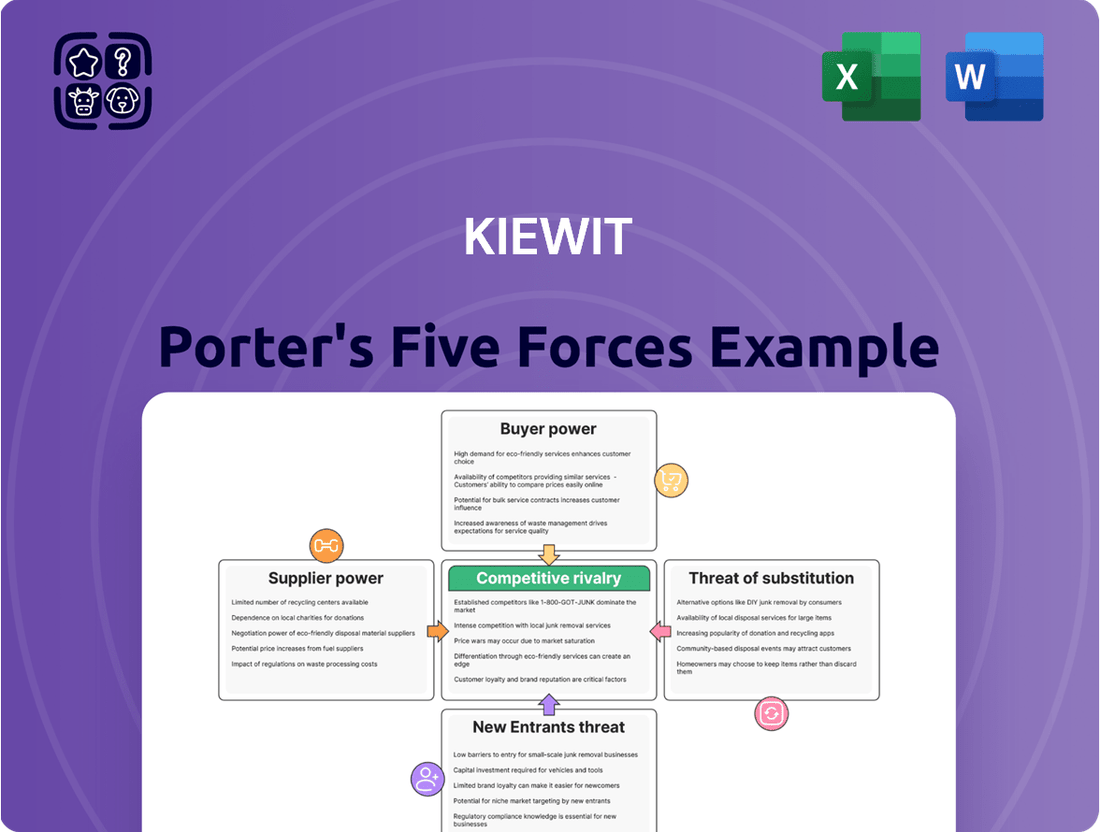

Kiewit Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kiewit Bundle

Kiewit's industry is shaped by intense competition, powerful suppliers, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder. Our analysis delves into the bargaining power of buyers and the ever-present challenge of substitute products. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Kiewit’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Kiewit's reliance on suppliers for highly specialized heavy construction equipment and advanced technologies means these suppliers can wield significant bargaining power. This is particularly true when equipment is proprietary or few alternative vendors exist, potentially driving up costs and extending delivery schedules.

For example, in 2024, the construction equipment market experienced a surge in demand, with companies like Caterpillar reporting strong sales, indicating a tightening supply chain for specialized machinery. This market dynamic can amplify the leverage of key equipment manufacturers in their negotiations with large contractors like Kiewit.

This dependence underscores the critical need for Kiewit to cultivate robust supplier relationships and implement strategic procurement practices to mitigate risks associated with supplier power, ensuring continuity and cost-effectiveness in its operations.

The availability and pricing of critical raw materials such as steel, concrete, and specialized chemicals directly influence Kiewit's project expenses and schedules. For instance, global steel prices saw significant volatility in 2023 and early 2024, with benchmarks like U.S. Midwest Heavy Melt Scrap fluctuating by over 15% within a few months, directly impacting Kiewit's material costs.

