Itho Daalderop PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itho Daalderop Bundle

Gain a critical advantage by understanding the external forces shaping Itho Daalderop's future with our comprehensive PESTLE analysis. Explore how political shifts, economic fluctuations, and technological advancements are impacting their operations and market position. This in-depth report provides actionable intelligence to inform your own strategic decisions and competitive positioning. Download the full version now to unlock crucial insights and stay ahead of the curve.

Political factors

European Union and Dutch governments are pushing for better building energy efficiency. The updated Energy Performance of Buildings Directive (EPBD), effective May 2024, sets stricter rules for new and old buildings. This includes encouraging heat pumps and smart home systems.

These directives are designed to speed up the move away from fossil fuels. For companies like Itho Daalderop, which focuses on energy-saving solutions, this regulatory trend is a significant advantage. It creates a strong market demand for their products and expertise.

Governments worldwide are actively promoting sustainable technologies through various financial mechanisms. In the Netherlands, the Investment Subsidy for Sustainable Energy and Energy Savings (ISDE) scheme is a prime example, directly impacting the market for heat pumps and ventilation systems like those offered by Itho Daalderop. These subsidies significantly influence consumer and developer decisions by lowering the upfront cost of these eco-friendly solutions.

The ISDE scheme is set to evolve in 2025, with notable adjustments to its structure. While the base subsidy amounts may see changes, the subsidy per kilowatt (kW) for larger heat pump systems is expected to increase. This targeted increase could encourage the adoption of higher-capacity units, potentially shifting Itho Daalderop's product development and marketing focus towards these larger, more powerful systems to align with government incentives.

The European Union is actively pushing for the phase-out of fossil fuel heating systems. This policy shift includes the cessation of subsidies for these systems starting January 2025, with a complete ban anticipated by 2040.

This regulatory environment mandates a transition to electric and renewable heating solutions, such as heat pumps. These technologies represent a significant and growing market, directly aligning with Itho Daalderop's core business operations.

The European Commission's Energy Performance of Buildings Directive (EPBD) is a key driver, aiming for nearly zero-energy buildings by 2030 for new constructions and 2050 for existing ones. This directive will accelerate the adoption of efficient heating systems, including those offered by Itho Daalderop.

National Building Renovation Plans

European Union member states are mandated to create national building renovation plans, a key element in achieving decarbonization goals. These plans often specify a percentage of the least energy-efficient buildings that must be renovated by certain dates, driving significant activity in the construction and retrofitting sectors. For instance, the EU's Renovation Wave strategy aims to at least double the annual renovation rate by 2030, focusing on energy performance improvements.

These national strategies, while aligned with EU objectives, are customized to each country's specific building stock and economic conditions. This tailored approach means that the demand for energy-efficient building solutions, like those offered by Itho Daalderop, will be shaped by diverse national implementation frameworks and timelines. The focus on deep renovations will particularly boost the market for integrated systems.

- EU Renovation Wave Target: Aiming to at least double the annual renovation rate by 2030.

- Focus on Worst-Performing Buildings: National plans often prioritize buildings with the lowest energy efficiency ratings.

- Market Driver: Decarbonization targets create a sustained demand for energy-efficient HVAC and ventilation systems.

- National Tailoring: Specific renovation percentages and deadlines vary by EU member state, creating diverse market opportunities.

Impact of Geopolitical Stability and Trade Policies

Global geopolitical shifts and evolving trade policies significantly impact supply chains and the cost of essential raw materials for HVAC manufacturers like Itho Daalderop, potentially affecting production expenses and investor sentiment. For instance, the ongoing volatility in global shipping, exacerbated by geopolitical tensions in key transit regions, has led to increased freight costs for components. In 2024, many European nations, including the Netherlands, are navigating complex trade relations, with concerns about potential tariffs on manufactured goods and materials impacting import costs.

While Itho Daalderop's specific exposure isn't itemized, the broader Dutch construction sector, a key market for HVAC solutions, is already contending with rising material prices and the specter of trade disputes. The European Union's trade balance in manufactured goods saw a surplus of €17.5 billion in Q1 2024, but uncertainties remain regarding future trade agreements and their impact on import costs for critical components used in HVAC production.

Key considerations for Itho Daalderop concerning political factors include:

- Supply Chain Resilience: Adapting to potential disruptions in the supply of metals and electronic components due to international trade disputes or conflicts.

- Regulatory Environment: Navigating evolving environmental regulations and energy efficiency standards across different European markets that influence product development and market access.

- Government Incentives: Leveraging national and EU-level subsidies or tax breaks aimed at promoting sustainable building practices and renewable energy integration, which directly benefit HVAC system sales.

- Trade Agreements: Monitoring the impact of new or revised trade agreements on the cost of imported materials and the competitiveness of exported products.

