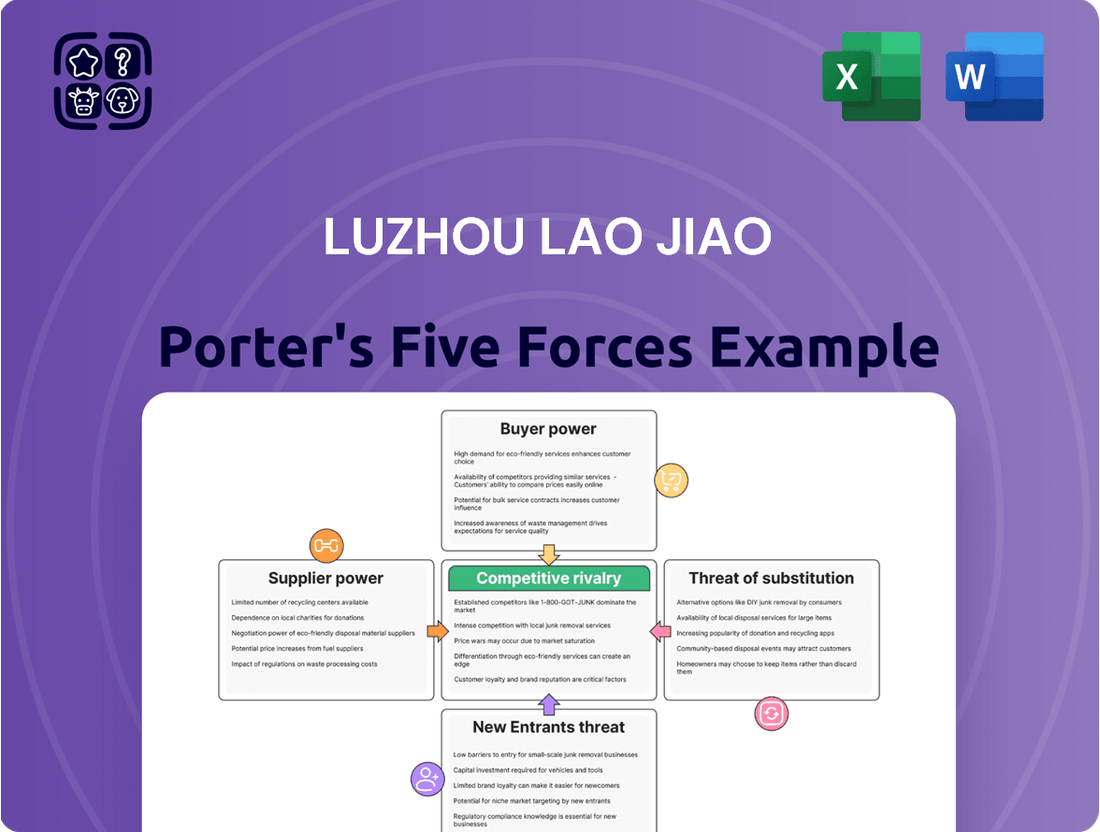

Luzhou Lao Jiao Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Luzhou Lao Jiao Bundle

Luzhou Lao Jiao navigates a complex landscape shaped by intense rivalry and formidable buyer power in the baijiu market. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and brand loyalty. Understanding the bargaining power of suppliers and the ever-present threat of substitutes is crucial for strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Luzhou Lao Jiao’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The primary raw materials for baijiu production, including sorghum, rice, and wheat, are agricultural commodities. Luzhou Lao Jiao procures these essential grains from a broad and diversified supplier base, which naturally diminishes its reliance on any particular vendor. This extensive availability and the inherent substitutability of these fundamental grains significantly constrain the bargaining leverage that individual suppliers can exert concerning pricing and contract conditions.

While the primary grain inputs for Luzhou Lao Jiao are commodity items, the specialized yeast strains and fermentation agents essential for its unique baijiu production represent a potential area of supplier influence. If these critical biological components are sourced from a limited number of highly specialized providers, their bargaining power could be elevated. However, it's important to note that much of Luzhou Lao Jiao's historical brewing expertise, including the cultivation and maintenance of proprietary yeast cultures, is likely developed and retained internally, mitigating external supplier dependence.

