Itho Daalderop Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itho Daalderop Bundle

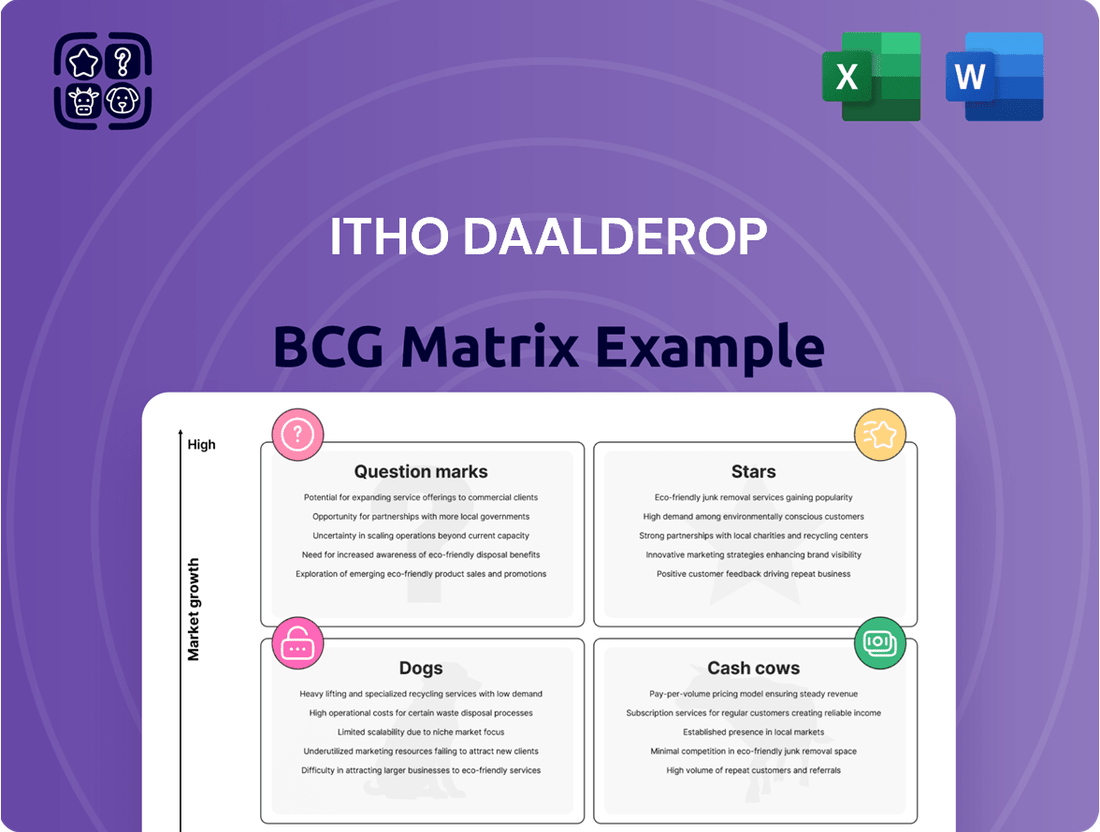

Is Itho Daalderop strategically navigating the market with their product portfolio? Our BCG Matrix analysis reveals whether their offerings are thriving Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks.

This snapshot offers a glimpse into their current market standing, but to truly unlock their strategic potential, you need the full picture.

Dive deeper into the intricacies of Itho Daalderop's product positioning and gain actionable insights for future growth.

Purchase the complete BCG Matrix to receive a detailed breakdown of each product's quadrant placement, empowering you to make informed decisions about resource allocation and investment.

This comprehensive report is your key to understanding where Itho Daalderop excels and where opportunities for improvement lie, setting you on a path to strategic success.

Stars

Itho Daalderop's advanced heat pump systems, particularly their air-to-water and ground source models, are firmly positioned as Stars in the BCG matrix. This classification is supported by the robust growth expected in the European heat pump market, with a projected compound annual growth rate of 10.04% between 2025 and 2033. This expansion is primarily fueled by stringent energy efficiency regulations and a widespread commitment to sustainability across the continent.

As a key player within the NIBE Group, Itho Daalderop enjoys a leading position in the Dutch air-to-water heat pump sector. They are recognized as one of the top three brands, collectively accounting for 80% of the market's sales. This strong market presence, coupled with their continuous investment in innovative heat pump technology, ensures they are well-equipped to capitalize on the significant growth opportunities within this dynamic sector.

