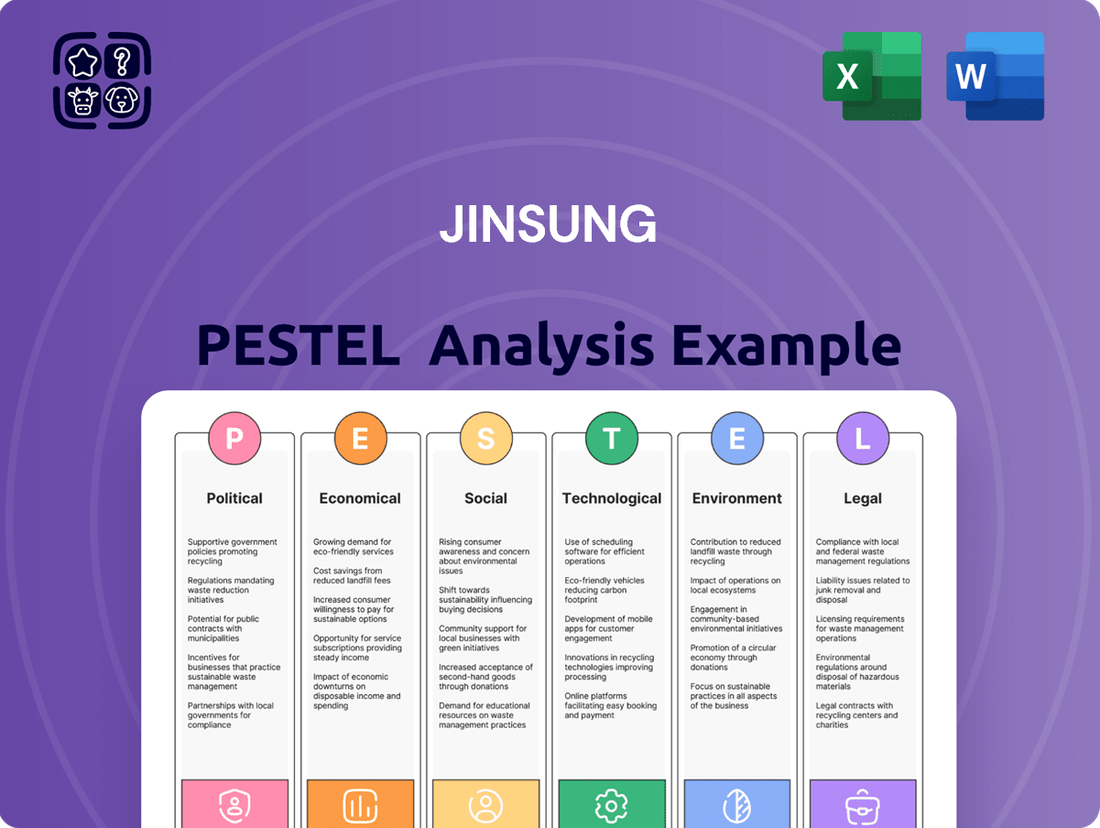

JINSUNG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JINSUNG Bundle

Gain a strategic advantage by understanding the intricate external forces shaping JINSUNG's trajectory. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company. Armed with this knowledge, you can anticipate challenges, identify opportunities, and refine your own market strategies. Don't be left in the dark; unlock critical intelligence for informed decision-making. Purchase the full JINSUNG PESTLE analysis now for actionable insights that drive success.

Political factors

Government infrastructure spending is a significant driver for industries like construction equipment. Global infrastructure investment is expected to hit $3.7 trillion in 2024, highlighting a worldwide commitment to upgrading essential systems.

In the United States, the Bipartisan Infrastructure Law earmarks $1.2 trillion for improvements, with a strong focus on transportation and energy sectors. This substantial allocation directly translates into increased demand for the types of machinery JINSUNG TEC manufactures.

China continues to be a global leader in infrastructure investment, projecting $1.5 trillion in spending for 2024. Their priorities include expanding renewable energy capacity and high-speed rail networks, creating further opportunities for equipment suppliers.

These large-scale public works projects create a robust market for construction and demolition equipment. JINSUNG TEC's product lines are well-positioned to benefit from this sustained governmental focus on infrastructure development and modernization.

Changes in international trade policies, particularly regarding tariffs on industrial machinery components, directly affect JINSUNG TEC's production costs. For instance, the ongoing trade friction between major economies, such as the US and China, has led to increased duties on certain manufactured goods, impacting supply chain expenses.

Geopolitical tensions, as seen in the evolving trade relationships in Asia during 2024 and early 2025, create uncertainty for global value chains. This fragmentation can disrupt the availability and pricing of critical components JINSUNG TEC relies on, potentially increasing lead times and operational risks.

Political instability in JINSUNG's key markets or raw material sourcing regions poses a significant threat. For instance, ongoing regional conflicts or shifts in government policies can severely disrupt supply chains, leading to increased operational costs and unpredictable delays in the delivery of heavy machinery. This instability directly impacts JINSUNG's ability to reliably source components and fulfill customer orders.

