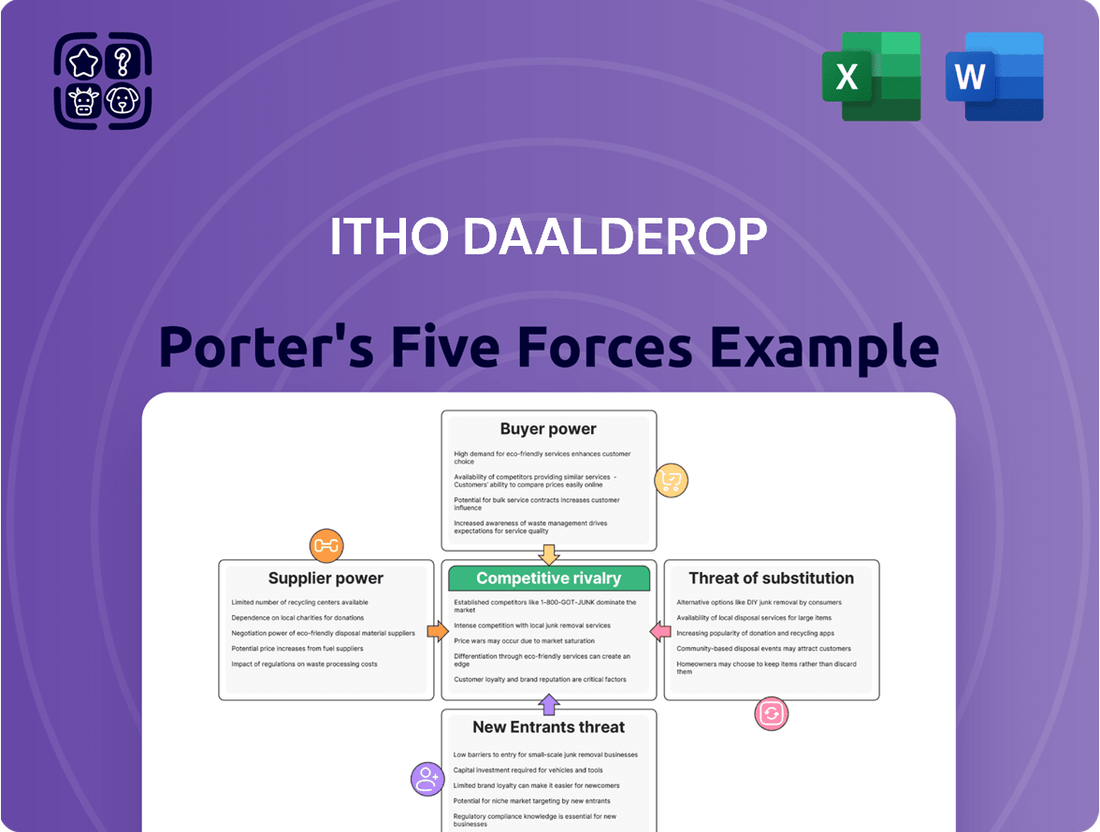

Itho Daalderop Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itho Daalderop Bundle

Itho Daalderop operates within a competitive landscape shaped by several key forces. Understanding the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for strategic planning. This brief overview highlights the critical dynamics at play.

The complete report reveals the real forces shaping Itho Daalderop’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Itho Daalderop's reliance on specialized components like compressors for its heat pumps and advanced control units positions its suppliers with considerable bargaining power. These critical parts often come from a concentrated pool of global manufacturers, giving them leverage. For instance, the European heat pump sector faces a notable dependence on these specialized components, with some nations actively developing domestic manufacturing capabilities for them, potentially impacting Itho Daalderop's procurement landscape.

The concentration of suppliers for critical, high-tech components like R290 refrigerants and advanced inverter technology significantly bolsters their bargaining power. When a limited number of manufacturers, such as Daikin and Mitsubishi Electric, dominate the supply of these essential elements within the broader HVAC market, they can dictate pricing and terms. This limited supplier base means Itho Daalderop must strategically manage these crucial relationships to secure consistent supply and competitive costs for its innovative heating and cooling solutions.

