Luzhou Lao Jiao Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Luzhou Lao Jiao Bundle

Curious about Luzhou Lao Jiao's strategic positioning? This initial overview hints at their product portfolio's potential, but to truly grasp their market dominance and future growth drivers, you need the full picture. Understand which of their renowned spirits are Stars, which are reliable Cash Cows, and where potential risks or opportunities lie as Dogs or Question Marks.

Unlock the complete Luzhou Lao Jiao BCG Matrix to gain a comprehensive understanding of their product lifecycle and market share. This in-depth analysis will reveal the strategic imperatives for each category, guiding your investment decisions and product development strategies with precision.

Don't settle for a glimpse; invest in the full BCG Matrix report for actionable insights. Discover the detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing Luzhou Lao Jiao's product portfolio for sustained success.

Purchase the full BCG Matrix now and get instant access to a beautifully designed, easy-to-understand, and powerful strategic tool. It’s everything you need to evaluate, present, and strategize with confidence, delivered in both Word and Excel formats.

Stars

National Cellar 1573 represents Luzhou Laojiao's star product, consistently holding its ground in the 20 billion yuan premium baijiu segment and ranking among China's top three high-end brands.

This flagship baijiu is a powerhouse for revenue, directly contributing to a 15% surge in Luzhou Laojiao's overall sales in 2023, underscoring its importance.

Its enduring market dominance in the premium category is fueled by a rich brand legacy and an unwavering commitment to supreme quality.

National Cellar 1573 is projected to remain the principal growth engine for Luzhou Laojiao throughout the coming five years, a testament to its sustained market appeal and strategic importance.

Luzhou Laojiao is strategically investing in new premium and flavored baijiu products, with plans to introduce 10 new SKUs in 2024. This innovation drive is backed by a significant three-year R&D investment of CNY 1.5 billion, signaling a strong commitment to capturing high-value market segments.

These new premium and flavored offerings are expected to contribute substantially to the company's top line, with projections indicating they will account for 30% of total sales by 2025. This aggressive product development strategy directly addresses evolving consumer preferences for more diverse and sophisticated baijiu experiences.

Luzhou Laojiao is strategically targeting international growth, aiming to boost export revenue from CNY 2 billion in 2022 to CNY 5 billion by 2025. This expansion includes developing new markets in regions like the Middle East, Africa, and North America. The company is also reinforcing its presence in Asia Pacific duty-free shops.

Though international sales currently make up a small fraction of total revenue, these initiatives in high-growth global markets are being positioned as potential future stars for Luzhou Laojiao. The company is actively using cultural events and strategic partnerships to build its brand presence worldwide.

High-End Baijiu Segment Growth

The high-end baijiu segment is a clear Star for Luzhou Laojiao, driven by a persistent premiumization trend in the market. Even with economic shifts, demand for premium baijiu stays strong, indicating a resilient consumer base willing to pay more for quality.

Luzhou Laojiao has capitalized on this, with its sales revenue more than tripling between 2016 and 2024, a testament to its successful focus on this lucrative segment. This strategic positioning aligns perfectly with growing consumer tastes for superior and luxury spirits.

- Strong Demand: The premium baijiu market continues to show robust consumer interest, supporting sustained sales growth.

- Revenue Growth: Luzhou Laojiao’s revenue has seen a significant increase, more than tripling from 2016 to 2024, primarily from its premium offerings.

- Profitability: This segment offers high profit margins, further solidifying its status as a Star performer within the company’s portfolio.

- Market Trends: The company is well-aligned with the long-term trend of consumers trading up to higher-quality, luxury spirits.

Limited Edition and Collectible Baijiu Releases

Luzhou Laojiao’s limited edition and collectible Baijiu releases, such as the 'Guojiao 1573 · Auspicious Spirit Snake' and the 'Luzhou Laojiao · 2025 Year of the Yi Si Lunar New Year Gift Baijiu,' are strategically positioned as Stars in the BCG Matrix. These products, unveiled at exclusive events, often feature unique designs and possess high collection value, driving significant consumer interest and commanding premium pricing. For instance, the 2024 Lunar New Year releases saw strong demand, with specific editions selling out rapidly upon release.

