KORE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KORE Bundle

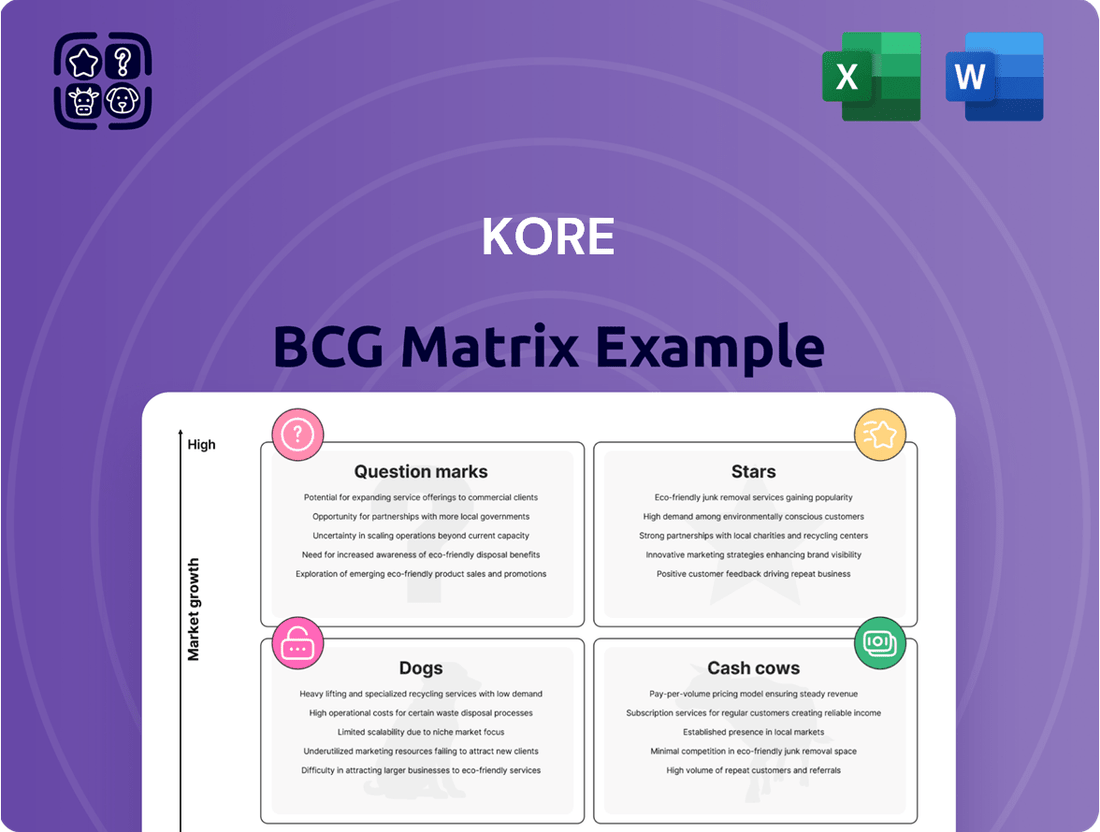

The BCG Matrix is a powerful tool for understanding a company's product portfolio. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market growth and relative market share. This fundamental understanding is crucial for strategic decision-making and resource allocation.

A glimpse into a company's BCG Matrix reveals the current health of its product lines. Are your products poised for growth, or are they consuming valuable resources without significant returns? This initial overview sparks critical questions about your business strategy.

To truly leverage this insight, dive deeper into the full BCG Matrix. Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

KORE is making significant strides in high-growth areas like healthcare and cloud communications, where the Internet of Things (IoT) is experiencing rapid expansion. By concentrating on tailored solutions for these industries, KORE aims to secure a substantial portion of the market. For instance, their connected health solutions are designed to meet crucial industry demands, utilizing cutting-edge technology to foster growth.

