KAP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KAP Bundle

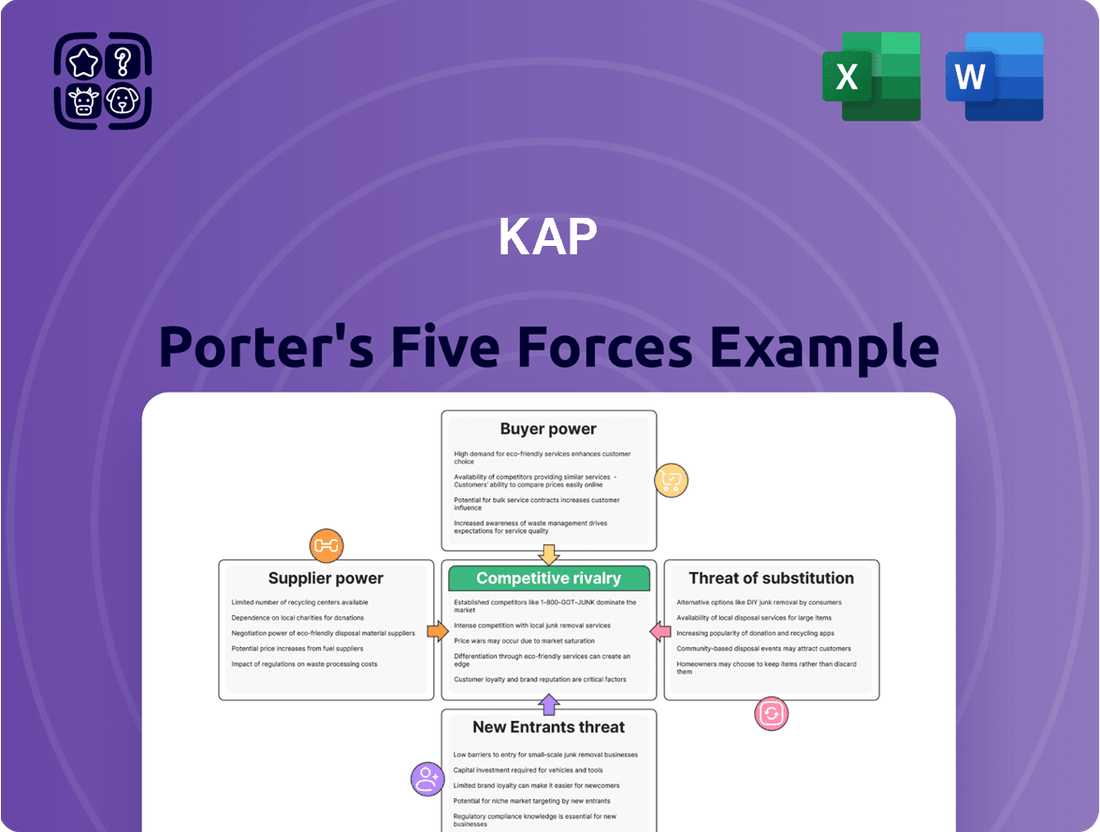

KAP's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the ever-present threat of new entrants. Understanding these dynamics is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore KAP’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

KAP Industrial Holdings' bargaining power of suppliers is notably high, primarily due to its significant reliance on Sasol for essential chemical inputs. For instance, ethylene, a crucial component for KAP's Safripol operations, is sourced almost exclusively from Sasol. This concentration makes KAP highly dependent, granting Sasol considerable leverage in price negotiations and supply management.

The existing commercial dispute between Safripol and Sasol over ethylene pricing and volume commitments underscores this supplier power. In 2024, the chemical industry has seen price volatility, with ethylene prices fluctuating based on global energy costs and supply-demand dynamics. This situation directly impacts KAP's cost structure and operational stability, as it has limited alternatives for securing these vital raw materials.

The specialized nature of essential chemical inputs, like ethylene, significantly elevates the bargaining power of KAP's suppliers. For divisions such as Safripol, transitioning to a new supplier would necessitate considerable investment in retooling machinery and re-certifying manufacturing processes. This adds layers of complexity and potential production disruptions, effectively anchoring KAP to its current suppliers even when facing price pressures.

