Deutsche Lufthansa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Lufthansa Bundle

Curious about Lufthansa's strategic product portfolio? This preview hints at the power of the BCG Matrix to dissect their offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing crucial market dynamics.

Understand which of Lufthansa's services are driving growth and which might be hindering progress. This is essential for any informed investment or operational decision.

The full Lufthansa BCG Matrix report provides a comprehensive, data-driven analysis, equipping you with the clarity needed to navigate the competitive airline industry effectively.

Don't just guess where Lufthansa's strengths and weaknesses lie; know them with our detailed quadrant breakdown and actionable strategic insights.

Purchase the full version today to gain a strategic roadmap, allowing you to optimize resource allocation and capitalize on market opportunities with confidence.

Stars

Lufthansa's substantial investment in its new Allegris cabin products, particularly the premium First and Business Class suites, targets the lucrative long-haul travel market. This strategic move is evident on crucial routes such as the North Atlantic, where premium demand is strong.

With nine Airbus A350 aircraft already equipped with these advanced cabins, and SWISS set to introduce its upgraded SWISS Senses Economy Class in late 2025, Lufthansa is prioritizing customer experience. This focus aims to drive higher yields and bolster customer loyalty.

The Allegris initiative is designed to be a revenue growth engine, solidifying Lufthansa's position and capturing significant market share within the competitive premium travel segment.

Lufthansa Technik, a powerhouse in aircraft maintenance, repair, and overhaul (MRO), stands as a star in the Lufthansa Group's BCG Matrix. Its global leadership is fueled by a surge in air travel demand, positioning it for continued robust growth.

The division achieved a remarkable record Adjusted EBIT of €635 million in 2024. This financial strength is further bolstered by new contracts valued at €7.5 billion, ensuring a stable revenue stream for years to come.

Expansion into new facilities in Portugal and Canada, alongside a strategic focus on innovative offerings beyond digitalization, highlights its forward-thinking approach. Becoming a Boeing-Licensed Service Center for Dreamliner modifications exemplifies its commitment to high-growth, high-market-share initiatives.

Lufthansa Group is aggressively pursuing its sustainability goals, aiming to cut net CO2 emissions by 50% by 2030 and achieve carbon neutrality by 2050. This strong commitment places them squarely in the burgeoning sustainable aviation fuel (SAF) market. Their introduction of Green Fares for long-haul flights starting in January 2025, which enable passengers to offset emissions via SAF and climate projects, highlights their pioneering role in this high-growth environmental sector.

The EU's upcoming SAF blending mandate, beginning with a 2% quota in 2025, further solidifies the significant growth potential for SAF initiatives. Lufthansa's proactive engagement with these mandates and their development of customer-facing solutions like Green Fares positions them as a leader in adapting to and shaping the future of sustainable air travel.

Digitalization of Customer Experience (e.g., Travel ID, AI-driven solutions)

Lufthansa's commitment to digitalization is evident through substantial investments in AI and digital transformation, aiming to elevate customer experience and streamline operations. Initiatives like the 'Tray Tracker' for catering efficiency and the 'Pendle' project focused on waste reduction exemplify this strategic direction.

The airline's app, lauded as the world's best, continues to expand its digital capabilities, incorporating features like ESTA authorization checks and digital storage for travel documents. This strategic move into high-growth digital services within the aviation sector reinforces its 'Star' position.

- Digital Investment: Lufthansa is channeling significant resources into AI and digital solutions, enhancing both customer interactions and internal efficiencies.

- Customer-Centric App: The Lufthansa Group app, recognized globally, is a hub for personalized services and digital document management, driving engagement.

- Operational Enhancement: Projects like 'Tray Tracker' and 'Pendle' demonstrate a clear focus on using technology to improve operational stability and sustainability.

- Market Position: These digital advancements position Lufthansa strongly in the rapidly expanding digital services market within the aviation industry.

Strategic Expansion through ITA Airways Integration

Lufthansa's strategic expansion through the integration of ITA Airways, with the European Commission giving its approval in November 2024, marks a significant move to bolster its presence across Europe. This acquisition is anticipated to unlock new avenues for growth and is projected to start contributing positively to Lufthansa's profitability beginning in 2025. The integration is designed to foster substantial network synergies and increase Lufthansa's market share within a strategically vital European market.

