Kaken Pharmaceutical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kaken Pharmaceutical Bundle

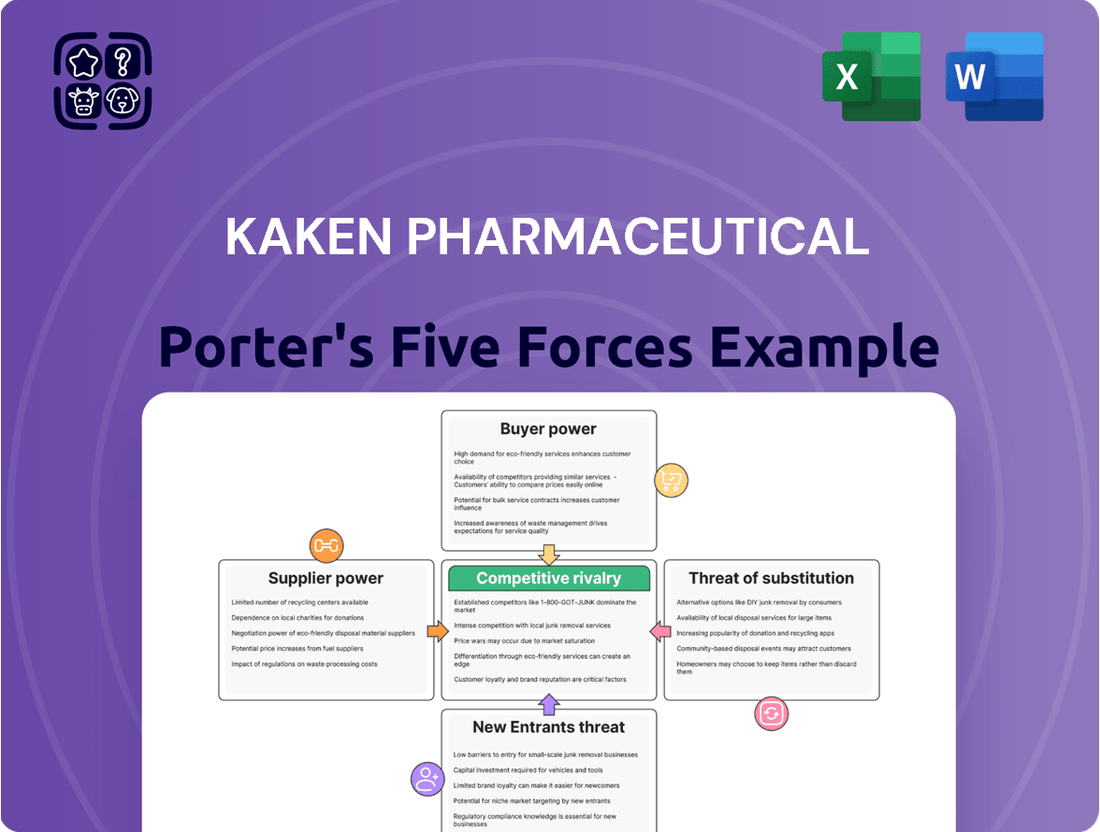

Kaken Pharmaceutical navigates a complex industry landscape, shaped by powerful market forces. Understanding the intensity of rivalry, the threat of new entrants, and the bargaining power of buyers is crucial for any stakeholder. The influence of suppliers and the availability of substitutes also present significant challenges and opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Kaken Pharmaceutical’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The pharmaceutical industry, including companies like Kaken Pharmaceutical, often faces significant supplier power due to its reliance on specialized raw materials and Active Pharmaceutical Ingredients (APIs). These critical components are frequently produced by a limited number of highly specialized manufacturers globally.

If Kaken Pharmaceutical's supply chain for proprietary or unique compounds involves only a few key suppliers, those suppliers gain substantial leverage. This can translate into their ability to dictate pricing and favorable contract terms, directly impacting Kaken's operational expenses and profitability.

This dependency can lead to increased production costs for Kaken. For instance, a significant price hike by a sole API supplier could directly affect the cost of goods sold. Furthermore, any disruption or delay from these specialized suppliers can potentially impede Kaken's drug development timelines or manufacturing schedules.

Kaken Pharmaceutical faces significant supplier power due to stringent regulatory requirements like Good Manufacturing Practices (GMP). These standards necessitate that suppliers maintain rigorous quality controls, effectively reducing the number of qualified and capable partners. This compliance burden inherently grants more leverage to those suppliers who can consistently meet these demanding specifications.