A dominant supplier, though rare for basic raw materials, might explore forward integration into KAP's operations. Imagine a monopoly supplier like Sasol for ethylene in South Africa; such a position grants them considerable power. This leverage could enable them to influence or even control subsequent stages of the value chain, indirectly pressuring KAP to accept less favorable terms.

Impact of Input Costs on KAP's Profitability

Fluctuations in raw material prices, especially for key chemicals and logistics inputs like fuel, directly impact KAP's operational costs and overall profitability. For instance, the average price of Brent crude oil saw significant volatility throughout 2024, with prices ranging from approximately $75 to $95 per barrel, impacting transportation and chemical feedstock costs.

Given KAP's diversified nature, increased input costs in one segment, such as chemicals, can strain margins across the group if not effectively managed or passed on to customers. This sensitivity underscores the power held by suppliers of these volatile commodities.

- Rising Chemical Feedstock Costs: Reports from early 2024 indicated a 10-15% increase in the cost of certain petrochemical feedstocks, crucial for KAP's chemical divisions.

- Fuel Price Volatility: Global fuel prices in 2024, influenced by geopolitical events, directly affect KAP's logistics expenses, which represent a significant portion of its operating budget.

- Supplier Concentration: In specific niche chemical markets, KAP may rely on a limited number of suppliers, granting these suppliers considerable leverage in price negotiations.

- Impact on Margins: If KAP cannot fully pass on increased input costs to consumers due to market competition or contractual limitations, its gross profit margins are directly eroded.

Supplier's Ability to Differentiate Inputs

Suppliers who can make their inputs distinct, perhaps through superior quality, cutting-edge technology, or unique formulations, can wield significant power. For instance, a supplier of specialized chemicals crucial for high-performance electronics might differentiate their product, making it tough for a company like KAP to switch to a cheaper, less capable alternative. This makes it harder for KAP to push back on pricing, as the unique value of the input justifies its cost.

This differentiation directly impacts KAP's negotiation leverage. When suppliers offer inputs that are not easily replicated, they can command higher prices. For example, in 2024, the semiconductor industry saw significant price increases for advanced silicon wafers due to limited suppliers with the necessary purity and precision, impacting manufacturers’ margins.

Access to proprietary technologies or unique manufacturing processes further amplifies a supplier's bargaining power. If a supplier holds patents on key components or has developed a more efficient production method, KAP might be locked into using that supplier, regardless of price. This situation was evident in the automotive sector in early 2025, where certain advanced battery materials were only available from a handful of suppliers with patented production techniques, leading to higher input costs for car manufacturers.

- Differentiated Inputs: Suppliers offering unique quality, technology, or formulations (e.g., specialized chemicals, advanced alloys).

- Reduced Negotiation Power: High differentiation limits KAP's ability to negotiate prices downwards.

- Proprietary Technology: Suppliers with exclusive patents or processes gain an advantage.

- Market Impact: In 2024, specialty material shortages in sectors like advanced manufacturing drove up costs for companies relying on those unique inputs.

The bargaining power of KAP's suppliers is significant, largely due to the specialized nature of essential inputs and limited alternative sources. For instance, Safripol's reliance on Sasol for ethylene highlights this dependency, as demonstrated by the ongoing commercial dispute over pricing and volume in 2024. This concentration of supply, coupled with the high switching costs associated with retooling and recertification, grants suppliers considerable leverage.

Suppliers who offer differentiated inputs, such as specialized chemicals with unique properties or proprietary technology, further amplify their bargaining power. This was evident in the semiconductor industry in 2024, where limited suppliers of advanced silicon wafers with specific purity levels led to increased costs for manufacturers. Such situations constrain KAP's ability to negotiate lower prices and directly impact its profit margins.

| Factor | Impact on KAP | 2024 Data/Example |

| Supplier Concentration (Ethylene) | High dependency, limited negotiation power | Safripol's near-exclusive reliance on Sasol for ethylene |

| Switching Costs | High investment in retooling/recertification | Makes it difficult to change suppliers even with price pressures |

| Input Differentiation | Suppliers with unique quality/technology command higher prices | 2024: Advanced silicon wafer prices increased due to limited specialized suppliers |

| Proprietary Technology | Locks KAP into specific suppliers | Early 2025: Limited suppliers of patented battery materials for automotive sector |

What is included in the product

This analysis dissects the five competitive forces impacting KAP, offering strategic insights into profitability and market positioning.

