Deutsche Lufthansa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Lufthansa Bundle

Navigating the skies of global aviation requires a keen understanding of the external forces at play. Deutsche Lufthansa, a titan in the industry, is significantly influenced by political stability, economic fluctuations, and evolving social trends. Our meticulously researched PESTLE analysis dives deep into these critical factors, offering you a strategic advantage.

Discover how technological advancements are reshaping airline operations and customer expectations, and understand the environmental regulations that impact sustainability efforts. This comprehensive report provides actionable intelligence to anticipate challenges and seize opportunities.

Don't be left grounded by unforeseen changes; gain the foresight needed to steer your own business towards success. For a complete, in-depth understanding of the external landscape impacting Deutsche Lufthansa, download the full PESTLE analysis now and equip yourself with the knowledge to fly ahead.

Political factors

Government policies are a major force shaping Lufthansa's business. These include rules about who can fly where, how landing and takeoff slots are given out at busy airports, and which routes airlines are allowed to use. For instance, the EU's open skies policy has historically fostered competition, but bilateral agreements still dictate much of international air travel.

Shifts in these governmental regulations directly affect Lufthansa's ability to grow its network and operate smoothly. For example, stricter environmental regulations, like the EU Emissions Trading System (ETS) which began covering aviation in 2012 and has been expanded, can increase operating costs for airlines like Lufthansa. In 2023, the ETS for aviation saw allowances trading around €90 per tonne of CO2, impacting carriers operating within the EU.

Adhering to both national and international aviation laws is critical for Lufthansa to keep its operating licenses. This involves compliance with safety standards set by bodies like EASA (European Union Aviation Safety Agency) and ICAO (International Civil Aviation Organization). Lufthansa, as a major European carrier, must navigate a complex web of regulations that can influence everything from aircraft maintenance to passenger rights.

Geopolitical stability significantly influences Lufthansa's operational landscape. For instance, ongoing conflicts in Eastern Europe have led to airspace closures and rerouting, increasing operational costs and flight times. The stability of major markets like China and the United States, which represent significant passenger volumes for Lufthansa, is paramount for sustained demand.

Trade policies significantly shape Lufthansa's operational landscape. For instance, the European Union's commitment to open skies agreements facilitates seamless air travel and cargo movement across member states, a key advantage for a major European carrier. However, potential shifts towards protectionism, such as new tariffs on goods or stricter import/export regulations, could dampen demand for air cargo, a revenue stream for Lufthansa. In 2023, air cargo accounted for a substantial portion of airline revenues globally.

Government decisions on visa requirements and travel restrictions also have a direct bearing on passenger numbers. Stricter visa policies for key markets or sudden travel bans, as seen during past global health events, can drastically reduce international passenger traffic. Conversely, liberalized visa regimes and bilateral air service agreements enhance connectivity and boost travel demand, benefiting airlines like Lufthansa. The airline industry's recovery in 2024 is closely tied to the easing of such restrictions.

State Aid and Airline Bailouts

Airlines, including Deutsche Lufthansa, have historically relied on government support during severe downturns. For instance, during the COVID-19 pandemic, Lufthansa received a significant state aid package. This package, valued at €9 billion, was approved by the European Commission in June 2020, underscoring the substantial government intervention seen in the sector.

The prospect of future government assistance, and the stipulations tied to it, directly impacts Lufthansa's financial health and strategic planning. Such aid can alter the company's capital structure and influence competitive dynamics within the European aviation market. The European Union's evolving regulations on state aid are therefore a critical factor for Lufthansa's long-term operational stability and strategic flexibility.

- Lufthansa's €9 billion state aid package in 2020 highlights the reliance on government support during crises.

- EU regulations on state aid dictate the conditions under which airlines can receive financial assistance.

- Future state aid could impact Lufthansa's debt levels and strategic investment capacity.

- The competitive landscape is shaped by the varying degrees of government support provided to different European carriers.

Aviation Safety and Security Policies

Deutsche Lufthansa, like all major airlines, operates under a stringent framework of aviation safety and security policies. These regulations, constantly updated by entities such as the European Union Aviation Safety Agency (EASA) and the International Civil Aviation Organization (ICAO), dictate everything from aircraft maintenance schedules and pilot training standards to passenger screening procedures and the implementation of robust cybersecurity measures. Adherence isn't just a legal requirement; it's fundamental to maintaining operational integrity and public trust.

These evolving policies directly influence Lufthansa's financial performance and strategic planning. For instance, new cybersecurity mandates, aimed at protecting sensitive passenger data and preventing operational disruptions, necessitate significant investments in advanced IT infrastructure and personnel training. Similarly, enhancements in aircraft maintenance protocols or passenger screening technologies often translate into increased capital expenditure and operational costs. Lufthansa's ability to adapt efficiently to these regulatory shifts is crucial for managing its cost structure and ensuring seamless operations in a highly competitive market.

Consider the impact of enhanced security measures: in 2023, global spending on aviation security technologies was projected to reach billions, a figure expected to grow as threats evolve. Lufthansa must allocate substantial resources to comply with these advancements, potentially affecting its profitability margins. The airline's commitment to safety is also reflected in its operational metrics; for example, maintaining a high on-time performance (OTP) often correlates with effective safety and security protocols, which in turn impacts customer satisfaction and loyalty.

