Johnson Electric Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Johnson Electric Holdings Bundle

Gain a crucial competitive advantage with our comprehensive PESTLE Analysis of Johnson Electric Holdings. Understand the intricate interplay of political stability, economic fluctuations, and technological advancements that are redefining the manufacturing landscape. Discover how evolving social demographics and stringent environmental regulations present both challenges and opportunities for this global leader.

Our expertly crafted analysis delves into the legal frameworks and geopolitical shifts impacting Johnson Electric Holdings's operations. Equip yourself with the foresight needed to navigate market complexities and anticipate future trends. Download the full PESTLE analysis now to unlock actionable intelligence and refine your strategic decision-making.

Political factors

Global trade tensions, exemplified by the ongoing US-China trade disputes, continue to create significant headwinds for international manufacturers. These disputes can lead to unpredictable tariff impositions, directly impacting the cost of components and finished goods. For Johnson Electric, this translates to higher operational expenses and potential disruptions in sourcing critical materials, as seen in the fluctuating costs of electronic components throughout 2024.

The implementation of tariffs and subsequent retaliatory measures necessitate a strategic re-evaluation of global supply chains. Companies like Johnson Electric must adapt by diversifying their supplier base and potentially relocating manufacturing to mitigate the impact of these trade policies. This agility is crucial for maintaining cost competitiveness and ensuring reliable access to necessary inputs, especially as geopolitical alignments shift.

The uncertainty stemming from these trade conflicts hampers long-term strategic planning and investment decisions for businesses. Johnson Electric, like many in the manufacturing sector, faces challenges in forecasting demand and managing inventory effectively when market access and input costs are subject to sudden changes. This environment demands flexible procurement and production strategies to navigate the volatile global trade landscape.

Governments globally are actively shaping industries vital to Johnson Electric, particularly electric vehicles (EVs) and smart technologies. For instance, many nations are offering substantial tax credits and subsidies to accelerate EV adoption; in the United States, the Inflation Reduction Act provides up to $7,500 in tax credits for qualifying new EVs purchased in 2024. These incentives directly translate to increased demand for Johnson Electric's motion components used in EV powertrains and battery systems.

Conversely, regulatory frameworks are also tightening, impacting product development. Stricter emissions standards for vehicles, such as the Euro 7 proposals in Europe aiming for lower pollutant levels by 2025, necessitate advanced motor control and efficiency in EV powertrains. Similarly, evolving safety and data privacy regulations for smart home devices and medical equipment require Johnson Electric to invest in compliance, influencing the design of its sensors and actuators.

Geopolitical stability is a critical concern for Johnson Electric, particularly as ongoing tensions and regional conflicts continue to create supply chain volatility. For instance, the continued disruptions in the Red Sea shipping lanes in early 2024 have significantly impacted global trade routes, increasing shipping costs and transit times. This instability directly affects companies like Johnson Electric, which rely on a global manufacturing and distribution network.

Johnson Electric's extensive global operations expose it to potential disruptions stemming from political instability, trade route blockages, or labor unrest in its various operating regions. The company's significant presence in Asia, a region often subject to geopolitical shifts, necessitates careful management of these risks. Diversified sourcing strategies are therefore paramount to mitigate the impact of localized political events on its production and delivery capabilities.

The drive for resilient supply chain strategies is amplified by these geopolitical factors. As of late 2024, reports indicate that 60% of supply chain executives are prioritizing resilience over cost efficiency, reflecting the tangible impact of geopolitical events. Johnson Electric's ability to adapt and maintain operational continuity in the face of such challenges will be key to its sustained performance.

Industrial Policy and Reshoring Trends

Governments worldwide are increasingly adopting industrial policies to bolster domestic manufacturing. For instance, the United States' CHIPS and Science Act, enacted in 2022, provides billions in subsidies and tax credits to encourage semiconductor manufacturing within the country. Similarly, the European Union's Critical Raw Materials Act aims to secure supply chains by promoting local extraction and processing, with a target of meeting at least 10% of the EU's annual consumption of critical raw materials from domestic sources by 2030. These initiatives signal a global trend towards reshoring and nearshoring.

These policies directly impact companies like Johnson Electric by influencing decisions on where to locate manufacturing facilities and how to structure supply chains. The push to bring production closer to major markets, driven by geopolitical considerations and a desire to reduce transportation expenses, could lead to a reconfiguration of Johnson Electric's global footprint. For example, the increased attractiveness of domestic production due to incentives might offset the cost advantages of manufacturing in lower-cost regions, prompting a strategic shift.

- Government Incentives: Tax credits and subsidies are being offered to encourage domestic production, as seen in the US semiconductor industry.

- Supply Chain Security: Policies like the EU's Critical Raw Materials Act aim to reduce reliance on external suppliers for essential components.

- Reshoring Impact: These trends could lead Johnson Electric to re-evaluate its manufacturing locations, potentially bringing production closer to key consumer markets.

- Cost Considerations: The balance between labor costs in offshore locations and the benefits of domestic incentives and reduced logistics costs will be crucial.

Political Stability in Operating Regions

Political stability in the key regions where Johnson Electric operates is a significant consideration. For instance, in 2024, countries like China and Mexico, major manufacturing hubs for the company, have experienced varying degrees of political focus on economic development and regulatory consistency.