Effortlessly identify and mitigate competitive threats by visualizing the interconnectedness of all five forces in a single, actionable dashboard.

Customers Bargaining Power

KAP Industrial Holdings' diverse customer base across segments like consumer, agriculture, petrochemical, mining, and passenger transport significantly dilutes the bargaining power of any single customer group. This broad market reach means KAP is not overly dependent on a few major clients, spreading its revenue streams and reducing the leverage individual buyers can exert.

KAP's Unitrans segment excels at delivering highly customized supply chain and operational services. This deep integration into client operations means switching providers isn't a simple matter of finding a new vendor; it involves significant disruption and cost.

For example, imagine a large manufacturing client relying on Unitrans for a highly specialized logistics network. The cost and effort to reconfigure this entire system with a new provider could be substantial, creating strong customer "stickiness."

This tailored approach directly impacts the bargaining power of customers. When it's difficult and expensive to switch, customers have less leverage to demand lower prices or more favorable terms, as the cost of switching outweighs the immediate benefit.

In 2024, Unitrans’s focus on bespoke solutions likely contributed to its strong performance, as clients increasingly seek partners who understand and can adapt to their unique operational needs, thereby reducing their own bargaining power.

Customers' sensitivity to price is a significant factor, especially in South Africa. High inflation rates, which were notably elevated in 2023 and projected to remain a concern into 2024, coupled with high interest rates, directly impact household disposable income. This economic pressure makes consumers more inclined to seek out better deals and lower prices.

Sectors like automotive, which often involve significant financial commitments, are particularly susceptible to these economic headwinds. When consumers face tighter budgets, their ability to absorb price increases diminishes, leading them to scrutinize purchases more closely and demand more competitive pricing from companies like KAP. This naturally amplifies the bargaining power of customers.

During economic downturns, this pressure intensifies. For instance, if household debt levels remain high, as they have been in recent years, consumers are less likely to tolerate price hikes. This can force KAP to reconsider its pricing strategies to remain competitive and retain its customer base, demonstrating a clear increase in customer bargaining power.

Lack of Significant Backward Integration Threat

The threat of customers backward integrating into KAP's core operations, which span logistics, chemicals, and industrial product manufacturing, is significantly limited. This is primarily due to the substantial capital investment and specialized expertise required across these diverse sectors. For instance, establishing the necessary chemical production facilities or a complex global logistics network demands billions in upfront capital and years of technical development, resources most customers do not possess.

Most of KAP's clientele, ranging from small businesses to large enterprises in various industries, typically lack the in-house capabilities to replicate KAP's integrated supply chain and manufacturing processes. The financial barrier alone is considerable; acquiring the necessary land, machinery, and skilled labor to match KAP's scale and efficiency would be prohibitively expensive for the vast majority of its customer base. This inability to produce KAP's offerings internally means customers remain reliant on KAP's services.

- Limited Expertise: Customers generally lack the specialized knowledge in chemical engineering, advanced logistics management, and industrial manufacturing processes that KAP possesses.

- High Capital Requirements: Backward integration would necessitate enormous capital expenditure, far beyond the reach of most of KAP's customers, especially for setting up operations comparable to KAP's scale. For example, building a chemical plant can cost upwards of $500 million to $2 billion.

- Operational Complexity: Managing diversified operations like KAP's requires sophisticated infrastructure, supply chain optimization, and regulatory compliance, which is a significant undertaking for most businesses.

- Focus on Core Competencies: Customers prefer to concentrate on their own core business activities rather than diverting resources and attention to complex operational areas best handled by specialists like KAP.

This lack of significant backward integration threat directly reduces the bargaining power of KAP's customers. They are less likely to demand lower prices or more favorable terms when the alternative of self-production is not a viable or cost-effective option. In 2024, the global logistics market alone was valued at trillions, underscoring the immense scale and investment needed to compete effectively.

Volume-Based Negotiation by Large Customers

Large customers, particularly those in KAP's logistics, chemical, and industrial sectors, can exert considerable bargaining power due to their substantial order volumes. This buying power enables them to negotiate for better pricing, such as bulk discounts, and more lenient payment terms, directly influencing KAP's profitability on significant contracts.

For instance, if a major industrial client doubles its order volume for a specific chemical product, it may leverage this increased commitment to seek a 5% price reduction. This is a prevalent scenario in business-to-business environments where scale dictates negotiation leverage.

