifying areas of competitive pressure.

This analysis allows for customized pressure level adjustments based on new data or evolving market trends, offering a dynamic view of the competitive landscape.

Customers Bargaining Power

Manali Petrochemicals Limited (MPL) caters to a broad range of sectors, including pharmaceuticals, food and fragrance, automotive, furniture, and construction. This diversification generally helps mitigate the bargaining power of individual customers.

However, if a significant portion of MPL's revenue is concentrated among a few large clients, these major customers gain considerable leverage. Such concentration would enable them to negotiate for lower prices or more favorable payment and delivery terms, thereby increasing their bargaining power.

For instance, a substantial reliance on a few key buyers in the automotive sector, which is a significant end-user for petrochemicals, could amplify customer concentration risks. If these automotive giants represent over 20% of MPL's sales, their ability to influence pricing and terms would be notably higher.

Customers wield significant leverage when readily available substitutes exist for Manali Petrochemicals' products. Should alternative glycols or polyols emerge with comparable performance characteristics and attractive pricing, customers possess the freedom to switch suppliers. This ease of substitution directly diminishes the bargaining power of Manali Petrochemicals, as clients can readily explore other options if perceived value or cost-effectiveness diminishes.

Customers in sectors where Manali Petrochemicals Limited (MPL) products represent a substantial cost, such as the polyurethane industry, exhibit higher price sensitivity. For instance, in 2023, the global polyurethane market faced pricing pressures due to fluctuating raw material costs, directly impacting manufacturers like MPL. This sensitivity means that even minor price increases from MPL can lead customers to seek alternative suppliers or reduce their order volumes, thereby exerting downward pressure on MPL's pricing strategies.

Customer Switching Costs

Customer switching costs significantly influence their bargaining power with Manali Petrochemicals. If it is easy and inexpensive for customers to switch to alternative suppliers or substitute products, they can demand lower prices or better terms. This low switching cost can stem from factors like readily available alternatives or minimal disruption to their own operations.

For Manali Petrochemicals, understanding these costs is crucial. If customers face minimal hurdles in re-formulating their products, conducting new testing, or adjusting their supply chains to accommodate a different supplier, their ability to negotiate aggressively increases. This is particularly relevant in the petrochemical industry where product specifications can be precise, but a range of suppliers might offer compatible materials.

- Low Switching Costs: If customers can easily switch from Manali Petrochemicals to competitors without incurring significant expenses or operational disruptions, their bargaining power is high.

- Re-formulation Expenses: Costs associated with modifying end-products to accommodate a competitor's petrochemicals can deter switching, thus reducing customer power.

- Testing and Qualification: The expense and time involved in re-testing and qualifying new materials from alternative suppliers directly impact switching costs and customer leverage.

- Supply Chain Integration: If a customer's supply chain is tightly integrated with Manali Petrochemicals' delivery and logistics, switching becomes more costly and complex, diminishing customer bargaining power.

Threat of Backward Integration

Customers might explore backward integration if producing propylene glycol or polyether polyols becomes economically viable for them. This move would involve significant capital investment, making it a more likely consideration for large industrial buyers seeking greater control over their supply chain and aiming for self-sufficiency.

For instance, a major automotive manufacturer, a key consumer of polyether polyols in foam production, might evaluate the feasibility of in-house production. If the cost savings and supply stability outweigh the upfront expenditure and operational complexities, such a threat could materialize. This is particularly true if Manali Petrochemicals' pricing or supply reliability were to falter.

While direct backward integration by customers is a substantial undertaking, the *potential* for it can still influence pricing power. The mere possibility encourages Manali Petrochemicals to maintain competitive pricing and service levels. Data from 2024 indicates that the global polyols market, a key segment for Manali Petrochemicals, is projected to grow, suggesting continued demand but also highlighting the scale of potential customer operations.

- Customer Integration Risk: Large-scale industrial consumers, such as those in the automotive or furniture sectors, possess the financial muscle and technical expertise to potentially undertake backward integration.

- Cost-Benefit Analysis: The decision for customers to integrate backward hinges on a thorough cost-benefit analysis, weighing the capital expenditure against potential savings in raw material costs and enhanced supply chain security.

- Market Dynamics: Shifts in raw material prices, such as those for propylene oxide, a key precursor for propylene glycol, can significantly impact the attractiveness of backward integration for customers.

- Competitive Pressure: The threat of backward integration acts as a constant pressure on Manali Petrochemicals to maintain competitive pricing and operational efficiency to retain its customer base.