In 2024, the global IoT healthcare market was projected to reach a significant valuation, with KORE's targeted strategies well-positioned to capitalize on this trend. Their investment in specialized IoT applications, such as remote patient monitoring and asset tracking within healthcare facilities, demonstrates a clear commitment to addressing specific vertical needs. This strategic focus allows KORE to offer differentiated value propositions in rapidly evolving sectors.

KORE's In-Vehicle Video (IVV) and Fleet Management Solutions are positioned strongly, evidenced by their 'Connected Car Product of the Year' win at the 2025 IoT Breakthrough Awards. This award underscores the solution's innovation and market relevance in the burgeoning connected vehicle sector. The integration of IoT dash cams with advanced AI technology directly addresses the critical need for enhanced driver safety and operational efficiency within fleets.

The global fleet management market, projected to reach over $40 billion by 2026, demonstrates the significant growth potential KORE is tapping into. KORE's IVV solution contributes to this by offering tangible benefits such as reduced fuel consumption and improved accident avoidance, directly impacting a fleet's bottom line. The company's strong competitive standing is further solidified by the adoption rates and positive feedback from early adopters in 2024.

The ongoing expansion of 5G networks is a key driver for the 5G-Enabled IoT Connectivity category. KORE's strategic investments in its connectivity solutions are designed to capitalize on this trend, aiming to support the increasingly sophisticated IoT applications that 5G enables.

As 5G becomes more prevalent in industrial and enterprise IoT deployments, KORE's connectivity services in this segment are positioned for substantial growth. For instance, the global 5G IoT market size was valued at USD 10.5 billion in 2023 and is projected to reach USD 98.6 billion by 2030, growing at a CAGR of 37.7% during the forecast period, according to a report by MarketsandMarkets. This indicates a strong market opportunity for KORE.

KORE's commitment to future-proofing its connectivity offerings directly addresses the high-growth potential of 5G IoT. By ensuring their solutions can handle the increased bandwidth, lower latency, and greater device density that 5G provides, KORE is aligning itself with a market segment expected to see significant expansion in the coming years.

AI-Powered Edge Computing for IoT

KORE is strategically positioned to leverage the powerful combination of Artificial Intelligence (AI) and the Internet of Things (IoT), particularly as edge computing technology continues to advance. This convergence allows for intelligent processing of data directly where it's generated, leading to faster insights and actions.

By embedding AI capabilities at the edge, KORE's solutions facilitate real-time decision-making. This is crucial for industries aiming to boost operational efficiency and minimize costly downtime. For instance, predictive maintenance powered by edge AI can anticipate equipment failures before they occur, preventing disruptions.

The market for AI-powered edge computing solutions is experiencing significant growth. Analysts project the global edge AI market to reach hundreds of billions of dollars by the early 2030s, with compound annual growth rates often exceeding 30%. KORE's offerings in this space place them in a segment poised for substantial expansion, though their precise market share in this emerging area is still solidifying.

- Market Growth: The global edge AI market is projected for exponential growth, driven by demand for real-time analytics and faster decision-making.

- Key Enabler: Edge computing is the critical infrastructure that allows AI algorithms to process data locally, reducing latency and bandwidth needs.

- Industry Impact: AI at the edge is transforming sectors like manufacturing, healthcare, and logistics by enabling predictive maintenance, enhanced safety, and optimized operations.

- KORE's Position: KORE's integration of AI with edge capabilities targets a high-growth market segment, capitalizing on the increasing need for intelligent, distributed IoT solutions.

Global IoT Connectivity with Scalable Connections

KORE's substantial growth in IoT connections, surpassing 20 million by mid-2025 and aiming for 30 million, solidifies its position as a leader in the global IoT connectivity market.

This impressive scale is a key indicator of their strength in the overall IoT landscape. Despite a recent minor dip in core connectivity revenue, the sheer volume of connections and the ambitious growth targets underscore their dominance in an ever-expanding sector.

Their ability to manage and scale these connections efficiently places their core connectivity offering firmly in the Star category of the KORE BCG Matrix.

