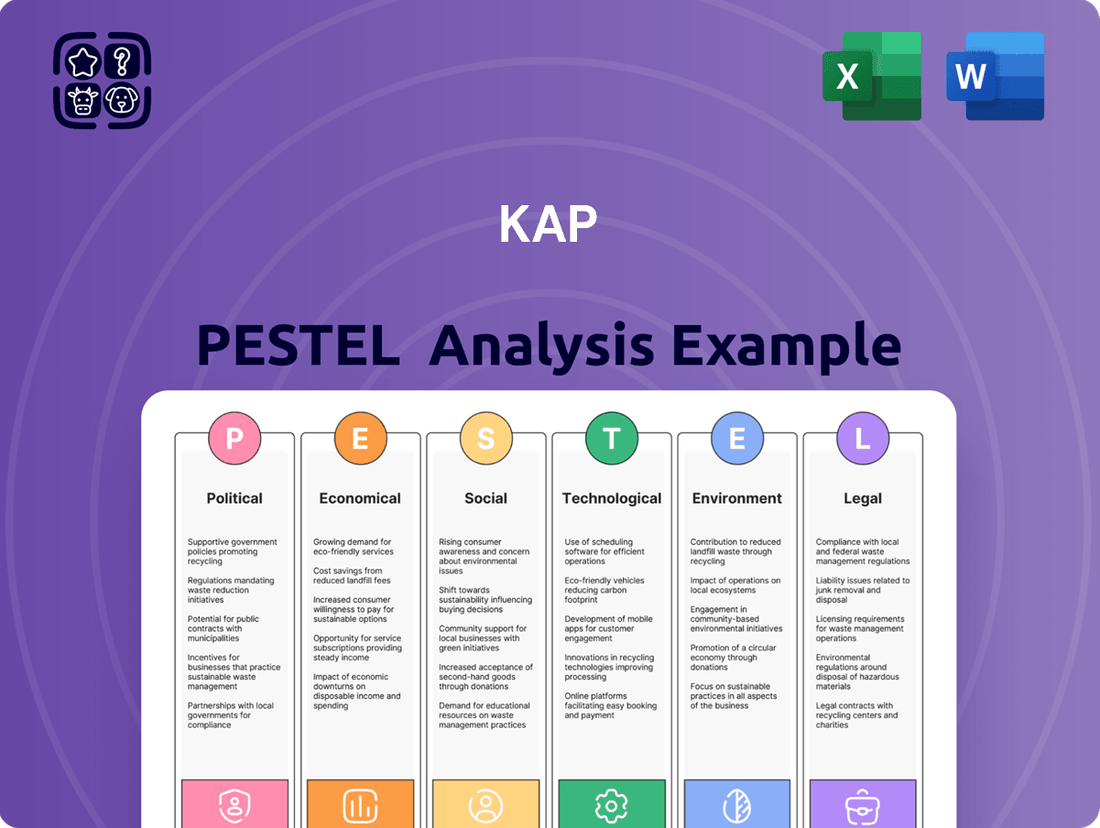

KAP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KAP Bundle

Unlock a strategic advantage for KAP with our comprehensive PESTLE analysis. Understand the intricate political, economic, social, technological, legal, and environmental factors influencing KAP's present and future. This expertly crafted report provides actionable intelligence to inform your business strategy and decision-making. Don't guess about external forces—know them. Purchase the full PESTLE analysis now and gain the clarity you need to thrive.

Political factors

The stability of the South African government and its policy direction are crucial for KAP's operational landscape. For instance, the outcome of the May 2024 general elections, resulting in a coalition government, introduces a new dynamic that could influence policy continuity or necessitate adjustments to strategic planning.

Major policy shifts, especially those impacting industrial sectors where KAP operates, can create both uncertainties and new avenues for growth. The government's approach to economic reforms and support for manufacturing will directly shape KAP's future investment decisions and market access.

South Africa's industrial policy, exemplified by the National Industrial Policy Framework (NIPF) and its subsequent Master Plans, actively seeks to bolster local manufacturing and value-adding sectors. These initiatives are designed to foster domestic production and reduce reliance on imports, creating a more robust industrial base.

KAP, with its diverse industrial operations, is well-positioned to leverage these government-led efforts. The company can potentially benefit from incentives, grants, and preferential procurement policies aimed at stimulating local production, enhancing the beneficiation of raw materials, and ultimately driving job creation within South Africa.

For instance, government support for renewable energy components manufacturing could directly benefit KAP's operations in this space. In 2023, South Africa's renewable energy independent power producer procurement program saw significant investment, and similar support for local content could translate into tangible advantages for KAP.

South Africa's trade policies significantly shape KAP's international operations, impacting everything from raw material sourcing for its packaging division to the export of its consumer products. For instance, South Africa's participation in regional trade blocs like the African Continental Free Trade Area (AfCFTA) could open new markets, while potential shifts towards protectionism might increase duties on imported components, affecting cost of goods sold. In 2024, South Africa continued to navigate complex global trade relations, with ongoing discussions around tariff adjustments and compliance with international standards playing a crucial role.