- Negotiating Power: Large institutional buyers can significantly influence pricing and terms due to their volume.

- Impact on Margins: Favorable terms like bulk discounts and extended payment cycles can reduce profitability per unit.

- Sectoral Influence: Customers in logistics, chemical, and industrial segments often hold higher bargaining power.

- B2B Dynamics: This volume-based negotiation is a standard characteristic of business-to-business transactions.

Customers' bargaining power is moderated by KAP's diverse customer base and the high switching costs associated with its integrated services. However, economic conditions, particularly price sensitivity in South Africa, can amplify this power, especially for large volume buyers in sectors like automotive.

Customers' ability to negotiate favorable terms is influenced by their volume. For example, a substantial increase in orders might lead to demands for price reductions. This is a common dynamic in business-to-business transactions, impacting KAP's margins.

The threat of backward integration by customers is minimal due to the immense capital and expertise required, limiting their leverage. Customers generally lack the resources to replicate KAP's complex operations, keeping them reliant on KAP's specialized services.

In 2024, inflation in South Africa remained a significant factor, impacting consumer spending and potentially increasing price sensitivity for KAP's offerings. For instance, if inflation persisted above 5%, it would likely embolden customers to negotiate harder on price points.

| Factor | Impact on Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Diversification | Reduces individual customer leverage | KAP's broad market reach in 2024 limited reliance on any single client segment. |

| Switching Costs (Unitrans) | Lowers customer power due to integration | Bespoke solutions in 2024 meant high disruption costs for clients changing providers. |

| Price Sensitivity (South Africa) | Increases customer power | High inflation and interest rates in 2024 made consumers more price-conscious, amplifying negotiation leverage. |

| Backward Integration Threat | Lowers customer power due to high barriers | The multi-billion dollar investment for chemical production or logistics networks in 2024 remained prohibitive for most clients. |

| Customer Order Volume | Increases customer power for large buyers | Significant order volumes in 2024 allowed major clients to negotiate bulk discounts and favorable payment terms. |

Same Document Delivered

KAP Porter's Five Forces Analysis

This preview shows the exact KAP Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, providing actionable intelligence for strategic decision-making without any placeholders.

Rivalry Among Competitors

KAP operates in sectors characterized by a crowded competitive field, featuring a wide array of players from large, diversified conglomerates to niche specialists in logistics, chemicals, and industrial goods. This broad spectrum of competitors ensures a dynamic and often aggressive market environment.

Within the logistics domain, KAP faces formidable competition from global giants such as DSV A/S and Dachser, alongside strong regional players like Value Logistics and Laser Group, all vying for market share and customer loyalty.

The chemical industry presents its own set of significant rivals, with established entities like Sasol and AECI representing substantial competitive forces, driving innovation and price pressures.

This highly fragmented yet intensely competitive landscape compels KAP to continuously adapt and differentiate its offerings to maintain its market position and profitability.

Moderate industry growth rates, such as the projected 3.5% to 6.8% CAGR for the South African logistics market between 2025 and 2030, can temper intense rivalry. However, this growth is not so rapid that it eliminates competition entirely. Companies still actively vie for market share, requiring strategies beyond simply capitalizing on market expansion.

KAP's diversified portfolio across logistics, chemicals, and industrial products acts as a shield against intense head-to-head competition in any single market. This strategy allows KAP to absorb shocks from downturns in one sector by relying on the stability of others, a crucial advantage in today's volatile economic climate. For instance, while the global chemical industry might experience price fluctuations, a strong performance in logistics can offset these challenges.

By not being solely reliant on one industry, KAP reduces its vulnerability to the intense rivalry that often characterizes highly specialized markets. This broad operational base fosters resilience, enabling the company to weather sector-specific downturns more effectively than competitors focused on a narrower niche. This strategic breadth is a key differentiator, allowing for more stable overall financial performance.

Furthermore, KAP can leverage cross-segment synergies, potentially sharing resources, technologies, or customer bases between its diverse business units. This integration can create efficiencies and unlock new competitive advantages that pure-play companies simply cannot replicate. For example, insights gained from optimizing logistics for chemical products could be applied to industrial goods, enhancing overall operational effectiveness.

