KKR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KKR Bundle

KKR's strengths lie in its diversified investment portfolio and strong brand recognition within the private equity sector. However, it faces challenges with regulatory scrutiny and the inherent risks associated with economic downturns. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind KKR's market positioning, potential threats, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

KKR's strength lies in its deeply diversified global investment portfolio, spanning private equity, credit, and real assets. This broad asset class exposure offers significant resilience, allowing the firm to navigate various market conditions effectively. By the end of Q1 2024, KKR reported approximately $578 billion in Assets Under Management (AUM), showcasing the scale of its diversified operations.

With a significant global footprint, KKR operates out of 16 offices worldwide, providing unparalleled access to diverse investment opportunities and robust risk mitigation strategies. This international presence is crucial for identifying and capitalizing on emerging trends across different geographies.

A key differentiator for KKR is its strategic holdings business. This approach involves acquiring additional stakes in existing core private equity businesses, thereby deepening its commitment and potentially enhancing returns within its established investment themes. This strategy was evident in their continued investment activity throughout 2024.

KKR's fundraising prowess is a significant strength, evident in its impressive capital raises. The firm secured $114 billion in 2024 and an additional $31 billion in the first quarter of 2025, highlighting robust investor confidence and demand for its alternative investment strategies.

This substantial capital inflow translates directly into significant purchasing power, often referred to as dry powder. It fuels KKR's capacity for ambitious mergers and acquisitions (M&A) and provides ample resources for exploring and executing new investment opportunities across its diverse portfolio.

Furthermore, KKR's ability to effectively deploy this capital is a key differentiator. The firm deployed a remarkable $88 billion over the twelve months leading up to Q1 2025, demonstrating its operational efficiency and strategic acumen in putting raised funds to work in the market.

KKR's disciplined investment strategy centers on acquiring control positions in companies, allowing for hands-on operational improvements. This focus is evident in their private equity, credit, and real assets portfolios, where they actively seek opportunities to enhance growth and performance.

The firm's emphasis on operational value creation, rather than solely relying on financial engineering, is a significant strength. This approach proved particularly valuable in 2024, as demonstrated by the strong performance of their portfolio companies, many of which benefited from strategic enhancements implemented by KKR's management teams.

For instance, KKR's real assets investments, often featuring inflation-linked contracts, provided a stable income stream. This strategy contributed to the firm's overall resilience, with reported assets under management growing robustly through the first half of 2025.

Strategic Partnerships and Market Access

KKR's strategic partnerships are a significant strength, notably its collaboration with Capital Group. This alliance, announced in late 2023, aims to expand access to KKR's private market investment solutions for individual investors, demonstrating a clear move to broaden its distribution channels.

These types of collaborations, including the development of public-private funds, are instrumental in KKR's strategy to reach new investor segments and bolster its overall market access. By forging these alliances, KKR effectively strengthens its competitive standing.

- Broadened Distribution: Partnerships like the one with Capital Group enhance KKR's ability to distribute its investment products.

- New Investor Segments: These alliances enable KKR to tap into previously underserved investor bases.

- Enhanced Market Access: Strategic collaborations solidify KKR's presence and reach within various financial markets.

Strong Financial Performance and Liquidity

KKR demonstrates exceptional financial health, highlighted by a 22% year-over-year increase in fee-related earnings per share during the first quarter of 2025. This strong performance extended to total operating earnings, which saw a 16% rise, showcasing the firm's growing profitability. This robust financial footing allows KKR to confidently pursue strategic growth initiatives and effectively manage its obligations.

The company maintains substantial liquidity, evidenced by its healthy operating cash flow and significant available undrawn credit facilities. This financial flexibility is a key strength, enabling KKR to capitalize on market opportunities and weather economic uncertainties. Such a strong financial foundation is critical for supporting its ongoing global expansion efforts and ensuring resilience in dynamic market conditions.

- Fee-related earnings per share increased by 22% year-over-year in Q1 2025.

- Total operating earnings grew by 16% in the same period.

- Robust operating cash flow provides a solid financial cushion.

- Significant liquidity through available undrawn credit facilities supports strategic flexibility.

KKR's diversified global portfolio, encompassing private equity, credit, and real assets, provides substantial resilience across market cycles. As of Q1 2024, their Assets Under Management (AUM) reached approximately $578 billion, underscoring the scale and breadth of their operations.

