Kiewit PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kiewit Bundle

Gain a critical understanding of the external forces shaping Kiewit's operations and future success. Our meticulously researched PESTLE analysis dissects the political, economic, social, technological, legal, and environmental factors impacting this major construction and engineering firm. Discover how regulatory shifts, economic volatility, and emerging technologies present both challenges and opportunities for Kiewit and its stakeholders. Equip yourself with actionable intelligence to inform your own strategic planning and investment decisions. Download the full PESTLE analysis now for a comprehensive overview and a significant competitive advantage.

Political factors

Government infrastructure spending is a massive driver for Kiewit, a company heavily involved in transportation, water, and power projects. The Infrastructure Investment and Jobs Act (IIJA) in the United States, enacted in 2021, is injecting substantial federal funds into these sectors. For example, the IIJA allocated $110 billion for roads, bridges, and major projects, and $55 billion for water infrastructure upgrades. This legislation, with funding extending through 2026 and beyond, directly translates into a robust pipeline of work for Kiewit and similar firms.

Kiewit navigates a complex web of regulations across its core sectors. For instance, evolving environmental standards, such as stricter emissions controls or water usage permits for mining operations, directly impact project planning and can add significant costs. In 2024, the infrastructure bill's continued implementation is driving demand but also scrutiny on environmental impact assessments for large-scale projects.

Labor laws also play a crucial role. Changes to prevailing wage requirements or worker safety regulations can alter project budgets and Kiewit's approach to workforce management. The ongoing focus on workforce development and fair labor practices, particularly in the skilled trades, means compliance and strategic HR are paramount for project success and company reputation.

Industry-specific policies, like those shaping the energy transition, present both opportunities and challenges. For example, regulations promoting renewable energy infrastructure create new project pipelines, but shifts in government support or permitting processes for projects like new transmission lines can affect Kiewit's project pipeline and execution strategies. The speed of permitting for critical infrastructure remains a key concern in 2025.

Kiewit's extensive infrastructure projects rely heavily on imported materials like steel and aluminum, making them susceptible to shifts in global trade policies. For instance, the U.S. imposed Section 232 tariffs on steel and aluminum imports in 2018, which, while partially revised, continue to influence material costs. In 2024, projected global steel prices indicate a potential increase of 5-10%, directly impacting Kiewit's project budgets and material sourcing strategies.

Trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), aim to streamline supply chains, but geopolitical tensions can still disrupt the flow of essential construction components. For example, ongoing trade disputes or the threat of new tariffs on goods from major steel-producing nations could lead to significant cost escalations and supply chain volatility throughout 2024 and into 2025, challenging Kiewit's ability to secure materials at predictable prices.

Political Stability and Geopolitical Risks

Kiewit's operations spanning North America are significantly influenced by political stability and geopolitical risks. Changes in government policies or unexpected political events can directly impact project timelines and costs. For instance, shifts in infrastructure spending priorities by the U.S. federal government, a key client, could alter demand for Kiewit's services.

Geopolitical tensions also pose a threat. An escalation of international conflicts could lead to supply chain disruptions for materials and equipment, or even affect labor availability. Investor confidence can waver during periods of heightened uncertainty, potentially impacting Kiewit's ability to secure financing for large-scale projects.

- U.S. Infrastructure Investment and Jobs Act (IIJA): Enacted in 2021, this provides a substantial funding stream for infrastructure projects, bolstering demand for Kiewit's services through 2025 and beyond, though its long-term implementation remains subject to political will.

- Canadian Federal Budget 2024: This budget outlined significant investments in clean energy and infrastructure, creating opportunities for Kiewit, but also highlighting potential shifts in provincial priorities and funding allocations.

- Global Supply Chain Volatility: Ongoing geopolitical events, such as conflicts in Eastern Europe, continue to impact the cost and availability of raw materials and specialized equipment crucial for Kiewit's projects.

- Election Cycles: Upcoming elections in both the U.S. and Canada in late 2024 and 2025 could lead to changes in regulatory environments and government spending on infrastructure, creating both opportunities and risks for Kiewit's project pipeline.

Public-Private Partnerships (PPPs)

Governments globally are increasingly leveraging Public-Private Partnerships (PPPs) to fund and execute major infrastructure projects, a trend that directly impacts companies like Kiewit. For instance, in 2023, the U.S. Department of Transportation announced over $2 billion in grant funding for infrastructure projects, many of which are expected to be delivered through PPP models, signaling continued government reliance on private sector expertise. This evolving landscape, coupled with specific incentives and policy frameworks designed to attract private investment in public works, presents both opportunities and challenges.

Kiewit's success hinges on its capacity to navigate the complexities of these partnerships and secure them for critical infrastructure development. The firm's engagement in PPPs is not merely about project acquisition; it's a strategic imperative for sustained growth and maintaining access to vital markets. The increasing number of large-scale transportation, energy, and water projects being structured as PPPs underscores the importance of Kiewit’s ability to forge and manage these collaborative ventures effectively.

The outlook for PPPs remains robust, with many nations prioritizing infrastructure upgrades. For example, Canada's infrastructure bank aims to mobilize billions in private capital, with a significant portion directed towards projects that can be delivered via PPPs. Kiewit's strategic positioning to capitalize on these government-led initiatives is crucial.

- Government Infrastructure Spending: The U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocates $1.2 trillion for infrastructure, with a substantial portion expected to be channeled through PPPs, creating a fertile ground for Kiewit.

