IRC Retail Centers LLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRC Retail Centers LLC Bundle

Understand how political, economic, and technological forces impact IRC Retail Centers LLC's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Government regulations and zoning laws significantly shape the commercial real estate landscape for IRC Retail Centers LLC. For instance, in 2024, many municipalities are tightening zoning restrictions on large retail developments, potentially increasing the complexity and cost of new projects. The average time to obtain building permits in major US metropolitan areas has seen an increase, with some cities reporting delays of up to 18 months, impacting development timelines.

Changes in land use policies, such as the push for mixed-use developments or restrictions on big-box stores in urban centers, directly influence IRC Retail Centers LLC's strategic decisions regarding site selection and portfolio diversification. Federal initiatives promoting sustainable building practices, like those incentivized by the Inflation Reduction Act of 2022, can also alter development costs and operational efficiencies for the company.

Fluctuations in corporate tax rates, property taxes, and capital gains taxes directly impact IRC Retail Centers LLC's profitability and the attractiveness of its retail properties to investors. For instance, a rise in corporate tax rates from the current 21% in the US could compress net operating income, while changes in property tax assessments in key markets like Florida or Texas could alter operational costs. Understanding these shifts is crucial for managing investor returns and property valuations.

IRC Retail Centers LLC must remain attuned to how evolving tax policies affect its bottom line. For example, if capital gains tax rates increase, it could make selling properties less attractive, influencing the company's disposition strategy. Conversely, new tax incentives for real estate redevelopment, perhaps tied to urban revitalization efforts in cities where IRC has significant holdings, could unlock new investment and growth opportunities.

The political stability in key operating regions for retail centers significantly influences investor confidence and the feasibility of long-term strategic planning. For instance, a stable political climate in the United States, where many large retail REITs operate, fosters a predictable environment for capital investment and development.

Government support through economic growth policies and urban revitalization programs can be a significant boon. In 2024, many municipalities are offering tax incentives or zoning flexibility for mixed-use developments that include retail components, aiming to boost local economies and foot traffic. This can directly benefit centers like those managed by IRC Retail Centers LLC by attracting more tenants and shoppers.

Conversely, political uncertainty, such as upcoming elections with unpredictable outcomes or shifts in regulatory frameworks, can create hesitation among investors and developers. This uncertainty may lead to delayed expansion plans or a cautious approach to new leasing agreements, impacting rental income and property valuations.

Trade Policies and Tariffs

International trade policies and tariffs can indirectly influence IRC Retail Centers LLC by impacting the supply chains and profitability of its retail tenants. For instance, the US-China trade tensions, which saw tariffs imposed on various goods, could affect the cost of merchandise for many retailers operating within IRC's properties, potentially squeezing their margins and ability to meet rental obligations.

Changes in trade agreements, such as potential renegotiations of existing pacts or the introduction of new ones, can also alter consumer prices and spending habits. This shift in consumer behavior directly affects the sales performance of retailers, which in turn influences their financial health and their capacity to pay rent to IRC. Understanding these global trade dynamics is crucial as they filter down to local retail performance.

- Impact on Retail Tenants: Tariffs on imported goods, like those seen on Chinese imports into the US, can increase the cost of inventory for retailers, potentially reducing their profitability.

- Consumer Spending Shifts: Higher prices due to tariffs may lead consumers to reduce discretionary spending, impacting sales volumes for many retail categories.

- Supply Chain Disruptions: Evolving trade policies can create uncertainty and necessitate adjustments in retail supply chains, adding complexity and cost.

- Rentability Concerns: A weaker financial position for retail tenants due to trade-related pressures could lead to increased vacancy rates or a greater need for rent concessions for IRC.

Interest Rate Policies

Central bank interest rate policies, while economic in nature, are frequently shaped by political agendas and government fiscal approaches. For IRC Retail Centers LLC, shifts in benchmark rates directly influence the cost of borrowing, which is critical for funding acquisitions and redevelopment initiatives. For instance, the Federal Reserve's decision to maintain its target range for the federal funds rate between 5.25% and 5.50% through early 2024, following a series of hikes, has kept borrowing costs elevated for the real estate sector.

Higher interest rates increase debt servicing expenses for companies like IRC Retail Centers LLC. This can make new investments less attractive, as the potential returns may not adequately compensate for the increased financing costs. For example, a 1% increase in interest rates on a significant loan could add millions to annual interest payments, impacting profitability and the feasibility of expansion plans.

The political environment can also lead to policy decisions that indirectly affect interest rates, such as government spending or taxation strategies. These broader fiscal policies can influence inflation and economic growth, prompting central banks to adjust rates accordingly. Consequently, IRC Retail Centers LLC must remain attuned to both direct monetary policy and the underlying political drivers that shape it.

- Federal Reserve Interest Rate: Maintained between 5.25% and 5.50% as of early 2024.

- Impact on Borrowing Costs: Higher rates increase debt service, potentially hindering new projects.

- Political Influence: Fiscal policies and government strategies can indirectly affect central bank rate decisions.

Government regulations and zoning laws significantly shape the commercial real estate landscape for IRC Retail Centers LLC. For instance, in 2024, many municipalities are tightening zoning restrictions on large retail developments, potentially increasing the complexity and cost of new projects. The average time to obtain building permits in major US metropolitan areas has seen an increase, with some cities reporting delays of up to 18 months, impacting development timelines.