Unstable political situations can introduce risks such as unexpected policy shifts or increased regulatory burdens, which could disrupt Johnson Electric's supply chains or market access. The company's reliance on stable operating environments is crucial for predictable revenue streams and efficient production.

Johnson Electric needs to continually assess political developments in its operating territories. For example, changes in trade policies or government stability in Southeast Asia, where it also has a presence, could directly impact its cost of goods sold and global sales strategy.

- Geopolitical Risk Assessment: Continuous monitoring of political stability in China, Mexico, and Southeast Asia is essential for Johnson Electric.

- Policy Impact Analysis: Evaluating potential impacts of evolving trade agreements and economic policies in these regions on operational costs and market access.

- Regulatory Environment Scrutiny: Staying abreast of changes in local regulations that could affect manufacturing processes or product compliance.

- Supply Chain Resilience: Proactive strategies to mitigate disruptions arising from political instability in key sourcing or production locations.

Government incentives are a significant political factor influencing Johnson Electric. For example, in 2024, the US government continued to offer substantial tax credits for electric vehicle purchases, directly boosting demand for EV components. Similarly, policies aimed at securing critical raw materials, like the EU's Critical Raw Materials Act targeting 10% of domestic consumption by 2030, are reshaping supply chain strategies and potentially increasing costs for certain inputs.

The trend towards reshoring and nearshoring, driven by government industrial policies, is also a key consideration. The US CHIPS and Science Act, providing billions for domestic semiconductor manufacturing, exemplifies this shift. This could lead Johnson Electric to re-evaluate its global manufacturing footprint, balancing lower labor costs in offshore locations against the benefits of domestic incentives and reduced logistics expenses in major markets.

Political stability in key operating regions remains critical. In 2024, countries like China and Mexico, significant manufacturing bases for Johnson Electric, faced ongoing political focus on economic development and regulatory consistency. Instability in these or other regions, such as Southeast Asia, could disrupt supply chains, impact market access, and increase operational costs, necessitating continuous risk assessment and mitigation strategies.

| Political Factor | Impact on Johnson Electric | Example/Data (2024-2025) |

|---|---|---|

| Government Incentives (EVs) | Increased demand for EV components | US EV tax credits up to $7,500 (2024) |

| Supply Chain Security Policies | Potential changes in raw material sourcing and costs | EU Critical Raw Materials Act (target 10% domestic by 2030) |

| Reshoring/Nearshoring Policies | Re-evaluation of manufacturing locations | US CHIPS and Science Act (billions for domestic semiconductor manufacturing) |

| Geopolitical Stability | Risk of supply chain disruption and increased operational costs | Monitoring political developments in China, Mexico, and Southeast Asia |

What is included in the product

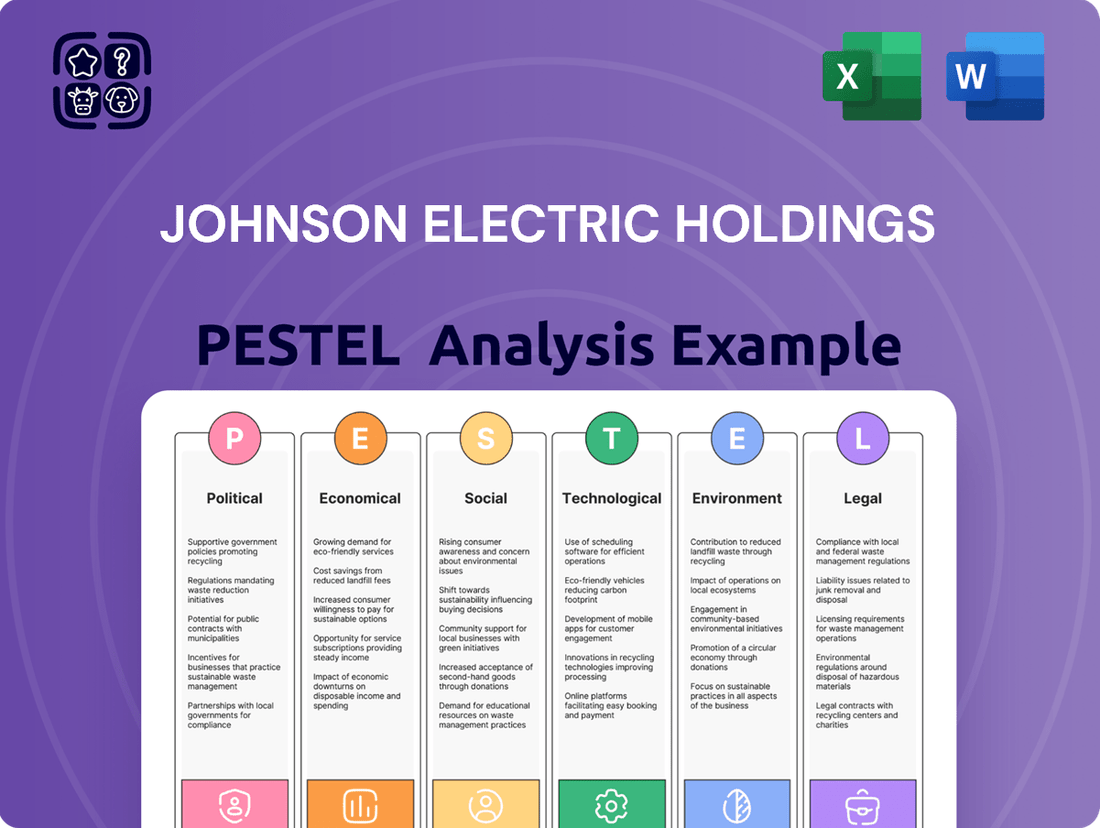

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Johnson Electric Holdings, covering political, economic, social, technological, environmental, and legal aspects.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on the company's operations and future growth.