Integrated Smart Climate Control Solutions represent a significant opportunity for Itho Daalderop, fitting squarely into the Stars quadrant of the BCG matrix. The global smart home market, valued at over $80 billion in 2023 and projected to reach more than $200 billion by 2030, underscores the robust demand for these technologies. Itho Daalderop's strategy of embedding smart capabilities into their heat pumps and ventilation units directly addresses this high-growth sector, offering consumers enhanced control and energy efficiency.

Itho Daalderop, a leader in ventilation, is launching next-generation Heat Recovery Ventilation (HRU) units, like the planned HRU 300 V and 375 V, by October 2025. These innovations address the increasing demand for superior indoor air quality and energy efficiency. The company's ongoing advancements, including retrofitting solutions, firmly establish these sophisticated HRU units as potential stars in the market.

Solutions for Nearly Zero-Energy Buildings (nZEB)

The construction sector is increasingly prioritizing sustainability, with nearly zero-energy buildings (nZEB) emerging as a significant trend. This shift is fueled by stricter regulations and growing environmental awareness, creating a robust demand for nZEB-compliant solutions. In 2024, the global green building market was valued at over $1.2 trillion, with nZEB technologies representing a substantial portion of this growth.

Itho Daalderop strategically positions its integrated solutions for nZEB projects as Stars in the BCG matrix. Their comprehensive product bundles, which seamlessly combine heating, ventilation, and hot water systems, directly address the needs of this rapidly expanding and increasingly mandated market segment. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) mandates that all new buildings constructed from 2021 onwards must be nZEB.

These bundled offerings are designed to simplify the complex requirements of nZEB construction, offering a cohesive approach to energy efficiency. This focus allows Itho Daalderop to capture significant market share in a segment characterized by high growth potential and regulatory support.

- High Growth Market: nZEB construction is a rapidly expanding segment driven by global regulations and environmental targets.

- Integrated Solutions: Itho Daalderop's product bundles offer a comprehensive approach to meeting nZEB requirements.

- Regulatory Tailwinds: Policies like the EU's EPBD create a strong demand for nZEB technologies.

- Energy Neutrality Focus: The company's commitment aligns with the core objective of achieving energy-neutral living spaces.

Hybrid Heat Pump Systems

Hybrid heat pump systems are a rapidly growing segment in the European heating market, driven by their efficiency and adaptability. These systems cleverly combine the benefits of a heat pump with a conventional boiler, offering a flexible solution for homeowners. Itho Daalderop's HP-M 25i model highlights this trend, showcasing its compatibility with any existing boiler, which is a significant advantage for market penetration. This category represents a crucial step towards full building electrification and is expected to capture a substantial market share in the sustainable heating sector. In 2023, the European heat pump market saw robust growth, with hybrid systems being a key contributor, reflecting a strong demand for energy-efficient and reliable heating solutions.

- Market Growth: The European hybrid heat pump market is experiencing strong growth, with projections indicating continued expansion through 2025 and beyond.

- Product Innovation: Itho Daalderop's HP-M 25i exemplifies the trend towards versatile hybrid solutions that can integrate with existing heating infrastructure.

- Sustainability Driver: Hybrid systems act as a vital bridge to full electrification, facilitating the transition to more sustainable heating methods.

- Market Position: This product category holds a significant market share in a segment that is rapidly gaining traction due to its dual-benefit approach.

Itho Daalderop's advanced heat pump systems, particularly their air-to-water and ground source models, are firmly positioned as Stars in the BCG matrix due to their strong performance in a high-growth market. The European heat pump market is projected to grow at a compound annual growth rate of 10.04% between 2025 and 2033, driven by sustainability initiatives and energy efficiency regulations.

As a leading brand in the Dutch air-to-water heat pump sector, Itho Daalderop's significant market share and continuous innovation in technology position them to capitalize on this growth. Their integrated smart climate control solutions also represent a Star, tapping into the global smart home market, which was valued at over $80 billion in 2023 and is expected to exceed $200 billion by 2030.

The company's next-generation Heat Recovery Ventilation (HRU) units, like the upcoming HRU 300 V and 375 V, are also considered Stars. These products cater to the rising demand for improved indoor air quality and energy efficiency, reinforcing Itho Daalderop's star status in this segment.