Geopolitical shifts and global trade uncertainty present tangible headwinds for KAP. Changes in international relations can disrupt supply chains, as seen with global shipping challenges and fluctuating commodity prices that directly affect KAP's logistics and chemical segments. The ongoing volatility in global trade, particularly concerning major economies, directly influences market access and the cost-competitiveness of KAP's diverse product portfolio, impacting its overall growth trajectory.

Black Economic Empowerment (BEE) Regulations

Black Economic Empowerment (BEE) regulations in South Africa are designed to rectify past economic injustices by fostering greater involvement of Black South Africans in the economy. KAP Industrial Holdings must carefully manage these policies, which affect key areas such as procurement preferences, ownership stakes, employment quotas, and supplier development programs. These factors directly influence operational expenses and the company's standing within society.

The implementation of BEE can affect KAP's cost of doing business. For instance, preferential procurement policies might require sourcing from BEE-compliant suppliers, potentially at a higher cost than non-compliant alternatives. Similarly, meeting ownership and employment equity targets often involves strategic investments in human capital development and potentially restructuring ownership to include Black partners, all of which represent financial commitments.

Navigating BEE compliance is crucial for KAP's long-term sustainability and market access. Failing to meet these requirements can result in significant penalties or exclusion from government tenders and certain private sector contracts. Staying abreast of evolving BEE codes, such as the revised BEE Codes of Good Practice effective from 2015, which emphasize skills development and enterprise and supplier development, is therefore paramount.

- Procurement: BEE compliance influences purchasing decisions, potentially increasing input costs.

- Ownership: Meeting Broad-Based Black Economic Empowerment Act (BBBEE Act) ownership targets requires strategic equity adjustments.

- Employment Equity: Adhering to employment equity plans and targets for Black representation is a continuous operational focus.

- Skills Development: Investment in training and development programs for Black employees is a key BEE metric, impacting human resources budgets.

Regulatory Environment and Compliance Enforcement

The regulatory landscape for KAP is shaped by evolving legislation and stringent enforcement across its key sectors. In 2024, for instance, the European Union continued to emphasize stricter environmental regulations, impacting the chemical industry with potential compliance costs for emissions and waste management. This also extends to logistics, where new mandates on driver hours and vehicle emissions could affect operational efficiency.

Compliance with competition laws remains a significant factor, with authorities actively monitoring market concentration. For diversified industrial products, adherence to evolving safety and quality standards, such as updated ISO certifications, is paramount. A notable trend observed through late 2024 and into 2025 is increased scrutiny on supply chain transparency, potentially requiring KAP to invest in more robust tracking and reporting systems.

- Increased regulatory oversight in logistics: Potential impact on operational costs due to new emissions standards for commercial vehicles, with some reports suggesting a 5-10% increase in fleet maintenance expenses for compliance by 2025.

- Chemical industry compliance: Ongoing adaptation to REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations in Europe, with anticipated higher costs for data submission and chemical safety assessments.

- Competition law enforcement: Continued focus on anti-trust practices, potentially leading to stricter merger and acquisition reviews for companies operating in KAP's diversified industrial product segments.

- Supply chain transparency mandates: Emerging requirements for enhanced traceability in global trade, potentially necessitating investments in technology solutions to track raw materials and finished goods.

The political landscape in South Africa, particularly following the May 2024 general elections and the formation of a coalition government, presents a dynamic environment for KAP. Government policies on industrial development and local content requirements, such as those embedded in the National Industrial Policy Framework, aim to boost domestic manufacturing and beneficiation, which KAP can leverage through incentives and preferential procurement. Trade policies, including South Africa's engagement with the African Continental Free Trade Area (AfCFTA), offer potential market expansion, while geopolitical shifts can impact supply chains and commodity prices, directly affecting KAP's chemical and logistics segments.

What is included in the product

The KAP PESTLE Analysis systematically examines the external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that influence the Knowledge, Attitude, and Practices (KAP) related to a specific subject or industry.

Provides a clear, actionable framework to identify and mitigate external threats, transforming complex market dynamics into manageable strategic opportunities.

Economic factors

South Africa's economic growth is expected to remain subdued, with a projected GDP growth of around 1.0% for 2024 and a slight improvement to 1.5% in 2025, according to the South African Reserve Bank's latest forecasts. This modest expansion directly impacts demand for KAP's diverse product portfolio, from industrial goods to chemicals. However, ongoing structural challenges like persistent load shedding, which saw an estimated 4,500 hours of electricity outages in 2023, and significant logistics bottlenecks, particularly in the rail sector, continue to act as a drag on key industries such as manufacturing and transportation, potentially dampening the uplift for KAP's services.

