IRC Retail Centers LLC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRC Retail Centers LLC Bundle

IRC Retail Centers LLC navigates a complex retail landscape where buyer bargaining power and the threat of substitutes significantly influence profitability. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping IRC Retail Centers LLC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The rising cost of essential building materials like steel, lumber, and concrete significantly impacts IRC Retail Centers LLC. For instance, lumber prices, which saw considerable volatility in 2023 and early 2024, have remained a key concern for new construction and renovation projects.

These elevated material expenses, exacerbated by ongoing supply chain issues and fluctuating energy prices, directly increase the cost for IRC Retail Centers LLC to undertake development or improvement work on its properties, thereby strengthening supplier bargaining power.

The construction industry, a key sector for IRC Retail Centers LLC's development projects, has been grappling with a significant shortage of skilled labor. This persistent challenge affects critical trades like electricians, plumbers, and carpenters, directly impacting project timelines and budgets.

This scarcity of qualified workers translates into higher wage demands, increasing overall labor costs for IRC Retail Centers LLC. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that median hourly wages for construction laborers increased by approximately 4.5% compared to the previous year, reflecting this tight labor market and driving up project expenses.

Consequently, IRC Retail Centers LLC may face potential delays in the completion of its retail development initiatives. These delays can lead to increased carrying costs for land and financing, as well as missed revenue opportunities from delayed store openings, thereby impacting the profitability and return on investment for its projects.

Suppliers of capital, like banks and private equity firms, wield considerable influence. This power is amplified by fluctuating interest rates and economic uncertainty, which can complicate securing funds for new developments. For instance, as of early 2024, the Federal Reserve maintained a target range for the federal funds rate, impacting borrowing costs across the economy.

While forecasts suggest a potential easing of interest rates, the cost of capital remains a critical determinant for the feasibility of real estate projects. Companies such as IRC Retail Centers LLC must carefully consider these financing costs when planning expansions or new ventures, as higher rates directly translate to increased project expenses and potentially lower returns.

Limited Land Availability for Acquisitions

The scarcity of prime land for retail center development, especially in sought-after urban and suburban locations, significantly bolsters the bargaining power of land sellers. This limited availability means IRC Retail Centers LLC faces heightened competition when pursuing acquisitions, directly impacting the cost of expanding its portfolio.

In 2024, the average price per acre for commercial land in high-demand metropolitan areas saw an increase, reflecting this constrained supply. For instance, in major growth corridors, land prices have escalated by an estimated 5-10% year-over-year, making strategic acquisitions more capital-intensive for companies like IRC Retail Centers LLC.

- Limited Land Supply: Prime retail land is a finite resource, particularly in economically vibrant regions.

- Increased Acquisition Costs: Sellers can command higher prices due to strong demand and restricted inventory.

- Competitive Market: IRC Retail Centers LLC competes with other developers for desirable land parcels, driving up prices.

- Impact on Expansion: Higher land acquisition costs can reduce the profitability or feasibility of new development projects.

Specialized Service Providers

For highly specialized services crucial to IRC Retail Centers LLC.'s operations, such as advanced property management software or sustainability consulting, suppliers can wield significant bargaining power. This is particularly true when their expertise is unique and the pool of comparable providers is small. For instance, a specialized sustainability consultant might charge a premium, impacting IRC Retail Centers LLC.'s operational expenses.

The bargaining power of these specialized service providers can translate into higher costs for IRC Retail Centers LLC. This is because the unique nature of their offerings means fewer alternatives are available, allowing them to dictate terms and pricing more effectively. As of early 2024, the demand for advanced proptech solutions continues to rise, potentially increasing the leverage of software providers.

- Unique Expertise: Providers of niche services like AI-driven tenant analytics or advanced energy efficiency retrofitting possess specialized knowledge that is difficult to replicate.

- Limited Competition: In markets where only a few firms offer a particular advanced service, their ability to negotiate favorable terms increases.

- Increased Operational Expenses: For IRC Retail Centers LLC., reliance on such specialized providers can lead to higher costs for essential services, impacting profitability.

- Supplier Dependence: If IRC Retail Centers LLC. depends heavily on a single specialized provider for critical functions, that supplier's bargaining power is amplified.

The bargaining power of suppliers for IRC Retail Centers LLC is influenced by several factors, including the cost of materials and labor, the availability of capital, and the scarcity of prime land. For instance, the U.S. construction industry faced a 6% increase in material costs during 2023, impacting development budgets.

Skilled labor shortages in construction, with wages rising approximately 4.5% in 2024 for construction laborers, also empower these suppliers. Furthermore, the cost of capital, influenced by Federal Reserve rate decisions in early 2024, directly affects IRC Retail Centers LLC's financing expenses.

