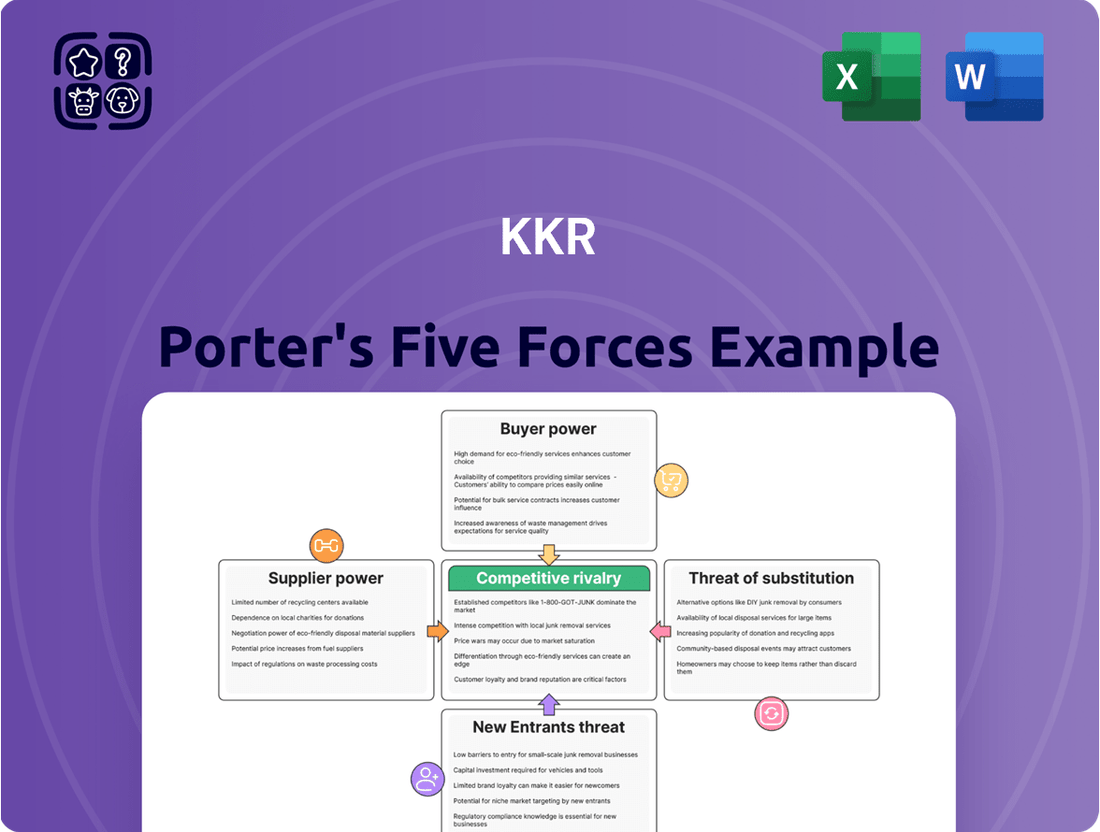

KKR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KKR Bundle

KKR's competitive landscape is shaped by significant forces, from the bargaining power of its clients to the looming threat of new entrants in private equity. Understanding the intensity of rivalry among existing firms and the availability of substitute investment strategies is crucial for KKR's sustained success. Furthermore, the influence of suppliers, such as limited partners providing capital, plays a vital role in their operational framework.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore KKR’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

KKR's primary 'suppliers' are its Limited Partners (LPs), who are the source of the substantial capital for its investment funds. These LPs, such as pension funds and sovereign wealth funds, wield considerable bargaining power, especially given the intense competition among alternative asset managers vying for their investment allocations.

The sheer volume of capital LPs commit, often in the billions, gives them leverage in negotiating terms and fees with firms like KKR. In 2023, KKR successfully raised over $55 billion across its various funds, demonstrating its ability to attract significant LP capital, yet the underlying power dynamic remains.

The increasing number of sophisticated alternative asset managers competing for these funds means LPs have more choices, further enhancing their bargaining position. This competitive landscape forces KKR to offer attractive terms and demonstrate strong performance to secure and maintain LP commitments.

The specialized nature of alternative asset management means that highly skilled investment professionals, deal originators, and operational experts are critical suppliers of intellectual capital to KKR. The market for this top talent is exceptionally competitive, granting these individuals considerable bargaining power concerning compensation and incentives.