- PPP Market Growth: Global PPP investment is projected to see steady growth, driven by the need for modernization and expansion of public services, offering a continuous pipeline of opportunities for experienced contractors.

- Policy Framework Evolution: Governments are refining policies to make PPPs more attractive, including risk-sharing mechanisms and streamlined procurement processes, which Kiewit can leverage.

- Kiewit's PPP Track Record: Kiewit's established history of successfully delivering complex projects under PPP agreements enhances its competitive advantage in securing future partnerships.

Government policy, particularly infrastructure spending, directly fuels Kiewit's project pipeline. The U.S. Infrastructure Investment and Jobs Act (IIJA), with significant allocations through 2026, underpins much of this demand. However, evolving regulations on environmental impact and labor standards, as well as shifts in energy transition policies, require constant adaptation and can influence project costs and feasibility.

Trade policies and geopolitical stability are critical for Kiewit's material sourcing and overall project execution. Tariffs on steel and aluminum, for example, directly impact budget predictability, and global supply chain disruptions stemming from international conflicts pose ongoing risks throughout 2024 and into 2025. The increasing use of Public-Private Partnerships (PPPs) by governments also presents a key avenue for securing large-scale projects, with Canada's infrastructure bank aiming to mobilize billions in private capital.

| Factor | Impact on Kiewit | 2024/2025 Data/Trend |

| Infrastructure Spending (US) | Drives project pipeline | IIJA funding continues, estimated $110B for roads/bridges |

| Environmental Regulations | Increases project costs/complexity | Ongoing scrutiny on large projects, stricter emissions controls |

| Trade Policy (Steel/Aluminum) | Affects material costs | Projected steel price increase of 5-10% in 2024 |

| Public-Private Partnerships (PPPs) | Opportunity for project acquisition | Canada's infrastructure bank to mobilize billions in private capital |

What is included in the product

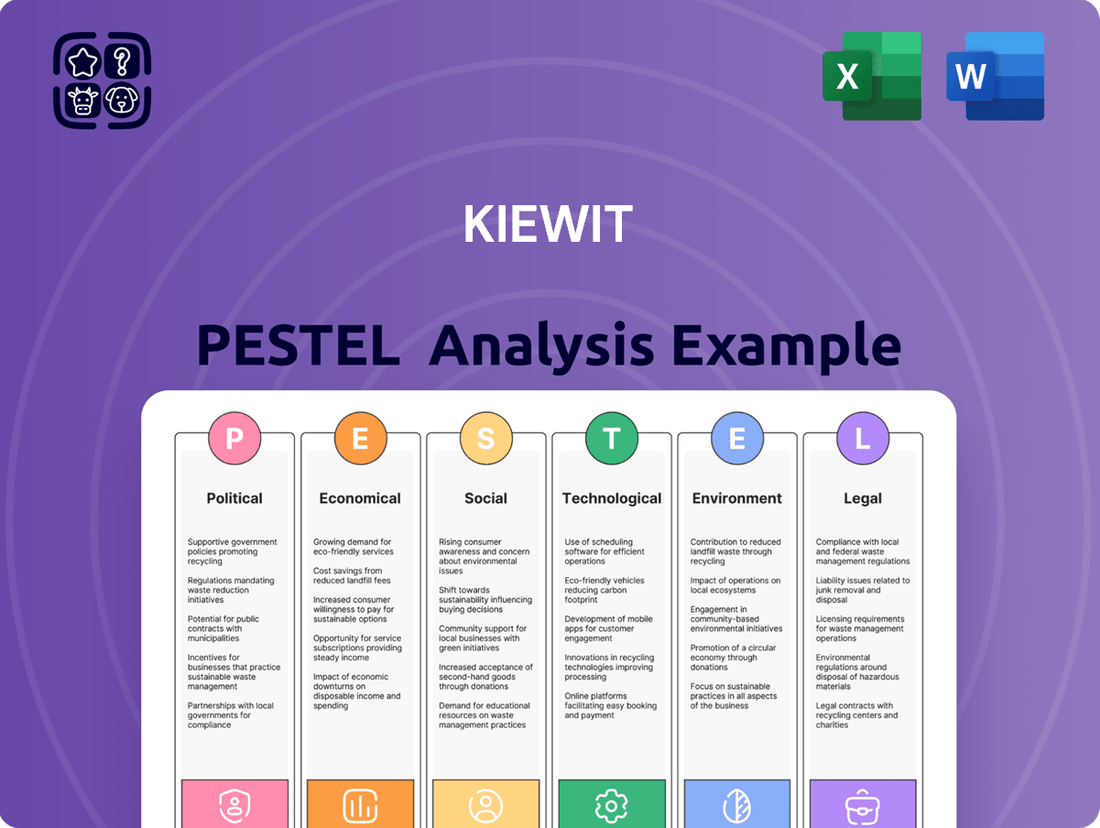

This Kiewit PESTLE analysis provides a comprehensive examination of the macro-environmental factors influencing the company's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Kiewit.

Economic factors

The health of the North American economy is a major driver for Kiewit's core sectors. For instance, robust GDP growth in the US and Canada typically translates to increased demand for infrastructure, commercial construction, and mining operations, all key areas for Kiewit. The Congressional Budget Office projected US real GDP growth to be 2.3% in 2024, and while forecasts for Canada vary, many anticipate a similar, albeit potentially slower, expansion. Conversely, economic slowdowns or recessions can lead to project deferrals or outright cancellations, directly impacting Kiewit's revenue streams and project pipeline.

