Korea Shipbuilding & Offshore Engineering Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Korea Shipbuilding & Offshore Engineering Bundle

Korea Shipbuilding & Offshore Engineering (KSOE) operates in a dynamic global market, and understanding its product portfolio's strategic positioning is crucial. Our analysis reveals how its various shipbuilding and offshore segments align with the BCG Matrix framework, offering a clear picture of potential growth and resource allocation.

This preview offers a glimpse into which of KSOE's offerings might be thriving as "Stars" or generating stable revenue as "Cash Cows," while also highlighting potential "Question Marks" or underperforming "Dogs." To fully grasp the strategic implications and unlock actionable insights for KSOE's future, a deeper dive is essential.

Gain a comprehensive understanding of KSOE's market standing by purchasing the full BCG Matrix. This detailed report provides quadrant-by-quadrant analysis, empowering you to make informed decisions about where to invest and where to divest.

Don't miss out on the strategic clarity that the complete KSOE BCG Matrix provides. Secure your copy now to reveal the full picture and chart a course for optimized performance and competitive advantage.

Stars

LNG dual-fuel container ships represent a significant growth opportunity for KSOE, aligning perfectly with global decarbonization trends. In 2024, KSOE secured substantial orders, including a $1.76 billion contract for eight vessels, demonstrating strong market demand. This positions these ships as a potential Star in the BCG matrix due to their high growth potential and KSOE's strong market share in the eco-friendly shipping sector.

Korea Shipbuilding & Offshore Engineering (KSOE) has been aggressively pursuing orders for ammonia and liquefied petroleum gas (LPG) carriers, a clear indication of their strategic focus on the evolving energy landscape. This push aligns with the global shift towards cleaner energy sources.

These specialized vessels are positioned in a high-growth sector, driven by the industry's increasing adoption of alternative fuels as a pathway to decarbonization. KSOE's commitment to this segment underscores their ambition to be at the forefront of developing and deploying technologies for future zero-carbon shipping.

For instance, in 2023, KSOE and its affiliates secured a substantial portion of global new orders for ammonia-ready carriers, further solidifying their market position. The demand for these carriers is projected to surge as international regulations tighten on emissions and the need for sustainable shipping solutions intensifies throughout 2024 and beyond.

The global offshore wind turbine installation vessel market is booming, with projections showing a compound annual growth rate between 12.0% and 16.5% from 2025 onwards, fueled by the worldwide push for renewable energy and the expansion of offshore wind farms. This robust growth trajectory highlights a prime opportunity within the sector.

While Korea Shipbuilding & Offshore Engineering (KSOE) may not currently be deriving substantial revenue from specific orders for these specialized vessels, their established expertise in offshore engineering places them in a strong position. The high growth potential of this market segment makes it a compelling area for KSOE's strategic focus and future investment.

Considering the market's significant expansion and KSOE's inherent capabilities, offshore wind turbine installation vessels represent a potential Star in the BCG matrix. This classification suggests that KSOE should consider investing further to capitalize on this high-growth, high-potential market segment and solidify its competitive standing.

Advanced Smart Ship Technologies

Korea Shipbuilding & Offshore Engineering (KSOE) is heavily investing in advanced smart ship technologies, recognizing their importance for future industry competitiveness and operational efficiency. This strategic focus encompasses integrating technologies like the Internet of Things (IoT), Artificial Intelligence (AI), robotics, and digital twins, which are reshaping shipbuilding and maritime operations.

These innovations are considered high-growth areas, transforming traditional shipyard processes and vessel management. While specific market share figures for these nascent smart ship technologies are not yet widely quantified, KSOE’s commitment to developing these cutting-edge solutions positions them as an early leader. For instance, by 2024, the global smart shipping market was projected to reach tens of billions of dollars, with significant growth driven by the adoption of these very technologies.

- IoT Integration: Enabling real-time data collection from sensors on vessels for performance monitoring and predictive maintenance.

- AI and Robotics: Automating shipyard tasks and enhancing vessel navigation and operational control.

