Kiewit Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kiewit Bundle

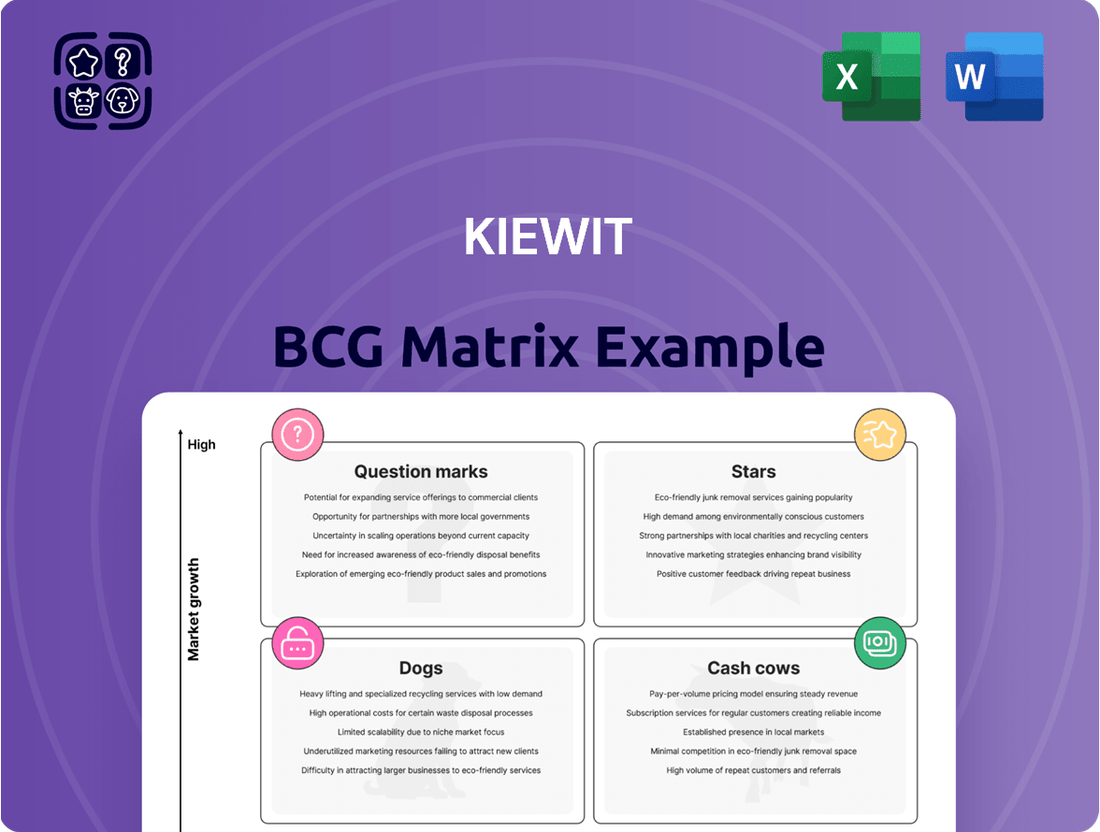

Curious about Kiewit's strategic product portfolio? This glimpse into the BCG Matrix reveals where their key offerings sit, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand the current landscape and identify opportunities for growth and resource allocation.

To truly unlock Kiewit's strategic advantage, dive into the full BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, enabling you to make informed decisions about investment and divestment.

This isn't just about categorization; it's about actionable intelligence. The complete BCG Matrix provides detailed insights and strategic recommendations tailored to Kiewit's specific market position.

Don't miss out on the opportunity to leverage this powerful analytical tool. Purchase the full Kiewit BCG Matrix today and equip yourself with the strategic clarity needed to navigate complex markets and drive future success.

Stars

Kiewit is a major force in the booming renewable energy market, particularly in large-scale solar and wind farms. They are also instrumental in developing advanced engineering for significant energy storage systems.

