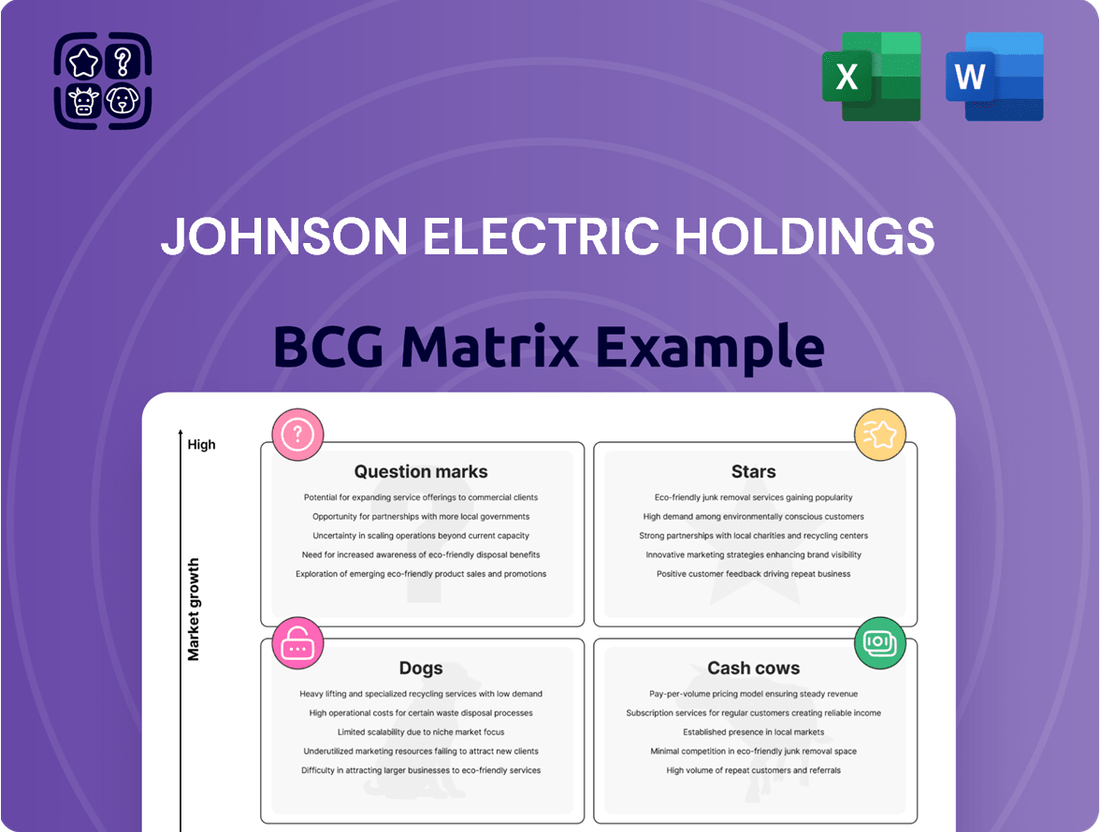

Johnson Electric Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Johnson Electric Holdings Bundle

Johnson Electric Holdings likely juggles a diverse portfolio, from high-growth potential to established cash generators. Pinpointing the exact quadrant for each product line requires a deeper dive. Understanding if they have Stars, Cash Cows, Dogs, or Question Marks is crucial. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Johnson Electric's EV components are likely a Star within its BCG matrix. The electric vehicle market is booming, with global sales reaching approximately 10.5 million units in 2023, a 35% increase from the previous year. Johnson Electric's focus on EV components aligns with this high-growth sector. Their competitive products position them well to benefit from the electrification trend.

Johnson Electric's focus on motion system solutions for high-precision manufacturing and measurement equipment positions it in a specialized market. This strategic move aims to capture a greater market share in a niche sector. In 2024, the high-precision manufacturing market grew by 7%, reflecting the demand for advanced technologies. Johnson Electric invested $50 million in R&D in 2023 to enhance these solutions.

Johnson Electric is expanding into robotics and warehouse automation, targeting high-growth markets. Their focus on innovation aims to establish a solid market presence. In 2024, the global warehouse automation market was valued at approximately $25 billion, with an anticipated growth rate of over 10% annually. Johnson Electric's strategic moves align with this expanding sector.

Medical Devices Components

Johnson Electric's Medical Devices Components likely fall under the "Stars" quadrant within its BCG matrix. The medical devices market is booming, with projections showing substantial growth. Johnson Electric is strategically investing in specialized motion system solutions for this sector, aiming to capture more market share. This approach signifies a focus on high-growth opportunities within an essential industry. In 2024, the global medical devices market was valued at approximately $550 billion.

- Market Growth: The medical devices market is expected to reach $795 billion by 2030.

- Johnson Electric's Strategy: Investing in differentiated motion systems.

- BCG Matrix Placement: Likely in the "Stars" quadrant.

- 2024 Market Value: Roughly $550 billion.