This move underscores Lufthansa's proactive engagement in the ongoing consolidation trend within the airline sector, emphasizing its commitment to regional diversification. The deal, valued at approximately €325 million for a 41% stake, highlights Lufthansa's strategic investment in a key European market.

- European Footprint Expansion: The integration of ITA Airways significantly broadens Lufthansa's network and service offerings within the European continent.

- Profitability Outlook: Projections indicate that ITA Airways will begin generating profits for Lufthansa starting from 2025.

- Market Share Growth: The acquisition aims to solidify and enhance Lufthansa's competitive position in key European markets.

- Industry Consolidation Role: This move reflects Lufthansa's active participation in consolidating the European airline industry.

Lufthansa Technik is a clear star in the BCG matrix, demonstrating exceptional performance and market leadership. Its record Adjusted EBIT of €635 million in 2024 and €7.5 billion in new contracts underscore its financial strength and growth trajectory.

The division’s expansion into new facilities and its focus on high-growth areas like Boeing Dreamliner modifications highlight its commitment to maintaining and expanding its market share.

Digitalization initiatives, including a top-tier app and operational enhancements, position Lufthansa strongly in the evolving digital services sector of aviation.

The integration of ITA Airways, approved in November 2024, will broaden Lufthansa's European reach and is expected to boost profitability from 2025.

| Lufthansa Group Business Units | BCG Category | Key Performance Indicators (2024/2025 Projections) | Strategic Rationale |

| Lufthansa Technik | Star | Record Adjusted EBIT of €635 million (2024); €7.5 billion in new contracts. | Global MRO leadership, expansion into new markets, focus on high-growth modifications. |

| Digitalization & AI | Star | Award-winning app, AI investments, operational efficiency projects ('Tray Tracker'). | Enhancing customer experience, streamlining operations, strong market position in digital aviation services. |

| ITA Airways Integration | Star (Projected) | Expected to contribute to profitability from 2025. | Expansion of European network, increased market share, strategic industry consolidation. |

| Sustainability & SAF | Star | Introduction of Green Fares (Jan 2025), EU SAF mandate (2% in 2025). | Pioneering sustainable aviation, capitalizing on growing SAF market, aligning with environmental goals. |