- EASA's 2024-2025 focus on sustainable aviation fuels and noise reduction mandates increased investment in fleet modernization and operational adjustments for Lufthansa.

- ICAO's ongoing efforts to standardize global aviation security, including advanced threat detection, require Lufthansa to invest in new screening technologies and training programs.

- Cybersecurity regulations are increasingly stringent, pushing airlines like Lufthansa to allocate significant portions of their IT budgets towards data protection and network security infrastructure.

- The cost of compliance with evolving safety regulations, such as updated maintenance procedures or pilot fatigue management rules, directly impacts Lufthansa's operational expenses and potentially its pricing strategies.

Government policies significantly influence Lufthansa's operations, from route access to environmental mandates. For example, the EU's Emissions Trading System (ETS) directly impacts operational costs, with allowances trading around €90 per tonne of CO2 in 2023. Lufthansa must also navigate complex safety regulations from bodies like EASA and ICAO to maintain its operating licenses, ensuring compliance with standards that affect everything from maintenance to passenger rights.

What is included in the product

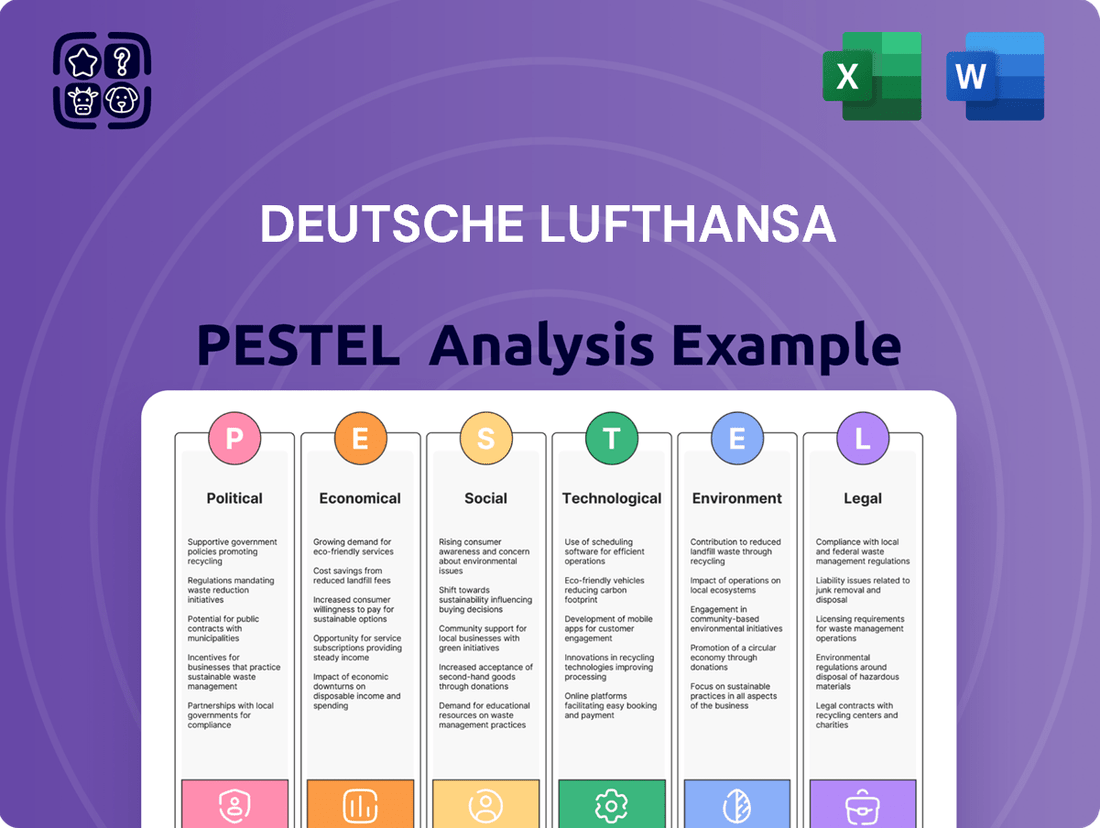

This PESTLE analysis of Deutsche Lufthansa dissects the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the airline's operations and strategic planning.

It offers a comprehensive overview of external forces, providing crucial insights for stakeholders to navigate the complex aviation landscape.

A PESTLE analysis for Deutsche Lufthansa can act as a pain point reliever by providing a clear, summarized version of external factors, enabling quicker decision-making and risk mitigation during strategic planning.

Economic factors

Fuel price volatility is a major economic factor for Deutsche Lufthansa. Jet fuel costs make up a substantial part of their operating budget, meaning they are very sensitive to changes in global oil prices. For instance, in 2023, jet fuel prices saw significant fluctuations, impacting airline profitability across the board, and Lufthansa is no exception.

Unforeseen jumps in fuel prices can quickly shrink profit margins. This often forces airlines like Lufthansa to consider adding fuel surcharges to ticket prices or engaging in fuel hedging. However, hedging itself comes with its own set of risks, as it involves complex financial instruments that can lead to losses if not managed carefully.

Given this economic reality, skillful fuel management and effective hedging strategies are absolutely crucial for Lufthansa to minimize their exposure to these price swings. Their ability to navigate these volatile fuel markets directly influences their financial performance and stability in the competitive aviation industry.