The process of switching suppliers in the pharmaceutical industry is both costly and complex. It involves extensive regulatory validation procedures and ensuring the integrity of the entire supply chain. For Kaken, this means that even if a supplier proposes unfavorable terms, the expense and time involved in qualifying a new partner make such transitions difficult, reinforcing the bargaining power of incumbent suppliers.

Kaken Pharmaceutical's concentration on specialized areas like dermatology, orthopedics, and infectious diseases often necessitates unique, patented ingredients or advanced biological materials. If these critical inputs are sourced from a limited number of exclusive suppliers, those suppliers gain significant bargaining power. This can translate into increased costs for Kaken and a potential risk of supply disruptions if they depend heavily on a single source for these specialized components.

Supplier Power 4

The global nature of pharmaceutical supply chains exposes Kaken Pharmaceutical to significant risks. Geopolitical events, evolving trade policies, and natural disasters can disrupt the availability and pricing of critical components, impacting operational stability and profitability. For instance, in 2024, several key regions experienced supply chain disruptions due to extreme weather events, leading to temporary shortages and price increases for certain chemical precursors used in drug manufacturing.

Suppliers possessing high production capacities or exclusive access to unique resources can exert considerable leverage, particularly if Kaken's sourcing strategy lacks geographical diversification. For example, a significant portion of active pharmaceutical ingredients (APIs) for many oncology drugs are manufactured in specific Asian countries. A disruption in these areas, as seen in early 2024 with new export regulations in one major producing nation, directly impacts Kaken’s ability to secure these vital materials at stable prices.

- Geopolitical Risks: Trade tensions or new tariffs implemented in 2024 between major economic blocs can increase the cost of imported raw materials, affecting Kaken's cost of goods sold.

- Supply Chain Concentration: Reliance on a limited number of suppliers for specialized chemicals, common in the pharmaceutical industry, grants those suppliers greater pricing power.

- Regulatory Changes: Shifts in environmental or labor regulations in supplier countries can lead to increased production costs, which may be passed on to Kaken.

- Logistical Bottlenecks: Port congestion or transportation disruptions, a recurring issue in 2024, can delay deliveries and increase shipping costs for essential pharmaceutical ingredients.

Supplier Power 5

While large suppliers often wield significant power, Kaken Pharmaceutical's substantial purchasing volume and the use of long-term contracts can effectively counterbalance some of this leverage. For instance, by consolidating its procurement, Kaken can negotiate better pricing and more favorable supply conditions, similar to how major pharmaceutical distributors secure discounts.

If Kaken constitutes a substantial portion of a particular supplier's annual revenue, or if it cultivates strategic partnerships, the company gains considerable negotiating strength. This can lead to more advantageous terms, potentially including price stability or guaranteed supply, which is crucial in the pharmaceutical industry where consistent input availability is paramount.

However, the inherent market power of suppliers of highly specialized or patented inputs remains a significant factor. Even with Kaken's considerable size, it may not fully offset the supplier's control over unique or proprietary materials, particularly if alternative suppliers are scarce or non-existent.

- Supplier Dependence: If Kaken represents a significant portion of a supplier's sales, its bargaining power increases.

- Contractual Strength: Long-term agreements can lock in favorable terms and mitigate price volatility.

- Input Specialization: For highly specialized or patented raw materials, supplier power is inherently higher.

- Strategic Partnerships: Collaborative relationships can foster mutual benefits and enhance negotiation leverage.

The bargaining power of suppliers for Kaken Pharmaceutical is notably high due to the specialized nature of its raw materials and active pharmaceutical ingredients (APIs). Many essential components are produced by a limited number of global manufacturers, granting them considerable leverage over pricing and contract terms. This concentration, coupled with stringent regulatory requirements like Good Manufacturing Practices (GMP), means only a select few suppliers can meet Kaken's quality and compliance standards, further solidifying their power.

The intricate and costly process of qualifying new pharmaceutical suppliers, involving extensive validation, makes switching difficult for Kaken. This inertia reinforces the position of existing suppliers, even if they propose less favorable terms. For example, disruptions in 2024 due to geopolitical shifts and extreme weather in key sourcing regions highlighted the vulnerability of pharmaceutical supply chains, leading to price hikes for certain chemical precursors.