The bargaining power of customers for Manali Petrochemicals is influenced by several factors, including the availability of substitutes and the cost sensitivity of their industries. If customers can easily switch to alternative suppliers or if MPL's products represent a significant portion of their costs, their leverage increases.

Low switching costs, such as minimal re-formulation expenses or easy supply chain adjustments, empower customers to negotiate more aggressively. Conversely, high switching costs, like intricate product integration or specialized logistics, reduce their bargaining power.

The threat of backward integration, where customers might produce their own petrochemicals, also looms. While a significant undertaking, the mere possibility forces MPL to remain competitive in pricing and service to retain its clientele.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2023-2024) |

|---|---|---|

| Availability of Substitutes | High if readily available, Low if unique | The global polyols market, a key segment for MPL, saw increased competition in 2023, potentially raising substitute availability. |

| Customer Price Sensitivity | High if product is a major cost component | The polyurethane sector, a significant end-user for MPL, experienced pricing pressures in 2023 due to raw material volatility. |

| Switching Costs | High if costly to switch, Low if easy | Low switching costs in petrochemicals often relate to minimal re-formulation needs for customers. |

| Threat of Backward Integration | High if feasible for large buyers | Large automotive manufacturers, key consumers of polyether polyols, may evaluate in-house production if cost-effective. |

Preview the Actual Deliverable

Manali Petrochemicals Porter's Five Forces Analysis

This preview showcases the complete Manali Petrochemicals Porter's Five Forces Analysis, providing a thorough examination of the competitive landscape. You are looking at the actual document, and once you complete your purchase, you’ll get instant access to this exact file. This includes detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the petrochemical industry. The document you see here is exactly what you’ll be able to download after payment, offering a ready-to-use strategic tool.

Rivalry Among Competitors

The Indian petrochemicals sector, particularly for products like polyols and propylene glycol (PG), faces intense competition. Manali Petrochemicals contends with both established domestic manufacturers and considerable imports from global giants such as Dow Chemicals and BASF. These international players often leverage economies of scale and advanced production techniques to offer more competitively priced products, putting pressure on domestic margins.

A significant factor in this rivalry is the market concentration. The top players in the Indian petrochemicals market command a substantial share, meaning smaller companies struggle to gain traction. For instance, in 2023, the top 3-4 domestic producers likely accounted for over 60% of the polyol and PG market, creating high barriers to entry and intense competition for the remaining market share.

The Indian petrochemicals market is on a strong growth trajectory, with an anticipated compound annual growth rate (CAGR) of 3.80% from 2025 to 2033. This expansion is fueled by increasing demand across diverse sectors such as electric vehicles, solar panel manufacturing, and the production of household appliances. Such healthy industry growth often leads to a moderation in competitive rivalry, as companies can focus on capturing market share within an expanding pie rather than engaging in aggressive battles for existing business.

Manali Petrochemicals operates in markets where product differentiation can be a key factor. For standard propylene glycol and polyether polyols, the degree of differentiation is often limited, meaning competitors can easily offer similar products. This lack of unique features means companies often find themselves competing primarily on price, which can heat up rivalry.

When differentiation is low, switching costs for customers also tend to be low. This makes it easier for buyers to switch from one supplier to another if they find a better deal elsewhere. For instance, in the polyurethane industry, where polyols are a core component, a manufacturer might not face significant hurdles in changing their polyol supplier if price or immediate availability is the primary concern.

In 2023, the Indian polyols market, a key segment for Manali Petrochemicals, saw significant price volatility influenced by raw material costs and global demand. This environment often pressures producers to maintain competitive pricing, especially for more commoditized grades of their products.

Exit Barriers

Manali Petrochemicals faces significant competitive rivalry, partly due to high exit barriers in the petrochemical sector. These barriers, like specialized plant and machinery, mean companies often continue operating even when unprofitable, leading to intensified price wars to retain market share. For instance, the capital-intensive nature of petrochemical production requires substantial investment in fixed assets, making it economically challenging to simply shut down operations.

The petrochemical industry is characterized by high fixed costs associated with its complex manufacturing processes and infrastructure. This financial commitment makes exiting the market extremely difficult and expensive. Companies might incur substantial costs for asset decommissioning, environmental remediation, and employee severance, effectively locking them into the industry, regardless of profitability.

Consider the implications for Manali Petrochemicals. In 2023, the company reported a net loss, highlighting the pressure to maintain operations despite challenging financial performance. This situation is not unique; many players in the global petrochemical market face similar dilemmas due to the sunk costs involved in their facilities.

