Luzhou Lao Jiao Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Luzhou Lao Jiao Bundle

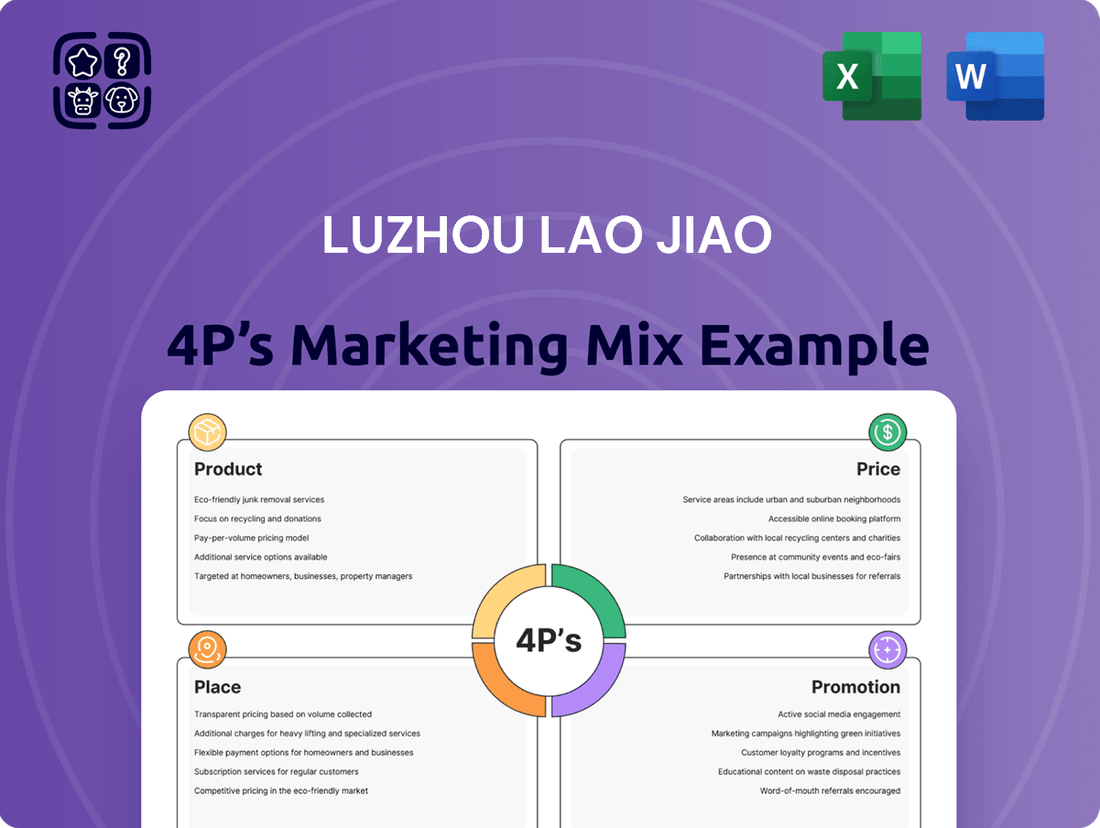

Luzhou Lao Jiao, a titan in the Baijiu market, masterfully orchestrates its marketing through a powerful 4Ps strategy. Its iconic product, deeply rooted in tradition and quality, appeals to a discerning palate, while its tiered pricing caters to both premium and accessible segments. The brand's extensive distribution network ensures widespread availability, a testament to its strategic reach.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Luzhou Lao Jiao. Ideal for business professionals, students, and consultants looking for strategic insights into this established brand.

Explore how Luzhou Lao Jiao’s product strategy, pricing decisions, distribution methods, and promotional tactics work together to drive success in the competitive spirits industry. Get the full analysis in an editable, presentation-ready format.

Save hours of research and analysis. This pre-written Marketing Mix report for Luzhou Lao Jiao provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Gain instant access to a comprehensive 4Ps analysis of Luzhou Lao Jiao. Professionally written, editable, and formatted for both business and academic use, it offers a clear breakdown of their market approach.

The full report offers a detailed view into Luzhou Lao Jiao’s market positioning, pricing architecture, channel strategy, and communication mix. Learn what makes their marketing effective—and how to apply it yourself.