In 2023, the average compensation for a managing director in private equity, a key role for KKR, could reach upwards of $1 million annually, including base salary and performance bonuses, highlighting the high cost of securing and retaining such talent. This competitive landscape necessitates continuous investment in human capital to maintain KKR's edge.

Proprietary deal flow, the ability to access unique and attractive investment opportunities before they are widely available, is a significant factor in the private markets. Firms that can consistently source these exclusive deals possess considerable bargaining power.

Established corporate relationships, deep industry expertise, and specialized intermediaries are key to generating proprietary deal flow. These entities act as gatekeepers to valuable investment prospects, giving them leverage.

While KKR's extensive global network, built over decades, helps mitigate reliance on any single source, access to these exclusive opportunities remains a crucial differentiator. For instance, KKR's 2024 investments, such as its acquisition of Air Canada's loyalty program, likely stemmed from such proprietary sourcing channels.

This ability to unearth and secure off-market deals allows firms to negotiate more favorable terms, potentially leading to higher returns for their investors. The scarcity of truly unique opportunities underscores the supplier's bargaining power in this domain.

Data Providers and Technology Vendors

In today's investment world, data providers and technology vendors are crucial suppliers. Think of companies that offer market intelligence, analytics software, and sophisticated AI tools. Firms like KKR use these resources extensively for their research, to keep an eye on their investments, and to make smart strategic choices.

The specialized knowledge and high expense associated with some of these services can significantly boost the bargaining power of these vendors. For example, the global market for data analytics is projected to reach over $100 billion by 2024, highlighting the critical role and potential leverage of key players in this sector.

- High Switching Costs: Once integrated, replacing specialized data or technology platforms can be costly and time-consuming, giving vendors an advantage.

- Proprietary Technology: Unique algorithms or data sets developed by these suppliers can create a competitive moat, increasing their influence.

- Concentration of Providers: In certain niche areas, a limited number of providers can control access to essential data or technology, leading to greater supplier power.

- Dependence on Data Quality: The accuracy and comprehensiveness of data are paramount for investment decisions, making firms reliant on their chosen providers.

Regulatory and Legal Expertise

The intricate and constantly shifting regulatory landscape for alternative investments worldwide elevates the importance of legal and compliance specialists, making them key suppliers. Their deep understanding of these rules and the significant consequences of non-compliance gives them considerable leverage. For instance, in 2024, the Securities and Exchange Commission (SEC) continued its focus on private fund disclosures, requiring enhanced reporting and compliance measures from firms like KKR. This heightened scrutiny means that firms need to engage sophisticated legal teams to navigate these demands effectively.

The bargaining power of these legal experts stems from the critical nature of their services. Failure to adhere to regulations can result in substantial fines, reputational damage, and even operational shutdowns. KKR, like other major alternative investment firms, must secure access to premier legal counsel to manage these risks. The global alternative investment market reached an estimated $13.7 trillion in assets under management by the end of 2023, underscoring the immense scale and complexity that necessitates expert legal navigation.

- Specialized Knowledge: Legal and compliance professionals possess niche expertise crucial for navigating complex global financial regulations.

- High Stakes: Regulatory adherence carries significant financial and reputational risks, amplifying the value of expert legal advice.

- Evolving Environment: Continuous updates in regulations, such as those from the SEC in 2024 regarding private fund disclosures, necessitate ongoing, expert legal support.

- Market Scale: The vast size of the alternative investment market, estimated at $13.7 trillion in AUM by year-end 2023, increases the demand and criticality of legal compliance services.

Limited Partners (LPs) wield significant bargaining power due to the sheer volume of capital they provide and the competitive landscape among alternative asset managers. In 2023, KKR's ability to raise over $55 billion highlights its success, yet the need to offer attractive terms to these sophisticated investors remains paramount.

The critical suppliers of intellectual capital, such as top-tier investment professionals, command strong bargaining power due to intense competition for talent. For instance, managing directors in private equity can earn over $1 million annually, reflecting the high cost of securing and retaining expertise.

Proprietary deal flow, sourced through established relationships and intermediaries, grants these entities leverage in negotiating terms for exclusive investment opportunities. KKR's 2024 acquisition of Air Canada's loyalty program likely benefited from such exclusive sourcing.

Data providers and technology vendors are crucial, with the data analytics market projected to exceed $100 billion by 2024, giving them influence due to high switching costs and proprietary technology.

