Korea Shipbuilding & Offshore Engineering PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Korea Shipbuilding & Offshore Engineering Bundle

Korea Shipbuilding & Offshore Engineering (KSOE) operates within a dynamic global landscape, influenced by a complex interplay of political, economic, social, technological, legal, and environmental factors. Understanding these forces is crucial for strategic planning and risk mitigation in the highly competitive shipbuilding and offshore industries. Don't get left behind in this evolving market.

Gain a critical advantage with our meticulously crafted PESTLE Analysis of Korea Shipbuilding & Offshore Engineering. We dissect how shifting geopolitical alliances, fluctuating commodity prices, evolving labor dynamics, rapid technological advancements, stringent environmental regulations, and changing legal frameworks are shaping KSOE's operational landscape and future prospects. Unlock actionable intelligence to refine your own market approach.

This comprehensive analysis provides the deep-dive insights you need to navigate the external environment effectively. From identifying emerging opportunities to anticipating potential threats, our PESTLE report equips you with the knowledge to make informed decisions. Ready to bolster your strategic foresight?

Whether you are an investor, competitor, or industry stakeholder, understanding the external forces impacting KSOE is paramount. Our PESTLE analysis delivers expert-level clarity, presented in an easily digestible format. Secure your competitive edge by purchasing the full version now and gain immediate access to invaluable market intelligence.

Political factors

The South Korean government is heavily backing its shipbuilding sector with substantial investments and forward-looking plans like the 'K-Shipbuilding Super Gap Vision 2040'. This initiative aims to solidify Korea's global leadership by channeling significant funds into crucial areas such as green shipping technologies, digitalization, and the development of autonomous vessels. These efforts are designed to ensure the industry remains competitive and at the forefront of innovation.

Key to this support is a notable increase in funding allocated for research and development of these advanced shipbuilding technologies. For instance, the government has committed to boosting R&D investment by 30% by 2025, targeting eco-friendly propulsion systems and smart shipbuilding solutions. This financial injection is a critical component of the 'Super Gap' strategy, aiming to create a sustainable competitive advantage.

Furthermore, the government is actively addressing industry challenges by providing direct subsidies specifically for the construction of eco-friendly ships. These incentives encourage shipowners to adopt greener technologies, directly benefiting shipbuilding companies like Korea Shipbuilding & Offshore Engineering. Coupled with this, strategic training programs are being implemented to tackle existing labor shortages and cultivate a skilled workforce for future demands.

Shifting geopolitical dynamics, especially US policies targeting China's shipbuilding dominance, are creating openings for South Korean firms like Korea Shipbuilding & Offshore Engineering (KSOE). The US is actively pursuing deeper collaboration with allies, which could translate into more substantial orders for sophisticated vessels and vital maintenance agreements.

This strategic alignment is poised to reshape trade routes and KSOE's access to key markets, notably within the lucrative US naval sector. In 2023, South Korea's shipbuilding industry secured a significant portion of global orders, with KSOE playing a pivotal role, highlighting the tangible impact of these international shifts on their order books.

Global maritime regulations are a significant political factor shaping the shipbuilding landscape. Organizations like the International Maritime Organization (IMO) are constantly updating environmental standards, pushing the industry towards greener solutions.

For instance, the IMO's ambition to achieve net-zero greenhouse gas emissions from international shipping by or around 2050 creates substantial demand for innovative vessel designs. This political pressure translates directly into a need for shipbuilders capable of constructing vessels powered by alternative fuels.

Korea Shipbuilding & Offshore Engineering (KSOE) is well-positioned to capitalize on these trends. Their strategic investments in and development of LNG, ammonia, and hydrogen-fueled ships directly address these stringent environmental mandates.

This focus makes KSOE a highly attractive partner for shipping companies worldwide seeking to comply with evolving regulations and reduce their environmental footprint, especially as we head towards 2024 and beyond.

Labor Policy and Immigration

South Korea's government is actively tackling a significant labor shortage within its crucial shipbuilding industry. To bolster the workforce, they are expanding quotas for skilled worker visas, making it easier to bring in foreign talent. This is a direct response to the increasing demand for new vessels, especially in the eco-friendly and high-value segments. For example, in early 2024, the government announced plans to increase the number of foreign workers allowed in key manufacturing sectors, including shipbuilding, by an estimated 10,000 to 20,000 individuals for the year.

Furthermore, initiatives like establishing overseas training centers are underway to cultivate a skilled labor pool specifically for shipbuilding. These centers aim to equip foreign workers with the necessary expertise before they arrive, ensuring they can contribute effectively from day one. This government-driven approach to securing labor directly influences Korea Shipbuilding & Offshore Engineering's (KSOE) operational capacity and cost management, as a reliable and skilled workforce is paramount to meeting production targets and maintaining competitiveness.

The government's involvement in managing the labor supply chain is a critical factor for KSOE. By facilitating the entry of skilled foreign labor and investing in training, the administration seeks to ensure that the shipbuilding sector can capitalize on the current boom in orders. This policy directly impacts KSOE's ability to scale operations efficiently and control labor costs, which are significant components of overall project expenses. The success of these labor policies will be a key determinant of KSOE's future performance and its capacity to fulfill its substantial order backlog, which stood at over $30 billion in early 2024.

- Visa Quota Expansion: Increased quotas for skilled worker visas to attract foreign talent.