The global shift towards cleaner energy sources and supportive government policies are fueling rapid expansion in this sector. For instance, the U.S. solar market alone is projected to install over 40 gigawatts of capacity in 2024, a substantial increase from previous years.

With its deep engineering and construction capabilities, Kiewit is well-positioned to secure a substantial portion of this growing market. Their involvement in projects like the Ivanpah Solar Electric Generating System, one of the world's largest, demonstrates their capacity and commitment.

Kiewit consistently secures a substantial share of major transportation infrastructure projects, including critical bridge replacements and extensive highway upgrades. As a leading contractor in this sector, their expertise is crucial for the nation's mobility. In 2024, the U.S. Department of Transportation announced over $15 billion in grants for highway and bridge projects, a significant portion of which Kiewit is well-positioned to pursue.

The demand for modernizing and expanding North America's transportation networks remains robust, creating a high-growth environment. Kiewit's strong competitive standing, evidenced by their consistent backlog of large-scale projects, allows them to capitalize on this ongoing infrastructure investment cycle. This sector continues to be a cornerstone of Kiewit's business, reflecting a stable and expanding market presence.

Kiewit is a significant player in the advanced nuclear and next-generation power facility sector, particularly in constructing large-scale natural gas plants that are crucial for powering data centers. This positions them in a high-growth, high-value market segment.

The increasing demand for reliable and innovative power solutions, driven by the exponential growth of technologies like artificial intelligence, underscores the strategic importance of this area for Kiewit. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to exceed $1.8 trillion by 2030, highlighting the immense power infrastructure needs.

Kiewit's expertise in handling complex infrastructure projects, including those with stringent safety and regulatory requirements inherent in nuclear construction, gives them a competitive edge. The U.S. nuclear energy sector alone accounted for about 19% of the nation's electricity generation in 2023, demonstrating a consistent need for advanced power solutions.

Marine Construction and Coastal Resiliency

Kiewit's Marine Construction and Coastal Resiliency segment is poised for significant expansion, particularly after the strategic 2023 acquisition of Weeks Marine. This move substantially bolstered Kiewit's expertise and market presence in critical areas like dredging and projects focused on fortifying coastlines against environmental changes. The company is now well-positioned to capitalize on the anticipated robust growth in this sector over the coming decade, driven by the increasing urgency of climate change adaptation and the ongoing need to modernize port infrastructure.

The demand for coastal resiliency solutions is escalating, with global spending on climate adaptation infrastructure expected to reach hundreds of billions of dollars annually by the late 2020s.

- Market Expansion: The acquisition of Weeks Marine in 2023 significantly broadened Kiewit's footprint in marine construction, enhancing its capabilities in dredging and coastal protection.

- Growth Projections: This sector is anticipated to experience substantial growth over the next decade, fueled by the impacts of climate change and the critical need for port infrastructure upgrades.

- Industry Drivers: Key drivers include rising sea levels, increased storm intensity, and the economic importance of maintaining and improving maritime trade routes and coastal communities.

- Strategic Importance: Kiewit's investment in this area aligns with global trends and governmental initiatives focused on infrastructure resilience and sustainable development.

Large-Scale Water and Wastewater Treatment Projects

Kiewit stands as a significant player in large-scale water and wastewater treatment projects, consistently securing major contracts. Their expertise spans critical infrastructure development, including advanced desalination plants and substantial upgrades to existing treatment facilities.

The sector is experiencing robust expansion, fueled by a growing global need for sustainable water management and the imperative to modernize aging water infrastructure. Kiewit's continued success in this area underscores its strong market position and ability to execute complex, high-value projects.

- Market Leader: Kiewit consistently ranks among the top contractors in the water and wastewater sector.

- Project Scope: They undertake major projects such as desalination plants and comprehensive treatment facility upgrades.

- Growth Drivers: Increased demand for sustainable water solutions and the necessity of infrastructure renewal propel consistent market growth.