While Kaken’s purchasing volume and long-term contracts can mitigate some supplier power, the inherent scarcity of highly specialized or patented inputs remains a significant challenge. For instance, the concentration of API manufacturing in specific Asian countries means that new export regulations, as observed in early 2024, can directly impact Kaken's ability to secure vital materials at stable prices.

| Factor | Impact on Kaken Pharmaceutical | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Limited suppliers for specialized APIs grant pricing power. | Continued reliance on key regions for API production. |

| Regulatory Compliance (GMP) | Reduces the pool of qualified suppliers, increasing their leverage. | Ongoing strict adherence to quality controls remains critical. |

| Switching Costs | High costs and time for supplier validation make transitions difficult. | Supplier relationships are often long-term due to these barriers. |

| Geopolitical & Logistical Risks | Disruptions can lead to shortages and price increases for raw materials. | Extreme weather and trade policies in 2024 caused notable supply chain volatility. |

What is included in the product

Tailored exclusively for Kaken Pharmaceutical, this analysis dissects the competitive forces shaping its pharmaceutical market, revealing strategic vulnerabilities and opportunities.

Instantly understand competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing Kaken Pharmaceutical to proactively address market challenges and relieve strategic pain points.

Customers Bargaining Power

Kaken Pharmaceutical's primary customers are hospitals, clinics, and pharmacies. These entities, particularly those operating as group purchasing organizations (GPOs) or buying in bulk, wield considerable influence. For instance, in 2023, the global pharmaceutical market saw intense price negotiations, with GPOs in the US alone influencing billions in drug spending, putting pressure on manufacturers like Kaken.

This buyer power is amplified when Kaken's drugs face competition from similar therapeutic alternatives. Customers can leverage these options to negotiate more favorable pricing, extended payment schedules, or demand for supplementary services. The ongoing global imperative to curb healthcare expenditures directly translates into increased buyer leverage, making price a critical factor in purchasing decisions.

For Kaken Pharmaceutical, the bargaining power of customers can be significant, especially for established products in less specialized therapeutic areas. In 2024, the increasing availability of generic drugs and biosimilars, particularly in fields like dermatology and orthopedics where Kaken has a presence, empowers customers to seek out lower-cost alternatives. This price sensitivity can limit Kaken's ability to command premium pricing on these particular offerings.

However, Kaken's pricing power is considerably stronger when it comes to truly innovative and unique products, those with limited or no direct substitutes. For instance, if Kaken secures patents for novel treatments in 2024 for conditions with high unmet needs, customers will have fewer options, thereby reducing their bargaining leverage and allowing Kaken to maintain more control over pricing.

Government healthcare systems and large insurance providers wield substantial influence over pharmaceutical pricing. These entities often dictate reimbursement rates, establish drug formularies, and manage approval processes, effectively acting as powerful customers that can significantly impact a company like Kaken Pharmaceutical’s market access and profitability. For instance, in 2024, many national health services continued to implement stringent cost-containment measures, directly affecting the revenue potential for new and existing drugs.

Customer Power 4

While Kaken Pharmaceutical's direct customers are typically healthcare providers and institutions, the bargaining power of end-users, or patients, can be indirectly significant. Patient advocacy groups and public opinion, though not direct purchasers, wield considerable influence. For instance, widespread public outcry over high drug prices, as seen in various global markets, can prompt regulatory bodies and large institutional buyers to demand more favorable pricing from pharmaceutical companies. This societal pressure forces Kaken to consider not just its direct customer relationships but also the broader social contract and the perception of its pricing strategies.

In 2024, the pharmaceutical industry continued to face intense scrutiny regarding drug affordability. Reports indicated that public opinion in key markets like the United States, where drug prices are a major political issue, strongly favored greater price controls. This sentiment directly impacts the negotiation leverage of large purchasers, such as government health programs and major hospital networks, who are increasingly empowered to push for lower costs for Kaken's products. Kaken's ability to maintain its pricing power will depend on demonstrating clear value and managing public perception effectively.

- Indirect Influence: Patient advocacy groups and public sentiment can pressure institutional buyers and regulators, indirectly boosting customer bargaining power.

- Pricing Scrutiny: Negative public perception regarding drug pricing can lead to increased negotiation demands for lower costs from Kaken.

- Societal Impact: Kaken must factor in the broader social implications and public reaction when formulating its pricing strategies for pharmaceuticals.

- 2024 Trends: Global markets in 2024 saw continued public demand for drug price transparency and affordability, strengthening the negotiating position of institutional customers.

