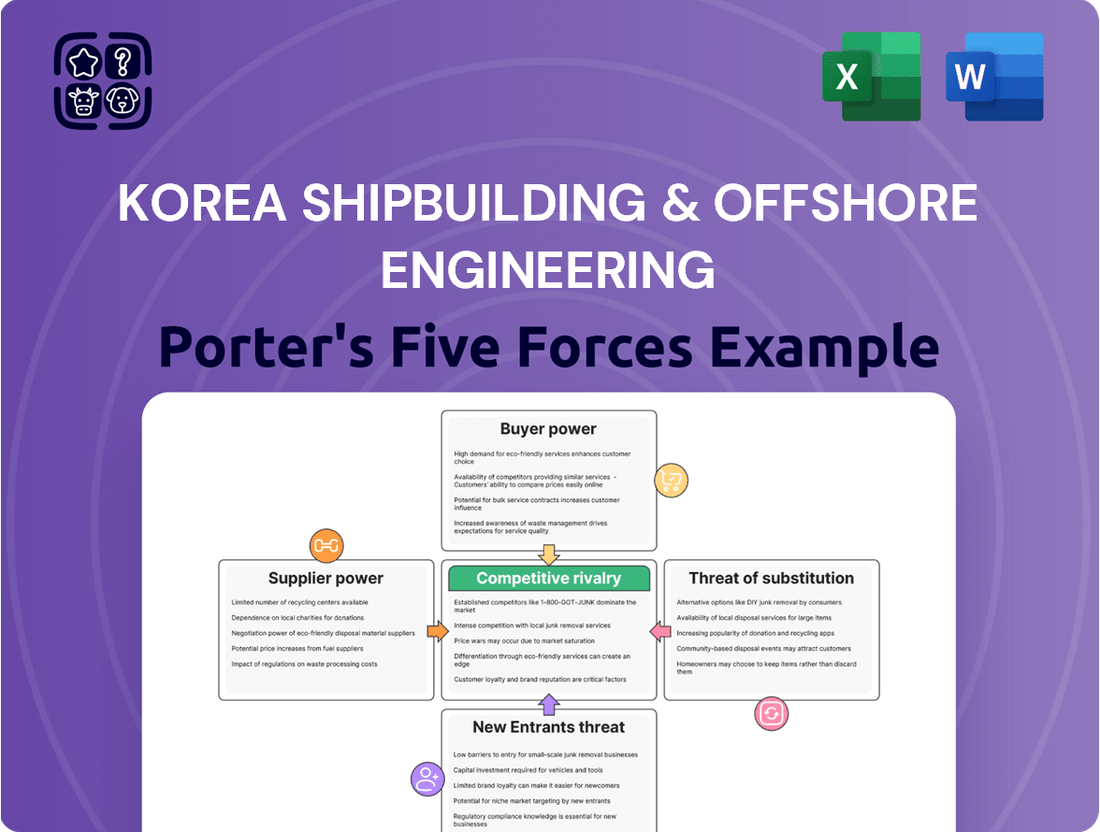

Korea Shipbuilding & Offshore Engineering Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Korea Shipbuilding & Offshore Engineering Bundle

Korea Shipbuilding & Offshore Engineering (KSOE) navigates a fiercely competitive landscape, where intense rivalry among existing players significantly impacts pricing and profitability. The threat of new entrants, while moderate, requires constant vigilance and innovation to maintain market share. Buyer bargaining power is substantial, driven by large, sophisticated clients demanding customized solutions and competitive pricing.

The industry's reliance on specialized materials and skilled labor gives suppliers considerable leverage, influencing production costs and lead times for KSOE. Furthermore, the availability of substitute technologies, though currently limited in large-scale shipbuilding, presents a long-term consideration for strategic planning. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Korea Shipbuilding & Offshore Engineering’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The shipbuilding industry, including major players like Korea Shipbuilding & Offshore Engineering (KSOE), depends on a global supply chain for essential components such as advanced engines, sophisticated navigation systems, and critical electronic parts. If a small number of suppliers control the market for these specialized components, they gain considerable leverage. This concentration means these suppliers can dictate terms, potentially increasing prices or extending delivery times for KSOE. For instance, a significant portion of high-powered marine diesel engines, crucial for large vessels, comes from a limited number of manufacturers, giving them substantial bargaining power.