The firm’s impressive fundraising capabilities are a testament to investor confidence, securing $114 billion in 2024 and an additional $31 billion in Q1 2025. This influx of capital translates into significant dry powder, empowering KKR’s M&A activities and new investment pursuits.

KKR's operational value creation strategy, focused on hands-on improvements within portfolio companies, has proven highly effective. This approach, rather than relying solely on financial engineering, drove strong performance in 2024, with a notable $88 billion deployed in the twelve months leading up to Q1 2025.

Strategic partnerships, such as the collaboration with Capital Group announced in late 2023, are expanding KKR’s market access to new investor segments. This focus on broadening distribution channels is a key strength, enhancing their competitive positioning.

| Metric | Q1 2025 (YoY Growth) | Significance |

|---|---|---|

| Fee-related Earnings Per Share | +22% | Indicates growing profitability from management fees. |

| Total Operating Earnings | +16% | Demonstrates overall business expansion and efficiency. |

| Capital Raised (2024) | $114 Billion | Highlights strong investor demand and KKR's fundraising prowess. |

| Capital Deployed (12 months to Q1 2025) | $88 Billion | Shows effective execution and deployment of raised capital. |

What is included in the product

Analyzes KKR’s competitive position through key internal and external factors, highlighting its robust investment platform and market opportunities alongside potential regulatory challenges and competitive pressures.

Identifies key competitive advantages and potential threats, enabling proactive risk mitigation and opportunity maximization.

Weaknesses

KKR's investment performance is closely linked to the health of capital markets and the overall economy. This means the firm is vulnerable to swings in market volatility and periods of economic slowdown. While KKR does diversify its investments, substantial economic changes can still hurt the value of its assets and make it harder to sell them profitably.

For instance, the volume of private equity deals saw a notable drop in 2024, reflecting a more cautious market environment. Valuations for assets are particularly sensitive to where we are in the economic cycle, meaning downturns can significantly reduce the worth of KKR's portfolio companies.

Even with KKR's expertise, there's an inherent risk that some investments within its broad portfolio might not perform as expected. This is a common challenge in the private equity space.

The reliance on mark-to-model valuations for private assets can present a weakness. While it helps to present a smoother return profile, it can sometimes mask or delay the acknowledgment of actual value decreases, creating a potential disconnect when compared to the more volatile, real-time pricing of public markets.

As of early 2024, certain KKR funds are reportedly experiencing pressure from elevated valuations on their portfolio companies. This situation, coupled with difficulties in finding suitable buyers or achieving desired exit multiples, can hinder the timely realization of gains and potentially impact overall fund performance.

KKR, like other alternative investment giants, is navigating a landscape of heightened regulatory scrutiny worldwide. This increased oversight, particularly in areas like transparency, investor protection, and risk management, presents a significant challenge.

New regulations, such as the SEC's proposed rules impacting private fund advisors and the EU's Alternative Investment Fund Managers Directive (AIFMD), demand more rigorous reporting and adherence to stricter compliance standards. For instance, the SEC's proposals, expected to be implemented in phases through 2024 and 2025, will likely increase data collection and disclosure requirements for private equity firms.

The complexity and constant evolution of these global regulatory frameworks demand substantial investment in compliance infrastructure and expertise. This can translate into higher operational costs and a diversion of resources that could otherwise be allocated to investment activities or growth initiatives.

Effectively managing these evolving compliance obligations is crucial for KKR to maintain its operational integrity and investor confidence, especially as the firm continues to expand its global footprint and product offerings into 2025.

Competition in a Crowded Market

The alternative asset management sector, especially private credit, is seeing a surge in new entrants, leading to thinner profit margins and a tougher fight for desirable investment opportunities. KKR is up against formidable rivals like Blackstone, Apollo Global Management, and Carlyle Group, alongside powerful sovereign wealth funds and substantial pension funds. This heightened competition makes securing exclusive deals and generating superior returns increasingly challenging.

The fierce competition means KKR must work harder to find unique investment opportunities and maintain its profit margins. For instance, by the end of 2024, the global private credit market was projected to exceed $2 trillion, a significant increase from previous years, indicating the crowded nature of the space. This environment puts pressure on KKR’s ability to source proprietary deals and achieve the outsized returns its investors expect.

