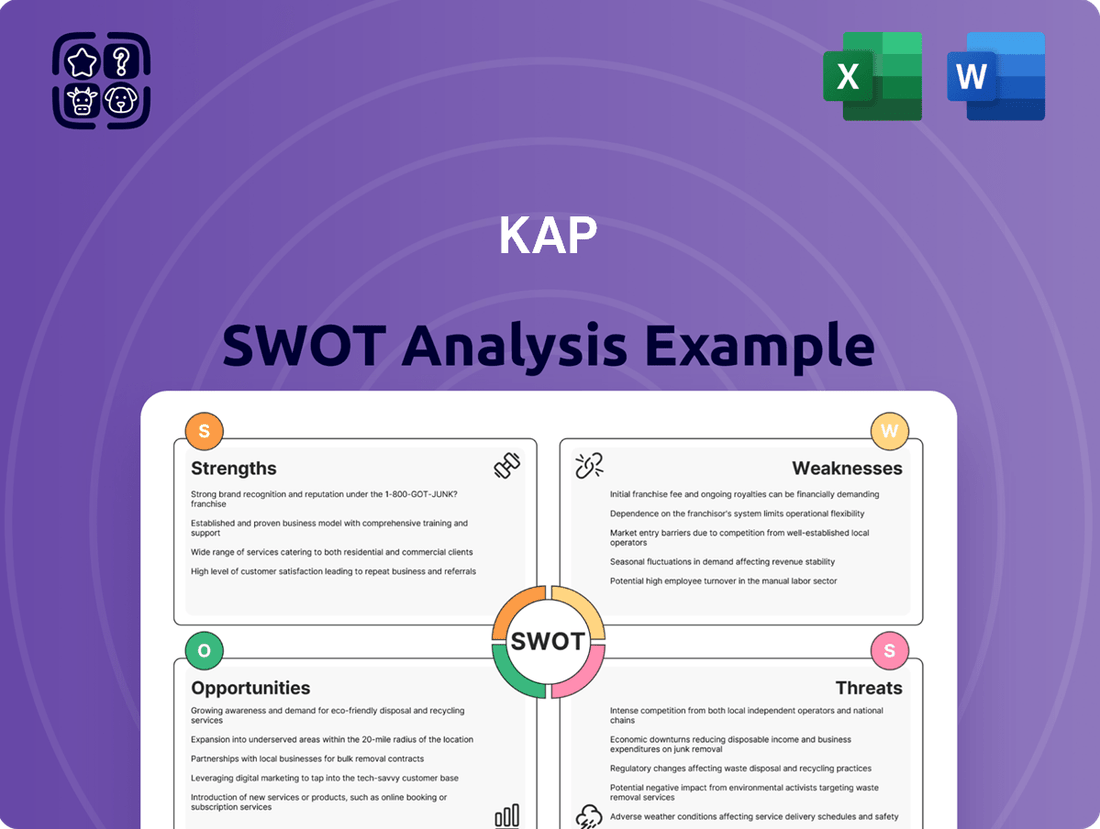

KAP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KAP Bundle

Understanding KAP's market position requires more than just a glimpse. Our comprehensive SWOT analysis dives deep into their unique strengths, potential weaknesses, exciting opportunities, and critical threats.

This in-depth report is your key to unlocking actionable strategies and informed decision-making for any business venture.

Want to move beyond the highlights and grasp the full strategic landscape of KAP?

Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Get the detailed breakdowns and expert commentary you need to strategize with confidence.

Strengths

KAP Industrial Holdings benefits significantly from its diversified business portfolio, which encompasses sectors like logistics, chemicals, and a range of industrial products. This spread across different industries acts as a crucial buffer, providing resilience against economic downturns that might disproportionately affect any single sector. For instance, in the fiscal year ending June 30, 2024, KAP reported that its diverse operations contributed to a stable revenue base, demonstrating the strength of this strategic advantage.

This broad operational footprint translates into more stable revenue streams and a substantial mitigation of risks tied to market volatility in specific industries. KAP’s key operating segments, including PG Bison, Safripol, Unitrans, Feltex, Restonic, and Optix, collectively form a robust and varied revenue generation engine. This variety ensures that the company is not overly reliant on the performance of any one segment, a key factor in maintaining financial stability and predictability.

