KORE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KORE Bundle

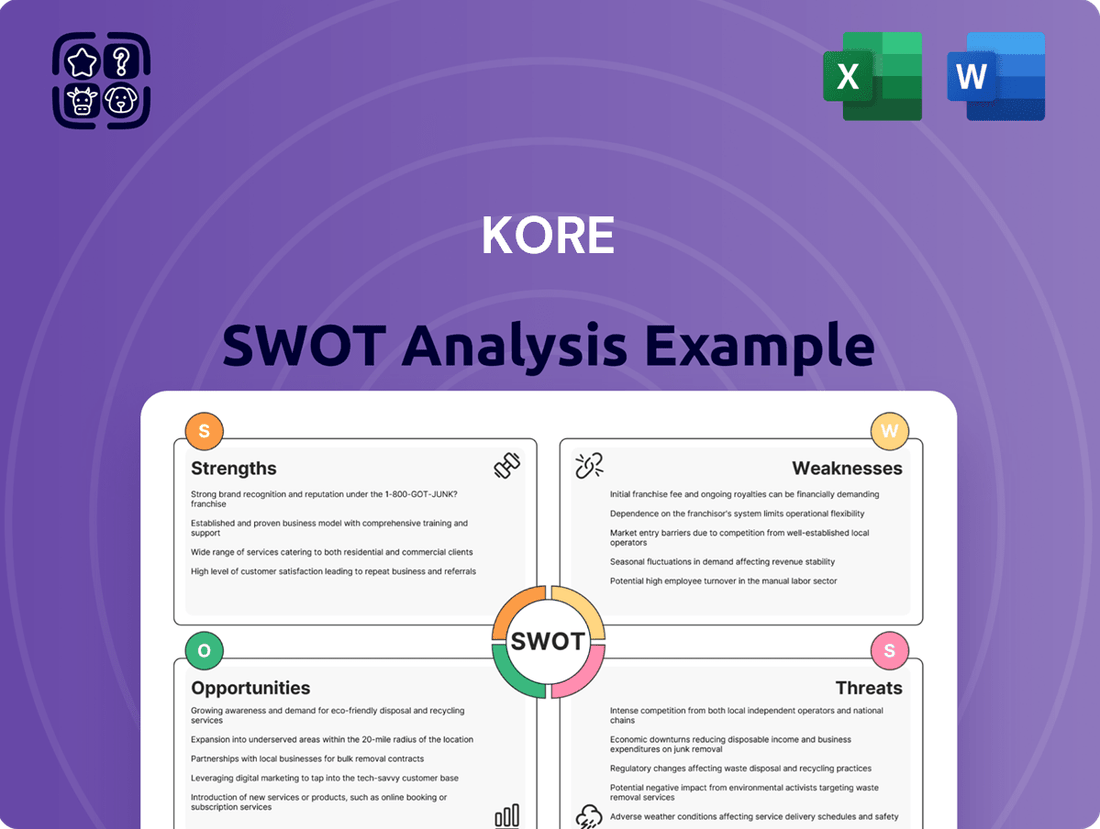

Curious about KORE's market standing? Our initial SWOT analysis reveals their core strengths, potential weaknesses, exciting opportunities, and looming threats.

But this is just a glimpse into the strategic landscape. Imagine having a comprehensive roadmap detailing KORE's competitive advantages and areas for improvement.

Want the full story behind KORE's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

KORE Wireless leverages an impressive global network, operating in over 180 countries. This extensive reach is facilitated through strategic partnerships with major network providers, enabling KORE to offer robust IoT connectivity solutions across diverse international markets.

KORE stands out as a comprehensive IoT solutions provider, functioning as a global pure-play IoT hyperscaler. This means they offer a complete package, from the essential connectivity services to the hardware, sophisticated software platforms, and insightful analytics needed for IoT deployments. This all-in-one approach significantly streamlines the often-complex process of bringing IoT projects to life.

By consolidating these critical components, KORE empowers businesses to effectively deploy, manage, and scale their IoT applications across a wide array of industries. This integrated strategy simplifies adoption and accelerates time-to-market for clients. For instance, KORE's platform supports diverse use cases, from fleet management to smart city initiatives, highlighting their broad applicability.

KORE has shown remarkable financial growth, achieving positive free cash flow for two consecutive quarters in Q1 2025. This marks a significant turnaround from prior performance, indicating enhanced operational efficiency and better cash generation capabilities.

