KKR Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KKR Bundle

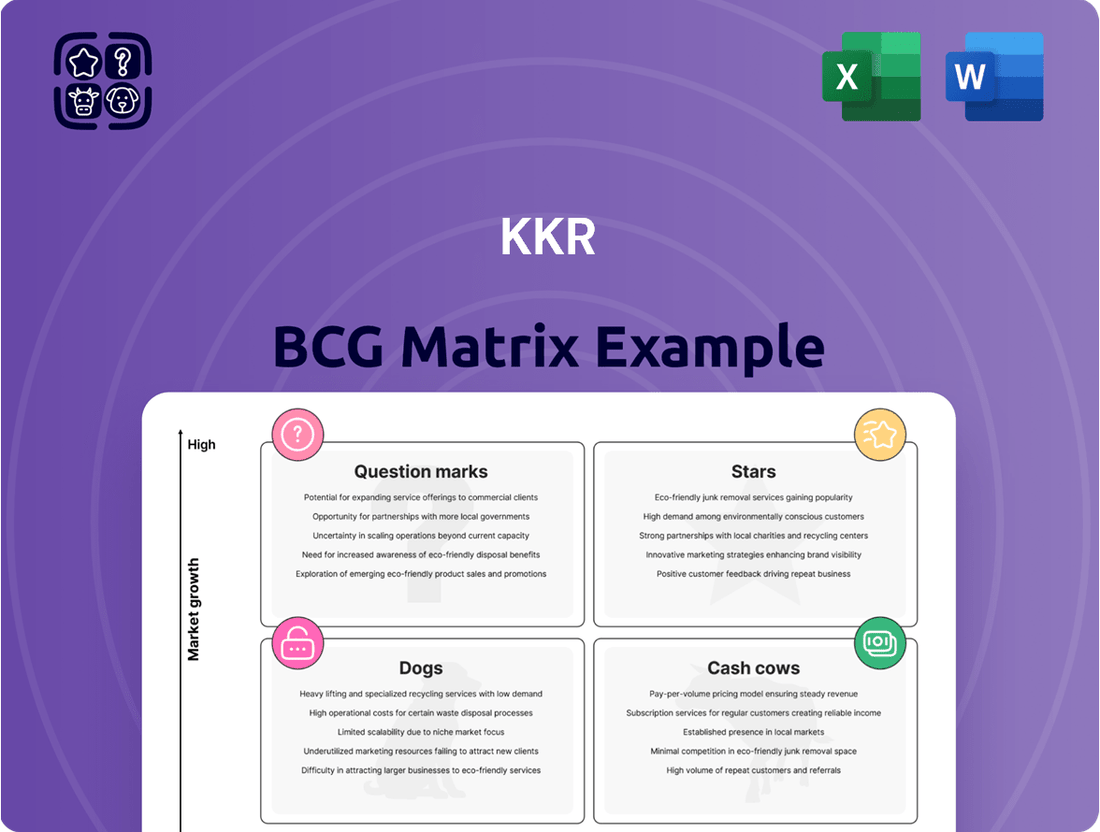

Unlock the strategic potential of the KKR BCG Matrix, a powerful tool that categorizes business units or products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs. Understanding these classifications is crucial for effective resource allocation and future growth planning. This preview offers a glimpse into how this framework can illuminate your company's market position.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

KKR is heavily investing in digital infrastructure, especially data centers and their power sources, due to the massive growth in AI and cloud computing needs. This sector is booming, and KKR's smart moves, like their $50 billion joint venture with Energy Capital Partners, make them a major player.

This strategic focus on digital infrastructure places KKR in a strong position within the high-growth tech market. The demand for data center capacity is projected to continue its upward trajectory, fueled by increasing data generation and the widespread adoption of artificial intelligence technologies globally.

KKR's complete acquisition of Global Atlantic Financial Group in January 2024 marked a pivotal moment, significantly bolstering KKR's earnings trajectory. With Global Atlantic managing a substantial $197 billion in assets, this move positions KKR to leverage a well-established player in the insurance sector.