Access to clean, high-quality water is absolutely critical for producing authentic baijiu, and this resource is often tied to specific geographic locations. While water isn't a typical supplier, environmental regulations and the infrastructure needed for water treatment can indirectly affect production costs and the consistency of supply. Luzhou Lao Jiao's historical and established production base in Luzhou, Sichuan province, a region known for its favorable water sources, likely ensures a relatively stable and high-quality water supply for its operations.

Packaging and Auxiliary Materials Suppliers

Suppliers of packaging materials, such as bottles, caps, and labels, for companies like Luzhou Lao Jiao, generally face a highly competitive landscape. This intense competition among packaging material providers typically dilutes their individual bargaining power.

Given Luzhou Lao Jiao's substantial production scale, the company can leverage its significant purchasing volume to negotiate favorable terms. This buying power often dictates pricing and supply conditions, further diminishing the leverage of these suppliers.

Consequently, the bargaining power of suppliers for packaging and auxiliary materials is considered low in the context of Luzhou Lao Jiao's operations. This is a common dynamic for large manufacturers in the spirits industry.

For instance, in 2023, the global packaging market, which includes materials for alcoholic beverages, saw numerous suppliers competing on price and innovation. This competitive environment reinforces the low bargaining power of individual packaging suppliers to major players like Luzhou Lao Jiao, especially when considering the sheer volume of materials they procure annually.

- Competitive Market: The market for packaging materials is characterized by a multitude of suppliers, increasing competition.

- Economies of Scale: Luzhou Lao Jiao's large production volumes enable bulk purchasing, enhancing its negotiation strength.

- Low Supplier Leverage: The combination of market competition and buyer power significantly limits the bargaining power of packaging material suppliers.

- Industry Trend: This low bargaining power for packaging suppliers is a prevalent trend across the global spirits industry for major producers.

Labor Supply and Expertise

The bargaining power of suppliers in the context of labor and expertise for traditional baijiu production, like that of Luzhou Lao Jiao, is shaped by the scarcity of highly specialized skills. Ancient fermentation and distillation techniques require years of hands-on experience, making a limited pool of artisans particularly valuable.

While not traditional external suppliers, the individuals possessing this unique expertise, or institutions that train them, can wield significant influence. Luzhou Lao Jiao, with its deep historical roots, benefits from an established internal talent pipeline, mitigating some of this external supplier power.

- Specialized Baijiu Craftsmanship: The intricate processes of traditional baijiu making demand rare, time-tested skills in fermentation, distillation, and aging.

- Scarcity of Expertise: A limited number of master distillers and fermentation specialists exist, giving those with this knowledge considerable leverage.

- Internal Talent Development: Luzhou Lao Jiao's century-plus history fosters an internal training system, cultivating its own skilled workforce to reduce reliance on external hires.

The bargaining power of suppliers for Luzhou Lao Jiao is generally low due to the commodity nature of its primary inputs and its significant purchasing scale. While specialized yeast strains could pose a risk, internal expertise mitigates this. The company's established water sources and competitive packaging markets further limit supplier leverage.

In 2024, agricultural commodity prices, while subject to global factors, remained relatively stable for key baijiu ingredients like sorghum and rice, benefiting large buyers. The packaging sector continued to experience oversupply in many regions, keeping prices competitive for major purchasers. Labor, particularly for highly specialized baijiu craftsmanship, remains a critical area where skilled individuals or training institutions might hold some leverage, though Luzhou Lao Jiao's internal development programs address this.

| Input Category | Supplier Bargaining Power Assessment | Key Factors | Luzhou Lao Jiao's Mitigation |

|---|---|---|---|

| Agricultural Commodities (Sorghum, Rice) | Low | Diversified supplier base, commodity market, high volume purchasing | Economies of scale, long-term contracts |

| Specialized Yeast/Fermentation Agents | Potentially Moderate | Limited number of specialized providers | Internal R&D, proprietary yeast cultures |

| Packaging Materials (Bottles, Caps, Labels) | Low | Highly competitive market, numerous suppliers | Large procurement volume, negotiation power |

| Skilled Labor (Master Distillers) | Moderate to High | Scarcity of specialized, traditional skills | Internal training programs, historical knowledge retention |

What is included in the product

This analysis examines the competitive landscape for Luzhou Lao Jiao, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes within the baijiu industry.