- Strategic Position: Kiewit maintains a leading position by effectively leveraging its expertise and capacity in this vital industry.

Kiewit’s involvement in renewable energy, transportation infrastructure, advanced power generation, marine construction, and water/wastewater treatment positions them strongly within the 'Stars' category of the BCG Matrix. These are high-growth, high-market-share segments where Kiewit demonstrates significant capability and demand. The company’s consistent success in these areas indicates a robust strategy for capitalizing on current and future market trends. Their substantial backlog and ongoing project wins in these sectors confirm their status as market leaders.

What is included in the product

The Kiewit BCG Matrix categorizes business units by market share and growth to guide investment decisions.

A Kiewit BCG Matrix visualizes each business unit's market share and growth, simplifying complex portfolio analysis.

Cash Cows

Kiewit's deep roots in traditional heavy civil construction, encompassing highways, bridges, and extensive earthmoving, firmly place this segment as a Cash Cow. This is a mature market where Kiewit has cultivated a significant market share through decades of experience and proven execution.

While the growth rate for these foundational infrastructure projects may not be exponential, they reliably generate consistent revenue streams and healthy profit margins. Kiewit's established operational efficiencies, supply chain advantages, and strong industry reputation contribute to these robust financial returns.

For instance, Kiewit's involvement in major infrastructure initiatives, such as the ongoing expansion of the I-40 in North Carolina and numerous bridge replacement projects across the United States, underscores their enduring strength in this sector. These large-scale, complex endeavors, often valued in the hundreds of millions or even billions of dollars, are a testament to their capabilities and market position.

Kiewit's expertise in oil, gas, and chemical midstream and downstream facilities, including pipelines, processing plants, and terminals, represents a significant Cash Cow. Despite potential market growth challenges, their deep-seated relationships and proven capabilities secure a consistent flow of high-value projects and essential maintenance contracts. In 2024, the energy infrastructure sector, while facing evolving demands, still saw substantial investment, with projects in natural gas processing and refined product terminals contributing to Kiewit's robust backlog.

Kiewit's General Building Construction division, encompassing commercial and institutional projects, serves as a reliable cash cow. This segment includes the development of corporate offices, universities, and arenas, demonstrating Kiewit's diverse building expertise.

While this market is mature, it consistently provides a steady stream of projects, underpinned by Kiewit's established reputation and strong ties with clients. For instance, in 2024, the infrastructure and construction sectors saw significant investment, with Kiewit securing notable contracts in building projects contributing to this stable demand.

Mining Infrastructure and Contract Mining

Kiewit's mining infrastructure and contract mining operations function as a Cash Cow within its business portfolio. This division leverages Kiewit's extensive experience in managing mine sites, constructing essential infrastructure, and executing contract mining projects. The company's deep-seated expertise in established mining territories, coupled with its ability to secure long-term agreements, ensures a consistent and reliable revenue generation, even amidst the inherent volatility of commodity markets.

This sector benefits from a stable income due to Kiewit's established presence and its strategic focus on long-term contracts. For instance, Kiewit has been a significant player in major mining projects globally, demonstrating its capacity to deliver complex infrastructure. In 2024, the demand for critical minerals and metals, driven by energy transition initiatives, continues to bolster the need for robust mining infrastructure and efficient contract mining services.

- Sector Contribution: Contributes a substantial and predictable revenue stream to Kiewit.

- Expertise Leverage: Capitalizes on Kiewit's decades of experience in mine development and operations.

- Market Stability: Benefits from long-term contracts that mitigate short-term commodity price fluctuations.

- Strategic Importance: Underpins Kiewit's broader infrastructure capabilities by supporting resource extraction.

Government Contracts (Maintenance & Upgrades)

Kiewit's government contracts in maintenance and upgrades function as significant cash cows within its business portfolio. These ventures, focusing on critical infrastructure like military bases and flood control systems, are characterized by their long-term nature and predictable revenue streams.