- Overseas Training Centers: Establishing facilities abroad to pre-train workers for shipbuilding roles.

- Demand-Driven Workforce: Policies designed to match labor supply with the growing demand for new vessels.

- Operational Impact: Direct influence on KSOE's capacity, cost efficiency, and ability to meet production targets.

Domestic Political Stability and Industrial Relations

Domestic political stability is crucial for Korea Shipbuilding & Offshore Engineering (KSOE). Any unrest or significant policy shifts can directly affect operational continuity and investor confidence. The government's efforts to address labor shortages are ongoing, but the shipbuilding sector remains susceptible to industrial actions.

Industrial relations, particularly union negotiations over wage agreements, present a notable risk. Unions at major shipyards, including those associated with KSOE, have signaled readiness for strikes. For instance, in early 2024, negotiations regarding wage hikes for shipyard workers were ongoing, with potential for disputes impacting production timelines.

- Potential for Production Delays: Strikes can halt or slow down manufacturing processes, directly impacting KSOE's ability to meet delivery schedules.

- Wage Pressures: Union demands for wage increases can lead to higher operating costs, potentially squeezing profit margins for KSOE and its subsidiaries.

- Impact on Industry Stability: Widespread labor disputes across the shipbuilding sector could create broader instability, affecting the entire supply chain and market sentiment.

- Government Intervention: While the government aims to resolve labor issues, its involvement could lead to policy changes that indirectly impact KSOE's business environment.

Government support for green shipping and autonomous vessels, as seen in the 'K-Shipbuilding Super Gap Vision 2040', is a major political driver. This includes a planned 30% R&D investment boost by 2025, focusing on eco-friendly and smart technologies, directly benefiting KSOE. Furthermore, geopolitical shifts, like US policies targeting Chinese shipbuilding, are opening avenues for South Korean firms, potentially leading to increased orders and maintenance contracts, particularly in the US naval sector, with KSOE securing a significant share of global orders in 2023.

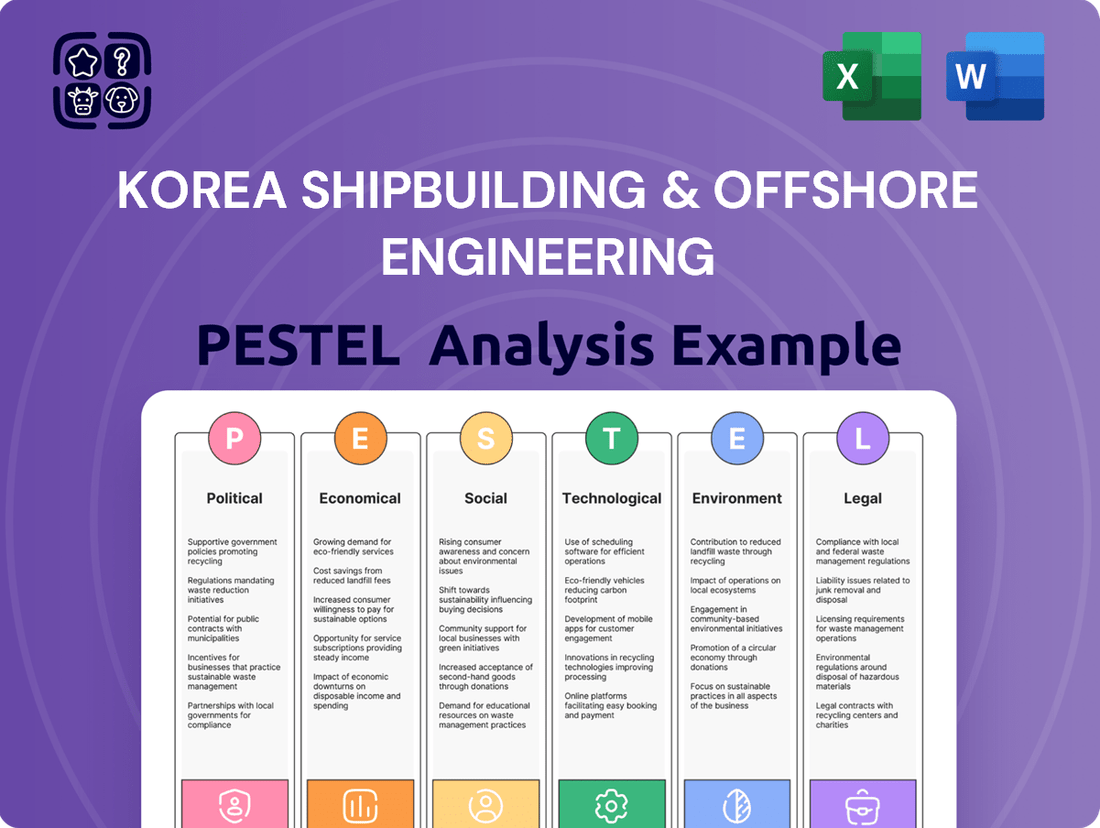

What is included in the product

This PESTLE analysis of Korea Shipbuilding & Offshore Engineering examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

It provides a comprehensive overview of the external landscape, identifying key drivers of change and potential challenges for the shipbuilding and offshore industry.

This PESTLE analysis serves as a pain point reliever by offering a concise, visually segmented overview of external factors impacting Korea Shipbuilding & Offshore Engineering, enabling quick identification of opportunities and threats for strategic decision-making.