Global economic growth, a key driver for airlines like Lufthansa, showed resilience in early 2024, with forecasts for the year generally hovering around 3% GDP growth. This positive outlook on global economic health directly impacts consumer disposable income, a crucial factor for leisure travel. As economies expand, individuals tend to have more money available for discretionary spending, including airfares.

The willingness of consumers to spend on travel is intrinsically linked to their disposable income levels. For instance, in 2024, many advanced economies are experiencing moderate wage growth, which, when combined with stable inflation, could translate into increased purchasing power for air travel. Conversely, economic slowdowns or rising inflation can significantly dampen consumer spending on non-essential items like flights.

Lufthansa's business model, serving both premium business travelers and the broader leisure market, means its performance is highly sensitive to these macroeconomic shifts. Periods of robust economic expansion, as anticipated by many institutions for the latter half of 2024 and into 2025, typically lead to higher passenger volumes and a greater propensity for customers to opt for higher-margin services.

In contrast, economic headwinds, such as those seen in some regions during 2023 which saw inflation pressures, can lead to a reduction in both leisure trips and corporate travel budgets. This directly impacts Lufthansa's revenue streams and profitability, highlighting the airline's dependence on a stable and growing global economy.

As a global player, Deutsche Lufthansa's financial health is significantly tied to exchange rate movements, especially concerning the Euro. When the Euro strengthens, it can make Lufthansa's services more expensive for customers in other countries, potentially reducing demand. Conversely, a weaker Euro can boost revenue when translated back into Euros from foreign currency earnings.

These currency shifts also affect costs. For instance, if Lufthansa purchases aircraft or essential maintenance services priced in U.S. dollars, a stronger dollar against the Euro directly increases these expenditures. In 2024 and looking into 2025, the volatility in currency markets, influenced by global economic conditions and central bank policies, presents a continuous challenge.

Lufthansa actively manages this exposure. For example, by hedging a portion of its foreign currency receivables and payables, the company aims to lock in favorable exchange rates and mitigate the impact of adverse currency fluctuations on its profit margins. This proactive approach is crucial for maintaining stable financial performance amidst global economic uncertainties.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Deutsche Lufthansa, directly impacting its operational expenses. For instance, the cost of jet fuel, a major expenditure, can surge with inflationary pressures. In 2024, global inflation rates have shown variability, but persistent upward trends in many economies mean Lufthansa faces increased costs for everything from aircraft parts and maintenance to employee wages and airport landing fees. If the airline cannot fully pass these increased costs onto consumers through higher ticket prices, profit margins will inevitably shrink.

The current economic climate of higher interest rates significantly affects Lufthansa's financial strategy. As of mid-2024, central banks in major economies have maintained or cautiously adjusted interest rates, making borrowing more expensive. This directly impacts Lufthansa's ability to finance crucial capital expenditures, such as acquiring new, fuel-efficient aircraft or upgrading its existing fleet. Refinancing existing debt also becomes costlier, potentially increasing the company's interest expense and impacting its overall financial leverage and investment capacity.

- Increased Operating Costs: Inflation can drive up expenses for fuel, labor, and airport services, impacting Lufthansa's bottom line.

- Higher Borrowing Costs: Rising interest rates make it more expensive for Lufthansa to finance new aircraft purchases and manage its debt portfolio.

- Impact on Consumer Spending: Persistent inflation can reduce disposable income, potentially leading to lower demand for air travel.

- Fleet Modernization Challenges: Increased financing costs can slow down Lufthansa's investment in newer, more efficient aircraft, affecting long-term cost savings and environmental goals.

Competition and Pricing Pressure

The aviation sector is incredibly competitive, with established airlines, budget carriers, and Middle Eastern airlines all fighting for passengers. This fierce rivalry often results in significant pricing pressure, especially on frequently traveled routes. For Lufthansa, this means their ability to raise ticket prices and sustain profitability can be constrained.

Lufthansa's response to this competitive landscape often involves strategic alliances and optimizing their network. For instance, in 2024, the airline group continued to leverage its Star Alliance membership and bilateral partnerships to expand its reach and offer more seamless travel options. This approach helps them compete more effectively by providing a wider network and potentially better pricing through code-sharing agreements.

- Intense Competition: Traditional carriers, low-cost carriers (LCCs), and Gulf carriers actively compete for market share.

- Pricing Pressure: High competition on popular routes limits fare increases and impacts profitability.

- Strategic Responses: Alliances and network optimization are crucial for maintaining a competitive edge.

- Market Dynamics: In 2024, the ongoing recovery in air travel continued to fuel competition, with LCCs particularly aggressive on price.

Global economic growth underpins airline demand, with forecasts for 2024 generally around 3% GDP growth, supporting consumer disposable income for travel. However, persistent inflation, evidenced by rising costs for fuel, labor, and airport services in 2024, directly squeezes Lufthansa's profit margins if these increases cannot be passed to consumers.

Higher interest rates, maintained by central banks through mid-2024, increase Lufthansa's borrowing costs for fleet modernization and debt management. Fuel price volatility remains a critical economic factor, with jet fuel costs representing a significant portion of operating expenses, as seen in the fluctuations experienced throughout 2023 and continuing into 2024.