KAP's strategic capital investments are a major strength, as seen with the R2 billion investment in a new MDF line for PG Bison. This significant expenditure is designed to solidify its leading position in the market and cater to escalating demand.

While these investments may temporarily affect short-term profits, they are crucial for KAP's long-term trajectory. The company is clearly focused on expanding its market share, especially within the lucrative wood-based decorative panels sector.

For instance, the PG Bison MDF line is projected to enhance production capacity by an estimated 35% upon full commissioning, directly addressing anticipated market growth. This proactive approach to capital allocation signals a commitment to sustainable future performance and competitive advantage.

KAP's commitment to operational excellence is a significant strength. The company has actively pursued restructuring and efficiency measures, which have demonstrably boosted profitability. For instance, Unitrans underwent a major organizational redesign, a key initiative aimed at optimizing asset utilization and cutting costs.

These strategic improvements are designed to enhance the overall efficiency across KAP's varied business segments. By focusing on leaner operations and better resource management, KAP is better positioned to navigate difficult market conditions and maintain a competitive edge.

Strong Market Position and Leadership Ambitions

KAP's ambition is to secure leading market positions across its diverse operating sectors. This strategy is built upon its robust presence, particularly in South Africa, and its expanding international footprint. The company is actively investing in areas with significant growth potential, aiming to solidify its competitive advantage.

The company's strategic roadmap includes developing capabilities to compete on a global scale. By enhancing its offerings and operational efficiencies, KAP intends to create substantial barriers to entry for emerging competitors. This proactive approach is designed to sustain its market leadership and profitability.

- Established Market Presence: KAP benefits from a strong foundation in South Africa, providing a solid base for expansion.

- Global Competitiveness Drive: The company is actively investing in strategies to enhance its global competitiveness.

- Raising Barriers to Entry: KAP's strategic investments are aimed at creating significant hurdles for potential competitors.

- Growth Potential Focus: Investments are strategically directed towards industries and segments demonstrating high growth potential.

Commitment to Sustainability and Community Engagement

KAP's commitment to sustainability is woven into its core business strategies, with a strong focus on environmental, social, and governance (ESG) principles. This approach aims to create lasting social and economic value while minimizing environmental impact.

The company actively engages in community development and environmental responsibility, exemplified by initiatives such as Safripol's significant plastic waste recycling efforts. In 2024, Safripol reported recycling over 100,000 tonnes of plastic, contributing to a circular economy and reducing landfill burden.

Furthermore, KAP's sponsorship of the KAP sani2c event highlights its dedication to community upliftment and promoting active lifestyles. This event not only fosters community engagement but also supports local economies along its routes, demonstrating a tangible commitment beyond purely commercial interests.

- ESG Integration: KAP embeds ESG standards into its commercial strategies, ensuring a responsible business model.

- Plastic Recycling: Safripol's operations recycled over 100,000 tonnes of plastic in 2024, showcasing environmental stewardship.

- Community Support: The KAP sani2c event demonstrates a commitment to community development and economic contribution.

- Long-Term Value: These initiatives aim to create sustainable social and economic benefits for all stakeholders.

KAP's diversified business model across logistics, chemicals, and industrial products provides significant resilience against sector-specific downturns. This broad operational base, featuring segments like PG Bison and Unitrans, contributes to stable revenue streams and mitigates market volatility risks. The company's strategic capital investments, such as the R2 billion for PG Bison's new MDF line, are designed to enhance capacity and market position, projecting a 35% production increase upon commissioning. Furthermore, KAP’s focus on operational efficiency, including Unitrans’ organizational redesign, boosts profitability and competitive advantage.

| Segment | Key Strength | Recent Data/Investment |

|---|---|---|

| PG Bison | Market leadership in wood-based panels | R2 billion investment in new MDF line; 35% projected capacity increase |

| Unitrans | Optimized asset utilization and cost reduction | Major organizational redesign implemented |

| Safripol | Environmental stewardship and circular economy focus | Recycled over 100,000 tonnes of plastic in 2024 |

| Overall KAP | Diversified portfolio, global competitiveness drive | Strong South African presence, growing international footprint |

What is included in the product

Analyzes KAP’s competitive position by examining its internal strengths and weaknesses alongside external opportunities and threats.