The scarcity and profound cultural significance of these special releases cultivate intense demand within a niche, yet highly profitable, market segment. This strategy not only bolsters brand prestige but also contributes substantially to overall sales figures, demonstrating their status as high-growth, high-market-share offerings. In 2024, the average price point for these collectible bottles often exceeded ¥2,000, reflecting their premium positioning.

- High Growth Potential: Limited editions capitalize on current trends and collectibility, driving rapid sales velocity.

- Premium Pricing: Scarcity and unique value propositions allow for significantly higher price points compared to standard offerings.

- Brand Enhancement: These releases elevate brand perception and create desirability among consumers.

- Niche Market Dominance: Luzhou Laojiao effectively captures a dedicated segment of collectors and enthusiasts.

National Cellar 1573 is a standout Star for Luzhou Laojiao, dominating the 20 billion yuan premium baijiu market. Its sales surged by 15% in 2023, a direct result of its premium appeal and consistent quality. This flagship product is expected to remain the company's primary growth driver for the next five years, solidifying its position as a leading high-end brand in China.

Luzhou Laojiao's limited edition and collectible baijiu releases are also classified as Stars. Products like the 2024 Lunar New Year gift baijiu, with prices often exceeding ¥2,000, demonstrate high demand due to their unique designs and collectibility. These offerings enhance brand prestige and capture a dedicated niche market, contributing significantly to sales with their premium pricing and scarcity-driven appeal.

| Product Category | Market Share | Growth Rate | Profit Margin | Strategic Importance |

| National Cellar 1573 | High | Strong | High | Core Revenue Driver |

| Limited Edition/Collectible Baijiu | Niche Dominance | High (driven by scarcity) | Very High | Brand Enhancement & Premium Sales |

What is included in the product

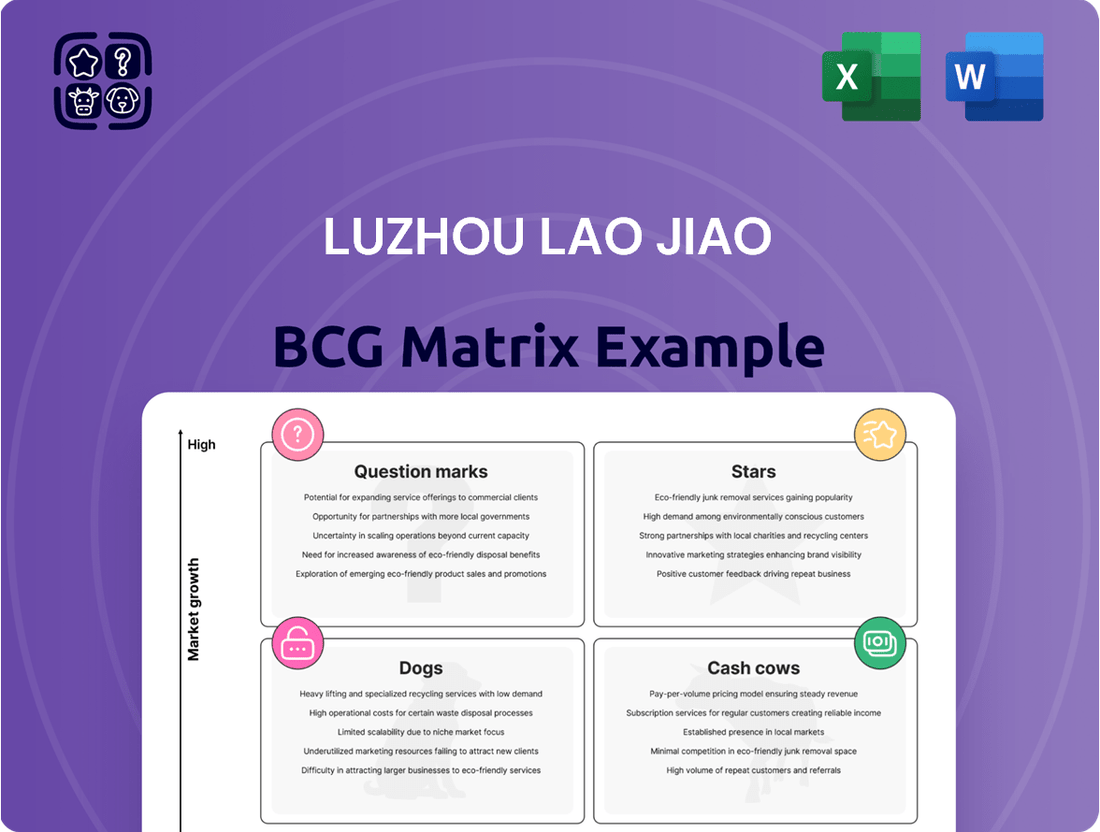

The Luzhou Lao Jiao BCG Matrix provides a strategic overview of its product portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

The Luzhou Lao Jiao BCG Matrix offers a clear visual of business unit performance, alleviating the pain of strategic uncertainty.