High Fixed Costs and Capacity Utilization Pressures

Sectors like industrial manufacturing, chemicals, and logistics are characterized by significant fixed costs. These often stem from investments in large-scale infrastructure, specialized machinery, and extensive transportation fleets. For a company like KAP, this means there's a constant need to operate at high capacity utilization to spread these substantial fixed costs over a larger output.

This pressure to maintain high capacity utilization frequently fuels intense competition on price. When demand softens or when the industry experiences overcapacity, companies are often compelled to lower prices to keep their operations running efficiently and avoid leaving expensive assets idle. This can lead to aggressive market share battles, particularly in environments where competitors face similar cost structures.

- High Fixed Costs: KAP likely faces significant capital expenditures in its operational infrastructure, machinery, and logistics network, typical of industrial and chemical sectors.

- Capacity Utilization Pressure: The need to cover these high fixed costs drives a strong incentive to maximize plant or fleet utilization.

- Pricing Competition: In periods of overcapacity or reduced demand, this pressure can lead to aggressive price wars as companies try to secure sales and cover overhead.

- Market Share Battles: Companies may engage in strategic moves to gain or defend market share, even at reduced profit margins, to maintain operational levels.

Challenges from Infrastructure and Economic Volatility

South Africa's competitive landscape is significantly shaped by infrastructure deficits and economic fluctuations. For instance, Transnet, the state-owned freight logistics company, has faced challenges with rail and port operations, impacting the cost and timeliness of moving goods. In 2023, rail freight volumes in South Africa saw a notable decline, exacerbating supply chain issues for many businesses.

These systemic issues force companies to compete on resilience and adaptability, not just traditional factors like price. Businesses must invest in robust logistics strategies and contingency planning to counteract potential disruptions. For example, many manufacturers are exploring alternative transport methods or holding larger inventories, which increases operational costs.

- Infrastructure Strain: South Africa's rail network, a critical artery for logistics, has experienced operational challenges, leading to delays and increased costs for businesses relying on efficient freight movement.

- Economic Volatility Impact: Fluctuations in currency exchange rates and inflation, common in emerging markets, add another layer of complexity, affecting input costs and consumer demand.

- Operational Adaptability: Companies must develop strategies to mitigate these external risks, potentially through diversified sourcing, localized production, or investing in private logistics solutions.

- Increased Competition on Resilience: The ability to maintain operations and supply chains amidst these challenges becomes a key competitive differentiator, adding a premium to reliable service providers.

Competitive rivalry within KAP's operating sectors remains a significant force. While diversified operations offer some insulation, intense competition on price and service is a constant. The pressure to utilize high fixed assets efficiently means that even moderate industry growth, like the projected 3.5% to 6.8% CAGR for South Africa's logistics market from 2025-2030, doesn't eliminate aggressive market share battles. Companies must continually innovate and optimize to stay ahead.

The South African context adds another layer, with infrastructure challenges like those faced by Transnet's rail network in 2023, which saw declining freight volumes, forcing companies to compete on resilience and adaptability. This means investing in robust logistics and contingency planning to counteract disruptions, making reliable service a key differentiator.

In the chemical sector, established players like Sasol and AECI exert significant competitive pressure, driving innovation and influencing pricing. Similarly, in logistics, global giants such as DSV A/S and Dachser, alongside strong regional competitors, create a dynamic and often aggressive market environment. This fragmented yet intense landscape necessitates continuous adaptation from KAP.

| Competitor Type | Example Players | Key Competitive Factor |

|---|---|---|

| Logistics (Global) | DSV A/S, Dachser | Scale, Network Reach, Technology |

| Logistics (Regional) | Value Logistics, Laser Group | Local Expertise, Agility, Customer Service |

| Chemicals | Sasol, AECI | Product Innovation, Cost Efficiency, Safety Standards |

| Industrial Goods | Diversified Conglomerates, Niche Specialists | Quality, Price, Customization, Supply Chain Reliability |

SSubstitutes Threaten

For KAP's vital logistics operations, specifically Unitrans, the threat of substitutes is a notable concern. Alternative transportation modes such as rail and sea freight present viable options, especially as South Africa continues to invest in and upgrade its rail infrastructure. For instance, Transnet Freight Rail has been making strides in modernizing its network, aiming to improve efficiency and capacity, which could make these modes more competitive.