- KORE’s IoT connections reached over 20 million by June 2025.

- The company has set a target of 30 million IoT connections.

- This volume demonstrates significant market leadership in IoT connectivity.

- The projected growth reinforces their Star status in the expanding IoT market.

KORE's significant expansion in IoT connections, reaching over 20 million by mid-2025 and targeting 30 million, firmly places its core connectivity services in the Star category of the KORE BCG Matrix. This substantial volume of managed connections signifies market leadership and a strong position in the rapidly growing IoT landscape.

The impressive scale of KORE's connectivity operations, despite a minor recent dip in core revenue, highlights their dominance and growth trajectory. This robust performance in a key sector confirms their Star status, indicating high market share in a high-growth industry.

Their strategic focus on managing and scaling these connections efficiently solidifies their leading role. This sustained strength in the core connectivity market is a testament to their strategic execution and market penetration.

The projected growth in IoT connections further reinforces KORE's Star designation. This indicates continued dominance and high potential for future success in the expanding IoT market.

| KORE BCG Matrix Component | Description | KORE's Position |

|---|---|---|

| Stars | High market share in high-growth industries. Require significant investment to maintain growth. | KORE's core IoT connectivity services are Stars. |

| Market Share | Significant, evidenced by 20+ million connections by mid-2025. | High. |

| Market Growth | Rapid expansion in the global IoT market. | High. |

| Key Indicator | Target of 30 million IoT connections by 2026. | Strong growth trajectory. |

What is included in the product

Strategic analysis of KORE's product portfolio, classifying units as Stars, Cash Cows, Question Marks, or Dogs.

Clear visualization of product portfolio performance.

Cash Cows

KORE's Core Global IoT Connectivity Services are undeniably their cash cow. Despite a minor dip in Q1 2025, this segment is KORE's largest revenue generator and a consistent cash flow engine. The company boasts nearly 20 million connections as of Q1 2025, highlighting their vast reach and established presence in the market.

This mature market segment experienced a robust 12% revenue increase in fiscal year 2024, underscoring its stability and KORE's significant market share. The recurring revenue generated from this substantial, globally distributed installed base provides a reliable foundation for the company's financial performance.

KORE’s established Connectivity Management Platforms (CMPs) represent a significant cash cow, offering stable, high-margin revenue streams. These platforms are crucial for businesses managing vast numbers of IoT devices, providing essential services like device provisioning, monitoring, and billing. In 2024, the IoT connectivity management market is projected to continue its robust growth, with KORE's established infrastructure and extensive customer base ensuring a recurring revenue model. Their position as a pure-play IoT hyperscaler underscores the efficiency and scale of their operations for these foundational, high-volume services.

KORE's managed services for enterprise IoT deployments act as a significant cash cow. These offerings, encompassing deployment, ongoing operational management, and long-term sustainment support, are designed to alleviate the inherent complexity of IoT for large organizations.

The recurring nature of these managed services, often secured through multi-year contracts, translates into predictable and high-margin revenue streams for KORE. This stability is bolstered by the critical role these services play in ensuring the continuous operation of enterprise IoT solutions.

KORE's demonstrated expertise in navigating the entire IoT lifecycle, from initial setup to maintenance, underpins the reliability and profitability of these cash cow offerings. Their commitment to customer intimacy further solidifies these relationships, ensuring sustained demand.

Multi-Carrier, Multi-IMSI Network Infrastructure

KORE's multi-carrier, multi-IMSI network infrastructure is a cornerstone of their business, acting as a true cash cow. This robust, globally distributed system ensures high uptime and reliability, crucial for mission-critical IoT applications.

The extensive and mature nature of this infrastructure allows KORE to serve a vast customer base across more than 180 countries. This global reach translates into consistent revenue streams.

- Global Network Reach: Operates in over 180 countries, a testament to its established presence and reliability.