The stability of these multi-year contracts, backed by government funding, ensures a consistent generation of cash flow for Kiewit. For instance, in 2023, Kiewit secured a significant contract with the U.S. Army Corps of Engineers for the ongoing maintenance and upgrades of levee systems along the Mississippi River, a project valued at over $500 million.

- Stable Funding: Government contracts provide a reliable and consistent source of revenue, often insulated from economic downturns.

- Multi-Year Engagements: The long-term nature of these projects allows for predictable cash flow planning and resource allocation.

- Essential Services: Maintenance and upgrades of critical infrastructure, such as military facilities and flood protection, are ongoing needs.

- Reduced Competition: Specialized government contracts can sometimes have fewer competitors, leading to more secure margins.

Kiewit's established presence in the power generation sector, particularly in traditional thermal power plants and transmission infrastructure, functions as a cash cow. This segment benefits from ongoing maintenance, upgrades, and the lifecycle management of existing assets, ensuring a steady demand for Kiewit's services.

The company's deep expertise in building and maintaining these complex facilities, coupled with its strong relationships with utility providers, translates into consistent project flow and profitability. In 2024, investments in modernizing aging power infrastructure and ensuring grid reliability continue to drive demand for these specialized construction services.

Kiewit's water and wastewater infrastructure projects represent another significant cash cow. This sector is characterized by consistent, government-funded initiatives aimed at upgrading and expanding essential public services. Kiewit's extensive experience in large-scale water treatment plants, pipelines, and distribution systems positions them to capitalize on these ongoing capital improvement programs.

The recurring need for water system maintenance and development, driven by population growth and regulatory requirements, provides a stable revenue base. For example, Kiewit's involvement in major municipal water system overhauls, such as those in major metropolitan areas in 2024, highlights the sustained demand and profitability in this essential infrastructure segment.

| Business Segment | BCG Category | Key Characteristics | 2024 Market Relevance |

|---|---|---|---|

| Heavy Civil Construction | Cash Cow | Mature market, high market share, stable revenue. | Ongoing major highway and bridge projects, e.g., I-40 expansion. |

| Oil, Gas & Chemical | Cash Cow | Deep relationships, proven capabilities, consistent high-value projects. | Investments in natural gas processing and refined product terminals. |

| General Building Construction | Cash Cow | Steady project flow, established reputation, strong client ties. | Secured notable contracts in commercial and institutional building. |

| Mining Infrastructure | Cash Cow | Long-term contracts, expertise in established territories, reliable revenue. | Demand for critical minerals bolsters mining infrastructure needs. |

| Government Contracts (Maintenance/Upgrades) | Cash Cow | Long-term, predictable revenue, insulated from economic downturns. | Multi-year contracts for military bases and flood control systems. |

| Power Generation (Traditional) | Cash Cow | Ongoing maintenance and upgrades, consistent project flow. | Modernizing aging power infrastructure and grid reliability. |

| Water & Wastewater Infrastructure | Cash Cow | Consistent, government-funded initiatives, essential public services. | Major municipal water system overhauls. |

What You See Is What You Get

Kiewit BCG Matrix

The Kiewit BCG Matrix preview you're examining is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis is ready for immediate integration into your strategic planning, providing actionable insights for Kiewit's diverse business units.

Dogs

Small-scale, highly competitive local projects represent a segment within the Kiewit BCG Matrix that is generally considered a 'Dog'. These are typically projects where Kiewit's significant scale and specialized expertise, which are its core competitive advantages, are not fully utilized or even necessary. Think of very localized road repairs or small commercial building expansions.

These types of projects are characterized by intense local competition, often from smaller, more agile firms that are deeply entrenched in a specific geographic area. Barriers to entry are low, meaning many players can participate, which drives down profit margins to thin levels. For instance, in 2024, the average profit margin for small general contractors in many regional markets hovered around 2-5%, a stark contrast to the higher margins Kiewit can achieve on its larger, more complex projects where its efficiencies and risk management capabilities shine.