The company's commitment to cost management is evident through its successful reduction of operating expenses. These savings were largely driven by strategic restructuring initiatives, which have streamlined operations and improved the bottom line.

Consistent Growth in IoT Connections

KORE demonstrates a robust ability to expand its customer base, evidenced by a consistent rise in total IoT connections. As of the first quarter of 2025, the company reported 19.8 million connected devices, marking an 8% increase from the previous year. This steady growth in connections underscores a significant and sustained demand for KORE's platform and services, reflecting their success in both attracting new clients and retaining existing ones.

This upward trend in connections signifies a healthy expansion of KORE's market penetration and customer engagement. The 8% year-over-year growth to 19.8 million connections by Q1 2025 highlights the company's effectiveness in capitalizing on the expanding Internet of Things market. It points to a strong foundation of customer trust and a reliable service offering that resonates with businesses seeking IoT solutions.

- 19.8 million total IoT connections reported by Q1 2025.

- 8% year-over-year increase in IoT connections.

- Indicates strong underlying demand for KORE's services.

- Demonstrates successful customer acquisition and retention strategies.

Recognized Industry Leader

KORE’s position as a recognized industry leader is a significant strength, underscored by numerous recent awards and recognitions. For instance, the company secured the 2024 IoT Evolution Product of the Year Award for its Connectivity Suite and the 2024 IoT Excellence Award for its KORE Super SIM, highlighting its innovative product development.

Further solidifying its leadership, KORE was named a Leader in the 2024 Gartner Magic Quadrant for Managed IoT Connectivity Services. This marks the fifth consecutive time the company has achieved this distinction, a testament to its consistent market performance and robust service offerings in the rapidly evolving IoT landscape.

- 2024 IoT Evolution Product of the Year Award for Connectivity Suite.

- 2024 IoT Excellence Award for KORE Super SIM.

- Fifth consecutive year as a Leader in Gartner Magic Quadrant for Managed IoT Connectivity Services (2024).

KORE's strengths lie in its comprehensive, end-to-end IoT solutions and its expansive global reach, operating in over 180 countries through strategic partnerships. The company has achieved significant financial improvements, reporting positive free cash flow for two consecutive quarters in Q1 2025 and demonstrating effective cost management. KORE also shows strong customer growth, with 19.8 million connected devices by Q1 2025, an 8% year-over-year increase, underscoring its market penetration and customer retention capabilities. Furthermore, KORE's industry leadership is validated by multiple awards in 2024 and its fifth consecutive year as a Leader in the Gartner Magic Quadrant for Managed IoT Connectivity Services.

| Metric | Value (Q1 2025) | Change | Significance |

|---|---|---|---|

| Global Network Reach | 180+ Countries | N/A | Extensive market access |

| Total IoT Connections | 19.8 Million | +8% YoY | Strong customer growth |

| Free Cash Flow | Positive (2 consecutive quarters) | Turnaround | Improved financial health |

| Industry Recognition | 2024 Awards, Gartner Leader (5th Yr) | Consistent | Market leadership |

What is included in the product

Analyzes KORE’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap by transforming complex SWOT data into easily digestible insights.

Weaknesses

KORE faced a notable challenge in the first quarter of 2025, reporting a 5% decrease in overall revenue compared to the previous year. A significant contributor to this downturn was a 7% drop in its crucial IoT Connectivity segment.

This decline in a foundational business area, even with a modest uptick in IoT Solutions revenue, highlights a key weakness for KORE. Managing and reversing this trend in core revenue streams will be critical for sustained growth.

KORE's strategic pivot towards higher-margin Internet of Things (IoT) solutions is crucial for its long-term profitability. However, the recent downturn in IoT connectivity revenue underscores a significant dependence on this transition to bolster overall financial health. A slower-than-expected shift could therefore exert considerable pressure on the company's financial performance.

KORE's Average Revenue Per Unit (ARPU) experienced a notable dip, falling 13.3% in the first quarter of 2025. This decline is attributed to a strategic shift in the company's product portfolio, with a particular emphasis on the phasing out of some less profitable offerings.

The challenge now lies in reversing this trend. Successfully maintaining and subsequently increasing ARPU will be a key determinant of KORE's long-term financial stability and revenue growth trajectory. This requires a careful balance of customer acquisition and value enhancement.