- High Uptime: The multi-carrier, multi-IMSI design inherently supports failover and resilience, minimizing service disruptions.

- Revenue Stability: This foundational asset generates predictable, recurring revenue from a diverse and large customer base.

- Low Incremental Cost: Due to its maturity, ongoing promotional investment required to maintain its market position is relatively lower.

Long-Term Client Relationships in Mature Industries

KORE's mature industry clients, including those in transportation and utilities, represent significant cash cows. These long-term relationships, often spanning years, foster deep integration of IoT solutions, making them mission-critical for clients. This integration translates into highly predictable and stable revenue streams for KORE, a hallmark of successful cash cow businesses.

The strategy of maximizing 'share of wallet' from these existing customers, coupled with a strong focus on customer satisfaction, demonstrates KORE's approach to milking these established, reliable revenue sources. For example, in 2024, KORE reported a significant portion of its revenue derived from its existing customer base, highlighting the value of these mature relationships.

- Predictable Revenue: Mature client relationships in sectors like transportation and utilities provide consistent, recurring income, crucial for cash cow stability.

- Deep Integration: IoT solutions are often mission-critical and deeply embedded in client operations, reducing churn and ensuring long-term value.

- Focus on Existing Customers: KORE prioritizes expanding its wallet share within its established client base, a key strategy for maximizing cash cow potential.

- Customer Satisfaction: High levels of customer satisfaction in these mature segments contribute to loyalty and reduced acquisition costs, further bolstering cash flow.

KORE's core IoT connectivity services are their undisputed cash cows, generating consistent and substantial revenue. Despite market fluctuations, this segment, boasting nearly 20 million connections as of Q1 2025, remains KORE's largest and most reliable cash flow engine.

These mature services, which saw a 12% revenue increase in fiscal year 2024, benefit from KORE's extensive market presence and recurring revenue model derived from a vast, globally distributed customer base. The stability and profitability of these offerings are further enhanced by the company's established Connectivity Management Platforms (CMPs).

The CMPs, vital for managing extensive IoT device fleets, contribute high-margin, recurring revenue. KORE's pure-play hyperscaler status optimizes these operations, ensuring efficiency and scale for these foundational services, which are projected for continued growth in 2024.

| Segment | Revenue Contribution (FY24 Est.) | Growth Rate (FY24) | Key Differentiator |

| Core IoT Connectivity | Largest Share | 12% | 20M+ Connections, Global Reach |

| Connectivity Management Platforms (CMPs) | Significant Recurring Revenue | Projected Growth | High Margin, Essential Service |

| Managed Services (Enterprise) | Predictable, High-Margin | Consistent | Lifecycle Management, Customer Intimacy |

| Multi-Carrier Network Infrastructure | Stable, Recurring | Consistent | 180+ Country Reach, High Uptime |

| Mature Industry Clients | Highly Predictable | Stable | Deep Integration, Share of Wallet Maximization |

Delivered as Shown

KORE BCG Matrix

The KORE BCG Matrix preview you see is precisely the comprehensive strategic tool you will receive upon purchase, offering a clear, actionable framework for evaluating your business portfolio. This document is not a sample; it is the complete, professionally formatted analysis ready for immediate integration into your strategic planning processes. You can confidently expect the exact same high-quality, data-driven KORE BCG Matrix report to be delivered to you instantly after your purchase. This ensures you gain immediate access to a powerful tool designed to illuminate your product and business unit performance and guide your investment decisions.

Dogs

Legacy 2G/3G connectivity services are firmly positioned in the Dogs quadrant of the BCG matrix. As mobile network operators worldwide systematically decommission their older 2G and 3G networks, KORE's reliance on these technologies places it in a declining market. For instance, by the end of 2023, many major carriers like AT&T and Verizon had fully retired their 3G networks, significantly impacting devices still dependent on them.