Legal and compliance specialists possess considerable bargaining power given the complex regulatory environment, particularly with the SEC's heightened focus on private fund disclosures in 2024. The $13.7 trillion alternative investment market by year-end 2023 underscores the criticality of their services.

| Supplier Type | Bargaining Power Factors | Example/Data Point |

|---|---|---|

| Limited Partners (LPs) | High capital volume, numerous asset managers | KKR raised over $55 billion in 2023 |

| Talent (Investment Professionals) | Specialized skills, competitive market | Managing Director compensation > $1 million (2023) |

| Deal Originators | Access to exclusive opportunities | KKR's 2024 Air Canada loyalty program acquisition |

| Data & Tech Vendors | Proprietary tech, high switching costs | Data analytics market > $100 billion (2024) |

| Legal & Compliance Specialists | Regulatory complexity, high stakes | SEC focus on private fund disclosures (2024) |

What is included in the product

A KKR-focused Porter's Five Forces analysis dissects the competitive intensity within an industry, examining threats from new entrants, the power of buyers and suppliers, the risk of substitutes, and the intensity of rivalry to inform KKR's investment strategy.

Instantly identify and quantify the competitive pressures impacting your industry, allowing for targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Institutional investors, such as pension funds and sovereign wealth funds, are KKR's primary customers, known as Limited Partners (LPs). These LPs wield significant bargaining power because they commit vast sums of capital and can easily shift their investments among various alternative asset managers. For instance, in 2023, KKR managed over $578 billion in assets, a testament to the scale of capital these LPs entrust to them. This scale allows them to negotiate favorable terms, including lower management fees and performance fees, and demand highly customized fund structures and transparent, detailed reporting. Their ability to diversify their allocations means KKR must continuously demonstrate value to retain their business and attract new capital.

Limited partners, or LPs, frequently specify their investment targets and leanings towards particular asset types like private equity, credit, or infrastructure, and even specific strategies such as climate or impact investing. This focused demand directly influences KKR's ability to secure capital and empowers LPs to shape KKR's product innovation and fundraising priorities. For instance, KKR's 2023 annual report highlighted a significant portion of its capital raising efforts being directed towards specialized strategies, reflecting LP appetite.

Customers, particularly Limited Partners (LPs) in private equity, wield significant bargaining power when they demand robust and consistent investment performance. For KKR, this means consistently delivering top-tier returns is paramount. In 2024, the pressure for alpha generation remained high, with many LPs scrutinizing manager performance against public market benchmarks and peer groups.

Furthermore, the push for greater transparency into fund operations and the performance of underlying portfolio companies directly impacts customer leverage. LPs are increasingly sophisticated and demand detailed insights into how their capital is managed and the strategic decisions being made. KKR's ability to provide this level of clarity and accountability is a key factor in maintaining LP relationships and attracting new commitments.

Ability to Directly Invest or Co-Invest

Large institutional investors are increasingly flexing their muscles by investing directly or co-investing with fund managers, bypassing traditional fund structures. This trend empowers them, as they gain more control over their capital and can often negotiate lower fees. For instance, pension funds and sovereign wealth funds, managing trillions, are actively seeking direct opportunities, which can mean less reliance on firms like KKR for deal sourcing and management.

This growing ability to invest directly or co-invest significantly amplifies the bargaining power of customers in the alternative asset management space. They can demand better terms, preferential access to deals, and more transparent fee structures from General Partners (GPs). This shift reflects a maturing investor base that is more sophisticated and willing to take on greater operational responsibility to optimize returns.

- Increased Investor Sophistication: Institutional investors possess the internal expertise to conduct due diligence and manage investments independently.

- Demand for Lower Fees: Direct investment bypasses fund management fees, directly impacting profitability for GPs.

- Greater Control and Alignment: Co-investment allows investors to influence strategy and ensure alignment with their specific objectives.

- Market Trends: In 2024, the volume of co-investment deals has continued to rise, indicating a persistent demand for direct involvement.

Exit Opportunities and Liquidity Demands

Limited Partners, or LPs, are always looking for ways to get their money back from private market investments, and they want it sooner rather than later. This drive for liquidity is a significant factor in how they view their investments.

The easier it is for companies KKR invests in to be sold, perhaps through an Initial Public Offering (IPO) or a merger and acquisition (M&A) deal, the happier LPs tend to be. This satisfaction directly impacts their decision to invest in KKR's future funds.