Exchange rate fluctuations, particularly for the Euro, impact Lufthansa's revenues and costs, with currency hedging strategies employed to mitigate these risks. The competitive landscape intensifies pricing pressure, forcing Lufthansa to rely on alliances and network optimization to maintain its market position.

Full Version Awaits

Deutsche Lufthansa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Deutsche Lufthansa delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline industry. It provides a detailed understanding of the external forces shaping Lufthansa's strategic decisions and operational environment. You'll gain insights into market trends, regulatory landscapes, and competitive pressures. This is the real, ready-to-use file you’ll get upon purchase.

Sociological factors

Consumer travel preferences are in constant flux, with a notable surge in demand for sustainable and eco-friendly travel options. Lufthansa, like other major carriers, is feeling this shift, prompting investments in newer, more fuel-efficient aircraft and the exploration of sustainable aviation fuels (SAFs). For instance, Lufthansa aims to increase its SAF usage significantly in the coming years, a direct response to these evolving consumer expectations.

Beyond sustainability, travelers increasingly seek personalized experiences, from tailored in-flight entertainment to flexible booking options. The desire for digital convenience is also paramount, with passengers expecting seamless online booking, mobile check-in, and real-time flight updates. Lufthansa's continued investment in its digital platforms and app functionality directly addresses this need for ease and personalization.

Global demographic shifts are significantly influencing air travel demand, a key consideration for Lufthansa. Emerging markets, particularly in Asia, continue to experience population growth, creating new demand for long-haul travel and business connectivity. For instance, the International Monetary Fund projected global population to reach 8.05 billion in 2024, with a substantial portion of this growth concentrated in Africa and Asia. Lufthansa needs to strategically position its services to tap into these burgeoning markets.

Conversely, established markets like Europe and North America are seeing an aging population. This demographic trend can lead to changes in travel patterns, with a potential increase in leisure travel for retirees but possibly a decrease in business travel as workforces mature. Lufthansa's fleet and route planning must adapt to cater to these evolving passenger needs, perhaps by offering more comfort-oriented services or focusing on routes popular with older travelers.

Urbanization is another critical factor. As more people move to cities, the demand for efficient air transportation between major urban centers intensifies. In 2023, the UN reported that over 57% of the world's population lived in urban areas, a figure expected to rise. This trend supports Lufthansa's strategy of connecting major global cities, but it also necessitates robust infrastructure and service capacity at key hubs to manage increased passenger volumes.

The lingering effects of the COVID-19 pandemic continue to shape consumer behavior, with health and safety remaining paramount for air travelers. Lufthansa, like its competitors, experienced a significant downturn in passenger numbers during the height of the crisis, with international travel plummeting by over 60% globally in 2020 compared to 2019 levels.

These health concerns can still trigger sudden drops in demand, necessitating flexible booking policies and stringent hygiene measures. For instance, the emergence of new variants can quickly lead to renewed travel advisories and restrictions, impacting Lufthansa's flight schedules and revenue streams.

Lufthansa has responded by investing in advanced air filtration systems and contactless passenger processing. The airline's operational resilience planning must therefore continue to prioritize robust crisis management protocols and adherence to evolving public health guidelines to maintain passenger trust and operational continuity in the face of potential future health emergencies.

Labor Relations and Union Power

Labor relations are a cornerstone of Lufthansa's operational stability. The airline employs a large workforce, and its interactions with powerful unions representing pilots, cabin crew, and ground staff directly influence its day-to-day activities. Recent wage negotiations, for example, have highlighted the potential for significant cost impacts and operational disruptions if agreements are not reached amicably.

The power of these unions means that disputes over working conditions or compensation can escalate quickly. In 2023, Lufthansa experienced several strikes by various employee groups, leading to flight cancellations and substantial financial losses. For instance, the Vereinigung Cockpit (VC) pilot union's industrial action in February 2023 alone resulted in the cancellation of hundreds of flights, affecting tens of thousands of passengers and costing the airline an estimated €30 million.

Maintaining positive and constructive labor relations is therefore not just about employee satisfaction but a strategic imperative for Lufthansa. The company aims to foster dialogue and reach mutually beneficial agreements to ensure smooth operations, predictable costs, and a motivated workforce, crucial for its competitive edge in the aviation sector.

- Pilot Union (Vereinigung Cockpit - VC): Represents flight crew, often involved in high-stakes wage and working condition negotiations.

- Cabin Crew Union (UFO): Advocates for flight attendants, whose agreements also impact service quality and operational costs.

- Ground Staff Unions (e.g., Verdi): Cover a broad range of essential airport and maintenance personnel, whose labor actions can halt operations entirely.

- Impact of Strikes: Past industrial actions in 2022 and 2023 led to significant flight cancellations and financial losses, underscoring the critical need for stable labor relations.

Public Perception and Brand Reputation

Lufthansa's brand reputation is a cornerstone of its success, influencing its ability to attract and keep customers, talented employees, and crucial investors. In 2024, passenger choices are heavily swayed by perceptions of safety, the quality of customer service, and a company's commitment to environmental sustainability and ethical corporate governance. Negative press or perceived ethical lapses can rapidly diminish customer trust and impact market position.