Interest rates play a crucial role in Kiewit's operational landscape, directly impacting the cost of financing for major infrastructure and construction projects. Fluctuations in these rates can significantly alter project viability and influence client investment decisions. For instance, if the Federal Reserve maintains its current monetary policy stance, which has seen rates remain elevated through early 2024, the cost of borrowing for both Kiewit and its clients increases. This can lead to a slowdown in private sector project initiations, as companies become more hesitant to commit to large capital expenditures when financing is more expensive.

The projected interest rate environment for 2024 and into 2025 suggests a cautious approach by central banks, with potential for gradual reductions if inflation continues to moderate. However, even a slight decrease in rates, say by 25-50 basis points from current levels, could provide a much-needed stimulus for project development. For Kiewit, higher borrowing costs directly affect its ability to finance new equipment purchases and manage working capital needs, potentially impacting bid competitiveness and profit margins on ongoing contracts.

Inflationary pressures significantly affect Kiewit's profitability, especially concerning construction materials like steel and concrete, as well as fuel and labor costs. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, impacting project bids.

Analyzing current inflation rates, which projected to remain elevated through 2024, reveals a direct challenge to Kiewit's cost management and bidding strategies. Maintaining profit margins on long-term contracts becomes difficult when material and labor expenses outpace initial estimates.

To combat these cost escalations, Kiewit likely employs strategies such as forward purchasing of key materials, negotiating fixed-price contracts with suppliers where feasible, and incorporating robust escalation clauses into client agreements.

The ability to accurately forecast and price for these rising costs is crucial for Kiewit's financial health, particularly given the capital-intensive nature of its infrastructure and energy projects.

Labor Market and Wage Trends

The construction industry continues to grapple with a significant shortage of skilled labor, a trend expected to persist through 2024 and into 2025. This scarcity directly impacts Kiewit by increasing the cost of labor due to wage inflation. For instance, average hourly wages for construction laborers saw a notable increase, potentially impacting project bids and overall profitability.

Wage inflation is a key concern, with some reports indicating double-digit percentage increases in certain skilled trades over the past year. This rise in labor costs can extend project timelines as companies compete for a limited pool of qualified workers. Kiewit must actively invest in robust training and retention programs to secure and keep the talent needed to execute its extensive project portfolio.

- Skilled Labor Shortage: The U.S. Bureau of Labor Statistics projected a need for hundreds of thousands of new construction workers annually in the coming years.

- Wage Inflation: Average hourly wages for construction occupations have outpaced general inflation in many regions.

- Impact on Costs: Higher wages directly translate to increased operational costs for Kiewit, affecting project margins.

- Project Timelines: Delays in staffing can push back project completion dates, leading to potential penalties or lost revenue.

- Retention Strategies: Companies like Kiewit are focusing on competitive compensation, benefits, and career development to retain their workforce.

Investment in Specific Sectors

Kiewit’s operational breadth across power, oil/gas/chemical, and water/wastewater sectors means economic investment trends in each are critical. For instance, the power sector is seeing robust investment, particularly in renewables. In 2023, global investment in the energy transition, including renewables and grid infrastructure, reached an estimated $1.7 trillion, a significant increase from previous years.

This surge in renewable energy investment, driven by climate goals and technological advancements, directly benefits Kiewit’s power segment. For example, the U.S. alone saw a record 37 gigawatts of solar capacity added in 2023, and wind power continues to expand, requiring substantial construction and engineering expertise. Conversely, while the oil and gas sector remains vital, investment patterns are more complex, influenced by price volatility and the ongoing energy transition.

The chemical sector, often tied to oil and gas feedstocks, experiences investment tied to global demand for petrochemicals and specialty chemicals. Data centers, a rapidly growing area, represent another significant investment opportunity, requiring specialized construction and infrastructure development that Kiewit can leverage. However, shifts away from traditional fossil fuels can create headwinds for Kiewit’s oil/gas/chemical segments, necessitating strategic adaptation and diversification.

- Renewable Energy Investment: Global investment in energy transition technologies, including renewables and grid modernization, saw a substantial rise in 2023, reaching approximately $1.7 trillion.

- U.S. Solar Growth: The United States added a record 37 gigawatts of solar power capacity in 2023, highlighting strong sector growth.

- Water Infrastructure Needs: Significant investment is also directed towards water and wastewater infrastructure, with the U.S. Environmental Protection Agency estimating a need for over $1 trillion in upgrades over the next 20 years.

- Data Center Expansion: The booming demand for digital services is fueling massive investment in data center construction globally, creating a strong market for specialized engineering and construction firms.

The economic outlook for North America directly influences Kiewit's demand. Positive GDP growth, projected at 2.3% for the US in 2024 by the Congressional Budget Office, typically boosts infrastructure, commercial construction, and mining projects. Conversely, economic downturns can lead to project delays, impacting Kiewit's revenue.

Interest rates significantly affect project financing costs, with current elevated rates through early 2024 making borrowing more expensive for Kiewit and its clients. Even modest rate reductions by central banks in 2024-2025 could stimulate project development, while higher borrowing costs impact Kiewit's working capital and competitiveness.

Inflationary pressures, particularly on construction materials and labor, challenge Kiewit's profitability. The Producer Price Index for construction materials saw increases in late 2023/early 2024, necessitating strategies like forward purchasing and escalation clauses to manage rising costs and maintain margins on long-term contracts.