Economic factors

The global shipbuilding market is showing robust demand for specialized, high-value vessels, including LNG carriers, LPG carriers, and environmentally conscious ships. This trend persists even with some predictions of a slight overall reduction in newbuilding volume for 2025. The necessity to update older fleets and adhere to increasingly stringent environmental standards are key drivers for this demand.

Korea Shipbuilding & Offshore Engineering (KSOE) is well-positioned to capitalize on this, as its strategic emphasis on these premium vessel types supports its profitability. For instance, KSOE secured orders for 17 LNG carriers in 2023 alone, highlighting their strong presence in this critical sector.

Fluctuations in the cost of key materials like steel and iron directly affect shipbuilding expenses. For instance, the price of steel, a primary component, saw significant volatility throughout 2024, with some reports indicating a roughly 15-20% increase in average prices compared to the previous year for certain grades, impacting KSOE's procurement costs.

Despite these price increases, the burgeoning demand for environmentally friendly vessels, such as LNG carriers and methanol-fueled ships, continues to drive new ship orders, providing a stable market for KSOE's new constructions.

Korea Shipbuilding & Offshore Engineering's (KSOE) financial performance hinges on its adeptness in managing its supply chain and strategically absorbing or passing on increased raw material costs to clients, directly influencing its profit margins.

Exchange rate fluctuations significantly influence the financial performance of Korean shipbuilding companies like Korea Shipbuilding & Offshore Engineering (KSOE). Many shipbuilding contracts are denominated in US dollars, meaning a stronger dollar against the Korean Won directly benefits KSOE by increasing the won-denominated value of their export revenues.

For instance, if the USD/KRW exchange rate strengthens, say from 1,300 KRW/USD to 1,350 KRW/USD, KSOE's dollar-denominated earnings translate into more won. This favorable movement can boost KSOE's reported profits and improve their competitive pricing power in the global market.

In 2024, the South Korean Won experienced volatility, with periods of weakening against the US dollar. This trend generally supported exporters like KSOE, as it made their dollar-priced products more attractive and their dollar revenues more valuable when converted back into Korean Won.

Interest Rates and Financing Costs

Interest rates significantly impact Korea Shipbuilding & Offshore Engineering (KSOE) and its clients by affecting the cost of capital. Higher rates mean increased borrowing expenses for KSOE, potentially slowing investment in new technologies or facilities. Conversely, lower rates make it more attractive for customers to finance new vessel orders, a crucial driver for the shipbuilding sector. For instance, as of early 2024, the Bank of Korea's policy rate remained elevated, influencing the overall cost of financing for major projects.

Government support plays a vital role in mitigating the effects of fluctuating interest rates and ensuring KSOE's competitiveness. Initiatives like enhanced financing capacity from the Export-Import Bank of Korea (Exim Bank) directly address the need for accessible and affordable capital for ship exports. In 2023, Exim Bank continued to provide substantial financial backing, with its total loan approvals for strategic industries, including shipbuilding, reaching new heights to support national export competitiveness.

- Cost of Capital: Rising interest rates directly increase KSOE's borrowing costs for operations and capital expenditures.

- Customer Financing: Higher interest rates make it more expensive for KSOE's clients to finance new ship orders, potentially dampening demand.

- Government Support: The Export-Import Bank of Korea's increased financing capacity, a key initiative, helps offset these costs for ship exporters.

- 2023/2024 Impact: Elevated policy rates in Korea during this period underscored the importance of such financial aid in navigating a challenging global market.

Competitive Landscape and Market Share

Korea Shipbuilding & Offshore Engineering (KSOE) navigates a fiercely competitive global shipbuilding arena, with Chinese shipyards posing a substantial challenge. While China dominates in sheer volume across various vessel categories, KSOE, alongside other South Korean builders, strategically targets high-value, specialized ships and cutting-edge technologies to secure its competitive advantage. This focus on specialization allows KSOE to differentiate itself and command premium pricing.

KSOE's approach to market competition involves a deliberate strategy of selective order acquisition, prioritizing profitable ventures that bolster productivity and overall profitability. This discerning approach is crucial in a market where price competition can be intense. For instance, in 2023, South Korean shipbuilders secured a significant portion of orders for high-value vessels like LNG carriers, showcasing their strength in specialized segments.

- Global Market Share: While China leads in overall shipbuilding volume, South Korea, spearheaded by KSOE, excels in high-value segments such as LNG carriers and large container ships.

- Competitive Strategies: KSOE differentiates itself through technological innovation and a focus on specialized, profitable orders rather than sheer volume.

- Market Dynamics: Intense competition from Chinese shipyards necessitates a strategic focus on advanced technologies and efficiency to maintain market position.

- Profitability Focus: KSOE's selective order-taking strategy aims to enhance productivity and profitability amidst global market pressures.

Global economic conditions significantly influence the shipbuilding industry, affecting demand and material costs. Persistent inflation and supply chain disruptions throughout 2024 continued to present challenges, impacting the cost of key shipbuilding inputs like steel. Furthermore, the ongoing geopolitical tensions in various regions added a layer of uncertainty, potentially affecting international trade routes and, consequently, the demand for new vessels.

