JINSUNG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JINSUNG Bundle

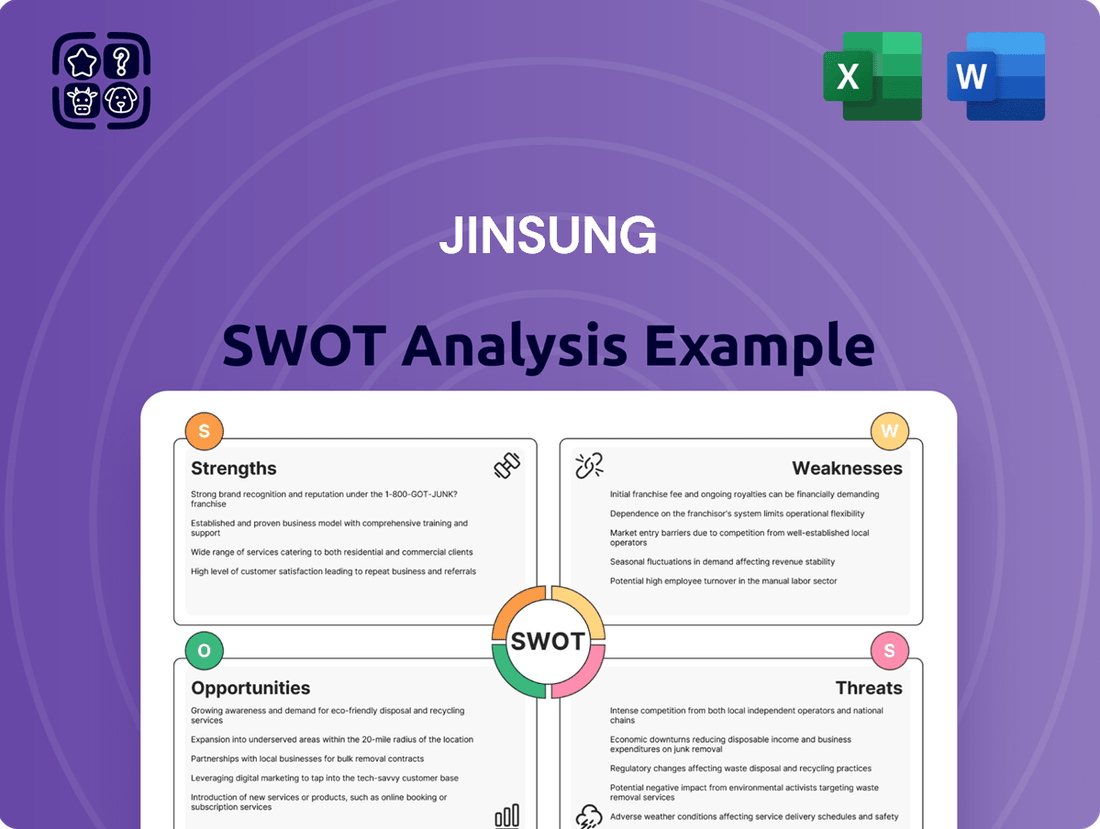

JINSUNG's SWOT analysis reveals a strong market presence and innovative product lines, but also highlights potential challenges in global expansion and intense competition. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind JINSUNG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

JINSUNG TEC Co., Ltd. distinguishes itself through a highly specialized product portfolio centered on heavy-duty industrial equipment. This includes robust hydraulic breakers, efficient crushers, and a variety of excavator attachments, all designed for demanding environments.

This strategic focus on a niche market allows JINSUNG to cultivate profound expertise, resulting in the development of superior quality products meticulously engineered for challenging tasks in construction, demolition, and mining. Their offerings are crucial for the effective breaking and processing of tough materials.

The consistent demand for JINSUNG's specialized equipment is a testament to their ability to meet the specific needs of these critical industries. For instance, the global market for demolition equipment, which heavily utilizes hydraulic breakers and crushers, was valued at approximately USD 10.5 billion in 2023 and is projected to grow, indicating a strong underlying demand for JINSUNG's core products.

JINSUNG benefits from its operations in construction, demolition, and mining, sectors poised for substantial global expansion. The mining equipment market, in particular, is expected to see robust growth, largely due to the increasing demand for essential minerals powering electric vehicles and the burgeoning renewable energy sector. This trend is a significant tailwind for companies like JINSUNG.