Government policies are a significant tailwind for Itho Daalderop, with the EU's push for energy efficiency and decarbonization creating a robust market for their sustainable solutions. The Netherlands' Investment Subsidy for Sustainable Energy and Energy Savings (ISDE) scheme, particularly its 2025 evolution with increased subsidies for larger heat pumps, directly fuels demand for Itho Daalderop's products.

The EU's ambitious targets, such as the Renovation Wave aiming to double renovation rates by 2030, and the mandated national renovation plans, will accelerate the adoption of energy-efficient heating and ventilation systems. This regulatory push, coupled with the phase-out of fossil fuel heating systems by 2040, solidifies the market for heat pumps and smart home technologies.

Geopolitical factors and trade policies present challenges, impacting supply chains and material costs for HVAC manufacturers. Itho Daalderop must remain agile in navigating these global dynamics, particularly concerning the cost of imported components and potential trade disputes affecting the European construction sector.

Key political considerations for Itho Daalderop include adapting to evolving environmental regulations, leveraging government incentives for sustainable building, and monitoring trade agreements' impact on material costs and export competitiveness.

What is included in the product

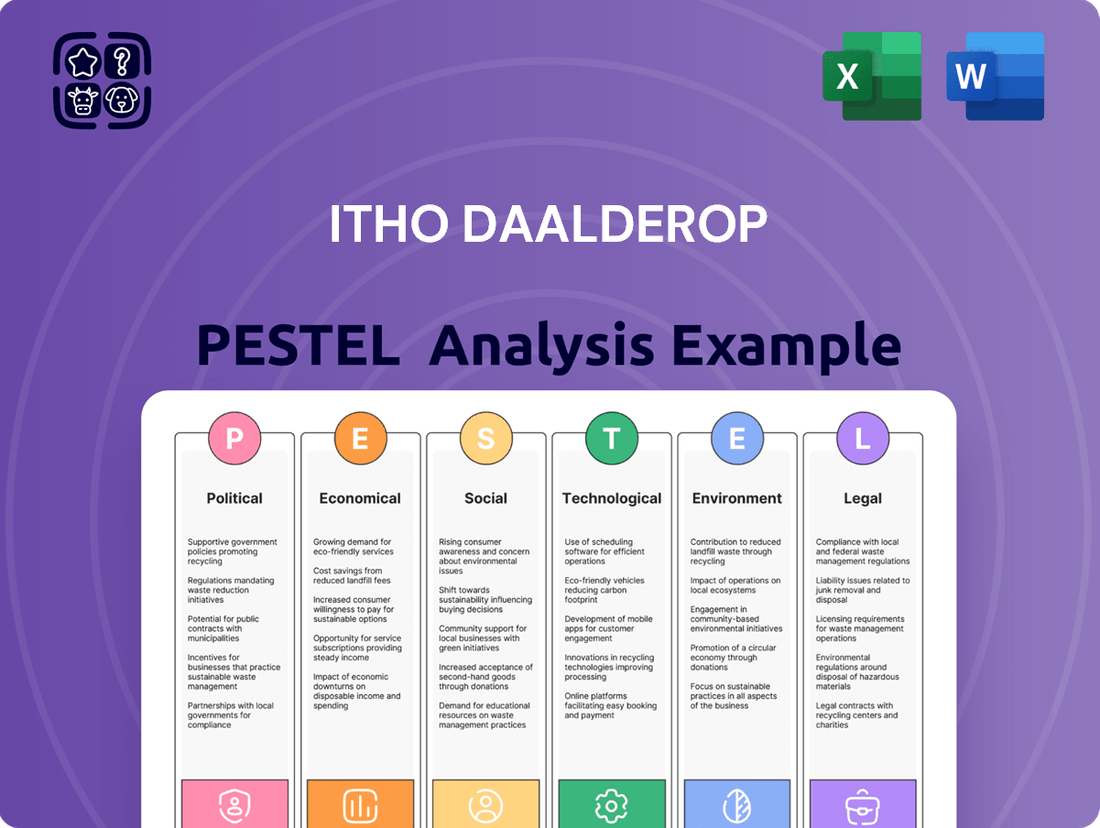

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Itho Daalderop across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering strategic insights for navigating the business landscape.

The Itho Daalderop PESTLE analysis offers a streamlined, visually segmented overview of external factors, relieving the pain of sifting through extensive data for quick strategic insights.

Economic factors

The construction market's vitality is a key driver for Itho Daalderop. While the Dutch construction sector experienced a slowdown in 2024, with a projected 1.5% contraction according to ING Economic Research, forecasts for 2025 indicate a rebound. This recovery is expected to be fueled by government infrastructure spending and a strong emphasis on energy-efficient building and renovations, directly influencing demand for Itho Daalderop's ventilation and climate control solutions.