When the supply of these essential materials is constrained or when suppliers operate in concentrated markets, their bargaining power increases. This can lead to higher input costs for Kiewit, potentially squeezing profit margins on fixed-price contracts.

While Kiewit's substantial purchasing volume provides some negotiating leverage with suppliers, the persistent risk of global supply chain disruptions, as seen during the COVID-19 pandemic and geopolitical events, means suppliers can still exert considerable influence.

For example, disruptions in cement production in certain regions in 2023 led to localized price spikes of up to 10% for concrete, illustrating the power suppliers can wield when supply chains are stressed.

Kiewit's reliance on a deep pool of skilled labor, encompassing engineers, project managers, and specialized craftspeople, directly influences the bargaining power of suppliers in this segment. The availability and cost of these critical human resources are paramount to project execution and profitability.

When certain specialized skills or unionized trades become scarce, their bargaining power escalates, potentially leading to increased labor costs and extended project timelines for Kiewit. For instance, shortages in specific engineering disciplines or highly skilled trades can drive up wages and create bidding wars for talent.

While Kiewit's employee-owned structure and robust internal training programs are designed to cultivate and retain talent, thereby somewhat buffering the impact of external labor market fluctuations, they do not entirely eliminate the inherent bargaining power of essential skilled labor suppliers.

Key Subcontractors

For its large and complex projects, Kiewit frequently relies on a diverse range of subcontractors to perform specialized tasks like advanced foundation engineering or critical electrical systems. When these subcontractors possess highly specialized skills, unique certifications, or operate in markets with a scarcity of comparable providers, their leverage over Kiewit can be significant. For instance, a company holding a patent on a specific tunneling technique or possessing rare environmental cleanup certifications can command higher prices and more favorable terms. Kiewit's strategic emphasis on cultivating enduring partnerships and implementing rigorous subcontractor oversight is therefore a critical factor in managing this aspect of supplier power.

The bargaining power of key subcontractors can be influenced by several factors:

- Specialized Expertise: Subcontractors with unique, hard-to-replicate skills or proprietary technologies hold more sway.

- Market Concentration: Limited availability of qualified subcontractors in a specific geographic region or for a particular service amplifies their power.

- Project Criticality: The more essential a subcontractor's role is to the overall project timeline and success, the greater their bargaining leverage.

- Contractual Terms: The structure of contracts, including payment schedules and performance clauses, can impact subcontractor power dynamics.

Bonding and Insurance Providers

For Kiewit, securing adequate bonding and insurance is absolutely essential, especially given the sheer size and inherent risks of its major construction projects. The ability to access these critical financial instruments directly impacts Kiewit's capacity to undertake and complete large-scale ventures.

The market for specialized bonding and insurance providers capable of handling Kiewit's project magnitudes isn't vast. This limited pool of qualified underwriters means these financial service firms often hold considerable bargaining power. Their willingness to provide coverage, and on what terms, can significantly influence project feasibility.

In 2024, the insurance market for large construction projects remained competitive yet demanding. Factors such as Kiewit's robust financial health and its demonstrable commitment to safety are key negotiating points. A strong safety record, often reflected in lower incident rates, can lead to more favorable premiums and terms from insurers.

- Limited Underwriting Capacity: A concentrated number of insurers and sureties can underwrite Kiewit's mega-projects, granting them leverage.

- Risk Assessment: Insurers and sureties meticulously assess project complexity, Kiewit's financial stability, and its safety performance.

- Financial Strength as a Lever: Kiewit's solid balance sheet and consistent profitability in 2024 provide a strong basis for negotiating terms.

- Safety Record Impact: A proven history of fewer workplace accidents and effective risk management directly influences the cost and availability of insurance.

Kiewit's reliance on specialized equipment manufacturers and raw material suppliers means these entities can exert considerable bargaining power. This is amplified when alternative sources are scarce or proprietary technologies are involved, as seen in 2024 with strong demand for construction machinery impacting supply chains. Furthermore, the availability of specialized labor and subcontractors with unique skills also grants them leverage, potentially increasing project costs and timelines.