Offers a clean, summarized version of Johnson Electric's PESTLE analysis, providing easy referencing during meetings and presentations to quickly understand external factors impacting the business.

Visually segmented by PESTEL categories, allowing for quick interpretation at a glance and helping to alleviate the pain of sifting through complex data, thereby supporting discussions on external risk and market positioning.

Economic factors

Johnson Electric's performance is closely tied to the global economic climate. For the fiscal year ending March 2025, a generally subdued global economic outlook and declining consumer confidence are presenting headwinds. This environment directly affects demand across Johnson Electric's key sectors, including automotive and consumer goods.

Specifically, a slowdown in automobile production, a major market for Johnson Electric's motion products, translates to fewer opportunities for sales. Similarly, when consumers feel less secure about the economy, they tend to cut back on discretionary spending, impacting the demand for products that utilize Johnson Electric's components.

Persistent inflation, a significant economic concern throughout 2024 and into 2025, directly impacts Johnson Electric by increasing its operational expenses. For instance, rising global commodity prices, a key driver of inflation, inflate the cost of essential raw materials for electrical components. This, coupled with higher labor and logistics expenses, puts considerable pressure on the company's profit margins.

Elevated interest rates, a common response to inflation, further exacerbate these challenges. High financing costs can deter investment and reduce consumer spending power, potentially leading to decreased demand for Johnson Electric's products. This environment often forces companies to engage in intense price competition to maintain sales volumes, further squeezing profitability.

Johnson Electric, as a global manufacturer, is significantly exposed to the volatility of currency exchange rates. Fluctuations can directly impact its reported revenues and profits when translating foreign earnings back into its reporting currency, typically Hong Kong Dollars (HKD) or US Dollars (USD). For example, a strengthening HKD against currencies where Johnson Electric has substantial sales could lead to lower reported sales figures, even if unit volumes remain constant. Conversely, a weaker HKD could boost reported sales but increase the cost of imported raw materials and components.

These currency movements also affect the company's competitive pricing in international markets. If the HKD strengthens, Johnson Electric's products might become more expensive for overseas customers, potentially impacting demand and market share. Conversely, a weaker HKD can make its products more attractive abroad, but if a significant portion of its manufacturing inputs are sourced from countries with stronger currencies, the cost savings might be offset by higher import expenses. In 2024, the ongoing global economic uncertainties and varying monetary policies by central banks, such as the US Federal Reserve and the European Central Bank, are likely to contribute to continued currency volatility, posing a persistent challenge for Johnson Electric's financial planning and international sales strategies.

Market Growth in Key End-Use Sectors

Despite broader economic uncertainties, several key sectors where Johnson Electric operates are exhibiting robust growth. The global electric motor market, a core area for the company, is anticipated to expand considerably. For instance, industry forecasts suggest this market could reach approximately USD 170 billion by 2027, showcasing significant expansion potential.

This growth is largely fueled by the escalating demand for automation across various industries and the accelerating adoption of electric vehicles (EVs). The EV sector, in particular, is a major driver, with global EV sales projected to surpass 15 million units in 2024, creating substantial opportunities for Johnson Electric's specialized motor solutions.

Furthermore, the markets for smart home devices and medical components are also demonstrating strong upward trends. The smart home market is expected to see continued expansion, with smart home device shipments globally predicted to reach over 1.3 billion units in 2024. Similarly, the medical device manufacturing sector, which increasingly relies on precision components, presents ongoing growth avenues for Johnson Electric's high-quality manufacturing capabilities.

- Global electric motor market projected to reach ~USD 170 billion by 2027.

- Global EV sales anticipated to exceed 15 million units in 2024.

- Smart home device shipments globally expected to surpass 1.3 billion units in 2024.

- Increasing demand for automation across industries.

Competition and Price Pressure

Johnson Electric operates in markets characterized by significant price competition, particularly within consumer electronics and industrial automation. This environment directly impacts the company's ability to maintain healthy profit margins. For instance, the automotive sector, a key market for Johnson Electric, saw global vehicle production growth moderate in early 2024 compared to earlier post-pandemic recovery trends, intensifying the need for cost efficiency.

Weakening consumer confidence in various regions, observed through fluctuating retail sales data and consumer sentiment surveys throughout 2024, further exacerbates this pricing pressure. When consumers are more hesitant to spend, companies like Johnson Electric often face demands for lower prices to stimulate demand, directly impacting their top-line revenue and bottom-line profitability. This necessitates a robust strategy focused on both continuous product innovation and stringent cost control measures to remain competitive.