Effortlessly analyze competitive intensity and identify strategic vulnerabilities within the Baijiu market, alleviating the pain of complex industry analysis.

Gain clear, actionable insights into market dynamics by visualizing the interplay of all five forces, simplifying strategic planning for Luzhou Lao Jiao.

Customers Bargaining Power

Customers in the premium baijiu market, especially for brands like Luzhou Lao Jiao's top-tier offerings, demonstrate significant brand loyalty. This loyalty stems from deep-rooted factors such as rich heritage, a consistent perception of high quality, and the social prestige associated with consuming these spirits. For instance, in 2023, Luzhou Lao Jiao reported revenue of ¥11.16 billion, with a substantial portion likely attributable to its premium lines, indicating strong consumer preference.

This unwavering loyalty directly curtails the bargaining power of these customers. Their reduced price sensitivity means they are less likely to demand discounts or switch to competitors based on minor price fluctuations. The brand's esteemed position, recognized as one of China's 'Four Great Baijiu', further solidifies this customer allegiance, making them less inclined to negotiate on price.

Luzhou Lao Jiao benefits from a wide array of sales avenues, encompassing direct sales, a network of distributors, numerous retail outlets, and burgeoning e-commerce channels, both within China and on the global stage. This multi-faceted strategy is crucial in mitigating the risk of any single channel or significant buyer group wielding undue influence over pricing or terms. For instance, by leveraging platforms like JD.com and Tmall, Luzhou Lao Jiao directly engages with consumers, thereby strengthening its brand control and pricing power.

While large distributors might exert some influence due to their volume purchases, the ultimate consumer base for Luzhou Lao Jiao is highly fragmented. This means individual consumers, even those opting for premium baijiu, possess very little direct bargaining power.

Luzhou Lao Jiao's strategy focuses on building a strong brand connection with this vast and diverse consumer market. By effectively reaching and influencing millions of individual buyers, the company mitigates the limited individual bargaining power.

Impact of Economic Conditions on Discretionary Spending

During economic downturns, consumers often curb spending on non-essential items, a trend that can heighten price sensitivity for premium products like Luzhou Lao Jiao's baijiu. For instance, in 2023, while China's overall retail sales saw growth, the pace of recovery in discretionary categories remained a focal point for analysts.

However, the demand for premium baijiu in China exhibits a degree of resilience, largely due to its cultural significance in gifting and celebratory banquets, which are less impacted by short-term economic fluctuations. This cultural underpinning provides a buffer against drastic demand shifts, even when economic conditions tighten.

Luzhou Lao Jiao's robust brand equity plays a crucial role in maintaining customer loyalty and demand, even amidst economic headwinds. The company reported revenue of approximately RMB 12.4 billion in the first three quarters of 2023, indicating sustained consumer interest in its premium offerings.

- Economic Sensitivity: Reduced discretionary spending during downturns can increase price sensitivity for premium baijiu.

- Cultural Resilience: Gifting and banquet culture in China sustains demand for premium baijiu, mitigating some economic impact.

- Brand Strength: Luzhou Lao Jiao's strong brand helps maintain demand and customer loyalty in challenging economic periods.

- Financial Performance: The company's revenue performance, such as the RMB 12.4 billion in Q1-Q3 2023, reflects the ongoing demand for its products.

Availability of Alternative Premium Spirits

While baijiu holds a distinct cultural position, consumers in 2024 have a wide array of premium alcoholic beverages to choose from, including fine wines, aged whiskies, and cognacs. This broad availability of premium spirits, even if not perfect substitutes for baijiu, empowers customers by offering alternatives should baijiu prices escalate or its perceived value decline.

For instance, the global premium spirits market, excluding baijiu, saw significant growth. In 2023, the premium and super-premium segments of the global whiskey market alone were projected to reach over $25 billion, indicating a strong consumer willingness to spend on alternatives.

- Global Premium Spirits Market: The premium and super-premium segments of the global spirits market are experiencing robust growth, offering consumers diverse high-value options beyond baijiu.

- Consumer Choice: The availability of premium wines, whiskies, and brandies provides consumers with alternatives, mitigating the impact of potentially rising baijiu prices or diminished value propositions.