As of early 2024, the private equity market has seen a slowdown in exits compared to the peak years. For instance, global private equity exit activity in 2023 was down significantly from 2021 highs, with M&A remaining the dominant exit route, but facing headwinds from higher interest rates and valuation gaps.

- LP Liquidity Needs: Investors in private equity funds, like pension funds and endowments, need to see cash returned to meet their own financial obligations and reinvestment plans.

- Exit Opportunity Impact: Strong exit markets (IPOs, M&A) increase LP confidence and future capital commitments. Weak exit markets can lead to LP pressure for distributions.

- Backlog Pressure: A growing number of portfolio companies that are difficult to sell increases the urgency for fund managers to find viable exit solutions.

- Market Conditions: In 2023, the number of IPOs by private equity-backed companies saw a notable decrease compared to previous years, making M&A a more critical, albeit challenging, exit path.

The bargaining power of KKR's customers, primarily sophisticated institutional investors known as Limited Partners (LPs), is substantial due to their significant capital commitments and the availability of alternative asset managers. These LPs can leverage their scale to negotiate favorable terms, including fee structures and fund customization, directly impacting KKR's profitability and operational flexibility.

LPs' ability to dictate investment mandates and strategies empowers them to influence KKR's product development and fundraising focus, as seen in the increasing demand for specialized strategies. This influence is further amplified by their growing preference for direct or co-investment opportunities, which allows them to bypass traditional fund structures, gain greater control, and potentially reduce fees.

The liquidity needs of LPs are a critical factor, as they seek timely returns from KKR's investments. The ease of exiting portfolio companies, through IPOs or M&A, directly influences LP satisfaction and their willingness to commit future capital, a dynamic made more challenging by market conditions that have slowed exit activity as of early 2024.

| Customer Type | Bargaining Power Drivers | Impact on KKR | 2023/2024 Trend/Data |

|---|---|---|---|

| Institutional Investors (LPs) | Large capital commitments, fund manager choice, direct/co-investment demand, liquidity needs | Fee negotiation, fund structure customization, strategy influence, exit pressure | KKR managed $578B+ in assets (2023). Slowdown in global PE exits in 2023 vs. 2021 highs. |

| Specific Strategy Demand | Preference for niche areas (e.g., impact investing) | Influences KKR's capital raising and product innovation priorities | KKR's 2023 fundraising highlighted allocation to specialized strategies. |

| Demand for Transparency | Increased sophistication, scrutiny of portfolio performance | Requires detailed reporting and accountability from KKR | Ongoing LP focus on operational and strategic transparency. |

What You See Is What You Get

KKR Porter's Five Forces Analysis

This preview showcases the complete KKR Porter's Five Forces Analysis you will receive. The document you see here is precisely the same professionally formatted and comprehensive report that will be available for your immediate download after purchase. You can trust that there are no placeholders or sample sections; what you are viewing is the actual deliverable ready for your strategic planning needs.

Rivalry Among Competitors

KKR faces significant competition from major, diversified global players like Blackstone, Apollo, Carlyle, and Ares. These behemoths vie for the same capital, top talent, and attractive investment opportunities across private equity, credit, real estate, and infrastructure, intensifying the rivalry.

For instance, in 2023, Blackstone reported over $1 trillion in assets under management, a testament to its scale and reach. Similarly, Apollo Global Management has also expanded its alternative asset offerings significantly, managing hundreds of billions. This sheer size and diversification mean these competitors can deploy substantial capital and absorb market fluctuations more readily than smaller firms.

The competition isn't just about size; it's also about expertise and track record. These large firms have established global networks and deep industry knowledge, allowing them to source proprietary deals and command premium valuations. Their ability to offer a broad suite of investment strategies also attracts a wider range of institutional investors, further consolidating their market position.

This intense rivalry necessitates KKR to continuously innovate and differentiate its strategies to secure a competitive edge. Staying ahead requires a proactive approach to deal sourcing, operational value creation, and investor relations to capture market share in this dynamic environment.

The battle to find and buy promising companies at reasonable prices is intense. KKR faces stiff competition from other private equity giants, strategic corporate buyers, and even large government-backed investment funds, all vying for the same control stakes and substantial investment opportunities. This constant competition naturally pushes asset valuations higher, creating a more challenging landscape for executing successful deals.

For instance, in 2023, global private equity deal volume reached approximately $1.7 trillion, reflecting the sheer scale of capital chasing attractive targets. This environment forces firms like KKR to be exceptionally agile and strategic in their deal sourcing and execution to gain an edge.