Proactive reputation management is therefore essential for Lufthansa. Transparent communication strategies are key to addressing public concerns and reinforcing positive brand attributes. For instance, in early 2024, Lufthansa highlighted its ongoing investments in fleet modernization and sustainable aviation fuels, aiming to bolster its image as an environmentally conscious carrier. This focus on transparency is critical in an era where social media can amplify both positive and negative sentiment almost instantaneously.

- Brand Loyalty: A strong reputation fosters customer loyalty, leading to repeat business and positive word-of-mouth referrals.

- Talent Acquisition: Employees are more likely to join and remain with companies that have a positive public image and strong ethical standing.

- Investor Confidence: A well-regarded brand can attract and retain investors, providing greater financial stability and access to capital.

- Crisis Mitigation: A solid reputation acts as a buffer during challenging times, making it easier to regain public trust after a crisis.

Societal attitudes towards air travel are evolving, with a growing emphasis on sustainability and ethical business practices. Lufthansa's commitment to reducing its carbon footprint, evidenced by its 2024 investments in SAFs and fleet upgrades, directly addresses these shifting consumer values. The airline's proactive approach to environmental responsibility is crucial for maintaining brand appeal.

Consumer demand for personalized and seamless travel experiences continues to rise. Lufthansa's ongoing digital transformation, focusing on user-friendly booking platforms and in-flight amenities, aims to meet these expectations. The airline recognizes that convenience and tailored services are key differentiators in today's competitive aviation market.

Demographic trends, such as global population growth in emerging markets and an aging population in developed regions, present both opportunities and challenges for Lufthansa. The airline's strategic route planning must accommodate these shifts, potentially expanding services to high-growth Asian markets while adapting offerings for older European travelers. For instance, by 2025, it's projected that over 60% of global travelers will be from emerging economies, a significant market for Lufthansa to target.

Labor relations remain a critical factor, with unions representing pilots, cabin crew, and ground staff wielding considerable influence. Past strikes in 2023, which led to significant flight disruptions and financial losses for Lufthansa, underscore the importance of constructive dialogue and fair negotiation. For example, Verdi’s industrial action in early 2024 impacted ground staff operations, highlighting the need for stable labor agreements to ensure operational continuity and cost predictability.

Technological factors

Lufthansa's operational efficiency is significantly impacted by ongoing advancements in aircraft technology. Newer planes feature more fuel-efficient engines, lighter materials, and quieter operations, directly supporting the airline's environmental targets and cost reduction strategies.

The airline is actively investing in next-generation aircraft like the Airbus A350 and Boeing 787. This fleet modernization is not just about passenger comfort; it's a strategic imperative that lowers operating expenses, with a single A350 capable of saving millions annually in fuel costs compared to older wide-body jets.

These technological upgrades translate into tangible benefits, such as a reduction in CO2 emissions. For instance, the A350 is designed to have a 25% reduction in fuel burn per seat compared to previous generation aircraft, a critical factor for airlines aiming to meet increasingly stringent environmental regulations and consumer expectations for sustainable travel in 2024 and beyond.

Lufthansa is navigating the digital transformation of the customer experience, which impacts everything from booking flights to in-flight services. The airline needs to constantly invest in technology to keep pace with customer expectations for seamless online interactions, mobile check-ins, and enhanced in-flight connectivity, aiming to personalize offerings and boost satisfaction.

By utilizing digital platforms, Lufthansa can streamline its operations and provide more convenient, tailored experiences for travelers. This digital push is crucial for improving both customer satisfaction and overall operational efficiency. For example, in 2023, Lufthansa Group's digital sales share continued to grow, reflecting the increasing reliance on online channels for booking and managing travel.

Leveraging data is central to this digital evolution. Lufthansa's ability to gather and analyze customer data allows for the creation of personalized offers and improved service delivery. This data-driven approach is essential for understanding passenger needs and preferences, ultimately leading to more effective customer engagement and loyalty programs.

Lufthansa is leveraging AI and advanced data analytics to enhance operational efficiency and customer experience. For instance, predictive maintenance, powered by AI, aims to reduce unscheduled downtime. In 2024, airlines globally are investing heavily in these technologies, with the aviation AI market projected to reach billions.

Dynamic pricing strategies, informed by sophisticated data analytics, allow Lufthansa to adjust ticket prices in real-time based on demand, competitor pricing, and other market factors. This approach is crucial for maximizing revenue, especially in the competitive landscape of 2024-2025. Personalized marketing, also driven by data insights, helps target specific customer segments with tailored offers, improving engagement and conversion rates.

Sustainable Aviation Fuels (SAF) Development and Adoption

The push for Sustainable Aviation Fuels (SAF) is a major technological factor impacting Lufthansa's future. These fuels are essential for the aviation sector to achieve its ambitious decarbonization targets, aiming to significantly reduce greenhouse gas emissions from air travel.

Lufthansa is actively investing in SAF development and has committed to increasing its usage, acknowledging it as a crucial but costly element of its environmental strategy. This commitment highlights the airline's proactive stance on sustainability, even with the current economic challenges of early adoption.

Technological progress in SAF production methods, such as advanced biofuels and synthetic fuels, is vital for improving availability and reducing costs. By 2024, Lufthansa aims to increase its SAF share to 5% of its total fuel consumption, a significant step towards its 2030 goal of 10%. This ongoing technological evolution directly supports Lufthansa's long-term environmental performance and its ability to meet stringent emission regulations.