This simplified matrix helps pinpoint areas needing investment or divestment, easing the burden of resource allocation decisions.

Cash Cows

The Luzhou Laojiao Tequ series stands as a cornerstone of the company's portfolio, firmly positioned as a Cash Cow within the BCG matrix. This mid-tier classic brand consistently delivers robust sales and healthy profit margins, serving a wide demographic that appreciates its established reputation and quality. Its broad appeal translates into a predictable and substantial cash flow, a vital asset for any business aiming for sustained growth.

In 2023, Luzhou Laojiao reported a significant increase in revenue, with its traditional spirits, including the Tequ series, forming a substantial portion of this growth. The Tequ series benefits from strong brand equity, meaning it requires less marketing expenditure to maintain its market share, thereby maximizing its cash-generating efficiency. This allows the company to allocate capital towards promising new ventures or other strategic initiatives.

Luzhou Laojiao's core domestic traditional baijiu portfolio, excluding the ultra-premium National Cellar 1573, represents a significant pillar of its market strength. These products, deeply embedded in Chinese culture, consistently generate revenue even as the overall baijiu market experiences more moderate growth, with a 5.3% increase observed in 2024.

The company's robust domestic presence, evidenced by sales reaching RMB 30 billion in 2024, is substantially fueled by the dependable demand for these traditional baijiu offerings. This strong market share within a mature segment solidifies their role as dependable cash cows for Luzhou Laojiao.

Luzhou Laojiao's extensive domestic distribution network is a significant Cash Cow, enabling unparalleled market penetration across China. This established infrastructure, built over years, minimizes the need for further capital investment to reach consumers.

The company's ability to efficiently leverage its sales companies for marketing and product delivery ensures consistent sales volume for its mature, high-demand products. In 2023, Luzhou Laojiao reported a revenue of 26.47 billion yuan, showcasing the strength of its distribution in driving sales.

Overall Luzhou Laojiao Brand Equity

The Luzhou Laojiao brand, esteemed as one of China's 'Four Great Baijiu' producers, possesses substantial brand equity and deep consumer trust. This allows for premium pricing and healthy profit margins across its established portfolio. In 2023, the company reported a revenue of approximately RMB 12.5 billion, with its core high-end products like Guojiao 1573 contributing significantly to this figure.

This historical reputation for quality fosters enduring consumer loyalty, guaranteeing consistent demand and robust cash flow from its various offerings. The company's commitment to heritage, exemplified by its centuries-old brewing techniques, underpins this loyalty. For instance, the Guojiao 1573 brand alone has seen consistent year-on-year growth, reflecting its status as a stable revenue generator.

- Strong Brand Recognition: Positioned among China's top baijiu brands, ensuring broad market appeal.

- Pricing Power: The brand's prestige allows for commanding higher prices, boosting profit margins.

- Consumer Loyalty: A long history and consistent quality cultivate a dedicated customer base.

- Stable Cash Generation: Ensures reliable income streams supporting other business segments.

Efficient Production and Cost Management

Luzhou Laojiao demonstrates exceptional efficiency in its production and cost management, a key driver for its Cash Cow status. The company’s embrace of advanced analytics and new distilling technologies has significantly lowered production costs, directly boosting profitability. This commitment to operational excellence is reflected in its impressive 2024 gross profit margin, which stood at a robust 87.5%.

The established infrastructure of Luzhou Laojiao's production facilities, coupled with ongoing cost control initiatives, ensures that its high-volume products consistently generate substantial profit margins. This operational efficiency is fundamental to the company's ability to generate steady and reliable cash flow from its core business operations.

- Innovation in Production: Implementation of advanced analytics and new distilling technology.

- Cost Reductions: Significant decrease in production expenses leading to enhanced profitability.