- Intensified Competition: The alternative asset management landscape, particularly private credit, is becoming increasingly saturated.

- Pressure on Spreads: This crowding leads to tighter profit margins and more intense competition for attractive investment opportunities.

- Key Competitors: KKR faces rivals such as Blackstone, Apollo Global Management, Carlyle Group, along with sovereign wealth funds and pension funds.

- Deal Sourcing Challenges: The competitive environment makes it more difficult to find and secure exclusive, high-return investment deals.

Illiquidity and Lengthy Holding Periods of Private Investments

KKR’s investments in private equity and real assets inherently face illiquidity. These funds are typically locked up for extended durations, often 10 years or more, which restricts KKR's ability to quickly redeploy capital or respond to shifting market conditions. This lack of liquidity can be a significant drawback for investors seeking more flexible investment options.

The private markets are currently experiencing a notable increase in the backlog of portfolio exits. As of late 2024, many private equity firms, including KKR, are facing longer holding periods for their investments. This situation ties up substantial amounts of capital, potentially delaying distributions to limited partners and impacting the overall pace of fund performance realization.

The extended holding periods can create challenges for KKR, especially in a dynamic economic environment. For instance, if market valuations decline or a specific portfolio company faces unexpected headwinds, KKR might be forced to hold onto the asset longer than initially planned, potentially impacting its internal rate of return (IRR) and investor confidence.

- Illiquidity: Private investments, by nature, cannot be easily bought or sold on public exchanges, leading to longer transaction times and potentially lower selling prices if an urgent exit is required.

- Extended Holding Periods: The industry trend shows a growing number of deals taking longer to exit, with many private equity funds now holding assets for 7-12 years, compared to historical averages of 5-7 years.

- Capital Tie-up: Illiquid assets and lengthy holding periods mean that capital committed to these investments remains unavailable for new opportunities or immediate investor withdrawals, affecting fund liquidity management.

KKR's reliance on mark-to-model valuations for private assets can be a weakness, potentially masking value decreases compared to public markets. As of early 2024, some KKR funds faced pressure from elevated portfolio company valuations, hindering profitable exits and impacting performance.

Heightened global regulatory scrutiny, including SEC proposals expected through 2024-2025 and AIFMD, demands significant investment in compliance infrastructure. This can increase operational costs and divert resources from core investment activities.

Intensified competition, especially in private credit where KKR faces rivals like Blackstone and Apollo, leads to thinner profit margins and challenges in sourcing exclusive, high-return deals. The global private credit market, projected to exceed $2 trillion by late 2024, highlights this crowded environment.

The inherent illiquidity of private investments, with extended holding periods often reaching 7-12 years, ties up capital and can delay distributions to investors. This lack of liquidity restricts KKR's ability to redeploy capital quickly or react to market shifts effectively.