Itho Daalderop's integrated solutions for nearly zero-energy buildings (nZEB) are also Stars, aligning with the global green building market's value of over $1.2 trillion in 2024. Mandates like the EU's Energy Performance of Buildings Directive (EPBD) further bolster the demand for these comprehensive nZEB-compliant offerings.

| Product Category | BCG Quadrant | Market Growth | Itho Daalderop's Position |

|---|---|---|---|

| Air-to-Water & Ground Source Heat Pumps | Stars | High (10.04% CAGR 2025-2033) | Top 3 in Netherlands, significant investment in innovation |

| Integrated Smart Climate Control Solutions | Stars | Very High (Global smart home market > $200B by 2030) | Embedding smart capabilities into core products |

| Next-Generation HRV Units | Stars | High (Demand for IAQ & energy efficiency) | Launching advanced models by Oct 2025 |

| nZEB Integrated Solutions | Stars | High (Global green building market > $1.2T in 2024) | Comprehensive bundles for regulatory compliance |

What is included in the product

Strategic analysis of Itho Daalderop's product portfolio using the BCG Matrix, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The Itho Daalderop BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Itho Daalderop’s standard electric water heaters are firmly positioned as Cash Cows within their product portfolio. With a heritage stretching back to 1880, the company boasts a significant and enduring market presence in this sector. The recent redesign of these units for enhanced installation simplicity underscores their status as a mature, yet continuously refined, product line.

These water heaters are known for their reliability and widespread adoption, contributing to a steady stream of revenue within a predictable market segment. Their established position means they require minimal marketing expenditure to maintain sales, allowing Itho Daalderop to benefit from consistent cash generation. For instance, in 2024, the electric water heater market, a segment where Itho Daalderop has a strong foothold, is projected to see steady, albeit moderate, growth, underscoring the stable cash-generating capabilities of these mature products.

Itho Daalderop's traditional mechanical ventilation units represent a significant cash cow within their product portfolio. These established systems, while not at the forefront of innovation, command a substantial market share, particularly in the retrofitting of existing residential and commercial properties. Their reliable performance ensures consistent demand in a mature market.

These units are crucial for maintaining fundamental indoor air quality, making them a staple in countless buildings. The demand for these systems is stable, reflecting their essential nature rather than susceptibility to rapid technological shifts. This stability translates into predictable and steady revenue streams for Itho Daalderop.

The mature market for these traditional units means that growth investments are minimal. Itho Daalderop can leverage their existing manufacturing and distribution infrastructure to generate consistent profits without the need for extensive research and development or aggressive market expansion. For example, in 2024, the demand for retrofitting solutions, including mechanical ventilation, saw a steady increase, driven by energy efficiency regulations and a focus on healthier indoor environments.

Itho Daalderop's indirect hot water cylinders are a solid performer, acting as a crucial complement to their heating systems. These tanks are a common sight in many homes, deeply embedded in the market and often part of broader heating installations. Their presence in existing buildings means they benefit from the natural replacement cycles of aging infrastructure.

This established market position translates into reliable and steady revenue for the company. Given their widespread adoption in mature building stock, these cylinders contribute significantly to consistent income streams, making them a dependable part of Itho Daalderop's product portfolio.

Basic Thermostats and Control Units

Itho Daalderop’s basic thermostats and control units function as Cash Cows within their product portfolio. These are foundational elements for heating and ventilation systems, enjoying consistent demand and a substantial market share due to their integration with other Itho Daalderop products.

Despite operating in a mature, low-growth market, these essential components provide a steady revenue stream, underpinning the company's financial stability. Their widespread adoption ensures predictable sales volumes, making them a reliable source of cash flow for the business.

- Market Share: High, due to integration with Itho Daalderop's ecosystem.

- Market Growth: Low, characteristic of mature, standard technology.

- Revenue Contribution: Stable and consistent, providing reliable cash flow.

- Strategic Role: Support overall sales and profitability with minimal investment.

Conventional Central Heating Boilers

Conventional central heating boilers, despite the industry's pivot towards heat pumps, likely remain a cornerstone for Itho Daalderop, especially in the retrofit sector. Many existing homes still rely on boiler systems, and replacement cycles ensure a steady demand. This segment offers predictable revenue streams, solidifying their role as a cash cow within the company's portfolio.

In 2024, the European market for gas boilers, while facing pressure from regulations and the heat pump transition, still represented a significant portion of heating installations, particularly in countries with extensive existing gas infrastructure. For instance, the Netherlands, a key market for Itho Daalderop, saw continued, albeit declining, installations of gas boilers in 2024, driven by their lower upfront cost compared to heat pumps and the familiarity for consumers.

- Established Market Presence: Itho Daalderop likely holds a strong, recognizable brand in the conventional boiler market, benefiting from years of sales and installations.