The construction machinery market also presents a strong growth opportunity. This expansion is being fueled by significant global investments in infrastructure projects and ongoing urbanization trends. Notably, the Asia-Pacific region is a key driver of this growth, indicating substantial potential for JINSUNG's products and services in these expanding markets.

For instance, the global mining equipment market was valued at approximately $150 billion in 2023 and is projected to reach over $200 billion by 2028, exhibiting a compound annual growth rate (CAGR) of around 6%. This trajectory underscores the favorable market conditions JINSUNG is currently navigating.

JINSUNG T.E.C. demonstrated robust financial performance in early 2025, reporting KRW 545.66 million in sales and a KRW 6,600.33 million net income for the first quarter ending March 31, 2025. This represents a substantial increase compared to the prior year, highlighting a strong operational and financial position.

The company's trailing twelve-month revenue, as of March 31, 2025, reached $280 million. This substantial revenue figure, coupled with the positive net income, underscores JINSUNG T.E.C.'s healthy financial standing and its capacity for sustained growth and investment.

Commitment to Quality and Innovation

JINSUNG TEC's dedication to quality and innovation is a significant strength, driving customer satisfaction through continuous R&D and new product development. This focus is vital in the competitive heavy equipment sector, where reliability is key. For instance, the company's investment in advanced manufacturing processes aims to enhance product durability and performance.

The company's strategic exploration into future power industries, specifically the modularization of undercarriage vehicles like small excavators and compact track loaders (CTLs), positions JINSUNG TEC for future growth. This forward-thinking approach acknowledges evolving market demands for versatile and efficient machinery.

- Commitment to R&D: JINSUNG TEC consistently invests in research and development to ensure its products meet the highest standards of quality and performance.

- Customer Satisfaction Focus: The company prioritizes customer needs by developing innovative solutions and improving existing product lines.

- Future Industry Exploration: JINSUNG TEC is proactively investigating opportunities in emerging power sectors, such as the modularization of undercarriage systems for smaller construction equipment.

- Quality Control Emphasis: Rigorous quality control measures are implemented throughout the production process to guarantee the reliability of JINSUNG TEC's heavy equipment.

Established International Distribution

JINSUNG T.E.C. boasts a robust international distribution network, extending its reach beyond South Korea to key markets like America, Japan, and China. This global presence is crucial for diversifying revenue streams and mitigating risks associated with over-reliance on a single domestic market. By tapping into these diverse geographical regions, JINSUNG enhances its customer base and unlocks significant potential for worldwide growth.

Their strategic positioning within the Asia-Pacific region, a dominant force in the construction and mining equipment sectors, provides a substantial competitive edge. In 2024, the Asia-Pacific construction equipment market was valued at approximately USD 48.5 billion, and JINSUNG's established presence there allows them to capitalize on this substantial demand. This international distribution allows JINSUNG to leverage global economic trends and adapt to varying market needs.

Key benefits of JINSUNG's established international distribution include:

- Diversified Revenue Streams: Reduced dependence on the South Korean market, promoting financial stability.

- Access to Global Markets: Opportunity to serve a wider customer base and capture international demand.

- Market Resilience: Ability to offset downturns in one region with growth in others, as seen in the varied economic recovery rates globally post-2023.

- Enhanced Brand Recognition: A broader international footprint builds greater brand awareness and reputation on a global scale.

JINSUNG TEC's specialized product line, focusing on heavy-duty hydraulic breakers, crushers, and excavator attachments, caters to critical demands in construction, demolition, and mining. This niche focus fosters deep expertise, leading to high-quality, durable equipment essential for challenging tasks.

The company demonstrates strong financial health, with Q1 2025 sales of KRW 545.66 million and a net income of KRW 6,600.33 million, a significant year-over-year increase. Their trailing twelve-month revenue as of March 31, 2025, reached $280 million, underscoring operational efficiency and market demand for their specialized offerings.

JINSUNG TEC's commitment to research and development drives product innovation and customer satisfaction, crucial for maintaining a competitive edge in the heavy equipment sector. Their exploration into modular undercarriage systems for smaller equipment signals a strategic move to capture evolving market needs.

With a robust international distribution network spanning America, Japan, and China, JINSUNG TEC effectively diversifies revenue and mitigates market-specific risks. Their strong presence in the Asia-Pacific region, valued at approximately USD 48.5 billion for construction equipment in 2024, provides a significant advantage in capitalizing on substantial global demand.