Consumer purchasing power, directly impacted by inflation and disposable income levels, significantly shapes the market for advanced heating and ventilation systems. In 2024, persistent inflation may temper consumer spending on non-essential upgrades, but rising energy prices are a strong counter-incentive. For instance, if electricity prices continue their upward trend into 2025, the long-term savings offered by energy-efficient heat pumps will become increasingly attractive, driving demand despite initial investment.

Fluctuations in the cost of key raw materials like copper, aluminum, and specialized electronic components directly influence Itho Daalderop's production expenses and, consequently, their pricing strategies for heat pumps and ventilation units. The HVAC sector is particularly susceptible to the volatile nature of metal markets, creating a consistent challenge for manufacturers aiming for stable pricing.

For instance, the price of copper, a critical material in heat exchangers, saw significant swings in 2024, with LME prices experiencing periods of rapid ascent and subsequent corrections, directly impacting the cost of goods sold for companies like Itho Daalderop.

Supply chain disruptions, amplified by geopolitical events and logistical bottlenecks, further exacerbate the volatility in raw material availability and pricing, forcing manufacturers to adapt quickly to unexpected cost increases or shortages.

Interest Rates and Investment Environment

Interest rates significantly shape the investment landscape for companies like Itho Daalderop. Changes in borrowing costs directly impact consumers looking to finance home improvements and developers undertaking new construction projects, both key customer segments.

A more accommodating interest rate environment, such as the slight easing observed in many markets through late 2024 and into 2025, can stimulate housing demand. This is because lower rates make mortgages more affordable, encouraging more people to buy homes, which in turn drives demand for HVAC and building solutions.

For instance, if central banks maintain or slightly reduce benchmark rates in 2025, this could lead to a noticeable uptick in mortgage applications. For example, a 0.25% reduction in a key policy rate could translate to savings of tens of thousands of dollars over the life of a mortgage, making home purchases more accessible.

This increased activity in the housing sector directly benefits Itho Daalderop, as new builds and renovations often incorporate their ventilation and climate control systems. The company's reliance on these key markets means that interest rate policy remains a critical external factor.

- Cost of Capital: Lower interest rates reduce the cost of borrowing for Itho Daalderop's own expansion or investment projects.

- Consumer Spending: Attractive mortgage rates can boost disposable income for homeowners, potentially increasing spending on home upgrades.

- Construction Activity: Developers rely on financing; lower rates make new building projects more financially viable, increasing demand for Itho Daalderop's products.

- Market Sensitivity: The building products sector is particularly sensitive to interest rate fluctuations, impacting sales volumes.

Competitive Landscape and Pricing Strategies

The European heating, ventilation, and air conditioning (HVAC) market is a crowded space with numerous companies vying for market share. This intense competition means Itho Daalderop must carefully balance its pricing strategies to remain attractive to consumers while still funding vital research and development for innovative products. Maintaining a competitive edge requires smart cost management and efficient operations.

The recent trend of decreasing heat pump prices, driven by technological advancements and increased production volumes, has directly impacted government subsidy programs. For instance, some European countries have adjusted their financial incentives for heat pump installations in 2024 and projections for 2025, reflecting the evolving cost-effectiveness of these systems. This dynamic pricing environment necessitates continuous monitoring and adaptation of Itho Daalderop's own pricing models.

- Market Competition: The European HVAC sector features a high number of domestic and international players, intensifying price pressures.

- Innovation Investment: Itho Daalderop's success hinges on its capacity to innovate and offer superior technology without compromising price competitiveness.

- Subsidy Adjustments: Declining heat pump costs in 2024 and anticipated trends for 2025 are leading to revisions in national and regional subsidy schemes across Europe, altering the total cost of ownership for consumers.

- Pricing Dynamics: The market is characterized by a fluid pricing landscape, requiring agile strategies to respond to competitor actions and changing consumer price sensitivities.

The Dutch construction market, predicted to contract by 1.5% in 2024, is expected to rebound in 2025, driven by infrastructure investments and a focus on energy efficiency. This recovery is crucial for Itho Daalderop as demand for their climate control solutions is directly tied to construction activity and renovation trends.

Preview Before You Purchase

Itho Daalderop PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Itho Daalderop. It provides actionable insights for strategic planning and market understanding. You'll gain a clear picture of the external forces shaping Itho Daalderop's business landscape.

Sociological factors

Consumers are increasingly prioritizing eco-friendly products, with a significant portion willing to pay more for sustainable options. For instance, a 2024 survey indicated that over 60% of homeowners consider energy efficiency a key factor when choosing new building materials. This trend directly benefits Itho Daalderop, as their portfolio heavily features energy-efficient heat pumps and solutions designed for sustainable construction, aligning perfectly with these evolving consumer values.