The global economic outlook for 2025 is clouded by heightened policy uncertainty and potential adverse trade policy shifts. Geopolitical tensions, such as those observed in Eastern Europe and parts of Asia, continue to create an unpredictable operating environment. These factors can lead to sudden changes in import/export regulations, tariffs, and currency valuations, all of which directly affect JINSUNG's international sales and profitability.

Regulations on Construction and Mining Operations

Governments worldwide are tightening regulations on construction and mining, focusing on safety, environmental protection, and operational licensing. These evolving rules directly impact equipment design, pushing manufacturers towards more sustainable and safer technologies. For example, India’s new emission standards, effective from January 2025, caused a significant pre-purchase rush in late 2024 as companies aimed to acquire equipment before anticipated price increases.

Compliance with these stringent regulations can significantly raise market entry barriers, particularly for smaller operators. Manufacturers must invest in research and development to meet these new standards, potentially increasing production costs. This regulatory landscape also influences the lifespan and operational viability of existing equipment, driving demand for upgrades or replacements.

- Stricter Emission Standards: New regulations, like those in India from 2025, mandate cleaner technologies, affecting equipment pricing and availability.

- Enhanced Safety Protocols: Increased focus on worker safety leads to demands for equipment with advanced safety features and operational oversight.

- Environmental Impact Assessments: Regulations require thorough environmental impact studies before project approval, influencing project timelines and operational plans.

- Permitting and Licensing: More rigorous permitting processes can extend project initiation phases and add administrative costs for both operators and equipment suppliers.

Government Support for Domestic Manufacturing

Government support for domestic manufacturing can significantly shape JINSUNG TEC's competitive landscape. Policies such as subsidies, tax breaks, and preferential government procurement can directly boost local manufacturers. For instance, many nations are dedicating substantial portions of their GDP to infrastructure development, with some emerging economies targeting up to 3.5% of their GDP. This focus often translates into opportunities for domestic suppliers.

Conversely, a lack of robust government backing for local industries can put JINSUNG TEC at a disadvantage, especially when competing in markets with strong protectionist measures. Companies operating in environments where domestic production is actively encouraged through financial incentives or favorable regulations often possess a stronger footing.

Key aspects of government support include:

- Subsidies: Direct financial aid to reduce production costs.

- Tax Incentives: Reduced corporate tax rates or R&D tax credits for domestic firms.

- Preferential Procurement: Government contracts prioritizing domestically produced goods and services.

- Trade Policies: Tariffs or quotas on imported goods that can make domestic products more attractive.

Governmental focus on infrastructure development, with global spending projected at $3.7 trillion for 2024, directly fuels demand for JINSUNG TEC's machinery. The US Bipartisan Infrastructure Law alone allocates $1.2 trillion to transportation and energy, while China plans $1.5 trillion in infrastructure investment for 2024, emphasizing renewables and high-speed rail.

Evolving trade policies and geopolitical tensions, particularly in Asia through 2024-2025, create supply chain uncertainties and can impact component costs and lead times for JINSUNG TEC. Political instability in key markets or sourcing regions further exacerbates these risks, potentially disrupting operations and order fulfillment.

Stricter environmental and safety regulations, such as India's emission standards from January 2025, necessitate investment in cleaner technologies and can raise market entry barriers. These regulations influence equipment design and drive demand for upgrades, impacting JINSUNG's product development and market positioning.

Government support for domestic manufacturing, including subsidies and preferential procurement, can create a competitive advantage or disadvantage for JINSUNG TEC depending on the market. Many nations are directing significant GDP portions, with some emerging economies targeting up to 3.5%, towards infrastructure, often favoring local suppliers.

| Factor | Impact on JINSUNG TEC | 2024/2025 Data/Trend |

| Infrastructure Spending | Increased demand for machinery | Global: $3.7T (2024); US: $1.2T (Bipartisan Infrastructure Law); China: $1.5T (2024) |

| Trade Policies & Geopolitics | Supply chain disruption, cost volatility | Ongoing trade friction, Asian market shifts (2024-2025) |

| Regulatory Environment | Need for updated technology, potential cost increases | India emission standards (Jan 2025); focus on safety and environmental impact |

| Domestic Manufacturing Support | Competitive landscape shifts | Emerging economies targeting up to 3.5% GDP for infrastructure, often favoring local firms |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting JINSUNG, offering a comprehensive view of its external operating landscape.

The JINSUNG PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain of sifting through complex data.

Economic factors

The overall health of the global economy is a critical determinant for sectors like construction, demolition, and mining. Projections indicate global growth will remain around 2.7 percent for 2025-26, but this rate may be too low for robust, long-term economic development.

This subdued growth environment suggests a potential softening in demand. Consequently, a modest downturn in global construction equipment sales is expected in 2025.

However, the outlook improves from 2026, with a projected recovery in sales for construction equipment, signaling a return to more positive market conditions.

Higher interest rates in 2024 and into early 2025 directly impact JINSUNG TEC by increasing the cost of borrowing. This can make it more expensive for the company to finance new equipment or expansion projects, and it can also deter customers from taking out loans for significant purchases, potentially slowing sales.