Preview Before You Purchase

Kiewit PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Kiewit PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview essential for understanding Kiewit's operational landscape and future challenges.

You will gain insights into regulatory shifts, market trends, and societal influences that shape Kiewit's business decisions. The document is meticulously structured to offer a clear and actionable understanding of these crucial external forces.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will immediately have access to this detailed PESTLE analysis upon completion of your purchase.

Sociological factors

North America's population is growing, with projections indicating continued urbanization. This trend directly fuels demand for infrastructure, from roads and bridges to housing and commercial spaces. For instance, the U.S. Census Bureau reported that the nation's population reached over 334.8 million in 2023, with a significant portion concentrating in urban areas.

Demographic shifts are also reshaping project needs. An aging population, for example, increases the demand for healthcare facilities and accessible housing solutions. Migration patterns, whether internal or international, can strain existing transportation networks and utilities, necessitating expansions and upgrades. By 2025, the median age in the U.S. is expected to continue its upward trend, impacting the types of construction projects prioritized.

Societal pressure for greater diversity, equity, and inclusion (DEI) is profoundly impacting the construction sector, historically a less diverse industry. As of 2024, construction firms are increasingly recognizing that a diverse workforce isn't just a social imperative but a business advantage.

Kiewit's proactive engagement with DEI initiatives, such as targeted recruitment programs and inclusive workplace policies, directly addresses this societal shift. By actively attracting and retaining a broader talent pool, Kiewit can bolster its brand image and attract top talent, particularly crucial in light of ongoing labor shortages in skilled trades.

Studies in 2023 indicated that companies with diverse leadership teams are more likely to outperform their less diverse counterparts financially. This suggests Kiewit's DEI focus can translate into enhanced innovation and better problem-solving capabilities, crucial for tackling complex construction projects.

Furthermore, a commitment to inclusion fosters a more engaged workforce, leading to increased productivity and reduced turnover. This is particularly relevant for Kiewit as it navigates the competitive landscape and the need for a stable, skilled workforce to deliver on its extensive project pipeline through 2025.

Societal expectations for worker health and safety are escalating, especially in demanding sectors like construction and mining where Kiewit operates. This increasing demand for comprehensive safety protocols, including robust mental health support and wellness initiatives, directly influences operational standards and employee morale.

Public and employee pressure for enhanced safety is a significant driver, impacting how companies like Kiewit manage risk and invest in protective measures. For instance, in 2024, the construction industry continued to see a focus on reducing incident rates, with many firms reporting investments in advanced safety training and technology to meet these rising expectations.

Kiewit's commitment to a strong safety culture is not just about compliance; it's a core element for employee well-being, safeguarding the company's reputation, and ensuring operational efficiency. In 2023, Kiewit reported a Total Recordable Incident Rate (TRIR) significantly below the industry average, underscoring their proactive approach to safety.

Community Engagement and Social License to Operate

Kiewit’s extensive operations in construction and mining inherently affect local communities, making robust community engagement a critical factor. Addressing resident concerns proactively, whether about environmental impact or economic benefits, is paramount. For instance, in 2023, Kiewit reported investing over $200 million in local communities through job creation and procurement across its North American projects, demonstrating a commitment to positive local impact.

Maintaining a strong social license to operate is not just beneficial; it's essential for Kiewit's long-term success. This social acceptance smooths the path for project approvals and helps mitigate potential delays caused by local opposition. A 2024 industry survey indicated that projects with strong community relations experienced 30% fewer regulatory hurdles and delays compared to those with poor engagement.

Kiewit’s approach to community engagement directly influences its brand reputation. Positive interactions foster goodwill, making future projects more palatable and potentially opening doors for new opportunities. By prioritizing local hiring and supporting community initiatives, Kiewit can build trust, which is invaluable in securing the necessary approvals and ensuring smooth project execution.

- Community Impact: Large projects necessitate addressing local concerns regarding noise, traffic, and environmental factors.

- Social License: Essential for project approvals, minimizing delays, and fostering positive relationships.

- Brand Reputation: Strong community engagement enhances Kiewit's image and trustworthiness.

- Economic Contribution: Local job creation and procurement are key elements of positive community impact.

Changing Consumer and Client Preferences

Clients, both public and private, are increasingly prioritizing sustainability and ethical considerations. This shift is evident in growing demand for green building certifications, like LEED, and resilient infrastructure designed to withstand climate impacts. For example, in 2024, the global green building market was projected to reach over $370 billion, highlighting a significant trend Kiewit must address.

Evolving client preferences for socially responsible contracting are reshaping project specifications and procurement. Companies are looking for partners who demonstrate strong environmental, social, and governance (ESG) performance. Kiewit's ability to adapt and integrate these values into its operations is crucial for securing future contracts and maintaining a competitive edge in the evolving construction landscape.

- Growing Demand for Green Infrastructure: Clients are actively seeking projects that minimize environmental footprints and promote sustainability.

- Resilience as a Key Factor: Infrastructure projects are increasingly specified with resilience in mind, anticipating climate change and natural disasters.

- ESG Integration in Procurement: Socially responsible contracting, encompassing strong ESG metrics, is becoming a standard requirement for many clients.

- Adaptability as a Competitive Advantage: Kiewit's responsiveness to these evolving societal values directly impacts its ability to win and execute future projects effectively.