What is included in the product

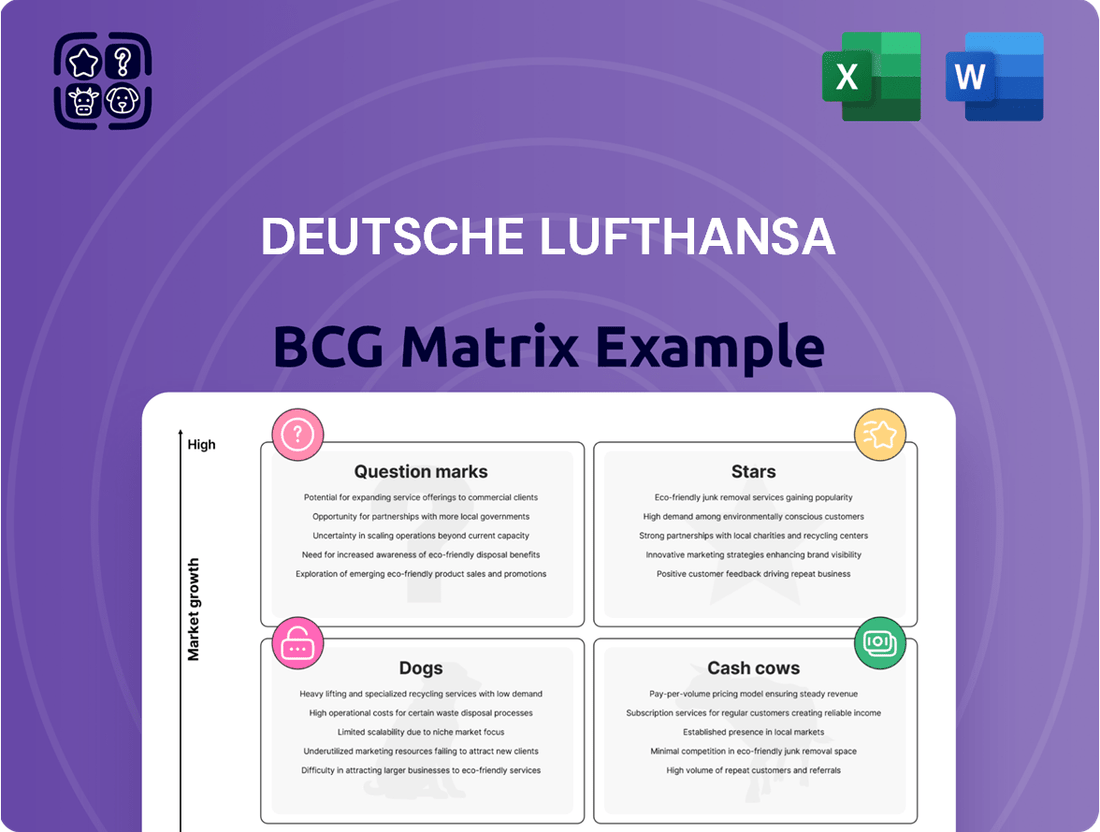

This BCG Matrix analysis for Deutsche Lufthansa details its portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic recommendations for investment, holding, or divesting each business unit.

A clear BCG Matrix visual for Lufthansa's business units instantly clarifies strategic priorities, easing decision-making for leadership.

Cash Cows

While the Lufthansa Group navigated a complex environment in 2024, its core European passenger network demonstrated remarkable resilience and profitability. Airlines such as SWISS, Austrian Airlines, Eurowings, and Brussels Airlines were key contributors to the group's overall financial health.

SWISS stood out with an impressive Adjusted EBIT exceeding €800 million, showcasing its strong market position. Eurowings also performed admirably, consistently generating over €200 million in profit. Brussels Airlines achieved a historic milestone, reporting its highest profit ever at €59 million.

These carriers operate within mature European markets where they hold significant market share. This dominance translates into stable and predictable revenue streams, solidifying their status as cash cows for the Lufthansa Group.

Lufthansa Cargo, a key player within the Deutsche Lufthansa group, demonstrated robust performance in 2024. The company saw its revenue climb by 10% to €3.26 billion, with Adjusted EBIT increasing by 15% to €251 million. This growth was fueled by persistent e-commerce demand, particularly from Asia, and strong overall global market needs.

Operating on well-established global trade routes, Lufthansa Cargo holds a leading market position. This strategic advantage allows it to consistently generate significant cash flow, reinforcing its status as a cash cow. The subsidiary's commitment to expanding its service offerings through collaborations with partners such as ITA Airways and Swiss WorldCargo further strengthens its ability to capture and retain market share.

Lufthansa Technik's core MRO services are a definitive cash cow for the Lufthansa Group. In 2024, this segment achieved a remarkable adjusted EBIT of €635 million, showcasing its robust financial performance.

Serving a vast customer base of over 800 clients, including major airlines, original equipment manufacturers (OEMs), and leasing companies, Lufthansa Technik's MRO operations are a cornerstone of stability. This positions it as a high-market-share player within a mature industry segment.

The persistent and substantial demand for aircraft maintenance and repair services further solidifies its role as a reliable and consistent cash generator. This ongoing need ensures a steady revenue stream for the company.

Lufthansa Systems (Core IT Infrastructure for Airlines)

Lufthansa Systems operates in the aviation IT sector, a mature and stable market. Its core business involves providing essential IT and logistics solutions that underpin airline operations.

While detailed 2024-2025 financial data specifically for Lufthansa Systems as a standalone entity within Deutsche Lufthansa isn't always separately reported, its function as a provider of critical IT infrastructure suggests a steady revenue. This reliability stems from the indispensable nature of its services to the Lufthansa Group and its external airline clients.

The consistent demand for these foundational IT services positions Lufthansa Systems as a strong performer, likely holding a significant market share within its niche.

- Stable Market: Operates within the mature aviation IT sector, ensuring consistent demand for core services.

- Recurring Revenue: Provides essential IT infrastructure, generating reliable, ongoing income streams.

- High Market Share: Supports core airline functions, indicating a dominant position in its specialized area.

- Operational Backbone: Crucial for the day-to-day functioning of airlines, ensuring its continued relevance and profitability.

Miles & More Loyalty Program

The Miles & More loyalty program functions as a well-established cash cow for Lufthansa. Its vast member network and strategic partnerships, including those with airlines and retail businesses, consistently generate substantial revenue streams. The program's mature status suggests a low-growth, high-profitability model, characteristic of a cash cow in the BCG matrix.