- Digital Twin Technology: Creating virtual replicas of ships for simulation, testing, and optimized lifecycle management.

- Future Market Position: KSOE's investments are geared towards capturing future market share in the burgeoning smart shipping sector.

Liquefied Natural Gas (LNG) Carriers (New Generation)

Korea Shipbuilding & Offshore Engineering (KSOE) is a dominant force in the new generation of Liquefied Natural Gas (LNG) carriers. Their impressive order book, including securing five vessels for 2025 delivery and being the world's most ordered LNG carrier builder in 2022, highlights their significant market share. This segment is a clear star within KSOE's portfolio.

The global LNG carrier market is experiencing robust growth, fueled by the increasing demand for cleaner energy solutions and decarbonization initiatives worldwide. This trend directly benefits KSOE's strategic focus on this high-margin, long-lead-time sector.

KSOE's commitment to innovation, particularly in carriers featuring advanced technologies, further solidifies their star status. These new generation carriers represent a high-growth, high-market-share segment for the company.

- Market Dominance: KSOE secured five LNG carrier orders for 2025 delivery, building on its position as the world's most ordered LNG carrier builder in 2022.

- Growth Drivers: Global LNG carrier market expansion is driven by decarbonization efforts and the demand for cleaner energy sources.

- Strategic Advantage: KSOE's focus on high-margin, long-lead-time new generation LNG carriers with advanced features positions them strongly.

KSOE's LNG dual-fuel container ships are solid stars due to strong global demand and KSOE's leading position in eco-friendly shipping. The company secured a significant $1.76 billion order for eight such vessels in 2024, underscoring this growth potential.

Ammonia and LPG carriers represent another star segment, driven by the industry's shift to alternative fuels. KSOE's substantial share of ammonia-ready carrier orders in 2023 highlights their market strength in this high-growth area.

Offshore wind turbine installation vessels are poised to become a star for KSOE, given the market's projected compound annual growth rate of 12.0% to 16.5% from 2025 onwards. KSOE's existing offshore engineering expertise positions them well to capitalize on this expansion.

KSOE's investment in advanced smart ship technologies, including IoT and AI, places these innovations in the star category. The global smart shipping market was projected to reach tens of billions of dollars by 2024, indicating substantial growth potential.

| Business Segment | BCG Classification | Rationale | Key Data/Facts (2024 & Projections) |

|---|---|---|---|

| LNG Dual-Fuel Container Ships | Star | High growth, strong market share | $1.76 billion order for 8 vessels in 2024; global decarbonization trend |

| Ammonia & LPG Carriers | Star | High growth, leading market position | Significant share of ammonia-ready carrier orders in 2023; industry shift to alternative fuels |

| Offshore Wind Turbine Installation Vessels | Potential Star | High growth potential, established capabilities | Projected CAGR of 12.0%-16.5% from 2025 onwards; KSOE's offshore engineering expertise |

| Smart Ship Technologies | Potential Star | High growth, early leadership | Global smart shipping market projected in tens of billions by 2024; investment in IoT, AI, digital twins |