- Retrofit Opportunities: The complexity and cost of full heat pump conversions in older buildings make conventional boiler replacements a practical and ongoing necessity.

- Consistent Revenue Generation: Replacement sales and new installations in specific niches provide a reliable and predictable income stream for the company.

- Market Share Data: While specific 2024 market share figures for Itho Daalderop's boilers are proprietary, industry reports indicated that established brands maintained significant portions of the boiler replacement market throughout the year.

Itho Daalderop's electric water heaters, a long-standing product line, are firmly established as cash cows. Their mature market position and consistent demand, especially in the retrofit sector, ensure a steady revenue stream. The company's focus on reliability and incremental improvements, like easier installation, maintains their appeal without significant new investment.

The steady demand for these units in 2024, driven by their essential function and widespread use in existing infrastructure, highlights their cash cow status. This segment requires minimal marketing and development spend, allowing Itho Daalderop to benefit from predictable and stable cash generation.

Itho Daalderop's traditional mechanical ventilation units are also key cash cows. These systems are vital for indoor air quality and benefit from consistent demand in the mature retrofit market. Their essential nature and minimal need for R&D allow for efficient profit generation.

The continued demand for these units in 2024, particularly for retrofitting older buildings to meet energy efficiency standards, reinforces their cash cow role. This stable market allows Itho Daalderop to leverage existing infrastructure for consistent profits.

The indirect hot water cylinders are another strong cash cow. Integrated into many existing heating systems, they benefit from natural replacement cycles and consistent demand in mature building stock. This predictable revenue stream solidifies their importance to Itho Daalderop's financial stability.

Basic thermostats and control units function as essential cash cows. Their foundational role in heating and ventilation systems, coupled with their integration into Itho Daalderop's broader product ecosystem, ensures consistent demand and a stable revenue source in a low-growth market.

Conventional central heating boilers, despite the industry's shift, remain significant cash cows for Itho Daalderop, especially in the retrofit market. Their continued installation in existing homes, driven by replacement cycles and lower upfront costs compared to alternatives, provides predictable revenue streams.

| Product Category | BCG Matrix Position | Market Share | Market Growth | Revenue Contribution | Strategic Focus |

|---|---|---|---|---|---|

| Standard Electric Water Heaters | Cash Cow | High | Low | Stable, Consistent | Maintain market share, optimize production |

| Traditional Mechanical Ventilation | Cash Cow | High | Low | Stable, Consistent | Leverage existing infrastructure, focus on retrofit market |

| Indirect Hot Water Cylinders | Cash Cow | High | Low | Stable, Consistent | Capitalize on replacement cycles, integration with systems |

| Basic Thermostats & Controls | Cash Cow | High | Low | Stable, Consistent | Ensure integration, leverage existing customer base |

| Conventional Central Heating Boilers | Cash Cow | High | Low (declining overall, but stable in retrofit) | Stable, Predictable | Focus on retrofit market, manage regulatory compliance |

What You’re Viewing Is Included

Itho Daalderop BCG Matrix

The Itho Daalderop BCG Matrix preview you're seeing is the identical, fully formatted document you will receive immediately after your purchase. This means you get a complete, analysis-ready report without any watermarks or demo content, ready for immediate strategic application. The preview accurately represents the professional quality and detail of the BCG Matrix you’ll download, empowering you to make informed business decisions. This is the actual strategic tool you’ll utilize, ensuring no surprises and a seamless integration into your planning processes.

Dogs

Older, less energy-efficient boiler models are definitely in the Dogs category of the BCG Matrix. As energy efficiency regulations get tougher and people want more sustainable options, these older boilers are becoming less popular. Think about it, in 2024, the EU's Ecodesign directive continues to push for higher efficiency, meaning many older models simply can't keep up. They have a low market share and are in a market that's shrinking year after year.

Basic, non-connected thermostats are firmly in the 'Dogs' category of the BCG matrix. Their market share is declining as consumers increasingly seek smart home integration and remote control capabilities. For example, in 2024, the global smart thermostat market was projected to reach over $4.7 billion, indicating a strong shift away from basic models.

These thermostats offer minimal growth potential in today's technologically driven market. The demand is clearly shifting towards connected devices that offer features like energy usage monitoring and learning capabilities. Consequently, Itho Daalderop is likely to see these products phased out as they focus on more advanced, integrated control systems that meet evolving consumer needs.