What is included in the product

Delivers a strategic overview of JINSUNG’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

JINSUNG's SWOT analysis simplifies complex strategic planning by offering a clear, actionable framework for identifying and addressing business challenges.

Weaknesses

JINSUNG TEC's heavy machinery production is significantly dependent on raw materials like steel, aluminum, and copper. For instance, in early 2024, steel prices saw notable volatility due to global supply chain adjustments and demand shifts, impacting manufacturers across sectors.

These commodity price swings can directly affect JINSUNG's production expenses and, consequently, its profit margins. An unexpected surge in material costs, as seen with copper in late 2023 driven by increased demand in the electronics sector, presents a direct challenge to maintaining predictable profitability.

JINSUNG TEC's core business is deeply rooted in construction, demolition, and mining. These sectors are notoriously capital-intensive, meaning they require significant upfront investment in machinery and infrastructure. For JINSUNG, this translates into a concentrated demand base for its products and services.

The company's reliance on these specific industries creates a vulnerability to economic cycles. For instance, the global construction equipment market is projected to see a sales decline in 2025, a trend that will directly affect JINSUNG's revenue streams. This cyclicality means that periods of economic slowdown can disproportionately impact the company.

Furthermore, a downturn in any of these key sectors, perhaps due to reduced government spending on infrastructure or a slowdown in commodity prices affecting mining investment, could lead to a significant drop in demand for JINSUNG's offerings. This concentrated market exposure presents a notable risk factor for the company's stability.

JINSUNG TEC operates in a highly competitive heavy construction and mining equipment landscape, where giants like Komatsu, Caterpillar, Volvo, and Sany Heavy Industry hold significant market sway. These established global entities benefit from vast economies of scale and extensive brand recognition, presenting a considerable hurdle for specialized manufacturers like JINSUNG. For instance, Caterpillar alone reported over $67 billion in revenue for 2023, dwarfing the scale of many specialized players. This disparity can impact JINSUNG's ability to compete on price, invest in cutting-edge research and development at the same pace, and secure large-scale contracts against these diversified corporations.

Vulnerability to Supply Chain Disruptions

JINSUNG TEC faces significant vulnerability due to ongoing global supply chain disruptions. Issues such as the persistent semiconductor shortage and widespread transportation delays continue to impact the availability and cost of essential components for heavy equipment production. These challenges directly translate into potential production delays and increased operational costs for JINSUNG, making it harder to meet customer demand efficiently.

The repercussions of these supply chain vulnerabilities are substantial, directly affecting JINSUNG TEC's operational efficiency and its ability to adhere to delivery timelines. For instance, in 2024, the automotive industry, a key sector for heavy equipment components, experienced an average increase of 15% in logistics costs due to these disruptions. This trend is expected to continue impacting manufacturing sectors reliant on global sourcing, including JINSUNG's operations.

- Semiconductor Shortages: Continued scarcity of critical chips impacts the production of advanced machinery components.

- Transportation Delays: Port congestion and rising freight rates add to lead times and increase inbound logistics expenses.

- Component Cost Volatility: Unpredictable pricing for raw materials and manufactured parts can erode profit margins.

- Production Bottlenecks: Limited availability of key inputs can halt or slow down assembly lines, delaying order fulfillment.

Need for Continuous Technological Investment

The heavy equipment sector is rapidly evolving, with automation, electrification, and AI becoming increasingly vital. JINSUNG must commit to ongoing, significant investments in research and development to integrate these advanced technologies. For instance, major competitors like Caterpillar have announced substantial R&D spending, with their 2024 R&D budget projected to be around $2.5 billion, highlighting the industry's investment trends. Without this continuous technological upgrade, JINSUNG risks falling behind, potentially rendering its current product offerings outdated in a competitive market.

This necessitates a proactive strategy for technological adoption. Key areas requiring investment include:

- Developing and integrating autonomous operation systems for improved efficiency and safety.

- Investing in electric and hybrid powertrain technologies to meet environmental regulations and customer demand.

- Incorporating IoT solutions for predictive maintenance and enhanced fleet management.

- Exploring AI applications for optimizing equipment performance and design.