Societal shifts, particularly amplified by the global pandemic, have significantly elevated the importance of indoor air quality and overall climate comfort. This growing awareness directly fuels demand for sophisticated ventilation systems and comprehensive climate control solutions.

Itho Daalderop is well-positioned to meet this demand with its range of products designed to enhance and optimize indoor living and working environments. For instance, the company's commitment to energy-efficient ventilation, such as their flagship CVE-S units, directly addresses consumer desire for healthier and more comfortable indoor spaces while also managing energy costs.

The market for healthy building solutions is expanding rapidly; a 2023 report indicated the global market for indoor air quality monitoring systems alone was valued at approximately $4.5 billion and is projected to grow significantly. This trend underscores the strong societal push for improved indoor environments, a core focus for Itho Daalderop's offerings.

The European Union faces a substantial challenge with its aging housing stock, with a significant percentage of buildings constructed before modern energy efficiency standards. This demographic shift towards older homes, coupled with increasing demand for better living conditions, directly translates into a vast market for renovation and retrofitting. For Itho Daalderop, this aging infrastructure represents a prime opportunity to offer their advanced ventilation and heating solutions, designed to enhance energy performance and occupant comfort in existing residential properties.

Recent reports indicate that over 75% of buildings in the EU are considered energy inefficient, and a considerable portion of these are residential. This reality underscores the immense need for upgrades. Itho Daalderop's expertise in providing integrated systems for ventilation, heating, and hot water can address these critical deficiencies, making older homes more sustainable and cost-effective to operate, a key driver for homeowners and property developers alike in the 2024-2025 period.

Shift Towards Smart Home Technologies

Consumer preferences are increasingly leaning towards smart home integration, with a growing desire for seamless control over heating, ventilation, and hot water systems via remote and intelligent platforms. This shift is driven by a demand for convenience, energy efficiency, and enhanced comfort. For instance, a significant portion of homeowners are actively seeking or already utilizing smart thermostats, with projections indicating continued strong growth in this sector through 2025. Itho Daalderop's product portfolio, featuring integrated smart home capabilities, is strategically aligned to capitalize on this evolving market trend, offering solutions that cater directly to these consumer desires.

The market for smart home devices is experiencing robust expansion. By the end of 2024, it's estimated that over 30% of households in North America will have at least one smart home device, with this figure expected to rise further by 2025. This widespread adoption highlights a fundamental change in how consumers interact with their living spaces. Itho Daalderop's focus on developing and promoting its smart-enabled solutions positions the company favorably to meet this escalating demand.

- Growing Consumer Demand: Over 60% of new home buyers in 2024 expressed interest in smart home features, including automated climate control.

- Energy Efficiency Focus: Smart home technology adoption is strongly linked to a desire to reduce energy consumption and utility bills, a key selling point for Itho Daalderop's intelligent systems.

- Remote Access and Control: The ability to manage home systems from anywhere is a primary driver, with smartphone-controlled HVAC systems seeing a 25% year-over-year increase in installations.

- Integration Capabilities: Consumers expect new devices to work seamlessly with existing smart home ecosystems, a capability Itho Daalderop is actively building into its product lines.

Energy Poverty and Affordability Concerns

Despite the strong drive towards renewable energy and energy efficiency, a significant portion of European households grapple with energy poverty. This means that while Itho Daalderop's innovative solutions are crucial for sustainability, their affordability remains a key consideration for consumers. For instance, in 2024, estimates suggest that around 15% of EU households were struggling to pay their energy bills, highlighting the need for cost-effective technologies that also offer long-term savings.

This societal challenge directly impacts product development and market penetration. Itho Daalderop must balance cutting-edge efficiency with accessible price points to appeal to a broader customer base. The focus might shift towards demonstrating clear return on investment through reduced energy consumption, making the initial outlay more justifiable. Furthermore, government support schemes and subsidies for energy-efficient upgrades, which are often targeted at lower-income households, could play a vital role in Itho Daalderop's market strategy.

- Energy Poverty Impact: Approximately 15% of EU households faced energy bill affordability issues in 2024, influencing demand for cost-effective solutions.

- Product Development Focus: Prioritizing affordability and long-term cost savings in new product designs is essential.

- Market Strategy: Leveraging government incentives and subsidies for energy-efficient upgrades can broaden market reach.

- Consumer Behavior: Highlighting the lifecycle cost benefits of efficient systems will be key to overcoming initial price barriers.

Growing awareness of health and well-being, particularly concerning indoor air quality, is a significant sociological driver for Itho Daalderop. Consumers are increasingly seeking solutions that promote healthier living environments. This trend is supported by data showing a rising concern for air purity, with many willing to invest in technologies that improve it.