Global Atlantic's expertise in fixed annuities and its impressive asset base are key contributors to KKR's financial resilience and recurring revenue streams. This strategic integration directly enhances KKR's diversification and its ability to generate consistent income.

KKR's strategic expansion into sustainable infrastructure, notably through its partnership with HASI and the creation of CarbonCount Holdings 1 LLC (CCH1), positions it in a robust growth sector driven by global energy transition needs. This focus aligns with increasing investor appetite for environmentally conscious assets.

Launched in 2024, CCH1 has already secured substantial investment commitments, signaling strong market confidence and KKR's commitment to scaling clean energy projects. This vehicle is actively increasing its capacity, reflecting the growing demand for sustainable energy solutions.

CCH1's investment strategy is designed to capitalize on the accelerating shift towards decarbonization, targeting projects that offer both environmental benefits and long-term financial returns. This positions KKR as a key player in financing the future of energy infrastructure.

Asia Pacific Infrastructure Funds (e.g., KKR Asia Pacific Infrastructure Investors III)

KKR's commitment to the Asia Pacific infrastructure landscape is exemplified by its successive funds, with KKR Asia Pacific Infrastructure Investors III aiming for substantial capital raises, building on the significant achievements of prior vehicles. This strategic focus underscores the region's burgeoning infrastructure needs and KKR's deep-rooted expertise.

These funds are actively deploying capital into critical growth areas. Investments span renewable energy projects, crucial for decarbonization efforts, and digital infrastructure, supporting the region's increasing connectivity demands. Transportation assets, vital for economic development, also form a core part of the investment strategy.

The Asia-Pacific region presents a compelling investment case due to its rapid economic expansion and evolving infrastructure requirements. KKR's established presence and proven track record in the region position it favorably to capitalize on these opportunities.

- Capital Focus: KKR Asia Pacific Infrastructure Investors III targets significant capital deployment, building on the success of previous funds.

- Sector Diversification: Investments are concentrated in high-growth areas like renewable energy, digital infrastructure, and transportation.

- Regional Strength: KKR leverages its strong market presence and established track record in the rapidly developing Asia-Pacific region.

Next Generation Technology Growth Fund III Investments (e.g., Qventus)

KKR's Next Generation Technology Growth Fund III is strategically deploying capital into promising technology enterprises. A prime example is its investment in Qventus, a company revolutionizing healthcare through AI-powered operational automation for health systems.

This investment underscores KKR's focus on the information technology sector, particularly in burgeoning fields like AI-driven healthcare solutions. The fund actively seeks out innovative, market-leading technologies poised for substantial expansion, aligning with a forward-looking investment strategy.

The fund's commitment to areas like Qventus reflects a broader trend of significant capital allocation towards AI and machine learning applications within the healthcare industry. In 2024, venture capital funding for health tech, especially AI-focused solutions, continued to show robust activity, with many companies reporting substantial year-over-year growth in adoption and revenue.

- Fund Focus: KKR's Next Generation Technology Growth Fund III targets high-potential technology companies.

- Key Investment: Qventus, an AI-driven care automation software provider for health systems, exemplifies the fund's strategy.

- Sector Concentration: The fund prioritizes the information technology sector, with a particular emphasis on AI and healthcare innovation.

- Market Trend Alignment: Investments reflect the growing demand and rapid expansion of AI applications in healthcare delivery and operations.

Stars in the KKR BCG Matrix represent high-growth, high-market-share businesses. These are the crown jewels of the portfolio, demanding significant investment to maintain their growth momentum and competitive edge. KKR's focus on sectors like digital infrastructure and AI-driven healthcare aligns with this, as these areas exhibit strong growth potential and KKR aims to capture substantial market share.

What is included in the product

Strategic assessment of business units based on market share and growth.

Guides investment decisions by categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Visualize your portfolio with a clear KKR BCG Matrix, pinpointing strategic focus areas.

Cash Cows

KKR's Established Credit and Liquid Strategies segment, boasting $284 billion in Assets Under Management (AUM) as of the first quarter of 2025, stands as a bedrock of stability within their broader portfolio. This segment is engineered to generate reliable, compounding income streams.