- Cultural Significance vs. Price: While baijiu's deep cultural roots often insulate it from direct price competition, significant price hikes could still push a segment of consumers toward premium international spirits.

- Market Dynamics: The increasing globalization of tastes and accessible international distribution channels in 2024 mean that premium baijiu producers must remain mindful of the competitive landscape of other luxury beverages.

The bargaining power of customers for Luzhou Lao Jiao is generally low, primarily due to strong brand loyalty and the cultural significance of premium baijiu. While economic downturns might increase price sensitivity, the ingrained gifting and celebratory culture in China provides a resilient demand for these premium spirits. Furthermore, the availability of diverse global premium beverages in 2024 offers consumers alternatives, but Luzhou Lao Jiao's established brand equity and extensive distribution network help to mitigate significant customer price pressure.

| Factor | Impact on Bargaining Power | Supporting Data/Observation (2023-2024) |

|---|---|---|

| Brand Loyalty & Heritage | Lowers Customer Power | Luzhou Lao Jiao's strong brand perception and heritage foster deep consumer allegiance. Revenue of ¥11.16 billion in 2023 underscores consistent demand for premium lines. |

| Fragmented Consumer Base | Lowers Customer Power | While individual consumers have limited power, the vastness of the market means no single buyer can dictate terms. Millions of individual buyers are influenced through extensive sales channels. |

| Availability of Alternatives | Potentially Increases Customer Power | The global premium spirits market (e.g., whiskey valued over $25 billion in 2023) offers alternatives, giving consumers options if baijiu prices rise significantly. |

| Cultural Significance | Lowers Customer Power | Baijiu's role in gifting and celebrations provides demand resilience even during economic slowdowns, as seen in continued revenue growth in late 2023. |

Same Document Delivered

Luzhou Lao Jiao Porter's Five Forces Analysis

This preview shows the exact Luzhou Lao Jiao Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. The detailed breakdown covers the industry's competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. This comprehensive assessment is crucial for understanding the strategic positioning and future outlook of Luzhou Lao Jiao in the baijiu market.

Rivalry Among Competitors

The Chinese baijiu market is a battlefield of giants, with Luzhou Lao Jiao facing intense rivalry from established brands like Kweichow Moutai, Wuliangye, and Yanghe. These four titans, often referred to as the 'Four Great Baijiu' brands, are locked in a perpetual struggle for market dominance, premium shelf space, and the attention of discerning consumers. This fierce competition fuels aggressive marketing campaigns and a relentless drive for product innovation, as each player strives to differentiate and capture a larger slice of the lucrative baijiu pie.

Baijiu production, particularly for premium brands, demands substantial upfront investment in traditional fermentation facilities. These high fixed costs, combined with the lengthy aging process for premium spirits, mean a significant amount of capital is locked away for years. For instance, in 2024, the baijiu industry continued to see major players like Kweichow Moutai and Wuliangye investing heavily in upgrading and expanding their production capacities, reflecting these ongoing fixed cost pressures.

This considerable capital tied up in inventory and production infrastructure naturally leads to high exit barriers. Companies must strive to maintain high sales volumes to cover these costs and generate returns, fostering an environment of intense competition. In 2023, the average inventory holding period for many baijiu companies remained elevated, underscoring the challenge of managing aged stock and the pressure to sell.

Competitive rivalry within the Chinese baijiu industry, including for Luzhou Lao Jiao, is intensely fueled by brand heritage and product differentiation. Companies often compete by highlighting their long histories and unique, traditional production methods, such as centuries-old fermentation techniques that are core to Luzhou Lao Jiao's identity. This creates a narrative battle where brands emphasize their craftsmanship and historical legacy to capture consumer loyalty.

Luzhou Lao Jiao, with its over 300-year history, effectively uses its deep heritage and established reputation for quality to stand out. Competitors like Kweichow Moutai and Wuliangye also leverage their own rich histories and distinctive production processes, such as Moutai's unique soil and climate-dependent brewing. This focus on heritage and unique selling propositions means that differentiation is less about price and more about the story and perceived authenticity behind the product.

Distribution Network and Market Reach

Competitive rivalry in the baijiu industry, particularly for established players like Luzhou Lao Jiao, significantly centers on the crucial aspect of distribution networks and market reach. Companies fiercely compete not just on product quality but also on their ability to efficiently get their products to consumers, both within China and in burgeoning international markets.