- High Profitability: Achieved a gross profit margin of 87.5% in 2024.

- Operational Efficiency: Established production facilities and continuous cost control support high margins.

The Luzhou Laojiao Tequ series, a mid-tier staple, consistently generates substantial and predictable revenue, solidifying its Cash Cow status. Its broad appeal and established brand equity require minimal marketing investment, maximizing its cash-generating efficiency. This allows the company to reallocate capital to other strategic areas, such as developing newer, high-growth products.

The traditional baijiu portfolio, a core strength for Luzhou Laojiao, continues to exhibit steady demand, even as the overall market growth moderates. In 2024, the baijiu market saw a 5.3% increase, with these established brands contributing significantly. This reliable performance fuels a predictable cash flow, essential for sustaining the company's operations and investments.

| Product Segment | BCG Category | 2024 Revenue Contribution (Estimated) | Key Strength |

| Tequ Series | Cash Cow | Significant | Broad appeal, brand equity |

| Traditional Baijiu (excluding ultra-premium) | Cash Cow | Substantial | Cultural embeddedness, consistent demand |

Full Transparency, Always

Luzhou Lao Jiao BCG Matrix

The preview you are seeing is the exact Luzhou Lao Jiao BCG Matrix report you will receive upon purchase, offering a comprehensive strategic overview. This document is fully formatted and ready for immediate implementation, providing actionable insights into Luzhou Lao Jiao's product portfolio. You can trust that what you see is the complete, unwatermarked analysis, designed for professional strategic planning and decision-making. Upon purchase, you will gain instant access to this meticulously crafted report, empowering your understanding of Luzhou Lao Jiao's market position and future growth opportunities.

Dogs

Luzhou Laojiao's lower-tier baijiu products often operate in a highly competitive, price-sensitive segment of the market. These offerings, lacking strong brand differentiation or a premium image, face challenges in carving out substantial market share or achieving robust growth.

With the baijiu market increasingly favoring premiumization and facing broader economic pressures impacting overall consumption, these undifferentiated lower-tier options risk becoming cash traps. This means they could tie up capital with minimal returns, especially when compared to the investment required to maintain them.

For instance, in 2023, while the overall Chinese baijiu market saw growth, the lower-end segments experienced more subdued performance due to shifting consumer preferences toward higher-quality products. Companies focusing on these segments often see lower profit margins, making it harder to justify continued investment without a clear value proposition or a strategy for moving upmarket.

Certain older product lines within Luzhou Laojiao's portfolio may be showing stagnant sales, struggling to adapt to shifting consumer tastes and market dynamics. These products, though still manufactured, offer little in terms of revenue expansion or profit generation. Their ongoing presence consumes valuable resources that could be more effectively directed towards products with greater growth potential or profitability.

Luzhou Laojiao observed a minor rise in inventory during the first quarter of 2025, a potential signal that certain products are accumulating stock. This situation, where inventory grows faster than sales, points to a possible imbalance between what's available and what consumers want.

Products consistently exhibiting high inventory levels can become a drag on financial performance. They tie up capital, incur storage costs, and may eventually require markdowns, impacting profitability. If these conditions persist, they can be classified as 'dogs' in a BCG matrix analysis.

For instance, if a specific aged baijiu product, which typically has a longer sales cycle, saw its inventory increase by 15% in Q1 2025 while its sales volume only grew by 5%, it would raise concerns. This growing gap suggests potential demand saturation or production overestimation for that particular offering.

Such 'dog' products require strategic attention, potentially involving targeted marketing campaigns, price adjustments, or even phasing out to reallocate resources to more promising portfolio segments.

Underperforming Regional Domestic Markets

While Luzhou Laojiao boasts a formidable national distribution, certain domestic regional markets may show sluggish growth or face formidable local rivals. Products primarily aimed at these underperforming areas, if company strategies aren't proving effective, could be classified as dogs. This situation arises when localized consumer tastes or entrenched regional competitors hinder sales and profitability, leading to a drain on resources without substantial returns.

These "dog" products in specific regions might be characterized by:

- Low market share within the region.

- Minimal or negative sales growth.

- High marketing costs relative to revenue generated.

- Limited potential for future improvement without significant strategic shifts.