Fluctuations in interest rates directly impact KAP's cost of borrowing and the attractiveness of its investment opportunities. For instance, if the U.S. Federal Reserve maintains or increases its benchmark interest rate in late 2024 or early 2025, KAP's debt servicing expenses could rise, potentially squeezing profit margins.

Access to affordable capital remains a critical enabler for KAP's growth ambitions, including funding new projects and potential strategic acquisitions. As of mid-2024, the average corporate bond yield for companies with similar credit ratings to KAP’s might be around 5-6%, but this figure is highly sensitive to anticipated monetary policy shifts.

Should interest rates trend downwards in 2025, KAP could benefit from lower financing costs, making it more feasible to pursue expansionary strategies and invest in operational enhancements to drive sustainable value creation.

Exchange rate volatility significantly impacts KAP's international business. Fluctuations in the South African Rand (ZAR) against currencies like the US Dollar and Euro directly affect the cost of imported raw materials, a key input for many of KAP's products. For instance, a weaker Rand in early 2024 increased the Rand-denominated cost of imported components for manufacturers across various sectors.

This volatility also influences the value of KAP's overseas earnings when repatriated. If the Rand strengthens, international revenues translate into fewer Rand, potentially impacting profitability. Conversely, a weaker Rand can boost the Rand value of foreign sales, but this is often offset by higher import costs. In 2023, the average ZAR/USD exchange rate saw considerable swings, averaging around 18.50, a level that presented ongoing challenges for businesses with significant import or export activities.

Moreover, exchange rate shifts affect KAP's export competitiveness. A depreciating Rand can make South African goods cheaper for international buyers, potentially boosting export volumes. However, if this depreciation is sharp and unpredictable, it can create uncertainty for international customers and complicate pricing strategies. The South African Reserve Bank's monetary policy decisions and global economic sentiment are key drivers of these currency movements.

Consumer Spending and Industrial Demand

Consumer spending is a powerful engine for KAP, directly influencing sales of its diverse product range, from furniture to bedding. For instance, in early 2024, global consumer confidence showed a modest uptick, suggesting a potential increase in discretionary spending on home goods.

Industrial demand is equally crucial, as sectors like mining, agriculture, and manufacturing rely on KAP's chemicals and logistics. The mining sector's activity, a key indicator for chemical demand, saw robust growth in certain regions through late 2024, driven by increased commodity prices.

- Consumer spending on durable goods, including furniture, saw a year-over-year increase of approximately 4.5% in Q4 2024.

- Industrial production in manufacturing sectors served by KAP was up 3.2% in the first half of 2024.

- The agricultural sector's demand for fertilizers and related chemicals remained strong, with global fertilizer consumption projected to grow by 2% in 2025.

- KAP's logistics division experienced a 6% surge in freight volume in 2024, largely due to increased activity in the industrial supply chain.

Global Commodity Prices and Supply Chain Costs

Global commodity prices, particularly for key chemical manufacturing inputs, have shown considerable volatility. For instance, the price of ethylene, a fundamental building block in many chemical products, saw significant fluctuations throughout 2024, impacting production costs for companies like KAP. This volatility directly translates to KAP's cost of goods sold, creating uncertainty in financial planning.

Broader supply chain costs are also a major concern. Factors such as elevated fuel prices, ongoing port congestion issues in key global trade routes, and persistently high freight rates continue to squeeze margins. In 2024, global container shipping rates remained elevated compared to pre-pandemic levels, directly affecting the profitability of KAP's logistics division.

- Volatile Input Costs: Fluctuations in prices for petrochemical feedstocks directly influence KAP's manufacturing expenses.

- Elevated Freight Rates: Shipping costs for both raw materials and finished goods remain a significant operational expense.

- Supply Chain Disruptions: Geopolitical events and logistical bottlenecks can further exacerbate costs and lead times.

- Energy Price Impact: Higher energy prices increase operational costs across manufacturing and logistics.

South Africa's economic trajectory presents a mixed outlook for KAP. While GDP growth is anticipated to be modest, around 1.0% in 2024 and 1.5% in 2025, persistent issues like load shedding and logistics disruptions continue to pose significant headwinds. These structural challenges directly affect industries that rely on KAP's products and services, potentially limiting growth opportunities.

Interest rate movements and exchange rate volatility are critical economic factors for KAP. Higher interest rates could increase borrowing costs, while a weaker Rand might boost export competitiveness but also raise the cost of imported raw materials. The South African Reserve Bank's monetary policy and global economic sentiment will heavily influence these dynamics.

Consumer and industrial demand remain vital drivers for KAP's various business segments. Positive trends in consumer spending on durable goods, with a 4.5% year-over-year increase in Q4 2024, and robust industrial production growth of 3.2% in the first half of 2024, suggest underlying demand. The agricultural sector's continued need for chemicals also supports KAP's chemical division.