Societal expectations for diversity, equity, and inclusion (DEI) are transforming the construction industry, pushing companies like Kiewit to adopt more inclusive practices. This focus on DEI is not merely a compliance issue but a strategic advantage, enhancing innovation and talent acquisition. By 2024, companies prioritizing DEI were increasingly recognized for stronger financial performance and better problem-solving capabilities.

Worker safety and well-being are paramount societal concerns, with increased demand for comprehensive safety protocols, including mental health support. Kiewit's strong safety culture, evidenced by a 2023 Total Recordable Incident Rate (TRIR) below industry averages, directly addresses these expectations. This commitment is vital for employee morale, operational efficiency, and maintaining a positive company reputation.

Community engagement is crucial for Kiewit's social license to operate, influencing project approvals and mitigating delays. In 2023, Kiewit's community investments exceeded $200 million, demonstrating a commitment to positive local impact through job creation and procurement. Strong community relations, as noted in a 2024 survey, can reduce regulatory hurdles by up to 30%.

Clients increasingly prioritize sustainability and ethical considerations, driving demand for green building certifications and resilient infrastructure. The global green building market's projected growth to over $370 billion by 2024 underscores this trend. Kiewit's ability to integrate Environmental, Social, and Governance (ESG) principles into its operations is key to securing future contracts.

| Societal Factor | Impact on Kiewit | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Diversity, Equity, and Inclusion (DEI) | Enhanced innovation, talent acquisition, and financial performance. | Companies with diverse leadership teams showed stronger financial outperformance in 2023 studies. |

| Worker Safety & Well-being | Improved morale, operational efficiency, and reputation. | Kiewit's 2023 TRIR was significantly below the industry average. |

| Community Engagement | Smoother project approvals, fewer delays, enhanced brand reputation. | Kiewit invested over $200 million in local communities in 2023; projects with good community relations face 30% fewer regulatory hurdles (2024 survey). |

| Sustainability & Ethics | Competitive advantage in securing contracts, meeting client demands. | Global green building market projected to exceed $370 billion by 2024. |

Technological factors

Kiewit is actively embracing digital construction technologies as the industry shifts towards greater automation and data-driven decision-making. The company's investment in tools like Building Information Modeling (BIM) and advanced project management software is designed to streamline workflows and boost efficiency.

The adoption of technologies such as digital twins and sophisticated data analytics platforms allows Kiewit to gain predictive insights into project performance. For instance, by leveraging data analytics, companies in the construction sector have reported reductions in project delays by up to 15% and cost overruns by as much as 10% in recent years, according to industry reports from 2024.

These digital advancements directly translate to tangible benefits on Kiewit's projects, including enhanced collaboration among project teams and a significant reduction in on-site errors. This focus on digital transformation is crucial for maintaining a competitive edge and ensuring successful project delivery in a rapidly evolving construction landscape.

Automation and robotics are increasingly vital in construction to combat labor shortages and boost safety. Kiewit, like others in the industry, is exploring robotics for tasks such as bricklaying, demolition, and site inspections, alongside the use of autonomous heavy equipment. This integration is projected to significantly increase productivity and lessen the physical demands on human workers.

These technological advancements are not just about efficiency; they directly improve site safety. For instance, autonomous machines can handle hazardous demolition or work in dangerous environments, reducing the risk of injury. The construction industry saw a 7.4% increase in construction spending in 2023, a trend automation is expected to support by ensuring projects stay on track despite workforce challenges.

Technological advancements are revolutionizing construction with materials like self-healing concrete, which can autonomously repair cracks, extending infrastructure lifespan. The global self-healing concrete market is projected to reach $3.4 billion by 2027, demonstrating significant adoption potential.

Advanced composites offer lighter yet stronger alternatives to traditional materials, improving structural integrity and reducing the need for heavy equipment, thus lowering project costs and emissions.

Modular and prefabricated construction techniques are gaining traction, enabling faster project completion and reducing on-site waste. In 2023, the global modular construction market was valued at $120 billion, with a strong growth forecast driven by efficiency gains.

These innovations directly address the demand for sustainable building practices, potentially cutting construction waste by up to 90% and significantly reducing the carbon footprint of projects.

Data Analytics and Artificial Intelligence (AI)

The construction industry, including Kiewit, is awash in data from project sites. Leveraging this data through analytics and AI presents a major opportunity for improvement. For instance, AI can predict when equipment might need maintenance, preventing costly breakdowns. In 2024, companies are increasingly adopting AI for these predictive capabilities.

Kiewit can utilize AI to better assess project risks, optimize its supply chain by forecasting material needs more accurately, and even automate checks for regulatory compliance. These applications enhance decision-making by providing deeper insights into complex operations. This technology is moving beyond theoretical applications, with real-world implementations showing tangible benefits in efficiency and cost savings.

- Predictive Maintenance: AI algorithms analyze sensor data from heavy machinery to forecast potential failures, reducing downtime.

- Risk Assessment: Machine learning models can identify patterns in historical project data to predict and mitigate future risks.

- Supply Chain Optimization: AI can improve demand forecasting for materials, ensuring timely delivery and reducing waste.

- Automated Compliance: AI tools can scan project documentation to ensure adherence to safety and environmental regulations.

Cybersecurity and Data Protection

Kiewit's increasing reliance on digital platforms for project management and data collection makes cybersecurity a critical technological factor. The company handles vast amounts of sensitive project data, intellectual property, and operational information, all of which are vulnerable to cyber threats. A significant data breach could lead to severe financial losses, reputational damage, and disruptions to ongoing projects, impacting operational continuity.