The bargaining power of suppliers for Kiewit is significantly influenced by factors such as specialized expertise, market concentration, and project criticality. For instance, a subcontractor holding a patent on a specific construction technique can command higher prices. Similarly, limited availability of qualified subcontractors in a region, as might occur during peak construction seasons, increases their negotiating leverage.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Kiewit | Example Scenario (2024/2025) |

|---|---|---|---|

| Specialized Equipment Manufacturers | Proprietary technology, limited vendors, high demand | Increased equipment costs, extended delivery times | Strong demand for advanced tunneling machines led to longer lead times and higher prices from key manufacturers. |

| Raw Material Suppliers (e.g., Steel) | Market concentration, global supply chain disruptions, price volatility | Higher input costs, potential project delays | Global steel prices experienced fluctuations in late 2023 and early 2024, impacting Kiewit's material expenses. |

| Skilled Labor/Subcontractors | Scarcity of specialized skills, unionization, project criticality | Increased labor costs, bidding wars for talent, project schedule risks | Shortages in specialized engineering disciplines or highly skilled trades can drive up wages and affect project timelines. |

| Bonding & Insurance Providers | Limited number of qualified underwriters, rigorous risk assessment | Higher insurance premiums, potential impact on project feasibility | The specialized insurance market for mega-projects remained competitive but demanding in 2024, with safety records being a key negotiation point. |

What is included in the product

Analyzes the construction industry's competitive intensity, buyer and supplier power, threat of new entrants, and substitutes, all specifically through the lens of Kiewit's operations and strategic advantages.

Quickly identify and quantify competitive threats, enabling proactive strategies to alleviate market pressure.

Customers Bargaining Power

Kiewit's customers are often massive organizations like government bodies, public utilities, and major corporations undertaking projects valued in the billions. The sheer size and intricacy of these endeavors mean that only a handful of contractors, like Kiewit, possess the necessary expertise and resources to execute them. This scarcity of qualified alternatives significantly limits a customer's power to switch providers, thereby strengthening Kiewit's negotiating leverage due to its demonstrated capability.

Government and public sector clients represent a substantial revenue stream for Kiewit, often involving intricate, multi-stage bidding processes and stringent compliance mandates. While the public nature of their funding can lead to price sensitivity, these entities also place a high premium on proven expertise, dependable execution, and meticulous adherence to detailed project specifications. Kiewit's consistent performance in these areas, evidenced by its numerous large-scale infrastructure projects, helps mitigate direct price pressure.

Kiewit benefits from high switching costs for its customers. Once a client commits to Kiewit for a substantial project, the financial and operational hurdles of changing contractors mid-stream are considerable, often involving significant delays and escalating costs. For instance, in 2024, large-scale infrastructure projects, which form a core part of Kiewit's business, can involve billions of dollars in investment, making mid-project contractor changes exceptionally disruptive.

The integration of Kiewit's design-build and Engineering, Procurement, and Construction (EPC) services further solidifies this customer lock-in. Clients are deeply embedded in Kiewit's processes, making a transition to another firm not just a change of vendor, but a complex unravelling and re-establishment of project infrastructure. This deep integration significantly limits the bargaining power of customers who might otherwise consider switching.

Reputation and Track Record

Kiewit's formidable reputation and extensive track record significantly diminish customer bargaining power. In the complex world of large-scale construction and engineering, clients prioritize reliability and a history of successful project completion. Kiewit's proven ability to deliver on time and within budget instills confidence, making customers hesitant to opt for less established competitors, even with more attractive pricing. This ingrained trust in Kiewit’s execution reduces the customer’s leverage to negotiate on quality or project certainty.

Kiewit's track record, particularly in delivering major infrastructure and energy projects, acts as a strong deterrent against customers seeking to exert downward price pressure. For instance, in 2024, the company continued its involvement in high-profile projects such as the expansion of the Denver International Airport, a testament to its enduring client relationships and consistent performance. This history of success means clients are often willing to pay a premium for the assurance of a project's successful outcome, thereby limiting their ability to bargain for lower costs.

The company’s commitment to safety and quality, reinforced by its decades of operation, further solidifies its position. Customers recognize that a strong safety record, like Kiewit's, translates to fewer delays and cost overruns. This focus on operational excellence means customers are less likely to bargain aggressively on price when the alternative is a higher risk of project failure or extended timelines.