While KORE offers solutions to help customers migrate away from these legacy networks, the core 2G/3G connections themselves represent a shrinking market share with very limited growth potential. This segment is characterized by declining revenue and increasing costs to maintain, making it a prime candidate for divestiture or discontinuation.

The strategic implication for KORE is to actively manage the phase-out of these services. The company is likely focusing resources on newer, more robust network technologies like 4G LTE and 5G, which offer superior performance and cater to evolving customer needs. This strategic shift aims to improve overall profitability by shedding low-margin, high-maintenance business lines.

KORE's strategic decision to shed unprofitable contracts and product lines, a move that contributed to a 5% revenue dip in Q1 2025, is a calculated step toward enhanced profitability. These underperforming segments, characterized by minimal market share and slim to negative profit margins, function as significant drains on resources, often referred to as cash traps.

This divestment clearly signals KORE's classification of these offerings as Dogs within the BCG Matrix framework. By exiting these low-growth, low-share ventures, the company is freeing up capital and management focus for more promising opportunities, ultimately aiming to improve its overall financial health and competitive standing.

Within KORE's product portfolio, hardware offerings that serve niche markets or have struggled to gain substantial traction would be categorized here. These might include specialized devices with limited demand or older hardware models that haven't been updated to compete effectively. Such products typically hold a small market share and generate negligible revenue, potentially diverting valuable resources from more promising areas.

Analyzing KORE's business model, the company's primary strength lies in its connectivity services and integrated solutions. Financial disclosures often highlight revenue streams from IoT platforms and managed services, suggesting that hardware, unless directly supporting these core offerings, may represent a less significant or underperforming segment. For example, if a specific device line, like certain older cellular modules, experienced declining sales in 2024 due to the prevalence of newer, more efficient technologies, it would fit this description.

Underutilized or Obsolete IoT Solutions

Some Internet of Things (IoT) solutions developed previously have struggled to gain significant traction or have been eclipsed by more advanced technologies. These might include specific sensor networks designed for niche industrial applications that never scaled or early-generation smart home devices with limited functionality. KORE's strategic review in 2024 likely involved identifying and potentially divesting from such underperforming or obsolete offerings to focus resources more effectively.

These types of IoT solutions typically exhibit a low market share within their particular segments and present minimal prospects for future growth. Consequently, they warrant only a slight continuation of investment, or in many cases, a complete phase-out to optimize resource allocation. Companies like KORE often streamline their product portfolios to concentrate on areas with higher potential returns.

Examples of such underutilized solutions could include:

- Legacy industrial asset tracking systems: Early RFID or GPS-based trackers that are power-hungry and offer limited real-time data compared to newer, more energy-efficient cellular IoT solutions.

- Basic environmental monitoring sensors: Standalone sensors for temperature or humidity that lack integrated analytics or connectivity to broader platforms, making them less valuable than comprehensive IoT solutions.

- Older generation M2M communication modules: Devices relying on 2G or early 3G networks that are being phased out, limiting their lifespan and future compatibility.

Low ARPU Connectivity Use Cases

KORE's ARPU saw a dip in Q1 2025, a trend influenced by new connections originating from low Average Revenue Per User (ARPU) connectivity segments. These segments, while boosting connection numbers, often represent high-volume, low-value business. Such opportunities can strain resources without yielding substantial profit if not managed strategically.

For instance, while the broader IoT market continued its expansion, certain low-ARPU applications, such as basic asset tracking or simple sensor networks, may have contributed to this ARPU dilution. By Q1 2025, it's estimated that these specific use cases might have represented an increasing, though smaller, percentage of KORE's total connections, impacting the overall revenue per user.

- Increased Connection Volume: Growth in connections from sectors like basic environmental monitoring or low-cost fleet management, which inherently have lower ARPU.

- Resource Consumption: These connections, while individually low-revenue, still require network resources and customer support, potentially impacting profitability.

- Strategic Management Need: The challenge lies in optimizing the cost-to-serve for these segments or identifying pathways to increase their value over time.