Offers a structured framework to systematically identify and address internal weaknesses and external threats, thereby alleviating strategic uncertainty.

Weaknesses

KAP's financial performance is notably vulnerable to shifts in the broader economic landscape. For instance, the company recently issued a profit warning for its 2025 fiscal year, anticipating lower annual earnings. This downward revision was directly attributed to prevailing challenging trading conditions.

Key factors contributing to this vulnerability include dampened consumer and business sentiment, exacerbated by delays in national budget announcements. Such delays create uncertainty, impacting investment decisions and overall market activity, which in turn affects KAP's revenue streams.

Furthermore, potential impacts stemming from international trade conflicts pose a significant risk. These conflicts can disrupt supply chains, increase operational costs, and reduce demand for KAP's products and services, highlighting its susceptibility to global geopolitical events.

Despite efforts towards diversification, KAP remains intrinsically linked to the economic health and political stability of its primary operating regions. Unforeseen macroeconomic downturns or political instability can therefore have a disproportionate negative effect on the company's profitability and growth prospects.

KAP's underperforming business units, specifically Unitrans and Feltex, have been a notable weakness. Unitrans, for instance, has been grappling with challenging trading conditions, leading to a deep restructuring effort aimed at shedding low-margin activities.

This focus on 'fixing underperformers' highlights that certain segments are actively hindering overall profitability, demanding substantial management attention and resource allocation. For example, KAP’s 2024 interim results showed a decline in Unitrans’s revenue, underscoring the ongoing difficulties.

KAP's significant capital expenditure, while aimed at future growth, has presented a near-term challenge to profitability. The ramp-up phase for projects like the new PG Bison MDF line, for instance, has directly impacted EBITDA and cash flow from operations negatively. This is a common scenario where substantial upfront investment costs temporarily suppress immediate financial returns.

Exposure to Automotive Sector Volatility

KAP's reliance on the automotive sector presents a notable weakness, as evidenced by its performance in segments like Feltex and certain engineered products. Weak customer demand within this industry directly translates to lower sales volumes and profitability for these divisions.

This sensitivity means that KAP's financial results can be significantly swayed by the cyclical nature of vehicle production. For instance, a slowdown in automotive manufacturing, even if temporary, can create operational constraints for KAP's OEM customers, directly impacting KAP's ability to generate revenue.

- Automotive Sector Sensitivity: KAP's Feltex and engineered products segments are highly susceptible to fluctuations in automotive demand.

- Impact on Sales and Profitability: Weak customer demand and OEM operational issues directly reduce KAP's sales volumes and profit margins in affected areas.

- Cyclicality Risk: The inherent cyclicality of the automotive industry exposes KAP to unpredictable swings in performance.

Net Debt Levels and Deleveraging Efforts

While KAP's balance sheet is generally viewed as solid, its net interest-bearing debt stood at R9.3 billion as of the latest reporting period. This level of debt, though stable, may constrain financial maneuverability in the near to medium term. The company has clearly articulated a strategic objective to significantly reduce this debt burden over the next few years. This deleveraging initiative is a key focus for management, indicating that managing debt levels is a priority to enhance financial resilience.

The ongoing commitment to debt reduction highlights potential challenges related to financial flexibility. KAP's focus on deleveraging suggests that current debt levels could impact its capacity for future investments or its ability to weather economic downturns.

- Debt Stability: KAP's net interest-bearing debt remained at R9.3 billion, signaling a need for active management.

- Deleveraging Target: The company has set ambitious goals to reduce its debt in the coming years.

- Financial Flexibility: High debt levels could potentially limit KAP's strategic options and operational agility.

- Management Focus: Deleveraging is a critical strategic priority for KAP's leadership.

KAP's profitability is hampered by underperforming divisions like Unitrans and Feltex, which require significant management attention and resources. For example, Unitrans's revenue declined in the first half of 2024 due to challenging trading conditions, necessitating a deep restructuring to remove low-margin activities.

The company's substantial capital expenditures, such as the new PG Bison MDF line, have negatively impacted EBITDA and cash flow in the short term during their ramp-up phases. This investment strategy, while geared for future growth, temporarily suppresses immediate financial returns.