Kiewit's robust pipeline of secured work, often valued in the billions of dollars annually, also indicates that its reputation provides a buffer against customer demands. For example, Kiewit reported securing $21.5 billion in new work in 2023, a figure that demonstrates strong demand driven by its reputation for dependable execution. This strong demand inherently reduces the bargaining power of individual customers.

- Proven Reliability: Kiewit's history of on-time, on-budget project delivery reduces customer leverage on price.

- Safety Record: A strong safety performance minimizes perceived project risk for clients, limiting their need to negotiate on cost.

- Client Confidence: Decades of successful complex project execution build trust, making clients less sensitive to price alone.

- Industry Demand: High demand for Kiewit's services, driven by its reputation, inherently limits individual customer bargaining power.

Limited Number of Qualified Bidders

For highly specialized and large-scale construction projects, such as nuclear power plants or intricate water treatment facilities, the number of contractors with the requisite expertise and experience is often limited. This scarcity of qualified bidders significantly diminishes a customer's ability to negotiate favorable terms. Kiewit's prominent position in these sectors, often evidenced by its top rankings in industry surveys, directly correlates with this reduced customer bargaining power. For instance, in 2023, Kiewit secured a significant portion of contracts for advanced nuclear reactor projects, a field with a very narrow set of qualified contractors.

The limited competition, particularly in design-build or Engineering, Procurement, and Construction (EPC) contracts, means customers have fewer alternatives. This lack of choice naturally shifts leverage towards the contractor. This dynamic is crucial in sectors where project complexity and risk are exceptionally high, requiring specialized knowledge and a proven track record.

- Limited Pool of Expertise: Specialized projects require contractors with unique skills and certifications, naturally restricting the number of viable bidders.

- High Barriers to Entry: The capital investment, regulatory hurdles, and extensive experience needed to compete in these niche markets create significant barriers for new entrants.

- Reduced Customer Options: With fewer qualified contractors available, customers have less leverage to demand lower prices or more favorable contract terms.

- Kiewit's Market Advantage: Kiewit's established reputation and demonstrated success in these complex fields allow it to benefit from this limited competition, enhancing its bargaining position.

Kiewit's customers, often large entities like government agencies and major corporations, face limited options for undertaking massive, complex projects. This scarcity of contractors with the required expertise and scale, like Kiewit, significantly curtails their ability to switch providers or exert strong price pressure. In 2024, the demand for specialized infrastructure and energy projects, where Kiewit excels, continues to outstrip the supply of equally capable firms, thereby bolstering Kiewit's negotiating position.

High switching costs are a major factor limiting customer bargaining power. Once a substantial project is underway with Kiewit, the financial and logistical implications of changing contractors are immense. For instance, in 2024, major infrastructure projects, often valued in the billions, would incur significant delays and cost escalations if a contractor change were attempted mid-stream, effectively locking in clients.

Kiewit's strong reputation and consistent delivery on large-scale projects, such as its continued work on high-profile infrastructure in 2024, build significant client confidence. This reduces the willingness of customers to risk project success on lower-cost, less proven alternatives, thereby limiting their leverage to negotiate solely on price.

The limited pool of contractors capable of handling highly specialized projects, like advanced nuclear facilities or intricate water systems, severely restricts customer choice. Kiewit's established dominance in these niche areas, demonstrated by its strong contract wins in 2023 for such projects, means clients have fewer viable alternatives, empowering Kiewit in negotiations.

Preview the Actual Deliverable

Kiewit Porter's Five Forces Analysis

This preview displays the complete Kiewit Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the construction industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use. This includes detailed insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. No mockups, no samples. The document you see here is exactly what you’ll be able to download after payment.

Rivalry Among Competitors

Kiewit faces significant competitive rivalry from other major players in the construction and engineering sector. Giants like Turner Construction, Bechtel, and Fluor have a substantial presence, mirroring Kiewit's own capabilities, extensive resources, and broad geographic reach. This parity among leading firms fuels a highly competitive environment for securing large-scale projects.

The competition for major infrastructure and industrial contracts is particularly intense, often characterized by aggressive bidding strategies. For instance, in 2024, the bidding for a significant portion of the $1.2 trillion Infrastructure Investment and Jobs Act projects saw numerous large contractors vying for a limited number of high-value opportunities. This dynamic directly impacts Kiewit's ability to win contracts and influences profit margins.