- Intense Price Rivalry: Johnson Electric contends with aggressive pricing from competitors across multiple product segments.

- Impact of Consumer Confidence: Declining consumer confidence in key markets places downward pressure on pricing power.

- Profitability Squeeze: The combination of competition and weaker demand challenges the company's profit margins.

- Strategic Imperatives: Continuous innovation and efficient cost management are crucial for sustained competitiveness and profitability.

Johnson Electric's financial performance is inherently linked to global economic trends, with a subdued outlook and declining consumer confidence in 2024 and early 2025 posing significant challenges. Persistent inflation continues to drive up operational costs, impacting raw material, labor, and logistics expenses. Elevated interest rates further complicate matters by increasing financing costs and potentially dampening consumer spending power.

Currency fluctuations represent another key economic factor, directly affecting Johnson Electric's reported earnings and competitive pricing strategies. For example, a strengthening Hong Kong Dollar (HKD) could decrease the value of foreign sales when translated back into the company's reporting currency. This economic volatility necessitates careful financial planning and agile international sales strategies.

Despite these headwinds, specific sectors like the global electric motor market, anticipated to reach approximately USD 170 billion by 2027, offer substantial growth opportunities. The burgeoning electric vehicle (EV) market, with projected global sales exceeding 15 million units in 2024, is a prime example of this expansion. Additionally, strong growth in smart home devices, with shipments predicted to surpass 1.3 billion units in 2024, and the medical components sector, further underscore positive market dynamics for Johnson Electric.

The company also faces intense price competition, particularly in consumer electronics and industrial automation, which can compress profit margins. Weakening consumer confidence throughout 2024 has intensified downward pressure on pricing. This environment underscores the critical need for Johnson Electric to maintain a strong focus on product innovation and rigorous cost management to ensure sustained competitiveness and profitability.

| Economic Factor | Impact on Johnson Electric | Supporting Data/Trend (2024/2025) |

| Global Economic Outlook | Subdued growth, reduced consumer confidence impacting demand | General economic forecasts indicate moderate global GDP growth for 2024-2025. |

| Inflation | Increased operational costs (raw materials, labor, logistics) | Global inflation rates remained elevated through 2024, impacting input costs. |

| Interest Rates | Higher financing costs, potential reduction in consumer spending | Central banks maintained higher interest rate environments to combat inflation in 2024. |

| Currency Exchange Rates | Volatility impacting reported earnings and international pricing | Ongoing global economic uncertainties contributed to currency fluctuations in 2024. |

| Sector Growth (EVs) | Significant opportunity due to increasing demand for electric motors | Global EV sales projected to exceed 15 million units in 2024. |

| Sector Growth (Smart Home) | Increased demand for components in connected devices | Smart home device shipments expected to surpass 1.3 billion units in 2024. |

| Price Competition | Pressure on profit margins | Moderating global vehicle production growth in early 2024 intensified cost efficiency needs in automotive sector. |

Same Document Delivered

Johnson Electric Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Johnson Electric Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Johnson Electric's strategic landscape, from global trade policies to emerging market trends. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Consumers are increasingly seeking out smart devices, from smart home hubs to connected car systems. This shift in preference fuels a demand for sophisticated motion components that allow for greater automation and user-friendly features. For instance, the global smart home market was projected to reach over $138 billion in 2024, highlighting this significant trend.

This growing appetite for interconnected technology directly benefits companies like Johnson Electric, whose motion systems are integral to the functionality of these smart devices. As consumers prioritize convenience and advanced capabilities, the market for specialized motors and actuators within these applications continues to expand, with the automotive segment alone seeing substantial growth in smart features.

The world's population is getting older, and with that comes a greater need for healthcare. This trend is a significant driver for the medical device market, creating more demand for the very components Johnson Electric specializes in. As people live longer and chronic diseases become more common, the need for sophisticated medical equipment, which often relies on precision motion technology, is on the rise. For instance, the global medical device market was valued at approximately $560 billion in 2023 and is projected to reach over $800 billion by 2030, showcasing substantial growth directly benefiting companies like Johnson Electric that supply essential parts.

Societal emphasis on health and wellness is a significant driver for innovation. Consumers are increasingly investing in products that support healthier lifestyles, evidenced by the projected 12.9% compound annual growth rate (CAGR) for the global wearable technology market, reaching an estimated $106 billion by 2025. This trend directly impacts sectors like medical devices and smart homes, where demand for integrated health monitoring and comfort-enhancing solutions is surging.

Johnson Electric is well-positioned to capitalize on this shift by supplying critical components for health-focused technologies. The company's expertise in motion and control systems can be applied to miniaturized actuators for portable medical diagnostic tools, precision motors for automated drug delivery systems, and smart sensors for environmental controls in homes that promote well-being. For instance, the smart home market is expected to grow substantially, with global revenues projected to reach $157 billion in 2023, indicating a strong consumer appetite for connected devices that offer convenience and health benefits.

Workforce Dynamics and Labor Availability

The availability of skilled labor is paramount for Johnson Electric, especially in high-tech manufacturing and engineering sectors. As of late 2024, global shortages persist in these specialized fields, with reports indicating a 15% gap in qualified engineers in key manufacturing hubs. This scarcity directly influences Johnson Electric's capacity for production efficiency and its drive for innovation.