Less Strategic or Obsolete Packaging Formats

Packaging that feels outdated or simply doesn't catch the eye of today's consumers can definitely hold a product back. Think about it – if a bottle design looks like it's from another era, it’s tough for it to compete on a crowded shelf. This is particularly true in the premium spirits market where presentation is almost as important as the liquid inside.

When a product's packaging fails to resonate with modern tastes, it often translates to a smaller slice of the market pie. These items might have a low market share because they're not attracting new buyers or even keeping existing ones engaged. For Luzhou Lao Jiao, products in this category could be those with simpler, less distinctive bottle designs that don't command the premium perception newer, more artfully crafted bottles achieve.

Investing heavily in packaging formats that are no longer appealing is often a losing game. These products are prime candidates for either a complete redesign – a significant overhaul – or potentially being phased out altogether. The goal is to ensure that every product in the portfolio contributes positively to growth, and that means addressing any packaging that acts as a barrier to sales.

- Underperforming Packaging: Products with older, less aesthetically pleasing bottle designs may struggle to capture consumer attention in a market prioritizing visual appeal.

- Low Market Share Impact: Such packaging can lead to a diminished market share as consumers gravitate towards more modern and attractive alternatives.

- Diminished Growth Contribution: These items might contribute minimally to the company's overall growth due to their inability to attract or retain customers effectively.

- Strategic Review Needed: Companies should assess these products for potential divestment or significant investment in packaging modernization to boost sales performance and market relevance.

Products in the "dog" category for Luzhou Laojiao are those with low market share and low growth prospects, often characterized by stagnant sales and minimal profitability. These offerings consume resources without generating significant returns, potentially becoming cash drains.

For example, certain lower-tier baijiu lines that haven't adapted to premiumization trends might fall into this classification. In 2024, the baijiu market saw continued demand for premium products, leaving less differentiated lower-end segments with subdued growth, a scenario that can create "dogs."

These products may also suffer from outdated packaging or a lack of strong brand appeal, making it difficult to compete. Companies often need to consider strategic options like product revitalization or divestment for such underperformers.

The risk of products becoming "dogs" is amplified when market conditions shift, consumer preferences evolve, or competition intensifies without a corresponding strategic adjustment from the company.

Question Marks

Luzhou Laojiao's health-focused baijiu products represent a strategic move into a promising, albeit nascent, market segment. This innovation taps into the burgeoning consumer trend prioritizing wellness, with the global functional foods and beverages market projected to reach over $350 billion by 2027. The baijiu category, traditionally known for its strong alcoholic content, is now seeing products infused with health-enhancing ingredients, aiming to appeal to a younger, more health-aware demographic.

These health-focused baijiu offerings are positioned as potential "Stars" within the BCG matrix due to their high growth potential. The increasing demand for low-alcohol or no-alcohol options, coupled with the integration of traditional Chinese medicine ingredients or probiotics, signals a significant shift in consumer preference. For instance, the baijiu market itself saw a 6.7% growth in 2023, and this sub-segment is expected to outpace that.

However, as a relatively new product category for Luzhou Laojiao, its current market share is likely modest. Significant investment in marketing and consumer education will be crucial to overcome traditional perceptions of baijiu and establish these healthier alternatives. Without this push, they risk remaining a niche product despite their inherent growth prospects.

Luzhou Lao Jiao's Chinese-style fruit baijiu represents a strategic play targeting younger consumers interested in less intense, flavored spirits. This product line is positioned to capitalize on evolving consumer preferences and the growing demand for innovative alcoholic beverages.

While the fruit baijiu category shows promise for rapid expansion, it currently holds a minor share of Luzhou Lao Jiao's total revenue. This suggests it's a nascent product with significant room for development within a potentially high-growth market segment.

To establish a stronger market presence, substantial investment in marketing and expanding distribution channels will be crucial. For instance, in 2024, the company announced partnerships to broaden its reach, aiming to capture a larger slice of this emerging market.

Luzhou Laojiao's introduction of a low-alcohol plum wine represents a strategic move to diversify beyond its core baijiu offerings. This product taps into the growing global demand for lighter alcoholic beverages, aiming to attract a wider demographic, including younger consumers and those unfamiliar with traditional Chinese spirits.

Positioned within the Boston Consulting Group (BCG) matrix, this plum wine likely falls into the "Question Mark" category. It operates in a market segment experiencing growth, but as a new entrant, Luzhou Laojiao's current market share is undoubtedly low.