Switching suppliers for critical components presents significant hurdles for Itho Daalderop. The process often necessitates substantial investments in redesigning products, obtaining new certifications for safety and efficiency, and recalibrating manufacturing lines. These extensive switching costs effectively lock Itho Daalderop into existing supplier relationships, bolstering the bargaining power of those suppliers.

Consider the impact of evolving regulations, such as Europe's F-Gas Regulation, which mandates changes in refrigerant usage for HVAC systems. This regulation alone can force Itho Daalderop to incur costs associated with qualifying new refrigerant-compatible components and retooling production, further increasing supplier leverage.

Threat of Forward Integration by Suppliers

Suppliers possessing strong technological prowess and a substantial market footprint could threaten Itho Daalderop by moving into finished HVAC system manufacturing, thus becoming direct competitors. This possibility of forward integration grants these suppliers significant bargaining power, as Itho Daalderop would be hesitant to cultivate a future rival. For instance, major component manufacturers like Daikin and Mitsubishi Electric are also prominent players in the HVAC systems market, illustrating this dynamic.

The strategic advantage for suppliers lies in their ability to leverage their manufacturing capabilities and market knowledge to enter Itho Daalderop's core business. This threat necessitates careful relationship management and potentially strategic sourcing agreements to mitigate the risk.

- Supplier Capability: Suppliers with advanced R&D and production facilities are better positioned for forward integration.

- Market Dynamics: A concentrated supplier market increases the likelihood of dominant players integrating forward.

- Competitive Landscape: The presence of large, diversified component manufacturers in the HVAC sector heightens this threat.

Uniqueness of Inputs

The uniqueness of inputs significantly boosts supplier bargaining power. For Itho Daalderop, this is particularly true when suppliers provide patented energy-saving technologies or specialized materials vital for their sustainable building solutions. If Itho Daalderop’s product differentiation hinges on these distinct inputs, suppliers can leverage their unique offerings to demand higher prices and more advantageous contract terms.

Consider a scenario where a key component for Itho Daalderop's high-efficiency heat pumps is protected by a patent held by a single supplier. This supplier, facing no direct competition for that specific component, can dictate pricing and supply conditions. In 2024, the global market for smart building technologies, which often incorporates such specialized components, saw significant growth, underscoring the importance of these unique inputs.

- Supplier Control: Proprietary technologies or materials give suppliers considerable leverage over manufacturers like Itho Daalderop.

- Price Premiums: Uniqueness allows suppliers to charge higher prices, impacting Itho Daalderop's cost of goods sold.

- Dependency Risk: Reliance on a sole supplier for critical, unique components creates a vulnerability for Itho Daalderop's production continuity.

- Market Dynamics: The increasing demand for sustainable building solutions amplifies the value of unique, eco-friendly components, strengthening supplier positions.

The bargaining power of suppliers to Itho Daalderop is significant due to the specialized nature of components like advanced heat pump compressors and control units. A limited number of global manufacturers produce these critical parts, granting them considerable leverage in pricing and terms. For example, the European heat pump market's dependence on these specialized components highlights this supplier strength.

Suppliers of unique, patented technologies, such as those enabling energy-saving features in Itho Daalderop's sustainable building solutions, can command higher prices. This is especially true when Itho Daalderop's product differentiation relies heavily on these distinct inputs. The growing global market for smart building technologies in 2024 further emphasizes the value and supplier leverage associated with these unique components.

What is included in the product

This analysis unpacks the competitive landscape for Itho Daalderop, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the prevalence of substitute products.

Navigate competitive pressures effortlessly with pre-populated industry benchmarks, eliminating the need for extensive primary research.

Quickly identify and address potential threats to profitability by visualizing the impact of each Porter's Five Force on your business.