Customer Power 5

For Kaken Pharmaceutical's highly specialized or innovative products, particularly those addressing significant unmet medical needs, customer bargaining power is considerably lower. This is primarily due to the limited availability of viable alternatives in the market, meaning patients and healthcare providers have fewer options. For instance, in therapeutic areas where Kaken holds strong patent protection and offers distinct clinical advantages, such as novel treatments in dermatology or orthopedics, customers possess less leverage to negotiate prices. This situation allows Kaken to maintain premium pricing for its truly differentiated pharmaceutical solutions, reflecting the value and uniqueness they bring to patient care. In 2023, Kaken reported strong performance in its orthopedic segment, driven by its innovative product pipeline, indicating the success of this strategy.

- Limited Alternatives: Kaken's specialized treatments often face few direct competitors, diminishing customer negotiation power.

- Patent Protection: Strong patents on unique therapeutic advantages, like those in dermatology, limit customer options and price sensitivity.

- Premium Pricing: Differentiated and innovative pharmaceutical solutions enable Kaken to command higher prices.

- Market Position: In 2023, Kaken's orthopedic segment demonstrated robust growth, highlighting the market's acceptance of its high-value offerings.

Kaken Pharmaceutical's customers, primarily hospitals and clinics, possess significant bargaining power, especially when purchasing in bulk or through group purchasing organizations. This leverage is amplified by the availability of competing drugs, allowing buyers to negotiate better terms or seek lower-cost alternatives. In 2024, the ongoing global push for healthcare cost containment further empowers these customers, making price a crucial factor in their decision-making process.

| Customer Type | Influence Factor | 2024 Trend Impact |

| Hospitals & Clinics (Bulk Buyers) | Volume discounts, negotiation leverage | Increased pressure for cost reductions |

| Group Purchasing Organizations (GPOs) | Consolidated purchasing power | Significant influence on pricing strategies |

| Pharmacies | Demand for favorable payment terms | Focus on supply chain efficiency and margins |

Same Document Delivered

Kaken Pharmaceutical Porter's Five Forces Analysis

This preview shows the exact Kaken Pharmaceutical Porter's Five Forces analysis you'll receive immediately after purchase, detailing the competitive landscape of the pharmaceutical industry. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Kaken's market. This professionally formatted document is ready for your strategic planning and decision-making.

Rivalry Among Competitors

Competitive rivalry within Kaken Pharmaceutical's operating segments, including dermatology, orthopedics, and infectious diseases, is exceptionally fierce. This intensity stems from the industry's constant need for innovation, demanding significant research and development investments. Global pharmaceutical titans and agile biotechnology firms alike are locked in a continuous battle for market dominance, driven by new drug approvals and expanded therapeutic uses.

In 2024, the pharmaceutical landscape saw continued consolidation and strategic alliances as companies sought to bolster their pipelines and market presence. For instance, the global pharmaceutical market size was projected to reach approximately $1.7 trillion in 2024, underscoring the vast economic stakes involved. Kaken, facing competition from entities with significantly larger R&D budgets and established market access, must continually demonstrate the efficacy and value of its specialized treatments to maintain and grow its market share.

The pharmaceutical industry, and by extension Kaken Pharmaceutical, experiences intense rivalry, especially as patents on key drugs expire. Generic competitors then flood the market with much cheaper versions, causing prices to plummet. For instance, the expiry of a blockbuster drug's patent can see its price drop by over 80% within a year due to generic entry.

Even for drugs still under patent protection, competition from similar, so-called 'me-too' drugs is a constant challenge. These drugs offer comparable therapeutic results, forcing companies like Kaken to constantly prove their products are superior in terms of effectiveness or safety. This competitive pressure demands continuous and substantial investment in research and development to stay ahead.

In 2024, the pharmaceutical sector continued to see significant R&D spending, with major players investing billions to develop novel treatments and maintain market share. Companies that fail to innovate risk being outpaced by rivals offering more effective or convenient therapies, impacting their revenue streams and overall market position.

Competitive rivalry in the pharmaceutical sector, including Kaken Pharmaceutical, is intense and multifaceted. It goes far beyond just developing new drugs. Companies are locked in a constant struggle to attract and retain the best scientific minds, leading to significant investments in research and development talent. For instance, in 2024, the global pharmaceutical R&D spending was projected to exceed $240 billion, a testament to this talent war.

Furthermore, the battle for intellectual property is fierce, with frequent legal disputes over patent infringements. These patent battles can significantly impact market exclusivity and profitability for companies like Kaken. In 2023, the U.S. District Courts saw thousands of patent litigation cases, many of which were within the pharmaceutical industry, highlighting the prevalence of these intellectual property conflicts.