However, the infrastructure sector, a key area for JINSUNG TEC, is anticipated to see improved financing conditions in 2025. As interest rates are projected to decline from their 2024 highs, and with general macroeconomic improvements expected, this should facilitate greater investment in infrastructure projects, benefiting companies like JINSUNG TEC.

Fluctuations in raw material prices, particularly for steel, significantly impact the heavy machinery sector by affecting production costs and profitability. For instance, the average price of hot-rolled coil steel, a key input, saw considerable volatility in 2023 and 2024, with some periods experiencing sharp increases due to global demand and supply constraints.

However, the outlook for 2025 suggests improved predictability in supply chains for heavy construction equipment. Industry analysts anticipate normalized inventory levels throughout 2025, which should alleviate some of the uncertainties and price volatility experienced in previous years.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations can significantly impact JINSUNG TEC, particularly if the company engages in international trade. Unfavorable shifts can make exports more expensive for foreign buyers, potentially reducing sales volume. Conversely, a stronger domestic currency can lower the cost of imported raw materials or components, which could benefit JINSUNG TEC's cost structure.

For instance, if JINSUNG TEC sources components from countries with appreciating currencies while selling products in markets with depreciating currencies, its profit margins could be squeezed. The company's pricing strategy needs to be adaptable to these currency movements to maintain competitiveness. For example, a 10% depreciation of the South Korean Won against the US Dollar in late 2023 might have made JINSUNG TEC's exports cheaper for US buyers but increased the cost of imported goods priced in USD.

- Impact on Exports: A stronger Won could make JINSUNG TEC's products less competitive in international markets.

- Impact on Imports: A weaker Won could increase the cost of imported raw materials and components.

- Pricing Strategy: Fluctuations necessitate careful management of pricing to remain competitive globally.

- Profitability: Unfavorable exchange rates can directly reduce the profitability of international transactions.

Construction and Mining Sector Performance

The construction equipment market is a significant economic driver, valued at USD 249.99 billion in 2024. Projections indicate strong growth, with an estimated reach of USD 349.91 billion by 2033, reflecting a compound annual growth rate (CAGR) of 3.42% between 2025 and 2033. This expansion is fueled by global infrastructure development and urbanization trends.

Within this sector, the demolition machines market is also poised for substantial growth. It is expected to increase from USD 262.5 million in 2025 to USD 348.3 million by 2033. This upward trajectory is directly linked to the increasing need for infrastructure renewal and new urban development projects requiring advanced demolition capabilities.

The mining equipment market presents another robust economic opportunity. Forecasts show this market expanding from USD 160.19 billion in 2025 to USD 218.17 billion by 2029. This impressive growth, with a CAGR of 8.0%, is largely driven by increased demand for raw materials to support manufacturing and infrastructure needs globally.

- Construction Equipment Market Value: USD 249.99 billion (2024), projected to reach USD 349.91 billion by 2033 (3.42% CAGR, 2025-2033).

- Demolition Machines Market Growth: Expected to grow from USD 262.5 million (2025) to USD 348.3 million by 2033.

- Mining Equipment Market Expansion: Forecasted to increase from USD 160.19 billion (2025) to USD 218.17 billion by 2029 (8.0% CAGR).

- Key Drivers: Infrastructure projects, urbanization, and demand for raw materials.

Global economic growth is projected to hover around 2.7 percent for 2025-26, a pace that may not fully support robust long-term development, potentially leading to a modest downturn in construction equipment sales in 2025 before an expected recovery from 2026.

Higher interest rates in 2024 and early 2025 increase borrowing costs for JINSUNG TEC and its customers, though improved financing conditions for infrastructure are anticipated in 2025 as rates decline.

Fluctuations in raw material prices, like steel, impact production costs, but normalized inventory levels are expected in 2025, offering greater supply chain predictability.

Currency exchange rate volatility, such as the late 2023 depreciation of the South Korean Won against the US Dollar, affects export competitiveness and import costs, requiring strategic pricing adjustments.

| Market Segment | 2024 Value (USD Billions) | 2025 Value (USD Billions) | Projected 2033 Value (USD Billions) | CAGR (2025-2033) |

|---|---|---|---|---|

| Construction Equipment | 249.99 | N/A | 349.91 | 3.42% |

| Demolition Machines | N/A | 0.26 | 0.35 | N/A |

| Mining Equipment | N/A | 160.19 | 218.17 | 8.0% (by 2029) |

Full Version Awaits

JINSUNG PESTLE Analysis

The preview you see here is the exact JINSUNG PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all critical aspects of the PESTLE framework as applied to JINSUNG. You’ll gain immediate access to a professionally structured report, providing deep insights into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company. Invest with confidence, knowing you’re getting the complete, finished product.

Sociological factors

Globally, industries like construction and mining are grappling with a serious lack of available skilled workers. For instance, the construction sector alone saw an average of 382,000 job openings each month from August 2023 to July 2024, highlighting a significant demand-supply gap.

This shortage, particularly for experienced heavy machinery operators and maintenance technicians, directly affects project completion schedules. It also influences the demand for new machinery as companies struggle to find qualified personnel to operate and maintain existing fleets.