What is included in the product

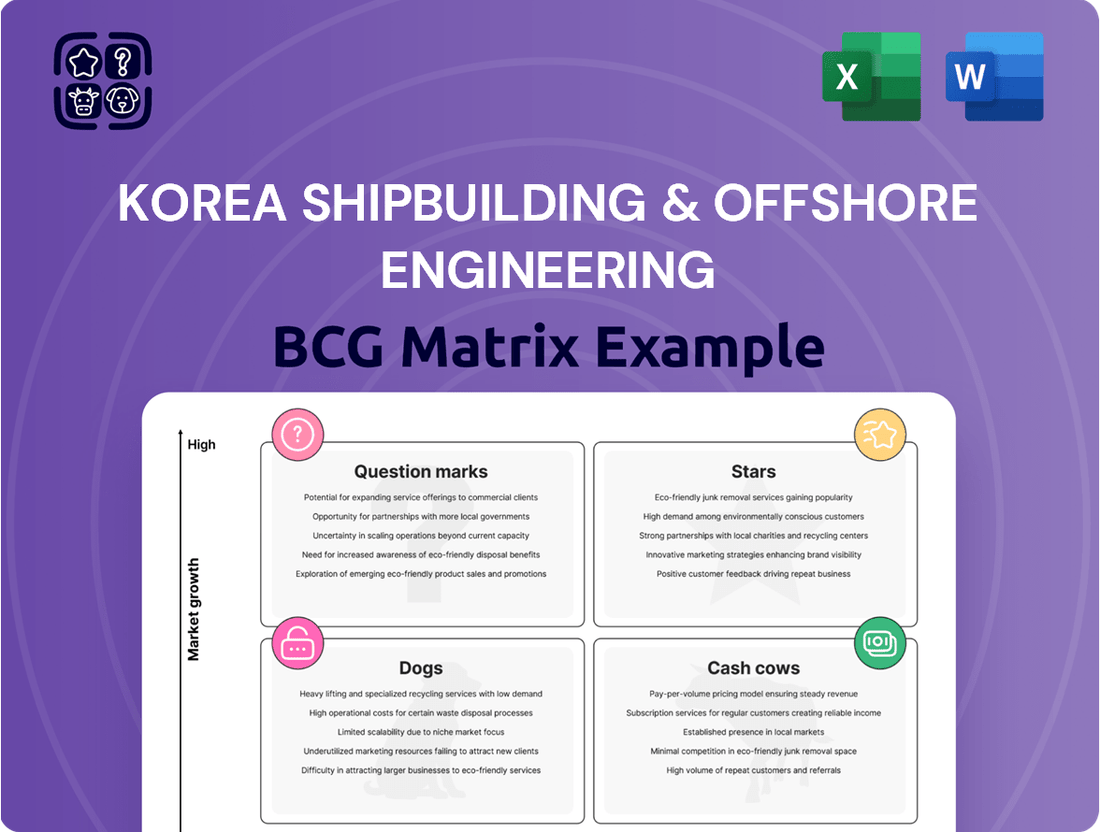

This BCG Matrix analysis offers a tailored view of Korea Shipbuilding & Offshore Engineering's portfolio, highlighting strategic insights for each quadrant.

It pinpoints which business units represent Stars, Cash Cows, Question Marks, or Dogs, guiding investment and divestment decisions.

A clear BCG matrix for KSOE simplifies strategic decisions by visually highlighting which business units require investment, which generate cash, and which need divestment, easing the burden of complex portfolio management.

Cash Cows

Traditional large container ships are a core Cash Cow for Korea Shipbuilding & Offshore Engineering (KSOE). Despite a market shift towards greener alternatives, KSOE maintains a significant order backlog, including 44 vessels scheduled for delivery in 2025, many equipped with dual-fuel capabilities. This segment reflects a mature market where KSOE has secured a strong market position and demonstrated consistent profitability.

The ongoing need for global trade underpins the steady cash flow generated by these established ship types. KSOE’s expertise in this area allows for efficient production and reliable revenue streams, solidifying their position as a Cash Cow within the BCG matrix.

Korea Shipbuilding & Offshore Engineering (KSOE) has a strong presence in the petrochemical product carrier and crude oil tanker markets. The company is set to deliver 50 chemical tankers in 2025, highlighting ongoing demand. These segments are considered mature, yet KSOE's expertise in building these vessels allows for high profit margins and consistent cash flow, positioning them as cash cows.

Despite potential future regulatory challenges for fossil fuel carriers, the current market dynamics and KSOE's efficient production capabilities ensure these operations remain robust cash generators. Their established reputation contributes to their ability to command favorable pricing and maintain profitability in these established sectors.

Korea Shipbuilding & Offshore Engineering (KSOE) has a significant presence in constructing offshore platforms and marine structures, representing a key area of its operations. These established projects, often characterized by long-term contracts and a stable demand, contribute substantially to the company's revenue stream.