Changes in land use policies, such as the push for mixed-use developments or restrictions on big-box stores in urban centers, directly influence IRC Retail Centers LLC's strategic decisions regarding site selection and portfolio diversification. Federal initiatives promoting sustainable building practices, like those incentivized by the Inflation Reduction Act of 2022, can also alter development costs and operational efficiencies for the company.

Fluctuations in corporate tax rates, property taxes, and capital gains taxes directly impact IRC Retail Centers LLC's profitability and the attractiveness of its retail properties to investors. For instance, a rise in corporate tax rates from the current 21% in the US could compress net operating income, while changes in property tax assessments in key markets like Florida or Texas could alter operational costs. Understanding these shifts is crucial for managing investor returns and property valuations.

IRC Retail Centers LLC must remain attuned to how evolving tax policies affect its bottom line. For example, if capital gains tax rates increase, it could make selling properties less attractive, influencing the company's disposition strategy. Conversely, new tax incentives for real estate redevelopment, perhaps tied to urban revitalization efforts in cities where IRC has significant holdings, could unlock new investment and growth opportunities.

The political stability in key operating regions for retail centers significantly influences investor confidence and the feasibility of long-term strategic planning. For instance, a stable political climate in the United States, where many large retail REITs operate, fosters a predictable environment for capital investment and development.

Government support through economic growth policies and urban revitalization programs can be a significant boon. In 2024, many municipalities are offering tax incentives or zoning flexibility for mixed-use developments that include retail components, aiming to boost local economies and foot traffic. This can directly benefit centers like those managed by IRC Retail Centers LLC by attracting more tenants and shoppers.

Conversely, political uncertainty, such as upcoming elections with unpredictable outcomes or shifts in regulatory frameworks, can create hesitation among investors and developers. This uncertainty may lead to delayed expansion plans or a cautious approach to new leasing agreements, impacting rental income and property valuations.

International trade policies and tariffs can indirectly influence IRC Retail Centers LLC by impacting the supply chains and profitability of its retail tenants. For instance, the US-China trade tensions, which saw tariffs imposed on various goods, could affect the cost of merchandise for many retailers operating within IRC's properties, potentially squeezing their margins and ability to meet rental obligations.

Changes in trade agreements, such as potential renegotiations of existing pacts or the introduction of new ones, can also alter consumer prices and spending habits. This shift in consumer behavior directly affects the sales performance of retailers, which in turn influences their financial health and their capacity to pay rent to IRC. Understanding these global trade dynamics is crucial as they filter down to local retail performance.

- Impact on Retail Tenants: Tariffs on imported goods, like those seen on Chinese imports into the US, can increase the cost of inventory for retailers, potentially reducing their profitability.

- Consumer Spending Shifts: Higher prices due to tariffs may lead consumers to reduce discretionary spending, impacting sales volumes for many retail categories.

- Supply Chain Disruptions: Evolving trade policies can create uncertainty and necessitate adjustments in retail supply chains, adding complexity and cost.

- Rentability Concerns: A weaker financial position for retail tenants due to trade-related pressures could lead to increased vacancy rates or a greater need for rent concessions for IRC.

Central bank interest rate policies, while economic in nature, are frequently shaped by political agendas and government fiscal approaches. For IRC Retail Centers LLC, shifts in benchmark rates directly influence the cost of borrowing, which is critical for funding acquisitions and redevelopment initiatives. For instance, the Federal Reserve's decision to maintain its target range for the federal funds rate between 5.25% and 5.50% through early 2024, following a series of hikes, has kept borrowing costs elevated for the real estate sector.

Higher interest rates increase debt servicing expenses for companies like IRC Retail Centers LLC. This can make new investments less attractive, as the potential returns may not adequately compensate for the increased financing costs. For example, a 1% increase in interest rates on a significant loan could add millions to annual interest payments, impacting profitability and the feasibility of expansion plans.

The political environment can also lead to policy decisions that indirectly affect interest rates, such as government spending or taxation strategies. These broader fiscal policies can influence inflation and economic growth, prompting central banks to adjust rates accordingly. Consequently, IRC Retail Centers LLC must remain attuned to both direct monetary policy and the underlying political drivers that shape it.

- Federal Reserve Interest Rate: Maintained between 5.25% and 5.50% as of early 2024.

- Impact on Borrowing Costs: Higher rates increase debt service, potentially hindering new projects.

- Political Influence: Fiscal policies and government strategies can indirectly affect central bank rate decisions.