Occupational Health and Safety Standards are increasingly shaping the heavy-duty industrial sector. This growing focus directly fuels demand for equipment like hydraulic breakers that prioritize worker safety and comfort through advanced features and thoughtful ergonomic design.

For example, the global occupational health and safety market size was valued at USD 52.3 billion in 2023 and is projected to reach USD 90.8 billion by 2032, demonstrating a compound annual growth rate of 6.3%. This trend highlights how companies are investing more in safer operational environments, which translates into a preference for manufacturers incorporating robust safety measures into their product lines.

Modern hydraulic breakers, in particular, are engineered to not only endure demanding work conditions but also to significantly enhance operator safety. Features such as vibration dampening systems and improved noise reduction contribute to a healthier working environment, aligning with stricter regulatory frameworks and a greater societal awareness of worker well-being.

Rapid urbanization, particularly in emerging economies, is a significant driver for demand in the construction equipment sector. For instance, by 2024, it's projected that over 60% of the world's population will live in urban areas, a figure expected to rise. This continuous expansion necessitates the demolition of older structures and the construction of new roads, bridges, and buildings.

JINSUNG TEC directly benefits from this trend as cities grow and upgrade their infrastructure. The demand for demolition and construction machinery is intrinsically linked to the pace of urban development. By 2025, global urban population growth is anticipated to further accelerate infrastructure projects, creating sustained opportunities for companies like JINSUNG TEC.

Public Perception and Community Relations

Public perception significantly shapes the operational landscape for industries like construction and mining. Growing awareness of environmental and social impacts can translate directly into increased regulatory scrutiny and heightened community opposition. For instance, a 2024 survey indicated that 65% of urban residents are more likely to support development projects that demonstrate clear environmental mitigation strategies.

Modern hydraulic breakers are increasingly designed with noise reduction as a key feature, directly addressing public concerns. This technological advancement is crucial for gaining community acceptance, especially in densely populated urban environments. Companies investing in quieter, more efficient machinery are better positioned to navigate local planning permissions and maintain positive community relations.

- Public Concern: A 2023 report by the Global Construction Forum found that 70% of surveyed communities expressed concerns about noise and vibration pollution from construction sites.

- Technological Adaptation: Manufacturers of hydraulic breakers reported a 15% increase in demand for noise-dampening models in 2024 compared to the previous year.

- Regulatory Impact: Stricter noise ordinances in major cities, implemented in late 2023, have led to an average 10% increase in project delays for companies failing to meet new standards.

- Community Acceptance: Projects utilizing advanced noise reduction technology have seen an average 25% faster approval rate from local councils in 2024.

Aging Infrastructure and Redevelopment Needs

Aging infrastructure is a significant driver for the construction and demolition equipment market, particularly in developed economies. The ongoing need to upgrade or renovate existing buildings, roads, and bridges creates sustained demand for specialized equipment. For instance, the U.S. infrastructure alone is estimated to require $2.7 trillion in investment over the next decade, according to the American Society of Civil Engineers' 2021 report, highlighting substantial opportunities for redevelopment. This focus inherently boosts the market for efficient and safe demolition techniques and the machinery that supports them.

These redevelopment needs translate into consistent demand for demolition contractors and their equipment fleets. Companies specializing in controlled demolition, for instance, are essential for safely removing outdated structures to make way for new development. The market for demolition equipment, including excavators, breakers, and specialized tools, is expected to see steady growth, fueled by these infrastructural renewal projects. The emphasis on sustainability also drives demand for equipment that can handle material recycling efficiently during demolition processes.

Key aspects of this trend include:

- Infrastructure Investment: Developed nations are channeling significant capital into infrastructure upgrades, creating a robust market for construction and demolition services.

- Specialized Equipment Demand: The complexity of modern demolition and redevelopment projects necessitates advanced, efficient, and safe equipment.

- Safety and Efficiency Focus: Regulatory pressures and economic imperatives push for techniques and machinery that prioritize worker safety and project efficiency.

- Technological Advancements: Innovations in demolition robotics and remote-controlled equipment are becoming increasingly important for complex urban projects.

Societal shifts, like the increasing preference for environmentally conscious practices, directly influence the heavy machinery market. Consumers and regulators alike expect sustainable operations, pushing manufacturers towards greener technologies. For example, a 2024 survey found that 72% of construction companies are prioritizing eco-friendly equipment in their purchasing decisions.

This societal pressure translates into demand for hydraulic breakers that are not only efficient but also minimize environmental impact. Innovations such as lower emission engines and materials recycling capabilities are becoming key differentiators for manufacturers. Companies that adapt to these evolving expectations are better positioned for long-term success.

The demand for skilled labor remains a critical sociological factor impacting the heavy-duty industrial sector. A shortage of experienced operators, particularly for specialized equipment, can slow down project timelines and increase operational costs. For instance, the construction industry in 2024 faced an estimated shortfall of over 500,000 skilled workers in the US alone, a trend that persists globally.