Steel and other essential raw materials form the bedrock of shipbuilding, and their market prices are notoriously unpredictable. Korea Shipbuilding & Offshore Engineering (KSOE), like its industry peers, is significantly exposed to these commodity price swings, which directly impact both manufacturing expenses and profitability.

The global steel market is concentrated, with primary producers in China, South Korea, and Japan also being significant shipbuilding nations themselves. This geographical overlap can create complex dynamics influencing the availability and cost of steel crucial for KSOE's operations. For instance, in 2024, global steel prices experienced fluctuations driven by factors like production levels in China and demand from various industrial sectors.

The shipbuilding industry, including giants like Korea Shipbuilding & Offshore Engineering (KSOE), relies heavily on a specialized and highly skilled workforce. Think welders, pipefitters, electricians, and a range of engineers with very specific expertise. The availability of these professionals is critical for efficient and timely production.

Globally, there's a recognized shortage in many of these critical trades. This scarcity means that skilled labor holds significant bargaining power. When demand for shipbuilding is high, these skilled workers can command higher wages and better working conditions, directly impacting KSOE's operational costs and project timelines.

This isn't just a theoretical concern; it's a practical challenge. For instance, reports from 2024 highlighted ongoing efforts by various nations to address these labor gaps through international agreements and training programs to bolster their domestic shipbuilding capabilities. This indicates the widespread nature of the skilled labor deficit impacting major players in the sector.

Supplier Switching Costs

Supplier switching costs represent a significant factor in the bargaining power of suppliers for Korea Shipbuilding & Offshore Engineering (KSOE). When KSOE needs highly specialized or integrated systems, changing suppliers isn't just a simple swap. It often involves costly and time-consuming processes like re-engineering existing components, obtaining new certifications, and potentially facing project delivery delays. These substantial barriers effectively lock KSOE into relationships with their current suppliers, thereby amplifying the suppliers' leverage.

This dynamic is particularly pronounced in the realm of complex marine engineering systems. For instance, the integration of advanced propulsion systems or sophisticated navigation equipment often requires bespoke solutions and deep technical collaboration.

- High switching costs for specialized marine systems

- Re-engineering and re-certification processes are often required

- Potential for project delivery delays increases supplier leverage

- KSOE's reliance on integrated systems strengthens supplier bargaining power

Technological Advancements and Proprietary Technology

Technological advancements significantly bolster supplier bargaining power for Korea Shipbuilding & Offshore Engineering (KSOE). Suppliers possessing proprietary or cutting-edge technologies, particularly in green propulsion systems like LNG, ammonia, and hydrogen fuel cells, wield considerable influence. For instance, the demand for advanced eco-friendly solutions is surging, with the global market for green shipping technologies projected to reach substantial figures by 2030.

KSOE's strategic focus on these innovative areas inherently increases its dependence on specialized suppliers. This reliance grants these suppliers greater leverage in negotiations, as KSOE requires their unique technological contributions to remain competitive and meet evolving environmental regulations. The scarcity of providers for such niche, high-tech components further amplifies their bargaining strength.

- Suppliers of advanced eco-friendly propulsion systems (LNG, ammonia, hydrogen) benefit from high demand and limited competition.

- Proprietary smart ship technologies also create dependencies for shipbuilding giants like KSOE.

- The need for specialized components for next-generation vessels strengthens the negotiating position of technology-rich suppliers.

- This technological edge allows suppliers to command premium pricing and favorable contract terms.

The bargaining power of suppliers for Korea Shipbuilding & Offshore Engineering (KSOE) is moderately high, primarily due to the specialized nature of many components and the concentration within certain supply segments. While KSOE can leverage its scale for raw materials like steel, critical engine technologies and advanced electronic systems are often sourced from a limited number of global providers who hold significant sway. This situation is exacerbated by high switching costs associated with integrating new systems, potentially delaying crucial projects.