Shifting workforce demographics and evolving educational landscapes present both challenges and opportunities. In many developed economies, aging workforces and a decline in younger individuals pursuing vocational trades are notable trends. Conversely, rising educational attainment in emerging markets offers a growing pool of potential talent, though bridging the skills gap through targeted training remains crucial for companies like Johnson Electric to leverage these demographic shifts effectively.

- Global Engineer Shortage: An estimated 15% deficit in skilled engineers in major manufacturing regions as of late 2024 impacts recruitment for advanced roles.

- Demographic Shifts: Aging workforces in some regions contrast with a growing, educated youth population in others, requiring adaptive HR strategies.

- Skills Gap in Manufacturing: A persistent mismatch between available technical skills and industry demand affects production and R&D capabilities.

- Labor Market Trends: Increasing demand for flexible work arrangements and a focus on continuous learning are reshaping employee expectations and retention strategies.

Sustainability and Ethical Consumption Trends

Consumers and stakeholders are increasingly demanding sustainability and ethical practices. This societal shift directly impacts manufacturers like Johnson Electric, pushing them to adopt responsible sourcing, cut down on waste, and boost energy efficiency. For instance, a 2024 survey revealed that over 70% of consumers consider a brand's sustainability efforts when making purchasing decisions, a significant rise from previous years.

This growing emphasis on environmental, social, and governance (ESG) factors is reshaping corporate reputations and influencing buying habits. Companies are responding by strengthening their ESG initiatives to align with these expectations. Johnson Electric, recognizing this trend, has been investing in greener manufacturing processes and transparent supply chains to meet the evolving demands.

- Growing Consumer Demand: A significant majority of consumers now factor sustainability into their buying choices.

- Stakeholder Pressure: Investors and business partners are increasingly scrutinizing companies' ESG performance.

- Reputational Impact: Strong ESG credentials enhance brand image and customer loyalty.

- Operational Adjustments: Manufacturers are adapting by focusing on waste reduction and energy efficiency.

Societal trends highlight an increasing demand for health and wellness, driving innovation in medical devices and smart home technology. This focus on well-being, coupled with an aging global population, directly boosts the market for precision motion components that Johnson Electric provides, as seen in the medical device market's projected growth to over $800 billion by 2030.

The workforce landscape presents challenges with ongoing global shortages in skilled engineers, estimated at a 15% deficit in key manufacturing regions as of late 2024. This scarcity impacts production efficiency and innovation capacity, necessitating adaptive human resource strategies to address demographic shifts and skills gaps.

Consumers and stakeholders are increasingly prioritizing sustainability and ethical practices, with over 70% of consumers considering sustainability in purchasing decisions in 2024. This societal pressure encourages manufacturers like Johnson Electric to adopt greener processes and transparent supply chains, influencing brand reputation and customer loyalty.

Technological factors

The increasing adoption of automation and robotics in manufacturing, with a notable move toward autonomous systems and human-robot collaboration, directly shapes Johnson Electric's industrial equipment division. This evolution fuels demand for advanced, high-precision motion control products and opens avenues for incorporating AI and machine learning into their industrial offerings.

For example, the global industrial robotics market was projected to reach $53.7 billion in 2024, with significant growth expected in collaborative robots. This surge indicates a strong market pull for the sophisticated components Johnson Electric provides for these advanced manufacturing systems.

Furthermore, Johnson Electric's exposure to sectors like electric vehicles, which heavily rely on automated assembly lines, means they benefit from the efficiency gains and precision that robotics bring. The company's ability to supply critical motion control components for these highly automated processes is a key technological advantage.

The increasing integration of the Internet of Things (IoT) and Artificial Intelligence (AI) across various sectors is a significant technological shift. This trend is particularly evident in smart home devices, sophisticated automotive systems, and advanced medical equipment, creating a demand for intelligent and connected components. Johnson Electric's motion control solutions are integral to these evolving product categories, providing the precise and reliable actuation needed for enhanced user experiences and advanced functionalities.

These intelligent systems leverage IoT for data collection and AI for analysis and decision-making, leading to improvements such as predictive maintenance and real-time operational insights. For instance, in the automotive sector, AI-powered systems rely on precise sensor data and actuator responses for features like autonomous driving and advanced driver-assistance systems. Johnson Electric's motors and actuators play a crucial role in enabling these capabilities, ensuring seamless operation and contributing to the overall performance and safety of the vehicles.

The market for AI-powered devices is experiencing substantial growth, with projections indicating continued expansion. For example, the global smart home market alone was valued at over $100 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 15% through 2030. Similarly, the automotive AI market is also seeing rapid development, with significant investments being made in connected and autonomous vehicle technologies.

Johnson Electric's strategic focus on developing high-performance motion components that are compatible with IoT and AI platforms positions them well to capitalize on these technological advancements. Their products are designed to meet the stringent requirements of these connected ecosystems, offering the precision, efficiency, and durability necessary for next-generation smart products. This technological alignment is crucial for maintaining competitiveness and driving future growth in an increasingly automated and data-driven world.