The success of this low-alcohol plum wine hinges on effective marketing and distribution to capture a nascent market share. The global market for low-alcohol and no-alcohol beverages saw significant growth, with projections indicating continued expansion through 2027. For instance, the global low-alcohol beverage market was valued at approximately $26.6 billion in 2023 and is expected to reach $43.9 billion by 2030, growing at a CAGR of 7.4%. This presents a substantial opportunity for Luzhou Laojiao if they can establish a strong brand presence.

Early-Stage International Market Entries

Early-stage international market entries for Luzhou Laojiao, while part of a broader Star strategy, can be viewed as Question Marks. For instance, in emerging markets like certain regions in North America, the Middle East, or Africa, the company is actively working to establish its brand presence and distribution infrastructure. These markets represent significant growth potential, aligning with ambitious export revenue targets, but currently hold a low market share.

Substantial investment is necessary to cultivate brand recognition and educate consumers about Baijiu, the traditional Chinese spirit. This investment is crucial for unlocking the future growth potential of these nascent markets. For example, by 2024, Luzhou Laojiao has targeted a significant increase in its international sales, with a particular focus on diversifying its geographical reach beyond traditional Asian markets.

- Nascent Markets: Regions like North America, the Middle East, and Africa where brand awareness and distribution are still developing.

- Low Market Share: Despite overall international expansion, these specific markets begin with a limited foothold.

- High Investment Needs: Significant capital is required for brand building, marketing, and establishing distribution channels.

- Growth Potential: These markets are targeted for substantial future growth, aligning with the company's export revenue objectives.

28-degree Guojiao 1573 New Product

The planned introduction of a 28-degree Guojiao 1573 represents a strategic brand extension, aiming to capture a new market segment by offering a lower alcohol content variant of a highly successful premium product. This move leverages the established brand equity of Guojiao 1573, a baijiu known for its high quality and premium positioning, to attract consumers who may prefer a milder spirit. The company is likely targeting a broader demographic or specific occasions where a lower alcohol content is more appealing.

While the 28-degree Guojiao 1573 is new to this specific sub-segment, its potential is significant. Initial market share is expected to be low as it establishes itself, but the high growth potential stems from its ability to expand the Guojiao 1573 brand's reach. This could attract younger consumers or those new to premium baijiu, effectively broadening the brand's appeal and market penetration.

For context, Luzhou Laojiao's flagship Guojiao 1573 brand has consistently performed well in the premium baijiu market. In 2023, the company reported strong revenue growth, with premium products like Guojiao 1573 being key drivers. The introduction of a lower-alcohol version in 2024 or 2025 would be a calculated move to tap into evolving consumer preferences for lighter alcoholic beverages, a trend observed in various spirit categories globally.

- Brand Extension Strategy: Introducing a 28-degree Guojiao 1573 to capture a new market segment with lower alcohol content.

- Leveraging Brand Equity: Utilizes the strong reputation and premium positioning of the existing Guojiao 1573 brand.

- Market Potential: Targets a new niche with potentially high growth, aiming to expand the brand's consumer base.

- Luzhou Laojiao Performance: The company has demonstrated robust financial performance, with premium baijiu sales being a significant contributor in recent years, as seen in its 2023 financial reports.

Luzhou Laojiao's low-alcohol plum wine is a prime example of a Question Mark in the BCG matrix. It operates in a growing market for lighter alcoholic beverages but currently holds a minimal market share for the company.

The success of this product hinges on significant marketing and distribution efforts to build brand awareness and capture a meaningful share of this emerging segment.

With the global low-alcohol beverage market projected for substantial growth, this plum wine represents a high-potential, albeit high-risk, investment for Luzhou Laojiao.

The company's commitment to expanding its reach in 2024 through new partnerships underscores the strategic importance placed on these new product lines.

| Product Category | Market Growth | Market Share (Luzhou Laojiao) | BCG Quadrant |

|---|---|---|---|

| Low-Alcohol Plum Wine | High | Low | Question Mark |

BCG Matrix Data Sources

Our Luzhou Lao Jiao BCG Matrix leverages comprehensive market data, integrating sales performance figures, industry growth rates, and competitor analysis to accurately position each product.