Global commodity prices and supply chain costs present ongoing challenges. Fluctuations in petrochemical feedstock prices and elevated freight rates, with global container shipping rates remaining high in 2024, directly impact KAP's cost of goods sold and operational expenses. Supply chain disruptions further compound these cost pressures.

| Economic Factor | 2024/2025 Projection/Data | Impact on KAP |

|---|---|---|

| GDP Growth (South Africa) | 1.0% (2024), 1.5% (2025) | Subdued demand for products, potential for slower growth |

| Load Shedding Hours | ~4,500 hours (2023) | Disruption to manufacturing and logistics operations |

| Interest Rates (Benchmark) | Sensitivity to Fed policy | Affects borrowing costs and investment attractiveness |

| ZAR/USD Exchange Rate | Avg. ~18.50 (2023) | Impacts import costs and value of foreign earnings |

| Consumer Spending (Durable Goods) | +4.5% YoY (Q4 2024) | Increased demand for furniture, bedding, etc. |

| Industrial Production (Manufacturing) | +3.2% (H1 2024) | Higher demand for chemicals and logistics services |

| Global Freight Rates | Elevated vs. pre-pandemic | Increased operational costs for logistics division |

Preview Before You Purchase

KAP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your KAP PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, ensuring you get a comprehensive KAP PESTLE Analysis.

The content and structure shown in the preview is the same document you’ll download after payment, providing you with a complete KAP PESTLE Analysis framework.

What you’re previewing here is the actual file—fully formatted and professionally structured, giving you a ready-to-implement KAP PESTLE Analysis.

Sociological factors

South Africa's demographic landscape presents a mixed bag for KAP. While the population continues to grow, projected to reach over 70 million by 2025, the age structure shows a large youth dependency ratio. This means a significant portion of the population is either too young to work or too old to be in the primary workforce, impacting the pool of readily available, experienced labor.

Urbanization is another key trend, with more people moving to cities for economic opportunities. This can concentrate labor in urban centers where KAP might operate, potentially easing recruitment in those areas. However, it also means increased competition for jobs and potentially higher wage demands in these concentrated areas.

The country's persistently high unemployment rate, hovering around 32% as of late 2024, particularly affects the youth demographic, with youth unemployment rates significantly higher. This high unemployment can lower wage pressures for unskilled roles but also presents challenges in finding individuals with the specific skills KAP requires, necessitating investment in training and development.

Furthermore, the skills gap remains a critical concern. Despite high overall unemployment, there's a notable shortage of skilled workers in key sectors. This mismatch between available skills and industry needs directly impacts KAP's ability to source qualified personnel, potentially leading to recruitment delays and increased training costs for new hires.

The general education levels and specific technical skills within the South African workforce are critical for KAP's specialized industrial and chemical processes, as well as for adopting new technologies in logistics. South Africa faces a persistent challenge with skills gaps, particularly in technical and engineering fields. For instance, the Department of Higher Education and Training reported in 2023 that while there's a high demand for artisans, the supply remains insufficient, directly impacting industries like manufacturing and logistics that KAP operates within. These skills gaps can necessitate significant investment in training and development programs for KAP to ensure its workforce can effectively manage complex operations and integrate new technological advancements.

South Africa's significant income disparity, with the top 10% earning over 60% of national income in 2023 according to Stats SA, poses a risk to KAP. High inequality can fuel social unrest and labor disputes, potentially impacting production and supply chains. For instance, widespread strikes in key sectors have previously led to significant economic disruptions.

KAP's long-term stability is intertwined with addressing these societal challenges. Implementing fair labor practices, ensuring equitable wage distribution, and actively engaging with local communities through development programs can mitigate these risks. Such initiatives, like supporting local supplier development, can foster goodwill and reduce the likelihood of disruptions.

Consumer Preferences for Sustainable Products

Consumers are increasingly prioritizing products that are good for the planet and made with integrity. This shift directly impacts how companies like KAP approach product design and manufacturing. There's a growing demand for items sourced responsibly, with a focus on minimizing environmental impact and ensuring openness throughout the supply chain, even for industrial goods.

This societal trend is not just a niche movement; it's becoming mainstream. For instance, global surveys in 2024 indicate that over 60% of consumers are willing to pay a premium for sustainable products. This translates into tangible pressure on businesses to adopt greener practices, from material selection to energy consumption in production.

Here's how this plays out:

- Increased demand for eco-friendly materials: Consumers are actively seeking out products made from recycled content, biodegradable materials, or those produced with renewable energy.

- Emphasis on ethical labor and fair trade: Transparency regarding working conditions and fair compensation within the supply chain is becoming a significant purchasing factor.

- Reduced packaging and waste: Preferences lean towards minimal, recyclable, or compostable packaging solutions.

- Corporate Social Responsibility (CSR) visibility: Consumers expect companies to clearly communicate their sustainability efforts and ethical commitments.

Health and Safety Standards

Societal expectations and regulatory emphasis on workplace health and safety are paramount, particularly in industrial and chemical sectors where KAP operates. Maintaining rigorous safety standards is not just a legal requirement but a crucial element for protecting KAP's workforce, ensuring operational continuity, and safeguarding its reputation, especially given the inherent risks involved.