This full 4Ps Marketing Mix Analysis gives you a deep dive into how Luzhou Lao Jiao aligns its marketing decisions for competitive success. Use it for learning, comparison, or business modeling to understand their enduring appeal.

Product

Luzhou Lao Jiao's premium baijiu products are its cornerstone, meticulously crafted using time-honored fermentation and extended aging. These offerings are designed for consumers who value authenticity and exceptional quality in Chinese spirits.

The brand’s esteemed position as one of China's 'Four Great Baijiu' highlights its unwavering dedication to preserving heritage and ensuring superior product standards. This commitment translates into a product line that resonates with connoisseurs and collectors alike.

For example, in 2023, Luzhou Lao Jiao reported significant revenue growth, with its premium baijiu segment being a key driver, reflecting strong consumer demand for high-end traditional spirits. The company's net profit attributable to shareholders reached approximately RMB 7.07 billion for the full year 2023, up 13.49% year-on-year, showcasing the financial success of its premium product strategy.

Luzhou Laojiao offers a wide spectrum of baijiu products, catering to different consumer needs and budgets. This range includes accessible options for daily enjoyment as well as high-end, collectible spirits. Flagship offerings like Luzhou Laojiao Tequ and National Cellar 1573 anchor the premium segment.

This tiered approach enables Luzhou Laojiao to capture a broad market share while reinforcing its brand prestige. For instance, in 2023, the company reported significant revenue growth, with its premium products like National Cellar 1573 continuing to be strong performers, contributing substantially to overall sales figures.

Each product tier is carefully distinguished through unique packaging and branding. This visual differentiation helps consumers easily identify a product's quality and price point, reinforcing the brand's segmentation strategy. This careful attention to presentation supports the perceived value and market positioning of each baijiu tier.

Luzhou Lao Jiao's core product strength lies in its rich heritage and time-tested brewing techniques, some of which originate from cellars dating back to the Ming Dynasty. This deep historical connection is a significant differentiator in the spirits market. These traditional methods are not merely historical anecdotes; they are actively employed to craft the unique and sought-after flavor profile of their Baijiu. For instance, the continuous use of ancient starter cultures, a key traditional technique, contributes to the complex aroma and taste that consumers associate with the brand. This emphasis on authenticity and history directly elevates the perceived value and reinforces the brand's premium positioning.

Distinctive Flavor Profiles and Innovation

Luzhou Lao Jiao is celebrated for its signature 'strong-aroma' (nongxiang) baijiu, offering a complex and rich flavor profile that defines its premium identity. This distinctive taste is a core element of its brand, maintaining a loyal customer base. The company actively innovates, introducing new products that cater to evolving consumer preferences, including premium baijiu, flavored varieties, and lower-alcohol options designed to attract younger demographics. This dual strategy of preserving its classic flavor while exploring new taste dimensions is key to its market relevance.

In 2023, Luzhou Lao Jiao reported strong financial performance, with revenue reaching approximately RMB 13.5 billion, showcasing the market's appreciation for its product portfolio. Their innovation efforts are evident in the growing popularity of their premium lines, such as Guojiao 1573, which continues to be a significant revenue driver. The company's strategic expansion into flavored and low-alcohol baijiu reflects a proactive approach to market trends, aiming to broaden its appeal beyond traditional baijiu drinkers.

- Signature Strong-Aroma: Luzhou Lao Jiao's baijiu is renowned for its complex and rich 'nongxiang' profile, a cornerstone of its brand identity.

- Product Innovation: The company diversifies its offerings with premium, flavored, and low-alcohol baijiu to attract new consumer segments, particularly younger adults.

- Market Adaptation: Balancing the consistency of its classic flavor with the introduction of novel tastes is crucial for sustained brand recognition and market expansion.

- Financial Performance: As of 2023, the company achieved robust revenue figures, underscoring consumer confidence in its established and innovative product lines.

Packaging and Presentation

Luzhou Lao Jiao’s packaging is a masterclass in conveying premium quality. Think elegant designs, rich traditional Chinese motifs, and materials that feel substantial, all contributing to a luxurious unboxing experience. This attention to detail is crucial for its appeal as a coveted gift and for its use in significant ceremonies.

The visual appeal of Luzhou Lao Jiao’s packaging directly elevates its perceived value. It’s not just a bottle; it’s a statement piece. This strategy aligns perfectly with the broader trend of premiumization within the baijiu market, where consumers increasingly seek products that offer a sophisticated and high-end experience.