Securing global market access also fuels intense competition. Pharmaceutical firms must navigate complex regulatory environments and build extensive distribution networks to reach patients worldwide. Companies are actively seeking advantageous licensing agreements and strategic partnerships to expand their geographic reach and product portfolios, as demonstrated by the numerous cross-border collaborations announced in early 2024.

Competitive Rivalry 4

Kaken Pharmaceutical navigates a competitive landscape characterized by fragmentation in key therapeutic areas like dermatology and orthopedics. This means Kaken contends not only with established giants but also with a multitude of smaller, nimble players. These smaller firms often possess the agility to rapidly innovate and target specific market niches, posing a potential disruptive threat. For instance, in 2024, the global dermatology market was valued at approximately $150 billion, with a significant portion attributed to specialized treatments where smaller biotechs can gain traction. Kaken's strategic imperative involves continuous monitoring of these emerging competitors and adapting its approach to sustain market relevance and its competitive standing.

The presence of numerous specialized companies means Kaken must remain vigilant. These entities, by focusing on particular unmet needs or leveraging novel technologies, can carve out significant market share quickly. Kaken's response needs to be dynamic, potentially involving strategic partnerships, acquisitions, or accelerated internal R&D to counter these agile threats. For example, in the orthopedic segment, the rise of personalized implant technologies developed by smaller firms highlights the need for Kaken to stay ahead of technological advancements.

- Fragmented Markets: Dermatology and orthopedics feature many competitors, ranging from large corporations to specialized, agile firms.

- Niche Specialization: Smaller companies often thrive by focusing on specific therapeutic niches or innovative technologies.

- Disruptive Potential: These agile competitors can quickly disrupt existing market dynamics with novel solutions.

- Strategic Adaptation: Kaken must continuously adapt its strategies to counter emerging threats and maintain its market position.

Competitive Rivalry 5

Competitive rivalry in the pharmaceutical sector, particularly for companies like Kaken Pharmaceutical, hinges significantly on marketing and sales capabilities. Heavy investment in promotional activities aims to build physician and patient awareness and acceptance of new treatments. Kaken's success in this area directly influences its ability to penetrate the market and establish a strong competitive position.

Effective sales forces and market access teams are critical for securing formulary listings, which is a key determinant of product accessibility and prescription volume. Kaken Pharmaceutical's capacity to navigate these complex processes and demonstrate the value proposition of its innovative products is paramount to its competitive standing.

- Market Penetration: Kaken's ability to reach target physicians and patients effectively through its sales and marketing efforts is a primary driver of its market share.

- Product Differentiation: Communicating the unique benefits and clinical advantages of Kaken's products is vital in a crowded market.

- Formulary Access: Securing favorable positions on hospital and insurance formularies, facilitated by strong market access teams, directly impacts prescription rates.

- Promotional Investment: In 2023, the global pharmaceutical market saw significant spending on sales and marketing, with many companies allocating over 20% of their revenue to these functions, a trend Kaken likely mirrors to remain competitive.

Competitive rivalry within Kaken Pharmaceutical's operating segments is intense, driven by the need for continuous innovation and substantial R&D investment. Global pharmaceutical giants and agile biotech firms vie for market dominance through new drug approvals and expanded therapeutic uses. In 2024, the global pharmaceutical market was projected to reach around $1.7 trillion, highlighting the high stakes.

Kaken faces competition from larger R&D-resourced entities and must consistently demonstrate the value of its specialized treatments to maintain market share. Patent expirations lead to significant price drops due to generic entry, with prices potentially falling over 80% within a year. Even for patented drugs, 'me-too' competitors offering similar results necessitate Kaken to prove product superiority in efficacy or safety, demanding sustained R&D investment.

The pharmaceutical sector's competitive intensity extends to attracting top scientific talent, with global R&D spending projected to exceed $240 billion in 2024. Furthermore, fierce battles over intellectual property and patent infringements are common, with thousands of pharmaceutical patent litigation cases filed annually. Navigating complex regulatory environments and establishing robust distribution networks are also critical for global market access, driving strategic alliances and licensing agreements.

Dermatology and orthopedics, key areas for Kaken, are fragmented with numerous competitors, from large corporations to agile niche players. These smaller firms can disrupt markets with novel solutions, requiring Kaken to monitor emerging threats and adapt its strategies. The global dermatology market, valued at approximately $150 billion in 2024, exemplifies the potential for specialized treatments developed by smaller companies.