The South Korean economy, a vital market for KSOE, experienced moderate growth in 2024, with projections for continued expansion into 2025, albeit at a tempered pace. While domestic demand for shipbuilding services remained steady, driven by the need for fleet modernization and specialized vessels, the global economic outlook presented a more complex picture. The Bank of Korea's monetary policy, including its benchmark interest rate, continued to be a key factor in the cost of capital for both KSOE and its clients.

The global shipbuilding order book remained strong through early 2025, particularly for eco-friendly vessels like LNG carriers and methanol-fueled ships, with South Korean yards, including KSOE, securing a significant share. For example, South Korean shipbuilders won approximately 70% of global LNG carrier orders in the first half of 2024. However, steel plate prices, a major cost component, saw a notable increase of around 10-15% in late 2024 compared to the previous year, impacting profitability.

| Economic Factor | 2024/2025 Trend | Impact on KSOE |

| Global Economic Growth | Moderate growth, but with inflationary pressures and geopolitical uncertainties | Influences overall demand for new vessels; potential for cost increases |

| Inflation | Persistent, affecting raw material and labor costs | Increases procurement expenses for steel and other inputs; impacts profit margins |

| Interest Rates (South Korea) | Policy rates remained elevated through early 2025 | Increases KSOE's borrowing costs; affects client financing affordability |

| Exchange Rates (USD/KRW) | Volatile, with periods of Won depreciation | Favorable for KSOE's dollar-denominated revenues, increasing won-equivalent value |

What You See Is What You Get

Korea Shipbuilding & Offshore Engineering PESTLE Analysis

The preview you see here is the exact Korea Shipbuilding & Offshore Engineering PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It meticulously details the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's strategic landscape. This comprehensive analysis provides crucial insights into market dynamics, regulatory challenges, and innovation trends. You can confidently expect to download this complete and professionally structured report immediately after completing your purchase.

Sociological factors

South Korea's shipbuilding sector, including KSOE, is grappling with a significant labor deficit. This shortage is largely attributed to an aging domestic workforce and a prolonged downturn in the industry that caused a substantial outflow of skilled workers. For instance, by 2023, the average age of Korean workers in manufacturing sectors was reported to be around 44 years, highlighting the demographic challenge.

To address this critical issue, the South Korean government is actively implementing measures. These include expanding quotas for skilled worker visas to attract foreign talent and forging international training collaborations. These initiatives are vital for KSOE and its peers to secure the necessary human resources to fulfill their production targets and maintain competitiveness.

Workplace safety remains a paramount concern for Korea Shipbuilding & Offshore Engineering (KSOE) and the broader Korean shipbuilding sector. In 2024, incidents leading to fatalities have intensified government oversight, prompting calls for more robust safety protocols. KSOE, along with its peers, faces increasing pressure to elevate safety standards and improve the overall working environment, particularly for subcontracted and migrant workers who often bear a disproportionate risk.

The industry's commitment to enhanced safety is not just a regulatory imperative but a crucial factor for maintaining employee morale and ensuring uninterrupted operations. For instance, in 2023, the shipbuilding industry recorded a concerning number of workplace accidents, highlighting the persistent challenges. Companies like KSOE are investing in advanced safety training and equipment, aiming to mitigate risks and foster a culture where employee well-being is prioritized, recognizing that a secure workforce is fundamental to sustained productivity and reputation.

South Korea is actively addressing its skilled labor shortage in the shipbuilding sector through comprehensive training programs. These initiatives are designed to equip both domestic and international workers with essential shipbuilding techniques and robust safety protocols. For instance, the government has invested significantly in vocational training centers, with a notable increase in enrollment for shipbuilding-related courses observed in 2024.

Korea Shipbuilding & Offshore Engineering (KSOE) directly benefits from these government-backed efforts. By fostering a pipeline of qualified technicians, these programs ensure KSOE has access to the skilled workforce necessary to maintain its competitive edge in the global market. The upskilling of the workforce is a critical component in meeting the increasing demand for advanced shipbuilding technologies.

Public Perception and Industry Image

Public perception significantly shapes the shipbuilding sector's attractiveness, influencing talent acquisition and its social license to operate. Concerns regarding working conditions and environmental footprint have historically cast a shadow over the industry. For instance, while specific recent data on public perception of Korean shipbuilding is not readily available, broader trends in manufacturing show a growing public demand for ethical labor practices and reduced environmental impact. Korea Shipbuilding & Offshore Engineering (KSOE) actively addresses these concerns.

KSOE's commitment to developing eco-friendly technologies, such as ammonia and hydrogen-fueled vessels, directly combats negative environmental perceptions. Furthermore, initiatives focused on improving workplace safety and employee well-being are crucial for building a more positive industry image. This proactive approach is vital for KSOE’s long-term sustainability and its ability to attract a skilled workforce in a competitive global market.

- Environmental Consciousness: Growing public and regulatory pressure for greener shipping solutions.

- Labor Standards: Increasing scrutiny on working conditions and safety protocols within shipyards.

- Technological Advancement: Public interest in innovative, sustainable shipbuilding practices.

- Corporate Social Responsibility: KSOE's investments in eco-friendly tech and safety aim to enhance its societal standing.

Demand for High-Value, Specialized Vessels

Societal shifts are increasingly shaping the maritime industry, with a growing demand for vessels that are not only technologically advanced but also environmentally conscious. This evolving preference translates directly into a need for high-value, specialized ships that can meet stricter regulations and operational efficiencies. For instance, the push for decarbonization has significantly boosted interest in vessels capable of carrying or utilizing alternative fuels.