These strategies, encompassing areas like high-yield bonds, bank loans, and various structured credit products, are specifically designed to offer consistent returns. They are also intended to serve as a buffer against the inevitable ups and downs of market fluctuations, thereby acting as dependable cash generators for the firm.

KKR's Core Private Equity strategy acts as a stable anchor within its broader investment framework, much like a Cash Cow in the BCG matrix. This approach targets established, high-quality businesses, often characterized by lower debt levels, with the objective of achieving consistent, long-term growth. For instance, KKR's Strategic Holdings segment, which encompasses these core investments, is designed to deliver predictable and substantial fee-related earnings for the firm.

The emphasis here is on operational excellence and value creation through strategic enhancements rather than aggressive financial engineering. This focus on improving underlying business performance helps to ensure a steady stream of returns, reinforcing the Cash Cow analogy. These investments are built for durability, aiming to generate reliable cash flows over extended periods.

KKR's substantial infrastructure arm, boasting $77 billion in assets under management as of September 2024, features a significant portfolio of mature assets. These are primarily found in essential sectors like power, utilities, and transportation.

These mature infrastructure assets are characterized by their contracted revenue streams and tangible value, which translates into consistent and reliable cash flows. This predictability stems from their critical role in the economy, even though their growth prospects are more modest compared to newer ventures.

The strong market share these assets command within their respective segments, combined with their essential service nature, solidifies their position as reliable generators of cash. They represent the classic definition of cash cows within an investment portfolio, offering stability and dependable returns.

Real Estate Credit Strategies (e.g., Opportunistic Real Estate Credit Fund II)

KKR's Real Estate Credit Strategy, exemplified by funds like Opportunistic Real Estate Credit Fund II, targets lucrative opportunities within the commercial real estate sector by focusing on stable, collateral-backed cash flows. This approach is designed to generate attractive and consistent income, particularly benefiting from environments with elevated interest rates, making it a dependable source of cash for the firm.

This strategy acts as a significant cash generator for KKR, embodying the characteristics of a 'Cash Cow' in the BCG matrix. By actively sourcing and managing real estate debt investments, the firm secures reliable returns that can be reinvested or utilized for other strategic initiatives.

- Fund Performance: Opportunistic Real Estate Credit Fund II successfully raised over $850 million in February 2025, demonstrating strong investor confidence and the strategy's appeal.

- Income Generation: The focus on collateral-based lending in commercial real estate aims to provide stable, predictable income streams.

- Market Positioning: This strategy thrives in higher interest rate environments, enhancing its attractiveness as a consistent cash provider.

- Strategic Allocation: Cash generated from these credit strategies can support KKR's investments in growth-oriented or question mark businesses.

Long-Term Diversified Private Equity Portfolio

KKR's long-term diversified private equity portfolio, featuring 285 companies in 2024 and $638 billion in assets under management, acts as a significant Cash Cow. This vast collection of mature investments consistently generates revenue and benefits from ongoing operational improvements.

The breadth of KKR's holdings, spanning multiple industries and regions, provides a stable foundation for consistent cash flow. This diversification mitigates risk while ensuring a predictable income stream.

- Diversification: KKR's portfolio spans numerous sectors, offering resilience against downturns in any single industry.

- Mature Investments: A substantial portion of the portfolio consists of established businesses with proven business models.

- Revenue Generation: These companies contribute significantly to KKR's overall revenue through their ongoing operations.

- Fee Income: The management of these diverse assets also generates substantial fee income for KKR.

Cash Cows, within the KKR BCG Matrix framework, represent established, low-growth, high-market-share businesses that generate more cash than they consume. These are KKR's reliable income generators, providing stability and funding for other strategic initiatives. Their consistent cash flow allows for reinvestment, debt repayment, or shareholder returns.

KKR's Established Credit and Liquid Strategies, with $284 billion in AUM as of Q1 2025, exemplifies a cash cow. This segment focuses on generating reliable income from assets like high-yield bonds and bank loans. Similarly, their extensive infrastructure arm, holding $77 billion in assets as of September 2024, includes mature, contracted assets in essential services that yield predictable cash flows.