JINSUNG TEC's reliance on a few key industries like construction and mining makes it susceptible to economic downturns. For example, a slowdown in global infrastructure projects, a common occurrence during recessions, could significantly reduce demand for JINSUNG's heavy machinery. This concentration risk means that a downturn in any single sector can disproportionately impact the company's revenue and profitability.

What You See Is What You Get

JINSUNG SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

This preview accurately represents the JINSUNG SWOT analysis you will receive upon completing your purchase.

You are viewing a direct excerpt from the complete JINSUNG SWOT analysis document, ensuring transparency.

Once you purchase, you will gain access to the entire, professionally formatted JINSUNG SWOT analysis.

Opportunities

The global push for infrastructure development presents a significant opportunity for JINSUNG TEC. Countries worldwide are injecting substantial capital into upgrading and expanding their infrastructure. For example, the U.S. Infrastructure Investment and Jobs Act of 2021 is set to invest over $1 trillion in projects like roads, bridges, and broadband, with a substantial portion allocated through 2025. Similarly, India's National Infrastructure Pipeline aims for $1.4 trillion in infrastructure spending by 2025, focusing on areas like transportation and energy.

These large-scale initiatives, encompassing everything from new highways and bridges to urban renewal and energy grids, create a robust demand for the specialized construction and mining equipment that JINSUNG TEC offers. The company is well-positioned to supply essential tools for these massive undertakings, potentially leading to increased sales and market share as these projects progress through their construction phases in 2024 and 2025.

The global hydraulic breaker market is expected to see significant growth, with projections indicating a compound annual growth rate (CAGR) of around 5.8% through 2028, reaching an estimated value of over $1.5 billion. This expansion is largely fueled by ongoing urbanization trends worldwide and the increasing need for effective demolition and excavation solutions.

This trend directly benefits JINSUNG TEC, as its core product, hydraulic breakers, are essential for these modern construction and infrastructure development activities. The company is well-positioned to capitalize on this demand by increasing sales of its hydraulic breakers and related crushing equipment.

Furthermore, the demand for specialized demolition tools, including those designed for specific materials or environments, is on the rise. This creates an opportunity for JINSUNG TEC to innovate and potentially expand its product line to cater to niche markets within the demolition sector.

The heavy equipment industry is rapidly embracing technological advancements. We're seeing a significant move towards automation, electrification, artificial intelligence (AI), and the integration of the Internet of Things (IoT) in machinery. This presents a prime opportunity for JINSUNG TEC to lead innovation.

By developing advanced, 'smart' versions of its products, JINSUNG can incorporate features like remote monitoring and sophisticated energy-saving systems. For instance, the global construction equipment market, valued at approximately $200 billion in 2023, is projected to grow with a CAGR of over 4% through 2030, largely driven by these technological integrations.

Meeting these evolving market demands with cutting-edge solutions will allow JINSUNG to sharpen its competitive edge. Companies that integrate AI for predictive maintenance, for example, can reduce equipment downtime by up to 20%, a tangible benefit for end-users that JINSUNG can leverage.

Expansion into New Geographic Markets and Rental Segment

JINSUNG TEC can capitalize on the significant growth potential within the Asia-Pacific construction and mining equipment sectors. This region is projected to see continued infrastructure development, driving demand for JINSUNG's offerings. For instance, the Asia-Pacific construction equipment market was valued at approximately USD 30 billion in 2023 and is expected to grow at a CAGR of over 5% through 2030.

Furthermore, the expanding rental market for construction equipment presents a compelling opportunity. As of 2024, the global construction equipment rental market is estimated to be worth over USD 120 billion, with substantial growth anticipated. JINSUNG can establish or enhance its rental fleet and distribution channels to tap into this lucrative segment, offering flexible solutions to a broader customer base.

- Asia-Pacific Construction Equipment Market Growth: Expected to exceed 5% CAGR through 2030.

- Global Rental Market Value: Estimated over USD 120 billion in 2024.

- Strategic Focus: Penetrating high-growth Asian markets and leveraging the rental sector.

Focus on Sustainable and Eco-Friendly Solutions

The global construction equipment market is seeing a significant shift towards sustainability. For JINSUNG TEC, this presents a prime opportunity to innovate. There's a growing industry-wide demand for eco-friendly solutions, particularly electric and hybrid-powered equipment, alongside a preference for machinery that operates with reduced noise and emissions. This trend is driven by stricter environmental regulations and increasing customer awareness.