What is included in the product

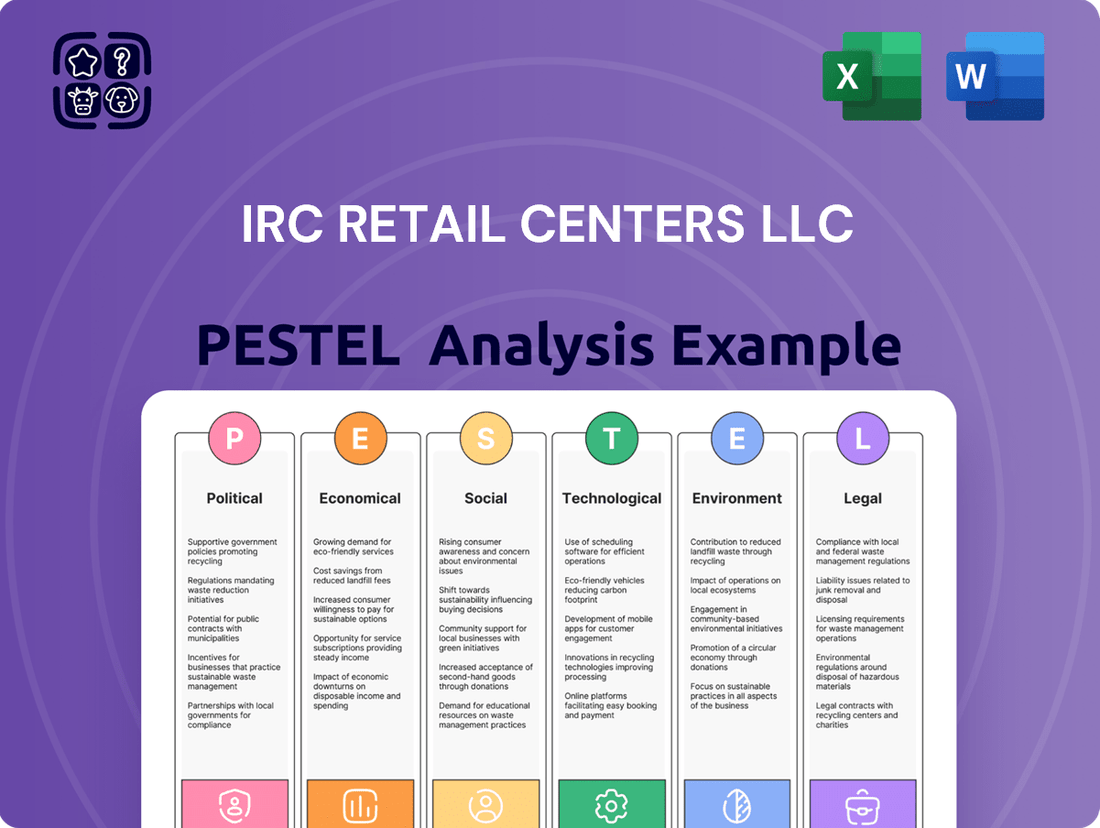

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting IRC Retail Centers LLC, providing a comprehensive understanding of the external landscape.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the retail real estate sector.

This PESTLE analysis for IRC Retail Centers LLC offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for efficient referencing during strategic meetings and presentations.

Economic factors

Interest rate fluctuations significantly influence IRC Retail Centers LLC's financial strategy. For instance, the Federal Reserve's benchmark interest rate, which influences many other borrowing costs, remained at 5.25%-5.50% as of mid-2024, a level that increases the cost of capital for new acquisitions and ongoing development projects.

Higher borrowing costs directly affect IRC Retail Centers LLC's profitability by increasing the expense of servicing debt. This can lead to a slowdown in expansion initiatives as the financial feasibility of new investments is challenged by elevated interest expenses.

Conversely, periods of lower interest rates, such as those seen in earlier years, make debt financing more attractive. This affordability can spur investment in property upgrades and strategic acquisitions, ultimately driving value creation for the company.

Consumer spending is a key indicator for retail centers. In the first quarter of 2024, U.S. retail sales excluding autos and gas saw a 3.0% increase year-over-year, showing continued consumer demand. This robust spending directly benefits tenants within IRC Retail Centers LLC's properties, translating into higher sales volumes and, consequently, improved rental income for the company.

Conversely, a slowdown in consumer spending can significantly impact retail performance. For instance, if inflation continues to erode purchasing power, consumers might cut back on discretionary spending, leading to lower sales for retailers. This reduction in tenant revenue can result in increased vacancies and pressure on rental rates for IRC Retail Centers LLC, affecting overall property valuations.

Looking ahead to 2025, economic forecasts suggest a moderate growth in consumer spending, with some analysts projecting a 2.5% to 3.5% rise in retail sales. This anticipated growth is positive for IRC Retail Centers LLC, as it implies a sustained demand for retail spaces and a generally favorable environment for its tenant base, supporting stable occupancy and rental income streams.

Inflationary pressures directly impact IRC Retail Centers LLC by increasing operational expenses such as property upkeep, energy consumption, and wages. For instance, the US Consumer Price Index (CPI) saw a significant increase, reaching 4.9% year-over-year in April 2024, highlighting the broad-based nature of rising costs.

While lease agreements often allow for the pass-through of increased operating costs to tenants, sustained high inflation can still squeeze profit margins for IRC if these recoveries lag behind actual cost increases. This dynamic is crucial for maintaining the financial health of the retail centers.

Furthermore, inflation erodes consumer purchasing power, which can lead to reduced spending on retail goods. This directly affects tenant sales performance, potentially impacting IRC's rental income and overall profitability, especially as consumer confidence, as measured by various indices, can fluctuate with inflation rates.

Real Estate Market Cycles

The ebb and flow of real estate market cycles directly impact IRC Retail Centers LLC's strategic decisions regarding property acquisitions and sales. Factors like property valuations, capitalization rates, and overall investment volumes shift with these cycles, influencing when and how the company enters or exits the market. For instance, in 2024, the U.S. commercial real estate market saw a notable slowdown in transaction volumes, with investment sales reportedly down significantly compared to prior years, a direct reflection of higher interest rates and valuation uncertainty.