Within KSOE's portfolio, these established offshore projects function as Cash Cows due to the company's high market share and proven expertise in a less volatile segment of the offshore industry. This strong competitive advantage allows for consistent, high cash flow generation once initial investments are made and projects are operational.

For instance, KSOE's backlog in offshore and gas projects as of early 2024 remained robust, reflecting the ongoing demand for these types of large-scale marine structures. The company secured notable orders for offshore facilities throughout 2023, solidifying its position in this segment.

The predictable nature of returns from these long-term contracts, coupled with KSOE's established operational efficiencies, ensures these projects act as reliable generators of capital. This consistent cash flow is vital for funding other business ventures and maintaining overall financial health.

Ship Repair and Maintenance Services

Ship repair and maintenance services represent a crucial, albeit less prominent, aspect of Korea Shipbuilding & Offshore Engineering's (KSOE) business portfolio. As a leading shipbuilding holding company, KSOE's extensive network of subsidiaries naturally caters to the ongoing upkeep of the vast fleet they deliver, alongside servicing other vessels. This segment operates within a mature, low-growth market characterized by consistent and predictable demand, making it a reliable source of revenue.

These specialized services typically command high profit margins. This profitability stems from the unique expertise required, the established long-term client relationships that foster loyalty, and the recurring nature of maintenance needs. Consequently, ship repair and maintenance contribute a steady stream of cash flow to KSOE, bolstering its overall financial stability.

While specific financial figures for this segment are not always granularly reported in recent order backlogs, the industry trend supports its cash cow status. For instance, the global maritime repair market was valued at approximately $25 billion in 2023 and is projected to grow at a modest CAGR of around 3% through 2030, indicating stability rather than rapid expansion. This stability, coupled with the high-margin nature of specialized repairs, solidifies its position.

- Consistent Demand: The ongoing need for vessel upkeep ensures a steady client base.

- High Profitability: Specialized skills and recurring business drive healthy profit margins.

- Mature Market: While growth is modest, the segment offers predictable cash generation.

- Strategic Importance: Supports KSOE's overall fleet management and client retention efforts.

Engineering and Investment Management Services

Korea Shipbuilding & Offshore Engineering (KSOE) operates its Engineering and Investment Management Services as a core Cash Cow. These specialized services, including research and development, engineering design, and strategic investment oversight for its subsidiaries, generate consistent, high-margin revenue. This stability stems from KSOE's deep intellectual capital and its crucial role in guiding its operating companies, ensuring a reliable contribution to the overall cash flow.

The demand for these internal, high-value services remains robust, underpinning their Cash Cow status. KSOE's ability to leverage its expertise in shipbuilding and offshore technology provides a competitive edge, allowing for strong profit margins on these essential functions. This consistent performance makes the Engineering and Investment Management Services a foundational element of KSOE's financial strength.

- Stable Revenue: KSOE's engineering and investment management services provide a predictable income stream.

- High Profit Margins: Leveraging intellectual capital and strategic oversight ensures profitability.

- Consistent Demand: Internal services are essential for subsidiary operations, guaranteeing consistent demand.

- Cash Flow Contribution: These services reliably bolster KSOE's overall cash generation.

Traditional large container ships, along with petrochemical product carriers and crude oil tankers, are established Cash Cows for KSOE, reflecting mature markets where the company holds strong positions and generates consistent profitability. These segments benefit from ongoing global trade demand and KSOE's expertise, ensuring reliable revenue streams.

Offshore platforms and marine structures also function as Cash Cows, driven by long-term contracts and KSOE's proven expertise in a less volatile sector. The company's robust backlog in these areas, as of early 2024, underscores the predictable returns and consistent cash flow generation.

Ship repair and maintenance, though a smaller segment, contributes steady, high-margin cash flow due to specialized expertise and recurring client needs in a stable market. The global maritime repair market's consistent valuation, around $25 billion in 2023, supports its role as a reliable cash generator.