- Potential for Scale: Despite low ARPU, these segments can offer significant scale, presenting an opportunity if bundled or integrated into higher-value service offerings.

The "Dogs" in KORE's BCG matrix represent legacy products and services with low market share and minimal growth potential. These often include older connectivity technologies like 2G/3G and specific hardware or IoT solutions that have been surpassed by newer advancements. The company's strategy involves managing the decline of these segments, focusing on phasing them out or divesting to reallocate resources to more promising areas.

For instance, KORE's decision to shed unprofitable contracts, which led to a 5% revenue dip in Q1 2025, directly reflects the management of these Dog products. These offerings are characterized by low profit margins and can act as cash traps, draining resources without significant returns. By exiting these ventures, KORE aims to enhance overall profitability and competitive standing.

Examples of such offerings include legacy industrial asset tracking systems, basic environmental monitoring sensors, and older M2M communication modules that rely on soon-to-be-decommissioned networks. These products, despite potentially serving niche markets, offer limited scalability and future growth prospects, making them prime candidates for strategic pruning.

The average revenue per user (ARPU) dip observed in Q1 2025, influenced by new connections from low-ARPU segments, further illustrates the characteristics of these Dog products. While increasing connection volumes, these low-value offerings can strain resources and require careful management to avoid impacting overall profitability. KORE's focus is on optimizing the cost-to-serve for these segments or finding ways to increase their value.

Question Marks

KORE is keenly observing the rapid ascent of AI-powered Internet of Things, or AIoT. This fusion allows IoT devices to not only collect data but also to analyze and act upon it in real-time, creating truly intelligent systems. Think of smart city infrastructure that reroutes traffic autonomously based on live sensor data or industrial equipment that predicts its own maintenance needs.

While the potential for AIoT is undeniably vast, with market forecasts predicting significant expansion in the coming years – some analyses suggest the global AIoT market could reach hundreds of billions of dollars by the late 2020s – KORE's current position in deeply integrated AIoT solutions is likely still in its nascent stages. This means that while the opportunity is a clear indicator of future growth, KORE's market share in this specific, advanced segment is probably modest.

To truly capitalize on the AIoT wave and move these nascent applications into the Star quadrant of the KORE BCG Matrix, substantial investment in research and development is paramount. This includes developing proprietary AI algorithms, enhancing device intelligence, and building robust cloud infrastructure to support these advanced capabilities. Simultaneously, aggressive market development strategies are needed to establish KORE as a leader in this high-potential space.

KORE's new vertical market expansions represent their 'Question Marks' on the BCG Matrix. These are areas where the company is venturing into less familiar territory, such as expanding into the burgeoning Internet of Things (IoT) sector for smart city initiatives or advanced manufacturing. These markets are characterized by high growth potential but also significant uncertainty regarding KORE's ability to capture substantial market share.

These initiatives demand considerable upfront capital for sales force expansion, targeted marketing campaigns, and the development of tailored solutions to meet the unique needs of these new verticals. For example, building out the specialized sales teams and engineering resources for complex industrial IoT deployments requires significant investment. The company must navigate new regulatory landscapes and establish credibility in sectors where they haven't previously operated.

The financial commitment is substantial, with the expectation of long-term payoff rather than immediate profitability. KORE needs to demonstrate a clear strategy for converting these investments into market leadership. As of late 2024, many of these nascent vertical expansions are still in their early stages, with revenue contributions being minimal but the strategic imperative to diversify and capture future growth being high.

The 2025 emergence of the eSIM IoT specification, SGP.32, is poised to significantly reshape how we manage device connectivity, creating a substantial growth avenue. KORE is actively engaged in eSIM technology, and its leadership in this new standard is still taking shape.

While KORE's investment in this burgeoning field could secure considerable future market share, it currently represents a speculative venture. The market for SGP.32 compliant eSIM solutions is expected to see rapid expansion, with analysts projecting a compound annual growth rate of over 25% for IoT eSIM deployments leading up to 2025.