Customers Bargaining Power

Customers, ranging from individual homeowners to large commercial developers, demonstrate significant price sensitivity when evaluating heating, ventilation, and hot water systems. The substantial initial investment required for these essential building components often leads them to scrutinize costs closely. For instance, in 2024, the average cost for a residential heat pump installation in Europe could range from €7,000 to €15,000, making price a critical factor.

The decision-making process is further influenced by the availability of a wide array of competing products and brands, each vying for market share with different price points and feature sets. Moreover, the long-term operational expenses, particularly energy consumption costs, play a crucial role in the overall value assessment, pushing customers towards solutions promising greater efficiency and lower running bills.

This heightened customer price sensitivity directly impacts Itho Daalderop by necessitating competitive pricing strategies. The company must effectively communicate the long-term economic benefits of its energy-efficient systems, such as reduced utility bills, to justify its product offerings against lower upfront cost alternatives.

The volume of purchases plays a crucial role in a customer's bargaining power with a company like Itho Daalderop. Large-scale commercial projects, housing associations, and public sector tenders often involve substantial order volumes. This sheer size of purchase gives these customers significant leverage to negotiate more favorable pricing, customized product specifications, and extended service agreements. For instance, Itho Daalderop's involvement in making homes more sustainable through collaborations with housing corporations highlights their engagement with these significant volume buyers.

While individual residential buyers might represent smaller individual purchase volumes, their collective influence can still be considerable. This can manifest through consumer organizations that aggregate demand or by leveraging the power of online reviews and social media. Such collective action can put pressure on companies to offer competitive pricing and high-quality products, even for smaller, individual transactions.

Customers can consider various alternatives to Itho Daalderop's heat pumps and ventilation systems. These include conventional fossil fuel boilers, access to district heating networks, or even passive building designs that minimize the need for active climate control systems.

The readily available substitutes directly enhance customer bargaining power. If switching to an alternative is simple and cost-effective, customers are less tied to Itho Daalderop's offerings.

While EU regulations targeting the phase-out of fossil fuel boilers by 2025 will diminish the long-term threat from this specific substitute, other alternatives remain competitive.

Customer Information and Transparency

Customers today have unprecedented access to information, readily available online. This includes detailed product specifications, crucial energy efficiency ratings, and candid comparative reviews from other users. This readily available data significantly reduces information asymmetry, allowing customers to thoroughly research and compare options from different manufacturers and installers before making a purchase decision.

The increased transparency directly translates into heightened bargaining power for customers. Armed with knowledge about pricing, performance, and available alternatives, they are better positioned to negotiate terms and demand greater value. For Itho Daalderop, this means a clear and compelling communication of their unique value proposition, particularly highlighting the long-term benefits of their energy-efficient and comfort-enhancing solutions, is essential to resonate with this informed consumer base.

- Increased Online Information: Over 80% of consumers research products online before purchasing, according to a 2024 Statista report.

- Comparative Reviews: Platforms like Trustpilot and Google Reviews allow customers to easily compare Itho Daalderop’s offerings against competitors based on real-world performance and customer satisfaction.

- Focus on Value: With energy prices fluctuating, customers are increasingly scrutinizing the long-term cost savings and return on investment offered by energy-efficient systems.

- Demand for Transparency: Consumers expect clear data on product lifecycles, maintenance requirements, and environmental impact.

Low Switching Costs for Customers

Even though swapping out an existing HVAC unit can be a significant expense, the initial decision for new builds or major renovations often presents a different scenario. For these projects, switching between brands or types of heating, ventilation, and air conditioning systems typically involves relatively low costs. This ease of comparison empowers customers, allowing them to readily evaluate various options and secure the most favorable deal.

The Dutch HVAC market, for instance, is projected to see continued growth, reaching an estimated €7.5 billion by 2028, up from around €6 billion in 2023. This expansion means a wider selection of products and services will be available, further strengthening the customer's position.

- Low initial switching costs for new installations and renovations.