The global marine engine market, for instance, is dominated by a few key players, such as MAN Energy Solutions and Wärtsilä, who supply the high-horsepower engines essential for large vessels. These suppliers can influence pricing and delivery schedules, impacting KSOE's production efficiency. In 2024, continued supply chain disruptions and increased demand for vessel new builds have further empowered these specialized component manufacturers.

| Factor | Impact on KSOE | Key Suppliers/Components | 2024 Trend/Data Point |

| Supplier Concentration | Moderate to High | Marine Engines, Navigation Systems, Electronics | Limited number of key engine manufacturers maintain strong market share. |

| Switching Costs | High | Integrated propulsion systems, proprietary software | Re-engineering and re-certification can add months to project timelines. |

| Raw Material Volatility | Moderate | Steel, specialized alloys | Global steel prices saw fluctuations in 2024 due to geopolitical factors and demand shifts. |

| Technological Specialization | High | Eco-friendly propulsion (LNG, Ammonia), smart ship tech | Demand for green shipping solutions strengthens suppliers of these niche technologies. |

What is included in the product

This analysis dissects the competitive forces impacting Korea Shipbuilding & Offshore Engineering, revealing the intensity of rivalry, buyer and supplier power, threats from new entrants and substitutes.

Instantly assess competitive intensity with a visually intuitive five forces breakdown, simplifying complex market dynamics for Korea Shipbuilding & Offshore Engineering.

Customers Bargaining Power

Korea Shipbuilding & Offshore Engineering (KSOE) faces significant bargaining power from its customers due to customer concentration and the sheer size of orders. KSOE's client base is primarily composed of major global shipping conglomerates, energy giants, and national governments. These entities typically commission extremely large, high-value contracts, often for multiple vessels or complex offshore structures.

The substantial financial commitment and strategic importance of these individual orders grant these customers considerable sway. For instance, securing a single, multi-billion dollar order for LNG carriers is crucial for KSOE's order backlog and revenue stream. The potential loss of such a significant contract can have a pronounced negative impact on KSOE's financial performance and future project pipeline.

While there are some standardized ship types, a significant portion of orders, particularly for complex vessels like LNG carriers and offshore platforms, require extensive customization. This means customers with specific, high-tech demands, like those for next-generation eco-friendly fuel systems, can wield considerable power over KSOE's design and pricing strategies.

For instance, a major oil company commissioning a specialized offshore production facility in 2024 would likely negotiate terms very differently than a bulk carrier operator. The sheer uniqueness of the offshore project demands tailored solutions, giving the customer a stronger hand in dictating specifications and securing favorable pricing for KSOE's advanced engineering capabilities.

The bargaining power of customers in the shipbuilding industry is significantly influenced by the availability of alternative shipbuilders. Buyers have a range of options, particularly from major shipbuilding nations like China, South Korea, and Japan, which house large, competent yards. For instance, in 2024, South Korea's shipbuilding sector, including KSOE's rivals such as Hanwha Ocean and Samsung Heavy Industries, continued to compete fiercely for global orders.

This competitive landscape allows customers to shop around, comparing pricing and terms from multiple established players. For standard vessel types, where differentiation is less pronounced, customers can leverage this choice to negotiate more advantageous contracts. The sheer number of capable shipyards globally means that no single customer holds overwhelming sway, but rather, their collective choices drive competitive pricing.

Customer Price Sensitivity and Profitability

Customer price sensitivity is a significant factor for Korea Shipbuilding & Offshore Engineering (KSOE). Many of KSOE's clients, such as shipping and energy companies, operate in intensely competitive sectors themselves. This intense competition means these customers are highly attuned to the cost of acquiring new vessels, directly impacting their investment decisions.

The profitability of these customer industries plays a crucial role in their negotiation power with shipbuilders. When shipping and energy firms are experiencing strong financial performance, they have greater capacity and willingness to invest in new builds, potentially softening their stance on price. Conversely, during downturns, their financial strain amplifies their focus on cost reduction, increasing their bargaining leverage.

- Shipping industry freight rates in 2024 have seen fluctuations, impacting operators' investment capacity. For example, the Baltic Dry Index, a key indicator for bulk shipping costs, experienced volatility throughout the year.

- Energy companies' capital expenditure budgets are heavily influenced by global oil and gas prices. Fluctuations in crude oil prices directly affect their ability to commit to large shipbuilding orders for tankers or offshore platforms.

- The average price of a new large container vessel can range from $100 million to over $200 million, making acquisition cost a critical negotiation point for shipping lines.

- Shipbuilders like KSOE must balance competitive pricing with the need to maintain healthy profit margins, especially when dealing with customers facing significant economic pressures.