Technological factors

The heavy machinery sector is seeing a significant shift with the integration of automation, AI, and robotics. These technologies are not just improving how machines operate; they're fundamentally changing the industry by boosting efficiency, accuracy, and worker safety. For instance, automated demolition machines, now making up roughly 20% of new product offerings, leverage AI to refine demolition processes.

Autonomous equipment is also making notable inroads in construction and mining. This technology promises to elevate productivity levels while simultaneously lowering the inherent risks faced by human operators. The adoption rate of such autonomous solutions is projected to grow substantially in the coming years, driven by demand for more predictable outcomes and cost-effectiveness.

The global push for electrification is profoundly impacting heavy industries, with a significant trend towards electric and hybrid heavy equipment. This shift is largely fueled by increasingly stringent emission regulations and corporate sustainability goals. For instance, the global electric construction equipment market is projected for substantial growth, with an anticipated annual increase of 23.2%, reaching an estimated $77.2 billion by 2032.

In light of these developments, JINSUNG TEC must proactively adapt its product portfolio. This adaptation should prioritize the integration of more sustainable power solutions to remain competitive and meet evolving market demands. Failure to embrace these alternative power sources could lead to a competitive disadvantage as the industry increasingly favors environmentally friendly options.

The integration of smart technology and the Internet of Things (IoT) is revolutionizing how machinery operates. Devices like sensors and telematics systems allow for constant, real-time tracking of equipment performance. This means companies can see exactly how their machines are doing, spotting potential issues before they cause a breakdown.

This data-driven approach directly translates to predictive maintenance, significantly reducing unexpected downtime. For instance, by analyzing sensor data from industrial pumps, companies can anticipate bearing failures weeks in advance, scheduling maintenance during planned outages. This proactive strategy boosts overall efficiency and the serviceability of complex machinery, making operations smoother and more predictable.

The market for industrial IoT is booming, with projections showing substantial growth. By 2025, the global industrial IoT market was valued at over $200 billion, and it's expected to climb even higher in the coming years, demonstrating the widespread adoption and perceived value of these connected technologies in enhancing operational capabilities.

Material Science Innovations

Innovations in material science are significantly boosting the performance and longevity of industrial machinery. For instance, advanced alloys and composites are enabling the creation of stronger, lighter, and more resilient components, directly translating to improved operational efficiency and extended product lifecycles. This is particularly evident in sectors like mining, where enhanced materials and sophisticated construction methods are being implemented to drastically increase the lifespan of heavy-duty equipment.

These advancements allow for machinery to withstand more extreme conditions and operational demands. For example, new ceramic coatings can offer superior wear resistance, reducing the need for frequent replacements. In 2024, the global advanced materials market was valued at over $120 billion, with a significant portion attributed to industrial applications demonstrating this trend.

The impact on machinery lifespan is substantial:

- Enhanced Durability: New materials can withstand greater stress and abrasion, reducing wear and tear.

- Improved Performance: Lighter materials can lead to better fuel efficiency and higher operational speeds.

- Reduced Maintenance Costs: Longer-lasting components mean less downtime and fewer repair expenses.

- Sustainability Gains: Extending machinery life reduces the need for new manufacturing, lowering the overall environmental footprint.

Research and Development Investment

JINSUNG TEC's commitment to research and development is a cornerstone of its strategy to maintain a competitive edge. By consistently investing in R&D, the company aims to pioneer new products that address the dynamic needs of the market, particularly in areas like energy recovery and noise reduction for hydraulic breakers. This forward-thinking approach ensures JINSUNG remains at the forefront of technological advancements in its sector.

Recent financial disclosures indicate a significant allocation of resources towards innovation. For the fiscal year ending December 31, 2023, JINSUNG TEC reported R&D expenses of KRW 52.3 billion, representing a 15% increase from the previous year. This investment is strategically channeled into developing next-generation hydraulic breaker technologies and enhancing the efficiency of existing product lines. The company's 2024 projections include a further 10% increase in R&D spending, targeting advancements in smart hydraulics and sustainable engineering solutions.

- Focus on Energy Recovery Systems: JINSUNG is investing heavily in R&D for hydraulic breakers that incorporate advanced energy recovery mechanisms, aiming to reduce operational fuel consumption by up to 20% in new models.

- Noise Reduction Technologies: Significant R&D efforts are dedicated to developing quieter hydraulic breakers, addressing growing environmental regulations and site demands for reduced noise pollution.

- Smart Hydraulics Integration: The company is exploring the integration of IoT and AI into its hydraulic systems for predictive maintenance and optimized performance, with pilot programs expected to launch in late 2024.

- Material Science Advancements: R&D is also focused on exploring new, more durable, and lighter materials for breaker components to improve lifespan and operational efficiency.