The firm's diversified private equity portfolio, encompassing 285 companies in 2024 with $638 billion in AUM, also functions as a cash cow. These mature investments across various sectors consistently generate revenue and fee income.

| Segment | AUM (as of 2024/2025) | Characteristics | Cash Flow Contribution |

| Established Credit & Liquid Strategies | $284 billion (Q1 2025) | Reliable income from high-yield bonds, bank loans | Consistent, compounding income |

| Infrastructure | $77 billion (Sept 2024) | Mature assets, contracted revenues in essential services | Predictable and stable cash flows |

| Diversified Private Equity | $638 billion (2024) | 285 mature companies, stable revenue, fee income | Significant, ongoing revenue generation |

Delivered as Shown

KKR BCG Matrix

The KKR BCG Matrix preview you're currently viewing is the complete, unwatermarked document you will receive upon purchase. This professionally designed report, ready for immediate application, will be delivered directly to you, containing all the strategic insights and analysis necessary for effective business planning.

Dogs

While KKR focuses on long-term value creation, some older investments in industries facing decline or stagnation can present challenges. These companies, often in mature sectors, might find it difficult to grow or even hold onto their existing market position.

These legacy assets can demand substantial management time and capital without delivering the anticipated growth or returns. For instance, by the end of 2023, KKR had an active portfolio that included companies in sectors like traditional manufacturing and retail, where growth prospects are often more constrained.

Such situations can lead to these entities becoming 'cash traps,' draining resources that could be better allocated elsewhere. This is why strategic reviews, including potential divestiture or significant restructuring, become crucial to optimize the overall portfolio performance.

KKR's vast portfolio often contains smaller, non-strategic minority interests. These might arise from earlier investment stages or when KKR has already divested a significant portion of its stake. For instance, in 2024, KKR managed a diverse array of private equity funds, and within these, certain legacy or less dominant positions could be classified as such.

When these minority stakes no longer align with KKR's current strategic objectives or are not generating substantial returns, they can be viewed as 'dogs' from a capital allocation perspective. The firm's focus is on maximizing returns across its investments, and capital tied up in underperforming or non-core minority interests might be better deployed elsewhere.

Consider a scenario where KKR holds a 5% stake in a company post-secondary buyout. If this holding doesn't offer significant governance influence or strategic upside, and its market value is relatively small compared to KKR's overall AUM (Assets Under Management), it could be a candidate for divestment to free up capital for more promising opportunities. KKR's approach emphasizes active portfolio management, which includes pruning non-essential holdings.

Investing in highly cyclical sectors like automotive or semiconductors, or those undergoing significant structural disruption, presents unique challenges. Without a clear competitive advantage, these investments can struggle, leading to underperformance. For instance, the semiconductor industry, while vital, experienced a significant downturn in early 2023, with global chip sales declining by 11.1% year-over-year according to the Semiconductor Industry Association.

While KKR's broader investment philosophy often prioritizes resilience, some portfolio companies might be exposed to sectors facing prolonged low growth. If these businesses lack adaptability to evolving market dynamics, such as the shift to electric vehicles impacting traditional auto manufacturers, they risk diminished market share and profitability. For example, as of late 2023, many legacy automakers were still grappling with the transition, with some reporting declining sales of internal combustion engine vehicles while struggling to scale EV production effectively.

Assets Approaching End of Fund Life Without Clear Exit Path

When investment funds near their expiry, some assets may find themselves without a straightforward path to sale or attractive return. This situation is particularly challenging for assets operating in stagnant markets and holding a minor market position. These are the classic 'dogs' within a portfolio.

KKR, like other private equity firms, faces the reality of managing these underperforming assets. A 'dog' asset that reaches its fund's maturity without a clear exit strategy can force difficult decisions. These might include accepting a significantly reduced valuation multiple upon sale or extending the holding period, tying up capital that could be deployed elsewhere.

For instance, if a KKR fund has a portfolio company in a mature, low-growth sector like traditional print media and that company holds less than 5% market share, it's a prime candidate for a 'dog' classification as the fund's life nears its end. Such assets are problematic because their limited growth prospects and weak competitive standing make them unattractive to potential buyers, especially at the multiples needed to meet fund return targets.

- Maturity Mismatch: Assets without a clear exit strategy when the fund is nearing its end.