Key technological drivers include:

- advancements in HEFA (Hydroprocessed Esters and Fatty Acids) technology for SAF production.

- research into power-to-liquid (PtL) synthetic fuels, which utilize renewable electricity and captured CO2.

- development of novel feedstocks and more efficient conversion processes to scale SAF availability.

- efforts to reduce the price premium of SAF compared to conventional jet fuel through technological innovation and economies of scale.

Cybersecurity Threats

As Deutsche Lufthansa continues to digitize its operations, from passenger bookings to flight management, the risk of cybersecurity threats escalates. The airline's extensive reliance on digital platforms makes it a prime target for malicious actors aiming to disrupt services or steal sensitive customer information. For instance, the aviation industry as a whole reported significant increases in cyberattacks in recent years, with some reports indicating a rise of over 100% in certain threat categories between 2022 and 2023, putting companies like Lufthansa under immense pressure to fortify their digital defenses.

Protecting against data breaches, ransomware, and other cyber incidents is not merely a technical challenge but a critical business imperative for Lufthansa. A successful cyberattack could lead to substantial financial losses through operational downtime, recovery costs, and regulatory fines, not to mention severe damage to its brand reputation. In 2024, the global average cost of a data breach reached an all-time high of $4.45 million, a figure that underscores the financial gravity of these threats for any large organization.

To counter these growing risks, Lufthansa must invest heavily in robust cybersecurity infrastructure and stringent protocols. This includes advanced threat detection systems, regular security audits, employee training on cyber hygiene, and comprehensive incident response plans. Compliance with data protection regulations, such as GDPR, further necessitates a proactive and well-managed cybersecurity posture, ensuring the integrity and confidentiality of passenger data and maintaining operational continuity in an increasingly interconnected world.

- Increased Digital Reliance: Lufthansa's operations are heavily dependent on digital systems, making them vulnerable to cyber threats.

- Financial and Reputational Risk: Cyberattacks can result in significant financial losses and damage to brand trust, with global data breach costs averaging $4.45 million in 2024.

- Essential Protective Measures: Investment in advanced cybersecurity infrastructure, regular audits, and employee training are crucial.

- Regulatory Compliance: Adherence to data protection laws like GDPR is a key driver for maintaining strong cybersecurity.

Technological advancements are reshaping Lufthansa's operational efficiency and customer experience. The airline is investing in next-generation aircraft like the A350, which offers a 25% reduction in fuel burn per seat, directly impacting cost savings and environmental goals. Furthermore, Lufthansa is digitizing its operations, utilizing data analytics and AI for personalized offers and predictive maintenance, with the global AI in aviation market projected to reach billions by 2024.

Sustainable Aviation Fuels (SAF) represent a critical technological frontier for Lufthansa. The airline aims to increase its SAF share to 5% of total fuel consumption by 2024, a significant step towards its 2030 goal of 10%. Key technological drivers include advancements in HEFA technology and research into power-to-liquid synthetic fuels, all aimed at reducing the cost premium of SAF.

Lufthansa faces escalating cybersecurity risks due to its increased digital reliance, with industry-wide cyberattacks seeing a reported rise of over 100% in certain categories between 2022 and 2023. The global average cost of a data breach reached $4.45 million in 2024, highlighting the financial and reputational stakes. To counter this, Lufthansa must invest in advanced cybersecurity infrastructure, regular audits, and employee training, alongside ensuring compliance with data protection regulations like GDPR.

Legal factors

Lufthansa navigates a complex web of antitrust and competition laws, especially within the European Union, where regulations heavily influence the aviation sector. These rules are designed to prevent monopolies and ensure fair competition, impacting everything from potential mergers to how airlines price their tickets.

For instance, the European Commission's scrutiny of airline alliances and slot allocations at major airports directly affects Lufthansa's ability to expand and partner. In 2023, the EU continued to investigate various aspects of airline competition, including potential abuse of dominant market positions.

Compliance is not just a legal requirement; it's a strategic imperative. Failure to adhere to these regulations can result in substantial fines, as seen in past cases involving other major European carriers. These penalties can significantly impact financial performance and strategic decision-making, forcing Lufthansa to carefully consider the competitive implications of its actions.

The ongoing dynamic of these laws shapes Lufthansa's approach to market entry, consolidation, and collaboration. For example, any proposed acquisition or significant partnership requires rigorous review to ensure it does not stifle competition, a process that can delay or even derail strategic growth initiatives.

Airlines like Lufthansa operate under a complex web of consumer protection laws, with EU Regulation 261/2004 being a prime example. This regulation ensures passengers receive compensation for significant flight delays, cancellations, and denied boarding. For instance, in 2023, European airlines collectively paid out billions in compensation under this regulation, impacting operational budgets significantly.

These stringent consumer protection measures translate into substantial financial liabilities and operational complexities for Lufthansa. The airline must maintain efficient customer service and claims processing systems to manage passenger rights effectively. Failure to comply can lead to legal penalties and damage to brand reputation, making adherence paramount for both legal standing and customer loyalty.