Market Volatility and Stock Performance

KORE's stock has demonstrated considerable volatility, reflecting broader market sentiment and sector-specific pressures. As of the first quarter of 2025, the company's shares have seen a notable year-to-date decline, signaling investor apprehension. This performance trend can make it more challenging for KORE to secure additional funding or maintain a strong market valuation.

The market's reaction to KORE's performance, particularly the year-to-date drop in early 2025, suggests that investors are adopting a more cautious approach. Such volatility can directly affect the company's ability to raise capital through stock offerings or debt financing. Furthermore, a consistently underperforming stock price can negatively influence market perception and analyst ratings, creating a headwind for future growth initiatives.

- Year-to-date stock performance as of Q1 2025 shows a significant decline.

- Market volatility impacts investor confidence and KORE's valuation.

- Challenges in future capital raising due to stock performance.

- Potential negative impact on market perception and analyst outlook.

Delayed Filing and Compliance Concerns

KORE faced a significant hurdle in April 2025 when it received a notice from the NYSE for failing to file its 2024 Annual Report (Form 10-K) on time. This delay, even with a grace period, raises concerns about potential internal operational inefficiencies or intricate financial reporting processes that require careful management.

These compliance issues can impact investor confidence and may lead to increased scrutiny from regulatory bodies. For instance, similar filing delays in the past have sometimes been linked to challenges in consolidating financial data or addressing complex accounting standards, potentially affecting the company's perceived stability.

- NYSE Notice: Received in April 2025 for delayed 2024 Form 10-K filing.

- Grace Period: Acknowledged, but signals potential operational or reporting issues.

- Investor Confidence: Such delays can negatively affect market perception and investor trust.

- Regulatory Scrutiny: Increased attention from regulatory bodies may follow non-compliance.

KORE's revenue from its core IoT Connectivity segment experienced a 7% decline in Q1 2025, contributing to an overall 5% revenue decrease year-over-year. This highlights a significant dependency on transitioning to higher-margin IoT solutions, as a slower-than-expected shift could pressure financial performance.

The company also saw its Average Revenue Per Unit (ARPU) drop by 13.3% in Q1 2025 due to a strategic shift away from less profitable offerings. Reversing this ARPU trend is crucial for KORE's long-term revenue growth and financial stability.

KORE's stock performance as of Q1 2025 showed a year-to-date decline, indicating investor caution and market volatility. This trend can complicate capital raising efforts and negatively impact market perception.

In April 2025, KORE received a NYSE notice for failing to file its 2024 Annual Report on time, raising concerns about internal operational efficiency and potentially increasing regulatory scrutiny.

Preview the Actual Deliverable

KORE SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. This ensures you know exactly what you're purchasing – a professionally crafted and comprehensive document. We believe in transparency, so what you see is truly what you get. Unlock the full, detailed report today.

Opportunities

The global Internet of Things (IoT) market is on a significant upward trajectory, with projections indicating it could reach over $356 billion by 2034. This robust expansion creates a favorable environment for KORE, as the increasing adoption of connected devices directly fuels demand for their IoT connectivity and service management solutions.

Analysts anticipate the IoT market could even reach between $1.1 trillion and $1.2 trillion by 2025, highlighting the vast scale of this opportunity. This substantial market growth acts as a powerful tailwind, offering KORE a broad base of potential customers and use cases for its offerings.

The ongoing expansion of 5G networks globally is a significant tailwind for KORE. This technology not only offers faster speeds but also lower latency, which is crucial for advanced Internet of Things (IoT) applications. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach over $2.5 trillion by 2028, demonstrating substantial growth potential.

KORE's strategic emphasis on providing secure and dependable connectivity, encompassing both 4G and the newer 5G broadband solutions, directly aligns with the increasing demand for robust IoT infrastructure. As AI and edge computing capabilities mature, the complexity and data demands of IoT deployments will escalate, creating a fertile ground for KORE's specialized services.

The Internet of Things (IoT) market is experiencing robust expansion, with projections indicating continued strong growth through 2025. This surge is driven by increasing adoption across various industries. For instance, the global IoT market size was valued at approximately $150 billion in 2023 and is expected to reach over $350 billion by 2027, demonstrating a compound annual growth rate (CAGR) of around 20%.