Strategic Partnerships for Novel IoT Solutions

KORE's strategic partnerships, exemplified by its collaboration on projects like Winnebago Connect™, signal a deliberate move into novel IoT solutions and emerging market segments. These ventures, while offering substantial growth potential, represent KORE’s initial low market share in these specific new areas. For instance, the Winnebago Connect™ platform, launched in 2024, aims to enhance RV connectivity and user experience, targeting a niche but growing segment of the recreational vehicle market.

These collaborations require significant investment and meticulous execution to achieve scalability and solidify KORE's position. The success of such partnerships hinges on effectively translating innovative concepts into commercially viable products. KORE's strategic focus on these high-potential, yet nascent, IoT applications aligns with a strategy to diversify its revenue streams and capture early market share in specialized verticals.

- Exploration of New Markets: Partnerships like Winnebago Connect™ allow KORE to tap into specialized IoT applications within sectors like recreational vehicles, indicating a strategy of market diversification.

- High Growth Potential, Low Initial Share: These novel solutions represent significant future growth opportunities, but KORE's market penetration within these new niches is currently minimal.

- Investment and Execution Focus: Successful scaling of these innovative IoT solutions necessitates substantial investment and robust operational execution to gain traction and market share.

Exploratory Solutions Leveraging New Technologies (e.g., NTNs)

KORE is actively investigating and integrating novel wireless networking technologies, often referred to as New Technologies Networks (NTNs). These include advancements beyond traditional terrestrial cellular networks, such as satellite-based IoT solutions. The primary goal is to extend Internet of Things (IoT) connectivity into previously inaccessible or underserved remote geographical areas, opening up new market opportunities.

These NTNs represent a significant frontier for growth and innovation within the IoT landscape. While the potential is substantial, KORE's current market penetration in these emerging NTN sectors is expected to be minimal, reflecting their nascent stage. Significant investment in research and development (R&D) and careful strategic planning are crucial for KORE to establish a strong foothold and transform these NTN ventures into future high-growth "Stars" within the KORE BCG matrix.

- NTN Market Growth: The global NTN market is projected for rapid expansion, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 20% in the coming years, driven by demand for ubiquitous connectivity.

- KORE's NTN Investment: KORE's strategic allocation towards NTN research and development in 2024 reflects a commitment to capitalize on this high-potential, albeit early-stage, market segment.

- Strategic Positioning: Success in NTNs hinges on forming strategic partnerships with satellite operators and developing specialized device management platforms tailored for non-terrestrial environments.

- R&D Focus: Key areas of R&D for KORE likely include low-power wide-area network (LPWAN) integration with satellite links and robust device management for harsh, remote conditions.

KORE's ventures into new vertical markets, such as smart cities and advanced manufacturing, are prime examples of their Question Marks. These are high-growth potential areas where KORE is still establishing its market share. Significant investment in sales, marketing, and tailored solutions is necessary to build credibility and capture market position in these unfamiliar sectors.

The company's exploration of the eSIM IoT specification (SGP.32) also falls into this category. While the market for IoT eSIMs is projected for substantial growth, with a CAGR potentially exceeding 25% leading up to 2025, KORE's leadership position in this evolving standard is still developing, making it a speculative but promising investment.

Similarly, KORE's strategic partnerships, like the Winnebago Connect™ platform launched in 2024, target niche but growing IoT segments. These initiatives require considerable investment and effective execution to scale and secure KORE's foothold, representing initial low market share in specialized new areas.

KORE's investment in New Technologies Networks (NTNs), such as satellite-based IoT, is another key Question Mark. These emerging sectors, with projected CAGRs over 20%, offer vast potential for extending connectivity but require substantial R&D and strategic planning for KORE to gain a significant market presence.

BCG Matrix Data Sources

Our KORE BCG Matrix utilizes a robust blend of internal sales data, customer usage patterns, and market penetration metrics to accurately position each offering.