JINSUNG TEC can capitalize on this by investing in the research and development of more sustainable versions of its hydraulic breakers and attachments. Aligning product offerings with global environmental standards and evolving market preferences is crucial for future growth. For instance, the global market for green construction equipment was projected to reach USD 75.2 billion in 2024 and is expected to grow significantly in the coming years, indicating a strong demand for these innovations.

- Growing Demand for Electric and Hybrid Equipment: The push for reduced carbon footprints is driving adoption.

- Stricter Environmental Regulations: Compliance with upcoming emissions standards necessitates eco-friendly product lines.

- Market Differentiation: Sustainable solutions can set JINSUNG TEC apart from competitors.

- Enhanced Brand Reputation: A commitment to sustainability can improve public perception and attract environmentally conscious clients.

JINSUNG TEC can leverage the global infrastructure boom, with countries like the U.S. investing over $1 trillion through 2025 in projects, and India targeting $1.4 trillion by 2025. The company's hydraulic breakers are essential for these massive undertakings, poised to boost sales. The hydraulic breaker market itself is projected for significant growth, with an estimated CAGR of 5.8% through 2028, driven by urbanization and demolition needs.

The company can also capitalize on the increasing demand for specialized demolition tools, potentially expanding its product line to meet niche market requirements. Furthermore, the heavy equipment industry's embrace of technology, including AI and IoT, offers JINSUNG an opportunity to innovate with advanced, 'smart' equipment, as the global construction equipment market, valued at approximately $200 billion in 2023, grows with technological integration.

JINSUNG TEC is well-positioned to benefit from the Asia-Pacific region's infrastructure development, with its construction equipment market valued at around USD 30 billion in 2023 and a projected CAGR over 5% through 2030. The expanding global construction equipment rental market, estimated at over USD 120 billion in 2024, also presents a significant opportunity for JINSUNG to enhance its rental fleet and distribution networks.

The growing emphasis on sustainability in construction offers JINSUNG TEC a chance to lead with eco-friendly innovations. The market for green construction equipment was projected at USD 75.2 billion in 2024, highlighting a strong demand for electric and hybrid machinery. By developing sustainable products, JINSUNG can gain a competitive edge and improve its brand reputation among environmentally conscious clients.

Threats

Economic downturns pose a significant threat to JINSUNG TEC, as both the construction and mining industries are highly susceptible to economic cycles. A projected slowdown in global construction equipment sales for 2025, with particular weakness anticipated in North America and Europe, could directly impact JINSUNG's revenue streams.

This potential reduction in demand for heavy equipment, a core market for JINSUNG's components, could lead to decreased sales volumes and put pressure on profit margins throughout 2025. For instance, if North American construction equipment sales decline by an estimated 5-7% as some analysts predict for 2025, JINSUNG could see a corresponding dip in its component orders from that region.

JINSUNG faces significant threats from intense competition in the heavy construction equipment and attachments market. Numerous domestic and international companies vie for market share, often leading to aggressive pricing strategies. This price pressure can erode profit margins, particularly when rivals launch comparable products at lower price points or with superior features, impacting JINSUNG's ability to maintain profitability and invest in future innovation.

Persistent inflation continues to pressure the prices of key raw materials like steel, aluminum, and copper, directly impacting the manufacturing costs for heavy equipment producers. For instance, global steel prices saw significant fluctuations throughout 2024, with some benchmarks increasing by over 15% at various points due to supply chain disruptions and increased demand from infrastructure projects.

Rising energy costs, a critical component of operational expenses, also present a substantial threat. The volatility in oil and natural gas prices in late 2024 and early 2025 means higher expenses for production, logistics, and transportation for companies like JINSUNG TEC.

These escalating raw material and energy expenses can significantly squeeze profit margins if JINSUNG TEC is unable to pass these increased costs onto its customers or implement effective cost-saving measures within its operations.

Technological Disruption from Competitors

Competitors, including major global manufacturers, are making significant investments in cutting-edge technologies such as full automation, artificial intelligence, and electrification. For instance, in the semiconductor equipment sector, key players are channeling billions into R&D for next-generation lithography and advanced packaging solutions, aiming to capture market share in 2024 and beyond. JINSUNG TEC's ability to keep pace with these advancements is critical.