KORE is well-positioned to capitalize on this trend, leveraging its deep industry knowledge to develop bespoke IoT solutions. Key growth sectors include healthcare, where remote patient monitoring and connected medical devices are becoming standard, and transportation, with the rise of smart logistics and connected vehicles. Utilities are also investing heavily in smart grids and intelligent metering, while manufacturing embraces Industry 4.0 principles through connected factory floors.

Smart city initiatives represent another significant opportunity, encompassing everything from intelligent traffic management and waste disposal to public safety and environmental monitoring. KORE's ability to provide end-to-end IoT solutions, from device management and connectivity to data analytics and application development, allows it to serve the unique needs of these diverse and rapidly evolving verticals effectively.

Strategic Partnerships and Acquisitions

Strategic partnerships and potential acquisitions represent a significant opportunity for KORE to solidify its market standing and broaden its geographical reach. The company’s proven track record of integrating acquired businesses can be a key enabler for scaling its operations and service offerings. For instance, KORE's acquisition of Access Control Solutions in late 2023 for $185 million demonstrates its commitment to expanding its capabilities in the identity and access management sector, which is crucial for IoT security.

Leveraging these strategic moves can unlock new revenue streams and enhance competitive advantages. KORE could explore alliances with technology providers to integrate cutting-edge solutions into its platform, thereby increasing its value proposition to customers. Furthermore, targeted acquisitions in emerging IoT markets or specialized technology niches could accelerate growth and market penetration. By strategically selecting partners and acquisition targets, KORE can effectively navigate the dynamic IoT landscape.

Key opportunities in this area include:

- Expanding into new geographic markets through partnerships with local service providers.

- Acquiring companies with complementary technologies to enhance KORE's IoT platform capabilities, particularly in areas like AI-driven analytics and edge computing.

- Forming strategic alliances with major cloud providers to offer more integrated and scalable IoT solutions.

- Targeting acquisitions of businesses with strong recurring revenue models to further stabilize KORE’s financial performance.

Focus on High-Margin IoT Solutions and Managed Services

KORE's pivot to high-margin IoT solutions and managed services is a significant growth avenue. This strategic move capitalizes on the increasing demand for end-to-end IoT management, which drives greater customer stickiness and recurring revenue streams.

The global managed services market is experiencing robust expansion, with projections indicating it will reach $397.6 billion by 2025. This substantial market size offers KORE a prime opportunity to capture a larger share by offering specialized, value-added services beyond basic connectivity.

- Expanding Recurring Revenue: Managed services provide a predictable and growing revenue base, enhancing financial stability.

- Higher Profitability: Focusing on solutions and services, rather than just connectivity, allows for better pricing power and improved margins.

- Market Growth: The increasing complexity of IoT deployments necessitates professional management, aligning with KORE's service offerings.

- Customer Retention: Comprehensive managed services foster deeper client relationships and reduce churn.

The expanding global IoT market, projected to exceed $356 billion by 2034, offers KORE a substantial growth runway driven by increased device adoption. The ongoing rollout of 5G networks, crucial for advanced IoT applications, further strengthens KORE's position by enabling faster, lower-latency connectivity solutions. KORE's focus on secure and reliable connectivity, including 5G, directly addresses the escalating demand for robust IoT infrastructure as AI and edge computing advance.

KORE's strategic move towards high-margin IoT solutions and managed services presents a significant avenue for growth, capitalizing on the increasing need for comprehensive IoT management and fostering customer loyalty. The global managed services market, anticipated to reach $397.6 billion by 2025, provides a fertile ground for KORE to expand its offerings and capture a larger market share. This shift to services not only stabilizes KORE's financial performance through predictable recurring revenue but also enhances profitability due to better pricing power in a market demanding expert management of complex IoT deployments.

| Opportunity Area | Market Projection/Data Point | KORE's Alignment |

|---|---|---|

| Global IoT Market Growth | Projected to exceed $356 billion by 2034 | Directly benefits KORE's connectivity and service demand |

| 5G Network Expansion | Enables advanced IoT applications | Supports KORE's 4G and 5G broadband solutions |

| Managed Services Market | Expected to reach $397.6 billion by 2025 | Key focus for KORE's high-margin strategy |

| Strategic Partnerships/Acquisitions | Enhances capabilities and market reach | KORE's demonstrated strategy (e.g., Access Control Solutions acquisition) |

Threats

The Internet of Things (IoT) landscape is incredibly crowded. Major telecom players like Verizon and AT&T, alongside specialized IoT firms and tech titans such as Amazon and Microsoft, are all vying for a piece of the market. This intense competition directly translates into pressure on pricing structures, making it harder for companies like KORE to maintain margins.