Sales and marketing capabilities are crucial for Kaken's competitive standing, requiring heavy investment in physician and patient awareness. Effective sales forces and market access teams are vital for securing formulary listings, directly impacting prescription volume. In 2023, global pharmaceutical sales and marketing spending often exceeded 20% of revenue, a trend Kaken likely follows to remain competitive.

| Factor | Description | 2024 Data/Trend |

|---|---|---|

| Innovation Race | Constant need for new drug development and R&D investment. | Global pharmaceutical market projected at $1.7 trillion. |

| Patent Expirations | Generic competition drastically reduces prices post-patent expiry. | Prices can drop >80% within a year after patent expiry. |

| 'Me-Too' Drugs | Competition from similar drugs requiring differentiation. | Continuous R&D spending essential to prove superiority. |

| Talent Acquisition | Competition for skilled scientific personnel. | Global pharmaceutical R&D spending projected >$240 billion in 2024. |

| Market Access | Navigating regulations and distribution networks. | Numerous cross-border collaborations announced in early 2024. |

SSubstitutes Threaten

For many conditions Kaken Pharmaceutical addresses, substitutes are readily available, impacting its market position. In the orthopedic sector, for example, physical therapy and surgical interventions can offer alternatives to pharmaceutical pain management and anti-inflammatory drugs. These non-drug approaches, alongside medical devices, represent a significant substitution threat, as patients might choose them based on factors like cost-effectiveness or desired treatment outcomes.

The increasing prevalence of generic drugs and biosimilars poses a significant threat to Kaken Pharmaceutical, particularly as its key product patents expire. These more affordable alternatives offer comparable therapeutic outcomes, which can quickly diminish the market share of original, higher-priced medications.

For example, the global market for biosimilars alone was valued at approximately $20.4 billion in 2023 and is projected to grow substantially, indicating a strong competitive force. Kaken's strategy must involve a robust pipeline of novel, patented pharmaceuticals to counteract the revenue erosion from established drugs facing generic or biosimilar competition.

Lifestyle shifts, including enhanced hygiene or dietary changes, can substitute for certain pharmaceutical interventions, especially in managing chronic conditions or dermatological issues. For instance, adopting a healthier diet might lessen the reliance on medications for conditions like metabolic syndrome, impacting the demand for Kaken's related products.

Preventive healthcare measures also pose a threat. Increased public awareness and adoption of preventive strategies, such as vaccinations or regular health screenings, can reduce the incidence of diseases that Kaken's therapies target. This can shrink the addressable market for their established and pipeline drugs.

While not direct pharmacological alternatives, these non-drug interventions can indirectly decrease the market size for Kaken Pharmaceutical's offerings. For example, a growing trend towards natural remedies in skincare could reduce the need for certain dermatological treatments, affecting sales in that segment.

The global preventive healthcare market was valued at approximately USD 3.5 trillion in 2023 and is projected to grow significantly, indicating a substantial shift towards proactive health management that could impact traditional pharmaceutical demand.

Threat of Substitution 4

The threat of substitutes for Kaken Pharmaceutical is intensified by rapid advancements in medical technology. Emerging fields like gene therapy and cell therapy are creating entirely new ways to treat diseases, potentially bypassing traditional drug-based solutions. For instance, the global gene therapy market was valued at approximately USD 7.5 billion in 2023 and is projected to grow significantly, reaching an estimated USD 25.9 billion by 2030, according to some market analyses. This rapid growth indicates a substantial shift in treatment paradigms.

Kaken must proactively address these disruptive technologies. Strategic partnerships or focused internal research and development are crucial to explore these innovative fields. By doing so, Kaken can ensure its product pipeline remains competitive and relevant in the face of evolving therapeutic landscapes, safeguarding its long-term market position.

- Advancements in Gene and Cell Therapies: These novel approaches offer alternative treatment modalities to traditional pharmaceuticals.

- Market Growth of Gene Therapy: The gene therapy market's substantial projected growth highlights its increasing viability as a substitute.

- Strategic Imperative for Kaken: Monitoring and investing in R&D or partnerships within these emerging technological areas is vital for future competitiveness.

- Maintaining Portfolio Relevance: Adapting to new treatment paradigms ensures Kaken's offerings remain valuable to patients and healthcare providers.