- Market Position: Typically found in low-growth markets with a low market share.

- Valuation Pressure: Potential for sales at significantly lower multiples than initially projected.

- Capital Lock-in: Extended holding periods tie up valuable capital, impacting overall fund performance.

Divested Businesses (e.g., Perrigo's Dermacosmetics)

KKR's acquisition of Perrigo's Dermacosmetics business, a transaction valued at $1.7 billion announced in 2023, highlights a classic BCG Matrix scenario. For Perrigo, shedding this segment, which faced intense competition and slower growth compared to its other segments, could be seen as divesting a 'dog' – a business with low market share and low growth prospects. This move allows Perrigo to refocus resources on its core pharmaceutical and consumer self-care products.

From KKR's perspective, this acquisition represents a new venture under its Core Private Equity strategy. The goal is clear: to revitalize the Dermacosmetics business, aiming to elevate it from a potential 'dog' in Perrigo's eyes to a 'star' or at least a 'cash cow' within KKR's portfolio. This transformation will likely involve strategic investments in product innovation, market expansion, and operational efficiencies.

The success of KKR's investment hinges on its ability to implement these strategic changes effectively. If KKR can successfully turn the business around, it will generate significant returns, demonstrating astute portfolio management. However, if the transformation falters, the Dermacosmetics business could remain a low-performing asset, becoming a 'dog' for KKR, impacting overall portfolio performance.

- Divestiture Rationale: Perrigo's sale of its Dermacosmetics business for $1.7 billion in 2023 likely stemmed from the segment's underperformance relative to its core offerings.

- KKR's Objective: KKR aims to reposition the acquired business as a high-growth 'star' or stable 'cash cow' within its private equity portfolio.

- Risk Factor: Failure to execute a successful turnaround strategy could result in the business becoming a 'dog' for KKR, characterized by low market share and limited growth.

- Market Dynamics: The dermacosmetics sector is highly competitive, demanding significant investment in R&D and marketing to achieve market leadership.

Dogs in KKR's portfolio are typically investments in mature or declining industries with low market share and growth potential. These assets may not generate significant returns and can even drain capital that could be better utilized elsewhere. KKR's active portfolio management strategy includes identifying and addressing these underperforming investments, often through restructuring or divestment.

For instance, KKR's 2023 acquisition of Perrigo's Dermacosmetics business, while an opportunity for KKR to grow, represented a divestment for Perrigo, likely due to the segment's challenges in a competitive market. This highlights how companies classify certain segments as 'dogs' when they no longer align with strategic growth objectives.

The challenge with 'dog' assets, especially when a fund nears its end, is finding a viable exit strategy without significant valuation haircuts. This can lead to capital being tied up in assets that offer minimal future upside, impacting overall fund performance metrics.

KKR's approach necessitates a rigorous assessment of all portfolio companies, ensuring that capital is allocated to those with the highest potential for value creation, thereby minimizing the drag from 'dog' investments.

Question Marks

Early-stage climate infrastructure investments, as represented by KKR's Global Climate Fund, fit squarely into the Question Marks quadrant of the BCG Matrix. As of Q1 2025, this fund had secured $2.749 billion towards its $7 billion goal, signaling substantial investor interest in a high-growth sector. These investments are characterized by their focus on emerging climate solutions and energy transition technologies, which, while promising, are still developing and require significant capital infusion to capture market share.

The introduction of KKR's new retail credit funds, like the Capital Group KKR Core Plus+ and Multi-Sector+ in April 2025, marks a strategic move to democratize private credit for individual investors. This expansion into the retail space taps into a market with significant growth potential, estimated to reach hundreds of billions of dollars in the coming years as defined contribution plans evolve.

These funds, while new entrants, begin with a low initial market share within the burgeoning retail private credit landscape. Achieving leadership will necessitate substantial investment in marketing, investor education, and building trust to overcome the inherent complexities of private credit for the average investor.

KKR's strategic investment in Gulf Data Hub (GDH) in January 2025, with a projected total investment exceeding $5 billion, positions it to capitalize on the burgeoning Middle East digital infrastructure market. This initiative specifically targets the region's rapid expansion, fueled by AI and data-intensive applications.