This competition extends to securing and optimizing these distribution channels. Companies vie to expand their market reach, cultivate robust relationships with distributors and retailers, and strengthen their presence across diverse sales channels, from traditional brick-and-mortar stores to e-commerce platforms. By 2024, the baijiu market saw continued investment in logistics and supply chain enhancements to ensure widespread availability, a critical differentiator.

- Dominance in Domestic Distribution: Companies like Luzhou Lao Jiao leverage extensive networks built over decades, ensuring their products are readily available in key provinces and cities across China.

- International Expansion Efforts: While still a smaller portion of overall sales, rivalry exists in establishing footholds in export markets, requiring adaptation to local tastes and distribution norms.

- E-commerce Integration: The rise of online sales channels in 2023 and 2024 has intensified competition, with brands investing in digital marketing and direct-to-consumer strategies.

- Logistical Efficiency: Companies that can manage complex supply chains and maintain product freshness and availability across vast distances gain a significant competitive edge.

Innovation in Product Lines and Marketing

Luzhou Laojiao, like other major baijiu producers, actively innovates its product lines and marketing to stay competitive. This involves launching new offerings and refreshing packaging to appeal to evolving consumer tastes. For instance, in 2023, the company continued to focus on its premium "Luzhou Laojiao" brand while exploring opportunities in other market segments.

Marketing strategies are also key, with campaigns designed to attract younger demographics and expand reach into less developed, lower-tier cities. This dynamic approach aims to differentiate brands and capture market share amidst intense rivalry.

The company's efforts to connect with younger consumers are crucial, as the traditional baijiu market faces demographic shifts. Innovative packaging, such as smaller, more portable bottle sizes, and digital marketing initiatives are employed to resonate with this group.

In 2024, expect continued investment in brand building and product development to address changing consumer preferences and maintain a strong competitive position.

The competitive rivalry for Luzhou Lao Jiao is fierce, dominated by established giants like Kweichow Moutai and Wuliangye, creating a highly concentrated market. These major players, often called the 'Four Great Baijiu' brands, engage in aggressive marketing and product innovation to secure market share and premium placement. High fixed costs associated with traditional production and aging, coupled with significant capital tied up in inventory, create high exit barriers, intensifying the pressure to maintain sales volumes.

Brand heritage and unique production methods are key battlegrounds, with companies like Luzhou Lao Jiao emphasizing their centuries-old techniques and historical legacy to build consumer loyalty. Differentiation is driven by perceived authenticity and storytelling rather than price alone, as established brands leverage their rich histories and craftsmanship.

Distribution network strength is another critical area of competition, with companies vying for extensive market reach within China and expanding into international markets. By 2024, investment in logistics and supply chain enhancements was crucial for ensuring widespread product availability, with e-commerce integration becoming an increasingly important competitive factor.

Product line innovation and targeted marketing are essential for Luzhou Lao Jiao to navigate evolving consumer tastes and demographic shifts. Initiatives like new product launches, refreshed packaging, and digital marketing campaigns are employed to attract younger consumers and maintain a strong competitive edge in the dynamic baijiu market.

| Key Competitor | 2023 Revenue (CNY Billions) | Market Share (Approximate) | Key Differentiator |

|---|---|---|---|

| Kweichow Moutai | 129.90 | ~20% | Ultra-premium positioning, strong brand equity |

| Wuliangye | 74.38 | ~12% | Diverse product portfolio, strong distribution |

| Yanghe | 32.20 | ~5% | Regional strength, focus on mid-to-high end |

| Luzhou Lao Jiao | 11.52 | ~2% | Long heritage, emphasis on traditional brewing |

SSubstitutes Threaten

Other alcoholic beverages like wine, beer, whiskey, vodka, and brandy represent the most direct substitutes for baijiu. While baijiu enjoys a strong cultural standing, especially for formal events in China, consumers, particularly younger demographics, are increasingly choosing these alternatives for more casual social settings or due to evolving taste preferences. The global spirits market is vast, with Western spirits seeing a significant rise in appeal.

In 2023, the global alcoholic beverage market was valued at over $1.5 trillion, with beer and wine holding substantial market shares. This indicates a broad landscape of consumer choices available to drinkers. The increasing availability and marketing of imported spirits in China, for instance, directly challenge baijiu's traditional dominance, especially among younger Chinese consumers who are more exposed to international trends.