Technological factors, particularly the ongoing miniaturization and efficiency improvements in motor technology, are reshaping industries. This trend is driving the development of smaller, more powerful, and energy-efficient motors and actuators. For Johnson Electric, this translates into a need to innovate for applications in compact smart devices, electric vehicles, and portable medical equipment.

The demand for higher performance in smaller packages is a key driver. For instance, the electric vehicle market, a significant area for motor manufacturers, saw global sales of electric cars reach approximately 13.6 million units in 2023, a substantial increase from previous years. This growth underscores the need for Johnson Electric to deliver increasingly efficient and compact motor solutions to remain competitive in this expanding sector.

Development of New Materials and Manufacturing Processes

Innovation in materials science and manufacturing processes, like advanced additive manufacturing, is reshaping component design. These advancements enable the creation of lighter, stronger, and more economical parts, a key factor for companies like Johnson Electric. For instance, the global 3D printing market was valued at approximately $17.8 billion in 2023 and is projected to reach over $60 billion by 2030, highlighting the significant growth and adoption of these technologies.

Johnson Electric can capitalize on these innovations to boost product performance and lower manufacturing expenses. This is particularly beneficial for developing bespoke solutions, allowing for quicker iteration and customization. The company's focus on mechatronic solutions can directly benefit from materials that offer improved durability and reduced weight, especially in the automotive and industrial sectors where efficiency gains are paramount.

Leveraging new manufacturing techniques can also significantly shorten new product development timelines. This agility is crucial in fast-paced markets. For example, the adoption of digital manufacturing technologies is projected to boost manufacturing productivity by 10-25% in many sectors by 2025, offering a tangible competitive edge.

- Advancements in materials science enable lighter and stronger components.

- Additive manufacturing (3D printing) offers cost-effectiveness and customization potential.

- Johnson Electric can enhance product performance and reduce production costs.

- Faster new product development cycles are achievable through these technological shifts.

Cybersecurity in Connected Systems

As Johnson Electric Holdings integrates more connected systems into its product lines and manufacturing, cybersecurity emerges as a paramount technological factor. The increasing reliance on digital infrastructure for everything from smart applications to automated production lines necessitates strong defenses against cyber threats. For instance, a 2024 report indicated that cyberattacks on industrial control systems cost businesses an average of $4.45 million per incident, highlighting the significant financial and operational risks involved.

Maintaining the security of motion subsystems and the vast amounts of data generated by smart applications is crucial for preventing breaches and preserving customer trust. This imperative is driving substantial investment in advanced cybersecurity measures across the industry. In 2025, global spending on cybersecurity is projected to reach $230 billion, with a significant portion allocated to protecting operational technology (OT) environments similar to those used in manufacturing.

- Increased Attack Surface: The proliferation of connected devices and IoT in manufacturing expands potential entry points for cyber threats.

- Data Integrity and Privacy: Protecting sensitive design, operational, and customer data is vital for maintaining competitive advantage and compliance.

- Operational Disruption: Successful cyberattacks can halt production, leading to significant financial losses and reputational damage.

- Investment in Solutions: Companies are prioritizing advanced threat detection, encryption, and access control technologies.

The increasing sophistication of automation and AI integration in manufacturing, particularly with collaborative robots, directly benefits Johnson Electric's industrial segment. This trend fuels demand for their advanced motion control solutions, with the global industrial robotics market expected to hit $53.7 billion in 2024.

The pervasive adoption of IoT and AI across smart homes, automotive, and medical devices creates a need for intelligent, connected components. Johnson Electric's motion control products are key enablers for these evolving smart systems, supporting features like predictive maintenance and autonomous driving functions. The smart home market alone was valued over $100 billion in 2023.

Miniaturization and efficiency gains in motor technology are critical, especially for the electric vehicle sector. With EV sales reaching approximately 13.6 million units globally in 2023, Johnson Electric must continue to innovate with compact, high-performance motor solutions to maintain its competitive edge.

Advancements in materials science and additive manufacturing, such as 3D printing (a market projected to exceed $60 billion by 2030), enable lighter, stronger, and more cost-effective components. This allows Johnson Electric to enhance product performance and accelerate new product development cycles.

Legal factors

Johnson Electric, a key player in producing components for demanding sectors like automotive and medical technology, faces significant legal hurdles concerning product safety and quality. For instance, the automotive industry's safety standards, such as those mandated by UNECE regulations, are constantly evolving, requiring substantial investment in R&D and rigorous testing to ensure compliance for components like braking systems or airbags.

Adherence to international quality benchmarks, including ISO 9001 and ISO 13485 for medical devices, is not just a recommendation but a prerequisite for market entry and sustained operations. Failure to meet these stringent requirements, such as those outlined by the US Food and Drug Administration (FDA) for medical device manufacturing, can lead to costly product recalls and severe reputational damage, impacting sales which in 2023 were reported at $2.9 billion.

Environmental regulations, such as the EU Green Deal, are becoming more stringent, affecting how Johnson Electric operates its manufacturing and designs its products, particularly concerning emissions and waste. Compliance with directives like RoHS and REACH, which govern hazardous substances, is essential. Failure to comply can result in significant fines and damage to the company's reputation.