KSOE's internal Engineering and Investment Management Services are also considered Cash Cows, providing high-margin revenue through intellectual capital and strategic oversight, essential for subsidiary operations and overall financial strength.

| Segment | Market Status | KSOE Position | Cash Flow Generation |

|---|---|---|---|

| Large Container Ships | Mature | Strong Market Share | Consistent Profitability |

| Petrochemical Carriers/Crude Oil Tankers | Mature | Proven Expertise | Reliable Revenue Streams |

| Offshore Platforms & Marine Structures | Mature, Stable Demand | High Market Share, Proven Expertise | Predictable Returns, Consistent Cash Flow |

| Ship Repair & Maintenance | Mature, Low Growth | Extensive Network, Specialized Skills | Steady, High-Margin Cash Flow |

| Engineering & Investment Management | Internal, Essential | Deep Intellectual Capital | High-Margin, Predictable Revenue |

What You’re Viewing Is Included

Korea Shipbuilding & Offshore Engineering BCG Matrix

The preview you are currently viewing is the identical, fully comprehensive BCG Matrix report for Korea Shipbuilding & Offshore Engineering that you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises—just the complete, professionally formatted analysis ready for your strategic planning. You can trust that the insights and structure you see here are precisely what you will download and utilize for your business decisions. This is the final, polished version, designed for immediate application in your competitive analysis and business strategy development.

Dogs

The market for older, less fuel-efficient traditional vessels is facing significant headwinds. Stricter environmental regulations, like those pushing for lower sulfur emissions and eventually zero-emission shipping, are directly impacting the demand for these ships. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap already made older, less efficient vessels more costly to operate. This trend is expected to intensify with future regulations, making them less attractive for charterers and owners.

Korea Shipbuilding & Offshore Engineering (KSOE) is strategically moving away from these less profitable segments. Their focus on eco-friendly ships, such as LNG-powered carriers and vessels equipped with advanced ballast water treatment systems, indicates a deliberate pivot. This suggests that KSOE likely holds a low market share in the segment of older, less fuel-efficient vessels, and the market itself is characterized by low growth prospects.

These older vessels can be considered cash traps for shipbuilders. They may still require maintenance and upgrades to meet basic operational standards, but they offer limited potential for future profitability due to their inherent inefficiencies and the evolving regulatory landscape. Consequently, KSOE would likely view these as candidates for divestiture or at least a minimized investment strategy, freeing up resources for more promising, greener shipbuilding technologies.

Standard product carriers with low-value contracts represent a segment where Korea Shipbuilding & Offshore Engineering (KSOE) may find itself in the "Dogs" category of the BCG Matrix. These are vessels that are less specialized and command lower profit margins, especially when orders are secured during periods of depressed ship prices. For instance, while KSOE is a significant player in the shipbuilding industry, focusing on these lower-margin contracts dilutes resources and potential profitability.

KSOE's strategic shift towards profitability-oriented selective ordering and a focus on high-value-added vessels directly addresses the challenges posed by these low-value contracts. This strategy aims to move away from segments with limited growth potential and a low market share in a highly competitive global shipbuilding market. For example, in 2023, KSOE secured orders for eco-friendly vessels, highlighting their pivot to higher-margin segments.

Certain older or less complex offshore structures, or those tied to declining oil and gas fields, might represent a low-growth, low-market-share segment for KSOE. As the global energy landscape shifts towards renewables, some traditional offshore projects may see reduced demand, making them less attractive for future investment.

These could be considered problematic if they tie up capital without significant future prospects. For example, if KSOE has older offshore support vessels with limited lifespans and declining charter rates, these assets might fall into this category. In 2023, the offshore drilling market saw a slight recovery, but demand for older, less efficient rigs remained subdued compared to newer, more capable ones.

Non-Strategic, Outdated Ship Designs

Non-strategic, outdated ship designs represent a category where KSOE might still possess manufacturing capabilities but offers products that have fallen behind in terms of competitiveness. These designs, while potentially functional, are no longer aligned with the industry's push for advanced features. The market is rapidly shifting, demanding 'future-ready features' and a strong focus on 'decarbonization,' leaving older models unable to compete effectively.