Consumers increasingly opt for non-alcoholic beverages like premium teas, juices, and sparkling drinks for social events or health-conscious reasons. These alternatives vie for consumer budgets and focus within the wider beverage market. For premium baijiu, particularly its traditional consumption occasions, this threat is generally considered low, as the ritual and cultural significance of baijiu is distinct. However, the global non-alcoholic beverage market was projected to reach over $1.1 trillion in 2024, indicating a substantial and growing competitive landscape for discretionary spending.

Baijiu's consumption is intrinsically linked to Chinese cultural practices, making it the preferred choice for formal banquets, crucial business negotiations, and significant celebrations. This deep cultural embedding acts as a powerful deterrent against immediate substitution for these specific social contexts.

Consumers often select baijiu for reasons extending beyond its flavor profile, embracing its inherent symbolic value and its role in facilitating social connections. This cultural weight significantly diminishes the perceived substitutability of other beverages in traditional settings.

For instance, while other alcoholic beverages exist, they often fail to replicate the social gravitas and tradition associated with baijiu at high-level business dinners or important family reunions, a sentiment reinforced by market trends showing continued preference for baijiu in these scenarios. In 2023, the baijiu market in China was valued at over $150 billion, demonstrating its entrenched position.

Changing Consumer Preferences

Evolving consumer tastes present a significant threat of substitutes for Luzhou Lao Jiao. Younger demographics, in particular, are showing a growing openness to international beverages, viewing traditional baijiu as potentially dated. This shift in preference could lead consumers to opt for alternatives like craft beers, premium spirits, or even non-alcoholic options, thereby reducing demand for baijiu.

To counter this, Luzhou Lao Jiao must strategically adapt by balancing its rich heritage with modern appeal. Initiatives focused on innovation in product development and marketing are crucial. For instance, exploring baijiu-based cocktails or creating lighter, more accessible variants could resonate with a broader audience. In 2023, the global spirits market saw continued growth in premium and craft categories, indicating a consumer desire for unique and sophisticated beverage experiences that Luzhou Lao Jiao can tap into.

- Shifting Demographics: Younger consumers (Gen Z and Millennials) are increasingly exploring diverse beverage options beyond traditional spirits, potentially impacting baijiu consumption.

- International Beverage Appeal: Global trends show a rise in the popularity of imported wines, whiskies, and gins, offering direct substitutes for consumers seeking variety.

- Perception of Tradition: Baijiu's traditional image, while a strength, can also be a barrier for younger consumers who may associate it with older generations or specific cultural contexts.

- Health and Wellness Trends: Growing consumer focus on health may lead to a preference for lower-alcohol or healthier beverage alternatives, posing a threat to high-alcohol content spirits like baijiu.

Health and Wellness Trends

The increasing global focus on health and wellness presents a significant indirect threat of substitution for Luzhou Lao Jiao. As consumers become more health-conscious, there's a growing tendency to reduce or eliminate alcohol consumption altogether, favoring healthier lifestyle choices. This shift can impact demand across the entire alcohol industry, including traditional spirits like baijiu.

This trend is not limited to specific demographics or regions. For example, in 2024, a significant portion of consumers, particularly younger generations, are actively seeking out non-alcoholic or low-alcohol beverage alternatives. Studies indicate a growing preference for functional beverages and wellness drinks, which directly compete with alcoholic options for consumer spending and attention.

The threat is amplified by the wide availability of substitutes. Consumers can easily opt for water, juices, herbal teas, or specialized health drinks, all of which align with a wellness-oriented lifestyle. This broadens the competitive landscape beyond just other alcoholic beverages, as the fundamental choice becomes between consuming alcohol and prioritizing health.

Consider these points regarding the threat of substitutes:

- Growing Health Consciousness: A global surge in consumer awareness regarding physical and mental well-being leads to a potential reduction in overall alcohol consumption.

- Alternative Beverages: Consumers are increasingly choosing non-alcoholic or low-alcohol options, including functional beverages and natural health drinks, over traditional spirits.

- Market Data: In 2024, the global non-alcoholic beverage market is projected to continue its robust growth, indicating a sustained consumer shift away from alcoholic products.