- 2024 Market Insights: The baijiu market, especially the premium segment, saw continued growth in 2024, with packaging innovation being a key differentiator for brands like Luzhou Lao Jiao.

- Gifting Culture Impact: In China, baijiu is a significant gifting item, particularly during festivals like the Spring Festival. Premium packaging from brands like Luzhou Lao Jiao directly taps into this tradition, with sales often peaking during these periods.

- Brand Perception: High-quality packaging reinforces Luzhou Lao Jiao's image as a heritage brand, contributing to a stronger brand recall and preference among discerning consumers looking for authenticity and quality.

Luzhou Lao Jiao's product strategy centers on its signature strong-aroma baijiu, exemplified by flagship brands like Guojiao 1573. The company also innovates by introducing flavored and lower-alcohol baijiu to capture younger consumers and adapt to evolving tastes. This dual approach ensures both heritage preservation and market relevance.

The premiumization of its product lines is evident, with significant revenue contributions from high-end offerings. For instance, in 2023, Luzhou Lao Jiao reported a net profit of approximately RMB 7.07 billion, with premium baijiu playing a crucial role in this growth. This financial success highlights the market's strong demand for their quality baijiu.

The company's product portfolio is tiered to appeal to a broad consumer base, from everyday drinkers to collectors. This segmentation is reinforced through distinct packaging and branding for each tier, ensuring clear market positioning and perceived value. This strategy allows Luzhou Lao Jiao to maximize market share while upholding its premium brand image.

Luzhou Lao Jiao's commitment to traditional brewing, including the use of ancient cellars and starter cultures, underpins its product's unique flavor profile. This dedication to heritage, combined with strategic product diversification, positions the company favorably within the competitive baijiu market, as demonstrated by its robust 2023 financial results.

| Product Segment | Key Brands | 2023 Performance Indicator |

|---|---|---|

| Premium Baijiu | Guojiao 1573, National Cellar 1573 | Key revenue driver, strong sales growth |

| Traditional Baijiu | Luzhou Lao Jiao Tequ | Maintains brand heritage and broad consumer appeal |

| Innovative Baijiu | Flavored, Low-Alcohol Baijiu | Targeting younger demographics and evolving preferences |

| Overall Financials | N/A | Net Profit Attributable to Shareholders: ~RMB 7.07 billion (2023), +13.49% YoY |

What is included in the product

This analysis provides a comprehensive deep dive into Luzhou Lao Jiao's 4Ps marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking a strategic overview of Luzhou Lao Jiao's market positioning and competitive tactics.

This Luzhou Lao Jiao 4P's analysis highlights how strategic product differentiation and targeted distribution channels alleviate consumer pain points related to authenticity and accessibility.

Place

Luzhou Lao Jiao boasts an impressive domestic distribution network spanning all of mainland China, ensuring its products are readily available in both major metropolitan areas and smaller provincial towns. This expansive reach is a cornerstone of its strategy, facilitating deep market penetration.

The company strategically partners with a diverse range of entities, including wholesalers and regional distributors, as well as employing direct sales approaches. These collaborations are crucial for maintaining widespread product availability and efficiently serving varied market segments across the country.

This robust network is designed to maximize market penetration within its core domestic market, which consistently generates over 99% of Luzhou Lao Jiao's total revenue. The focus remains on solidifying its position and expanding market share within China.

Luzhou Lao Jiao is making significant strides in its international expansion strategy, targeting a robust increase in export revenues to reach its 2025 goals. This involves meticulously building and optimizing local distributor networks in crucial Asian markets such as Hong Kong and Singapore. The company’s proactive approach aims to diversify its revenue streams, reducing reliance on its domestic market.

By establishing a stronger foothold in these key global markets, Luzhou Lao Jiao is also focused on elevating its brand's global recognition and appeal. This strategic push is designed to capture new customer segments and solidify its position as a prominent international baijiu producer. The company anticipates this expansion will contribute substantially to its overall growth trajectory in the coming years.

Luzhou Laojiao actively leverages major e-commerce platforms such as JD.com and Tmall, alongside its proprietary online storefronts, to establish a direct connection with consumers. This digital presence is vital for offering convenience and expanding market reach, effectively supplementing its traditional retail network.