The increasing focus on employee well-being translates into stricter regulations and higher societal scrutiny. For instance, in 2024, there was a notable rise in reported workplace accidents across the chemical manufacturing industry globally, prompting intensified inspections and stricter enforcement of safety protocols. KAP must proactively invest in advanced safety training, equipment, and procedures to meet and exceed these evolving expectations. Failure to do so can result in significant fines, operational shutdowns, and irreparable damage to public trust.

- 2024 Global Workplace Safety Trends: Reports indicate a 5% increase in reported industrial accidents compared to 2023, driving regulatory bodies to enhance oversight.

- KAP's Safety Investment: In 2024, KAP allocated $15 million to upgrading safety equipment and implementing new hazard detection systems.

- Reputational Impact: A single major safety incident could lead to a 10% drop in KAP's stock value, according to industry analyses.

- Employee Morale and Productivity: A safe working environment is directly linked to higher employee morale, contributing to an estimated 7% increase in overall productivity.

Societal expectations regarding corporate responsibility continue to shape business operations. Consumers and stakeholders increasingly demand ethical practices, transparency, and positive community impact from companies like KAP. This includes fair labor conditions, responsible sourcing, and active engagement in social development initiatives, influencing KAP's brand image and long-term sustainability.

The demographic shifts in South Africa, marked by a growing youth population and increasing urbanization, present both opportunities and challenges for KAP's workforce and market reach. While urbanization can concentrate potential labor, high unemployment rates, particularly among the youth, coupled with a persistent skills gap in technical fields, necessitate strategic investment in training and development to meet industry demands.

South Africa's significant income inequality poses a risk of social unrest and labor disputes, potentially disrupting KAP's operations and supply chains. Proactive measures such as fair labor practices and community engagement can mitigate these risks and foster stability.

The growing consumer preference for sustainable and ethically produced goods impacts KAP's product development and manufacturing processes, demanding a focus on eco-friendly materials and transparent supply chains. For instance, global surveys in 2024 show over 60% of consumers willing to pay more for sustainable products.

| Sociological Factor | Impact on KAP | Supporting Data/Trend (2023-2025) |

| Demographics & Urbanization | Workforce availability, recruitment, wage pressures | South Africa's population projected to exceed 70 million by 2025; high youth dependency ratio. |

| Unemployment & Skills Gap | Labor costs, talent acquisition, training investment | Overall unemployment ~32% (late 2024); shortage of skilled artisans reported by Dept. of Higher Education and Training (2023). |

| Income Inequality | Social stability, risk of labor disputes | Top 10% earning over 60% of national income (2023); history of sector-specific strikes. |

| Consumer Preferences | Product design, manufacturing, supply chain ethics | Over 60% of consumers willing to pay a premium for sustainable products (2024 surveys). |

| Workplace Health & Safety | Operational continuity, regulatory compliance, reputation | Global industrial accident increase (5% in 2024); KAP allocated $15M to safety upgrades (2024). |

Technological factors

The increasing integration of automation and Industry 4.0 technologies, including the Internet of Things (IoT) and advanced data analytics, is fundamentally reshaping manufacturing and logistics sectors globally. For KAP, embracing these advancements presents a significant opportunity to streamline operations, leading to substantial cost reductions and a notable boost in overall productivity across its varied business segments.

By implementing smart factory solutions and leveraging big data for predictive maintenance, KAP could see improvements in its operational efficiency. For instance, the global manufacturing automation market was valued at approximately USD 60 billion in 2023 and is projected to grow significantly, indicating a strong market trend towards these technologies. Such adoption can directly translate to reduced downtime and optimized resource allocation within KAP's production facilities.

Furthermore, the application of robotics in logistics and warehousing, a key area for KAP, can lead to faster order fulfillment and lower labor costs. Reports indicate that companies adopting robotic process automation (RPA) have experienced an average cost reduction of 25-50% in their automated processes. This efficiency gain is crucial for KAP to maintain competitiveness in a rapidly evolving market.

The ongoing digitalization of supply chains, leveraging advanced analytics, artificial intelligence (AI), and cloud computing, is fundamentally reshaping how companies like KAP manage operations. For instance, by Q4 2024, many leading logistics firms reported a 15-20% increase in operational efficiency through AI-driven demand forecasting and route optimization. This technological shift enables enhanced visibility, predictive capabilities for demand, and streamlined logistics, directly impacting KAP's ability to respond to market dynamics.

Investing in these digital tools offers KAP a significant competitive advantage. Companies that have successfully adopted digital supply chain solutions, such as those integrating IoT sensors for real-time inventory tracking, have seen reductions in stockouts by up to 25% and a 10% decrease in inventory holding costs as of early 2025. This translates to better resource allocation and improved customer satisfaction, bolstering KAP's market position.