- Customers can easily compare a wide range of brands and system types.

- The growing Dutch HVAC market (projected €7.5 billion by 2028) offers more choices.

- This increased choice directly enhances customer bargaining power during the purchase decision.

The bargaining power of customers for Itho Daalderop is significantly influenced by their price sensitivity, the availability of substitutes, and the ease of switching. In 2024, European homeowners faced installation costs for heat pumps ranging from €7,000 to €15,000, making price a primary consideration. This sensitivity is amplified by the wide array of competing products and the long-term operational costs, such as energy consumption.

Large-scale buyers, like housing associations, wield considerable power due to high purchase volumes, enabling them to negotiate favorable pricing and customized specifications. Even individual buyers, through collective action and online reviews, can exert pressure for competitive pricing and quality, especially with over 80% of consumers researching online before buying in 2024.

The availability of alternatives, such as conventional boilers or district heating, alongside relatively low switching costs for new installations, further strengthens customer leverage. As the Dutch HVAC market is projected to reach €7.5 billion by 2028, this expanding choice directly enhances the customer's negotiating position.

What You See Is What You Get

Itho Daalderop Porter's Five Forces Analysis

This preview displays the comprehensive Itho Daalderop Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape. The document you see here is precisely the same professionally written and formatted analysis that you will receive immediately after purchase. It includes detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. You can be confident that this preview represents the exact, ready-to-use deliverable you will gain access to, with no hidden surprises or placeholders.

Rivalry Among Competitors

The European market for heating, ventilation, and air conditioning (HVAC) and sustainable building solutions is a crowded space. Itho Daalderop finds itself in direct competition with major global players such as Daikin, Bosch, Carrier, Mitsubishi Electric, Vaillant, and Viessmann, all of whom offer a wide array of products. This intense rivalry extends to regional specialists and smaller, agile companies that often focus on specific niches, creating a complex competitive landscape.

Itho Daalderop’s specific areas of operation, including heat pumps, ventilation systems, and water heaters, are particularly competitive. Companies like Daikin, for instance, reported a net sales revenue of ¥4,027.3 billion (approximately $26.5 billion USD based on average 2024 exchange rates) in fiscal year 2023, showcasing their significant market presence and resources. This means Itho Daalderop must constantly innovate and differentiate to capture market share against these substantial competitors.

The competitive intensity is further amplified by the projected growth within the HVAC market itself, particularly in regions like the Netherlands. Analysts anticipate continued expansion in the adoption of sustainable building technologies, which naturally attracts more players and intensifies existing rivalries. This growth dynamic means that while opportunities exist, the fight for customers will likely become even more vigorous in the coming years.

While the European heat pump and sustainable building market is poised for substantial growth, driven by regulations and sustainability goals, the pace can differ across segments and areas. A noticeable slowdown in heat pump sales occurred in several European nations during 2024, suggesting a market adjustment or a shift where heightened competition for current demand might overshadow expansion into new niches. Despite this, the long-term forecast remains robust, supported by consistent policy backing.

Competitive rivalry at Itho Daalderop is heavily influenced by product differentiation, with companies vying to offer superior energy efficiency, smart technology integration like IoT and AI-driven controls, enhanced indoor climate comfort, and sustainable features. Itho Daalderop itself focuses on advanced, energy-efficient solutions as a key differentiator.

Continuous innovation is paramount to staying ahead and avoiding a solely price-driven market. This is particularly true with upcoming regulations such as the Energy Performance of Buildings Directive (EPBD), which mandates zero-emission buildings and encourages greener technologies. For instance, in 2024, several market players launched new heat pump models boasting higher Seasonal Coefficient of Performance (SCOP) ratings, often exceeding 5.0, directly addressing the demand for greater energy efficiency.

High Fixed Costs and Exit Barriers

The manufacturing of sophisticated HVAC systems, such as heat pumps and ventilation units, demands considerable upfront capital for research and development, state-of-the-art production facilities, and extensive distribution channels. For instance, in 2024, the global HVAC market saw significant investment in advanced heat pump technology, with companies like Daikin reporting substantial R&D expenditures to enhance energy efficiency and smart features.