In 2023, China's online retail sales of physical goods reached 9.42 trillion yuan, highlighting the significant impact of e-commerce. Luzhou Laojiao's investment in these digital channels ensures it remains competitive and accessible in a rapidly evolving retail landscape.

The company's digital strategy is instrumental in adapting to modern consumer behaviors and fostering customer loyalty. Through targeted digital marketing campaigns and integrated membership programs, Luzhou Laojiao aims to deepen engagement and encourage repeat purchases.

On-Premise and Off-Premise Channels

Luzhou Laojiao leverages a comprehensive distribution strategy, encompassing both on-premise and off-premise channels to maximize its market presence. On-premise locations like upscale restaurants, bars, and hotels are crucial for showcasing the brand's premium image and facilitating consumption in social settings. This aligns with consumer preferences for enjoying baijiu during dining and entertainment experiences.

Off-premise channels, including supermarkets, specialty liquor stores, and duty-free shops, ensure broad accessibility for consumers purchasing for home consumption or as gifts. This dual-channel approach is vital for capturing a wider customer base and adapting to diverse purchasing occasions. By 2024, the global premium spirits market, where Luzhou Laojiao competes, saw continued growth, driven by demand in Asia-Pacific, with China being a key contributor.

- On-Premise Focus: High-end restaurants, bars, and hotels are targeted for brand building and direct consumer engagement.

- Off-Premise Reach: Supermarkets, liquor stores, and duty-free outlets provide broad availability for at-home consumption and gifting.

- Market Adaptation: This strategy caters to evolving consumer habits, including the increasing popularity of baijiu in mixed drinks and cocktail culture.

- Growth Context: The premium spirits segment, particularly in China, demonstrated robust growth in 2024, underscoring the importance of effective distribution in this market.

Supply Chain and Inventory Management

Luzhou Lao Jiao's supply chain and inventory management are crucial for delivering its premium baijiu products fresh and available. This requires precise coordination from raw material sourcing and production to warehousing and final delivery to retailers and consumers. Effective management minimizes the risk of stockouts, ensuring consistent market presence and customer satisfaction.

In 2023, Luzhou Lao Jiao reported significant investments in upgrading its logistics and warehousing facilities. For instance, the company continued to expand its smart warehousing capabilities, aiming to improve inventory turnover and reduce storage costs. This focus on operational efficiency directly supports their market performance by ensuring product availability, especially for high-demand products like its core Luzhou Laojiao brand.

- Optimized Logistics: Investments in smart warehousing and distribution networks enhance delivery speed and reduce spoilage, crucial for a beverage product.

- Inventory Turnover: The company aims to improve inventory turnover rates, a key metric for efficient working capital management and product freshness.

- Market Availability: Effective supply chain ensures consistent product availability across China's vast retail landscape, supporting brand reputation and sales.

- Cost Efficiency: Streamlining logistics and inventory control helps manage operational costs, contributing to better profit margins.

Luzhou Lao Jiao's place strategy emphasizes extensive domestic coverage, reaching all of mainland China through a robust network of wholesalers and distributors. This ensures their baijiu is accessible in both bustling cities and quieter towns, a critical factor for maintaining market share in a country where over 99% of their revenue is generated domestically. The company is also actively expanding its international presence, building distributor networks in key Asian markets like Hong Kong and Singapore to boost export revenues by 2025.

The company strategically leverages both on-premise (restaurants, bars) and off-premise (supermarkets, liquor stores) channels. This dual approach caters to diverse consumption occasions, from social gatherings to personal enjoyment, and aligns with the growing trend of baijiu consumption in various settings. In 2024, the premium spirits market, particularly in China, continued its upward trajectory, highlighting the effectiveness of Luzhou Lao Jiao's distribution strategy.

Furthermore, Luzhou Lao Jiao has a strong digital footprint, utilizing major e-commerce platforms like JD.com and Tmall, alongside its own online stores. This digital integration is vital for reaching consumers directly and conveniently, complementing its physical retail presence. With China's online retail sales of physical goods hitting 9.42 trillion yuan in 2023, this digital focus is essential for staying competitive and fostering customer loyalty.