The increasing financial acumen and negotiating leverage of limited partners (LPs) are directly contributing to a downward trend in management fees and carried interest across the alternative investment industry. This pressure is intensified by the sheer volume of capital seeking deployment and the growing number of firms vying for those mandates.

To secure new business and retain existing relationships, investment firms are increasingly finding themselves in a position where they must offer more adaptable fee structures and bespoke investment products. This strategic flexibility, while necessary for competitive positioning, can directly impact a firm's overall profitability and revenue generation.

For instance, in 2024, many private equity funds saw their average management fees hover around 1.75% to 2%, a noticeable dip from previous years where 2% was more standard. This reflects the competitive landscape where LPs, managing trillions in assets, can demand better terms.

Furthermore, the pressure extends to carried interest, with some deals in 2024 featuring hurdle rates or tiered carry structures that benefit LPs more directly. This shift forces managers to demonstrate exceptional performance to earn their full incentive compensation.

Fundraising Intensity and Capital Deployment

Firms like KKR operate in a perpetual fundraising cycle, constantly vying for capital commitments from a diverse investor base. The success in deploying existing capital and demonstrating robust returns directly fuels their ability to attract new funds, creating a powerful feedback loop. This intense competition for limited investor capital means that consistent performance is paramount.

KKR has demonstrated significant fundraising momentum, even within a more challenging macroeconomic environment. For instance, in late 2023, KKR closed its European Fund IV at €7.5 billion, exceeding its target. This success highlights their ability to attract significant capital, underscoring the importance of a strong track record.

- Fundraising Competition: Private equity firms, including KKR, face intense rivalry from other asset managers for investor allocations.

- Performance as a Driver: Superior capital deployment and strong realized returns are critical for securing future fundraising success.

- Recent Successes: KKR’s ability to raise substantial capital, such as its European Fund IV exceeding its target, showcases its competitive edge.

- Investor Demand: Despite market headwinds, significant investor appetite exists for well-performing private market strategies.

Innovation in Product Offerings and Technology

Competitive rivalry within the investment management sector is intensely driven by innovation in product offerings and technology. Firms are constantly developing novel investment strategies, such as those focused on climate infrastructure or complex public-private hybrid solutions, to attract capital and differentiate themselves. For instance, the growth in sustainable investing has seen significant capital allocation, with ESG (Environmental, Social, and Governance) assets projected to reach $33.9 trillion globally by 2026.

The adoption of advanced technologies is another critical battleground. Artificial intelligence (AI) is increasingly being leveraged for more efficient deal sourcing, risk assessment, and sophisticated portfolio management. According to a 2024 industry survey, 70% of asset managers reported using AI or machine learning in at least one area of their business, highlighting its growing importance.

- Product Innovation: Development of niche strategies like climate infrastructure and public-private partnerships.

- Technological Adoption: Integration of AI and machine learning for deal sourcing and portfolio management.

- Competitive Edge: Firms that innovate and adopt new technologies quickly gain a significant advantage.

- Market Trend: ESG assets are a key area of growth, indicating a shift in investor demand towards sustainable investments.

The competitive rivalry in the private equity space is fierce, with KKR contending against well-established global players like Blackstone, Apollo, and Carlyle. These firms compete intensely for capital, talent, and lucrative investment opportunities across various asset classes.

In 2023, global private equity deal volume neared $1.7 trillion, underscoring the substantial capital chasing attractive targets and driving up valuations, making deal execution more challenging for all participants.

The pressure on fees is mounting, with management fees in 2024 averaging around 1.75% to 2%, reflecting limited partners' increased negotiating power due to the vast amount of capital seeking deployment.

Innovation in product offerings, such as climate infrastructure, and the adoption of AI for deal sourcing, are crucial differentiators, with 70% of asset managers employing AI in their operations by 2024.

| Competitor | Approx. AUM (as of late 2023/early 2024) | Key Competitive Factors |

|---|---|---|

| Blackstone | Over $1 trillion | Scale, diversification, global reach |

| Apollo Global Management | Hundreds of billions | Broad alternative asset offerings, significant capital deployment |

| Carlyle Group | Over $400 billion | Established networks, industry expertise |

| Ares Management | Over $350 billion | Credit expertise, diversified strategies |

SSubstitutes Threaten

Traditional public market investments, like stocks and bonds traded on exchanges, are a significant substitute for alternative assets such as private equity and private credit. Investors can always shift their capital into these more liquid and familiar public markets, particularly when public markets are performing well or when alternative investments face increased uncertainty.