Lufthansa's global operations mean it must adhere to a patchwork of national and international employment and labor laws. These regulations dictate everything from pay scales and working hours to the right to unionize and prohibitions against discrimination. In 2024, for instance, Germany's Works Constitution Act continues to grant significant co-determination rights to employee representatives, influencing staffing and operational decisions.

Navigating these varied legal landscapes is crucial for managing Lufthansa's extensive, often unionized, workforce. The airline’s ability to manage collective bargaining agreements, such as those with the German pilots' union Vereinigung Cockpit (VC) or the UFO cabin crew union, directly impacts operational stability and costs. Failure to comply can lead to costly disputes and operational disruptions, as seen in past strikes impacting flight schedules.

Data Privacy Regulations

Lufthansa, like all major airlines, navigates a complex web of data privacy regulations, with the General Data Protection Regulation (GDPR) in Europe being a paramount concern given its extensive collection and processing of passenger and employee data. Strict adherence to GDPR mandates rigorous data security measures, transparent consent mechanisms for data usage, and careful management of cross-border data flows. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This legal framework directly impacts how Lufthansa handles sensitive information, influencing its operational strategies and IT infrastructure investments.

The legal landscape for data privacy is continually evolving, requiring Lufthansa to remain agile in its compliance efforts. Key areas of focus include:

- Data Minimization: Collecting only the data absolutely necessary for service provision.

- Consent Management: Implementing clear and unambiguous consent processes for data processing.

- Data Subject Rights: Facilitating passenger and employee rights to access, rectify, and erase their data.

- Cross-Border Data Transfers: Ensuring legal mechanisms are in place for transferring data outside the EU.

International Air Law and Bilateral Agreements

International air travel operates under a dense network of treaties and conventions, such as the Chicago Convention and the Montreal Convention. These legal instruments, alongside bilateral air service agreements between nations, establish the rules for traffic rights, safety protocols, and liability. Lufthansa's extensive global operations are fundamentally shaped by these agreements, making any shifts or disagreements a significant factor in its operational scope and financial performance.

These agreements are crucial for airlines like Lufthansa, defining market access and operational parameters. For instance, the Open Skies agreements, which many countries have pursued, liberalize air transport services, allowing for greater competition and potentially lower fares. As of late 2024, the trend towards further liberalization continues, though specific routes may still be subject to negotiated terms.

- Chicago Convention (1944): Established the basis for international air navigation, including the principle of national sovereignty over airspace and the establishment of the International Civil Aviation Organization (ICAO).

- Montreal Convention (1999): Modernized and consolidated the rules governing airline liability for passenger injury, death, baggage loss, and cargo damage in international carriage.

- Bilateral Air Service Agreements (BASAs): Contracts between two countries that grant airlines of one country the right to fly to, from, and through the other country. These agreements specify routes, frequencies, and types of services.

- Open Skies Agreements: These liberalize air transport policies between countries, reducing government intervention and allowing airlines more freedom in pricing, route selection, and capacity. Many European countries and the United States have numerous such agreements.

Lufthansa must navigate stringent antitrust laws, particularly within the EU, impacting mergers and pricing strategies, with the European Commission actively monitoring competition in 2023 and 2024. Consumer protection laws, such as EU Regulation 261/2004, impose significant liabilities for flight disruptions, with billions paid out annually by European airlines collectively. Furthermore, compliance with diverse international employment laws and data privacy regulations like GDPR is critical, with GDPR fines potentially reaching 4% of global annual revenue, influencing operational and IT investments.

Environmental factors

Lufthansa is navigating a landscape of intensifying climate change regulations, a crucial environmental factor impacting its operations. The European Union Emissions Trading System (EU ETS) and the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) are primary examples of these stringent rules. These frameworks mandate that airlines like Lufthansa reduce their carbon footprint, often requiring the purchase of carbon allowances, which directly adds to operational expenses.

The global push towards net-zero emissions by 2050 presents a significant strategic challenge for Lufthansa. Meeting these ambitious targets necessitates substantial investment in sustainable aviation fuels (SAFs) and more fuel-efficient aircraft. For instance, in 2023, Lufthansa announced plans to increase its SAF usage, aiming for a significant portion of its fuel mix, though the exact percentage remains under development and subject to availability and cost. This transition, while essential for long-term viability, represents a considerable financial commitment and a key element in the company's future strategic planning.

Aircraft noise remains a primary environmental concern, especially for residents near major aviation hubs. Lufthansa navigates a complex web of stringent noise regulations set by airport operators and national aviation authorities. These rules directly influence operational flexibility, dictating flight timings and influencing the airline's fleet modernization strategies. For instance, the EU's stringent noise standards often push airlines like Lufthansa towards investing in newer, quieter aircraft models, impacting capital expenditure.

Lufthansa, like any major airline, faces the challenge of significant waste generation from its extensive operations, encompassing everything from in-flight service disposables to materials used in aircraft maintenance, repair, and overhaul (MRO). In 2023, the airline group continued to focus on enhancing its waste management and recycling initiatives across its fleet and ground operations.

To address this, Lufthansa is actively implementing comprehensive recycling programs targeting cabin waste, including plastics, paper, and aluminum, alongside specialized recycling for MRO materials. These efforts are not only vital for meeting evolving environmental regulations but also for showcasing a strong commitment to corporate social responsibility.