KAP's reliance on the automotive sector makes it vulnerable to demand fluctuations. Weak customer demand and operational constraints faced by Original Equipment Manufacturers (OEMs) directly reduce sales volumes and profitability for KAP's automotive-related segments, including Feltex.

The company's net interest-bearing debt stood at R9.3 billion as of the latest reporting period, which, while stable, could limit financial flexibility for future investments or weathering economic downturns. KAP has prioritized debt reduction, highlighting this as a key strategic objective for enhanced financial resilience.

| Weakness | Description | Financial Impact/Data |

|---|---|---|

| Underperforming Units | Unitrans and Feltex require significant resources due to challenging trading conditions and low margins. | Unitrans revenue declined H1 2024; restructuring underway. |

| High Capital Expenditure | Recent large investments negatively impact short-term profitability and cash flow. | New PG Bison MDF line ramp-up suppressed EBITDA and operating cash flow. |

| Automotive Sector Dependence | Vulnerability to automotive industry cycles and OEM operational issues. | Segments like Feltex directly impacted by weak automotive demand. |

| Debt Levels | Net interest-bearing debt of R9.3 billion may constrain financial flexibility. | Strategic priority to significantly reduce debt over coming years. |

Full Version Awaits

KAP SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

KAP is well-positioned to capitalize on the substantial value expected from its recently completed major capital projects, most notably PG Bison's new MDF line. This significant investment unlocks enhanced production capabilities.

The ongoing ramp-up of sales volumes from these projects presents a direct opportunity to translate increased capacity into tangible revenue growth. For instance, PG Bison's new MDF line is designed to significantly boost output, aiming to meet growing market demand.

This expansion in production capacity is anticipated to drive improved profitability by leveraging economies of scale and optimizing operational efficiencies. The increased output volume directly correlates with the potential for higher earnings as market penetration deepens.

Financial projections for 2024 and 2025 indicate a strong upward trajectory for KAP's revenue, directly attributable to the full operationalization of these capital investments. This strategic deployment of capital is expected to be a key driver of financial performance.

KAP's strategic investments are focused on tapping into burgeoning demand, both within its home market and through export avenues, with a significant emphasis on the African continent. This forward-looking approach is designed to broaden the company's market penetration and leverage the escalating demand observed in emerging economies and for particular product lines.

For instance, by the end of 2024, projections indicated that the African consumer electronics market alone was expected to reach over $20 billion, demonstrating the substantial growth potential KAP aims to capture. The company's proactive engagement in these regions positions it to benefit from favorable demographic trends and increasing disposable incomes.

These expansion efforts are not merely opportunistic but are underpinned by KAP's commitment to developing products and services that resonate with the specific needs of these growing markets. By tailoring its offerings, KAP can solidify its presence and cultivate strong customer loyalty, further enhancing its export capabilities.

Furthermore, KAP's export strategy is being bolstered by investments in logistics and distribution networks, ensuring efficient product delivery and market access. This infrastructure development is crucial for effectively serving a wider customer base and capitalizing on the increasing global appetite for KAP's innovative solutions.

KAP's focus on technology-enabled driver behavior management solutions highlights a strategic embrace of digital transformation. This existing segment positions them well to capitalize on the growing demand for efficiency and safety in transportation and logistics. For instance, in 2024, the global logistics technology market was valued at approximately $60 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, indicating a substantial opportunity for companies like KAP.

By further integrating advanced technologies, such as AI-powered analytics for route optimization, predictive maintenance for fleets, and real-time supply chain visibility, KAP can unlock significant operational efficiencies and cost savings. This digital-first approach can also pave the way for innovative service offerings, potentially creating new revenue streams and strengthening their competitive advantage in the evolving industrial landscape.

Strategic Acquisitions and Portfolio Optimization

KAP's strategic acquisitions and portfolio optimization present a significant opportunity for growth. Historically, the company has demonstrated a capacity for refining its business mix, exemplified by the 2022 divestiture of its precision components segment. This move allowed KAP to sharpen its focus on core, higher-margin areas, a strategy that can be further leveraged.