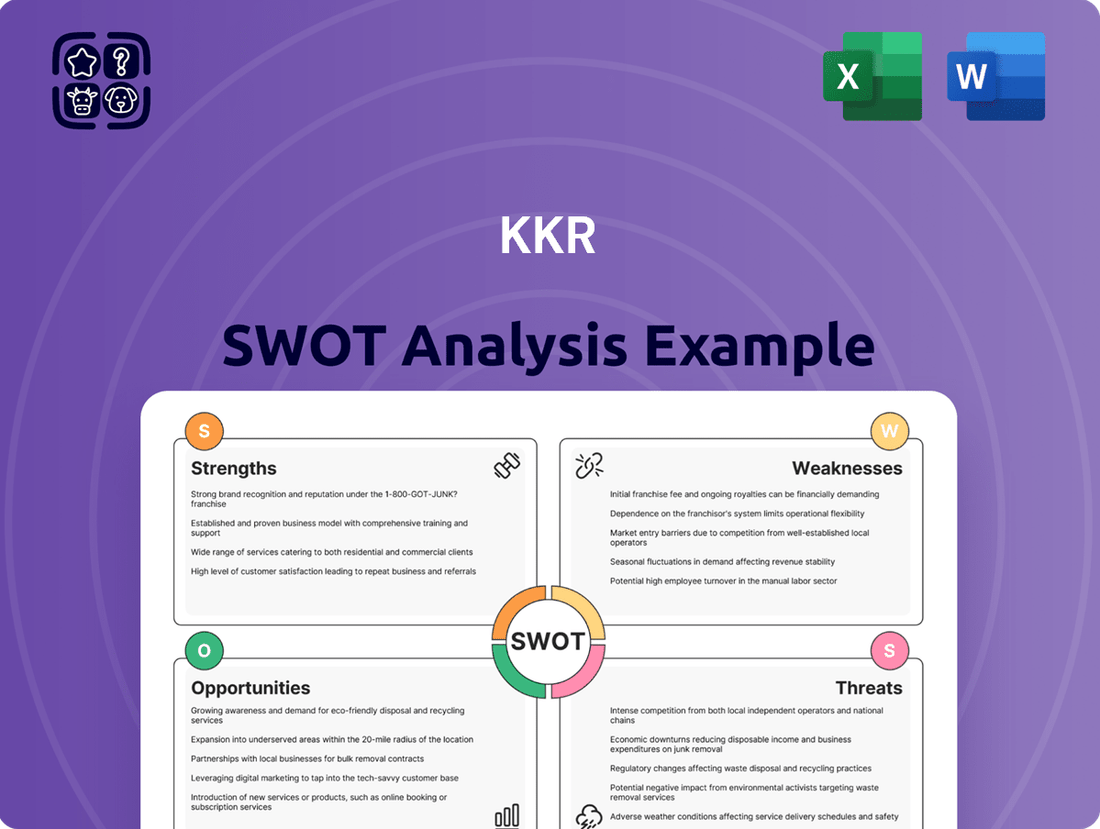

Preview Before You Purchase

KKR SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual KKR SWOT analysis, providing a clear overview of their strategic landscape. Upon purchase, you'll unlock the complete, in-depth report, ready for immediate application. This ensures you get exactly what you need to understand KKR's position.

Opportunities

The appetite for alternative assets, from private equity to infrastructure, continues to surge as investors, both institutional and individual, seek diversification and enhanced returns beyond traditional stocks and bonds. This persistent demand, fueled by a quest for yield and portfolio resilience, positions alternative investment managers favorably. By 2024, the global alternative assets market was projected to reach over $20 trillion, with significant growth anticipated through 2027.

KKR is actively leveraging this trend. Their strategic partnership with Capital Group, for instance, is designed to tap into this expanding investor pool by offering integrated public-private investment solutions. This move directly addresses the growing investor desire to access innovative opportunities that lie outside the public markets, a key driver of alternative asset growth.

KKR has significant opportunities to broaden its reach by entering new geographical markets, especially in rapidly expanding economies like India and the Middle East, alongside other Southeast Asian nations. This expansion leverages KKR’s established global platform and investment expertise.

Beyond its traditional investment areas, KKR can capitalize on the growing demand for digital infrastructure, AI-driven businesses, and the global shift towards energy transition technologies. These emerging sectors align perfectly with KKR's stated strategic priorities and offer substantial growth potential.

The firm's recent strategic moves, including key acquisitions and the establishment of Ascend Asia, clearly signal this commitment to tapping into these high-potential markets and sectors. For instance, KKR's investment in the Indian digital infrastructure space has been a notable focus.

KKR can seize opportunities by integrating advanced data analytics and artificial intelligence. This can significantly sharpen deal sourcing, streamline due diligence processes, and optimize portfolio management, leading to more informed and timely investment decisions.

Embracing cutting-edge technology and AI solutions positions KKR to attract and retain premier talent, as professionals increasingly seek firms at the forefront of innovation. This also drives substantial operational efficiencies across the organization.

KKR's existing strategic emphasis on productivity and capital efficiency is a perfect complement to this technological evolution. For instance, in 2023, KKR reported record levels of capital raised, exceeding $200 billion, demonstrating strong investor confidence that can be further amplified by technological advancements.

By investing in AI-powered platforms, KKR can gain a competitive edge in identifying undervalued assets and predicting market trends, potentially enhancing returns. The firm's commitment to digital transformation efforts, which have been ongoing since 2022, supports this strategic direction.