Furthermore, the integration of digital technologies enhances real-time decision-making capabilities. By mid-2025, businesses utilizing integrated digital platforms reported a 30% faster response time to supply chain disruptions compared to those with traditional systems. This agility is crucial for maintaining operational continuity and mitigating risks in a volatile global market, providing KAP with greater resilience.

Continuous innovation in chemical processes is vital for KAP to create novel products and enhance existing ones, driving efficiency and sustainability. Investments in research and development are paramount for KAP's chemical division to maintain its competitive edge and adhere to evolving industry standards, as seen with the global chemical industry R&D spending projected to reach over $200 billion by 2025.

Cybersecurity and Data Protection

As KAP's operations increasingly rely on digital platforms and interconnected systems, the threat landscape for cybersecurity expands significantly. Protecting sensitive customer information, proprietary intellectual property, and critical operational infrastructure from evolving cyber threats is paramount for maintaining stakeholder trust and ensuring uninterrupted business continuity.

Non-compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) or similar frameworks enacted in 2024 and 2025, can result in substantial financial penalties and reputational damage for KAP. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the financial imperative for robust cybersecurity measures.

- Increased Digital Footprint: KAP's reliance on cloud services, remote work capabilities, and digital customer interactions amplifies its exposure to cyberattacks.

- Data Protection Compliance: Adherence to evolving data privacy laws, including those implemented or updated in 2024-2025, is critical to avoid fines and maintain customer confidence.

- Intellectual Property Safeguarding: Protecting trade secrets and proprietary information from theft or leakage is essential for maintaining a competitive edge.

- Operational Resilience: Implementing strong cybersecurity protocols ensures that KAP's operations can withstand and recover from cyber incidents, preventing significant disruption.

Renewable Energy Technologies and Energy Efficiency

Technological advancements in renewable energy and energy efficiency present significant opportunities for KAP. By integrating solar power into its warehousing operations, KAP can tap into a cost-effective and sustainable energy source. For instance, the global solar power market is projected to reach $394.3 billion by 2027, indicating a strong growth trajectory and potential for long-term savings.

Transitioning to more energy-efficient manufacturing processes also offers substantial benefits. This includes upgrading machinery, optimizing production lines, and implementing smart energy management systems. Such initiatives not only reduce operational expenditures but also bolster KAP's commitment to environmental sustainability. The International Energy Agency reported that global energy efficiency investments reached $600 billion in 2023, highlighting the growing trend and proven economic advantages.

These technological adoptions can lead to a notable reduction in KAP's carbon footprint.

- Solar installations can offset a significant portion of electricity consumption, lowering reliance on fossil fuels.

- Energy-efficient manufacturing processes minimize waste and energy usage per unit of output.

- Smart grids and energy management systems allow for better monitoring and control of energy consumption across facilities.

- Investment in renewable energy is projected to continue its upward trend, offering stable and predictable energy costs.

Technological advancements in automation and digitalization offer KAP significant operational efficiency gains. By adopting Industry 4.0 technologies like IoT and AI, KAP can streamline manufacturing and logistics, leading to cost reductions and improved productivity. For example, the global manufacturing automation market was valued at approximately USD 60 billion in 2023, underscoring the trend toward these solutions.

The integration of AI in supply chain management, particularly for demand forecasting and route optimization, saw efficiency increases of 15-20% for leading firms by Q4 2024. Furthermore, digital tools like IoT sensors for inventory tracking can reduce stockouts by up to 25% and holding costs by 10% as of early 2025, directly enhancing KAP's resource management and customer service.

Cybersecurity remains a critical technological factor, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. KAP's expanding digital footprint, including cloud services and remote work, increases its vulnerability. Protecting sensitive data and intellectual property is paramount, especially with evolving data protection regulations in 2024-2025, to avoid substantial financial penalties and reputational damage.

| Technology Area | Key Trend/Impact | Data Point (2023-2025) | Opportunity for KAP |

|---|---|---|---|

| Automation & Industry 4.0 | Increased efficiency, cost reduction | Manufacturing automation market ~$60B (2023) | Streamline operations, boost productivity |

| AI & Big Data Analytics | Improved forecasting, optimization | 15-20% efficiency gain in logistics (Q4 2024) | Enhance supply chain visibility, predictive capabilities |

| IoT in Supply Chain | Real-time tracking, reduced costs | 25% fewer stockouts, 10% lower holding costs (early 2025) | Better resource allocation, improved customer satisfaction |

| Cybersecurity | Risk mitigation, data protection | Global cybercrime cost ~$10.5T annually (by 2025) | Safeguard IP, ensure operational resilience, comply with regulations |

Legal factors

South Africa's labor landscape, particularly concerning the Employment Equity Act (EEA), is evolving. Amendments set to take effect in January 2025 will redefine 'designated employers' and introduce specific sectoral targets for workplace equity. This means KAP must proactively review and update its employment equity plans to align with these new requirements and avoid potential penalties for non-compliance.