For instance, in 2023, the European Environment Agency reported a 5% increase in environmental fines across various industries for non-compliance with emissions standards, highlighting the financial risks involved. Johnson Electric's commitment to sustainability is therefore not just a matter of good practice but a critical business imperative to meet the evolving expectations of customers and investors who increasingly prioritize environmental responsibility.

Johnson Electric navigates a complex web of labor laws across its global operations, from China to Mexico and Europe. These regulations dictate everything from minimum wages and working hours to employee benefits and termination procedures, directly impacting operational costs and talent acquisition strategies. For instance, in 2024, many European nations continued to strengthen worker protections, potentially increasing labor expenses for manufacturers like Johnson Electric.

Compliance with health and safety standards is paramount, with stringent regulations in place to prevent workplace accidents. Failure to adhere to these laws can result in significant fines and reputational damage, influencing investment in safety equipment and training. As of early 2025, global trends indicate a continued focus on workplace safety, particularly in manufacturing sectors, requiring ongoing vigilance from Johnson Electric.

Intellectual Property Rights and Patents

Johnson Electric Holdings relies heavily on its intellectual property rights (IPR), including patents, to protect its vast engineering knowledge and bespoke product offerings. This is paramount for maintaining its edge in a competitive global market. The company actively manages its patent portfolio to shield its innovations.

Navigating complex patent landscapes and actively preventing any infringement is vital for Johnson Electric to preserve its competitive advantage. This legal vigilance safeguards its significant technological advancements and ongoing research and development investments.

- Patent Portfolio Strength: In 2023, Johnson Electric maintained a robust patent portfolio, with a significant portion focused on its core motion control technologies and advanced manufacturing processes.

- R&D Investment: The company's commitment to innovation is underscored by its consistent investment in research and development, aiming to secure new patents for future product generations.

- Infringement Monitoring: Johnson Electric employs strategies to monitor the market for potential patent infringements, taking legal action when necessary to protect its innovations.

Data Privacy and Security Laws

Johnson Electric's increasing reliance on IoT and AI in its product lines, particularly for smart home and medical devices, necessitates strict adherence to global data privacy and security regulations. Laws like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) directly impact how the company collects, processes, and protects user data. Failure to comply can lead to significant fines; for example, GDPR violations can incur penalties of up to 4% of global annual turnover or €20 million, whichever is higher. This regulatory landscape demands robust data governance frameworks and continuous investment in cybersecurity measures to safeguard sensitive information and maintain user trust.

The company must ensure transparency in data collection practices and provide users with control over their personal information. This includes obtaining explicit consent for data usage and implementing secure data storage and transmission protocols. For instance, the global cybersecurity market was projected to reach over $231 billion in 2024, reflecting the significant resources companies dedicate to meeting these security demands. Johnson Electric's commitment to data privacy is therefore not just a legal obligation but a critical factor in its product's market acceptance and brand reputation.

Johnson Electric operates within a dynamic legal framework, where compliance with product safety and quality standards is paramount, especially in regulated sectors like automotive and medical technology. Evolving regulations, such as those concerning emissions and hazardous substances, necessitate ongoing investment in R&D and rigorous adherence to directives like RoHS and REACH to avoid substantial fines and reputational damage.

The company's global operations are governed by diverse labor laws, impacting costs related to wages, benefits, and working conditions, with trends in 2024 indicating a continued strengthening of worker protections in many regions. Furthermore, robust intellectual property protection is critical for maintaining competitive advantage, requiring active management of patent portfolios and vigilance against infringement.

In the realm of digital integration, adherence to data privacy laws like GDPR and CCPA is crucial, with non-compliance risks including substantial penalties that can impact global turnover. This necessitates significant investment in cybersecurity and transparent data governance to build and maintain customer trust in an increasingly data-driven market.

Environmental factors

Johnson Electric faces increasing pressure to enhance resource efficiency, a trend that intensified through 2024 and is projected to continue into 2025. This includes minimizing energy and water usage across its global manufacturing operations. For instance, the company is exploring advancements in manufacturing processes that could lead to a projected 15% reduction in energy consumption per unit by 2026.

The adoption of sustainable materials is another critical environmental factor. Johnson Electric is actively researching and integrating eco-friendly alternatives into its motion product designs. This strategic shift is driven by both regulatory demands and growing consumer preference for environmentally responsible products, with a focus on materials that offer reduced lifecycle environmental impact.

The global push towards a circular economy, prioritizing material recovery and recycling, significantly influences manufacturing. Johnson Electric will likely integrate waste minimization strategies across its product lifecycle, from initial design to end-of-life, to meet sustainability targets. In 2023, the manufacturing sector's waste generation was a significant concern, with many industries aiming to reduce landfill waste by at least 30% by 2030.

Manufacturers like Johnson Electric face mounting pressure to slash carbon emissions, covering direct (Scope 1), indirect (Scope 2), and value chain (Scope 3) emissions. In 2024, global industrial emissions continued to be a focal point, with many nations setting ambitious decarbonization targets.

To comply with regulations and investor demands, Johnson Electric must allocate capital towards developing and implementing low-carbon manufacturing techniques. This includes enhancing energy efficiency and exploring greener materials. The company’s commitment to sustainability is critical for its long-term viability.