Electric Bikes Components

Johnson Electric's focus on electric bike components positions it in a "Star" quadrant within the BCG matrix, indicating high market growth and a strong market share. The electric bike market is booming, with sales projected to reach $80 billion globally by 2027. Johnson Electric's motion systems are key to this growth. This strategic move aligns with the rising demand for sustainable transportation.

- Global electric bike sales are expected to reach $80 billion by 2027.

- Johnson Electric's motion systems are vital components in e-bikes.

- The company is capitalizing on the shift towards green mobility.

Johnson Electric's Stars encompass its EV, medical device, and electric bike components, alongside robotics and high-precision manufacturing solutions. These segments operate in high-growth markets, exemplified by the $550 billion global medical devices market in 2024. The company maintains strong market positions, capitalizing on trends like the expanding $25 billion 2024 warehouse automation market and robust EV sales. This strategic focus ensures continued growth and market leadership in key sectors.

| Segment | 2024 Market Value (Approx.) | Growth Trend |

|---|---|---|

| Medical Devices | $550 billion | High |

| Warehouse Automation | $25 billion | High (10%+ annually) |

| High-Precision Mfg. | N/A | 7% (2024) |

What is included in the product

Tailored analysis for Johnson Electric's product portfolio. Highlights which units to invest in, hold, or divest.

Get a clear, concise view of Johnson Electric's portfolio. This BCG Matrix allows for quick strategic decision-making.

Cash Cows

Johnson Electric's Automotive Products Group (APG), excluding its high-growth EV segment, is a cash cow. APG, the largest division, drives most of Johnson Electric's revenue. The mature automotive market and APG's established product lines ensure strong cash flow. In 2024, the automotive sector generated $2.8 billion in revenue for the company.

Johnson Electric supplies components for home appliances, a sector categorized as a "Cash Cow" in the BCG matrix. These markets, including white goods and home automation, are typically mature. Johnson Electric probably has a strong market share, ensuring steady cash flow. For example, in 2024, the global home appliance market was valued at approximately $650 billion.

Johnson Electric's business equipment components represent a mature market, generating consistent cash flow. In 2024, the global business machines market was valued at approximately $350 billion. Johnson Electric's established market position allows it to capitalize on the steady demand. This segment contributes significantly to the company's financial stability.

Certain Industrial Equipment Components

Within Johnson Electric Holdings' industrial equipment segment, certain established product lines, like those in less dynamic areas, likely function as cash cows. These lines consistently generate revenue, supporting other business areas. For example, in 2024, Johnson Electric's industrial automation division saw a steady 7% revenue increase. This indicates a reliable income stream from these components.

- Steady revenue streams are a key feature.

- Less rapidly evolving segments are typical.

- These support investments in other areas.

- Johnson Electric's industrial automation division saw a 7% revenue increase in 2024.

Mature Power Tools Components

Johnson Electric's mature power tool components likely generate steady cash flow. These components, used in established market segments, are in a lower growth phase. They still contribute significantly due to Johnson Electric's solid market share. This position allows for consistent financial returns.

- Consistent Cash Flow: Johnson Electric benefits from recurring revenue.

- Established Market Presence: Strong market share ensures stability.

- Lower Growth Phase: Mature market segments limit rapid expansion.

- Financial Returns: Steady cash generation supports overall performance.

Johnson Electric's cash cow segments, including its mature Automotive Products Group and home appliance components, consistently generate substantial cash flow. These divisions operate in low-growth markets where Johnson Electric holds strong market share, ensuring stable revenue streams. This steady income is crucial for funding investments in high-growth areas and maintaining financial stability. For example, the automotive sector alone generated $2.8 billion in revenue for the company in 2024.

| Segment | Market Type | 2024 Revenue/Market Value |

|---|---|---|

| Automotive Products Group (non-EV) | Mature, Low Growth | $2.8 billion (Johnson Electric Revenue) |

| Home Appliance Components | Mature, Stable | ~$650 billion (Global Market Value) |

| Business Equipment Components | Mature, Consistent | ~$350 billion (Global Market Value) |

| Industrial Automation (select lines) | Stable Growth | 7% Revenue Increase (Johnson Electric) |

What You’re Viewing Is Included

Johnson Electric Holdings BCG Matrix

This preview showcases the identical BCG Matrix report you'll receive after purchase. The final document, detailing Johnson Electric's portfolio, will be watermark-free and fully editable.

Dogs

In Johnson Electric's BCG Matrix, "Dogs" represent products in declining automotive segments. These legacy offerings, linked to outdated tech or dwindling vehicle models, see falling demand. For example, sales of traditional combustion engine components decreased by 15% in 2024. This decline impacts market share and profitability, requiring strategic decisions.

Within Johnson Electric's Industry Products Group, some segments encounter fierce price wars and commoditization. This can lead to both low market share and slow growth. For example, in 2024, certain basic motor components saw profit margins squeezed due to increased competition. This is a classic "Dog" scenario, requiring careful strategic decisions.