Threat of Substitution 5

The threat of substitutes for Kaken Pharmaceutical's products, particularly in areas like dermatology, comes from readily available over-the-counter (OTC) medications and traditional remedies. For less severe conditions, patients often choose these more accessible and affordable options before considering prescription drugs. This means Kaken must strongly highlight the advanced benefits of its prescription treatments.

For instance, in the dermatology market, the global OTC skincare market was valued at approximately USD 150 billion in 2023 and is projected to grow. This vast market offers consumers a wide array of creams, ointments, and natural solutions that can address minor ailments, directly competing with Kaken's prescription offerings. The accessibility and lower price points of these substitutes are significant factors.

- OTC Medication Market Size: The global market for OTC drugs was estimated to be over USD 200 billion in 2024, with a significant portion dedicated to topical treatments.

- Consumer Preference for Affordability: Studies indicate that up to 40% of patients with minor dermatological issues will first try an OTC product due to cost savings.

- Traditional Remedies' Appeal: The increasing popularity of natural and holistic health approaches provides a growing base of consumers opting for traditional remedies over pharmaceuticals.

- Kaken's Differentiation Imperative: To counter this, Kaken needs to emphasize superior efficacy, improved safety profiles, and unique pharmacological mechanisms in its prescription dermatology portfolio.

The threat of substitutes for Kaken Pharmaceutical is multifaceted, encompassing non-drug interventions, generics, and emerging medical technologies. In 2024, the global biosimilar market is projected to exceed USD 30 billion, a significant increase from 2023, directly challenging Kaken's revenue from branded drugs. Furthermore, the preventive healthcare market's growth, estimated to reach USD 4.3 trillion by 2026, indicates a societal shift that could reduce the incidence of diseases Kaken treats.

| Substitute Category | Example | Market Indicator (2023/2024 Data) | Impact on Kaken |

|---|---|---|---|

| Non-Drug Interventions | Physical Therapy, Lifestyle Changes | Preventive Healthcare Market: USD 3.5 Trillion (2023) | Reduces demand for certain Kaken treatments. |

| Generics & Biosimilars | Affordable versions of branded drugs | Biosimilar Market: USD 20.4 Billion (2023), projected growth | Erodes market share and pricing power of Kaken's patented drugs. |

| Advanced Medical Technologies | Gene Therapy, Cell Therapy | Gene Therapy Market: USD 7.5 Billion (2023), projected to reach USD 25.9 Billion by 2030 | Offers disruptive alternative treatment paradigms. |

| Over-the-Counter (OTC) Products | Dermatology creams, topical remedies | OTC Skincare Market: USD 150 Billion (2023) | Captures patients with less severe conditions, impacting prescription uptake. |

Entrants Threaten

The threat of new entrants in the pharmaceutical sector, particularly for companies like Kaken Pharmaceutical, is generally low due to exceptionally high barriers. The sheer cost of drug discovery and development is a major deterrent; estimates suggest bringing a new drug to market can exceed $2 billion and often takes more than ten years. This massive capital requirement for extensive research, clinical trials, and regulatory approvals makes it incredibly difficult for new players to emerge and compete effectively.

The pharmaceutical industry, including companies like Kaken Pharmaceutical, faces a significant threat from new entrants due to the immense barriers to entry. Regulatory hurdles are a primary concern, with bodies like the FDA and EMA imposing strict requirements for drug approval. For instance, the average cost to bring a new drug to market in 2023 was estimated to be over $2 billion, a figure that underscores the financial strain on newcomers.

New companies must navigate complex and lengthy clinical trial processes, which are essential for proving a drug's safety and efficacy. These trials are not only time-consuming, often taking a decade or more, but also carry a high failure rate, meaning substantial investment can be lost without a marketable product. Kaken Pharmaceutical, like established players, has built extensive experience and internal capabilities to manage these trials effectively, a resource new entrants would struggle to replicate quickly.

Furthermore, the sheer cost and specialized expertise required to manage these regulatory pathways present another formidable barrier. New entrants often lack the deep understanding of regulatory nuances and the financial capacity to sustain the long development cycles and potential setbacks. This creates a substantial competitive advantage for established firms that have already invested heavily in R&D infrastructure and regulatory affairs departments.

Established pharmaceutical companies, including Kaken, benefit significantly from robust patent protection. For instance, Kaken's key products often enjoy patent exclusivity for many years, preventing competitors from easily replicating their innovations. This legal shield is a primary barrier, making it difficult for newcomers to enter the market with comparable offerings.