Outdated mechanical ventilation units are firmly in the Dogs category of the BCG Matrix. The ventilation market in 2024 is seeing a significant shift towards advanced heat recovery systems and smart, connected controls, making older, less efficient units increasingly obsolete. These older models lack the energy-saving capabilities and user-friendly features that consumers and building codes now demand.

Their low market share is a direct consequence of this technological evolution. For instance, while the global ventilation market reached an estimated USD 35.5 billion in 2023 and is projected to grow, older, non-heat-recovering units represent a shrinking segment. Investing in or continuing to market these units ties up valuable resources, such as R&D and manufacturing capacity, with little prospect of substantial returns in a market that prioritizes performance and sustainability.

Legacy Hot Water Storage Tanks (non-HP compatible)

Legacy hot water storage tanks, those traditional models not designed for heat pump integration or lacking advanced efficiency features, are increasingly becoming a challenge in the market. Their declining market appeal is directly linked to a growing consumer demand for more energy-conscious and space-saving alternatives.

These older systems struggle to compete as regulations and environmental awareness push for solutions like tankless water heaters or heat pump water heaters. Consequently, legacy tanks are projected to experience a steady decrease in sales and market share.

- Declining Market Share: Expect continued erosion of market share for non-HP compatible tanks as newer, more efficient technologies gain traction.

- Reduced Sales Volume: Sales are likely to shrink as consumers prioritize energy savings and government incentives favor greener alternatives.

- Integration Challenges: The inability to easily integrate with heat pumps makes them obsolete for many modern home upgrades.

- Consumer Preference Shift: A significant shift in consumer preference towards compact, high-efficiency units will further marginalize these legacy products.

Niche Products with Declining Demand

Niche products with declining demand, often referred to as Dogs in the BCG Matrix, represent offerings where Itho Daalderop might have seen past success but now face diminished market interest or technological obsolescence. These products are characterized by low market share and low market growth, meaning they generate minimal revenue and offer little potential for future expansion. For instance, if Itho Daalderop once offered a specialized ventilation system for a now-outdated building technology, that product would likely be a Dog. In 2024, companies often divest or phase out such products to reallocate resources to more promising ventures.

These products typically consume resources without yielding significant returns, acting as cash traps. Their low sales volume means they contribute little to overall revenue, while their stagnant or shrinking market prevents them from becoming cash cows. For example, a product line with less than 2% annual market growth and a market share below 5% would generally be classified as a Dog. Companies must carefully manage these offerings, often by discontinuing them or finding niche, low-cost ways to maintain them if absolutely necessary.

- Low Market Share: Products with a market share significantly below industry averages, often less than 10%.

- Low Market Growth: Industries or product categories experiencing minimal or negative annual growth, typically below 3%.

- Resource Drain: These products often require ongoing investment in maintenance or limited marketing without generating proportional returns.

- Potential Divestment: Companies commonly consider discontinuing or selling off Dog products to free up capital and management focus.

Products in the Dogs category represent Itho Daalderop's offerings with low market share in slow-growing or declining markets. These are typically older, less efficient models that no longer meet current consumer demands or regulatory standards.

For instance, basic, non-connected thermostats have a declining market share as smart home technology advances. Similarly, older mechanical ventilation units are being phased out in favor of more energy-efficient heat recovery systems. These products often require resources without generating significant returns, making them candidates for discontinuation.

The global smart thermostat market's projected growth to over $4.7 billion in 2024 highlights the decline of basic models. The ventilation market, estimated at USD 35.5 billion in 2023, also shows a clear trend away from older, less efficient units.

Itho Daalderop's legacy hot water storage tanks, not designed for heat pump integration, also fall into this category. Their sales are shrinking as consumers opt for more energy-conscious alternatives like tankless or heat pump water heaters.

| Product Category | BCG Classification | Market Trend | Key Characteristics |

|---|---|---|---|

| Older Boiler Models | Dog | Declining (due to efficiency regulations) | Low energy efficiency, low market share |

| Basic Thermostats | Dog | Declining (shift to smart home) | No connectivity, minimal features |

| Outdated Mechanical Ventilation | Dog | Declining (shift to heat recovery) | Low energy saving, obsolete features |

| Legacy Hot Water Tanks | Dog | Declining (shift to heat pump integration) | Incompatible with modern systems, low efficiency |

Question Marks

Itho Daalderop's current smart home offerings, while valuable, represent a foundation for more advanced IoT-integrated home energy management systems. These comprehensive systems, which go beyond heating and ventilation to encompass solar, battery storage, and smart grid interaction, are poised for significant growth. The market for these all-encompassing solutions is still developing, necessitating substantial investment for Itho Daalderop to capture a leading position.