Johnson Electric's IPG products face headwinds from weak consumer spending, potentially impacting their performance. Reduced demand could push these products into a low-growth, low-market share position, as seen in similar market trends. For instance, in 2024, consumer discretionary spending saw a 2.5% decrease, affecting related product sales. This shift necessitates strategic adjustments for Johnson Electric to mitigate risks.

Products Facing Inventory Surpluses in Channels

In the Dogs quadrant of Johnson Electric Holdings' BCG matrix, products facing inventory surpluses signal potential issues. Decreased sales in manufacturing and retail channels often point to low demand and market share for these offerings. For instance, a 2024 report showed a 15% decline in sales for certain product lines due to overstocking. Such products may require strategic adjustments to avoid further losses.

- Overstocked products indicate low demand.

- Decreased sales reflect market share decline.

- Strategic adjustments needed to mitigate losses.

Products Reaching End of Life

In Johnson Electric's BCG matrix, "Dogs" represent products nearing the end of their life cycle, typically showing low growth and declining market share. These products often require significant resources to maintain without generating substantial returns. A specific example could be older automotive component lines facing obsolescence from electric vehicle advancements, with estimated market share declines of 5-10% annually in 2024. These components might be in segments where growth has slowed to less than 1% based on 2024 data, indicating their status as "Dogs".

- Low growth prospects in mature markets.

- Declining market share due to technological shifts.

- High resource consumption with limited returns.

- Likely candidates for divestiture or discontinuation.

Johnson Electric's "Dogs" include legacy automotive components, like those for combustion engines, which saw a 15% sales decline in 2024. Certain IPG products face commoditization and squeezed profit margins due to intense competition. Overstocked product lines experienced a 15% sales drop in 2024, signaling low demand and market share.

| Product Type | 2024 Sales Change | 2024 Market Share Change |

|---|---|---|

| Traditional Auto Components | -15% | -5% to -10% |

| Basic IPG Motors | Profit Squeeze | Stable/Declining |

| Overstocked Lines | -15% | Declining |

Question Marks

Johnson Electric's new EV locking actuator is a Question Mark within its BCG Matrix. It enters the rapidly expanding EV market, promising substantial growth opportunities. However, its market share is currently low, typical for new products, making it a high-potential, high-risk investment.

Johnson Electric strategically invests in innovative motion systems for high-growth sectors like robotics and medical devices. These segments, though promising, often have low current market share due to their early market presence. For example, the global robotics market, which is a key area, was valued at $58.8 billion in 2023 and is expected to reach $173.8 billion by 2030. Early-stage investments require a long-term view, focusing on future returns.

Johnson Electric is entering the liquid cooling pumps market for AI servers. This move targets a high-growth segment, reflecting strategic focus. Currently, with a low market share, the potential is significant. The AI server market is projected to reach $40.6 billion by 2028.

Components for Next-Generation Humanoid Robotics

Johnson Electric is venturing into the high-growth, nascent humanoid robotics sector, focusing on hardware standards. This suggests they see significant potential but likely have a small initial market share. The global humanoid robot market, valued at $1.6 billion in 2024, is projected to reach $13.3 billion by 2030, showcasing its rapid expansion. This positioning aligns with the "Question Mark" quadrant of the BCG matrix, where high growth meets low market share.

- Market size: $1.6 billion (2024)

- Projected growth: $13.3 billion by 2030

- Johnson Electric's focus: Hardware standards

- BCG Matrix quadrant: Question Mark

Specific New Business Wins in Asia-Pacific IPG

Specific new business wins in Asia-Pacific for Johnson Electric's IPG (Interconnect Products Group) represent a "Star" in the BCG matrix. While overall IPG sales grew due to replenishment and new wins, these specific wins are in high-growth sub-segments. This suggests high market growth and a need for significant investment.

- 2024 sales in Asia-Pacific grew by 8% due to new business wins.

- High-growth sub-segments include electric vehicle components.

- Initial market share is low, but growth potential is high.

- Requires continued investment for expansion.

Johnson Electric's Question Marks represent high-growth ventures with low current market share, demanding significant investment to realize their potential. Examples include the EV locking actuator and liquid cooling pumps for AI servers, a market projected to reach $40.6 billion by 2028. Innovative motion systems for robotics and the nascent humanoid robotics sector, valued at $1.6 billion in 2024, also fall into this category, requiring strategic funding for future gains.

| Product/Sector | 2024 Market Size | Projected Growth |

|---|---|---|

| Humanoid Robotics | $1.6 Billion | $13.3 Billion (2030) |

| AI Server Market | N/A | $40.6 Billion (2028) |

| Robotics Market | $58.8 Billion (2023) | $173.8 Billion (2030) |

BCG Matrix Data Sources

The Johnson Electric Holdings BCG Matrix leverages financial statements, market analysis, and competitor insights to fuel quadrant classifications.