The sheer cost and complexity of drug discovery and development also act as a substantial deterrent. Bringing a new drug to market typically requires billions of dollars and over a decade of research, clinical trials, and regulatory approvals. This lengthy and expensive process significantly raises the barrier to entry for potential new players.

Furthermore, regulatory hurdles are immense. New entrants must navigate stringent approval processes from bodies like the FDA in the US or EMA in Europe, which are time-consuming and resource-intensive. Successfully clearing these regulatory pathways demands considerable expertise and financial backing, further limiting the threat of new competition.

Threat of New Entrants 4

The threat of new entrants for pharmaceutical companies like Kaken Pharmaceutical is generally low due to substantial barriers to entry. Building robust distribution networks and establishing strong relationships with healthcare providers are crucial for market access. Gaining formulary approvals, which determine which drugs are covered by insurance, also requires significant time and investment, often running into millions of dollars and years of effort.

Newcomers must also contend with the formidable sales forces and extensive marketing capabilities of established players. Kaken Pharmaceutical, for instance, has spent years cultivating these assets, making it challenging for new entrants to gain market traction and compete effectively on a large scale. For example, in 2023, major pharmaceutical companies reported marketing and sales expenses in the billions, showcasing the scale of investment required to compete.

- High Capital Requirements: Pharmaceutical R&D and market launch costs can easily exceed hundreds of millions, if not billions, of dollars.

- Regulatory Hurdles: Navigating complex and lengthy approval processes from bodies like the FDA or EMA is a significant barrier.

- Intellectual Property: Patents protect existing drugs, limiting market entry for generics or similar compounds until expiry.

- Brand Loyalty and Physician Relationships: Established companies benefit from trust and long-standing relationships with medical professionals.

Threat of New Entrants 5

The threat of new entrants for Kaken Pharmaceutical is relatively low, primarily due to the significant brand loyalty and trust established with both physicians and patients. This trust, cultivated over years of delivering consistent product quality and demonstrating clinical success, acts as a formidable barrier. For instance, in 2024, established players in the Japanese pharmaceutical market, where Kaken is prominent, continue to benefit from strong physician relationships, often built through extensive medical education and support programs that new entrants find difficult to replicate quickly.

Healthcare professionals, by nature of their responsibility for patient well-being, tend to favor prescribing medications from companies they know and trust. This inherent advantage makes it challenging for new entrants to gain market share and build the necessary credibility in an industry where risk aversion is paramount. The lengthy and costly process of drug development, coupled with stringent regulatory approvals, further deters potential new competitors.

- Established Brand Recognition: Kaken's long-standing reputation for quality and efficacy provides a significant competitive edge.

- Physician Preference: Doctors' ingrained habits of prescribing trusted brands present a hurdle for newcomers.

- High R&D and Regulatory Barriers: The substantial investment and time required for new drug approval deter market entry.

- Trust and Credibility Gap: New entrants must overcome a lack of established trust in a risk-sensitive sector.

The threat of new entrants for Kaken Pharmaceutical is low, largely due to the substantial capital investment and lengthy development timelines required in the pharmaceutical industry. For example, the average cost to develop a new drug in 2023 was estimated to be over $2 billion, with over a decade often needed for research and clinical trials.

Stringent regulatory approvals from bodies like the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan are another significant barrier. New companies must navigate these complex processes, which demand considerable expertise and financial resources, making it difficult to compete with established firms like Kaken that possess established infrastructure and knowledge.

Furthermore, patent protection for Kaken's innovative drugs shields them from immediate competition, and building brand loyalty and strong relationships with healthcare professionals takes considerable time and investment. New entrants face the challenge of overcoming this established trust and market presence.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Drug development costs can exceed $2 billion, with over a decade required for R&D and trials. | High barrier due to extensive financial needs. |

| Regulatory Approvals | Complex and time-consuming processes by agencies like PMDA. | Requires specialized expertise and significant resources to navigate. |

| Intellectual Property | Patent exclusivity protects Kaken's products. | Limits immediate competition from generics or similar compounds. |

| Brand & Relationships | Established trust with physicians and patients. | Difficult for newcomers to replicate, requiring time and investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Kaken Pharmaceutical is built upon a foundation of comprehensive industry data, including financial reports, market research from firms like IQVIA, and insights from pharmaceutical trade publications.

We also leverage publicly available information from Kaken Pharmaceutical's investor relations website, regulatory filings with PMDA, and news releases to provide a robust assessment of competitive dynamics.