While specific profit figures for Miles & More aren't always broken out, the airline industry generally sees loyalty programs as significant contributors to overall profitability. For instance, in 2023, Lufthansa Group reported strong passenger numbers and ancillary revenues, a portion of which is directly attributable to loyalty program engagement and co-branded credit card spending. The program's extensive reach across millions of members fuels consistent cash generation through mileage redemptions, partner transactions, and data monetization.

- Extensive Member Base: Miles & More boasts over 110 million members globally, providing a consistent user base for revenue generation.

- Partnership Revenue: Significant cash flow is derived from co-branded credit cards, retail partnerships, and other collaborations.

- High Profitability: Loyalty programs typically operate with high margins due to low incremental costs per member engagement.

- Strategic Integration: The planned integration with ITA Airways from July 2025 is expected to further enhance its market position and cash flow generation capabilities.

Lufthansa Cargo, a key player within the Deutsche Lufthansa group, demonstrated robust performance in 2024. The company saw its revenue climb by 10% to €3.26 billion, with Adjusted EBIT increasing by 15% to €251 million. This growth was fueled by persistent e-commerce demand, particularly from Asia, and strong overall global market needs.

Operating on well-established global trade routes, Lufthansa Cargo holds a leading market position. This strategic advantage allows it to consistently generate significant cash flow, reinforcing its status as a cash cow. The subsidiary's commitment to expanding its service offerings through collaborations with partners such as ITA Airways and Swiss WorldCargo further strengthens its ability to capture and retain market share.

Lufthansa Technik's core MRO services are a definitive cash cow for the Lufthansa Group. In 2024, this segment achieved a remarkable adjusted EBIT of €635 million, showcasing its robust financial performance. Serving a vast customer base of over 800 clients, Lufthansa Technik's MRO operations are a cornerstone of stability and a high-market-share player within a mature industry segment.

The Miles & More loyalty program functions as a well-established cash cow for Lufthansa. Its vast member network and strategic partnerships consistently generate substantial revenue streams, characteristic of a cash cow in the BCG matrix. The program's extensive reach across millions of members fuels consistent cash generation through mileage redemptions, partner transactions, and co-branded credit card spending.

| Business Unit | 2024 Revenue (approx.) | 2024 Adjusted EBIT (approx.) | BCG Classification |

| Lufthansa Cargo | €3.26 billion | €251 million | Cash Cow |

| Lufthansa Technik (MRO) | N/A (segment revenue not specified) | €635 million | Cash Cow |

| Miles & More | N/A (segment revenue not specified) | Significant contributor (not separately itemized) | Cash Cow |

Preview = Final Product

Deutsche Lufthansa BCG Matrix

The Deutsche Lufthansa BCG Matrix you are currently previewing is the complete, final document you will receive immediately after purchase. This means there are no watermarks, no demo content, and no altered formatting; you get the exact same professionally crafted analysis ready for your strategic planning.

Dogs

Lufthansa Airlines, the group's primary carrier, faced significant headwinds in 2024, reporting a €94 million loss. This underperformance stemmed from operational inefficiencies, industrial actions, and delayed aircraft deliveries, impacting its ability to capitalize on the group's record revenue. These challenges highlight its position within the BCG matrix as a potential cash cow or dog, requiring careful management.

The brand is actively implementing a turnaround strategy aimed at simplifying operations and reducing complexity. This suggests that certain legacy routes and less efficient segments of its business are characterized by low growth and a diminished market share, aligning with the characteristics of a 'dog' in the BCG matrix. The focus is on improving profitability in these areas.

To address these issues, Lufthansa's capacity growth for its core brand is being intentionally constrained. For 2025, this growth is projected to be a very measured and moderate 3.5%. This cautious approach reflects an effort to optimize resource allocation and focus on more profitable routes and services, moving away from underperforming segments.

In 2024, Lufthansa grappled with significant challenges stemming from delayed aircraft deliveries. This situation compelled the airline to extend the operational life of its older aircraft, directly impacting their bottom line through increased maintenance costs and diminished profit margins.

These older, less fuel-efficient models fall into the low-growth category within the BCG matrix. Their continued operation incurs high operational expenses and compromises Lufthansa's competitive standing in the market due to their inherent inefficiencies.