The demand for comfort and convenience, amplified by smart home technology adoption, also plays a crucial role. Consumers expect seamless integration and remote control of their home climate systems. This aligns with Itho Daalderop's offering of intelligent, user-friendly solutions designed to enhance daily living.

Societal attitudes towards sustainability and energy efficiency continue to evolve, with a strong preference for eco-friendly products. This preference translates into a market eager for energy-saving technologies like heat pumps and efficient ventilation systems, areas where Itho Daalderop excels.

The aging European housing stock presents a substantial market opportunity for renovation and retrofitting. As many older homes lack modern energy efficiency standards, there's a clear need for solutions that improve comfort and reduce energy consumption, directly benefiting Itho Daalderop's product range.

Technological factors

Continuous innovation in heat pump technology is a significant technological factor influencing Itho Daalderop. Improvements in efficiency, quieter operation, and the adoption of natural refrigerants are driving market acceptance and meeting stricter environmental regulations. For instance, the development of models like the Itho Daalderop Amber, which utilizes the natural refrigerant R290, demonstrates a commitment to staying ahead of these evolving requirements.

Technological advancements in ventilation are rapidly moving towards smart, demand-controlled systems. These systems leverage sensors to dynamically adjust airflow based on real-time factors like occupancy levels, ambient temperature, and crucial air quality indicators. This intelligent approach ensures optimal ventilation precisely when and where it's needed, avoiding unnecessary energy expenditure.

Itho Daalderop's strategic emphasis on developing integrated and smart ventilation solutions aligns perfectly with this technological evolution. By focusing on these forward-thinking products, the company is well-positioned to benefit from the increasing market demand for systems that enhance both energy efficiency and overall indoor comfort for occupants.

The increasing integration of Internet of Things (IoT) and Artificial Intelligence (AI) into HVAC systems is revolutionizing building management. These technologies enable real-time performance monitoring, proactive fault detection through predictive maintenance, and significant improvements in energy efficiency by optimizing system operations based on occupancy and environmental data.

Itho Daalderop's strategic focus on developing smart, network-aware solutions for building control directly aligns with these advancements. Their commitment to smart home and building technology positions them to capitalize on the growing demand for connected and intelligent HVAC solutions.

For instance, the global smart HVAC market was valued at approximately $17.6 billion in 2023 and is projected to reach over $45 billion by 2030, demonstrating a substantial growth trajectory driven by IoT and AI adoption. This trend underscores the market opportunity for Itho Daalderop's forward-thinking approach.

Renewable Energy Integration and Grid Awareness

The increasing focus on renewable energy integration is a significant technological factor for HVAC systems. Technologies that allow HVAC systems to intelligently interact with sources like solar photovoltaic (PV) installations and the broader electricity grid are crucial for managing energy demand and preventing grid congestion. Itho Daalderop is actively developing innovative solutions in this area, such as their Green Energy Smartboiler, designed to maximize the self-consumption of electricity generated by PV systems. This trend is supported by growing renewable energy adoption; for instance, in 2024, solar PV capacity additions globally were projected to reach over 440 GW, highlighting the demand for smart grid integration solutions.

These advancements are not just about efficiency; they are about creating a more resilient and sustainable energy infrastructure. By enabling HVAC systems to communicate with the grid, buildings can better manage their energy usage during peak demand periods, potentially reducing strain on the electricity network. This smart interaction can also lead to cost savings for consumers by optimizing energy consumption based on real-time electricity prices and renewable energy availability. The development of such technologies aligns with global efforts to decarbonize the building sector, a key component of achieving net-zero emissions targets by 2050.

- Smart Grid Interoperability: Technologies enabling HVAC systems to communicate with and respond to grid signals are becoming essential.

- PV Self-Consumption: Solutions like Itho Daalderop's Green Energy Smartboiler facilitate the use of on-site solar energy for heating and cooling.

- Demand Response: HVAC systems integrated with smart grids can participate in demand response programs, adjusting operation to stabilize the grid.

- Energy Efficiency Gains: Intelligent integration leads to optimized energy use, reducing waste and operational costs for buildings.

Modular and Scalable System Architectures

The drive for modular and scalable system architectures in HVAC, like those from Itho Daalderop, is reshaping the industry. This modularity simplifies installation and maintenance, making it easier to adapt systems to diverse building sizes and needs. For example, the increasing adoption of Building Information Modeling (BIM) in construction projects, which was projected to reach 70% adoption by 2025 in the UK, directly supports the integration of these modular systems.

This flexibility translates into tangible benefits, including reduced installation times and potentially lower overall project costs. As the construction sector continues to embrace prefabrication and offsite manufacturing, the demand for easily integrated, modular HVAC components is expected to grow. This trend aligns with the market growth for smart buildings, with the global smart building market size estimated to reach over $100 billion by 2025.