Robust data protection measures are essential to safeguard Kiewit's digital infrastructure and maintain client trust. For instance, the construction industry saw a 71% increase in ransomware attacks in 2023, highlighting the escalating risks. Kiewit’s investment in advanced cybersecurity solutions, including encryption, multi-factor authentication, and regular security audits, is vital to mitigate these threats and ensure the integrity of its operations and client data.

- Cybersecurity Investment: Kiewit likely invests heavily in cybersecurity, mirroring industry trends where companies are allocating significant portions of their IT budgets to protection. For example, global spending on cybersecurity is projected to reach $237.3 billion in 2024.

- Data Breach Impact: A data breach could expose proprietary project designs, financial records, and client information, leading to potential litigation and regulatory fines. The average cost of a data breach in the US reached $9.48 million in 2023.

- Client Trust: Demonstrating strong cybersecurity practices is paramount for securing new contracts and maintaining existing client relationships, especially in large-scale infrastructure projects where data security is a key concern.

- Operational Continuity: Protecting against ransomware and other cyberattacks ensures that Kiewit's project execution and management systems remain operational, preventing costly delays and downtime.

Technological advancements are fundamentally reshaping the construction industry, pushing Kiewit towards greater efficiency and data-driven operations. The company's adoption of Building Information Modeling (BIM) and advanced project management software streamlines workflows, while digital twins and data analytics offer predictive insights, with industry reports from 2024 indicating potential reductions in project delays by up to 15%.

Automation and robotics are critical for addressing labor shortages and enhancing site safety, with Kiewit exploring autonomous heavy equipment and robotics for tasks like demolition. This integration is expected to boost productivity, as evidenced by the 7.4% increase in construction spending in 2023, a trend automation is poised to support.

Innovations in materials like self-healing concrete and advanced composites, alongside modular construction techniques—a market valued at $120 billion in 2023—are contributing to more sustainable and efficient building practices. These advancements can significantly reduce waste and carbon footprints.

Artificial intelligence (AI) and data analytics are being leveraged for predictive maintenance, risk assessment, and supply chain optimization, with companies increasingly adopting these capabilities in 2024. Cybersecurity is also paramount, given the escalating risks, with the construction sector experiencing a 71% rise in ransomware attacks in 2023, and the average cost of a data breach in the US reaching $9.48 million.

| Technology Area | Impact on Kiewit | Industry Trend/Data (2023-2025) |

|---|---|---|

| Digitalization & BIM | Streamlined workflows, enhanced collaboration, reduced errors | Increased adoption for project efficiency |

| Automation & Robotics | Improved productivity, enhanced safety, mitigation of labor shortages | Growing investment in autonomous equipment |

| Advanced Materials & Modular Construction | Increased sustainability, faster project completion, reduced waste | Modular construction market valued at $120 billion (2023) |

| AI & Data Analytics | Predictive maintenance, risk assessment, optimized supply chain | Increasing use for operational insights in 2024 |

| Cybersecurity | Protection of sensitive data, client trust, operational continuity | 71% increase in ransomware attacks in construction (2023) |

Legal factors

Kiewit navigates a complex legal landscape shaped by diverse contract types like design-build and EPC, each carrying distinct legal implications. These structures critically influence liability allocation, with models like CMAR often shifting more risk to the contractor. Understanding these nuances is key to managing potential disputes and ensuring performance guarantees are met.

Dispute resolution mechanisms, whether through arbitration, mediation, or litigation, are integral to Kiewit's contract frameworks. For instance, the American Arbitration Association (AAA) reported a significant volume of construction-related arbitrations in 2023, highlighting the prevalence of such avenues. Effective contract management minimizes the likelihood and impact of these processes.

Performance guarantees, a standard contractual element, require Kiewit to adhere to stringent project specifications and timelines. Failure to meet these can trigger financial penalties or legal challenges. As of early 2024, major infrastructure projects often include liquidated damages clauses, which can amount to millions if deadlines are missed.

Staying abreast of evolving contract law and industry best practices, such as updated FIDIC (International Federation of Consulting Engineers) standards, is paramount for Kiewit's risk management strategy. These legal updates often impact indemnification clauses and force majeure provisions, directly affecting project profitability and legal exposure.

Kiewit must adhere to strict Health, Safety, and Environmental (HSE) regulations as a fundamental legal obligation. This involves navigating evolving Occupational Safety and Health Administration (OSHA) standards, comprehensive environmental protection laws like the Clean Air Act and Clean Water Act, and sector-specific safety mandates. Failure to comply can result in substantial penalties; for instance, OSHA fines can reach tens of thousands of dollars per violation. These regulations directly impact project timelines and Kiewit's public image, potentially leading to costly legal entanglements.

Kiewit, as a significant employer, must meticulously adhere to a broad spectrum of labor and employment laws. These include federal and state mandates on minimum wage, overtime pay, and fair labor standards, alongside regulations governing unionization and collective bargaining, such as the National Labor Relations Act.

The company also faces scrutiny under anti-discrimination statutes like Title VII of the Civil Rights Act and the Age Discrimination in Employment Act, necessitating robust policies to prevent bias in hiring and employment practices. Worker classification rules, determining employee versus independent contractor status, are particularly critical, with potential penalties for misclassification.