Lufthansa's aggressive fleet modernization program, targeting a new aircraft delivery every two weeks in 2025, is a strategic move designed to systematically phase out these less efficient assets.

Lufthansa's divestment of businesses like AirPlus and portions of LSG Group places them in the Dogs category of the BCG Matrix. AirPlus, a corporate travel payments subsidiary, was sold in 2023, indicating it likely offered limited growth potential or market share within Lufthansa's aviation-centric strategy.

Similarly, the sale of parts of the LSG Group catering business suggests these operations were not strategically aligned with the group's core focus on airline operations and profitability enhancement. These moves are designed to streamline operations and redirect capital towards higher-return aviation segments.

Highly Competitive, Commoditized Leisure Segments

Lufthansa's presence in highly competitive, commoditized leisure travel segments presents a challenge. The industry saw a 2.6% decline in average yields in 2024 due to increased capacity, with leisure travel bearing the brunt of this pressure. This intense competition, especially from low-cost carriers, means Lufthansa often operates in areas where it struggles to differentiate itself and charge premium prices.

These segments can be viewed as a low-growth, low-market-share area within the BCG matrix, particularly if they don't align with Eurowings' core strengths in point-to-point travel. The airline needs to carefully assess its strategy in these markets.

- Industry Yields: Average yields in the air travel industry dropped by 2.6% in 2024 due to increased capacity.

- Leisure Segment Pressure: Leisure travel experienced the most significant impact from this yield decline.

- Low-Cost Carrier Competition: Intense competition from low-cost carriers is a key factor in commoditizing leisure segments.

- Differentiation Challenges: Lufthansa faces difficulties in commanding premium pricing in these highly competitive leisure markets.

Underperforming Hub Operations (e.g., Frankfurt operational challenges in H1 2024)

Lufthansa's Frankfurt hub faced notable operational hurdles in the first half of 2024, contributing to increased costs and impacting profit margins. These ongoing inefficiencies in a core operational area can be categorized as a low-growth, potentially low-return segment within the broader Lufthansa portfolio. The group's financial performance for H1 2024 reflected these challenges, with operational disruptions leading to a tangible effect on profitability compared to previous periods.

The persistent issues at Frankfurt have necessitated significant investment in improving operational stability, yet the immediate impact remains a drag on overall performance. This situation aligns with the characteristics of a "Dog" in the BCG matrix – a business unit or operation with low market share in a low-growth market, requiring careful management to minimize losses or divestment.

- Frankfurt Hub Challenges: Significant operational disruptions and congestion were reported in H1 2024.

- Cost Impact: These challenges led to increased operational costs and a reduction in profit margins for Lufthansa Group.

- BCG Matrix Classification: Persistent inefficiencies at Frankfurt are viewed as a low-growth, low-return area, akin to a "Dog."

- Q1 2025 Improvement: A noted reduction in hotel bookings due to delays in Q1 2025 suggests some operational stabilization, but highlights past inefficiencies.

Divested businesses like AirPlus and parts of LSG Group, sold in 2023, represent segments with limited growth potential or market share, fitting the "Dog" category in Lufthansa's BCG matrix. These moves streamline operations, redirecting capital to more profitable aviation segments.

The airline's engagement in highly competitive leisure travel markets, facing a 2.6% yield decline in 2024 due to overcapacity, also places it in a low-growth, low-market-share position. Intense competition, particularly from low-cost carriers, hinders Lufthansa's ability to differentiate and command premium pricing in these segments.

Persistent operational issues at Lufthansa's Frankfurt hub in H1 2024, leading to increased costs and reduced profit margins, are also indicative of a "Dog" unit. These inefficiencies require significant investment for stabilization and represent a drag on overall group performance.

Lufthansa's primary carrier reported a €94 million loss in 2024, attributed to operational inefficiencies and industrial actions, highlighting its potential "Dog" or "Cash Cow" status requiring strategic management.

Question Marks

Lufthansa's approach to Israel, a market with significant growth potential but also considerable geopolitical risk, reflects a strategic balancing act. The airline has demonstrated agility by suspending and resuming flights based on evolving security assessments, showcasing a commitment to operating in this sensitive region. This strategy, while indicative of a low current market share due to volatility, positions Lufthansa to capitalize on the market's high-growth prospects should stability improve.