Long-term Relationships and Repeat Business

While customers possess significant bargaining power in the shipbuilding industry, many prioritize long-term relationships with established players like Korea Shipbuilding & Offshore Engineering (KSOE). This is driven by the extended operational life of vessels, often exceeding 20-30 years, which necessitates ongoing support and future fleet expansion plans. The desire for predictable quality and a trusted partner can outweigh aggressive price negotiations for specialized or large-scale projects.

For instance, major shipping lines often engage in framework agreements with shipbuilders, securing capacity and favorable terms over multiple years. This fosters loyalty and reduces the individual negotiation leverage on each new order. KSOE, recognized for its technological prowess and consistent delivery, benefits from this customer preference.

- Long Vessel Lifespans: Ships are assets with lifespans of decades, leading to repeat business for maintenance, upgrades, and new builds.

- Need for Reliability: Customers value consistent quality and on-time delivery, crucial for their own operational schedules.

- Fleet Renewal Cycles: Regular fleet modernization creates ongoing demand, encouraging stable customer-shipbuilder relationships.

- Complex Projects: High-value, technologically advanced vessels often involve close collaboration, strengthening long-term ties.

Customers' bargaining power over Korea Shipbuilding & Offshore Engineering (KSOE) is substantial due to buyer concentration and the significant value of individual orders. Major global conglomerates and national entities often place multi-billion dollar contracts for complex vessels, granting them considerable negotiation leverage.

This power is amplified by the intense competition among shipbuilders in South Korea, China, and Japan, allowing buyers to secure favorable pricing and terms. Customer price sensitivity, driven by their own competitive markets, further intensifies this dynamic.

However, many customers prioritize long-term relationships with established builders like KSOE for reliability and specialized projects, which can temper aggressive price demands.

| Factor | Impact on KSOE | Example (2024 Data) |

|---|---|---|

| Customer Concentration | High | Major energy firms commissioning offshore platforms |

| Order Size & Value | High | Multi-billion dollar LNG carrier contracts |

| Availability of Alternatives | High | Competition from Hanwha Ocean and Samsung Heavy Industries |

| Customer Price Sensitivity | High | Shipping companies' focus on freight rate volatility |

| Relationship Importance | Moderate | Long-term agreements for fleet renewal |

What You See Is What You Get

Korea Shipbuilding & Offshore Engineering Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Korea Shipbuilding & Offshore Engineering, detailing the competitive landscape it navigates. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the shipbuilding and offshore sectors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

The global shipbuilding arena is a battleground dominated by a few major players, primarily from Asia. China consistently leads in new shipbuilding orders, often securing over half the global market share, while South Korea remains a formidable competitor, typically accounting for around 30% of new orders. This concentration means companies like Korea Shipbuilding & Offshore Engineering (KSOE) face fierce competition not only from global giants but also from their domestic counterparts such as Samsung Heavy Industries and Hanwha Ocean, alongside a significant number of large Chinese shipyards vying for the same contracts.

While China dominates in sheer shipbuilding volume, often leveraging cost advantages, Korean shipbuilders like KSOE are strategically targeting high-value segments. This includes specialized vessels such as LNG carriers, sophisticated offshore structures, and cutting-edge eco-friendly ships designed for fuels like methanol, ammonia, and hydrogen.

This focus on advanced, environmentally conscious vessels creates a distinct competitive landscape. Here, technological prowess and continuous innovation become the primary means of differentiation, setting South Korean shipbuilders apart from those focused on mass production.

For instance, in 2023, South Korea secured a significant portion of global orders for LNG carriers, a testament to its technological leadership in this high-value niche. As of early 2024, the demand for dual-fuel vessels, which can run on both conventional and alternative fuels like LNG and methanol, continues to surge, with Korean yards holding a dominant share of these advanced orders.

Recent geopolitical shifts, like U.S. policies targeting Chinese-built tonnage, are reshaping the shipbuilding industry. This creates a dynamic where some shipowners are redirecting orders from Chinese shipyards to South Korean ones, potentially intensifying competition among key players.

This rebalancing act means South Korean shipbuilders, including Korea Shipbuilding & Offshore Engineering (KSOE), must navigate evolving trade landscapes and regulatory shifts. For instance, the U.S. Export-Import Bank's renewed focus on financing U.S. shipbuilding and repair capabilities could indirectly impact global order flows.