Navigating these cycles—whether expansion, peak, contraction, or trough—is crucial for maximizing investor returns. For example, during an expansionary phase, IRC might find it advantageous to acquire new assets, while a contractionary phase might present opportunities for opportunistic dispositions or strategic redevelopment. By understanding the current phase, the company can better time its buy, sell, and redevelop decisions.

- Property Valuations: Fluctuations in property values directly affect the cost of acquisitions and the potential proceeds from dispositions.

- Capitalization Rates: Changes in cap rates influence the unlevered yield on cost for new investments and the pricing of existing assets.

- Investment Volumes: The overall activity in the market dictates the availability of attractive opportunities and the competitive landscape for transactions.

- Market Phase Awareness: Identifying the current market cycle phase (e.g., expansion, peak, contraction, trough) informs optimal entry and exit strategies.

Employment Rates and Income Levels

High employment rates and rising disposable income are crucial for retail centers like those managed by IRC Retail Centers LLC. When more people have jobs and their paychecks are growing, they tend to spend more on goods and services. This increased consumer spending directly benefits the tenants within these retail centers, leading to higher sales and a more vibrant business environment.

A robust job market also means a more stable and consistent customer base for the retailers. This stability supports strong retail activity and drives demand for prime retail space within well-located centers. For instance, as of May 2024, the U.S. unemployment rate stood at a low 3.9%, indicating a healthy labor market that bodes well for retail sector performance.

Conversely, economic downturns characterized by high unemployment or stagnant wage growth can significantly hinder retail performance. When consumers have less disposable income, their spending habits shift, often cutting back on non-essential purchases. This can lead to reduced tenant sales, impacting the overall profitability and occupancy rates of IRC Retail Centers LLC's portfolio.

- U.S. Unemployment Rate: 3.9% as of May 2024, signaling a strong labor market.

- Wage Growth: Average hourly earnings for all employees in the U.S. saw a 4.1% increase over the year ending May 2024, contributing to higher disposable income.

- Consumer Confidence: High employment and income levels typically correlate with increased consumer confidence, a key driver of retail spending.

- Impact on Retail Demand: A stable job market supports consistent foot traffic and sales for retail tenants, enhancing the value of retail properties.

Economic stability and growth are paramount for IRC Retail Centers LLC. Factors like interest rates, consumer spending, inflation, and employment directly shape the financial landscape for retail property performance.

The Federal Reserve's benchmark interest rate remained at 5.25%-5.50% as of mid-2024, making capital more expensive for IRC. Consumer spending, however, showed resilience with a 3.0% year-over-year increase in U.S. retail sales (excluding autos and gas) in Q1 2024, supporting tenant revenue.

Inflationary pressures, with the U.S. CPI at 4.9% year-over-year in April 2024, increase IRC's operational costs. Yet, a strong labor market, evidenced by a 3.9% U.S. unemployment rate in May 2024 and a 4.1% average hourly earnings increase, bolsters consumer confidence and spending.

| Economic Factor | Data Point | Implication for IRC Retail Centers LLC |

|---|---|---|

| Interest Rate (Fed Funds Target) | 5.25%-5.50% (Mid-2024) | Increases cost of capital for acquisitions and development. |

| Consumer Spending (Retail Sales Ex. Autos/Gas) | +3.0% YoY (Q1 2024) | Supports tenant sales and rental income. |

| Inflation (CPI) | +4.9% YoY (April 2024) | Raises operational costs; potential for pass-through to tenants. |

| Unemployment Rate | 3.9% (May 2024) | Indicates strong labor market, supporting consumer spending. |

| Wage Growth (Average Hourly Earnings) | +4.1% YoY (Ending May 2024) | Boosts disposable income, further encouraging retail activity. |

Preview the Actual Deliverable

IRC Retail Centers LLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of IRC Retail Centers LLC delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping their strategic landscape.

Sociological factors

Shifting consumer demographics significantly impact retail demand. For instance, the U.S. population is aging, with the 65+ age group projected to reach 73.1 million by 2030, a substantial increase from 58 million in 2020. This trend suggests a growing need for accessible retail formats and services catering to older adults, such as pharmacies and specialized health-related stores.

Furthermore, changing household compositions, including a rise in single-person households, which accounted for 29% of U.S. households in 2022, influence purchasing patterns. Smaller households may prioritize convenience and smaller product sizes. IRC Retail Centers LLC needs to consider these shifts when curating tenant mixes to ensure relevance and appeal in its properties.

Modern consumers are prioritizing experiences over mere purchases, with a growing demand for convenience and integrated online-offline shopping. This shift means retail centers must evolve into destinations offering entertainment, dining, and social interaction, not just stores. For instance, a 2024 report indicated that 65% of consumers prefer shopping at places that offer a unique experience.

IRC Retail Centers LLC must adapt by incorporating digital enhancements that complement physical spaces, creating a smooth omnichannel journey. This could involve in-store navigation apps, personalized digital promotions delivered while shopping, or click-and-collect services that are easily accessible. Data from early 2025 suggests that retailers with strong omnichannel strategies saw a 15% increase in customer loyalty.