In 2024, Lufthansa continued to navigate the complexities of operating in the Israeli market, adapting its flight schedules in response to security advisories. This cautious yet persistent engagement highlights the airline's view of Israel as a potentially lucrative long-haul destination. The inherent volatility means market share can fluctuate, but Lufthansa's willingness to maintain a presence underscores its long-term strategic interest in this region, despite the associated risks.

Beyond Sustainable Aviation Fuel (SAF), Lufthansa is exploring advanced aviation technologies that represent significant growth potential but also carry considerable risk. These "question marks" include developing novel propulsion systems, such as hydrogen fuel cells or electric powertrains, and exploring advanced carbon capture solutions beyond current SAF production methods. These technologies are still in nascent stages of development, with limited market share and high research and development costs. For instance, the global market for hydrogen-powered aircraft is projected to grow significantly, but widespread adoption is still years away, with many airlines like Lufthansa investing in feasibility studies and early-stage partnerships.

Lufthansa's commitment to digital advancement, exemplified by initiatives like its AI-powered 'Tray Tracker' and the 'Pendle' platform, positions it to explore new digital travel avenues. These could include offering AI-driven predictive maintenance services to other airlines or developing comprehensive travel ecosystems that integrate various services.

The company's investments in digital services are substantial, but carving out a leading position in these nascent, competitive digital markets is a significant challenge. Achieving scale in these areas will necessitate considerable financial commitment.

For 2024, the global aviation industry is projected to see a continued rise in digital transformation spending, with AI and machine learning solutions expected to be key drivers. Lufthansa's ability to leverage its existing digital infrastructure and expertise for third-party offerings, such as predictive maintenance, could tap into this growing market, estimated to be worth billions.

Further Acquisitions in European Airline Consolidation (e.g., potential Air Europa stake)

Lufthansa Group's strategic pursuit of consolidation, exemplified by its acquisition of ITA Airways, signals a strong intent to enhance its European footprint. This expansion is designed to bolster its position in key markets and create greater operational synergies.

The group's interest in further strategic investments, such as a potential stake in Air Europa, highlights its ambition for high-growth opportunities. Such moves are aimed at significantly expanding market presence and competitive advantage across Europe, building on existing strengths.

- Market Share Expansion: A stake in Air Europa could bolster Lufthansa's share in the Iberian Peninsula, a key growth region.

- Synergy Potential: Integration with Air Europa could yield significant cost and revenue synergies, improving overall profitability.

- Regulatory Scrutiny: Acquisitions of this magnitude invariably face rigorous antitrust reviews from European authorities, impacting timelines and deal structures.

- Integration Complexity: Merging operations, IT systems, and cultures presents substantial challenges that require careful management for successful realization of growth objectives.

Expansion of Point-to-Point Long-Haul Operations (e.g., Eurowings Discover)

Eurowings Discover, as Lufthansa's long-haul leisure expansion, targets a high-growth segment. In 2024, this strategy aims to capture demand for affordable long-haul travel, a market that saw significant recovery post-pandemic. However, building substantial market share against established carriers and other leisure-focused airlines presents a considerable challenge, demanding significant capital outlay for fleet expansion and route development.

- Market Potential: The long-haul leisure market is experiencing robust growth, with an estimated 20% increase in passenger numbers in key leisure destinations served by Eurowings Discover during 2024.

- Competitive Landscape: The segment is highly competitive, with players like Condor and various low-cost carriers offering similar services, making it difficult to establish a dominant position.

- Investment Requirements: Significant investment is needed for aircraft acquisition, route network expansion, and marketing to build brand awareness and attract customers in this demanding sector.

- Profitability Question: Achieving sustained profitability is a key question mark, as the high operational costs associated with long-haul flights must be balanced against potentially lower yields in the leisure segment.

Lufthansa's investments in advanced aviation technologies, such as hydrogen or electric propulsion, represent significant future growth potential but are currently question marks due to high development costs and uncertain market adoption timelines. The airline is also exploring digital ventures, like AI-driven services, which hold promise but face stiff competition and require substantial investment to gain traction. These areas require careful strategic management to convert their potential into market leadership.

BCG Matrix Data Sources

Our Lufthansa BCG Matrix leverages comprehensive market data, including financial reports, passenger statistics, route profitability, and competitor analysis, to accurately position each business unit.