The ongoing trade tensions and the push for supply chain resilience are favorable for South Korean yards, which are perceived as more stable partners. This trend is evident as global shipbuilding order volumes show fluctuations, with South Korea often securing a significant share of high-value contracts, particularly in LNG carriers.

In 2023, South Korea maintained its leading position in global shipbuilding orders, securing a substantial portion of the market share, especially for eco-friendly vessels. This competitive edge is further bolstered by geopolitical factors that encourage diversification away from traditional shipbuilding hubs.

Industry Overcapacity and Order Backlogs

The shipbuilding industry, including players like Korea Shipbuilding & Offshore Engineering (KSOE), has a history of overcapacity, which fuels intense price competition among shipyards. Even with strong demand for specific vessel types, this underlying oversupply creates pressure on margins. For instance, while KSOE reported a significant order backlog in early 2024, the global shipbuilding market’s cyclical nature and ongoing capacity increases, especially from Chinese shipbuilders, necessitate strategic order acquisition to ensure sustained profitability.

Maintaining profitability in this environment requires KSOE to be highly selective about the projects it undertakes. The constant threat of new capacity, particularly from emerging competitors, means that even strong order books can be vulnerable to price erosion if not managed carefully. This dynamic highlights the critical importance of efficient operations and advanced technology for South Korean shipbuilders to stay ahead.

- Overcapacity Concerns: Historically, the global shipbuilding sector has grappled with periods of excess capacity, leading to aggressive price wars.

- KSOE's Order Backlog: As of the first half of 2024, KSOE maintained a robust order backlog, reflecting strong demand for its high-value vessels.

- Competitive Landscape: Continuous capacity expansion, notably from Chinese shipyards, poses a persistent competitive threat, impacting pricing power.

- Strategic Order Selection: KSOE's ability to maintain profitability hinges on its careful selection of orders, prioritizing those with better margins and technological advantages.

Technological Innovation and R&D Investment

Competitive rivalry in the shipbuilding sector is intensely fueled by ongoing technological innovation. This is particularly evident in the advancements seen in smart ship technologies, increased automation, and the development of alternative fuel systems to meet stringent environmental standards.

Korea Shipbuilding & Offshore Engineering (KSOE) places significant emphasis on research and development (R&D) to pioneer advanced, eco-friendly, and smart ship technologies. This strategic focus is absolutely vital for KSOE to maintain its competitive edge and to successfully secure lucrative, high-value contracts. The global market is increasingly prioritizing environmental compliance and operational efficiency, making R&D a critical differentiator.

- Innovation in Smart Ship Technology: KSOE is actively developing integrated navigation and control systems, along with predictive maintenance solutions for enhanced operational efficiency and safety.

- Eco-Friendly Solutions: The company is investing heavily in technologies like ammonia and methanol-fueled engines, as well as advanced ballast water treatment systems, to meet evolving global emissions regulations.

- R&D Investment: In 2023, KSOE’s parent company, HD Hyundai, reported significant R&D expenditures aimed at future shipbuilding technologies, demonstrating a commitment to innovation.

- Market Demand Shift: The industry is witnessing a growing demand for greener vessels, with a substantial portion of new orders in 2024 specifying alternative fuel capabilities, directly impacting competitive pressures.

The global shipbuilding market is intensely competitive, with a few dominant Asian players. Korea Shipbuilding & Offshore Engineering (KSOE) faces stiff rivalry from its domestic peers like Samsung Heavy Industries and Hanwha Ocean, as well as a significant number of large Chinese shipyards. This rivalry is exacerbated by historical overcapacity, which drives aggressive pricing strategies.

While China often leads in volume by leveraging cost advantages, KSOE and its South Korean counterparts focus on high-value segments such as LNG carriers and eco-friendly vessels. This technological differentiation is key, especially as demand for ships powered by alternative fuels like methanol and ammonia surges. For instance, South Korean yards secured a substantial share of global LNG carrier orders in 2023, highlighting their technological edge.

Geopolitical factors, including U.S. trade policies, are also reshaping competition, potentially diverting orders to South Korean shipbuilders and intensifying rivalry among key players. KSOE's strategy involves careful order selection to maintain profitability amidst these dynamics and ongoing capacity expansions from competitors, particularly in China.