The construction industry, particularly for large infrastructure and energy projects, operates within a fiercely bid-driven environment. Companies like Kiewit primarily win work by submitting proposals that detail price, project timelines, technical methodologies, and a track record of successful past performance. This intense competition often leads to margin compression, especially for projects that are more standardized and lack unique differentiating factors.

In 2024, the demand for skilled labor and specialized equipment in the construction sector continued to put upward pressure on bid pricing. For instance, the U.S. Bureau of Labor Statistics reported that average hourly wages for construction laborers saw an increase of approximately 4.5% year-over-year by the third quarter of 2024, directly impacting bid costs. Kiewit's success hinges on its capacity to develop innovative project execution strategies and demonstrate superior efficiency to secure these competitive contracts.

Competitive rivalry in the infrastructure sector often transcends mere price competition. Companies like Kiewit distinguish themselves through deep specialized expertise, particularly in demanding fields such as nuclear construction, marine engineering, and massive infrastructure projects. This technical prowess, coupled with a proven track record of innovative project delivery methods, like integrated design-build approaches, allows firms to secure lucrative, high-value contracts.

A strong emphasis on safety is not just a compliance matter but a critical differentiator. Kiewit, for instance, consistently highlights its commitment to safety as a core value, which translates into fewer accidents and disruptions, ultimately impacting project timelines and costs favorably. This dedication to a safe working environment is a significant factor for clients when selecting a contractor for complex and potentially hazardous projects.

In 2023, Kiewit reported a Total Recordable Incident Rate (TRIR) of 0.44, significantly below the industry average, underscoring their safety focus. This commitment is essential for winning bids where safety performance is a key evaluation criterion.

Industry Capacity and Demand Fluctuations

The construction and engineering sector inherently experiences significant rivalry due to its cyclical nature, heavily tied to economic health and public infrastructure investment. During booms, the intense demand for resources and skilled labor escalates competition among firms. Conversely, economic downturns sharpen the fight for a diminished project pipeline.

Kiewit's strategic diversification across various sectors, including infrastructure, power, oil, gas, and water, acts as a crucial buffer. This broad reach mitigates the impact of localized market downturns by allowing the company to leverage strengths in other, more resilient segments.

- Industry Capacity and Demand Fluctuations: The construction and engineering industry's cyclicality means periods of high demand can strain capacity, intensifying competition for labor and materials. Conversely, economic slowdowns or shifts in government spending can lead to overcapacity and fierce competition for fewer available projects.

- Kiewit's Diversification Strategy: Kiewit's presence in sectors like transportation infrastructure, energy transition projects, and industrial facilities helps to smooth out the impact of fluctuations in any single market. For example, while traditional oil and gas projects might see cyclical dips, investments in renewable energy infrastructure can provide a more stable revenue stream.

- Impact of Economic Conditions: In 2024, global infrastructure spending remained a key driver, but rising interest rates and inflation presented challenges, increasing project costs and potentially delaying some public works. This environment necessitates efficient operations and strong bidding capabilities to remain competitive.

- Labor Market Dynamics: The demand for skilled labor in construction and engineering remained robust in 2024, with shortages in key trades contributing to higher labor costs and increased competition for qualified personnel among firms like Kiewit.

Geographic and Sector-Specific Saturation

While Kiewit’s extensive reach across North America offers diversification, certain geographic areas and specific market segments can indeed become quite saturated. For instance, general building construction in established, mature markets often sees a higher density of competitors vying for projects. This intense competition can naturally lead to more aggressive pricing strategies and a heightened rivalry within those particular niches.

Kiewit actively mitigates this by leveraging its broad capabilities to identify and pursue opportunities across a wide spectrum of sectors. This strategic approach allows the company to avoid over-reliance on any single, highly saturated market. For example, in 2024, Kiewit continued to secure substantial infrastructure projects, a sector that, while competitive, often presents different dynamics than highly commoditized building segments.

- Geographic Saturation: Mature construction markets in the US Northeast and California, for example, often exhibit higher levels of competition for general building projects.

- Sector-Specific Rivalry: While infrastructure remains a strong sector for Kiewit, areas like data center construction, a booming segment in 2024, also attract significant competition from specialized firms.

- Pricing Pressure: In highly saturated segments, bidding wars can drive down profit margins, making differentiation through expertise and project delivery crucial.