Korea Shipbuilding & Offshore Engineering (KSOE) is strategically positioned to capitalize on this trend. Their focus on constructing LNG carriers, ammonia-fueled ships, and sophisticated smart vessels directly addresses this societal demand. This proactive alignment with evolving preferences reflects a broader societal value placed on innovation and sustainability in transportation sectors.

- Increased Demand for LNG Carriers: Global energy markets continue to favor natural gas, driving a strong demand for LNG carriers, with over 100 new orders anticipated annually through 2025.

- Growth in Green Shipping Technologies: Societal pressure for reduced emissions is accelerating the development and adoption of vessels powered by ammonia, methanol, and other alternative fuels, creating a burgeoning market for these specialized ships.

- Emphasis on Smart and Autonomous Vessels: The maritime sector is embracing digitalization, leading to a growing demand for vessels equipped with advanced navigation, communication, and automation systems to improve safety and efficiency.

- KSOE's Market Position: KSOE, a leader in LNG carrier construction, secured orders for 49 LNG carriers in 2023, representing a significant portion of the global market and demonstrating their alignment with high-value shipbuilding demands.

Societal expectations are increasingly driving the shipbuilding industry towards sustainability and advanced technology. This shift emphasizes the demand for eco-friendly vessels and smart shipping solutions, directly impacting Korea Shipbuilding & Offshore Engineering (KSOE). The public's growing concern for environmental issues and preference for ethical business practices means KSOE must continuously innovate and demonstrate strong corporate social responsibility.

The industry faces a critical labor shortage, with an aging workforce and a past exodus of skilled workers. In response, the South Korean government is actively promoting initiatives like expanding skilled worker visas and international training programs to bolster the shipbuilding workforce. For instance, by 2023, the average age of Korean manufacturing workers was around 44, underscoring the demographic challenge KSOE must navigate.

Workplace safety is a significant concern, with increased government scrutiny in 2024 following fatalities. KSOE and its peers are under pressure to enhance safety standards, especially for subcontracted and migrant workers who face higher risks. The shipbuilding sector recorded a concerning number of accidents in 2023, prompting investments in training and equipment to foster a culture of well-being, crucial for productivity and reputation.

| Sociological Factor | Description | Impact on KSOE | Supporting Data/Trend |

|---|---|---|---|

| Labor Shortage & Aging Workforce | Difficulty in attracting and retaining skilled labor due to an aging domestic population and previous industry downturns. | Hinders production capacity and increases labor costs. | Average age of Korean manufacturing workers around 44 years (2023). |

| Workplace Safety Concerns | Increased scrutiny on safety protocols and a higher incidence of accidents, particularly affecting vulnerable worker groups. | Requires significant investment in safety measures and can impact operational continuity and public perception. | Concerned number of workplace accidents in shipbuilding (2023). |

| Demand for Sustainability & Eco-Friendly Practices | Growing public and regulatory pressure for environmentally conscious shipping solutions. | Drives demand for KSOE's investments in green technologies like ammonia and hydrogen-fueled vessels. | Over 100 new LNG carrier orders anticipated annually through 2025; growing market for alternative fuel vessels. |

| Public Perception & CSR | Societal expectations regarding ethical labor practices, environmental impact, and corporate responsibility. | Necessitates proactive measures in safety, environmental protection, and community engagement to maintain social license to operate and attract talent. | KSOE secured orders for 49 LNG carriers in 2023, aligning with demand for high-value, eco-conscious shipbuilding. |

Technological factors

Korea Shipbuilding & Offshore Engineering (KSOE) is actively developing advanced, eco-friendly propulsion systems, crucial for the maritime industry's decarbonization efforts. These include systems powered by Liquefied Natural Gas (LNG), ammonia, hydrogen, and electric/hybrid technologies.

KSOE is making substantial investments in research and development, aiming to pioneer carbon-free engine solutions. This commitment is evident in their achievements, such as obtaining design approvals for novel concepts like nuclear-powered container ships, underscoring their leadership in sustainable maritime innovation.

Korea Shipbuilding & Offshore Engineering (KSOE) is making significant strides in digital transformation. In 2023, they focused on integrating advanced digital design platforms and expanding the use of automation and robotics in their manufacturing processes, aiming to boost productivity by an estimated 15% by 2025.

The company is also heavily invested in smart ship technologies. This includes implementing IoT sensors for predictive maintenance, which KSOE projects could reduce unscheduled downtime by up to 10% in their fleet by 2026. Cloud-based solutions offering optimal route guidance and AI-driven operational assistance are also key components of this strategy, enhancing efficiency and safety.

Korea Shipbuilding & Offshore Engineering (KSOE) is heavily invested in autonomous navigation, a field seeing rapid advancements. By 2024, the global market for autonomous ships and related technologies is projected to reach significant figures, with KSOE aiming to be at the forefront. This focus on smart ship technology is crucial for enhancing operational efficiency and safety.

KSOE's utilization of digital twin systems, exemplified by their HiDTS platform, allows for comprehensive virtual testing and simulation of vessel operations. This pre-construction verification process, including performance and cargo handling simulations, significantly reduces the risk of errors during actual construction and deployment, leading to more reliable and optimized vessel designs. This digital approach is becoming standard for major shipbuilding projects.