Anticipated shifts in labor laws, such as potential reclassifications of gig economy workers or changes in rules around project labor agreements, could directly influence Kiewit's workforce management strategies and overall operational expenditures. For instance, a broader application of independent contractor status rules could increase payroll taxes and benefit costs if more workers are reclassified as employees.

In 2024, the U.S. Department of Labor continued to emphasize enforcement of wage and hour laws, with significant settlements reached in cases involving contractor misclassification and overtime violations, highlighting the financial risks associated with non-compliance for large construction firms like Kiewit.

Land Use and Permitting Laws

Kiewit's large-scale infrastructure and mining operations are heavily dependent on navigating complex land use and permitting laws. Securing these approvals involves rigorous legal processes, including detailed environmental impact assessments (EIAs) and adherence to local zoning regulations. For instance, major projects often require multiple federal, state, and local permits, each with its own set of review periods and public comment phases. In 2024, the average time to obtain key environmental permits for large infrastructure projects in the US could extend beyond 18-24 months, depending on the project's complexity and location.

Stakeholder consultations are a critical component of the permitting process, aiming to address concerns from communities, indigenous groups, and other affected parties. Failure to adequately engage stakeholders can lead to significant delays or even legal challenges. These challenges, such as litigation over environmental impact findings or land rights, can add millions of dollars in costs and push back completion dates. For example, a major highway expansion project might face a two-year delay due to legal disputes regarding land acquisition and environmental mitigation, directly impacting its financial viability.

- Permitting Complexity: Projects require numerous permits, often spanning multiple governmental levels, each with specific review timelines.

- Environmental Impact Assessments (EIAs): Thorough EIAs are legally mandated, detailing potential environmental effects and mitigation strategies.

- Zoning and Land Use Regulations: Strict adherence to local zoning laws and land use plans is essential for project approval.

- Stakeholder Consultation: Early and ongoing engagement with affected communities and groups is crucial to prevent legal hurdles.

- Legal Challenges: Litigation over environmental concerns, land rights, or procedural errors can significantly impact project schedules and budgets.

Intellectual Property (IP) and Technology Licensing

Kiewit navigates a complex legal landscape concerning intellectual property (IP) and technology licensing. As the company increasingly integrates advanced technologies like AI-driven project management and autonomous construction equipment, understanding IP ownership is paramount. This includes safeguarding innovations developed internally and clarifying rights stemming from collaborations with technology partners. For example, a partnership to develop a new drone-based inspection system would require clear agreements on who owns the resulting software and data.

The implications of licensing new construction technologies are significant for maintaining Kiewit's competitive edge. Licensing agreements dictate terms for using patented software, specialized machinery, or novel building materials. Failing to secure proper licenses or improperly managing them can lead to costly disputes and hinder the adoption of efficiency-boosting innovations. In 2024, the global market for construction technology was projected to reach billions, highlighting the value and potential legal entanglements in this sector.

- IP Ownership Clarity: Establishing clear ownership of innovations, whether developed in-house or through joint ventures, is critical for protecting Kiewit's investments and competitive advantage.

- Technology Licensing Terms: Scrutinizing licensing agreements for new construction technologies ensures Kiewit can legally leverage advancements in areas like BIM software or advanced materials.

- Global IP Protection: As Kiewit operates internationally, understanding and adhering to diverse IP laws in different jurisdictions is essential to prevent infringement and protect its technological assets.

- Data Rights in Partnerships: Agreements must define data ownership and usage rights when collaborating on technology development, particularly concerning data generated by smart construction sites.

Kiewit operates under a strict framework of contractual obligations, including performance guarantees and dispute resolution clauses. Failure to meet project specifications, as often detailed in liquidated damages clauses in 2024 infrastructure contracts, can lead to significant financial penalties.

Navigating evolving contract law, such as updates to FIDIC standards impacting indemnification and force majeure, is crucial for managing legal exposure. This proactive approach to contract management is essential for mitigating risks and ensuring project success.

Adherence to Health, Safety, and Environmental (HSE) regulations is a fundamental legal requirement, with OSHA fines potentially reaching tens of thousands of dollars per violation as of early 2024. Compliance directly impacts project timelines and Kiewit's reputation.

Labor laws, including those governing wages, overtime, and unionization, are critical for Kiewit as a major employer. The U.S. Department of Labor's continued emphasis on enforcing these laws in 2024 underscores the financial risks of non-compliance, particularly regarding worker classification.

Environmental factors

Climate change is intensifying extreme weather, directly affecting Kiewit's construction and mining projects. Increased frequency of events like floods, wildfires, hurricanes, and extreme heat poses significant risks to project timelines, site safety, and existing infrastructure.

For instance, the 2023 wildfire season in Canada saw over 18 million hectares burned, leading to widespread evacuations and disruptions that could impact supply chains and labor availability for infrastructure projects in affected regions. Similarly, rising sea levels and more powerful storm surges are a growing concern for coastal construction, demanding more robust designs.

Kiewit's expertise in engineering resilient infrastructure is becoming paramount. This includes developing designs that can withstand higher wind speeds, increased rainfall, and prolonged periods of extreme temperatures, ensuring long-term project viability and minimizing future repair costs.

The availability of essential natural resources like water and aggregates directly influences Kiewit's project costs and timelines, especially with growing demand. For instance, in 2024, many regions experienced heightened water scarcity, increasing the cost of water-intensive construction projects and requiring Kiewit to invest more in water management solutions. The global push for sustainable sourcing is also reshaping material supply chains, with a notable increase in demand for recycled content in construction materials.