- Diversification Strategy: Kiewit's ability to operate in diverse sectors such as transportation, energy, and water infrastructure helps balance exposure to regional or sector-specific saturation.

The competitive rivalry within the construction and engineering sector is substantial, driven by a concentrated group of major players like Turner Construction, Bechtel, and Fluor. These firms possess comparable capabilities, extensive resources, and wide geographic reach, leading to intense competition for large-scale projects, particularly in infrastructure and industrial sectors. This often results in aggressive bidding strategies and margin compression, especially on more standardized projects.

In 2024, the bidding for projects funded by the Infrastructure Investment and Jobs Act exemplified this intense rivalry, with numerous large contractors competing for limited high-value opportunities. This environment necessitates a focus on efficiency and differentiation. For example, the U.S. Bureau of Labor Statistics noted a 4.5% increase in construction laborer wages by Q3 2024, directly impacting bid costs and highlighting the need for innovative project execution.

| Competitor | Key Strengths | 2023 Revenue (Est.) | Focus Areas |

|---|---|---|---|

| Turner Construction | Building expertise, large project management | ~$15 Billion | Commercial, Healthcare, Sports |

| Bechtel | Global project delivery, heavy industrial | ~$30 Billion | Energy, Infrastructure, Mining |

| Fluor Corporation | Engineering, procurement, construction (EPC) | ~$13 Billion | Energy, Chemicals, Infrastructure |

SSubstitutes Threaten

While a physical bridge or power plant has few direct substitutes, the threat emerges from alternative project delivery methods. Customers might choose Public-Private Partnerships (PPPs) or integrated project delivery models, which can shift risk and responsibility away from traditional design-bid-build structures. For instance, the U.S. Department of Transportation reported that PPPs accounted for an increasing share of infrastructure funding discussions, with several major projects in 2024 leveraging this approach.

Kiewit counters this by providing a broad spectrum of flexible delivery options, allowing clients to select the model that best suits their risk tolerance and project objectives. This adaptability in offering solutions like Design-Build or Construction Manager at Risk (CMAR) helps retain clients who might otherwise explore alternative procurement routes to manage their project's financial and operational exposure.

Large corporate and government clients possess the potential to cultivate or enhance their internal engineering and construction departments for specific project types or routine maintenance. While not a direct threat to Kiewit's massive infrastructure undertakings, this in-house development could substitute for the external services Kiewit typically provides for smaller, ongoing operational requirements. For instance, a large energy company might decide to handle its own plant upgrades rather than contracting them out.

New technologies like modular construction and advanced robotics present a growing threat of substitution for traditional on-site construction services. These innovations can streamline processes, reduce labor needs, and potentially lower costs, offering an alternative to conventional building methods. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow significantly, indicating a strong shift towards these alternative approaches.

While Kiewit is a leader in adopting technology and digital tools, a complete paradigm shift towards highly automated or off-site manufacturing could alter the nature of its core business. This long-term substitution threat necessitates continuous adaptation and investment in emerging construction technologies to maintain competitive advantage.

Shift to Maintenance/Upgrade vs. New Construction

Clients are increasingly opting to maintain and upgrade existing infrastructure rather than undertaking entirely new construction projects. This shift, driven by cost-effectiveness and sustainability goals, represents a subtle yet significant change in demand for Kiewit's core services. For instance, the U.S. infrastructure market saw significant investment in repairs and upgrades in 2024, with a notable portion of the Bipartisan Infrastructure Law funds allocated to modernizing existing assets rather than purely new builds.

This trend doesn't eliminate the need for Kiewit's expertise but necessitates a strategic pivot towards specialized maintenance, rehabilitation, and modernization services. Kiewit's established capabilities in remediation, retrofitting, and extending the life of existing structures, such as bridge rehabilitation projects, position it well to capture this evolving market segment. The company's focus on complex upgrades allows it to leverage its engineering and construction prowess on projects that demand intricate solutions.

- Shift in Client Priorities: A growing preference for extending the lifespan and enhancing the efficiency of existing infrastructure over new large-scale construction.

- Market Adaptation: Kiewit's ability to adapt its service offerings to meet this demand for maintenance and upgrade projects is crucial for continued relevance.

- Kiewit's Strengths: The company possesses strong capabilities in remediation, upgrades, and retrofitting, aligning with this market trend.