These substantial fixed costs act as formidable exit barriers, compelling businesses to persevere and compete aggressively, even when market demand softens, to amortize their investments. This dynamic inherently fuels persistent competitive intensity throughout the industry.

Consequently, companies often engage in price competition or focus on innovation to maintain market share rather than withdrawing, which can lead to prolonged periods of rivalry. The European heat pump market, for example, experienced a growth rate of approximately 15% in 2023, yet the high initial costs for manufacturers meant that established players continued to battle for market dominance.

- High Capital Requirements: The HVAC sector necessitates significant investment in specialized machinery, skilled labor, and advanced R&D, creating a high entry barrier.

- Exit Barriers: Companies with sunk costs in manufacturing plants and distribution networks are reluctant to exit, even during downturns, leading to sustained competitive pressure.

- Industry Structure: The presence of large, established players with significant fixed assets contributes to an oligopolistic market structure where rivalry is intense.

- Innovation as a Differentiator: To offset high fixed costs, companies often invest heavily in technological advancements, intensifying competition through product differentiation.

Strategic Stakes and Market Leadership

The drive for market leadership in sustainable heating and ventilation is intense, with companies like Itho Daalderop pouring resources into R&D and capacity expansion. This is fueled by the significant long-term growth prospects tied to global decarbonization targets, making market share a crucial strategic objective. Consequently, competitive behavior is often aggressive, pushing for continuous innovation to capture a larger slice of this expanding market.

Companies recognize that securing a leading position now sets them up for sustained profitability as demand for eco-friendly solutions escalates. For instance, the European market for heat pumps, a key product in this sector, saw substantial growth, with sales increasing by approximately 15% in 2023 compared to the previous year, according to industry reports. This rapid expansion underscores the high stakes involved.

- Strategic Importance: Market leadership is paramount due to the sector's long-term growth potential driven by decarbonization mandates.

- Investment Focus: Companies are heavily investing in R&D, marketing, and production capacity to gain or defend market share.

- Competitive Intensity: The pursuit of leadership results in aggressive competitive actions and a strong emphasis on innovation.

- Market Growth: The sustainable heating and ventilation sector, including products like heat pumps, experienced significant growth in 2023, highlighting the attractive nature of the market.

Competitive rivalry for Itho Daalderop is exceptionally high, featuring global giants like Daikin and Bosch, alongside specialized regional players. This intense competition is driven by the substantial growth in sustainable building solutions, particularly heat pumps, which saw approximately 15% growth in Europe in 2023.

Companies differentiate through energy efficiency, smart technology, and sustainability features, with many new heat pump models in 2024 boasting SCOP ratings above 5.0. The sector requires significant capital for R&D and production, leading to high exit barriers that ensure persistent competition, even during market adjustments like the slowdown in some European heat pump sales during 2024.

Strategic importance is placed on market leadership due to long-term decarbonization goals, prompting heavy investment in R&D, marketing, and capacity. This pursuit of leadership fuels aggressive competitive actions and innovation, as seen with major players like Daikin, which reported net sales of ¥4,027.3 billion (approx. $26.5 billion USD) in fiscal year 2023, underscoring the scale of resources involved.

| Competitor | Key Product Areas | 2023 Revenue (Approx. USD) | Key Differentiator Focus |

| Daikin | Heat Pumps, Air Conditioners, Ventilation | $26.5 Billion | Energy Efficiency, Smart Controls |

| Bosch | Heat Pumps, Boilers, Ventilation | N/A (Part of Bosch Group) | Integrated Home Solutions, Efficiency |

| Carrier | HVAC Systems, Refrigeration | $22.1 Billion (2023) | Innovation, Global Reach |

| Mitsubishi Electric | Heat Pumps, Air Conditioners | ¥4,757.1 Billion (approx. $31.2 Billion USD, FY23) | Technology, Reliability |

| Viessmann | Heat Pumps, Boilers, Solar | €4 Billion (approx. $4.3 Billion USD, 2023) | Sustainable Solutions, Integrated Systems |