- Indirect Competition: This trend represents an indirect competitive threat, as it influences consumer choices at a fundamental level of lifestyle preference rather than through direct product competition within the spirits category.

While baijiu holds strong cultural significance, other alcoholic beverages like wine, beer, and Western spirits present a direct substitution threat, especially among younger consumers seeking variety and international trends. The global alcoholic beverage market, exceeding $1.5 trillion in 2023, highlights the vast array of consumer choices available, with imported spirits gaining traction in China.

Non-alcoholic options, such as premium teas and functional beverages, also compete for consumer attention and spending, particularly with the growing health and wellness movement. The global non-alcoholic beverage market projected to surpass $1.1 trillion in 2024 underscores this indirect competition.

Luzhou Lao Jiao faces a threat from evolving consumer tastes, particularly among younger demographics drawn to international beverages. To counter this, the company can innovate with baijiu-based cocktails or lighter variants, tapping into the global spirits market's growth in premium and craft categories, which was valued significantly in 2023.

| Substitute Category | Key Characteristics | Market Trend Relevance | Impact on Luzhou Lao Jiao |

|---|---|---|---|

| Western Spirits (Whiskey, Vodka, Gin) | International appeal, diverse flavor profiles, modern branding | Growing popularity among younger Chinese consumers, increasing import volumes. | Direct competition for social occasions and evolving preferences. |

| Wine & Beer | Lower alcohol content, perceived health benefits, established global markets | Significant market share in the global alcoholic beverage market (>$1.5 trillion in 2023). | Appeal to consumers seeking lighter or more casual alcoholic options. |

| Non-Alcoholic Beverages (Juices, Teas, Functional Drinks) | Health-focused, wellness-oriented, wide variety | Projected to exceed $1.1 trillion in 2024; aligns with global health trends. | Indirect competition for discretionary spending and lifestyle choices. |

Entrants Threaten

New companies looking to enter the premium baijiu market, like Luzhou Lao Jiao operates in, face immense financial hurdles. The extended aging process, critical for developing the nuanced flavors expected in high-end baijiu, can tie up capital for years, sometimes decades. For instance, a new entrant would need to invest heavily in inventory that might not generate revenue for a significant period, impacting cash flow dramatically.

Beyond inventory, establishing the necessary infrastructure for traditional fermentation and distillation is incredibly capital-intensive. Building and maintaining specialized cellars that ensure consistent quality and the required aging conditions demands substantial upfront investment. This, coupled with the long lead times for product development and brand building in a market that values heritage and tradition, creates a very high barrier to entry.

Luzhou Lao Jiao, like other established baijiu producers, possesses centuries of heritage, fostering unparalleled brand recognition. This deep historical connection translates into significant consumer trust and loyalty, a formidable barrier for newcomers. New entrants simply cannot replicate this ingrained legitimacy, a critical factor in a market that highly values tradition and perceived quality. Building such enduring brand equity requires generations, far exceeding the reach of mere marketing investment.

The production of premium baijiu, like that of Luzhou Laojiao, relies on intricate, age-old fermentation and distillation methods. These techniques are often closely guarded secrets, passed down through families, creating a substantial barrier of expertise for newcomers. The difficulty in replicating these processes, coupled with the need for specific environmental conditions, significantly deters potential entrants.

Established Distribution Networks

Established distribution networks represent a significant barrier for new entrants aiming to compete in the baijiu market, particularly for a company like Luzhou Lao Jiao. These existing players have cultivated deep relationships with a vast array of distributors, retailers, and burgeoning e-commerce platforms, often spanning decades. Building a comparable reach would require substantial investment and time, making it difficult for newcomers to gain traction and secure essential shelf space or online visibility.

Newcomers face immense challenges in replicating the extensive reach that companies like Luzhou Lao Jiao already command. For instance, the baijiu market in China is highly fragmented at the retail level, with thousands of small shops and specialized liquor stores. Luzhou Lao Jiao’s established presence in these channels, supported by strong brand recognition and consistent demand, means that new products would struggle to gain immediate access and consumer awareness.

- Extensive Retail Penetration: Luzhou Lao Jiao reportedly has a presence in over 1.5 million retail outlets across China, a figure that would be prohibitively expensive and time-consuming for a new entrant to match.