- Investment Trends: In 2024, a significant portion of infrastructure spending focused on modernizing and repairing existing assets, highlighting the growing importance of this segment.

Regulatory or Policy Shifts

Changes in environmental rules, energy strategies, or infrastructure investment can steer clients toward alternatives that sidestep massive construction projects. For instance, a significant move toward localized power generation might lessen the need for large power plants. Kiewit's broad range of services across multiple industries allows for flexibility in adapting to these shifting policy environments. In 2024, governments worldwide continued to emphasize green infrastructure, potentially impacting demand for traditional large-scale projects in favor of more sustainable or distributed solutions.

These policy adjustments can act as a substitute threat by making alternative approaches more economically viable or mandated. For example, stricter emissions standards could favor renewable energy installations over traditional fossil fuel power plants, thus substituting the need for the type of large-scale construction Kiewit historically undertakes. The company's strategic diversification is a key factor in mitigating this threat.

Consider the implications of policy shifts:

- Increased adoption of renewable energy sources could reduce demand for large, traditional power generation facilities.

- Government incentives for decentralized infrastructure might favor smaller, localized projects over Kiewit's typical large-scale endeavors.

- Stricter carbon pricing mechanisms could make carbon-intensive construction materials and methods less attractive, pushing for alternative solutions.

The threat of substitutes for Kiewit's services arises from alternative project delivery methods like Public-Private Partnerships (PPPs) and integrated project delivery, which shift risk away from traditional structures. For example, the U.S. Department of Transportation noted an increasing share of infrastructure funding discussions in 2024 involving PPPs, with several major projects utilizing this approach. Kiewit addresses this by offering flexible delivery options, such as Design-Build or Construction Manager at Risk (CMAR), to retain clients seeking customized risk management.

New technologies like modular construction and advanced robotics also present a substitution threat by offering streamlined processes and potentially lower costs compared to traditional on-site building. The global modular construction market, valued at around $100 billion in 2023, is projected for significant growth, indicating a strong trend toward these alternative methods.

Furthermore, clients increasingly prioritize maintaining and upgrading existing infrastructure over new construction, a trend supported by substantial investment in repairs and upgrades in 2024, a notable portion of which was allocated from the Bipartisan Infrastructure Law. This shift necessitates Kiewit's adaptation towards specialized maintenance and modernization services, leveraging its expertise in complex upgrades and retrofitting.

| Substitution Threat | Description | 2024 Relevance/Data Point |

|---|---|---|

| Alternative Project Delivery | PPPs, Integrated Project Delivery | Increasing share of infrastructure funding discussions in the U.S.; several major projects in 2024 leveraged PPPs. |

| Emerging Construction Technologies | Modular Construction, Robotics | Global modular construction market valued at ~$100 billion in 2023, with significant projected growth. |

| Infrastructure Modernization & Maintenance | Upgrading existing assets vs. new builds | Significant investment in repairs and upgrades in 2024; portion of Bipartisan Infrastructure Law funds allocated to modernizing existing assets. |

Entrants Threaten

The threat of new entrants in the large-scale construction and engineering sector is significantly mitigated by exceptionally high capital requirements. New players need vast sums for sophisticated heavy machinery, cutting-edge technology, and the substantial bonding capacity essential for securing major projects.

Established firms, such as Kiewit, benefit from decades of investment in asset bases and robust financial health, creating a formidable barrier. For instance, Kiewit's extensive fleet of specialized equipment and its proven ability to secure multi-billion dollar contracts demonstrate the scale of investment needed.

In 2024, the average cost of a large tunnel boring machine can exceed $20 million, and securing performance bonds for a single mega-project can run into hundreds of millions of dollars, showcasing the immense financial hurdles for any newcomer aiming to compete effectively.

Clients seeking to undertake mega-projects, often valued in the billions, place an immense premium on a contractor's demonstrable history of successfully completing similar complex undertakings. Newcomers, by their very nature, lack this critical experience, making it exceptionally difficult to gain the confidence of these discerning clients.

Kiewit's extensive legacy, spanning over a century and encompassing a vast portfolio of successfully delivered projects, serves as a formidable barrier to entry. This deep well of experience translates into a tangible reputation and a level of trust that new entrants simply cannot replicate in the short term, especially in an industry where reliability is paramount.