- Modular design allows for quicker on-site assembly and adaptation.

- Scalability ensures systems can grow or shrink with building needs, optimizing efficiency.

- Reduced labor costs are a direct benefit of simplified installation processes.

- Enhanced future-proofing through easier upgrades and component replacements.

Advancements in heat pump technology, focusing on efficiency and natural refrigerants like R290 in models such as the Itho Daalderop Amber, are key. Smart, demand-controlled ventilation systems that use sensors for real-time adjustments based on occupancy and air quality are also crucial.

The integration of IoT and AI into HVAC systems allows for real-time monitoring, predictive maintenance, and optimized energy use, with the global smart HVAC market projected to exceed $45 billion by 2030.

Furthermore, technologies enabling HVAC systems to intelligently interact with renewable energy sources, like Itho Daalderop's Green Energy Smartboiler for PV self-consumption, are vital. This trend is supported by the projected 440 GW of global solar PV capacity additions in 2024.

Modular and scalable HVAC system designs are also gaining traction, simplifying installation and maintenance, and aligning with the projected 70% adoption of Building Information Modeling (BIM) in construction by 2025.

| Technological Factor | Impact on Itho Daalderop | Relevant Data/Trend |

| Heat Pump Innovation | Improved efficiency, quieter operation, natural refrigerants | Models like Itho Daalderop Amber using R290 |

| Smart Ventilation | Demand-controlled, sensor-based airflow adjustments | Optimized energy use and indoor comfort |

| IoT & AI Integration | Real-time monitoring, predictive maintenance, energy optimization | Global smart HVAC market projected to reach over $45 billion by 2030 |

| Renewable Energy Integration | PV self-consumption, smart grid interaction | Itho Daalderop's Green Energy Smartboiler; 440 GW global solar PV additions projected for 2024 |

| Modular & Scalable Design | Simplified installation, adaptability to building needs | Alignment with BIM adoption (70% projected by 2025 in UK) |

Legal factors

The revised EU Energy Performance of Buildings Directive (EPBD), effective May 2024, sets ambitious targets for energy efficiency. New buildings must meet zero-emission standards by 2030, and existing structures will face minimum energy performance requirements, driving significant renovation activity across the bloc.

Itho Daalderop needs to ensure its product portfolio aligns with these increasingly stringent energy efficiency benchmarks. This includes developing solutions that not only meet but exceed these standards, enabling building owners to comply with the EPBD's mandates and achieve their sustainability goals.

The directive's focus on renovations means a substantial market opportunity for energy-efficient building technologies. For instance, the European Commission estimates that renovating 3% of the building stock annually could create 1.7 million jobs by 2030, highlighting the economic potential of compliance.

Itho Daalderop's ability to provide compliant and innovative heating, ventilation, and air conditioning (HVAC) systems will be crucial. Supporting building owners in navigating the EPBD requirements, including potential financial incentives for upgrades, will be a key aspect of their market strategy moving forward.

The F-Gas Regulation (EU) 2024/573, which came into effect in March 2024, is a significant development for companies like Itho Daalderop. It drastically speeds up the phasing out of refrigerants with high global warming potential (GWP). This means a quicker transition away from traditional F-gases, pushing for environmentally friendlier alternatives.

For Itho Daalderop, this regulation directly impacts their heat pump offerings. The company must prioritize the development of products that utilize natural refrigerants. This includes a greater focus on refrigerants like propane (R290), which has a GWP of around 3, and CO2 (R744), with a GWP of 1, compared to some older F-gases that could have GWPs in the thousands.

The European Commission's goal with this updated regulation is to reduce F-gas emissions by two-thirds by 2030 compared to 2014 levels. This ambitious target underscores the urgency for manufacturers to innovate and adapt their product lines. Itho Daalderop's investment in R&D for natural refrigerant systems becomes crucial for compliance and market competitiveness.

Itho Daalderop must navigate stringent national building codes in the Netherlands, particularly concerning ventilation efficiency and safety standards for HVAC systems. For instance, the Dutch Building Decree (Bouwbesluit) mandates specific performance levels for energy efficiency and indoor air quality, directly impacting product design and installation practices. Failure to comply can result in significant penalties and project delays.

The permitting process within the Dutch construction sector can be a considerable hurdle. Obtaining the necessary permits for new installations, especially those involving innovative technologies like advanced ventilation or heating solutions, often involves multiple stages and can be time-consuming. Reports from the Dutch construction sector in 2024 indicated that permit acquisition times can extend by several months, potentially impacting Itho Daalderop's project delivery schedules and increasing overall project costs.