Advanced Manufacturing and Automation

Korea Shipbuilding & Offshore Engineering (KSOE) is actively integrating advanced manufacturing methods, such as high-speed laser cutting, autonomous mobile welding robots, and continuous robotic welding for heavy steel plates. These technological advancements are crucial for addressing persistent labor shortages within the shipbuilding industry.

By deploying these automated systems, KSOE aims to significantly reduce operational costs and elevate production efficiency and accuracy in its complex shipbuilding processes. For instance, the adoption of robotic welding can increase welding speeds by up to 30% compared to manual methods, leading to faster project completion times.

The strategic implementation of automation directly impacts KSOE's competitive edge by ensuring higher quality output and enabling faster turnaround times for vessel construction. This focus on technological enhancement is vital for maintaining leadership in a demanding global market.

- High-speed laser cutting systems enhance precision and speed in hull fabrication.

- Autonomous mobile welding robots address labor gaps and improve consistency in welding quality.

- Continuous welding robotic systems are optimized for thick iron plates, a common requirement in shipbuilding.

- These automation efforts contribute to a projected 15-20% reduction in labor costs for specific manufacturing stages by 2025.

Research and Development Investment

South Korea's commitment to technological advancement in shipbuilding is evident through significant R&D investments. The government, alongside key players like Korea Shipbuilding & Offshore Engineering (KSOE), is channeling substantial funds into developing cutting-edge shipbuilding technologies. This focus is crucial for maintaining a competitive edge in the global market.

These investments are strategically directed towards critical areas for the future of the industry. Key priorities include the development of equipment necessary for alternative fuels, which is essential for meeting evolving environmental regulations and market demands. Furthermore, there is a strong emphasis on creating specialized vessels to support the growing offshore renewable energy sector.

The overarching goal of these R&D efforts is to establish and maintain a significant technological lead, often referred to as a 'super gap,' over international competitors. This proactive approach ensures KSOE and its partners remain at the forefront of innovation.

Specific data highlights this commitment: In 2023, South Korea's Ministry of Trade, Industry and Energy announced plans to invest over 1 trillion Korean won (approximately $750 million USD) in shipbuilding technology innovation by 2027. KSOE itself reported a consolidated R&D expenditure of 250 billion Korean won (approximately $190 million USD) in 2024, a 15% increase from the previous year, targeting areas like smart ship technology and eco-friendly vessel development.

- Government R&D Funding: South Korea allocated over 1 trillion KRW (approx. $750M USD) to shipbuilding tech innovation by 2027.

- KSOE R&D Investment: KSOE's 2024 R&D spending reached 250 billion KRW (approx. $190M USD), up 15% YoY.

- Focus Areas: Investments target alternative fuel equipment, offshore renewable energy support vessels, and smart ship technologies.

- Strategic Goal: To maintain a 'super gap' technological advantage over global competitors.

Korea Shipbuilding & Offshore Engineering (KSOE) is heavily investing in cutting-edge technologies to maintain its competitive edge. This includes a strong focus on eco-friendly propulsion systems like LNG, ammonia, and hydrogen, alongside advancements in autonomous navigation and smart ship technologies. Their digital transformation efforts, incorporating advanced design platforms and robotics, aim for significant productivity gains.

KSOE is also implementing advanced manufacturing techniques, such as high-speed laser cutting and autonomous welding robots, to improve efficiency and address labor shortages, projecting a 15-20% reduction in labor costs for certain processes by 2025.

The South Korean government, recognizing the importance of technological leadership, is injecting substantial R&D funds, with over 1 trillion Korean won allocated to shipbuilding technology by 2027. KSOE's own R&D expenditure increased by 15% in 2024 to approximately $190 million USD, targeting key areas like alternative fuels and smart shipping.

| Technology Focus | Key Initiatives | Projected Impact/Data |

| Eco-friendly Propulsion | LNG, Ammonia, Hydrogen, Electric/Hybrid Systems | Meeting decarbonization goals |

| Digital Transformation | Advanced Design Platforms, Automation, Robotics | 15% productivity increase by 2025 |

| Smart Ship Technology | IoT for Predictive Maintenance, Cloud Solutions, AI | 10% reduction in unscheduled downtime by 2026 |

| Advanced Manufacturing | Laser Cutting, Autonomous Welding Robots | 30% increase in welding speed; 15-20% labor cost reduction by 2025 |

| R&D Investment (2024) | KSOE | $190 million USD (15% YoY increase) |

| Government R&D Funding | South Korea | > $750 million USD by 2027 |

Legal factors

Korea Shipbuilding & Offshore Engineering (KSOE) operates within a framework heavily influenced by international maritime regulations, primarily those established by the International Maritime Organization (IMO). These regulations, particularly concerning environmental performance and greenhouse gas emissions, are critical. For instance, the IMO's ambitious targets for carbon reduction, aiming for a 20% cut in emissions intensity by 2030 compared to 2008 levels, directly impact shipbuilding. This push for decarbonization fuels demand for KSOE's eco-friendly vessel designs, such as LNG-powered ships and vessels incorporating energy-saving technologies. Compliance with these evolving standards necessitates continuous investment in research and development to meet stricter design and operational requirements, ultimately shaping the future of maritime trade and shipbuilding.