Furthermore, large corporate clients might consider developing their own in-house logistics departments to gain greater control over their supply chains. Smaller, specialized courier services also emerge as substitutes, particularly for businesses with unique or time-sensitive delivery needs, offering tailored solutions that larger providers may not easily replicate.

The ultimate decision for a customer to switch to a substitute solution often hinges on a careful evaluation of cost-effectiveness, delivery speed, and overall reliability. For example, if rail freight costs significantly decrease or transit times improve due to infrastructure upgrades, it could draw business away from road-based logistics like Unitrans.

The chemical sector is witnessing a significant shift towards sustainable and eco-friendly products, with biopesticides and biofertilizers gaining traction. This trend directly threatens KAP's Safripol segment, which offers traditional chemical products. As environmental regulations become more stringent and consumer demand leans towards greener alternatives, the viability of conventional chemicals diminishes. For instance, the global biopesticides market was valued at approximately USD 5.1 billion in 2023 and is projected to grow significantly, indicating a substantial substitution risk.

Technological advancements in material science pose a significant threat of substitution for KAP’s diverse industrial products. Innovations could yield new materials that are either superior in performance or more cost-effective than KAP’s current offerings.

For example, the development of advanced composites or novel recycled materials might directly displace traditional inputs like wood or foam used in KAP's PG Bison, Feltex, and Restonic divisions. This substitution pressure necessitates ongoing research and development to maintain market relevance and competitiveness.

In 2024, the global advanced materials market was valued at over $100 billion and is projected to grow significantly, indicating a strong trend towards material innovation that could impact KAP's product lines.

Shifting Consumer Preferences and Lifestyles

Changes in consumer preferences represent a significant threat of substitutes for KAP. A growing demand for sustainable products, for instance, could lead consumers to opt for eco-friendly alternatives, impacting demand for KAP's traditional offerings. Similarly, the increasing digitalization of services might reduce the need for physical products in certain sectors.

For example, the rise of remote work, accelerated by events in 2020 and continuing through 2024, directly affects demand for office furniture and related components. Companies are re-evaluating their office space needs, potentially leading to a decrease in purchases of traditional office setups. This shift encourages substitution towards home office solutions or entirely different work arrangements.

KAP's diversified business model, encompassing various industries and product lines, serves as a crucial mitigator against this threat. By not relying on a single product category, KAP can absorb the impact of shifting preferences in one area by leveraging growth in others. This strategic diversification helps to spread the risk associated with evolving consumer behaviors.

- Consumer Preference Shift: Growing consumer demand for sustainable and digital solutions can lead to the substitution of KAP's existing product lines.

- Remote Work Impact: Trends like increased remote work, prevalent in 2024, directly influence demand for specific office-related components, potentially reducing sales for KAP's manufacturing divisions.

- Digitalization Threat: The ongoing move towards digital alternatives over physical products poses a substitution risk across various KAP segments.

- Diversification as Mitigation: KAP's broad portfolio helps to balance the risks associated with changing consumer tastes, as shifts in one market may be offset by stability or growth in others.

Cost-Effectiveness and Performance of Substitutes

The threat of substitutes for KAP is significantly shaped by how cost-effective and performant these alternatives are. If competitors can offer similar or even better results for less money, customers are more likely to switch. For instance, in the energy sector, while KAP might offer advanced energy solutions, the increasing efficiency and falling prices of solar panels from companies like JinkoSolar, which saw its revenue grow by 23% in 2023, present a compelling substitute for traditional energy sources that KAP might supply.

KAP needs to actively monitor and improve its cost efficiency to remain competitive against these emerging substitutes. This involves not only technological innovation but also streamlining operations across all its business segments. For example, in the automotive sector, the rising adoption of electric vehicles (EVs) by brands like BYD, which reported a substantial increase in net profit for the first half of 2024, poses a direct threat to traditional internal combustion engine vehicles and the components KAP might supply for them.

- Cost-Effectiveness: Substitutes that offer a lower total cost of ownership, including initial purchase price and ongoing operational expenses, pose a significant threat.

- Performance Parity or Superiority: Alternatives that match or exceed KAP's product performance, such as advanced materials or digital solutions, can easily attract customers.

- Customer Switching Costs: If switching to a substitute involves minimal effort, time, or financial outlay, the threat is amplified.