Product Safety Standards and Certifications

Itho Daalderop must adhere to stringent product safety standards and secure essential certifications for its heating, ventilation, and hot water systems to operate legally in key markets. This compliance is crucial for market access and consumer trust. For instance, in 2024, the European Union continued to emphasize safety regulations for HVAC equipment, with ongoing updates to directives like the Ecodesign and Energy Labelling regulations, which indirectly impact product safety by setting performance and material standards.

A significant legal factor for Itho Daalderop involves ensuring that installers meet new refrigerant handling requirements. The phase-down of high-GWP (Global Warming Potential) refrigerants, driven by regulations like the EU F-Gas Regulation (which is undergoing revisions projected for impact in 2024-2025), necessitates specialized training and certification for technicians. Failure to comply can lead to substantial fines and operational disruptions. For example, as of early 2024, reports indicated an increasing focus on leak checks and technician certification across the EU to manage the transition to lower-GWP alternatives.

- Compliance with EU F-Gas Regulation: Ongoing revisions in 2024-2025 mandate strict handling of refrigerants, impacting installer training and certification.

- Product Safety Certifications: Itho Daalderop requires certifications like CE marking for its systems, demonstrating adherence to EU safety, health, and environmental protection standards.

- National Building Codes: Adherence to specific national building regulations in countries where Itho Daalderop operates is mandatory for installation and sale of HVAC systems.

- REACH Compliance: Ensuring all materials used in products comply with the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation is a continuous legal requirement.

Intellectual Property Rights and Patents

Protecting its innovations through patents and intellectual property (IP) rights is paramount for Itho Daalderop to sustain its competitive advantage in the advanced climate systems market. These legal protections are essential to safeguard the substantial investments made in research and development, ensuring that their technological breakthroughs are not easily replicated by competitors. For instance, the European Patent Office (EPO) reported a 3% increase in patent filings in 2023, highlighting the growing importance of IP protection across industries.

The legal landscape surrounding IP directly impacts Itho Daalderop's ability to monetize its innovations and maintain market share. Robust patent portfolios can deter infringement and provide leverage in licensing agreements. In 2024, companies across the HVAC sector are increasingly focusing on securing patents for energy-efficient technologies and smart building solutions, reflecting a global trend.

Key legal considerations for Itho Daalderop include:

- Patent Registration: Securing patents for novel heat pump technologies, ventilation systems, and smart control algorithms in key markets like the EU and North America.

- IP Enforcement: Actively monitoring the market for potential infringements and taking legal action to protect their patented technologies.

- Licensing Agreements: Negotiating favorable terms for any technology licensing to third parties, ensuring continued revenue streams and market access.

- Trade Secret Protection: Implementing strong internal policies to protect proprietary manufacturing processes and design information that may not be patentable.

Itho Daalderop must navigate evolving legal frameworks, including the EU's revised Energy Performance of Buildings Directive (EPBD) and the F-Gas Regulation. These regulations, with significant updates expected in 2024-2025, mandate higher energy efficiency standards and the phasing out of high-GWP refrigerants, influencing product development and market strategy.

Compliance with national building codes, such as the Dutch Bouwbesluit, is critical for ensuring product safety and performance, while navigating complex permitting processes can impact project timelines. The company also needs to secure essential product safety certifications and adhere to chemical regulations like REACH to maintain market access and consumer trust.

Protecting intellectual property through patents and trade secrets is vital for Itho Daalderop's competitive edge, especially as the company invests in innovative, energy-efficient technologies. The company must also ensure its installers are certified for handling new refrigerants, a growing requirement across the EU.

Environmental factors

The global imperative to address climate change is a significant driver for Itho Daalderop. Governments worldwide, including those in the EU, are implementing policies that favor low-carbon technologies and energy efficiency. This creates a favorable market environment for Itho Daalderop's core product offerings, which are designed to reduce energy consumption and greenhouse gas emissions.

Itho Daalderop's heat pumps and sustainable ventilation systems are directly aligned with ambitious decarbonization targets. For instance, the EU aims to achieve climate neutrality by 2050, with interim goals for emission reductions by 2030. In 2023, the EU's renewable energy directive set a binding target of at least 42.5% renewable energy in its gross final energy consumption by 2030, further supporting the market for electric heating solutions like heat pumps.

Growing concerns about resource scarcity are pushing industries towards circular economy principles, directly impacting product design with a focus on durability, recyclability, and efficient material use. Itho Daalderop's commitment to sustainability, therefore, likely translates into prioritizing these elements throughout their manufacturing processes and product lifecycles.

For instance, the European Union's Circular Economy Action Plan, updated in late 2023, emphasizes extending product lifespan and increasing recycled content. This regulatory push means companies like Itho Daalderop are increasingly evaluated on their ability to minimize waste and maximize resource efficiency in their HVAC and home automation solutions.