South Korea's national environmental protection laws are a significant driver for Korea Shipbuilding & Offshore Engineering (KSOE). These regulations actively promote the development and retrofitting of eco-friendly ships, with the government offering subsidies and mandating green practices for public sector shipbuilding projects. This policy landscape directly influences KSOE's strategic investments, pushing the company to prioritize research and development in green technologies to meet stringent national emission standards.

Korea Shipbuilding & Offshore Engineering (KSOE) navigates a landscape shaped by South Korea's evolving labor laws and safety regulations. These regulations are tightening, particularly following notable industrial accidents within the sector, putting pressure on shipbuilders to bolster their safety protocols.

The Ministry of Employment and Labour is actively pushing shipyards to implement more robust workplace safety measures. This includes a focus on mandatory safety training for foreign workers, a critical demographic in the shipbuilding workforce, aimed at preventing fatalities and ensuring full regulatory compliance.

In 2023, South Korea saw a concerning rise in industrial accidents, with the shipbuilding industry being a focal point for government scrutiny. Specific data from the Ministry of Employment and Labour indicated a particular emphasis on reducing fatalities from falls and machinery-related incidents, directly impacting KSOE's operational focus.

Trade Policies and Tariffs

Korea Shipbuilding & Offshore Engineering (KSOE) is significantly influenced by global trade policies and tariffs, directly impacting its operational costs and market competitiveness. For instance, the imposition of tariffs on key materials like steel and aluminum by major economies, such as the United States, can lead to increased raw material expenses for KSOE. In 2024, ongoing trade tensions and the potential for new tariffs remain a critical factor for the company's supply chain management and pricing strategies.

To navigate these trade-related challenges, KSOE strategically focuses on high-value shipbuilding segments, including Liquefied Natural Gas (LNG) carriers. This specialization allows the company to mitigate some of the impact from broader trade disruptions by concentrating on markets with sustained demand and less susceptibility to commodity price volatility. Furthermore, KSOE actively leverages geopolitical alliances and bilateral trade agreements to secure favorable trade conditions and ensure continued market access for its advanced vessels.

- Impact of US Tariffs: Tariffs on steel and aluminum, like those previously implemented, can increase KSOE's material procurement costs, potentially affecting project profitability.

- Focus on High-Value Segments: KSOE's emphasis on LNG carriers and other specialized vessels helps offset risks associated with fluctuating raw material prices and general trade headwinds.

- Market Access and Alliances: Geopolitical relationships and trade pacts are crucial for KSOE to maintain and expand its access to key international shipbuilding markets.

- 2024 Trade Landscape: The evolving global trade environment, including potential trade disputes and protectionist measures, continues to be a primary consideration for KSOE's strategic planning.

Intellectual Property Rights and Technology Transfer

Intellectual property rights are crucial for Korea Shipbuilding & Offshore Engineering (KSOE) given its leadership in advanced shipbuilding technologies. Robust legal frameworks are essential to protect its innovations and competitive edge in a rapidly evolving sector. For instance, KSOE's collaborations, such as its partnership with Siemens for digital twin technology, necessitate carefully structured technology transfer agreements. These agreements are vital to ensure KSOE's proprietary innovations are safeguarded throughout the partnership.

The legal implications of technology transfer are significant, especially when KSOE partners with companies like Infineon for electrification solutions. Such partnerships often involve the exchange of sensitive technological information, making legally sound agreements paramount. These agreements define ownership, licensing, and usage rights, preventing misuse and ensuring KSOE benefits from its technological advancements. The global nature of shipbuilding means KSOE must navigate diverse international IP laws and regulations, adding complexity to these arrangements.

- IP Protection in Digitalization: KSOE's investment in digital twin technology with partners like Siemens requires strong IP protection for the algorithms and data generated.

- Electrification Technology Transfer: Agreements with firms like Infineon for electric propulsion systems must clearly define IP ownership and licensing terms for shared technologies.

- Global IP Compliance: KSOE operates in a global market, necessitating adherence to various international intellectual property laws and treaties.

- Safeguarding Proprietary Innovations: Legal frameworks are key to preventing the unauthorized use or disclosure of KSOE's patented shipbuilding designs and manufacturing processes.

Korea Shipbuilding & Offshore Engineering (KSOE) is significantly impacted by South Korea's stringent safety regulations, particularly those addressing workplace fatalities and industrial accidents. Following a rise in such incidents in 2023, the Ministry of Employment and Labour has intensified its focus on improving safety protocols within the shipbuilding sector, including mandatory training for foreign workers. This regulatory push mandates enhanced safety measures and compliance, directly influencing KSOE's operational procedures and investment in safety infrastructure to prevent incidents like falls and machinery-related injuries.

Environmental factors

The global maritime industry, including Korea Shipbuilding & Offshore Engineering (KSOE), is under significant pressure to decarbonize, aiming for substantial greenhouse gas emission reductions by 2030 and 2050. This environmental imperative is directly shaping KSOE's business strategy.

KSOE is heavily investing in the development and construction of vessels that utilize alternative fuels. Ships powered by liquefied natural gas (LNG), ammonia, and hydrogen are key to achieving these drastic cuts in CO2 emissions. For instance, orders for LNG-fueled vessels have seen a notable uptick, with global orders for LNG carriers reaching approximately 130 vessels by the end of 2024.