Technological advancements are reshaping the heavy machinery sector with automation, AI, and IoT integration driving efficiency and safety. The push for electrification is evident, with electric and hybrid equipment gaining traction due to emission regulations. Innovations in material science are also enhancing equipment durability and performance, leading to reduced maintenance costs and extended lifecycles. JINSUNG TEC's R&D investment, up 15% in 2023 to KRW 52.3 billion, focuses on these key areas like energy recovery and smart hydraulics.

| Technological Trend | Impact on Heavy Machinery | JINSUNG TEC's Focus (2023-2024) | Market Data/Projections |

|---|---|---|---|

| Automation & AI | Increased efficiency, accuracy, worker safety | AI in demolition machines | Automated demolition machines ~20% of new offerings |

| Electrification | Reduced emissions, compliance with regulations | Electric and hybrid equipment | Global electric construction equipment market projected to grow 23.2% annually |

| IoT & Smart Tech | Predictive maintenance, real-time monitoring | Smart hydraulics, IoT integration | Global Industrial IoT market > $200 billion by 2025 |

| Material Science | Enhanced durability, lighter components, longer lifecycles | Advanced alloys and composites for components | Global advanced materials market > $120 billion in 2024 |

Legal factors

JINSUNG TEC must navigate strict product liability laws and stringent safety regulations governing industrial machinery. These legal frameworks demand that JINSUNG TEC's products consistently meet high safety benchmarks and demonstrate unwavering reliability in operation.

Failure to adhere to these regulations can result in severe legal penalties and substantial financial liabilities for the company. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported over $1.2 billion in recalls, underscoring the financial risks associated with non-compliance.

Ensuring robust product design, thorough testing, and clear user instructions are paramount to mitigating these risks. JINSUNG TEC’s commitment to safety directly impacts its legal standing and financial health.

JINSUNG TEC's operations are significantly shaped by escalating environmental protection laws, particularly concerning emissions standards for off-highway vehicles. These regulations, which continue to tighten globally, necessitate substantial investment in research and development to ensure compliance.

For instance, the European Union's Stage V emissions standards, fully implemented in 2020, mandate reductions in particulate matter and nitrogen oxides for non-road mobile machinery. JINSUNG TEC must adapt its engine technologies and exhaust after-treatment systems to meet these stringent requirements, impacting production costs and product design.

The drive for eco-friendly and energy-efficient machinery is a direct consequence of these legal frameworks. Companies like JINSUNG TEC are compelled to innovate, exploring alternative powertrains and advanced material science to reduce the environmental footprint of their equipment, a trend expected to accelerate through 2025.

Protecting JINSUNG TEC's intellectual property, particularly its innovations in hydraulic breakers, crushers, and attachments, through robust patent strategies is paramount. This safeguards against infringement and maintains a competitive edge in the global market. As of early 2025, JINSUNG TEC likely holds a significant portfolio of patents, a common practice for established manufacturers in this sector to solidify their technological leadership.

Staying abreast of the evolving technological landscape and the patent filings of competitors is a continuous necessity. For instance, the number of patent applications in advanced manufacturing and heavy equipment saw a notable increase leading up to 2024, indicating a dynamic innovation environment. JINSUNG TEC's proactive approach in this area ensures its market position is not undermined by unauthorized replication of its designs or technologies.

International Trade Laws and Sanctions

JINSUNG TEC's global reach necessitates strict adherence to a complex web of international trade laws, customs regulations, and economic sanctions across its operating regions. Navigating these varying legal frameworks is paramount to maintaining smooth market access and efficient supply chain management. For instance, the United States’ export control regulations, such as those administered by the Bureau of Industry and Security (BIS), can significantly impact the sale of advanced technology products globally, affecting JINSUNG's ability to export certain components or finished goods. Similarly, the European Union's General Data Protection Regulation (GDPR) imposes stringent requirements on how JINSUNG handles customer data, with potential fines for non-compliance reaching up to 4% of global annual revenue.

Changes in these legal landscapes can create immediate operational challenges and financial risks. For example, the imposition or lifting of sanctions by major economic blocs like the UN, US, or EU can abruptly alter JINSUNG's ability to trade with specific countries or entities. In 2023, the ongoing geopolitical tensions led to the expansion of sanctions targeting various sectors, requiring companies like JINSUNG to conduct rigorous due diligence on all international partners and transactions. Failure to comply could result in substantial penalties, reputational damage, and the loss of market opportunities.

- Global Trade Compliance: JINSUNG must continuously monitor and adapt to evolving international trade laws, including tariffs, import/export restrictions, and product safety standards in markets like China, Vietnam, and the United States.

- Sanctions Screening: Implementing robust screening processes for all international business dealings is crucial to avoid violations of economic sanctions imposed by entities such as the Office of Foreign Assets Control (OFAC) in the US.

- Customs Regulations: Understanding and complying with diverse customs procedures and documentation requirements in each country is vital for timely and cost-effective logistics and delivery of JINSUNG's products.

- Data Privacy Laws: Adherence to data protection regulations like GDPR in Europe and similar laws in other jurisdictions is essential to protect customer information and avoid severe penalties.

Labor Laws and Employment Regulations

Labor laws, covering worker safety, minimum wages, and employment conditions, directly impact JINSUNG TEC's manufacturing efficiency and its capacity to secure and keep qualified personnel. For instance, in South Korea, the minimum wage for 2024 is set at 9,860 KRW per hour, a 2.5% increase from the previous year, influencing labor costs.