Continued investment in these obsolete designs would likely result in diminishing returns and a shrinking market share for KSOE. For instance, while the global maritime industry saw a significant surge in newbuilding orders in 2023, with reports indicating over 4,000 vessels ordered, the demand for eco-friendly solutions like LNG-fueled or methanol-powered ships has been particularly strong. KSOE's older, less efficient designs would struggle to capture this growing segment.

- Outdated Technology: Designs lacking advanced fuel efficiency, automation, or emissions control systems are no longer market leaders.

- Low Competitiveness: These ships struggle to meet new environmental regulations and operational cost expectations compared to modern vessels.

- Reduced Investment Appeal: Continued focus on these designs yields low returns on investment and erodes KSOE's competitive edge in a rapidly evolving market.

- Market Share Erosion: Competitors offering greener and more advanced solutions are capturing a larger portion of the global shipbuilding market.

Small, Undifferentiated Domestic Orders

Within Korea Shipbuilding & Offshore Engineering's (KSOE) strategic portfolio, small, undifferentiated domestic orders might be categorized as Dogs. These are typically contracts that don't fully utilize KSOE's cutting-edge technological expertise or contribute substantially to their long-term strategic objectives. Such orders likely represent a minimal market share and operate within a low-growth segment of the domestic shipbuilding market.

KSOE's strategic focus remains firmly on securing high-value, technologically advanced projects and maintaining its global leadership in the offshore and shipbuilding sectors. While these smaller domestic orders may provide some revenue, they do not align with the company's ambition to lead in innovation and large-scale, complex projects. For instance, while specific order values for this category are not publicly broken down, KSOE's overall backlog in 2024 demonstrates a clear emphasis on larger, more profitable contracts, with the company securing significant orders for LNG carriers and other high-specification vessels throughout the year.

- Low Market Share: These orders typically represent a small fraction of KSOE's total order book.

- Low Growth Potential: The domestic market segment for such undifferentiated orders may exhibit limited growth prospects.

- Strategic Misalignment: They do not leverage KSOE's core strengths in advanced shipbuilding and offshore technologies.

- Focus on High-Value: KSOE prioritizes large-scale, technologically demanding projects to maximize profitability and market position.

Standard product carriers with low-value contracts are likely considered Dogs for KSOE. These vessels offer lower profit margins, especially when orders are secured at depressed prices, and do not align with the company's focus on high-value, eco-friendly shipbuilding. While KSOE is a major player, concentrating on these segments dilutes resources and future profitability.

KSOE's strategic shift towards selective ordering and high-value-added vessels directly addresses the challenges of these low-value contracts. This strategy aims to move away from segments with limited growth and a low market share in a competitive global market. For example, KSOE secured significant orders for LNG carriers and other high-specification vessels throughout 2023 and into 2024, underscoring this pivot.

The market for older, less fuel-efficient traditional vessels also falls into the Dog category due to stricter environmental regulations. These ships are becoming more costly to operate, making them less attractive. KSOE's focus on eco-friendly vessels signifies a strategic move away from these less profitable segments, indicating a low market share and low growth prospects for older ship types.

Outdated ship designs lacking advanced features and environmental compliance also represent Dogs. These products struggle to compete with modern, greener solutions and yield low returns on investment. In 2023, the maritime industry saw strong demand for eco-friendly ships, a segment where older designs would not perform well.

Question Marks

Korea Shipbuilding & Offshore Engineering (KSOE) is making significant strides in developing vessels powered by Small Modular Reactors (SMRs), aiming to establish a marine nuclear business by 2030. This initiative places SMR-powered vessels squarely in the Question Mark quadrant of the BCG Matrix. The market for these advanced vessels presents substantial growth potential, driven by global decarbonization efforts and the pursuit of energy independence.

However, the commercialization and widespread adoption of SMR technology in the maritime sector are still in their nascent stages. This means KSOE, while a pioneer, currently holds a minimal market share in this emerging field. The high upfront investment required for research and development, navigating complex regulatory approvals, and building necessary infrastructure underscores the high-risk, high-reward nature of this venture.