SSubstitutes Threaten

Traditional fossil fuel heating systems, such as gas boilers and oil furnaces, continue to represent a significant threat of substitution for newer, more sustainable alternatives like those offered by Itho Daalderop. Despite regulatory pressures, like the EU's push to phase out financial incentives for stand-alone fossil fuel boilers from January 2025 under the Energy Performance of Buildings Directive (EPBD), these systems remain prevalent. Their established infrastructure and often lower initial purchase price can still make them an attractive, albeit temporary, option for some consumers, especially when energy prices fluctuate or subsidy programs introduce uncertainty.

Customers increasingly consider alternatives to traditional active climate control systems. For example, advancements in district heating networks, particularly in Europe, offer a centralized and often more efficient solution for heating and cooling. In 2024, the global district heating market was valued at approximately $230 billion and is projected to grow significantly, indicating a growing acceptance of these alternative infrastructure-based solutions.

Geothermal systems, extending beyond Itho Daalderop's core product lines, represent another potent substitute. These systems tap into the earth's stable temperature for heating and cooling, reducing reliance on active mechanical systems. The global geothermal energy market saw substantial investment in 2024, with renewable energy initiatives pushing for wider adoption of such technologies.

Solar thermal systems, which directly use solar energy to heat water, also pose a threat by fulfilling the hot water requirement with a different technology. Furthermore, a strong emphasis on passive design principles in new construction and renovations aims to minimize the need for active heating and cooling altogether. The focus on net-zero energy buildings in many regions directly supports these passive strategies, reducing the overall demand for products like those offered by Itho Daalderop.

Advances in building insulation and passive design strategies are increasingly reducing the need for high-capacity HVAC systems. For instance, the adoption of Passive House standards, which demand extremely low energy consumption for heating and cooling, means buildings require far less active climate control. This directly substitutes for the core function of traditional HVAC solutions.

As buildings become more energy-efficient through better insulation and design, the perceived necessity and scale of Itho Daalderop's advanced climate control systems could diminish. This trend, a cornerstone of sustainable building, means that a building's inherent efficiency acts as a direct substitute for the output capacity of HVAC manufacturers.

Decentralized Ventilation Solutions

The threat of substitutes for Itho Daalderop's ventilation solutions, particularly their decentralized units like HRU models, is moderate. Customers might opt for simpler, localized ventilation systems, such as individual window ventilators or even rely on natural ventilation strategies in certain building scenarios. These alternatives can be appealing for smaller renovations or less complex commercial applications where a fully integrated, whole-building system might be overkill or cost-prohibitive. For instance, in 2024, the market saw continued interest in smart window sensors that can automatically open or close based on air quality, offering a degree of localized ventilation without a full system installation.

Consider the following factors regarding substitutes:

- Localized Ventilation: Simpler, single-room or window-based ventilation units offer a lower-cost alternative for basic air exchange.

- Natural Ventilation: Strategic building design leveraging operable windows and passive airflow can reduce reliance on mechanical systems.

- DIY Solutions: In some residential markets, consumers may implement basic ventilation measures using readily available components.

- Cost Sensitivity: The initial and installation costs of integrated systems can drive adoption of less complex, albeit less comprehensive, substitutes.

Behavioral Changes and Lifestyle Adjustments

Behavioral shifts can act as a subtle yet significant substitute for sophisticated climate control. For instance, homeowners might opt to manually adjust thermostat settings, embrace natural ventilation strategies, or simply tolerate a broader range of indoor temperatures. These low-cost behavioral adaptations can diminish the perceived necessity of advanced, energy-efficient systems, thereby impacting consumer demand for premium solutions like those offered by Itho Daalderop.