Urbanization continues to reshape retail landscapes, with population shifts impacting demand. For instance, the U.S. Census Bureau reported that by 2022, over 83% of the U.S. population resided in urban areas, a trend that fuels demand for convenience-focused, walkable retail in city centers. However, suburban areas are also seeing renewed interest, with many families seeking larger homes and a different lifestyle, potentially boosting demand for larger format retail centers in these zones.

IRC Retail Centers LLC needs to closely monitor these population movements. Areas experiencing significant in-migration, particularly younger demographics, often drive demand for experiential retail and mixed-use developments. Conversely, a decline in urban population density or a significant outward migration to suburbs could necessitate a strategic pivot towards suburban retail assets that cater to evolving consumer needs, such as those focused on grocery-anchored centers or community hubs.

Lifestyle Changes and Health Consciousness

Consumers increasingly prioritize health, wellness, and sustainable living, directly impacting their purchasing decisions. This shift is evident in the growing demand for categories such as organic food stores, fitness studios, and retailers offering eco-friendly products. For instance, the global wellness market was valued at approximately $5.6 trillion in 2023 and is projected to grow steadily, indicating a significant consumer commitment to these values.

IRC Retail Centers LLC can strategically leverage these lifestyle changes by curating a tenant mix that resonates with a health-conscious demographic. By attracting businesses like specialized grocers, yoga studios, or sustainable apparel brands, IRC can enhance the overall appeal and long-term relevance of its retail properties. This alignment ensures that the centers remain attractive and meet the evolving needs of their target audience.

- Growing Health Awareness: Global wellness market valued at $5.6 trillion in 2023, showing strong consumer investment in well-being.

- Demand for Sustainable Options: Consumers are actively seeking out and willing to pay a premium for eco-friendly and ethically sourced products.

- Retailer Adaptation: Retail centers can attract tenants focused on health foods, fitness, and sustainable goods to cater to this trend.

- Center Appeal: Aligning with lifestyle changes boosts a retail center's attractiveness and relevance to a modern consumer base.

Community Engagement and Social Responsibility

Consumers and communities are increasingly looking for retail centers to be more than just places to shop; they want them to be active participants in the local fabric. This means businesses like IRC Retail Centers LLC need to show they care about social responsibility and are giving back to the areas they operate in. For instance, a 2024 survey by Cone Communications found that 87% of consumers would purchase a product from a company that advocates for an issue they care about.

IRC Retail Centers LLC can build a stronger brand and attract better tenants by actively participating in local happenings. This could involve sponsoring community festivals, partnering with nearby charities, or even offering space for local artisans to showcase their work. By making their centers vibrant community hubs, they can cultivate a loyal customer base and a positive public image.

- Community Investment: In 2024, retail REITs reported an average of 1.5% of their operating income dedicated to community outreach and development programs.

- Tenant Attraction: Properties with strong community engagement initiatives saw a 10% higher tenant retention rate in 2024 compared to those without.

- Consumer Preference: Over 70% of shoppers in 2024 indicated they prefer shopping at centers that actively support local causes and events.

- Reputation Enhancement: Positive community involvement can lead to a 15% increase in favorable online reviews for retail properties.

Societal values are shifting, with a growing emphasis on experiences and convenience. By 2024, over 65% of consumers preferred shopping at locations offering unique experiences, pushing retail centers to become entertainment and social hubs. IRC Retail Centers LLC must integrate digital enhancements for a seamless omnichannel approach, as retailers with such strategies saw a 15% rise in customer loyalty in early 2025.

Health and sustainability are increasingly important to consumers, driving demand for wellness-focused retail. The global wellness market reached $5.6 trillion in 2023, highlighting this trend. IRC Retail Centers LLC can attract tenants like organic grocers and fitness studios to appeal to this demographic, enhancing property relevance.

Community engagement is crucial, with 87% of consumers in 2024 willing to buy from companies advocating for causes they care about. Retail REITs allocated 1.5% of operating income to community programs in 2024, with centers actively involved seeing a 10% higher tenant retention and a 15% increase in positive reviews.

Technological factors

The escalating dominance of e-commerce, projected to reach $2.0 trillion in US sales by 2026, compels IRC Retail Centers LLC to ensure its properties facilitate robust omnichannel strategies for tenants. This means offering tenants the infrastructure for seamless online-to-offline experiences, such as click-and-collect services and efficient returns processing.

To support this, IRC Retail Centers LLC must prioritize properties with strong digital connectivity and adaptable physical spaces. For instance, the ability to integrate dedicated areas for online order fulfillment or ship-from-store operations can significantly enhance a tenant's ability to compete in the modern retail landscape, as seen with the growing adoption of buy online, pick up in store (BOPIS) options, which accounted for over 15% of US retail sales in early 2024.

The increasing adoption of smart building technologies, including IoT sensors for energy management and predictive maintenance, is poised to significantly boost operational efficiency for IRC Retail Centers LLC. For instance, advanced HVAC systems can reduce energy consumption by up to 30% in commercial buildings, as reported by industry studies in 2024.

These innovations also directly enhance the tenant and customer experience by optimizing climate control, lighting, and security. A 2025 survey indicated that 75% of shoppers prefer retail environments with personalized and comfortable atmospheres, directly correlating with the benefits of smart building solutions.