For instance, in 2023, while alternative asset fundraising saw some moderation, public equity markets, represented by the S&P 500, delivered a robust return of over 24%. This strong performance in public markets can draw investor capital away from less liquid alternatives, highlighting their substitutability.

The accessibility and transparency of public markets also make them a ready alternative. When private market deals become less attractive due to valuation concerns or a lack of compelling opportunities, investors can easily deploy capital into publicly listed companies that offer clear financial reporting and readily available pricing.

Furthermore, the sheer size and diversity of public markets mean that investors can typically find sufficient investment opportunities to meet their goals without needing to venture into alternative asset classes, reinforcing the threat of substitution.

Large institutional investors, like pension funds and sovereign wealth funds, are increasingly handling their private investments in-house. This trend means they can bypass external asset managers, potentially saving on fees and gaining more direct control over their capital. For example, the California Public Employees' Retirement System (CalPERS) has been actively expanding its direct investing capabilities, aiming to deploy billions directly into private equity and real estate, reducing reliance on firms like KKR. This internal expertise effectively serves as a substitute for the fund management services KKR and similar firms offer.

For investors looking for diversification and reliable returns, hedge funds and other liquid alternatives present a significant competitive threat to KKR's less liquid private market investments. These strategies offer distinct liquidity features and investment methodologies, catering to a broad spectrum of investor preferences.

In 2024, the global hedge fund industry managed approximately $4.1 trillion in assets, demonstrating their substantial market presence and appeal. This vast pool of capital indicates a strong alternative for investors who might otherwise consider private equity or other illiquid options.

Furthermore, the rise of liquid alternatives, including certain types of managed futures and long/short equity strategies, provides accessible substitutes. These vehicles often boast shorter lock-up periods compared to private markets, directly addressing investor demands for greater flexibility.

The availability of these liquid alternatives means investors can potentially achieve similar diversification and return objectives without committing capital for extended, illiquid periods, thereby reducing the perceived necessity of KKR's traditional private market funds.

Private Credit from Banks and Non-Bank Lenders

While KKR is a major force in private credit, traditional banks and other non-bank lenders offer competing debt financing. The terms and availability of credit from these established institutions can serve as a direct substitute for KKR's private credit offerings. For example, in 2024, bank lending, though facing regulatory scrutiny, continued to be a primary source of capital for many businesses, potentially limiting the demand for private credit if terms become more attractive.

The competitive landscape includes a diverse array of non-bank financial institutions, such as specialized debt funds and credit unions, that also provide alternative financing solutions. These entities can offer flexible terms and specialized structures, presenting a credible substitute for companies seeking capital. As of mid-2025, the non-bank lending sector is projected to grow, with total assets under management expected to reach trillions, underscoring the significant threat of substitution.

- Banking Sector Competitiveness: Traditional banks, bolstered by deposit bases and regulatory frameworks, remain significant providers of debt, especially for larger, established corporations.

- Non-Bank Lender Diversification: A growing number of specialized debt funds and credit unions offer tailored financing, increasing the range of substitutes available to borrowers.

- Market Condition Impact: Favorable interest rate environments or easing regulatory pressures for banks can enhance their attractiveness as a substitute, directly impacting demand for private credit.

- Fintech Innovation: Emerging fintech platforms are streamlining the lending process, offering faster access to capital and potentially serving as a substitute for more traditional private credit arrangements.

Real Estate Investment Trusts (REITs) or Publicly Traded Infrastructure Funds

For investors seeking exposure to real assets like real estate and infrastructure, publicly traded Real Estate Investment Trusts (REITs) and infrastructure funds present a significant threat of substitution. These vehicles offer greater liquidity and typically require lower initial investment amounts compared to direct investments in KKR's private real estate or infrastructure funds. This accessibility makes them a viable alternative for a broader range of investors.

While these substitutes may not offer the same level of customization or direct operational control as KKR's funds, their ease of access and market-driven pricing provide a compelling alternative. For instance, the U.S. REIT market had a market capitalization of approximately $2.5 trillion as of early 2024, demonstrating the substantial scale and liquidity available through this channel.

- Accessibility: Public REITs and infrastructure ETFs are readily available on major stock exchanges, requiring no specialized investor accreditation.

- Liquidity: Investors can buy and sell shares in publicly traded funds daily, offering a stark contrast to the longer lock-up periods common in private equity real asset funds.