- High Capital Investment: Petrochemical plants require billions in upfront investment, creating a significant barrier to exit.

- Specialized Assets: The machinery and infrastructure are highly specific and difficult to repurpose or sell, increasing the cost of leaving the market.

- Employee Severance and Contractual Obligations: Large workforces and long-term contracts add to the financial burden of shutting down operations.

- Environmental Regulations: Decommissioning and site cleanup often involve substantial environmental compliance costs, further deterring exits.

Capacity Utilization and Fixed Costs

Industries with substantial fixed costs, such as petrochemicals, heavily rely on high capacity utilization to effectively amortize these expenses. Manali Petrochemicals Limited (MPL), operating in this sector, faces intense competitive rivalry driven by this dynamic. When capacity outstrips demand, companies may engage in aggressive pricing to move inventory, intensifying competition.

MPL's strategic expansion of its Propylene Glycol (PG) capacity is a significant factor influencing its domestic market share. This expansion, aiming to boost production, will inevitably put pressure on existing market dynamics as MPL seeks to absorb its increased output.

- High Fixed Costs: Petrochemical plants require massive upfront investment, making capacity utilization a critical determinant of profitability.

- Excess Capacity Risk: When production capacity exceeds market demand, it can trigger price wars as companies compete to sell surplus products.

- MPL's Expansion: Manali Petrochemicals' ongoing PG capacity expansion directly impacts its ability to maintain or grow its domestic market share amidst existing competition.

Competitive rivalry within the Indian petrochemical sector, particularly for polyols and propylene glycol, is substantial. Manali Petrochemicals faces pressure from both domestic players and international suppliers like Dow and BASF, who often leverage economies of scale. The market is somewhat concentrated, with a few large domestic producers holding significant shares, making it tough for smaller entities.

Limited product differentiation for standard polyols and PG means competition frequently centers on price, a situation exacerbated by low customer switching costs. In 2023, price volatility, driven by raw material costs and global demand, further intensified this pricing pressure for Manali Petrochemicals.

The inherent high fixed costs and specialized assets in petrochemicals create high exit barriers, meaning companies often continue operating even at low profitability, leading to aggressive competition to maintain capacity utilization. Manali Petrochemicals' own expansion in Propylene Glycol capacity adds another layer to this rivalry as it aims to capture market share.

SSubstitutes Threaten

The threat of substitutes for Manali Petrochemicals' products, particularly propylene glycol, is a notable concern. Alternatives like 1,2-propanediol, 1,3-propanediol, glycerol, and ethylene glycol can be used in various applications, especially in cosmetics and pharmaceuticals. The increasing availability and adoption of bio-based propylene glycol further intensifies this threat, offering a more sustainable option for consumers and industries.

The threat of substitutes for Manali Petrochemicals (MPL) is significant, particularly when these alternatives offer a compelling price-performance trade-off. This means if other products can do the same job, or even better, for less money, customers might switch. MPL faces direct competition from cheaper imported polyols and propylene glycol (PG) from international manufacturers. These imports can undercut MPL's pricing, especially during periods of favorable exchange rates or when global supply outstrips demand.

Customers' inclination to switch to alternative products for Manali Petrochemicals' offerings is influenced by several key factors. The ease with which a substitute can be integrated into existing processes, coupled with the time and cost associated with obtaining necessary regulatory approvals for new materials in specific end-use applications, significantly impacts switching decisions. Furthermore, any perceived risks, whether technical or market-related, associated with adopting an alternative also play a crucial role in customer retention.

The increasing global emphasis on environmental sustainability is a significant driver that could foster a shift towards bio-based alternatives for petrochemical products. For instance, by 2024, the global market for bio-based chemicals is projected to reach over $120 billion, demonstrating a growing appetite for more environmentally friendly options. This trend presents a tangible threat to traditional petrochemical producers as customers seek materials with a lower carbon footprint.

Innovation in Substitute Technologies

The threat of substitutes for petrochemicals, including those produced by Manali Petrochemicals, is evolving due to significant advancements in green chemistry and material science. Ongoing research and development are creating more sustainable and potentially cost-competitive alternatives. For example, the global bio-based chemicals market, a key area of substitute development, was valued at approximately USD 250 billion in 2023 and is projected to grow substantially in the coming years.

These innovations include the rise of bio-refineries and hydrogen-based production methods, which offer pathways to produce chemicals with a reduced environmental footprint. Such advancements could directly challenge the market share of traditional petrochemicals by providing comparable or superior performance characteristics at competitive price points. This is particularly relevant as regulatory pressures and consumer preferences increasingly favor eco-friendly materials.