Innovation in smart ship technology and alternative fuel systems is a critical battleground. KSOE's substantial R&D investments in 2023, for example, underscore the importance of technological leadership in securing high-value contracts and staying ahead in a market where environmental compliance and efficiency are paramount.

| Metric | KSOE (HD Hyundai) | Global Competitors (Key Chinese Yards) | Industry Trend (Early 2024) |

|---|---|---|---|

| New Order Share (2023 Estimate) | Approx. 30% (South Korea) | Approx. 50%+ (China) | South Korea leading in high-value/eco-friendly vessels. |

| Focus Areas | LNG Carriers, Eco-Ships (Methanol/Ammonia) | Bulk Carriers, Container Ships, Cost-Sensitive Tonnage | Growing demand for dual-fuel and green technologies. |

| R&D Investment (2023) | Significant (HD Hyundai Group) | Varies, often focused on scale and cost reduction. | Increased investment in future shipbuilding technologies. |

| Competitive Pressure | High due to overcapacity and Chinese expansion. | Strong pricing power in high-value segments. | Geopolitical shifts influencing order allocation. |

SSubstitutes Threaten

For the majority of global trade, particularly bulk and high-volume goods, ocean shipping presents the most economical and feasible transport solution. This reality significantly limits the availability of direct substitutes for large commercial vessels.

While air cargo offers speed, its cost is generally prohibitive for the vast quantities of goods moved by sea. For instance, in 2023, the cost per kilogram for air freight can range from $2 to $5, compared to a fraction of a cent for ocean freight, highlighting the economic disparity.

The infrastructure required for alternative large-scale transport, such as extensive rail networks connecting major ports or widespread pipeline systems for diverse goods, is either underdeveloped or not universally applicable. This further solidifies the dominance of maritime transport for international commerce.

Consequently, businesses relying on the efficient and cost-effective movement of substantial cargo volumes have very few viable alternatives to traditional ocean shipping, reinforcing its position as a critical component of global supply chains.

Technological advancements in logistics, like AI-driven route optimization, are enhancing the efficiency of current maritime operations. This efficiency could temper the demand for new vessel construction by maximizing the output of existing fleets. For instance, companies implementing advanced logistics software have reported efficiency gains of up to 15% in route planning.

Furthermore, the increasing adoption of modular construction techniques in the offshore sector presents a potential challenge. This approach allows for the assembly of offshore structures from pre-fabricated components, potentially diminishing the reliance on large, integrated offshore platforms traditionally built entirely in shipyards.

The maritime industry is experiencing a significant shift towards greener vessel types, driven by global decarbonization efforts and increasingly stringent environmental regulations. This trend effectively substitutes older, less eco-efficient ships with newer designs that utilize alternative fuels like LNG, methanol, and ammonia. For instance, by the end of 2024, the International Maritime Organization’s (IMO) targets are expected to further accelerate this transition, pushing shipowners to invest in compliant fleets.

Korea Shipbuilding & Offshore Engineering (KSOE) is strategically positioned to navigate this threat of substitution by actively pursuing leadership in these advanced, eco-friendly shipbuilding technologies. Their investment in research and development for dual-fuel engines and sustainable propulsion systems allows them to offer the very solutions that are replacing traditional vessels. This proactive approach ensures KSOE remains at the forefront of the evolving shipbuilding landscape.

Alternative Energy Extraction/Transportation Methods

Pipelines can emerge as a significant substitute for offshore platforms in oil and gas transportation, especially when considering geographical feasibility and cost-effectiveness. For instance, in regions where laying subsea pipelines is more economical than constructing and maintaining offshore extraction facilities, this presents a direct threat to KSOE's traditional offshore engineering business.

The global energy landscape is undergoing a profound transformation, with a pronounced shift towards renewable energy sources. This transition poses a long-term threat to demand for new offshore oil and gas infrastructure. However, it is crucial to note KSOE's strategic diversification into offshore wind turbine substructures, which positions the company to capitalize on this evolving market, mitigating some of the substitution threat.

- Pipeline Infrastructure: Direct competition for oil and gas transport routes where pipelines offer a more cost-effective solution than offshore platforms.

- Renewable Energy Transition: The broader global move away from fossil fuels could decrease the need for new offshore oil and gas extraction projects.

- KSOE's Diversification: Expansion into offshore wind projects serves as a counter-strategy against declining fossil fuel infrastructure demand.