- Diversification: Many public funds offer diversified portfolios across various property types or infrastructure assets, reducing single-asset risk for investors.

- Lower Fees: While management fees exist, they are often lower on average for publicly traded vehicles compared to the performance fees and carried interest typical of private funds.

The threat of substitutes for KKR's offerings is substantial, stemming from both traditional and evolving financial instruments. Publicly traded assets like stocks and bonds, along with liquid alternatives such as hedge funds, provide readily accessible and more liquid options for investors. These substitutes can attract capital away from private markets, especially when public markets offer strong returns, as seen with the S&P 500's over 24% gain in 2023.

Furthermore, the increasing trend of large institutional investors managing private investments in-house, like CalPERS, creates an internal substitute for external asset management services. In 2024, the global hedge fund industry's $4.1 trillion in assets under management highlights its appeal as an alternative to less liquid private market strategies.

The private credit market also faces substitutes from traditional banks and a growing array of non-bank lenders. As of mid-2025, the non-bank lending sector is projected to grow significantly, with trillions in assets under management, intensifying this competitive pressure.

Finally, publicly traded REITs and infrastructure funds, with their accessibility and liquidity, act as direct substitutes for KKR's real asset investments. The U.S. REIT market's $2.5 trillion capitalization in early 2024 underscores the scale of these alternatives.

| Substitute Category | Key Characteristics | 2023/2024/2025 Data Point | Impact on KKR |

|---|---|---|---|

| Public Markets (Stocks & Bonds) | High Liquidity, Transparency, Accessibility | S&P 500 returned >24% in 2023 | Attracts capital from less liquid alternatives |

| Liquid Alternatives (Hedge Funds) | Diversification, Moderate Liquidity, Diverse Strategies | Global Hedge Fund AUM ~$4.1 trillion (2024) | Offers flexible alternatives to private market commitments |

| In-House Investing (Institutional Investors) | Direct Control, Fee Savings | CalPERS expanding direct investing capabilities | Reduces reliance on external asset managers like KKR |

| Traditional & Non-Bank Lending | Established relationships, Varied terms | Non-bank lending sector projected trillions in AUM by mid-2025 | Direct competition for debt financing opportunities |

| Publicly Traded Real Assets (REITs, Infrastructure ETFs) | Liquidity, Lower Entry Barrier, Diversification | U.S. REIT market cap ~$2.5 trillion (early 2024) | Provides accessible exposure to real assets |

Entrants Threaten

The threat of new entrants into the alternative asset management space, particularly for firms aiming to rival established players like KKR, is significantly tempered by substantial capital requirements. Launching and scaling a credible alternative asset manager demands hundreds of millions, if not billions, of dollars to establish the necessary infrastructure, attract top-tier investment professionals, and have the capacity to deploy capital effectively in large-scale transactions. For instance, a new private equity fund might need to raise a minimum of $1 billion to be competitive, a figure that presents a formidable barrier.

Furthermore, new entrants confront considerable fundraising hurdles. Limited Partners (LPs), such as pension funds and endowments, are typically risk-averse and prioritize managers with a proven history of generating strong returns and a demonstrated ability to navigate complex market cycles. Without this established track record, convincing LPs to commit capital becomes an arduous task, effectively creating a high barrier to entry that favors established firms with deep relationships and a history of successful fundraises.

A long and successful investment track record is crucial in alternative asset management, acting as a bedrock for building trust and attracting vital institutional capital. New entrants face a steep climb without this established credibility.

KKR's decades of experience, marked by consistent and strong performance, present a formidable barrier to entry. Firms without a similar history struggle to gain the confidence of sophisticated investors who prioritize proven management capabilities.

For instance, KKR reported total Assets Under Management (AUM) of $578 billion as of March 31, 2024, a testament to its long-standing ability to attract and manage significant capital. This scale itself is a deterrent to newcomers.

The reputation built over years of successful deal-making and value creation is another significant hurdle. New firms must overcome the perception that established players possess superior market insight and operational expertise.

New private equity firms face a significant hurdle in replicating the extensive global networks and proprietary deal sourcing capabilities that established players like KKR have cultivated over decades. This makes it difficult for them to access the high-quality, non-auctioned deals that are often critical for generating superior investment returns.

In 2024, the private equity landscape continues to be dominated by firms with deep relationships. For instance, KKR’s ability to source deals off-market, meaning they are not publicly advertised or subject to competitive bidding, gives them a distinct advantage. This often allows them to negotiate better terms and acquire assets at more favorable valuations.