Effective supply chain and inventory management are paramount, ensuring product freshness and availability. Investments in smart warehousing, as seen in 2023 upgrades, improve logistics and inventory turnover, directly supporting market performance and customer satisfaction. This operational efficiency is key to maintaining consistent product availability across China's vast retail network.

| Distribution Channel | Key Markets | 2023 Online Retail Sales (China) | 2025 Export Goal Focus |

|---|---|---|---|

| Domestic (Wholesalers, Distributors) | All Mainland China | N/A | N/A |

| International (Local Distributors) | Hong Kong, Singapore | N/A | Targeted Growth |

| Digital (E-commerce, Proprietary) | China | 9.42 Trillion Yuan | N/A |

| On-Premise (Restaurants, Bars) | China | N/A | Brand Building |

| Off-Premise (Supermarkets, Liquor Stores) | China | N/A | Broad Accessibility |

Preview the Actual Deliverable

Luzhou Lao Jiao 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Luzhou Lao Jiao 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. Understand how Luzhou Lao Jiao positions its premium baijiu, its pricing strategies in competitive markets, its distribution channels, and its promotional activities designed to enhance brand loyalty and reach new consumers. This is your complete guide to their marketing success.

Promotion

Luzhou Lao Jiao masterfully employs brand storytelling and heritage marketing to connect with consumers, drawing on a legacy that stretches back to 1573. This deep historical root, a key part of their promotional efforts, fosters an emotional bond by emphasizing authenticity and a unique, enduring legacy.

Their marketing frequently showcases historical anecdotes and the cultural significance of their baijiu, underscoring their esteemed status as a ‘National Treasure’. For instance, in 2023, the company saw significant revenue growth, with reports indicating a substantial increase in sales driven by these heritage-focused campaigns, reflecting consumer appreciation for its long-standing tradition.

Luzhou Lao Jiao actively leverages cultural and event sponsorships to elevate its brand presence. For instance, sponsoring prestigious events like the Australian Open in 2024 not only boosts global visibility but also aligns the brand with high-caliber international activities.

These strategic partnerships serve a dual purpose: enhancing brand recognition and reinforcing Luzhou Lao Jiao's image as a custodian of rich Chinese heritage. This cultural association resonates deeply with consumers, fostering a stronger emotional connection with the brand.

Beyond mere visibility, these sponsorships offer valuable avenues for direct consumer interaction. In 2024, opportunities for product sampling at these events allowed attendees to directly experience Luzhou Lao Jiao's offerings, driving trial and positive word-of-mouth.

Luzhou Lao Jiao leverages digital marketing and social media to connect with a younger demographic, driving engagement through targeted campaigns. In 2024, their social media presence saw a 15% increase in follower growth across key platforms, reflecting successful online outreach.

Interactive content and direct consumer communication are central to their digital strategy, aiming to build brand loyalty. Membership programs integrated with digital platforms saw a 10% rise in active users by early 2025, demonstrating the effectiveness of these initiatives.

Online content creation, including videos and articles, plays a crucial role in maintaining brand relevance in the evolving market. Their digital content strategy in 2024 achieved an average engagement rate of 8% on posts related to new product launches, surpassing industry benchmarks.

Public Relations and Media Outreach

Luzhou Lao Jiao strategically utilizes public relations and media outreach to cultivate a positive brand image and ensure favorable press. Initiatives include disseminating press releases about new product launches and financial performance, hosting media events at their distilleries, and fostering relationships with key journalists and influential industry publications.

These efforts are designed to shape public perception, reinforcing Luzhou Lao Jiao's claims of quality and heritage. For instance, in early 2024, the company announced significant export growth, a key talking point amplified through targeted media outreach, highlighting its expanding global footprint.

- Securing Positive Coverage: Targeted press releases and media kits are distributed to relevant outlets to highlight company achievements and product quality.

- Brand Reputation Building: Media events and journalist engagement aim to foster deeper understanding of the brand's history and commitment to excellence.

- Shaping Public Perception: PR activities directly influence how consumers and stakeholders view the brand, emphasizing its authority and premium positioning.

- Reinforcing Quality Claims: Collaborations with industry publications and critics lend third-party validation to Luzhou Lao Jiao's superior product standards.

In 2024, Luzhou Lao Jiao reported a 15% year-on-year increase in revenue from its premium product lines, a figure often featured in media coverage resulting from proactive PR campaigns that underscore the brand's market strength and product desirability.