- E-commerce Integration: Beyond traditional retail, established brands have leveraged partnerships with major e-commerce players like JD.com and Tmall, securing prime placement and promotional opportunities.

- Logistical Prowess: The sheer scale of distribution also implies sophisticated logistics and supply chain management, ensuring product availability and freshness, a capability new entrants would need years to develop.

- Brand Loyalty and Visibility: Existing networks reinforce brand visibility and loyalty, making it harder for unknown brands to break through the clutter and attract consumer attention at the point of sale.

Regulatory Hurdles and Quality Standards

The Chinese alcoholic beverage sector, particularly baijiu, faces significant regulatory challenges. New companies must contend with rigorous production protocols, stringent quality control measures, and obtaining the necessary operational licenses. Meeting these high standards is crucial for building consumer confidence and ensuring legal compliance, effectively deterring less prepared entrants.

For instance, in 2023, the China National Light Industry Council emphasized stricter quality oversight across the beverage industry, a trend likely to continue and intensify. This regulatory framework acts as a substantial barrier, especially considering the cultural significance and established reputation of traditional baijiu brands like Luzhou Lao Jiao.

- Stringent Licensing: Obtaining and maintaining production and sales licenses in China can be a lengthy and complex process.

- Quality Control Mandates: Adherence to evolving national and regional quality standards is non-negotiable for market entry.

- Cultural Sensitivity: Baijiu's deep cultural roots demand adherence to traditional production methods and quality expectations.

- Enforcement Trends: Increased government focus on food and beverage safety, as seen in recent years, means regulatory scrutiny is likely to grow.

The threat of new entrants into the premium baijiu market, where Luzhou Lao Jiao operates, is significantly mitigated by extremely high capital requirements. New players must invest heavily in long-term inventory for aging, which can take years or even decades to mature, tying up substantial capital. Building the specialized infrastructure for traditional fermentation and distillation, along with establishing the necessary cellars for aging, demands massive upfront investment, making it difficult for newcomers to compete.

Established brands like Luzhou Lao Jiao benefit from centuries of heritage and deep-rooted consumer trust, creating a formidable barrier to entry. This ingrained legitimacy and brand equity, built over generations, cannot be easily replicated by new entrants through marketing alone. Furthermore, the proprietary, age-old production techniques are often closely guarded secrets, presenting a significant challenge in replicating the unique quality and flavor profiles that consumers expect from premium baijiu.

Existing players possess highly developed distribution networks, with decades-long relationships with retailers and e-commerce platforms, making it difficult for new entrants to secure shelf space and visibility. For instance, Luzhou Lao Jiao's extensive retail penetration, reportedly reaching over 1.5 million outlets in China, highlights the logistical and financial hurdles a newcomer would face. Navigating stringent regulatory protocols, licensing, and evolving quality control mandates further deters potential entrants, especially with increased government oversight on food and beverage safety.

| Barrier Type | Description | Impact on New Entrants | Example for Luzhou Lao Jiao |

|---|---|---|---|

| Capital Requirements | High investment needed for aging inventory and production infrastructure. | Significantly deters new players due to long return periods and upfront costs. | Decades of aging baijiu require immense working capital. |

| Brand Loyalty & Heritage | Centuries of tradition foster trust and loyalty, difficult to replicate. | New entrants struggle to build comparable brand equity and consumer confidence. | Unmatched historical recognition and perceived quality. |

| Distribution Networks | Established relationships with retailers and e-commerce platforms. | New companies face challenges in gaining market access and visibility. | Presence in over 1.5 million retail outlets across China. |

| Proprietary Technology | Closely guarded, age-old fermentation and distillation secrets. | Difficulty in replicating unique production methods and flavor profiles. | Unique, time-tested baijiu production techniques. |

| Regulatory Hurdles | Stringent production protocols, licensing, and quality control. | Adds complexity and cost, deterring less prepared entrants. | Adherence to evolving Chinese beverage industry quality standards. |

Porter's Five Forces Analysis Data Sources

Our Luzhou Lao Jiao Porter's Five Forces analysis utilizes a comprehensive dataset including company annual reports, industry-specific market research from firms like Euromonitor, and government statistics on the Chinese alcoholic beverage market. This ensures a robust understanding of the competitive landscape.