Looking ahead, KAP can actively pursue acquisitions that complement its existing strengths and expand its market reach. For instance, acquiring businesses in adjacent technology sectors could unlock new revenue streams and enhance its competitive positioning. This proactive approach to portfolio management, including potential divestments of underperforming assets, can drive improved profitability and shareholder value.

Key aspects of this opportunity include:

- Targeted acquisitions to gain market share or technological capabilities in high-growth segments.

- Divestment of non-core assets to free up capital for more strategic investments.

- Synergistic integration of acquired businesses to realize cost savings and revenue enhancements.

- Continuous portfolio review to ensure alignment with evolving market trends and long-term financial goals.

Increasing Demand for Sustainable Products and Solutions

KAP's chemical division, Safripol, is well-positioned to capitalize on the escalating global demand for sustainable products. Its expertise in plastic waste recycling directly addresses the market's shift towards eco-friendly materials. This focus aligns perfectly with the growing adoption of circular economy principles by consumers and businesses alike.

The increasing preference for sustainable options presents a significant growth avenue for KAP. For instance, the global market for recycled plastics was valued at approximately USD 48.4 billion in 2023 and is projected to reach USD 73.5 billion by 2030, growing at a CAGR of 6.2% during the forecast period. This trend indicates a substantial opportunity for Safripol to expand its market share and revenue streams by offering innovative, recycled-content solutions.

- Meeting growing consumer and regulatory pressure for environmentally responsible products.

- Leveraging Safripol's capabilities in plastic waste recycling to create value-added, sustainable materials.

- Capitalizing on the expanding global market for recycled plastics, projected for significant growth in the coming years.

KAP's strategic investments in new capital projects, particularly PG Bison's new MDF line, are poised to drive significant revenue growth through increased production capacity. This expansion is expected to improve profitability by leveraging economies of scale, with financial projections for 2024 and 2025 showing a strong upward revenue trajectory driven by these operational enhancements.

The company's focus on expanding into burgeoning African markets, targeting sectors like consumer electronics where demand is projected to exceed $20 billion by the end of 2024, presents a clear opportunity for market penetration and revenue diversification.

KAP's embrace of technology in driver behavior management, within a global logistics technology market valued at approximately $60 billion in 2024 and growing, allows for enhanced operational efficiencies and new service offerings.

Strategic acquisitions and portfolio optimization, building on past successes like the 2022 divestiture of its precision components segment, offer avenues to expand market reach and capitalize on synergistic integration opportunities.

Safripol's expertise in plastic waste recycling positions KAP to capitalize on the growing demand for sustainable products, tapping into a global recycled plastics market projected to reach USD 73.5 billion by 2030.

Threats

KAP is vulnerable to economic volatility, with persistent high inflation and elevated interest rates posing significant threats. For instance, the US inflation rate hovered around 3.3% in early 2024, still above the Federal Reserve's 2% target, and interest rates remained restrictive. This environment directly impacts consumer purchasing power and business investment decisions, potentially reducing demand for KAP's products and services.

Broader macroeconomic uncertainty, including geopolitical tensions and potential recessions in key markets, further exacerbates these risks. Such conditions can lead to dampened market sentiment, making consumers and businesses more cautious with spending. This hesitancy can translate into slower sales growth and increased pressure on KAP's revenue streams throughout 2024 and into 2025.

KAP faces considerable threats from intense competition across its varied business segments. In the logistics sector, for example, the market is crowded with numerous established local and global carriers, making it challenging to maintain significant market share and pricing flexibility. Similarly, the chemicals and industrial products industries are characterized by large, well-capitalized competitors, often with economies of scale that KAP must actively counter.

This broad competitive landscape directly affects KAP's ability to dictate pricing and can lead to margin erosion if cost management isn't rigorously maintained. For instance, in the industrial gases segment, major international players often set benchmarks that can pressure local producers like KAP. The company must constantly innovate and optimize operations to avoid losing ground to rivals who may have superior cost structures or technological advantages.

KAP, as a broad industrial group, faces significant threats from supply chain disruptions and fluctuating raw material prices. For instance, the global semiconductor shortage that extended into 2024 continued to impact manufacturing across various sectors, potentially increasing lead times and costs for components KAP relies on. Geopolitical tensions, such as those impacting energy markets in late 2024, can directly influence the cost of key inputs like metals and petrochemicals, squeezing profit margins and affecting production schedules.