These behavioral adjustments present a threat because they offer a less expensive alternative to purchasing and maintaining advanced climate control technology. For example, a household consciously opening windows during cooler parts of the day or using fans instead of air conditioning represents a direct behavioral substitute. In 2024, the increasing awareness of energy conservation, driven by rising utility costs and environmental concerns, is likely to amplify these behavioral changes. Reports from late 2023 indicated that a notable percentage of consumers were actively seeking ways to reduce their energy consumption, with thermostat adjustments being a frequently cited tactic.

The threat of substitutes is amplified when these behavioral changes are widespread and easily adopted. Consider the impact of smart home technology adoption; while it can enhance climate control, it also enables users to fine-tune usage based on occupancy and preference, potentially reducing the need for constant, high-level system operation. This nuanced control, driven by user behavior, can be seen as a form of substitution for the continuous, high-performance output that climate control systems are designed to provide.

The perceived value of advanced climate control systems can be eroded by these behavioral adjustments. If consumers find that simple actions like wearing warmer clothing indoors or utilizing passive cooling techniques are sufficient for their comfort, they may be less inclined to invest in or upgrade to more technologically advanced and expensive systems. This trend is particularly relevant in the residential market, where cost sensitivity can be a primary driver of purchasing decisions.

Traditional fossil fuel heating systems, despite increasing regulatory pressure, remain a viable substitute due to established infrastructure and often lower upfront costs. However, the growing adoption of district heating networks, valued at approximately $230 billion globally in 2024, presents a significant infrastructure-based alternative. Geothermal and solar thermal systems also offer direct substitutions by leveraging natural energy sources, further diminishing reliance on active mechanical climate control.

Entrants Threaten

Entering the advanced HVAC, heat pump, and ventilation manufacturing sector, where companies like Itho Daalderop operate, requires a significant financial commitment. This includes substantial outlays for research and development to innovate and refine product lines, along with establishing cutting-edge manufacturing facilities. The need for specialized machinery and robust, efficient supply chains further amplifies these entry barriers.

These considerable upfront investments serve as a powerful deterrent for potential new entrants. For instance, a new player might need to invest hundreds of millions of euros to match the production capacity and technological sophistication of established companies. This high capital threshold inherently limits the number of new businesses that can realistically challenge incumbents like Itho Daalderop, thereby reducing the threat of new entrants.

Itho Daalderop's dedication to advanced systems for energy efficiency and indoor climate comfort necessitates substantial investment in research and development, leading to proprietary technologies. For potential new entrants, replicating this level of technological sophistication requires significant time, capital, and expertise, making entry challenging.

The development and acquisition of comparable technological capabilities represent a formidable hurdle for newcomers. Furthermore, Itho Daalderop's existing patents and intellectual property rights act as strong deterrents, protecting their innovation-driven market position.

Established players like Itho Daalderop have built robust distribution networks, fostering strong ties with installers and cultivating significant brand loyalty among both residential and commercial customers. This existing infrastructure presents a substantial barrier for newcomers.

New entrants must invest heavily to replicate these established channels and gain market access, a process that can take years and considerable capital. For instance, in the competitive Dutch HVAC market, where Itho Daalderop holds a strong position, building trust with a new installer base is a slow and costly endeavor.

Customer preference for trusted, familiar brands like Itho Daalderop, often due to perceived reliability and after-sales support, further solidifies the challenge for new market entrants. This loyalty means potential customers are less likely to switch to an unknown brand, even if it offers competitive pricing.

Regulatory and Certification Hurdles

The HVAC and sustainable building sector faces considerable barriers due to a complex web of regulations and certification requirements. New companies must invest significantly in ensuring their products comply with evolving energy efficiency standards, such as the EU's Energy Performance of Buildings Directive (EPBD) and Ecodesign requirements. Meeting these stringent criteria, alongside crucial safety certifications and environmental compliance like the F-gas regulations, demands substantial resources and expertise, acting as a significant deterrent for potential new entrants.