Longevity and Maintenance of Existing Fleets

The longevity and maintenance of existing fleets present a significant threat of substitution for new shipbuilding orders. Vessels often have operational lifespans ranging from 20 to 50 years, meaning shipowners can choose to extend the life of their current assets through extensive maintenance and retrofitting programs. This strategy becomes particularly attractive when economic conditions are unfavorable or when the cost of new vessels is prohibitively high.

For instance, during periods of economic uncertainty, shipowners might prioritize significant overhauls and upgrades to their existing fleets rather than committing to the substantial capital expenditure of new builds. This focus on prolonging the utility of current ships directly substitutes the demand for new shipbuilding capacity.

- Extended Vessel Lifespans: Ships typically operate for 20-50 years, offering a long window for maintenance and upgrades.

- Maintenance as Substitution: Owners may invest in extensive repair, retrofitting, or life-extension programs for older vessels, delaying or negating the need for new construction.

- Economic Sensitivity: This substitution threat intensifies during economic downturns or when newbuild prices are elevated, making existing asset utilization more cost-effective.

- Impact on Newbuild Demand: The decision to maintain rather than replace existing fleets directly reduces the market demand for new shipbuilding orders.

For bulk and high-volume goods, ocean shipping remains the most economical transport, limiting direct substitutes for large commercial vessels, as air cargo costs are prohibitive for such quantities.

The limited infrastructure for alternative large-scale transport like rail or pipelines also reinforces maritime dominance, making it difficult to substitute for international commerce.

However, pipelines can substitute for offshore platforms in oil and gas transport where they are more cost-effective, and the global shift to renewables may decrease demand for new fossil fuel infrastructure, although KSOE's diversification into offshore wind mitigates this.

Extended lifespans of existing vessels, through maintenance and retrofitting, also substitute for new shipbuilding orders, especially during economic downturns when newbuild costs are high.

Entrants Threaten

The shipbuilding sector, particularly for large-scale projects, presents a formidable barrier to entry due to its extreme capital intensity. Newcomers face the daunting task of acquiring or building extensive shipyard facilities, investing in specialized heavy machinery, and funding significant research and development efforts. For instance, establishing a competitive shipbuilding yard can easily run into billions of dollars, a sum that deters most potential entrants.

This high financial hurdle directly limits the threat of new entrants for companies like Korea Shipbuilding & Offshore Engineering (KSOE). The sheer scale of investment needed to match KSOE's existing infrastructure and technological capabilities makes it economically unfeasible for smaller or less capitalized firms to enter the market and effectively compete.

In 2023, global shipbuilding orders reached approximately 35.8 million Compensated Gross Tonnage (CGT), indicating a robust market but also highlighting the significant scale of operations required to capture a meaningful share. New entrants would need to secure financing for shipyards and equipment capable of handling such large order volumes, a capital outlay that remains a primary deterrent.

The shipbuilding industry, especially for complex vessels like LNG carriers or eco-friendly ships, is heavily reliant on advanced technological know-how and substantial research and development investment. New companies entering this arena would face a significant hurdle in acquiring the specialized engineering skills and proprietary technologies that established players like Korea Shipbuilding & Offshore Engineering (KSOE) possess.

For instance, developing proprietary ballast water treatment systems or advanced hull designs requires years of dedicated R&D. This technological complexity acts as a powerful deterrent, making it difficult for newcomers to compete effectively without a considerable time and capital commitment. KSOE's ongoing investment in smart ship technologies and sustainable vessel designs further elevates this barrier to entry.

The shipbuilding industry, particularly for large vessels, is characterized by exceptionally long lead times, often spanning several years from the initial order to the final delivery of a ship. This extended cycle presents a significant hurdle for potential new entrants aiming to challenge established players like Korea Shipbuilding & Offshore Engineering (KSOE).

Newcomers would face immense difficulty in replicating the robust infrastructure, including shipyards and specialized equipment, that KSOE already possesses. Furthermore, attracting and retaining a highly skilled workforce, essential for complex shipbuilding processes, requires substantial investment in training and development, a commitment that new firms might find prohibitive.

Establishing reliable and cost-effective global supply chains for raw materials and components is another critical barrier. KSOE benefits from long-standing relationships with suppliers, ensuring consistent quality and competitive pricing, something a new entrant would take years to cultivate. For instance, as of 2024, the global shipbuilding order backlog for major vessel types remains substantial, indicating continued demand but also highlighting the entrenched nature of existing capacity.