Korea Shipbuilding & Offshore Engineering (KSOE) is actively investing in hydrogen-powered vessels and their associated storage solutions. This forward-thinking approach includes securing approval in principle for innovative, optimized tank designs, crucial for the safe and efficient transport of hydrogen.

While hydrogen holds immense promise as a zero-carbon fuel for the maritime industry, its widespread adoption and the necessary infrastructure are still in their early stages. KSOE's commitment positions them to capitalize on this high-growth future market, though current market share in this niche segment remains low.

The company's strategic investments are geared towards building essential capabilities to achieve leadership in this emerging sector. This involves significant capital expenditure to overcome technological hurdles and establish a strong foothold as hydrogen fuel becomes more prevalent in global shipping.

South Korea's 10-year roadmap for autonomous marine vehicles positions fully autonomous commercial vessels as a star in the BCG Matrix for companies like KSOE. KSOE's work on navigation algorithms and ammonia-fueled ship tech directly feeds into this burgeoning sector.

While the market for these vessels is projected for high growth, its current penetration is minimal, with significant regulatory and technological challenges still needing to be overcome. This high-risk, high-reward profile firmly places them in the 'star' category.

KSOE's strategic investment here is highly speculative; success hinges on navigating these hurdles and establishing early market leadership. The potential for substantial returns exists if they can capitalize on the future demand, which is expected to grow significantly in the coming decade.

Carbon Capture and Storage (CCS) Ready Ships

While eco-friendly ships, including those utilizing LNG, methanol, and ammonia as fuels, are considered Stars for Korea Shipbuilding & Offshore Engineering (KSOE) due to their strong market demand and growth potential, the specific integration of onboard carbon capture and storage (CCS) systems for operational vessels represents an emerging technology, likely falling into the Question Mark category. KSOE's ongoing commitment to eco-friendly and smart ship technologies strongly suggests active research and development in this nascent area.

This segment possesses substantial long-term growth potential, driven by increasingly stringent global emission regulations and the maritime industry's decarbonization goals. However, the current market share and adoption rates for onboard CCS are very low, necessitating significant investment in research, development, and extensive market education to foster wider acceptance and application.

- Emerging Technology: Onboard CCS for operational vessels is still in early development stages, facing technical and economic hurdles.

- High Growth Potential: Future regulations are expected to drive demand for CCS solutions in shipping.

- Low Market Share: Current adoption of onboard CCS technology in the global fleet is minimal.

- R&D Intensive: Significant investment is required for technological advancement and cost reduction.

Specialized Vessels for Emerging Niche Offshore Energy Markets (e.g., Floating Solar)

For emerging niche offshore energy markets like floating solar, Korea Shipbuilding & Offshore Engineering (KSOE) could develop highly specialized vessels. These are new sectors with significant growth possibilities, though currently very limited in market share. KSOE's investment here would be focused on research and development to gain an early advantage.

- Floating Solar Market Growth: The global floating solar market is projected to reach USD 11.4 billion by 2027, indicating substantial growth potential.

- Wave Energy Potential: Wave energy converters, while less developed, represent another frontier for specialized offshore vessel needs, with estimated global market potential in the tens of billions by 2030.

- KSOE's Strategic Position: KSOE's existing expertise in offshore construction and vessel design positions it well to adapt for these nascent markets.

- Early Mover Advantage: Investing in R&D now allows KSOE to secure intellectual property and establish a strong market presence before competitors.

The development of SMR-powered vessels and onboard carbon capture and storage (CCS) systems for operational ships represent key Question Marks for KSOE. While these areas offer substantial future growth potential driven by decarbonization, their current market penetration is minimal, requiring significant R&D investment and facing regulatory hurdles. KSOE is positioning itself to be an early mover, but success is contingent on overcoming these challenges and establishing market leadership in these nascent, high-risk, high-reward segments.

BCG Matrix Data Sources

Our Korea Shipbuilding & Offshore Engineering BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research, and expert commentary to ensure reliable insights.