For instance, Kiewit's involvement in transformative infrastructure projects, such as the ongoing expansion of the Hampton Roads Bridge-Tunnel in Virginia, a project valued at over $3.9 billion, exemplifies the scale and complexity that clients expect. This track record of managing such colossal endeavors builds a powerful moat against potential new competitors.

The construction and engineering sector, especially for large infrastructure and industrial projects, is a minefield of regulations. New entrants must contend with a multitude of permits, licenses, and stringent safety standards, such as OSHA regulations in the United States which saw over 5,000 worker fatalities in 2022. Navigating this intricate web adds significant time and cost, acting as a substantial barrier to entry for nascent firms seeking to compete with established players like Kiewit.

Difficulty in Attracting and Retaining Skilled Labor

The construction and engineering sector grapples with a consistent deficit in skilled labor and seasoned professionals. Newcomers would find it exceptionally challenging to recruit and keep the essential workforce when competing with established firms like Kiewit. These established players can leverage their robust compensation packages, clear career advancement paths, and a unique employee-owned culture to their advantage.

For instance, the U.S. Bureau of Labor Statistics projected a need for 564,000 new construction laborers in 2024 alone. This scarcity directly impacts a new entrant's ability to scale operations or even initiate projects. Kiewit, with its strong brand recognition and proven track record, has an inherent advantage in attracting top-tier talent, making it a significant barrier for new companies looking to enter the market.

- Skilled Labor Shortage: Industry-wide, there's a documented lack of qualified workers.

- Recruitment Challenges for New Entrants: Attracting talent is difficult against established firms.

- Retention Advantages of Incumbents: Companies like Kiewit offer competitive benefits and culture.

- Impact on New Entrant Operations: Difficulty in staffing hinders growth and project execution.

Established Relationships and Brand Recognition

Kiewit's success is heavily bolstered by its extensive network of established relationships with clients, subcontractors, and suppliers. These deep-seated connections, forged over decades of consistent performance and unwavering trust, create a significant hurdle for newcomers. The company's brand recognition as a dependable and quality-focused contractor further solidifies this advantage.

New entrants struggle to penetrate this established ecosystem because replicating Kiewit's history of successful project execution and the associated trust takes considerable time and consistent delivery. For instance, Kiewit's 2024 project pipeline reflects the ongoing reliance of major clients on their proven capabilities, demonstrating the inertia created by these strong relationships.

- Client Loyalty: Decades of successful project delivery foster strong client loyalty, making it difficult for new firms to secure initial contracts.

- Subcontractor Network: Kiewit benefits from a preferred network of specialized subcontractors, often offering them better terms due to consistent business.

- Supplier Partnerships: Long-term relationships with suppliers can lead to preferential pricing and material availability, a significant cost advantage.

- Brand Reputation: Kiewit's strong brand equity as a reliable and high-quality contractor acts as a powerful deterrent to potential new entrants seeking to establish credibility.

The threat of new entrants into the large-scale construction and engineering sector, where Kiewit operates, is notably low. This is largely due to the immense capital investment required for specialized equipment, technology, and performance bonds, often running into hundreds of millions for major projects. For example, a single tunnel boring machine can cost over $20 million in 2024.

Furthermore, clients demand a proven track record of successfully completing complex, multi-billion dollar projects, a credential that new firms inherently lack. Kiewit's century-long history and extensive portfolio, including the $3.9 billion Hampton Roads Bridge-Tunnel expansion, solidify its market position.

Navigating stringent regulations and securing a skilled workforce further erects significant barriers. The scarcity of skilled labor, with a projected need for 564,000 new construction laborers in the U.S. in 2024, means established firms with strong recruitment advantages, like Kiewit's employee-owned culture, present a considerable challenge to newcomers.

Established relationships with clients, subcontractors, and suppliers, built on trust and consistent delivery, create a powerful moat. Kiewit's extensive project pipeline in 2024 demonstrates this ongoing reliance on their proven capabilities, making it exceedingly difficult for new entrants to penetrate the existing ecosystem and gain crucial market access.

Porter's Five Forces Analysis Data Sources

Our Kiewit Porter's Five Forces analysis is built upon a foundation of robust data, including Kiewit's own investor relations materials, industry-specific trade publications, and publicly available financial filings from competitors and related companies.