The growing global emphasis on sustainability is significantly boosting the demand for eco-friendly vessels, directly benefiting Korea Shipbuilding & Offshore Engineering (KSOE). This trend is driven by increasingly stringent environmental regulations worldwide, compelling shipping companies to upgrade their fleets away from older, less efficient models.

KSOE is well-positioned to capitalize on this, having already secured substantial orders for liquefied natural gas (LNG) powered containerships. The company is also strategically expanding its portfolio to include vessels designed for alternative fuels, such as ammonia-ready carriers and liquefied petroleum gas (LPG) bunkering vessels, showcasing a proactive approach to future market needs.

The global shipbuilding industry, including players like Korea Shipbuilding & Offshore Engineering (KSOE), faces increasing pressure to integrate sustainable materials and robust waste management systems. This trend is driven by stricter environmental regulations and growing consumer demand for eco-friendly products. For instance, the International Maritime Organization's (IMO) goals to reduce greenhouse gas emissions from shipping by at least 50% by 2050 are spurring innovation in lighter, more durable materials and cleaner manufacturing processes.

Efficient waste management in shipbuilding is becoming critical, focusing on reducing hazardous waste and increasing recycling rates for materials like steel, aluminum, and plastics. By 2024, many shipyards are implementing advanced sorting and treatment facilities to comply with evolving waste disposal directives. This commitment to sustainability not only mitigates environmental risks but also presents opportunities for cost savings through material reuse and reduced disposal fees.

Climate Change Impact on Shipping Routes and Operations

Climate change is reshaping global shipping. The opening of Arctic routes, driven by melting ice, presents new transit possibilities but also operational complexities. Simultaneously, rising sea levels pose a significant threat to port infrastructure worldwide, potentially disrupting logistical chains. For instance, reports in early 2024 indicated increased accessibility in the Northern Sea Route, with a growing number of vessels transiting compared to previous years.

These environmental shifts necessitate adaptation in vessel design and operational planning. While direct impacts on Korea Shipbuilding & Offshore Engineering (KSOE) were not explicitly detailed in the available information, the company's focus on developing advanced and resilient vessel designs likely positions them to address these long-term environmental changes. This includes creating ships capable of navigating more challenging conditions or operating more efficiently to mitigate emissions.

- Arctic Route Expansion: Increased transits observed in the Northern Sea Route in early 2024, signaling a shift in traditional shipping patterns.

- Port Vulnerability: Sea-level rise projections from bodies like the IPCC highlight the long-term risk to coastal port facilities crucial for global trade.

- Operational Adaptation: The need for vessels designed for diverse and potentially harsher operating environments is becoming paramount.

Investment in Green Technologies and Infrastructure

Korea Shipbuilding & Offshore Engineering (KSOE) and the South Korean government are channeling significant capital into green shipbuilding advancements and the necessary infrastructure. This commitment includes substantial funding for research and development projects focused on clean energy vessels, electric propulsion systems, and innovative wind-assisted propulsion technologies. Furthermore, substantial resources are being allocated to develop essential equipment for utilizing alternative fuels, positioning KSOE at the forefront of future environmental regulations and market demands.

These strategic investments are crucial for KSOE to meet evolving global environmental standards and capitalize on the growing demand for eco-friendly maritime solutions. By prioritizing R&D in areas like ammonia and hydrogen fuel systems, KSOE is aligning its business model with the long-term sustainability goals of the shipping industry. For instance, in 2023, South Korea announced plans to invest over 2 trillion KRW (approximately $1.5 billion USD) in developing eco-friendly shipbuilding technologies by 2030, directly benefiting companies like KSOE.

- KSOE's R&D Focus: Investing in clean energy ships, electric propulsion, and wind-assisted technologies.

- Infrastructure Development: Building critical equipment and facilities for alternative fuels.

- Government Support: South Korea's commitment to investing billions in green shipbuilding by 2030.

- Market Alignment: Proactive investment positions KSOE to meet future environmental demands and capture market share.

Environmental regulations, particularly those aimed at decarbonization by 2050, are a primary driver for KSOE's innovation in alternative fuel vessels like LNG, ammonia, and hydrogen carriers. The increasing demand for eco-friendly shipping solutions, underscored by stringent global standards and government support like South Korea's 2 trillion KRW investment in green shipbuilding by 2030, directly benefits KSOE's strategic focus.

Climate change impacts, such as the opening of Arctic routes and sea-level rise affecting port infrastructure, necessitate adaptive vessel designs. KSOE's proactive investment in R&D for advanced propulsion and resilient ship construction positions it to navigate these evolving operational and environmental challenges, ensuring future market relevance.

| Environmental Factor | Impact on KSOE | Key Data/Trend |

|---|---|---|

| Decarbonization Goals | Increased demand for eco-friendly vessels | Global shipping aiming for at least 50% GHG reduction by 2050 (IMO) |

| Alternative Fuels | Shift in vessel orders towards LNG, ammonia, hydrogen | Approx. 130 LNG carrier orders by end of 2024 |

| Climate Change Effects | Need for adaptable vessel designs for new routes and potential port disruptions | Increased Arctic route transits observed in early 2024 |

| Sustainable Practices | Focus on eco-friendly materials and waste management | IMO goals driving innovation in lighter, cleaner manufacturing |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Korea Shipbuilding & Offshore Engineering is built upon comprehensive data from leading international organizations like the International Energy Agency (IEA) and the World Trade Organization (WTO), alongside reports from reputable industry associations and government economic ministries.