The potential impact on Manali Petrochemicals can be seen in:

- Development of bio-based polymers: These can replace petroleum-derived plastics in packaging, textiles, and automotive industries.

- Advancements in recycled materials: Improved recycling technologies are making it more feasible to use recycled plastics as substitutes for virgin materials.

- Emergence of novel materials: Research into materials like advanced composites or cellulose-based products could offer new alternatives.

- Shifting consumer preferences: Growing demand for sustainable products encourages the adoption of these innovative substitutes.

Regulatory and Environmental Pressures

Increasing environmental regulations and a global push towards sustainability are significantly amplifying the threat of substitutes for petrochemical products. As governments worldwide implement stricter rules on emissions and waste, alternatives derived from renewable resources or those with a lower carbon footprint become more attractive. For instance, the European Union's Green Deal aims for climate neutrality by 2050, which will likely accelerate the adoption of bio-based plastics and chemicals, potentially impacting demand for traditional petrochemicals.

Even if bio-based or more environmentally friendly substitutes currently carry a higher price tag, their long-term viability and increasing market acceptance, driven by consumer and corporate ESG (Environmental, Social, and Governance) commitments, pose a growing threat. Companies are increasingly seeking to reduce their reliance on fossil fuels, making these alternatives a strategic imperative. This trend is supported by global investments in green chemistry, with funding for bio-based material research and development seeing substantial growth. For example, the global bio-based chemicals market was valued at approximately USD 100 billion in 2023 and is projected to grow considerably in the coming years.

- Growing Demand for Sustainable Alternatives: Consumer and corporate pressure for eco-friendly products is a major driver.

- Governmental Support and Regulations: Policies favoring green alternatives and penalizing polluting ones enhance their competitive position.

- Technological Advancements: Innovations in bio-manufacturing and material science are making substitutes more cost-competitive and performant.

- Shifting Investment Landscape: Increased venture capital and corporate investment in sustainable materials signal a long-term shift away from traditional petrochemicals.

The threat of substitutes for Manali Petrochemicals' products, especially propylene glycol (PG), is amplified by the growing demand for sustainable alternatives. Bio-based PG and other bio-derived chemicals offer a compelling value proposition, driven by environmental consciousness and evolving regulations. For instance, the global bio-based chemicals market, a direct source of substitutes, was projected to exceed $120 billion by 2024.

Customers are increasingly willing to switch to these greener options, even if they initially carry a premium, due to corporate ESG goals and consumer preferences. Technological advancements in bio-manufacturing are also making these substitutes more cost-competitive and performant, directly challenging traditional petrochemicals.

MPL faces competition from cheaper imported polyols and PG, particularly when global supply is abundant or exchange rates are favorable. This price sensitivity, combined with the increasing availability of sustainable alternatives, creates a dynamic market environment.

| Substitute Type | Key Applications | Competitive Factor |

|---|---|---|

| Bio-based Propylene Glycol | Cosmetics, Pharmaceuticals, Food | Sustainability, Lower Carbon Footprint |

| Glycerol | Cosmetics, Pharmaceuticals, Industrial | Renewable Source, Biodegradability |

| Ethylene Glycol (as substitute for some PG uses) | Antifreeze, Polymers | Price Competitiveness (depending on market conditions) |

| Other Bio-derived Polyols | Polyurethanes, Resins | Environmental Credentials, Potential Performance Benefits |

Entrants Threaten

The petrochemical sector demands massive upfront investment, making it tough for newcomers. Building a new facility for products like polyols, a key offering from Manali Petrochemicals, requires hundreds of millions of dollars for plants, advanced machinery, and the necessary infrastructure. For instance, global petrochemical project costs often run into the billions, a figure that deters many potential competitors.

Existing players in the petrochemical industry, such as Manali Petrochemicals, leverage significant economies of scale. This means they can produce chemicals at a much lower cost per unit due to their large-scale operations. For instance, in 2023, Manali Petrochemicals reported a production capacity that allows for efficient cost absorption over a vast output volume.

New companies entering the market would face a substantial hurdle in matching these cost efficiencies. Without the established infrastructure and high production volumes, their initial per-unit costs would be considerably higher. This cost disadvantage makes it challenging for new entrants to compete on price with established players like Manali Petrochemicals, thus acting as a deterrent.