This fierce rivalry also challenges KORE's ability to capture and retain market share. As more companies enter the IoT space, the fight for customer acquisition intensifies, potentially leading to increased marketing and sales expenses without a guaranteed return. For instance, the global IoT market size was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.7 trillion by 2030, indicating substantial growth but also heightened competition for that expanding pie.

Macroeconomic headwinds and a general sense of caution among customers are creating a more challenging environment for KORE. This translates into customers delaying their adoption of new IoT solutions and taking longer to make purchasing decisions, directly impacting KORE's revenue streams. For instance, in the first quarter of 2024, KORE reported slower-than-anticipated growth in new customer acquisition, a trend attributed in part to these broader economic uncertainties.

The Internet of Things (IoT) landscape is constantly shifting, with breakthroughs in areas like AI integration and new chip designs demanding KORE's sustained commitment to research and development. For instance, the continued evolution of 5G and emerging 6G technologies necessitates ongoing adaptation to ensure seamless connectivity for KORE's solutions. Falling behind in these technological races could significantly diminish KORE's market position.

Data Security and Privacy Concerns

The intensifying scrutiny on data security and privacy within the Internet of Things (IoT) landscape presents a significant challenge for KORE. New regulations, such as the EU's Data Act and Cyber Resilience Act, are setting demanding compliance benchmarks.

Failure to consistently adhere to these stringent security and privacy mandates could result in penalties and reputational damage. KORE must invest in robust security protocols and transparent data handling practices to navigate this evolving regulatory environment effectively.

- Regulatory Compliance: KORE faces the threat of non-compliance with evolving data privacy laws like the EU's Data Act, which came into effect in September 2023, and the upcoming Cyber Resilience Act.

- Data Breach Risks: A successful cyberattack leading to a data breach could incur substantial financial losses and erode customer trust, impacting KORE's market position.

- Operational Costs: Meeting increasingly rigorous security standards necessitates ongoing investment in advanced cybersecurity infrastructure and personnel, potentially increasing operational expenses.

Supply Chain Disruptions and Component Costs

While the semiconductor supply chain has shown signs of improvement, the Internet of Things (IoT) sector, including companies like KORE, still faces risks related to component availability and cost volatility. These ongoing uncertainties can directly affect KORE’s ability to secure necessary hardware and influence pricing for its customer base.

For instance, while the global semiconductor shortage that significantly impacted many industries in 2022 and 2023 has largely abated, geopolitical tensions and unexpected global events can still trigger localized shortages or price spikes. The cost of essential components, such as microcontrollers and specialized sensors, can fluctuate, impacting KORE's cost of goods sold and, consequently, its service pricing.

- Component Cost Fluctuations: Continued volatility in the price of critical components like memory chips and communication modules can impact KORE's hardware procurement costs.

- Supply Chain Bottlenecks: Despite general improvements, specific niche components or manufacturing capacities can still experience temporary bottlenecks, affecting hardware delivery timelines.

- Geopolitical Risks: International trade policies and geopolitical instability can create unforeseen disruptions in the global supply chain for electronic components.

Intense competition from major telecom providers and tech giants puts pressure on KORE's pricing and market share. The global IoT market's projected growth to $2.7 trillion by 2030 signals opportunity but also increased rivalry.

Economic uncertainty causes customers to delay IoT solution adoption, impacting KORE's revenue, as seen in slower Q1 2024 new customer acquisition. Rapid technological advancements, like 5G and 6G, demand continuous R&D investment to prevent KORE from falling behind.

Evolving data privacy regulations, such as the EU's Data Act, impose significant compliance burdens. Failure to meet these standards risks penalties and reputational damage, requiring ongoing investment in robust security protocols.

Component availability and cost volatility in the semiconductor supply chain remain a threat, potentially affecting KORE's hardware procurement and pricing strategies, despite general improvements since the 2022-2023 shortages.

SWOT Analysis Data Sources

The KORE SWOT analysis is built upon a foundation of comprehensive data, including KORE's official financial statements, detailed market research reports, and insights from industry experts. This blend of internal performance metrics and external market dynamics ensures a robust and well-rounded assessment.