Developing a truly integrated home energy management system that optimizes all residential energy consumption could position Itho Daalderop as a market leader in a high-growth sector. As of late 2024, the adoption rate for such advanced systems remains relatively low, indicating a substantial opportunity for early movers. The global smart home market, a key indicator, was projected to reach over $130 billion in 2024, with energy management being a significant driver.

For large-scale commercial heat pump applications, Itho Daalderop can leverage its existing expertise by developing specialized, higher-capacity units. This segment is experiencing robust growth, with the global commercial heat pump market projected to reach over $10 billion by 2027, presenting a significant opportunity.

Expanding their product line to include modular systems capable of meeting the demands of larger buildings, such as office complexes or industrial facilities, is crucial. This strategic move addresses a high-growth market where their current share may be smaller, turning a potential weakness into a strategic advantage.

Itho Daalderop's Green Energy Smartboiler exemplifies a niche renewable energy integration product, specifically optimizing photovoltaic (PV) power for water heating. This targeted approach addresses a growing segment of consumers keen on maximizing their self-generated solar energy. While the market for such specialized solutions is still developing, its high potential is evident in the increasing adoption of solar PV systems globally. For instance, global solar PV capacity reached an estimated 1,370 GW by the end of 2023, a significant increase that fuels demand for complementary integration products.

Ultra-Compact, Space-Saving Climate Solutions for Existing Builds

Itho Daalderop is actively developing ultra-compact, space-saving climate solutions specifically for existing buildings, a critical segment in the Dutch renovation market. This strategic focus addresses the inherent space constraints common in older structures, aiming to make energy efficiency upgrades more accessible. The company recognizes this as a significant growth area, driven by increasing demand for retrofitting older properties.

This niche represents a potentially high-growth opportunity for Itho Daalderop. As the Netherlands pushes for greater energy efficiency in its building stock, solutions that easily integrate into existing infrastructure are in high demand. While the market share in this specific, compact retrofitting niche may still be solidifying for Itho Daalderop, the underlying market trend is undeniably strong.

Consider the following points regarding this segment:

- Market Growth: The Dutch government has set ambitious energy efficiency targets, driving significant investment in building renovations. For instance, by 2030, a substantial portion of the existing housing stock is slated for energy performance improvements.

- Itho Daalderop's Position: The company's commitment to space-saving designs positions it well to capture market share as this trend accelerates. Their product development is aligned with the practical needs of installers working on existing homes.

- Competitive Landscape: While innovation in compact climate solutions is growing, Itho Daalderop's specific focus on retrofitting existing builds offers a competitive edge.

Future-Ready Heating Technologies (e.g., Hydrogen-Ready)

Hydrogen-ready heating technologies are positioned as future stars in the evolving energy landscape. These systems tap into a high-growth potential market as the world transitions towards cleaner energy sources. For a company like Itho Daalderop, venturing into or developing hydrogen-ready boilers would fall into the Question Mark category within a BCG Matrix analysis. This is because it represents a significant investment in a burgeoning sector with uncertain but promising future returns.

Currently, Itho Daalderop's strength lies in its established sustainable heating solutions. However, the nascent hydrogen market requires substantial research and development, meaning their current market share in hydrogen-ready systems would likely be minimal. By 2024, the UK government, for instance, was investing significantly in hydrogen production and infrastructure, with projects like the HyNet North West aiming to deliver low-carbon hydrogen. This trend highlights the growing industry momentum, making it a strategic area for future consideration.

- Emerging Market: Hydrogen-ready boilers are part of a high-growth future market driven by decarbonization efforts.

- Investment Needs: Significant R&D investment is required to develop and bring hydrogen-ready technologies to market.

- Low Current Share: Itho Daalderop's existing market share in this specific technology is likely minimal, characteristic of a Question Mark.

- Industry Support: Government initiatives and industry collaborations, such as those seen in the UK's hydrogen strategy by 2024, are fueling this sector's growth.

Hydrogen-ready heating technologies represent a significant future growth opportunity for Itho Daalderop, fitting the Question Mark category in a BCG Matrix. While the market is still developing, substantial investment in research and development is necessary for Itho Daalderop to establish a strong position. The growing global emphasis on decarbonization, supported by government initiatives and industry collaborations, underscores the potential of this emerging sector.

BCG Matrix Data Sources

Our Itho Daalderop BCG Matrix leverages comprehensive market data, including sales figures, market share analysis, and industry growth projections, to accurately position each product.