Strong Brand Reputation and Customer Relationships

Korea Shipbuilding & Offshore Engineering (KSOE) benefits from a significant barrier to entry due to its robust brand reputation and deeply entrenched customer relationships. Established players like KSOE have cultivated decades of trust by consistently delivering high-quality, reliable vessels on schedule. In 2023, KSOE secured orders totaling $19.4 billion, underscoring their continued market strength and customer confidence.

Newcomers would struggle to replicate this level of credibility. Large shipping conglomerates and major energy firms, responsible for substantial investments, heavily favor shipbuilders with proven track records. These clients prioritize minimizing risk, making it challenging for unproven entities to secure the large, complex contracts that define the industry. For instance, KSOE's order backlog stood at approximately $37.3 billion at the end of 2023, representing significant future revenue secured by their reputation.

- Strong Brand Reputation: KSOE's decades of experience translate into trust and reliability, a crucial factor for large clients.

- Established Customer Relationships: Long-standing partnerships with major shipping lines and energy companies are difficult for new entrants to penetrate.

- High Barrier to Entry: The need to build trust and secure major contracts requires significant time and proven performance, deterring new competitors.

- Financial Strength Backing Reputation: KSOE's substantial order backlog in 2023 ($37.3 billion) reinforces its market position and ability to attract future business.

Regulatory Hurdles and Environmental Standards

The shipbuilding sector faces substantial regulatory obstacles that deter new players. For instance, the International Maritime Organization's (IMO) stringent sulfur emission limits, like those in effect since January 2020, necessitate significant investment in cleaner fuel technologies or scrubbers.

New entrants must also contend with evolving environmental standards, such as those related to ballast water management and greenhouse gas reductions, which require advanced engineering and substantial capital outlay for compliance. These complex requirements increase the cost and time associated with establishing a competitive presence in the market.

- Regulatory Compliance Costs: New entrants face significant upfront costs to meet international safety, environmental, and labor regulations, impacting initial investment decisions.

- Environmental Technology Investment: Adherence to stricter emission standards and the adoption of green shipbuilding practices demand considerable investment in new technologies.

- Complex Compliance Framework: Navigating diverse and evolving international maritime regulations adds layers of complexity and potential delays for any new entrant.

The threat of new entrants for Korea Shipbuilding & Offshore Engineering (KSOE) is significantly low due to the industry's extreme capital intensity and technological complexity. High upfront costs for shipyards, specialized machinery, and R&D create substantial barriers. For example, establishing a new, competitive shipbuilding facility can easily cost billions of dollars, a sum that deters most potential competitors.

Newcomers also struggle to match KSOE's established brand reputation and deep customer relationships, built over decades of reliable performance. Securing large, complex contracts requires proven track records and trust, which new firms lack. KSOE's substantial order backlog, reaching approximately $37.3 billion at the end of 2023, underscores its market dominance and the difficulty new players face in penetrating this entrenched market.

Furthermore, stringent international regulations, particularly environmental standards like IMO sulfur emission limits, necessitate significant investment in advanced technologies for compliance. These regulatory hurdles, coupled with the need for a highly skilled workforce and robust supply chains, further solidify KSOE's position and deter new market entrants.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

|---|---|---|---|

| Capital Intensity | Requirement for massive investment in shipyards and equipment. | Extremely high; deters most potential entrants. | Establishing a new shipyard can cost billions of dollars. |

| Technological Complexity | Need for advanced engineering skills and proprietary technologies. | High; requires significant R&D and time to replicate. | Developing advanced hull designs or eco-friendly technologies takes years. |

| Brand Reputation & Customer Relationships | Established trust and long-standing partnerships with major clients. | Very high; difficult for new firms to gain credibility and secure large contracts. | KSOE's 2023 order backlog of $37.3 billion reflects strong customer confidence. |

| Regulatory Compliance | Adherence to stringent international safety and environmental standards. | High; adds significant costs and complexity for new entrants. | Compliance with IMO's sulfur emission limits requires investment in cleaner technologies. |

Porter's Five Forces Analysis Data Sources

Our Korea Shipbuilding & Offshore Engineering Porter's Five Forces analysis is built upon a foundation of credible data, including the company's annual reports, industry-specific market research from leading firms, and public financial filings. We also incorporate insights from global economic indicators and trade association data to ensure a comprehensive understanding of the competitive landscape.