If JINSUNG TEC falls behind in adopting or innovating these transformative technologies, it faces a substantial risk of losing market share. Customers are increasingly demanding products that incorporate AI-driven efficiency, fully automated processes, and electrified components for improved performance and sustainability. Companies that fail to integrate these capabilities risk offering less competitive solutions.

For example, in the industrial automation market, competitors offering AI-powered predictive maintenance solutions have seen a notable uptick in adoption rates. Reports from late 2024 indicate that companies integrating AI into their manufacturing lines experienced an average of 15% reduction in downtime compared to those relying on traditional methods. This technological gap can translate directly into a loss of business for JINSUNG TEC.

- Increased R&D spending by global competitors: Major players are allocating upwards of 10-15% of their revenue to technological innovation in 2024.

- Market demand for automation and AI: The global industrial automation market is projected to grow by over 10% annually through 2027, with AI being a key driver.

- Risk of obsolescence: Failure to adopt new technologies could render JINSUNG TEC's current product offerings less appealing or even obsolete.

- Competitive pricing pressure: Technologically advanced products from rivals may enable them to offer more competitive pricing or superior value propositions.

Geopolitical Instability and Trade Policies

Geopolitical tensions and evolving trade policies present significant threats to JINSUNG TEC. For instance, the ongoing trade disputes between major economies, particularly those involving tariffs on semiconductors and electronic components, could directly increase JINSUNG's input costs. In 2024, global trade protectionism saw a rise, with the World Trade Organization reporting an increase in trade-restrictive measures compared to previous years, directly impacting companies reliant on international sourcing and sales.

Disruptions to global supply chains are a major concern, as seen with past events like the COVID-19 pandemic and subsequent shipping crises. These events highlighted vulnerabilities in just-in-time manufacturing models. If geopolitical instability leads to further disruptions, JINSUNG may face challenges in securing necessary raw materials and components, potentially leading to production delays and increased operational expenses.

Changes in trade policies, such as the imposition of new tariffs or non-tariff barriers, can significantly alter the cost-competitiveness of JINSUNG's products in international markets. For example, a hypothetical 10% tariff on imported electronic parts could add millions to JINSUNG's cost of goods sold, impacting profitability and market share. The International Monetary Fund's 2024 outlook indicated a persistent risk of trade fragmentation, underscoring the dynamic nature of these policy shifts.

These external factors create an environment of heightened uncertainty, making it difficult for JINSUNG to forecast demand, manage inventory, and plan long-term investments. The company's ability to source materials efficiently and distribute its products globally could be hampered, potentially affecting revenue streams and overall financial performance.

Intensified competition from both established global players and emerging domestic manufacturers poses a significant threat to JINSUNG TEC's market position. Competitors are increasingly leveraging technological advancements and aggressive pricing strategies, which could erode JINSUNG's market share and profit margins. For instance, in 2024, several competitors launched advanced hydraulic components with integrated IoT capabilities, directly challenging JINSUNG's existing product lines.

The rapid pace of technological innovation, particularly in automation, AI, and electrification, creates a risk of obsolescence for JINSUNG's current offerings if the company fails to invest adequately in R&D. The industrial automation market is projected to see a compound annual growth rate of over 10% through 2027, driven by AI integration, and companies lagging in these areas could face substantial market share loss. For example, a competitor's introduction of AI-powered predictive maintenance solutions in late 2024 reportedly reduced downtime by 15% for early adopters.

Global economic downturns and sector-specific slowdowns, especially in construction and mining, directly impact JINSUNG's revenue. Analysts forecast a potential 5-7% decline in North American construction equipment sales for 2025, which could translate into reduced component orders for JINSUNG. Furthermore, persistent inflation in raw materials, such as steel (which saw benchmark price increases of over 15% in 2024), and rising energy costs are squeezing profit margins, as JINSUNG may struggle to pass these increased costs onto customers.

Geopolitical instability and evolving trade policies introduce uncertainty and potential cost increases. Tariffs, trade disputes, and supply chain disruptions, as seen with increased global trade protectionism in 2024, can inflate input costs and hinder efficient global distribution. The IMF has highlighted persistent risks of trade fragmentation, making it crucial for JINSUNG to navigate these complex international dynamics.

SWOT Analysis Data Sources

This SWOT analysis for JINSUNG is built upon a robust foundation of data, including JINSUNG's official financial statements, comprehensive market research reports, and insights from industry experts. These sources ensure a thorough and accurate assessment of the company's internal capabilities and external environment.