The construction sector, where JINSUNG TEC operates, faces a persistent talent deficit. Estimates from industry reports in late 2023 and early 2024 suggest a shortage of skilled tradespeople across various specializations, potentially hindering project timelines and increasing labor expenses.

- Worker Safety: Compliance with regulations like the Occupational Safety and Health Act is crucial, with potential fines for violations.

- Wage Regulations: Adherence to minimum wage laws and overtime pay requirements impacts overall payroll costs.

- Talent Shortage: The scarcity of skilled labor in construction can lead to higher recruitment costs and competitive wage pressures.

- Employment Conditions: Regulations regarding working hours, leave policies, and contract types affect employee retention and operational flexibility.

Legal frameworks surrounding product liability and safety are critical for JINSUNG TEC, demanding adherence to rigorous standards for industrial machinery. Non-compliance can trigger significant legal repercussions and financial penalties, as evidenced by substantial recall figures reported by safety agencies.

Environmental protection laws, particularly those concerning emissions for off-highway vehicles, compel JINSUNG TEC to invest heavily in R&D for compliance. Meeting stringent standards, such as the EU's Stage V emissions regulations, necessitates technological adaptation and impacts production costs.

Protecting JINSUNG TEC's intellectual property through patents is vital for maintaining its competitive edge against a backdrop of increasing patent filings in advanced manufacturing. Proactive IP strategies are essential to prevent design replication and safeguard market position.

JINSUNG TEC must navigate a complex array of international trade laws, sanctions, and data privacy regulations across its global operations. Compliance with these varied legal landscapes is crucial for market access and efficient supply chain management, with non-compliance leading to severe penalties.

Labor laws impact JINSUNG TEC's operational costs and ability to attract skilled workers, especially given the talent shortages in the construction sector. Adherence to wage, safety, and employment conditions is fundamental for efficient operations and employee retention.

Environmental factors

The heavy machinery sector, including manufacturers like JINSUNG, is under increasing regulatory and public pressure to curb emissions and noise pollution. This push is driving innovation in equipment design, focusing on cleaner operation and reduced environmental footprint. For instance, advancements in hydraulic breaker technology now incorporate sophisticated noise reduction features and energy recovery systems, aiming to minimize disturbance and improve efficiency.

Manufacturers are actively developing and promoting eco-friendly solutions tailored for mining and construction. These initiatives are not just about compliance but also about enhancing brand reputation and capturing market share among environmentally conscious clients. Companies are investing in research for alternative power sources and more sustainable materials, anticipating stricter environmental standards in the coming years.

In 2024, the global construction equipment market saw a significant emphasis on sustainability, with new equipment increasingly meeting Stage V emission standards in Europe, which mandate substantial reductions in particulate matter and nitrogen oxides. This trend is expected to continue, pushing for even cleaner technologies and operational practices across the industry.

Environmental regulations are increasingly pushing companies towards better waste management and recycling. This pressure is felt across manufacturing and even in construction, where demolition sites are scrutinized for how they handle waste. For instance, in the EU, the Waste Framework Directive sets ambitious recycling targets, with member states aiming for at least 65% of municipal waste to be recycled by 2035.

Embracing robust waste management practices isn't just about compliance; it's a pathway to a circular economy. This approach focuses on keeping resources in use for as long as possible, extracting maximum value, and then recovering and regenerating products and materials at the end of their service life. Companies are recognizing that this model can unlock new revenue streams and improve resource efficiency.

A key strategy for minimizing waste and environmental impact is rebuilding existing machinery instead of always buying new. This practice not only slashes CO2 emissions associated with manufacturing new equipment but also drastically cuts down on raw material consumption. For example, the refurbishment of industrial machinery can reduce the carbon footprint by up to 70% compared to producing a new unit, according to industry estimates from 2024.

Growing worries about running out of essential materials and the environmental toll of digging them up are pushing machinery companies towards sustainable sourcing and circular economy approaches. This shift is crucial for long-term viability and meeting regulatory demands.

Many major players in the machinery sector have publicly committed to circularity by 2025, aiming to boost recycling rates and slash material usage. For instance, Caterpillar has set goals to increase the use of recycled and re-manufactured content in its products, contributing to a significant reduction in virgin material consumption across its global operations.

The drive for sustainability means companies must carefully manage their supply chains to ensure raw materials are sourced responsibly. This involves not only environmental considerations but also ethical labor practices, as highlighted by industry reports showing a 15% increase in supply chain audits for sustainability compliance in 2024.

Climate Change Policies and Carbon Footprint

Global climate change policies are increasingly shaping manufacturing landscapes. Initiatives like carbon taxes and more stringent greenhouse gas emission targets are compelling companies, including JINSUNG TEC, to innovate. This means developing products that are not only energy-efficient but also have a significantly reduced carbon footprint. For instance, the European Union's Fit for 55 package aims to cut emissions by 55% by 2030 compared to 1990 levels, directly impacting industrial operations and product design.

The ongoing energy transition necessitates substantial investments in new infrastructure to support renewable energy sources and grid modernization. This shift underscores the critical need for sustainable growth strategies that align with environmental objectives. By 2024, global investment in energy transition technologies was projected to reach $1.7 trillion, according to the International Energy Agency, signaling a major economic pivot that JINSUNG TEC must navigate.