Kiewit's strategic focus, therefore, naturally gravitates away from these 'Dog' segments. The company thrives on large, complex infrastructure and industrial projects, such as major highway construction, power plant development, or large-scale industrial facilities, where its integrated capabilities, robust supply chain, and advanced technology offer a distinct and profitable advantage. In 2023, Kiewit reported revenues exceeding $15 billion, a testament to its success in pursuing these larger, more impactful projects.

Legacy technologies in declining markets, within the Kiewit BCG Matrix framework, represent areas where the company has minimal market share and the overall industry is shrinking. These segments offer limited future growth potential and are characterized by a lack of competitive advantage for Kiewit. For instance, if Kiewit had a small presence in a niche construction segment heavily reliant on outdated industrial machinery that is no longer in demand, it would fit this category. As of 2024, Kiewit's strategic focus is on actively shedding such low-yield, high-risk assets to reinvest in more promising growth areas.

Projects in remote or exceptionally difficult-to-access locations that do not align with Kiewit's strategic regional hubs or large-scale project execution model could be considered Geographically Isolated or Logistically Challenging Small Bids. These projects often present significant hurdles for efficient resource allocation and cost management.

The high mobilization costs associated with these types of bids, coupled with complex logistical requirements, can significantly eat into potential profits. For instance, transporting specialized equipment and personnel to isolated sites can incur substantial expenses, potentially exceeding 20% of the total project cost in some extreme cases, impacting overall bid competitiveness and profitability.

Kiewit's operational strategy focuses on optimizing its footprint and leveraging its existing infrastructure. Consequently, small bids in challenging locations that do not offer strategic advantages or economies of scale are often avoided to maintain focus on core competencies and maximize resource efficiency. This approach helps ensure that Kiewit can deliver value on projects that best fit its capabilities.

Highly Specialized Niche Construction Without Scalability

If Kiewit were to focus on a highly specialized niche in construction that inherently lacks scalability, it would likely be classified as a 'Dog' within the BCG Matrix. This scenario implies a service with limited market growth potential and a narrow scope of application, making it difficult to expand revenue streams or leverage existing expertise across broader projects.

While deep specialization can be a strength, if the market for such a niche service is stagnant or declining, and Kiewit cannot meaningfully increase its market share, its contribution to the company's overall financial health and strategic objectives would be minimal. Kiewit's business model typically thrives on applying its extensive capabilities to a diverse range of projects, a strategy that would be undermined by such a limited focus.

- Limited Market Size: Niche services often cater to a small, specific segment of the construction industry, restricting revenue growth.

- Stagnant or Declining Demand: If the demand for the specialized service is not growing or is shrinking, it becomes a less attractive business area.

- Lack of Synergies: Unlike scalable services, highly specialized niches may not easily integrate with or benefit from Kiewit's broader operational capabilities.

- Resource Allocation Concerns: Maintaining expertise in a non-scalable niche might divert resources that could be better utilized in areas with higher growth and return potential.

Commoditized Basic Material Supply

Direct involvement in the commoditized supply of basic construction materials, where Kiewit lacks a distinct competitive edge through vertical integration or significant scale, could classify this activity as a 'Dog' within the BCG framework. Margins in such markets are typically razor-thin, making it an inefficient use of resources for a company of Kiewit's caliber.

Kiewit's core strength lies in project execution and delivery, not in the speculative trading of raw materials. Acting solely as a low-margin supplier in a mature, stagnant market would dilute their strategic focus and operational efficiency. For instance, while the global construction materials market is substantial, with sectors like aggregates and cement experiencing significant price volatility, Kiewit's competitive advantage stems from its engineering and construction capabilities, not from being a primary material supplier.