The building sector is a significant contributor to energy consumption and greenhouse gas emissions. Beyond specific regulations on fluorinated gases (F-gases), a global trend is pushing for a broader reduction of all greenhouse gas outputs from buildings. This environmental imperative directly influences the demand for energy-efficient solutions.

Itho Daalderop's product portfolio, particularly its focus on heat pumps and ventilation systems, plays a crucial role in addressing this. By enabling a transition away from fossil fuel-based heating systems, these products help lower the carbon footprint of buildings. For instance, in 2023, the European Union reported that buildings account for approximately 40% of the EU's energy consumption and 36% of its CO2 emissions, highlighting the sector's critical impact.

This push for emission reduction creates a favorable market environment for Itho Daalderop. As governments and consumers increasingly prioritize sustainability, the demand for low-emission heating and cooling solutions is expected to grow. The company's ability to offer products that align with these environmental goals positions it well for future market penetration and growth.

Air Quality Concerns and Ventilation Solutions

Growing public and governmental concern over both indoor and outdoor air pollution highlights the critical need for advanced ventilation solutions. As of 2024, reports from the World Health Organization indicate that over 90% of people globally breathe air that exceeds WHO guideline limits for pollutants, underscoring the urgency. Itho Daalderop's commitment to developing high-efficiency ventilation units directly addresses these environmental health challenges by ensuring cleaner indoor air environments.

These systems play a vital role in mitigating the health impacts associated with poor air quality, such as respiratory illnesses and allergies. For instance, studies in 2024 continue to show a correlation between improved indoor air quality and reduced instances of asthma exacerbations. Itho Daalderop's technology focuses on removing particulates, allergens, and volatile organic compounds (VOCs), thereby creating healthier living and working spaces.

- Health Impact: The WHO estimates that ambient air pollution causes millions of premature deaths annually, with indoor air quality contributing significantly to respiratory and cardiovascular diseases.

- Regulatory Push: Governments worldwide are implementing stricter building codes and air quality standards, driving demand for compliant ventilation systems.

- Technological Advancement: Itho Daalderop's product lines feature advanced filtration and energy recovery technologies, aiming to improve air quality while minimizing energy consumption, a key trend in the 2024-2025 market.

Noise Pollution Regulations

Noise pollution regulations are becoming increasingly stringent, particularly for outdoor HVAC equipment like heat pumps. These regulations are crucial for maintaining quality of life in residential areas, where noise disturbances can be a significant concern. Itho Daalderop's proactive approach to developing quieter heat pump models, such as the Amber series, demonstrates a commitment to addressing these environmental factors.

The Amber series heat pumps are engineered with noise reduction technology, aiming to minimize sound emissions. For instance, the Amber S model boasts sound pressure levels as low as 28 dB(A) at a 3-meter distance, a notable achievement in the industry. This focus on acoustic performance not only helps Itho Daalderop comply with evolving noise ordinances but also enhances customer satisfaction and marketability.

- Quieter Operation: Itho Daalderop's Amber heat pumps are designed with noise reduction as a key feature.

- Regulatory Compliance: Development of low-noise models directly addresses increasing noise pollution regulations.

- Community Impact: Reduced noise levels improve acceptance in residential neighborhoods.

- Market Advantage: Quieter units provide a competitive edge in markets with strict noise standards.

Environmental regulations are a significant driver for Itho Daalderop, pushing for greener technologies. The EU’s commitment to climate neutrality by 2050 and a binding target of at least 42.5% renewable energy by 2030 directly supports the market for their energy-efficient heat pumps and ventilation systems. These products align with the global push to reduce greenhouse gas emissions from buildings, which accounted for 36% of the EU's CO2 emissions in 2023.

Concerns about air quality are also paramount. With over 90% of the global population breathing air exceeding WHO guidelines as of 2024, Itho Daalderop's advanced ventilation solutions are vital for creating healthier indoor environments. Their focus on removing pollutants and allergens addresses the growing demand for improved air quality, which studies in 2024 continue to link to reduced respiratory illnesses.

Furthermore, noise pollution regulations are tightening, especially for outdoor HVAC units. Itho Daalderop's Amber series heat pumps, with models like the Amber S achieving sound pressure levels as low as 28 dB(A) at 3 meters, demonstrate a commitment to quiet operation. This not only ensures compliance with stricter ordinances but also provides a competitive advantage in noise-sensitive markets.

PESTLE Analysis Data Sources

Our PESTLE analysis for Itho Daalderop is grounded in data from official government publications, respected industry associations, and leading market research firms. We leverage reports on energy efficiency standards, building regulations, economic forecasts, and technological advancements in smart home technology to ensure a comprehensive view.