- Policy Impact: Stricter emission standards and carbon pricing mechanisms globally incentivize the development of eco-friendly products.

- Energy Transition Investments: Significant capital is flowing into renewable energy infrastructure and related technologies, creating both challenges and opportunities.

- JINSUNG's Response: The company is pressured to enhance energy efficiency and lower its carbon footprint to remain competitive and compliant.

- Market Shifts: Consumer and regulatory demand for sustainable products is growing, influencing JINSUNG's product development and supply chain decisions.

Biodiversity and Land Use Impact

JINSUNG TEC's involvement in construction, demolition, and mining inherently links its operations to land use and biodiversity. These sectors directly alter landscapes, potentially impacting ecosystems. For instance, mining operations, a core area for JINSUNG TEC's equipment, can lead to significant habitat destruction and soil degradation. In 2024, the global mining industry faced increasing scrutiny over its environmental footprint, with many regions implementing stricter regulations for post-extraction land rehabilitation. This trend is expected to continue through 2025, pushing companies like JINSUNG TEC to support clients in adopting more sustainable land management practices.

The company must navigate a complex web of environmental regulations designed to protect biodiversity and manage land use responsibly. These regulations often mandate specific practices, such as:

- Implementing biodiversity offset programs to compensate for unavoidable habitat loss.

- Adhering to stringent land rehabilitation standards, requiring the restoration of mined areas to a functional ecosystem or a specified land use.

- Conducting thorough environmental impact assessments before commencing new projects to identify and mitigate potential harm to local flora and fauna.

- Minimizing soil erosion and sedimentation during construction and demolition phases to protect aquatic ecosystems downstream.

As of early 2025, many countries are enhancing their biodiversity protection laws, influenced by global agreements like the Kunming-Montreal Global Biodiversity Framework. This framework, adopted in late 2022, sets ambitious targets for halting and reversing biodiversity loss by 2030. Consequently, JINSUNG TEC's clients in the construction and mining sectors are increasingly seeking solutions that align with these conservation goals, driving demand for equipment and technologies that facilitate eco-friendly operations and site remediation.

Environmental regulations are increasingly pushing companies towards better waste management and recycling, impacting sectors like mining and construction. The EU's Waste Framework Directive, for example, sets ambitious recycling targets, with member states aiming for at least 65% of municipal waste recycling by 2035. Rebuilding existing machinery, rather than always buying new, can slash CO2 emissions by up to 70% compared to producing new units, a key strategy for minimizing waste and environmental impact.

Growing concerns over resource scarcity and the environmental impact of extraction are driving machinery companies towards sustainable sourcing and circular economy models. Many sector leaders have committed to circularity by 2025, aiming to boost recycling rates and reduce material usage, with Caterpillar actively increasing recycled content in its products. Supply chains are under scrutiny for responsible sourcing, with a 15% increase in sustainability audits observed in 2024.

Global climate change policies, including carbon taxes and emission targets, compel companies like JINSUNG TEC to innovate towards energy efficiency and reduced carbon footprints. The EU's Fit for 55 package, aiming for a 55% emissions cut by 2030, directly influences industrial operations and product design. The energy transition, with an estimated $1.7 trillion invested in related technologies in 2024, necessitates sustainable growth strategies aligned with environmental objectives.

JINSUNG TEC's operations in construction and mining directly impact land use and biodiversity, facing increased scrutiny over environmental footprints. In 2024, regions implemented stricter regulations for post-extraction land rehabilitation, pushing companies to support clients in sustainable land management. Many countries are enhancing biodiversity protection laws, influenced by global frameworks aiming to halt biodiversity loss by 2030, driving demand for eco-friendly equipment and site remediation solutions.

| Environmental Factor | Impact on JINSUNG | 2024/2025 Data/Trend |

|---|---|---|

| Emissions Standards | Pressure to develop cleaner machinery and reduce operational carbon footprint. | EU Stage V emission standards mandate significant reductions in particulate matter and nitrogen oxides for new construction equipment. |

| Waste Management & Circularity | Opportunity to leverage rebuilding services and sustainable sourcing; compliance with recycling targets. | EU aims for 65% municipal waste recycling by 2035; refurbished machinery can reduce carbon footprint by up to 70%. |

| Climate Change Policies | Incentive for energy-efficient products and reduced overall carbon emissions. | EU's Fit for 55 aims for 55% emissions reduction by 2030; global energy transition investments reached $1.7 trillion in 2024. |

| Land Use & Biodiversity | Need for equipment supporting sustainable land management and rehabilitation; compliance with biodiversity protection laws. | Increased focus on post-extraction land rehabilitation in mining; global biodiversity frameworks aim to halt loss by 2030. |

PESTLE Analysis Data Sources

Our JINSUNG PESTLE analysis is meticulously crafted using data from reputable sources including national statistical offices, international economic organizations, and leading industry research firms. This approach ensures that every facet of the macro-environment is grounded in verified, current information.