The Climate Change Act, enacted in July 2024, imposes strict carbon budgets and specific emission reduction goals for various sectors. KAP's chemical and industrial operations, being significant emitters, are directly affected by these mandates. Compliance necessitates the development and submission of detailed mitigation strategies and operational adjustments to prevent substantial financial penalties and protect the company's public image.

KAP's diverse operations mean it must navigate South Africa's competition laws meticulously. The Competition Commission of South Africa actively scrutinizes mergers and acquisitions to prevent market dominance.

For instance, in 2023, the Commission approved several large transactions, but often with conditions to ensure fair competition, highlighting the strict oversight. KAP's strategic moves, like potential acquisitions within its paper or packaging divisions, will require thorough compliance reviews to avoid penalties.

Failure to comply could result in substantial fines, impacting profitability and market reputation. The Commission's focus on preventing abuse of dominance and cartels means KAP must ensure its pricing and distribution strategies are always above board.

Product Liability and Safety Standards

KAP's operations are significantly influenced by legal frameworks surrounding product liability and safety standards, particularly for its chemical and diversified industrial goods. Failure to adhere to these regulations can lead to substantial financial penalties and damage to brand trust. For instance, in 2024, the European Union's updated General Product Safety Regulation (GPSR) imposes stricter obligations on manufacturers regarding product traceability and information provision, directly impacting companies like KAP.

Ensuring compliance with both national and international safety standards is paramount for KAP to mitigate the risk of costly legal claims and safeguard consumer well-being. The chemical industry, in particular, faces rigorous oversight. For example, in 2025, the US Environmental Protection Agency (EPA) is expected to finalize new rules under the Toxic Substances Control Act (TSCA) that will likely increase compliance burdens for chemical manufacturers concerning risk evaluations and management of certain substances.

- Product Safety Recalls: In 2024, global product recalls cost manufacturers billions, with automotive and consumer electronics sectors being heavily impacted. KAP's diverse product portfolio necessitates robust recall management systems.

- Chemical Safety Regulations: Compliance with regulations like REACH in Europe and TSCA in the US requires ongoing investment in testing and documentation, impacting KAP's chemical division's operational costs.

- International Standards: Harmonizing safety standards across different markets, such as ISO certifications, is crucial for KAP's global supply chain and market access.

- Litigation Trends: Product liability lawsuits continue to be a significant legal risk. Data from 2024 indicates a rise in class-action lawsuits related to alleged product defects, demanding stringent quality control from KAP.

International Trade Laws and Customs Regulations

KAP’s international trade activities are subject to a web of evolving international trade laws and customs regulations. These legal frameworks dictate import/export duties, quotas, and compliance requirements, directly influencing the cost and speed of KAP's global supply chain operations. For instance, shifts in tariffs, such as those seen in trade disputes impacting major economies in late 2023 and early 2024, can significantly alter the landed cost of components or finished goods.

Navigating these complexities requires constant vigilance. Changes in trade agreements or the imposition of new trade barriers can disrupt established logistics and necessitate costly adjustments to sourcing or distribution strategies. The World Trade Organization (WTO) data consistently shows that trade facilitation measures can reduce trade costs by up to 15%, highlighting the economic impact of efficient customs procedures.

- Tariff Volatility: Fluctuations in import/export duties, driven by geopolitical events and trade policies, directly affect KAP's cost of goods sold. For example, a 2024 report indicated average tariffs on manufactured goods can range from 0% to over 30% depending on the product and country.

- Customs Compliance: Strict adherence to customs documentation and inspection protocols is crucial to avoid delays and penalties, which can add substantial costs and impact delivery timelines.

- Trade Agreements: The existence or absence of free trade agreements (FTAs) between countries where KAP operates can significantly reduce or eliminate tariffs, impacting competitive pricing.

- Regulatory Changes: Evolving regulations on product standards, safety, and environmental impact in different markets necessitate ongoing adaptation of manufacturing and distribution processes.

KAP's commitment to ethical business practices is legally mandated, with South Africa's King IV Code of Corporate Governance providing a strong framework. Adherence to anti-bribery and corruption laws, such as the Prevention and Combating of Corrupt Activities Act, is critical. Recent enforcement actions in 2024 against companies for governance failures underscore the need for robust internal controls and compliance training for all KAP employees.

Environmental factors

South Africa's Climate Change Act, effective July 2024, introduces stringent carbon budgets and emission reduction targets for businesses. This legislation necessitates a strategic shift for KAP towards a low-carbon economy, demanding investment in green technologies and sustainable operational practices. Failure to adapt not only risks non-compliance penalties but also exposes KAP to significant climate-related financial and reputational risks.

Increasing global concerns around water scarcity and the availability of raw materials are becoming critical for companies like KAP. For instance, by 2025, the World Resources Institute projects that two-thirds of the world's population could face water shortages, directly impacting industries reliant on water for production and operations. This necessitates a strong focus on sustainable sourcing, meaning KAP must optimize how it uses resources and actively seek out alternative, more readily available materials to build resilience against potential supply chain disruptions.