The airline group has set ambitious goals to reduce the overall volume of waste produced and to consistently increase its recycling rates. For instance, by the end of 2024, Lufthansa aims to increase the percentage of cabin waste recycled by an additional 5% compared to 2023 figures, building on previous successes.

Public Pressure for Sustainable Practices

Public sentiment is increasingly pushing airlines like Lufthansa towards sustainability, extending beyond just reducing carbon footprints. Consumers, investors, and even employees are demanding greater transparency in environmental reporting, ethical supply chain management, and positive contributions to biodiversity. This heightened scrutiny means Lufthansa's genuine commitment to environmental stewardship directly impacts its brand perception, customer loyalty, and crucially, its ability to secure financing from increasingly ESG-conscious investors. Failure to meet these expectations carries the significant risk of accusations of greenwashing, which can severely damage reputation and financial standing.

Lufthansa has been actively addressing these pressures. For instance, in 2023, the airline group continued its efforts in SAF (Sustainable Aviation Fuel) adoption, aiming to significantly increase its usage. By 2025, the goal is to have 2% of its total fuel consumption be SAF, a substantial increase from previous years. This commitment is vital for maintaining a positive brand image in a market where environmental consciousness is becoming a key differentiator.

- Growing Demand for Transparency: Lufthansa faces pressure for clear, verifiable environmental data beyond simple emissions reports.

- Ethical Sourcing and Biodiversity: The airline is expected to demonstrate responsible practices throughout its operations and supply chain, including protecting biodiversity.

- Brand Image and Customer Loyalty: Demonstrating strong environmental commitment is crucial for maintaining and enhancing Lufthansa's brand reputation and attracting environmentally aware customers.

- Access to Sustainable Finance: Investors are increasingly prioritizing airlines with robust sustainability credentials, making genuine environmental action key to securing capital.

- Risk of Greenwashing Accusations: Misrepresenting environmental efforts can lead to significant reputational damage and loss of trust.

Resource Scarcity and Circular Economy

The aviation industry, including Lufthansa, faces increasing pressure from resource scarcity. This is particularly relevant as the global demand for air travel continues to grow, placing a strain on finite resources. Lufthansa's operations consume significant amounts of water, require specialized raw materials for aircraft construction and upkeep, and depend on various chemicals.

The global shift towards a circular economy directly impacts Lufthansa's strategic decisions. This includes how the airline sources its materials and manages its maintenance, repair, and overhaul (MRO) activities. For instance, the European Union is actively promoting circular economy principles, which could influence material sourcing and waste management regulations for airlines operating within or connected to the EU market.

Embracing sustainable practices in material usage, prioritizing repair over replacement, and implementing robust recycling programs are becoming critical for Lufthansa's long-term operational stability and financial health. By adopting these strategies, Lufthansa can mitigate the risks associated with dwindling resources and potentially achieve greater cost efficiencies.

- Resource Dependence: Lufthansa relies on a steady supply of aviation fuel, specialized metals like aluminum and titanium for aircraft, and various chemicals for maintenance and operations.

- Circular Economy Impact: The airline must adapt to a model that emphasizes reusing, repairing, and recycling aircraft components and materials to reduce waste and reliance on virgin resources.

- Sustainable Procurement: Lufthansa's procurement strategies will increasingly favor suppliers who demonstrate sustainable sourcing practices and offer materials with a lower environmental footprint.

- MRO Innovation: Investing in advanced MRO techniques that extend the life of components and facilitate easier disassembly for recycling is crucial for operational resilience.

Lufthansa is actively responding to growing environmental pressures, including increasing scrutiny on its carbon footprint and waste management. The airline group is committed to expanding its use of Sustainable Aviation Fuels (SAFs), with a target of 2% of total fuel consumption being SAF by 2025. This strategic shift aims to reduce emissions and align with global sustainability goals, impacting operational costs and fleet modernization plans.

The airline is also enhancing its waste management and recycling initiatives, aiming for a 5% increase in cabin waste recycling by the end of 2024 compared to 2023. This focus on resource efficiency and circular economy principles addresses concerns about resource scarcity and meets evolving regulatory demands, positioning Lufthansa for long-term operational stability.

Public and investor expectations for transparency and ethical practices are high. Lufthansa's commitment to environmental stewardship directly influences its brand perception, customer loyalty, and access to capital from ESG-conscious investors. Failure to meet these expectations risks reputational damage and accusations of greenwashing.

| Environmental Factor | Lufthansa's Response/Challenge | Key Data/Target |

| Climate Change Regulations & Emissions | Adherence to EU ETS and CORSIA, investment in SAFs | Target: 2% SAF usage by 2025 |

| Waste Management & Circular Economy | Enhanced recycling programs, focus on resource efficiency | Aim: 5% increase in cabin waste recycling by end of 2024 |

| Public Sentiment & ESG Demands | Improving transparency, ethical sourcing, biodiversity efforts | Brand perception, investor access |

PESTLE Analysis Data Sources

Our Deutsche Lufthansa PESTLE Analysis draws on a comprehensive mix of data, including official reports from aviation authorities like EASA and FAA, economic forecasts from institutions such as the IMF and Eurostat, and industry-specific publications. We also incorporate data on environmental regulations and geopolitical events impacting global travel.