Navigating these regulatory landscapes is a costly and time-consuming endeavor. For instance, obtaining CE marking, a prerequisite for many products sold within the European Economic Area, involves rigorous testing and documentation to demonstrate conformity with health, safety, and environmental protection standards. In 2024, the continuous updates to these directives mean that ongoing investment in research and development is essential to maintain compliance, further escalating the cost of entry for new players.

- Stringent Energy Efficiency Standards: Compliance with directives like the EPBD mandates advanced technologies and product design.

- Safety and Environmental Certifications: Obtaining necessary safety marks and adhering to F-gas regulations adds complexity and cost.

- Costly Certification Processes: The financial outlay for testing, documentation, and approvals can be substantial for new market entrants.

- Evolving Regulatory Landscape: Continuous updates to standards require ongoing R&D investment to remain competitive and compliant.

Economies of Scale and Experience Curve

Incumbent manufacturers like Itho Daalderop enjoy significant advantages from economies of scale. This means they produce more goods at a lower cost per unit. For instance, in 2024, major HVAC manufacturers often reported production volumes in the hundreds of thousands or even millions of units annually, enabling substantial savings in raw material purchasing and streamlined manufacturing processes. This scale allows them to invest more heavily in research and development, further solidifying their market position.

Furthermore, the experience curve plays a crucial role. As companies like Itho Daalderop gain more experience in producing and selling their products, they become more efficient. This accumulated knowledge leads to optimized production techniques, reduced waste, and improved product quality over time. For example, a company with decades of experience in heat pump technology might have refined its compressor design and refrigerant management systems, leading to a 5-10% reduction in manufacturing costs compared to a newer entrant.

Newcomers face a steep challenge in overcoming these cost disadvantages. Without the benefit of large-scale production or years of operational refinement, new entrants would likely incur higher per-unit costs. This would make it difficult to compete on price with established players like Itho Daalderop, potentially hindering their ability to gain market share and achieve profitability in the competitive HVAC sector.

- Economies of scale in manufacturing allow for lower per-unit production costs for established players.

- The experience curve enables continuous efficiency improvements and cost reductions over time.

- New entrants struggle to match the cost advantages of incumbents due to lack of scale and experience.

- This makes it difficult for new companies to compete effectively on price in the market.

The threat of new entrants in the HVAC and heat pump sector, where Itho Daalderop operates, is moderate due to significant capital requirements for R&D, manufacturing, and distribution. Established players benefit from economies of scale and a strong experience curve, making it challenging for newcomers to compete on cost. Stringent regulations and certifications further act as barriers, demanding substantial investment and expertise to ensure product compliance and market access.

| Barrier Type | Description | Impact on New Entrants | Example/Data (2024) |

|---|---|---|---|

| Capital Requirements | High R&D, advanced manufacturing facilities, specialized machinery | Significant financial hurdle, limiting the number of potential entrants | Estimated €100M+ to establish competitive production capacity |

| Technology & IP | Proprietary technologies, patents, and expertise in energy efficiency | Requires substantial investment in innovation and time to replicate | Itho Daalderop's focus on advanced heat pump technology |

| Distribution & Brand Loyalty | Established installer networks, strong brand recognition, customer trust | New entrants need time and capital to build comparable channels and trust | Building installer relationships can take years in the Dutch market |

| Regulatory Compliance | Energy efficiency standards (EPBD), safety certifications, F-gas regulations | Demands significant resources for testing, documentation, and ongoing R&D | CE marking and EPBD compliance costs can be tens of thousands of euros per product line |

| Economies of Scale & Experience Curve | Lower per-unit costs due to high production volumes and operational efficiency | New entrants face higher costs, making price competition difficult | Large manufacturers achieve 5-10% lower production costs through scale |

Porter's Five Forces Analysis Data Sources

Our Itho Daalderop Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, company annual filings, and expert interviews with sector professionals. This comprehensive data gathering ensures a robust understanding of competitive dynamics.