This trend necessitates that Kiewit actively explores and integrates recycled aggregates and other sustainably produced materials into its operations. Kiewit's proactive approach to sustainable procurement, demonstrated through initiatives like their 2025 sustainability targets aiming for a 15% reduction in embodied carbon across projects, is vital for mitigating risks associated with resource scarcity and ensuring long-term operational viability.

Construction and mining, core to Kiewit's operations, inherently produce emissions like greenhouse gases and dust, alongside potential water and soil pollution.

Environmental regulations are becoming more stringent globally, impacting air quality standards, water discharge permits, and waste disposal protocols. For instance, the U.S. Environmental Protection Agency (EPA) continues to update National Ambient Air Quality Standards (NAAQS) which directly affect construction site operations.

Kiewit's proactive approach to minimizing its environmental footprint is crucial. This includes detailed carbon footprint analysis to identify reduction opportunities, as seen in their investments in cleaner equipment and more efficient project planning.

In 2024, Kiewit reported a focus on reducing Scope 1 and Scope 2 emissions, aligning with industry trends and client demands for sustainable project delivery. This commitment is essential for both regulatory compliance and maintaining a strong corporate reputation.

Biodiversity and Habitat Protection

Kiewit's large-scale infrastructure projects, from transportation networks to energy facilities, inevitably interact with natural environments, raising concerns about biodiversity and habitat protection. Environmental regulations, such as those under the Endangered Species Act and the National Environmental Policy Act, mandate impact assessments and mitigation strategies. Societal expectations for corporate environmental stewardship are also growing, pushing companies like Kiewit to demonstrate genuine commitment to preserving natural habitats and protecting vulnerable species.

In 2024, the increasing focus on ESG (Environmental, Social, and Governance) factors means Kiewit's performance in minimizing ecological disruption is under greater scrutiny from investors, regulators, and the public. This necessitates robust biodiversity conservation efforts and effective ecological restoration plans as integral parts of project development and execution. For instance, projects might involve detailed surveys of flora and fauna, the establishment of wildlife corridors, or the implementation of habitat restoration post-construction.

- Regulatory Compliance: Kiewit must adhere to a complex web of federal, state, and local environmental laws governing habitat protection and endangered species.

- Societal Pressure: Growing public awareness of climate change and biodiversity loss fuels demand for companies to demonstrate proactive environmental management.

- Mitigation Strategies: Effective biodiversity conservation often involves habitat restoration, species translocation, and the creation of protected areas to offset project impacts.

- ESG Reporting: Kiewit's commitment to environmental sustainability, including biodiversity efforts, is a key component of its ESG performance and investor relations.

Waste Management and Circular Economy Principles

The construction and mining sectors are notorious for generating significant waste streams. In 2023, the global construction industry produced an estimated 2.2 billion tons of waste, according to the UN Environment Programme. This highlights a critical environmental challenge and a growing area of focus for companies like Kiewit.

There's a clear global trend towards reducing this waste, boosting recycling efforts, and embracing circular economy principles. This shift is driven by both regulatory pressures and increasing stakeholder demand for sustainable practices. For Kiewit, integrating these principles means actively seeking ways to reuse materials on-site, diverting waste from landfills, and exploring innovative recycling methods for construction debris.

Effective waste management directly supports sustainability objectives and offers tangible cost efficiencies. By minimizing the volume of materials sent to landfills, Kiewit can reduce disposal fees and potentially generate revenue from recycled materials. Furthermore, a proactive approach to waste reduction can enhance the company's reputation and appeal to clients with strong environmental, social, and governance (ESG) commitments.

- Waste Generation: Construction and mining industries are major contributors to global waste, with the construction sector alone generating billions of tons annually.

- Circular Economy Adoption: A growing emphasis is placed on reducing waste, increasing recycling rates, and implementing circular economy models within these industries.

- Kiewit's Role: Kiewit's ability to effectively manage waste through reuse and minimization strategies is crucial for meeting sustainability goals.

- Benefits: Successful waste management translates to cost savings through reduced disposal fees and potential income from recycled materials, alongside improved corporate image.

Kiewit faces increasing environmental scrutiny due to its operations' inherent impact on air, water, and land. Stricter regulations, like updated EPA air quality standards, necessitate continuous investment in emission control technologies and efficient project planning to minimize Kiewit's ecological footprint. For instance, in 2024, Kiewit highlighted efforts to reduce Scope 1 and 2 emissions, aligning with client demands for sustainable construction practices.

Biodiversity and habitat protection are critical considerations for Kiewit's large-scale projects, influenced by laws such as the Endangered Species Act. Growing societal expectations for environmental stewardship mean Kiewit must integrate robust biodiversity conservation and habitat restoration plans, as evidenced by their 2025 sustainability targets aimed at reducing embodied carbon.

Waste generation, a significant issue in construction, is being addressed through a global push for circular economy principles. Kiewit's proactive waste management, including material reuse and recycling, not only supports sustainability goals but also offers cost efficiencies, with the construction sector generating billions of tons of waste annually.

PESTLE Analysis Data Sources

Our PESTLE analysis for Kiewit is meticulously crafted using a diverse range of data, including publicly available government reports, economic indicators from reputable financial institutions, and industry-specific market research. We also incorporate insights from Kiewit's own published sustainability reports and investor relations materials to ensure a comprehensive view.