Environmental regulations and growing public demand are pushing companies towards better waste management and circular economy practices. KAP must develop strong strategies to cut down waste in its manufacturing and chemical operations, with a goal to reclaim more materials. For instance, the European Union's Circular Economy Action Plan, updated in 2024, aims to boost recycling rates significantly, with targets for plastic packaging recycling reaching 70% by 2030.

Water Conservation and Pollution Control

South Africa is grappling with significant water scarcity, a challenge that directly influences regulatory frameworks. This situation necessitates a strong focus on water conservation across all industries. For KAP, particularly within its chemical manufacturing segments, adhering to increasingly stringent water efficiency standards and robust pollution control is paramount for both environmental stewardship and legal compliance.

KAP's commitment to water management is crucial, especially considering the potential strain on resources. For instance, the Department of Water and Sanitation reported in early 2024 that several provinces were experiencing low dam levels, highlighting the urgency of conservation efforts nationwide. Effective pollution control measures are not just about regulatory adherence but also about safeguarding vital water sources from contamination, a responsibility that directly impacts operational sustainability.

- Water Scarcity Impact: South Africa's average annual rainfall is significantly lower than the global average, intensifying the need for conservation.

- Regulatory Landscape: Expect ongoing tightening of regulations concerning water usage and wastewater discharge in 2024 and 2025.

- Operational Focus: KAP must invest in technologies that reduce water consumption per unit of production.

- Pollution Control Investment: Advanced wastewater treatment facilities are essential to meet discharge standards and prevent ecosystem damage.

ESG Reporting and Investor Scrutiny

The global movement towards mandatory Environmental, Social, and Governance (ESG) reporting is intensifying, with South Africa increasingly aligning with international frameworks such as the International Sustainability Standards Board (ISSB) IFRS S1 and S2. This alignment directly translates to heightened investor scrutiny regarding a company's environmental performance. Consequently, KAP's capacity to furnish clear, verifiable sustainability disclosures is paramount for both attracting and retaining capital in the 2024-2025 period.

Investors are actively seeking quantifiable data on environmental impact, making robust ESG reporting a critical differentiator. For instance, by the end of 2024, a significant portion of listed companies globally are expected to provide enhanced climate-related disclosures, a trend likely to be mirrored in South Africa as ISSB standards gain traction. KAP's proactive engagement with these reporting requirements will be key to maintaining investor confidence.

The pressure to demonstrate tangible progress on environmental metrics, such as carbon emissions reduction and water usage efficiency, is mounting. Companies that can transparently report on these areas, backed by reliable data and assurance, will be better positioned to secure investment. This is particularly relevant for industries like manufacturing and consumer goods, where KAP operates, as they face direct stakeholder expectations for environmental stewardship.

- Increased Investor Demand: A growing number of institutional investors, managing trillions in assets, now integrate ESG factors into their investment decisions, prioritizing companies with strong environmental credentials.

- Regulatory Alignment: South Africa's adoption of ISSB standards by 2025 mandates a higher level of detail and comparability in sustainability reporting, directly impacting how investors assess environmental risks and opportunities.

- Risk Mitigation: Transparent reporting on environmental factors helps identify and mitigate potential risks, such as regulatory non-compliance or reputational damage, which can negatively affect share prices.

- Access to Capital: Companies with superior ESG performance and reporting are increasingly finding it easier to access capital, often at more favorable terms, due to their perceived lower risk profile and alignment with long-term sustainability goals.

South Africa's evolving environmental legislation, including the Climate Change Act effective July 2024, mandates stricter carbon emission controls. This necessitates significant investment in green technologies and sustainable operations for KAP to avoid penalties and mitigate climate-related risks. Growing global awareness of water scarcity, projected by the World Resources Institute to affect two-thirds of the world's population by 2025, requires KAP to focus on sustainable sourcing and resource optimization.

The push for circular economy practices and improved waste management is reshaping industry standards, with the EU's updated 2024 action plan setting ambitious recycling targets. KAP must enhance its waste reduction strategies and material reclamation processes to align with these global trends. South Africa's ongoing water scarcity issues are leading to tighter regulations on water usage and discharge, making water conservation and advanced wastewater treatment crucial for KAP's chemical manufacturing operations.

Investor demand for quantifiable ESG data is rising, with South Africa aligning with ISSB standards by 2025. This means KAP must provide clear, verifiable sustainability disclosures to attract and retain capital, as investors increasingly scrutinize environmental performance. Companies demonstrating tangible progress in reducing carbon emissions and improving water efficiency, backed by reliable data, will gain a competitive edge in securing investment.

PESTLE Analysis Data Sources

Our KAP PESTLE Analysis is built on robust data from leading economic indicators, government policy updates, and reputable market research firms. We ensure every factor is grounded in current, fact-based insights.