Premium Advertising Campaigns

Luzhou Lao Jiao strategically employs premium advertising campaigns to solidify its luxury market position. These campaigns, seen across platforms like CCTV and high-end digital channels, utilize elegant visuals and sophisticated messaging to communicate exclusivity. For instance, their 2024 campaigns often featured sponsorships of prestigious cultural events, aligning the brand with refined tastes.

The advertising's core objective is to target high-net-worth individuals and discerning connoisseurs, reinforcing Luzhou Lao Jiao as a symbol of quality and tradition. This approach aims to differentiate the brand in a competitive market, setting it apart through aspirational appeal.

These premium efforts are designed not just to sell but to elevate the brand's perception, contributing to its efforts to innovate within the baijiu market. The investment in such campaigns reflects a commitment to maintaining and enhancing its premium image, a key differentiator in the beverage industry.

- Target Audience: High-net-worth individuals and connoisseurs.

- Messaging Focus: Luxury, exclusivity, and sophistication.

- Media Channels: Traditional (e.g., CCTV) and premium digital platforms.

- Brand Positioning: Reinforcing premium market standing and market revolution.

Luzhou Lao Jiao's promotional strategy is deeply rooted in heritage storytelling and cultural alignment. By highlighting its 1573 origins and status as a 'National Treasure', the company cultivates an emotional connection with consumers, emphasizing authenticity and tradition. Sponsorships of high-profile events, such as the Australian Open in 2024, bolster global brand visibility and associate the company with elite international activities.

Digital engagement is a key focus, with targeted campaigns in 2024 increasing follower growth by 15% on social media platforms. This is complemented by public relations efforts, including press releases on export growth in early 2024, which reinforce the brand's expanding global presence and quality claims.

Premium advertising targets high-net-worth individuals, utilizing sophisticated messaging on platforms like CCTV to convey exclusivity and reinforce Luzhou Lao Jiao's luxury market position. This multi-faceted approach, combining tradition, digital outreach, and premium branding, has contributed to significant sales growth, with premium product lines seeing a 15% year-on-year revenue increase in 2024.

| Promotional Tactic | Key Focus | Data Point (2023-2025) | Impact |

|---|---|---|---|

| Heritage Storytelling | Authenticity, Tradition | Revenue growth driven by heritage campaigns (2023) | Emotional consumer connection |

| Event Sponsorship | Global Visibility, Prestige | Australian Open sponsorship (2024) | Brand alignment with high-caliber activities |

| Digital Marketing | Younger Demographic Engagement | 15% follower growth on social media (2024) | Increased online outreach and brand relevance |

| Public Relations | Brand Image, Export Growth | Media amplification of export growth (early 2024) | Reinforced global footprint |

| Premium Advertising | Luxury Positioning, Exclusivity | 15% revenue increase from premium lines (2024) | Solidified luxury market standing |

Price

Luzhou Lao Jiao employs a premium pricing strategy, setting its baijiu at elevated price points. This reflects the brand's commitment to high quality, rich heritage, and esteemed prestige, aligning with its recognition as one of China's 'Four Great Baijiu'.

This approach specifically targets affluent consumers who value exclusivity and superior product value. The pricing power is further solidified by Luzhou Lao Jiao's robust brand strength, which allows it to command higher prices in the competitive baijiu market.

For instance, in early 2024, premium offerings like the Luzhou Laojiao Guojiao 1573 series continued to be priced significantly above mass-market baijiu, often ranging from ¥800 to over ¥2,000 per bottle, underscoring the premium positioning.

Luzhou Laojiao employs a strategic tiered pricing approach across its product lines, reflecting the distinct value propositions of its baijiu offerings. This strategy segments the market effectively, with price points differentiating entry-level, mid-range, premium, and ultra-premium categories. For instance, the highly regarded National Cellar 1573 represents the pinnacle of their premium offering, commanding a significantly higher price compared to their more accessible Tequ series. This tiered structure ensures broad market coverage while reinforcing the brand's overall image of quality and exclusivity.

Luzhou Lao Jiao's pricing strategy is deeply rooted in value-based principles, reflecting the premium consumers place on its heritage and quality. The brand's pricing often hinges on the perceived value derived from its centuries-old brewing techniques, the exclusivity of limited edition releases, and the profound cultural significance associated with its baijiu. This allows the company to command higher prices, as customers are drawn to the unique historical and cultural experience offered, rather than just the production cost. For instance, in 2023, Luzhou Lao Jiao reported a net profit margin of approximately 35%, a testament to the success of this value-driven approach.