Increased Focus on ESG and Sustainable Investments

The growing global commitment to Environmental, Social, and Governance (ESG) investing is a prime opportunity for KKR. This trend allows KKR to attract capital from a widening pool of investors prioritizing sustainability, a segment that has seen substantial growth. For instance, by the end of 2023, global sustainable investment assets reached an estimated $37.4 trillion, indicating a strong demand for ESG-aligned strategies.

KKR can capitalize on this by expanding its investments in sectors like renewable energy and climate technology. Furthermore, integrating ESG factors directly into how they manage their existing portfolio companies can enhance long-term value and appeal to a broader investor base. This strategic alignment not only meets investor demand but also positions KKR as a leader in responsible investing.

KKR's proactive stance is already evident through strategic moves, such as increasing its investment in biofuel businesses. This move demonstrates a tangible commitment to the energy transition and ESG principles. Such actions are crucial as investors increasingly scrutinize the sustainability practices of their fund managers.

Key opportunities stemming from this trend include:

- Attracting significant capital from sustainability-conscious investors.

- Expanding investment into high-growth areas like renewable energy and climate tech.

- Enhancing portfolio company value through integrated ESG management.

- Strengthening KKR's brand reputation as a responsible investment leader.

Strategic Acquisitions and Partnerships for Specialization

KKR can strategically expand its reach and deepen its expertise through targeted acquisitions and partnerships. This approach allows for diversification and increased market share within specialized investment areas. For example, further investment in its core private equity operations or forming new alliances can bolster its capabilities.

By leveraging complementary strengths, KKR can enhance its proficiency in specific asset classes or distribution networks. The firm's partnership with Capital Group, for instance, exemplifies this strategy, enabling access to broader expertise and client bases. These moves are crucial for staying competitive in a dynamic financial landscape.

- Expanding Private Equity Dominance: KKR's commitment to growing its private equity segment, which has consistently been a core driver of its business, can be further solidified through strategic bolt-on acquisitions of smaller, specialized funds or management teams.

- Deepening Sector Specialization: Partnerships or acquisitions in niche sectors where KKR seeks to build deeper expertise, such as renewable energy technology or specialized healthcare services, can provide a competitive edge.

- Enhancing Distribution Channels: Collaborations with firms that have established distribution networks in regions or client segments where KKR aims to grow can significantly expand its reach and fundraising capacity.

- Leveraging Technology Partnerships: Acquiring or partnering with fintech companies that offer innovative data analytics or client engagement platforms can modernize KKR's operational capabilities and improve client service.

KKR is well-positioned to capitalize on the increasing global demand for alternative assets, with the market projected to exceed $20 trillion by 2024. The firm can expand its investor base and offerings through strategic partnerships, such as the one with Capital Group, to provide integrated public-private investment solutions.

Emerging sectors like digital infrastructure, AI, and energy transition technologies present significant growth avenues for KKR. The firm's ongoing digital transformation efforts and investments in areas like Indian digital infrastructure underscore its commitment to these high-potential markets.

The growing emphasis on ESG investing offers KKR a prime opportunity to attract substantial capital from sustainability-focused investors. By increasing investments in renewable energy and climate technology, and integrating ESG management into portfolio companies, KKR can enhance value and its reputation as a responsible investor.

Strategic acquisitions and partnerships can further bolster KKR's market share and expertise in specialized investment areas. For instance, deepening sector specialization in renewable energy or enhancing distribution channels through collaborations can significantly expand its reach and fundraising capabilities.

Threats

Economic downturns and persistent market volatility pose a significant threat to KKR. For instance, a sharp contraction in global GDP, as seen in potential scenarios for late 2024 or 2025, could drastically reduce the number of attractive investment opportunities available. This also directly impacts asset valuations downwards, making it harder for KKR to achieve its target returns when exiting investments.

Furthermore, geopolitical instability, including ongoing trade disputes and regional conflicts, heightens market uncertainty. This unpredictability complicates the execution of new deals and the management of KKR's diverse, cross-border portfolio. For example, disruptions in supply chains or sudden tariff changes in key markets could negatively affect the performance of portfolio companies, impacting KKR's overall financial results.

Fluctuations in interest rates pose a significant threat, directly impacting the cost of debt for KKR's portfolio companies, which can compress profitability and lower valuations. While KKR's private credit strategies can benefit from floating rates, sustained inflation and rising rates also increase operating expenses and dampen consumer demand, negatively affecting overall portfolio performance.