The chemical and petrochemical sectors face substantial regulatory burdens, demanding rigorous adherence to environmental protection and safety standards. For instance, in 2024, companies operating in the European Union continued to navigate the complexities of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), which requires extensive data submission and risk assessment for chemical substances. This intricate web of permits and compliance protocols acts as a significant deterrent for potential new entrants, demanding considerable upfront investment in expertise and infrastructure to even begin operations.

Access to Distribution Channels and Raw Materials

New companies looking to enter the petrochemical market, like Manali Petrochemicals, often face significant hurdles in securing essential raw materials and establishing effective distribution channels. Established players typically have deeply entrenched relationships with suppliers, granting them preferential pricing and reliable access to key feedstocks such as propylene and benzene. For instance, in 2023, the global petrochemical industry saw continued supply chain complexities, with some regions experiencing shortages of crucial raw materials due to geopolitical factors and production disruptions, making it harder for newcomers to compete on cost and availability.

These existing relationships translate into competitive advantages for incumbent firms. New entrants must invest heavily to build their own supply chain networks or negotiate less favorable terms, which can significantly impact their profitability and market entry strategy. This can create a substantial barrier, as Manali Petrochemicals has likely benefited from its established supplier contracts over the years, ensuring consistent input for its operations.

- Established Relationships: Existing petrochemical companies often hold long-term contracts with raw material suppliers, ensuring consistent and potentially lower-cost inputs.

- Distribution Network Control: Incumbents benefit from well-developed logistics and distribution networks, making it difficult for new players to reach customers efficiently.

- Capital Investment: Overcoming these barriers requires substantial capital for building new facilities, securing supply agreements, and establishing distribution infrastructure.

- Market Access: Difficulty in accessing key markets or securing shelf space in retail or industrial channels can stifle growth for new entrants.

Brand Loyalty and Switching Costs for Buyers

While not as intense as in consumer markets, brand loyalty does play a role in the petrochemical sector. Existing relationships, built on trust and consistent product quality, can make buyers hesitant to switch suppliers. For instance, a long-standing supplier might offer tailored technical support and product customization that a new entrant struggles to replicate quickly.

Switching costs can also be a significant barrier. These aren't just monetary; they can include the time and resources needed to qualify new suppliers, retool production processes, or conduct extensive testing to ensure compatibility. In 2024, the complexity of many industrial applications means these switching costs can easily run into tens of thousands of dollars, or even more, for a single product line.

- Established suppliers in petrochemicals often cultivate loyalty through consistent quality and dedicated technical support.

- Switching costs for buyers can include financial outlays for retooling and the time investment in supplier qualification.

- These costs deter customers from easily moving to new, unproven petrochemical suppliers, even if prices are marginally lower.

- The complexity of petrochemical applications amplifies these barriers, making loyalty a key factor.

The threat of new entrants for Manali Petrochemicals is moderately high, primarily due to substantial capital requirements and regulatory hurdles. However, established relationships with suppliers and customers, coupled with significant economies of scale, act as considerable deterrents.

The petrochemical industry demands immense capital investment for plant construction and technology, often in the hundreds of millions of dollars. For example, a new polyol plant can cost upwards of $500 million. Existing players like Manali Petrochemicals benefit from economies of scale, reducing per-unit production costs, a challenge for newcomers to match.

New entrants must also navigate stringent environmental and safety regulations, a complex and costly process. Furthermore, securing reliable feedstock supply and establishing robust distribution networks are critical barriers, often requiring years of relationship building. In 2023, global supply chain disruptions highlighted the advantage of established players with secure raw material contracts.

| Barrier Type | Description | Impact on New Entrants | Example for Manali Petrochemicals |

|---|---|---|---|

| Capital Requirements | Building petrochemical plants requires billions in investment. | High barrier, limits the number of potential new entrants. | A new polyol plant can cost $500M+ to build. |

| Economies of Scale | Large production volumes lower per-unit costs. | New entrants face higher initial costs, impacting price competitiveness. | Manali Petrochemicals' established capacity allows for cost efficiencies. |

| Regulatory Hurdles | Strict environmental and safety compliance is mandatory. | Significant upfront investment in expertise and infrastructure needed. | Navigating REACH regulations in the EU adds complexity and cost. |

| Supplier & Distribution Access | Established relationships ensure feedstock and market reach. | New entrants struggle to secure favorable terms and logistics. | Manali Petrochemicals likely benefits from long-term supplier contracts. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Manali Petrochemicals is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and public filings. We also incorporate industry-specific reports from reputable market research firms and insights from chemical industry trade publications.