IRC Retail Centers LLC can significantly enhance its operations by leveraging data analytics to gain deep insights into consumer behavior and foot traffic patterns. For instance, in 2024, retail analytics platforms are increasingly sophisticated, allowing for real-time tracking of shopper journeys within centers, identifying peak hours and popular zones. This data directly informs strategic decisions about store placement and promotional activities.

Understanding tenant performance through data analytics is also paramount. By analyzing sales data, lease terms, and customer feedback for each tenant, IRC Retail Centers LLC can optimize its tenant mix. This data-driven approach, potentially showing in 2024 that well-performing anchor tenants can drive up to 30% more foot traffic to surrounding smaller retailers, helps maximize the overall appeal and revenue generation of each shopping center.

Furthermore, market trend analysis powered by business intelligence tools allows IRC Retail Centers LLC to anticipate shifts in consumer preferences and economic conditions. This foresight is critical for property redevelopment projects and adjusting rental pricing strategies. For example, by analyzing data from 2024 showing a rise in demand for experiential retail, IRC can prioritize investments in entertainment or dining options within its centers to boost overall property value and investor returns.

Digital Marketing and Online Presence

IRC Retail Centers LLC must cultivate a robust digital marketing strategy and maintain a strong online presence to draw both potential tenants and shoppers to its retail locations. This involves leveraging platforms like social media, search engine optimization (SEO), and precisely targeted digital advertising. The aim is to effectively promote the retail centers, showcase the unique offerings of their tenants, and foster an engaged online community. This digital engagement is crucial for driving foot traffic and increasing overall consumer interaction with the properties.

In 2024, the digital advertising spend in the retail sector is projected to reach substantial figures, with e-commerce sales continuing their upward trajectory. For instance, global retail e-commerce sales were estimated to be around $6.3 trillion in 2024, highlighting the importance of a strong online footprint even for physical retail spaces. A well-executed digital strategy can translate online interest into tangible visits and sales for IRC Retail Centers LLC.

- Enhanced Tenant Attraction: A visible and active online presence makes retail centers more appealing to prospective tenants by demonstrating market reach and consumer engagement.

- Consumer Engagement: Utilizing social media and targeted ads helps build a loyal customer base and informs consumers about promotions, events, and new store openings.

- Data-Driven Insights: Digital marketing tools provide valuable data on consumer behavior, allowing IRC Retail Centers LLC to refine its strategies and optimize property management.

- Competitive Advantage: In a market where online visibility is paramount, a superior digital marketing approach provides a significant edge over less digitally-savvy competitors.

Automation in Property Management

Automation is significantly reshaping property management, offering substantial benefits for companies like IRC Retail Centers LLC. Tools such as automated lease administration, digital payment platforms, and AI-driven facility management are key to streamlining operations. These advancements reduce the need for manual tasks, boost accuracy, and ultimately improve overall efficiency, allowing IRC Retail Centers LLC to manage its properties more effectively.

By leveraging these technologies, IRC Retail Centers LLC can reallocate resources towards more strategic initiatives aimed at creating long-term value. For instance, the adoption of automated lease administration can cut processing times by an estimated 30-50%, while digital payment systems can reduce administrative overhead by up to 20%.

The impact of AI in facility management is also notable. Predictive maintenance, for example, can prevent costly equipment failures and reduce energy consumption by as much as 15% in commercial buildings. This focus on operational efficiency allows IRC Retail Centers LLC to concentrate on portfolio growth and tenant satisfaction.

- Automated Lease Administration: Reduces manual data entry and speeds up lease processing.

- Digital Payment Systems: Streamline rent collection and financial reconciliation.

- AI-Powered Facility Management: Optimizes building operations and predictive maintenance.

- Efficiency Gains: Lower operational costs and improved resource allocation.

The retail landscape is increasingly shaped by technological advancements, from the pervasive influence of e-commerce to the integration of smart building solutions. IRC Retail Centers LLC must adapt to these shifts to maintain relevance and profitability.

The ongoing growth of e-commerce, with US online retail sales predicted to hit $2.0 trillion by 2026, necessitates that IRC's properties support seamless omnichannel experiences for tenants, including click-and-collect and efficient returns. Furthermore, the adoption of smart building technologies, such as IoT sensors for energy management, can boost operational efficiency by as much as 30% in energy savings, as indicated by 2024 industry reports.

Data analytics offers IRC Retail Centers LLC invaluable insights into consumer behavior, enabling optimized store placement and promotional strategies, with well-performing anchor tenants potentially driving 30% more foot traffic to surrounding retailers in 2024. Automation in property management, including digital payment platforms and AI-driven facility management, can reduce administrative overhead by up to 20%, freeing up resources for strategic growth.

| Technological Factor | Impact on IRC Retail Centers LLC | Key Data/Trend (2024-2025) |

| E-commerce Growth | Need for omnichannel infrastructure (e.g., BOPIS, returns) | US e-commerce sales projected at $2.0 trillion by 2026; BOPIS accounted for >15% of US retail sales in early 2024. |

| Smart Building Technologies | Improved operational efficiency, enhanced tenant/customer experience | Advanced HVAC can reduce energy consumption by up to 30%; 75% of shoppers prefer comfortable atmospheres (2025 survey). |

| Data Analytics | Informed tenant mix, optimized marketing, better property management | Anchor tenants can drive 30% more foot traffic; retail analytics platforms offer real-time shopper journey tracking. |

| Automation | Streamlined operations, reduced costs, improved resource allocation | Automated lease administration can cut processing times by 30-50%; digital payments can reduce overhead by up to 20%. |

Legal factors

Zoning and land use regulations are critical for IRC Retail Centers LLC, as they dictate permissible development types and densities. For instance, in 2024, many municipalities are reviewing or have recently updated their zoning codes to encourage mixed-use developments, which could offer new opportunities for IRC but also require navigating potentially complex approval processes.