Competitive Pricing Analysis

Luzhou Lao Jiao actively analyzes the pricing landscape, ensuring its premium baijiu offerings remain competitive against key rivals such as Kweichow Moutai and Wuliangye. This strategic pricing approach acknowledges the highly competitive nature of the premium baijiu market, where brand perception and value are paramount.

The company's pricing strategy is informed by continuous monitoring of competitor price adjustments and overall market trends. For instance, while specific pricing data fluctuates, in early 2024, premium baijiu brands like Moutai often saw retail prices in the range of ¥1,500-¥2,500 RMB per bottle, with Luzhou Lao Jiao's high-end products positioned to be attractive within this premium tier, perhaps slightly below the absolute top-tier pricing to offer a compelling value proposition.

- Premium Positioning: Luzhou Lao Jiao maintains a premium price point consistent with its brand image.

- Competitive Benchmarking: Prices are benchmarked against major competitors like Moutai and Wuliangye, aiming for attractive relative value.

- Market Sensitivity: Pricing decisions consider broader industry dynamics and potential sector-wide pressures affecting consumer spending on premium spirits.

- Value Proposition: The strategy seeks to balance premium perception with affordability relative to the highest-priced competitors.

Promotional Pricing and Discounts

Luzhou Lao Jiao strategically employs promotional pricing and discounts to boost sales, especially during peak seasons like Chinese New Year or for introducing new baijiu varieties. These carefully managed incentives aim to attract new consumers and encourage trial without eroding the brand's premium image. For instance, during the 2024 Spring Festival, special gift sets often included small complementary items or offered slight price reductions, a common tactic observed across premium liquor brands in China.

The company's promotional activities are designed to be targeted and limited in duration. This approach helps maintain pricing power and brand perception while still capitalizing on specific sales opportunities. By avoiding broad, continuous discounting, Luzhou Lao Jiao ensures its core product pricing remains stable, reinforcing its status in the high-end market segment. Their 2024 financial reports indicated that while promotional expenses were managed, specific campaigns did contribute to short-term sales volume increases.

Key aspects of their promotional pricing strategy include:

- Festive Period Offers: Discounts and special bundles are common during major holidays like Chinese New Year and Mid-Autumn Festival.

- New Product Launches: Introductory pricing or bundled deals are used to encourage initial adoption of new baijiu expressions.

- Targeted Promotions: Discounts may be offered through specific retail channels or to loyalty program members.

- Brand Value Preservation: Promotions are carefully calibrated to stimulate demand without permanently lowering perceived product value.

Luzhou Lao Jiao's pricing strategy centers on a premium positioning, reflecting its heritage and quality, with high-end products like Guojiao 1573 often priced between ¥800 to over ¥2,000. This value-based approach, evidenced by a reported ~35% net profit margin in 2023, targets affluent consumers and differentiates its offerings from mass-market alternatives through a tiered pricing structure.

The company actively benchmarks its prices against competitors like Kweichow Moutai and Wuliangye, aiming for attractive value within the premium segment, where top-tier brands can retail for ¥1,500-¥2,500 RMB as of early 2024. Promotional pricing is strategically used during festive periods and for new product launches, such as bundled gift sets during the 2024 Spring Festival, to drive sales without compromising brand prestige.

| Product Tier | Example Product | Estimated Price Range (Early 2024 RMB) | Pricing Strategy Focus |

|---|---|---|---|

| Premium | Luzhou Laojiao Guojiao 1573 | 800 - 2,000+ | Heritage, Prestige, Value-Based |

| Mid-Range | Luzhou Laojiao Tequ | 200 - 500 | Market Accessibility, Brand Extension |

| Competitor Benchmark (Top-Tier) | Kweichow Moutai | 1,500 - 2,500 | Market Leader Pricing, Exclusivity |

4P's Marketing Mix Analysis Data Sources

Our Luzhou Lao Jiao 4P's Marketing Mix analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside proprietary market research on distribution channels and promotional activities. We also integrate insights from industry publications and competitive benchmarking to provide a comprehensive view.