While the Middle East digital infrastructure sector demonstrates significant growth potential, KKR is still in the process of establishing a substantial market share within this niche. This makes GDH a classic question mark in the BCG matrix for KKR, characterized by high growth prospects coupled with a developing market position.

New Technology Growth Investments (e.g., smaXtec, XOi Technologies)

KKR's Next Generation Technology Growth Fund III is actively deploying capital into emerging technology firms such as smaXtec and XOi Technologies, as of 2025. These investments represent KKR's strategy of identifying and nurturing early to growth-stage companies within rapidly expanding technology sectors.

The fund's objective is to fuel the scaling capabilities of these businesses, enabling them to aggressively pursue market share expansion. However, the long-term market leadership and ultimate success of these ventures remain subjects of ongoing observation and market validation.

- Newer, Smaller Bets: KKR's recent investment strategy, evidenced by the deployment in companies like smaXtec and XOi Technologies, indicates a focus on building a portfolio of potentially high-growth, yet less established, technology players within its 2025 outlook.

- Growth Stage Focus: These companies are typically in their growth phases, meaning they have demonstrated product-market fit and are looking to scale operations, sales, and marketing efforts, often with the support of KKR's capital and strategic guidance.

- High-Growth Sector Exposure: Investments are concentrated in sectors experiencing significant technological advancement and market demand, suggesting KKR is positioning its fund to capitalize on future market trends and disruptions.

- Uncertainty and Potential: While these investments carry the potential for substantial returns, they also inherently involve higher risk due to the unproven nature of long-term market dominance and the competitive landscape these companies navigate in 2025.

Investments in Specific Healthcare Sub-sectors (e.g., Healthcare Global Enterprises, India)

KKR's strategic investments, such as its significant backing of Healthcare Global Enterprises (HCG) in India and its increased commitment to BrightSpring Health Services, highlight a clear emphasis on burgeoning healthcare sectors. This dual approach demonstrates a strategy to capitalize on both established and emerging market growth. For instance, HCG is a prominent cancer care provider in India, and KKR's investment aims to expand its reach and capabilities within this critical medical field.

The Indian healthcare market is indeed experiencing robust expansion, driven by factors like increasing disposable incomes, a growing middle class, and a greater emphasis on preventative care. KKR's position within specific sub-sectors like cancer care, while growing, may still be establishing its market leadership. For example, while HCG is a significant player, the competitive landscape in India's healthcare sector is dynamic, with numerous established and emerging providers.

KKR's strategy with HCG is indicative of a broader trend of private equity firms targeting high-potential healthcare markets. The firm's commitment to doubling down on BrightSpring Health Services in the US further underscores its belief in the long-term viability of specialized healthcare services. This suggests a portfolio approach that balances geographic diversity with a focus on resilient and growing healthcare segments.

- KKR invested $150 million in Healthcare Global Enterprises (HCG) in 2023, aiming to bolster its cancer care network in India.

- BrightSpring Health Services, a US-based provider of home and community-based healthcare services, saw KKR increase its investment in 2024.

- The Indian healthcare market was projected to reach $636 billion by 2025, growing at a CAGR of 17%, according to some reports prior to mid-2025.

- HCG operates over 25 cancer centers across India, positioning it as a key player in the country's oncology segment.

Question Marks in KKR's portfolio represent investments in high-growth markets where KKR currently holds a relatively low market share. These are often newer ventures or those in rapidly evolving sectors where significant capital is required to build a strong competitive position.

Companies in this category, like those in KKR's Next Generation Technology Growth Fund III, are positioned for expansion but require continued investment to achieve market leadership. The success of these ventures hinges on their ability to scale effectively and outcompete rivals in dynamic environments.

The firm's expansion into retail credit, for example, taps into a growing market, but KKR is still building its presence and investor base in this space. Similarly, digital infrastructure in the Middle East, while a high-growth area, sees KKR establishing its footprint.

These investments are characterized by high potential returns but also carry inherent risks due to market uncertainty and the need for substantial capital deployment to capture market share and achieve dominance.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to accurately position business units.