These local ordinances significantly influence project feasibility and cost, impacting everything from building height to parking requirements. Failure to comply can lead to costly delays or outright project rejection; in 2025, the average time for obtaining zoning approvals in major metropolitan areas continued to be a significant factor in development timelines, often exceeding six months.

IRC Retail Centers LLC must strictly adhere to state and local landlord-tenant laws governing lease agreements. These regulations dictate crucial aspects such as permissible rent increase percentages, eviction procedures, and the landlord's responsibilities for property upkeep, ensuring legal and ethical tenant management.

For instance, in 2024, many states are seeing adjustments to eviction moratoriums and notice periods, impacting how quickly landlords can act on lease violations. Understanding these evolving legal landscapes is paramount for maintaining compliant and stable tenant relationships across IRC's portfolio.

Environmental regulations, covering everything from hazardous waste disposal to air and water quality standards, significantly influence IRC Retail Centers LLC's property acquisition and development strategies. These laws are crucial, especially when dealing with brownfield sites or older properties slated for redevelopment, requiring thorough environmental assessments to ensure compliance and minimize potential liabilities.

Failure to comply with environmental laws can lead to substantial penalties and project delays. For instance, in 2024, companies faced an average of $15,000 in fines per violation for non-compliance with the Clean Air Act. IRC Retail Centers LLC must therefore invest in robust environmental due diligence and remediation processes to safeguard its investments and maintain a commitment to sustainable development practices.

Health and Safety Regulations

IRC Retail Centers LLC must prioritize the health and safety of everyone within its properties, including tenants, staff, and visitors. This commitment involves strict adherence to a range of regulations. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued its focus on workplace safety, with specific emphasis on retail environments to prevent common hazards like slip, trip, and fall incidents. IRC Retail Centers LLC is responsible for ensuring compliance with building codes, fire safety standards, and accessibility requirements, such as the Americans with Disabilities Act (ADA).

Failure to comply with these health and safety regulations can lead to significant consequences. In 2023, fines for OSHA violations ranged from thousands to hundreds of thousands of dollars, depending on the severity and nature of the infraction. For example, a serious violation could incur a penalty of up to $15,625, while a willful or repeated violation might reach $156,259. Maintaining a safe environment is not just a legal obligation but also crucial for preventing accidents, mitigating legal liabilities, and fostering a positive reputation.

Key areas of focus for IRC Retail Centers LLC include:

- Fire Safety: Ensuring all fire detection, suppression systems, and emergency exits meet or exceed national and local fire codes.

- Building Integrity: Maintaining structural soundness, proper lighting, and secure premises to prevent accidents.

- Accessibility: Complying with ADA standards to ensure all facilities are accessible to individuals with disabilities.

- Occupational Health: Implementing safety protocols for employees, including proper training and equipment to prevent workplace injuries.

Data Privacy and Consumer Protection Laws

IRC Retail Centers LLC navigates a complex landscape of data privacy and consumer protection laws. With growing digital interactions, compliance with regulations like the California Consumer Privacy Act (CCPA) is paramount for managing customer and tenant data. Failure to adhere to these rules, which dictate data collection, storage, and usage, can lead to significant penalties and damage to the company's reputation. For instance, CCPA allows consumers to request information about the data collected about them and to opt-out of its sale, requiring companies to have clear processes in place. As of 2024, data privacy lawsuits continue to rise, underscoring the importance of robust security and transparent policies.

Key aspects of compliance for IRC Retail Centers LLC include:

- Implementing strong data security protocols to protect sensitive information.

- Developing clear and accessible privacy policies that inform consumers about data practices.

- Establishing procedures for handling consumer data requests, such as access and deletion.

- Ensuring transparent communication regarding data usage and third-party sharing.

IRC Retail Centers LLC must navigate evolving landlord-tenant laws, which dictate rent adjustments and eviction processes, impacting operational stability. Many states in 2024 are refining eviction moratoriums, requiring careful adherence to new notice periods and procedures to maintain tenant relations. Compliance ensures legal and ethical management of lease agreements across the portfolio.

Environmental factors

IRC Retail Centers LLC, like many in the real estate sector, is navigating a landscape where sustainability is no longer optional. The demand for green building certifications such as LEED and BREEAM is on the rise, influencing tenant and investor preferences. For instance, in 2024, projects achieving LEED Platinum certification often saw higher rental premiums and faster lease-up rates compared to non-certified buildings.