- Availability and Accessibility: The widespread availability and ease of access to substitutes make them a more potent competitive force.

The threat of substitutes for KAP is a multifaceted challenge, driven by evolving consumer preferences, technological advancements, and economic considerations. Alternatives in logistics, chemicals, industrial materials, and energy all present viable options for customers, potentially diverting business away from KAP's core offerings.

For instance, in 2024, the increasing efficiency and decreasing costs of renewable energy sources, like solar panels, directly challenge traditional energy providers. Similarly, the growing adoption of electric vehicles impacts the automotive supply chain, a sector where KAP has interests.

Customers will often switch to substitutes if they are more cost-effective, offer superior performance, or involve lower switching costs. The ongoing trend towards digitalization also presents a broad substitution risk across many of KAP's segments, as services increasingly replace physical products.

KAP's diversification is a key strategy to mitigate this threat, allowing it to absorb market shifts in individual segments. However, continuous innovation and cost management are crucial to remain competitive against these readily available alternatives.

| Substitute Area | Example Substitute | Impact on KAP | Relevant 2024 Data/Trend | Mitigation Strategy |

|---|---|---|---|---|

| Logistics | Rail and Sea Freight | Potential loss of road freight business | Ongoing rail infrastructure upgrades in South Africa | Improving efficiency and cost-effectiveness of Unitrans |

| Chemicals | Biopesticides and Biofertilizers | Reduced demand for traditional chemical products | Global biopesticides market projected for significant growth | Research into sustainable chemical alternatives |

| Industrial Materials | Advanced Composites, Recycled Materials | Displacement of traditional inputs | Global advanced materials market exceeding $100 billion in 2024 | Investment in R&D for material innovation |

| Energy | Solar Power | Threat to traditional energy solutions | Falling prices and increasing efficiency of solar panels | Cost efficiency improvements and exploring new energy solutions |

Entrants Threaten

Entering KAP's core industries, which include logistics, chemicals, and diversified industrial manufacturing, demands a considerable initial investment. For instance, establishing a modern chemical production facility can easily cost hundreds of millions of dollars, while building out a comprehensive logistics network, complete with warehouses and fleets, might require billions. This extensive capital requirement acts as a formidable barrier, making it exceptionally difficult for new companies to gain a foothold without significant financial backing.

Established players like KAP leverage significant economies of scale in procurement, production, and distribution, leading to lower per-unit costs. For instance, in the chemical sector, a typical large-scale producer might achieve cost savings of 10-20% compared to a smaller operation due to bulk purchasing power and optimized logistics.

New entrants face a substantial hurdle in matching these cost efficiencies from the outset. They would need to invest heavily to build comparable volume and operational experience, a process that can take years and substantial capital, placing them at a considerable disadvantage.

The experience curve, where costs decrease with cumulative production, further solidifies the advantage of incumbents. As KAP produces more, its processes become more refined and less costly, creating a barrier that new, less experienced competitors find difficult to overcome.

This scale and experience advantage acts as a protective moat around KAP's market position, deterring potential new entrants who cannot immediately compete on price or efficiency.

KAP's subsidiaries, such as PG Bison and Safripol, benefit from deeply entrenched distribution networks. These channels are not easily replicated, requiring new entrants to invest heavily in logistics and market access. For instance, PG Bison’s reach across various industries, from furniture manufacturing to construction, is a testament to years of relationship building and infrastructure development.

Brand loyalty is another significant hurdle. Customers have grown accustomed to the quality and reliability associated with KAP's brands, like Safripol in the plastics sector. This loyalty translates into a preference for established suppliers, making it challenging for newcomers to capture market share without offering a compellingly superior value proposition or significantly lower prices, which are often unsustainable.

Consider the plastics industry where Safripol operates. High switching costs for manufacturers who rely on specific polymer grades and consistent supply chains can solidify existing customer relationships. New entrants would need to not only match product specifications but also demonstrate an equivalent level of supply chain reliability, a difficult feat in a competitive landscape.

The financial commitment required to establish comparable distribution capabilities and achieve brand recognition is substantial. Newcomers would face considerable upfront investment in logistics, sales forces, and marketing campaigns. This financial barrier, coupled with the time needed to cultivate trust and loyalty, effectively deters many potential entrants from challenging KAP's market position.