Consider the cement industry, a key basic material. In 2024, the average price for Portland cement in the US hovered around $130-$150 per ton, a figure that offers minimal profit margins for a non-integrated supplier. Kiewit's strategic advantage is in managing complex projects, not in competing on price for basic commodities.

- Low Margins: Basic material supply often operates on single-digit profit margins, especially without vertical integration.

- Lack of Differentiation: In commoditized markets, there's little room for product or service differentiation, leading to price-based competition.

- Stagnant Growth: Mature markets for basic materials typically exhibit slow growth, not aligning with Kiewit's growth objectives.

- Strategic Misalignment: Kiewit's focus on large-scale project delivery is fundamentally different from raw material trading.

Dogs in the Kiewit BCG Matrix represent business segments with low market share and low growth potential, often characterized by intense competition and thin profit margins. These are typically smaller, localized projects where Kiewit's scale advantages are not fully leveraged, or niche services in stagnant markets. As of 2024, Kiewit actively seeks to divest from or minimize involvement in these 'Dog' areas to reallocate resources towards higher-growth, higher-return opportunities that align with its core competencies in large-scale infrastructure and industrial projects.

These segments are often characterized by low barriers to entry, leading to price wars and reduced profitability. For instance, in 2024, small, localized construction projects often saw profit margins in the single digits, significantly below the double-digit margins Kiewit can achieve on its large, complex endeavors. Kiewit's strategic imperative is to focus on ventures where its expertise in engineering, procurement, and construction (EPC) can command premium pricing and deliver substantial value.

The company's success, evidenced by its over $15 billion in revenue in 2023, is built on tackling projects that require sophisticated management, advanced technology, and robust supply chain capabilities. These 'Dog' segments, by contrast, offer limited opportunities for innovation or competitive differentiation, making them strategically unattractive for a company of Kiewit's stature.

Consider the following comparison of market characteristics for Kiewit's typical project types versus 'Dog' segments:

| Characteristic | Kiewit's Core Business (Stars/Cash Cows) | 'Dog' Segments (e.g., Small Local Projects, Stagnant Niches) |

|---|---|---|

| Market Share | High | Low |

| Market Growth | High | Low/Declining |

| Profit Margins (2024 Est.) | 10-20%+ | 2-5% |

| Competitive Advantage | Scale, Expertise, Technology | Limited/Commoditized |

| Strategic Focus | Large Infrastructure, Industrial, Energy | Divestment/Minimal Involvement |

Question Marks

Kiewit is strategically positioning itself in the carbon capture and hydrogen production sectors, recognizing them as high-growth emerging markets. These areas represent future opportunities, even though their current market share is modest.

The company's involvement in these nascent technologies is driven by the anticipation of significant future demand. For instance, the global carbon capture market is projected to reach over $40 billion by 2030, with hydrogen production infrastructure also experiencing rapid expansion.

These ventures require considerable investment to establish a leadership position. Kiewit's commitment to these capital-intensive projects underscores their long-term vision for dominating these emerging energy landscapes.

Kiewit is actively integrating advanced digital construction technologies, including AI, machine learning, and AR/VR, into its operations. The construction industry is seeing significant growth in these areas, with the global construction technology market projected to reach $143.9 billion by 2025. Kiewit's focus is on leveraging these tools to enhance project delivery and efficiency.

While Kiewit utilizes these technologies extensively internally, its market share in offering them as a distinct service to external clients is still in its nascent stages. This positions advanced digital construction technologies as a high-potential area for Kiewit, characterized by rapid technological advancement but currently a relatively low share of the market in terms of external service provision.

Smart city infrastructure development, encompassing integrated urban systems like advanced sensor networks and intelligent transportation, is a rapidly expanding market. Kiewit's broad experience in diverse infrastructure projects provides a strong base for entering this sector.

While Kiewit has a presence in areas like intelligent transportation, its specific market share in fully integrated smart city solutions is likely still developing. The global smart city market was valued at over $1.6 trillion in 2023 and is projected to reach nearly $5 trillion by 2030, indicating significant growth potential.