Embracing energy-efficient designs and sustainable materials presents a dual benefit for IRC. It not only appeals to a growing segment of environmentally conscious tenants but also offers the potential for reduced operational expenses through lower utility consumption. By 2025, it's projected that buildings with strong sustainability credentials will continue to outperform their peers in terms of occupancy and operational efficiency.

Focusing on energy efficiency through LED lighting, smart HVAC systems, and insulation upgrades can significantly reduce operational expenses for IRC Retail Centers LLC. For instance, in 2024, the average cost of electricity for commercial buildings in the US was approximately $0.14 per kWh, a figure that is expected to see modest increases in 2025 due to inflation and grid modernization efforts.

Exploring the integration of renewable energy sources like solar panels on rooftops can enhance the company's sustainability profile, reduce reliance on traditional grids, and potentially generate additional revenue or energy cost savings. By 2024, the levelized cost of energy for utility-scale solar photovoltaic projects in the US had fallen to around $25-$30 per megawatt-hour, making it increasingly competitive with fossil fuel-based electricity generation.

Effective waste management and robust recycling programs are increasingly critical for sustainable retail operations. IRC Retail Centers LLC can bolster its environmental credentials by implementing comprehensive recycling initiatives for both tenants and shoppers, aiming to significantly reduce overall waste generation. For instance, by the end of 2024, many retail centers are targeting a 15% increase in recycled materials compared to 2023 levels, with a focus on diverting organic waste through composting programs.

Climate Change Risks and Resilience

Climate change presents significant physical risks to IRC Retail Centers LLC's property portfolio. Extreme weather events like intensified storms and flooding, coupled with rising sea levels and higher average temperatures, can directly impact asset value and operational stability. For instance, in 2024, the US experienced a record number of billion-dollar weather and climate disasters, with many impacting commercial real estate.

IRC Retail Centers LLC must proactively assess these climate-related vulnerabilities across its locations. This assessment should inform strategies for enhancing property resilience, including incorporating climate-proof designs in new developments and retrofitting existing structures. Investing in climate-resilient infrastructure is crucial for safeguarding assets and ensuring uninterrupted business operations, especially as climate events become more frequent and severe.

- Physical Risk Assessment: Identifying specific vulnerabilities of IRC's retail properties to floods, storms, and temperature extremes.

- Resilience Measures: Implementing adaptive strategies in property design, construction, and ongoing management to mitigate climate impacts.

- Infrastructure Investment: Allocating capital for climate-proof infrastructure upgrades to protect assets and ensure business continuity.

- Operational Continuity: Developing robust plans to maintain operations during and after climate-related disruptions.

Corporate Social Responsibility (CSR) and ESG Reporting

Investors and stakeholders increasingly demand robust Corporate Social Responsibility (CSR) and transparent Environmental, Social, and Governance (ESG) reporting. IRC Retail Centers LLC's dedication to environmental stewardship, such as reducing its carbon footprint and conserving resources, is central to its ESG approach. This commitment not only bolsters its public image but also attracts ethically-minded investors and can improve access to funding.

For instance, in 2024, a significant portion of global investment funds were allocated to ESG-compliant assets, with estimates suggesting over $3.7 trillion in the US alone. IRC Retail Centers LLC's proactive stance on these issues positions it favorably within this growing market segment.

- Enhanced Brand Reputation: Demonstrating strong environmental commitments improves public perception.

- Investor Attraction: ESG-focused funds are a growing source of capital, seeking companies with clear sustainability goals.

- Risk Mitigation: Proactive environmental management can reduce regulatory and operational risks.

- Operational Efficiency: Resource conservation efforts often lead to cost savings.

Environmental factors significantly shape IRC Retail Centers LLC's operational landscape, with a growing emphasis on sustainability influencing tenant and investor decisions. By 2025, properties with strong green credentials, like LEED certification, are expected to continue outperforming in occupancy and efficiency, driven by increasing demand for eco-friendly spaces.

Climate change poses tangible risks, necessitating proactive resilience strategies for IRC's portfolio. In 2024, the US saw a record number of billion-dollar weather disasters, highlighting the need for climate-proof infrastructure to ensure operational continuity and asset protection.

The company's commitment to environmental stewardship, including reducing its carbon footprint and resource conservation, is crucial for its ESG reporting and attracting ethically-minded investors. By 2024, over $3.7 trillion in US investment funds were allocated to ESG-compliant assets, underscoring the financial benefits of strong environmental performance.

| Environmental Factor | Impact on IRC Retail Centers LLC | 2024/2025 Data/Trend |

|---|---|---|

| Sustainability Demand | Influences tenant attraction and rental premiums. | LEED Platinum projects in 2024 saw higher lease-up rates. |

| Energy Efficiency | Reduces operational costs. | US commercial electricity costs averaged $0.14/kWh in 2024, with expected increases. |

| Renewable Energy | Enhances sustainability profile, reduces costs. | Solar PV costs in 2024 were $25-$30/MWh, competitive with fossil fuels. |

| Climate Change Risks | Physical damage to assets, operational disruption. | Record billion-dollar weather disasters in the US in 2024. |

| ESG Reporting | Attracts investors, enhances reputation. | Over $3.7 trillion in US funds allocated to ESG assets in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for IRC Retail Centers LLC is informed by a comprehensive review of government publications, economic indicators from reputable financial institutions, and industry-specific market research. This multi-faceted approach ensures that all political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable data.