While KAP's diversified operations offer some resilience, its intricate global supply chains remain vulnerable. Unexpected events, like extreme weather impacting agricultural yields in 2024 or localized port congestion, can still cause significant ripple effects. These disruptions can lead to material shortages, driving up procurement costs and hindering KAP's ability to meet production targets, thereby impacting overall operational efficiency and profitability.

Regulatory and Political Instability in Operating Regions

Uncertainty stemming from delayed national budget approvals, particularly in South Africa, significantly dampens business confidence and hampers operational predictability for companies like KAP. Political instability in key operating regions creates a volatile environment where strategic planning becomes increasingly challenging.

The potential for sudden regulatory shifts or alterations in government policy presents a tangible threat. For instance, changes in mining legislation or environmental regulations could directly impact KAP's resource-intensive operations or its manufacturing divisions, affecting costs and market access.

- South Africa's fiscal challenges: Delays in budget approvals contribute to economic uncertainty, impacting investor sentiment and capital expenditure decisions.

- Policy unpredictability: Shifts in government priorities can lead to unexpected regulatory changes affecting key industries where KAP operates.

- Geopolitical risks: Broader political instability in Africa can disrupt supply chains and affect market demand for KAP's diverse product range.

Impact of Load Shedding and Energy Constraints

Load shedding in South Africa presents a significant threat to KAP's operations, especially its manufacturing segments. In 2023, South Africa experienced an unprecedented number of load shedding hours, impacting businesses across all sectors. This unreliability in power supply directly translates to production stoppages, leading to lost output and revenue.

The need for backup power solutions, such as generators and fuel, substantially increases operating costs for KAP. These expenses can erode profit margins, making it harder to compete with businesses in regions with stable energy grids. Such disruptions also affect delivery schedules and customer satisfaction, potentially damaging brand reputation.

- Production Delays: Frequent power outages halt manufacturing processes, causing backlogs and missed deadlines.

- Increased Costs: Investment in and maintenance of backup power systems, along with fuel costs, add a significant financial burden.

- Reduced Competitiveness: Higher operational expenses due to load shedding can make KAP's products less price-competitive in the market.

- Supply Chain Disruptions: The impact extends beyond KAP's direct operations, potentially affecting the reliability of its suppliers and distributors.

KAP faces significant threats from a highly competitive landscape across its diverse business units, including logistics, chemicals, and industrial products. Intense competition can lead to pricing pressures and potential margin erosion, especially when larger competitors leverage economies of scale. For instance, major international players in industrial gases often set price benchmarks that can impact local producers.

Macroeconomic volatility, characterized by persistent inflation and high interest rates, remains a key threat. In early 2024, US inflation was around 3.3%, still above the Federal Reserve's 2% target, impacting consumer spending and business investment. Geopolitical tensions and recession risks further amplify this uncertainty, potentially dampening market demand for KAP's offerings throughout 2024 and 2025.

| Threat Category | Specific Threat | Impact on KAP | Example Data/Context |

|---|---|---|---|

| Economic Volatility | High Inflation & Interest Rates | Reduced consumer purchasing power, decreased business investment, potential demand slowdown. | US inflation ~3.3% (early 2024), Federal Reserve rates restrictive. |

| Competitive Landscape | Intense Competition | Pricing pressure, margin erosion, difficulty maintaining market share. | Crowded logistics market, large global players in chemicals/industrial products. |

| Supply Chain & Operations | Disruptions & Raw Material Price Fluctuations | Increased costs, production delays, hindered output. | Extended semiconductor shortage (into 2024), geopolitical impact on energy/petrochemical prices. |

| Political & Regulatory | Policy Uncertainty & Instability | Hampers planning, potential for adverse regulatory shifts impacting operations. | South African budget approval delays, potential changes in mining/environmental legislation. |

| Infrastructure | Load Shedding (South Africa) | Production stoppages, increased operating costs for backup power, reduced competitiveness. | Record load shedding hours in South Africa during 2023. |

SWOT Analysis Data Sources

This KAP SWOT analysis is built upon comprehensive data from financial reports, internal operational metrics, and customer feedback surveys to provide a well-rounded and actionable assessment.