The sheer time and capital investment required to build comparable networks are prohibitive for most new entrants. Without access to these exclusive deal flows, emerging firms often find themselves competing in more crowded, auctioned environments, which typically yield lower returns on investment.

Talent Acquisition and Retention Challenges

New entrants face significant hurdles in acquiring and retaining the highly specialized talent needed in private equity, credit, and real assets. Established firms like KKR have cultivated deep pools of experienced professionals, offering competitive compensation and career advancement opportunities that are difficult for newcomers to match.

This talent gap presents a substantial barrier, as successful private equity operations rely on individuals with proven track records in deal sourcing, due diligence, and portfolio management. For example, the demand for experienced private equity professionals often outstrips supply, driving up compensation packages significantly, as seen in the robust bonuses and carried interest structures prevalent in the industry.

- Talent Specialization: Private equity, credit, and real assets demand niche expertise, making talent acquisition a critical challenge for new players.

- Established Firm Advantage: Firms like KKR benefit from existing deep talent pools and attractive compensation structures that deter new entrants.

- Compensation Wars: The competitive landscape for top investment professionals drives up salaries and bonus expectations, increasing operational costs for new firms.

- Retention Difficulty: Retaining skilled professionals is equally challenging, as they are often lured by the success and established networks of leading firms.

Regulatory Complexity and Compliance Costs

The alternative asset management industry is characterized by intricate and ever-changing regulatory landscapes across different jurisdictions. This complexity presents a significant hurdle for new players. For instance, in 2024, firms seeking to manage private equity or hedge funds must adhere to stringent reporting requirements under frameworks like the EU's Alternative Investment Fund Managers Directive (AIFMD) or the U.S. Securities and Exchange Commission's (SEC) regulations.

Navigating these rules necessitates substantial investment in compliance infrastructure, legal counsel, and operational processes. These compliance costs can be prohibitive, particularly for smaller firms lacking established resources or scale. For example, the cost of setting up a compliant operational framework for a new fund can easily run into hundreds of thousands of dollars, a considerable barrier to entry.

- Global Regulatory Patchwork: Firms must understand and comply with varying regulations in each market they operate in, increasing complexity and costs.

- Significant Compliance Burden: Requirements for investor protection, risk management, and reporting demand substantial resources and expertise.

- High Setup Costs: Establishing the necessary legal, operational, and technological infrastructure to meet regulatory standards is capital-intensive.

- Evolving Rules: Continuous updates to regulations require ongoing adaptation and investment, posing a persistent challenge for new entrants.

The threat of new entrants in the alternative asset management sector, especially for those looking to compete with giants like KKR, is considerably low due to immense capital requirements. Establishing a credible operation demands significant financial resources for infrastructure, talent acquisition, and capital deployment, often in the billions of dollars. This financial barrier significantly favors established firms with deep pockets and proven operational capabilities.

Newcomers face a steep uphill battle in fundraising, as institutional investors (Limited Partners) prioritize managers with a strong, verifiable track record of performance and resilience through market cycles. Without this history, securing commitments from these sophisticated investors is exceptionally difficult, creating a substantial moat for firms like KKR that have consistently delivered results and cultivated long-term relationships.

| Barrier | Description | Example (KKR) |

|---|---|---|

| Capital Requirements | Need for substantial funds to establish infrastructure and deploy capital. | Minimum $1 billion for a competitive private equity fund. |

| Fundraising Hurdles | Limited Partners favor proven track records, making it hard for new firms to attract capital. | KKR's $578 billion AUM (Q1 2024) demonstrates established LP confidence. |

| Established Track Record | Decades of consistent performance and experience are crucial for investor trust. | KKR's long history provides a significant competitive advantage. |

| Global Networks & Deal Sourcing | Access to proprietary, off-market deals is key and built over time. | KKR's ability to source deals outside competitive auctions offers better terms. |

| Talent Acquisition & Retention | Attracting and keeping specialized investment professionals is costly and difficult. | Competitive compensation and career paths at KKR deter new talent from joining startups. |

| Regulatory Compliance | Navigating complex global regulations requires significant investment in infrastructure and expertise. | Adherence to AIFMD or SEC rules incurs substantial setup and ongoing costs for new firms. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available company filings, industry-specific market research reports, and economic indicators to provide a comprehensive view of competitive forces.