A significant aspect of this strategy involves increasing the adoption of renewable energy sources for its manufacturing facilities. For instance, many leading manufacturers are aiming to source over 50% of their electricity from renewables by 2025. Johnson Electric's progress in this area will be closely watched.

Addressing emissions across the entire supply chain is also paramount. This means working collaboratively with suppliers to reduce their environmental impact, a task that requires robust data collection and transparent reporting throughout 2024 and into 2025.

Supply Chain Environmental Transparency

Johnson Electric faces growing pressure to ensure its extensive global supply chain is environmentally transparent. This means actively verifying that suppliers meet stringent environmental standards, a crucial step in mitigating risks associated with pollution, resource depletion, and climate change impacts. Failing to do so can lead to reputational damage and regulatory penalties.

To maintain its sustainability commitments, Johnson Electric must embed responsible sourcing practices and environmental integrity throughout its operations. This involves detailed tracking and auditing of supplier performance, ensuring compliance with regulations and internal policies. For instance, companies in the electronics sector, where Johnson Electric operates, are increasingly being held accountable for the carbon footprint of their entire value chain.

- Supplier Audits: Johnson Electric’s 2024/2025 strategy likely includes enhanced audits of key suppliers to assess their environmental management systems and compliance with emissions and waste reduction targets.

- Traceability Initiatives: The company is probably investing in technology to improve the traceability of raw materials, ensuring they are sourced from environmentally responsible locations and processes.

- Risk Mitigation: By proactively addressing environmental concerns within its supply chain, Johnson Electric aims to prevent disruptions caused by environmental incidents or non-compliance, which could cost millions in fines and lost production.

- Regulatory Landscape: With evolving environmental regulations globally, such as extended producer responsibility schemes and carbon reporting mandates, Johnson Electric needs robust transparency to adapt and maintain market access.

Climate Change Impact on Operations and Supply Chains

Climate change presents significant operational challenges for Johnson Electric. The physical impacts, like increasingly frequent and severe extreme weather events, directly threaten its global supply chains and manufacturing facilities. For instance, a 2024 report highlighted that supply chain disruptions due to weather events cost global businesses an estimated $150 billion in 2023 alone, a figure expected to rise. Johnson Electric must proactively build resilience into its supply chain strategy.

This resilience is crucial for mitigating risks and ensuring business continuity. By diversifying suppliers, investing in weather-resilient infrastructure, and developing robust contingency plans, the company can better withstand climate-related disruptions. This proactive approach helps safeguard production schedules and timely deliveries to customers, minimizing potential revenue losses and maintaining market competitiveness. For example, companies that invested in supply chain visibility and risk management saw a 15% reduction in weather-related losses during the same period.

- Physical Risks: Increased frequency of floods, storms, and heatwaves impacting manufacturing sites and logistics networks.

- Supply Chain Disruptions: Potential for raw material shortages and transportation delays due to extreme weather.

- Operational Continuity: Need for robust contingency plans to maintain production and delivery schedules.

- Resilience Investments: Strategic focus on diversifying suppliers and upgrading infrastructure to withstand climate impacts.

Johnson Electric faces increasing pressure to enhance resource efficiency, aiming to minimize energy and water usage across its global manufacturing operations. The adoption of sustainable materials is also critical, driven by regulatory demands and consumer preferences. The company must also address emissions across its entire supply chain, working collaboratively with suppliers to reduce their environmental impact.

Climate change presents operational challenges, with extreme weather events threatening supply chains and manufacturing facilities. Johnson Electric must build resilience into its supply chain strategy by diversifying suppliers and investing in weather-resilient infrastructure to ensure business continuity and mitigate risks.

| Environmental Factor | Key Trend/Challenge | Impact on Johnson Electric | 2024/2025 Data/Projection |

|---|---|---|---|

| Resource Efficiency | Minimizing energy & water usage | Operational cost reduction, regulatory compliance | Projected 15% reduction in energy consumption per unit by 2026 |

| Sustainable Materials | Integrating eco-friendly alternatives | Product differentiation, meeting consumer demand | Focus on materials with reduced lifecycle environmental impact |

| Circular Economy | Waste minimization & recycling | Reduced landfill waste, improved resource management | Sector aiming for 30% reduction in landfill waste by 2030 |

| Carbon Emissions | Reducing Scope 1, 2, & 3 emissions | Regulatory compliance, investor relations, brand reputation | Global industrial emissions a focal point in 2024 with ambitious decarbonization targets |

| Renewable Energy | Sourcing electricity from renewables | Reduced carbon footprint, operational cost stability | Leading manufacturers aiming for >50% renewable electricity by 2025 |

| Supply Chain Transparency | Verifying supplier environmental standards | Risk mitigation, brand protection, regulatory adherence | Increased scrutiny on value chain carbon footprints in electronics sector |

| Climate Change Resilience | Mitigating physical risks from extreme weather | Ensuring business continuity, supply chain stability | Weather disruptions cost global businesses $150 billion in 2023; companies with risk management saw 15% reduction in losses |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Johnson Electric Holdings is informed by a comprehensive review of official government publications, reports from international organizations like the IMF and World Bank, and reputable industry-specific market research. This ensures a robust understanding of the political, economic, and technological landscapes impacting the company.