Kiewit's ability to leverage its existing capabilities in areas such as construction, engineering, and technology integration positions it to capitalize on this trend. The company’s investment in digital transformation and innovation will be key to its success in this high-growth, evolving market.

Small Modular Reactor (SMR) Construction

Kiewit's role as a lead constructor for advanced nuclear projects, including potential Small Modular Reactor (SMR) developments, places them in a burgeoning, high-growth sector of the power industry.

While the commercial rollout of SMRs is still nascent, Kiewit's early involvement signals substantial future potential, positioning them to capture significant market share as this technology matures.

- Market Potential: The global SMR market is projected to reach tens of billions of dollars by the early 2030s, with significant investment anticipated from governments and private entities in North America and Europe.

- Kiewit's Position: As a constructor with extensive experience in complex infrastructure and energy projects, Kiewit is well-positioned to capitalize on this growth, though current market share in SMR construction is minimal due to the technology's early stage.

- Growth Trajectory: The anticipated rapid expansion of SMR deployment over the next decade presents a "question mark" opportunity for Kiewit, requiring strategic investment and execution to convert potential into market leadership.

Specialized Data Center Infrastructure (beyond power)

Kiewit's current focus on building power plants for data centers positions them well, but the broader data center construction and fit-out market, beyond just power, represents a potential Question Mark. This segment is experiencing substantial growth, with the global data center construction market valued at approximately $200 billion in 2023 and projected to reach over $300 billion by 2028, according to various industry reports. Kiewit's direct involvement in the highly specialized and rapidly evolving areas of data center building and fit-out could offer significant opportunities, provided they cultivate the necessary expertise.

To capitalize on this growing market, Kiewit would need to invest in developing specialized skills and technologies related to advanced cooling systems, specialized IT infrastructure integration, and sophisticated building management systems. The demand for hyperscale and edge data centers, which require highly specific environmental controls and networking capabilities, is a key driver of this expansion. For instance, the market for data center cooling alone is expected to grow significantly, with some projections indicating a compound annual growth rate (CAGR) of over 10% in the coming years.

Key considerations for Kiewit in this Question Mark area include:

- Developing specialized expertise in advanced cooling technologies and environmental controls.

- Gaining proficiency in integrating complex IT infrastructure and networking solutions.

- Acquiring knowledge of hyperscale and edge data center design and construction requirements.

- Understanding the evolving regulatory and sustainability demands within the data center industry.

Question Marks represent business units or products with low market share but high growth potential. Kiewit's involvement in emerging technologies like advanced nuclear construction and specialized data center infrastructure fits this category. These areas demand significant investment to develop expertise and market presence.

For Kiewit, these segments are characterized by rapid market expansion, such as the projected growth in the global smart city market, which was valued at over $1.6 trillion in 2023 and is expected to reach nearly $5 trillion by 2030. Successfully navigating these Question Marks will require strategic capital allocation and a focus on building specialized capabilities to capture future market leadership.

| Business Area | Market Growth Potential | Kiewit's Current Market Share | Strategic Implication |

|---|---|---|---|

| Advanced Nuclear (SMRs) | High (Tens of billions by early 2030s) | Low (Nascent technology) | Requires investment to build expertise and secure early projects. |

| Specialized Data Center Construction | High (Global market ~ $200B in 2023, projected > $300B by 2028) | Developing (Focus on power, expanding to fit-out) | Needs development of specialized skills in cooling, IT integration, and advanced design. |

| Smart City Infrastructure | High (Projected ~$5T by 2030 from $1.6T in 2023) | Developing (Broad infrastructure experience, specific smart city solutions nascent) | Leverage existing capabilities and integrate new technologies for comprehensive solutions. |

BCG Matrix Data Sources

This BCG Matrix leverages comprehensive data, including financial reports, market share analysis, industry growth rates, and competitive intelligence, to provide a robust strategic framework.