Regulatory Hurdles and Government Policies

The chemical and logistics sectors in South Africa present considerable barriers to entry due to a stringent regulatory environment. New companies must navigate a complex web of licensing, environmental standards, and safety regulations, which can be costly and time-consuming to comply with. For instance, the Responsible Care initiative, adopted by many chemical companies, requires adherence to specific environmental, health, and safety protocols. Established players like KAP have already invested heavily in achieving and maintaining compliance, giving them an advantage.

Government policies can further influence the threat of new entrants. Initiatives such as the South African Automotive Masterplan (SAAM) can shape market dynamics by promoting local content and specific industry development goals. These plans often favor existing, well-established companies that are already integrated into the supply chains and possess the necessary infrastructure and relationships to meet the plan's objectives. New entrants may find it challenging to align with or benefit from such government-driven strategies without significant upfront investment and strategic partnerships.

- Regulatory Compliance Costs: New entrants face substantial costs associated with obtaining licenses and meeting environmental and safety standards in South Africa's chemical and logistics industries.

- Legal and Expertise Requirements: Navigating South Africa's regulatory landscape requires specialized legal expertise that established firms have already secured.

- Government Policy Impact: Initiatives like the SAAM plan can create preferential conditions for existing players, increasing the difficulty for new companies to enter the market.

- Absorbed Costs by Incumbents: KAP and similar established firms have already borne the significant costs of regulatory compliance, creating a cost disadvantage for potential new entrants.

Access to Key Raw Materials and Technology

Newcomers often face significant hurdles in securing essential raw materials and proprietary technologies. Specialized chemicals, for instance, are frequently controlled by a limited number of suppliers, many of whom have long-standing relationships with established players. These existing partnerships can translate into exclusive supply agreements or preferential pricing, effectively barring new entrants from obtaining critical inputs at competitive rates.

This difficulty in accessing necessary resources directly impacts a new entrant's ability to establish a foothold and compete. Without consistent and affordable access to key materials or advanced technologies, their production costs can be significantly higher, and their product quality may suffer, making it challenging to capture market share. For example, KAP's well-publicized dispute with Sasol in early 2024 underscored the critical nature of securing reliable access to specialized chemicals, a dispute that impacted KAP's production capabilities.

- Limited Supplier Base: The market for certain specialized chemicals and advanced manufacturing technologies is often concentrated among a few key suppliers.

- Exclusive Agreements: Incumbents may hold exclusive contracts with these suppliers, preventing new entrants from accessing vital inputs.

- Proprietary Technology Barriers: Acquiring or licensing essential proprietary technologies can be prohibitively expensive or simply unavailable to new firms.

- Impact on Cost Structure: Inability to secure raw materials at competitive prices can lead to higher production costs for new entrants, eroding their profit margins.

The threat of new entrants for KAP is generally moderate to low across its core industries of logistics, chemicals, and diversified industrial manufacturing. Significant capital requirements, estimated in the hundreds of millions to billions for logistics networks and chemical facilities, act as a primary deterrent. Established economies of scale, providing 10-20% cost advantages in sectors like chemicals, further disadvantage newcomers who cannot match the volume and experience of incumbents like KAP. These advantages, coupled with strong distribution networks and brand loyalty, particularly in sectors like plastics where Safripol operates, create substantial barriers. Furthermore, navigating South Africa's stringent regulatory environment and securing access to specialized raw materials, as highlighted by KAP's 2024 dispute with Sasol, add further layers of difficulty for potential entrants.

| Barrier Type | Industry Example | Estimated Cost/Impact | KAP's Advantage |

| Capital Requirements | Chemical Plant Construction | Hundreds of millions USD | Established infrastructure |

| Economies of Scale | Chemical Procurement | 10-20% cost savings | Bulk purchasing power |

| Distribution Networks | Furniture & Construction (PG Bison) | Years of infrastructure development | Extensive reach |

| Brand Loyalty/Switching Costs | Plastics Sector (Safripol) | High for manufacturers | Proven reliability |

| Regulatory Compliance | Chemicals & Logistics | Significant licensing & standards costs | Existing compliance infrastructure |

| Raw Material Access | Specialized Chemicals | Limited suppliers, exclusive agreements | Established supplier relationships |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of credible data, including industry-specific market research reports, company annual filings, and economic indicators from reputable sources like the World Bank and Bloomberg.