KKR's own 2025 outlook highlights that higher valuations and evolving interest rate environments create a more challenging landscape for achieving target returns. For example, the Federal Reserve's policy rate in the US, which influences borrowing costs globally, has seen significant adjustments throughout 2023 and into 2024, creating an uncertain cost of capital environment for many KKR investments.

The alternative asset management landscape is increasingly crowded, with more players competing for investor capital and attractive deals. This heightened rivalry often translates into downward pressure on management fees and performance fees, potentially impacting profitability for firms like KKR. For instance, while specific fee structures vary, the industry average for management fees in private equity can range from 1.5% to 2%, with carried interest typically around 20%.

Firms that cannot clearly articulate their unique value proposition or consistently deliver top-tier returns risk losing investor mandates. In 2023, KKR reported fee-related earnings of $2.1 billion, a testament to its ability to attract and manage capital, but sustained fee pressure remains a persistent threat in this competitive environment.

Adverse Regulatory Changes and Geopolitical Risks

KKR faces significant threats from unpredictable shifts in government policies and corporate regulations, particularly concerning tariffs and international capital movement. For instance, the ongoing trade disputes and potential for new tariffs in 2024-2025 could impact the profitability of KKR’s portfolio companies operating globally. Increased regulatory scrutiny, a common theme under evolving administrations, can lead to compliance burdens and operational uncertainty, affecting investment valuations.

Geopolitical risks also present a substantial challenge, disrupting global supply chains and hindering cross-border investment opportunities. Tensions, such as those observed in Eastern Europe and the Middle East, can create volatile market conditions. For KKR, which manages a diverse global portfolio, these risks necessitate careful risk management and strategic adaptation to navigate an increasingly complex international landscape.

- Regulatory Uncertainty: Potential changes in financial regulations, environmental standards, and antitrust laws in key markets like the US and EU could affect KKR’s investment strategies and the performance of its portfolio companies.

- Trade Policy Shifts: Increased protectionism or changes in trade agreements can disrupt international supply chains and increase costs for KKR’s portfolio companies, impacting their profitability and KKR’s returns.

- Geopolitical Instability: Conflicts and political instability in regions where KKR has significant investments can lead to asset devaluation, operational disruptions, and capital flight.

Talent Shortage and Retention Challenges

The private equity industry, including firms like KKR, is grappling with a significant talent shortage, especially for professionals skilled in accounting, data analytics, and technology leadership. This scarcity directly impacts operational efficiency and the ability to manage increasingly complex global portfolios effectively.

The competition for top talent is fierce, driving up compensation and making it difficult for firms to attract and retain the necessary expertise to navigate evolving market demands and technological integration. For instance, the demand for data scientists in finance saw a notable increase of over 30% in job postings between 2023 and early 2024, highlighting this competitive landscape.

- Talent Gap: Shortage of experienced professionals in key areas like cybersecurity and AI implementation.

- Increased Costs: Higher salaries and recruitment expenses to secure specialized talent.

- Retention Difficulty: Challenges in keeping skilled employees due to competitive offers from other firms.

- Operational Strain: Limited availability of expertise can hinder the execution of strategic initiatives and portfolio management.

KKR faces significant threats from an increasingly competitive alternative asset management landscape, with more firms vying for investor capital and attractive deals. This rivalry can lead to downward pressure on fees, impacting profitability. For example, while specific fee structures differ, industry averages for private equity management fees often fall between 1.5% and 2%, with carried interest around 20%.

Furthermore, regulatory uncertainty, including potential shifts in financial regulations, environmental standards, and antitrust laws in key markets like the US and EU, could alter KKR’s investment strategies and portfolio company performance. Trade policy shifts, such as increased protectionism, can disrupt supply chains and increase costs for portfolio companies, thereby affecting KKR’s returns.

Geopolitical instability, including ongoing conflicts and political tensions in regions where KKR has investments, presents a substantial challenge. These situations can lead to asset devaluation, operational disruptions, and capital flight, necessitating careful risk management for KKR’s diverse global portfolio.

SWOT Analysis Data Sources

This KKR SWOT analysis is built upon robust data from their official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a solid foundation for understanding KKR's operational landscape and strategic positioning.