The limited supply of prime retail land in desirable locations, with prices increasing 5-10% year-over-year in growth corridors during 2024, strengthens land sellers' positions. Similarly, specialized service providers with unique expertise, such as advanced proptech solutions in early 2024, can command higher prices due to limited competition.

| Factor | Impact on IRC Retail Centers LLC | 2023-2024 Data Point |

|---|---|---|

| Material Costs | Increased development and renovation expenses | 6% rise in construction material costs (2023) |

| Skilled Labor | Higher labor expenses and potential project delays | 4.5% increase in construction laborer wages (2024) |

| Cost of Capital | Increased financing costs for new developments | Federal Reserve target range for federal funds rate (early 2024) |

| Land Availability | Higher acquisition costs for prime locations | 5-10% year-over-year price increase for commercial land in growth corridors (2024) |

| Specialized Services | Potentially higher costs for unique expertise | Rising demand for advanced proptech solutions (early 2024) |

What is included in the product

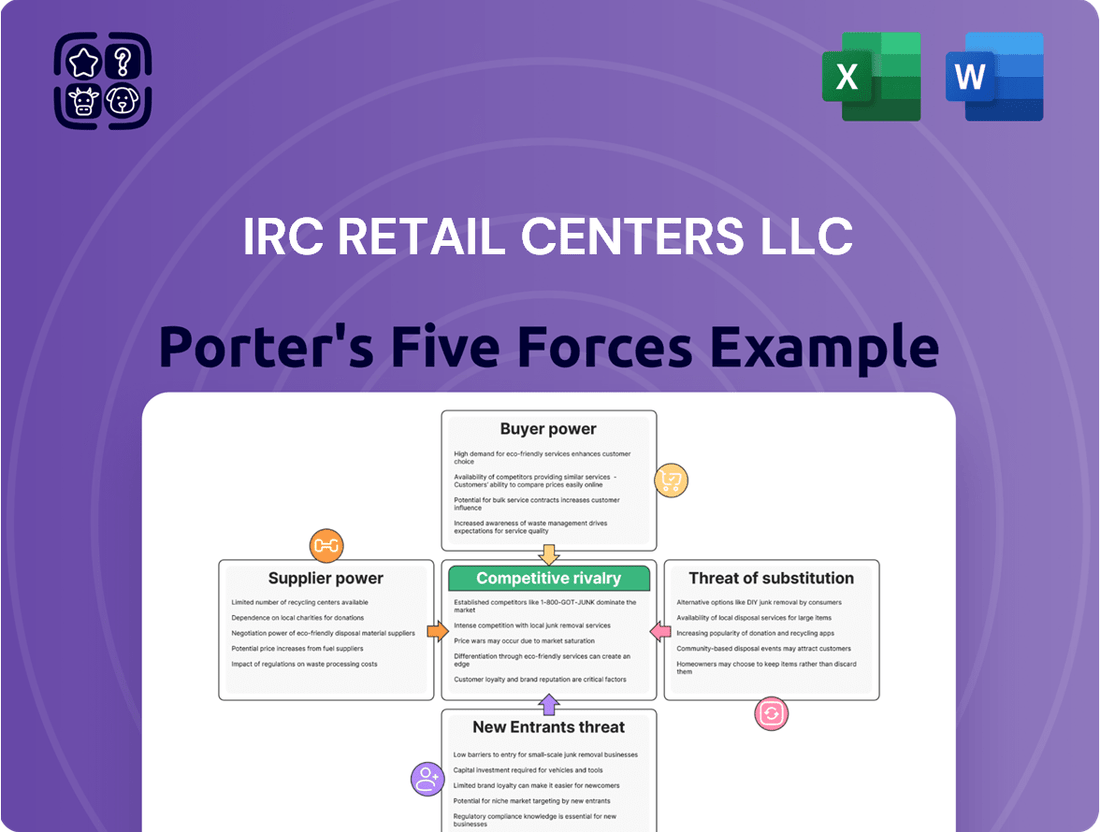

IRC Retail Centers LLC's Porter's Five Forces analysis reveals the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes, all within the context of the retail real estate market.

Instantly assess competitive threats and opportunities with a dynamic, interactive Porter's Five Forces model for IRC Retail Centers LLC.

Customers Bargaining Power

With retail availability rates hitting historic lows, especially for premium locations, tenants find themselves competing fiercely for desirable spaces. This scarcity of high-quality retail real estate significantly bolsters the negotiating power of property owners like IRC Retail Centers LLC.

In 2024, the U.S. retail vacancy rate hovered around 3.5%, a substantial decrease from previous years, indicating a landlord's market. This low availability allows IRC Retail Centers LLC to command higher rental rates and secure more advantageous lease agreements from prospective tenants.

The demand for experiential and necessity-based retail strongly influences the bargaining power of customers. For instance, grocery-anchored centers, fitness studios, and entertainment venues are highly sought after by consumers, driving consistent foot traffic. This means customers have a degree of choice and can exert pressure on pricing and offerings from retailers within these categories.

Tenants, particularly retailers, are increasingly prioritizing shopping centers that offer robust omnichannel capabilities. This means properties that can easily integrate features like dedicated curbside pickup zones and buy-online-pick-up-in-store (BOPIS) areas are highly sought after. For example, in 2024, a significant portion of retail sales are expected to be influenced by omnichannel strategies, making these features critical for tenant attraction.

The ability of a retail center to accommodate these evolving tenant needs directly impacts its appeal and rental potential. Properties that can facilitate seamless online-to-offline customer experiences are better positioned to attract and retain major tenants, potentially commanding higher lease values as a result. This trend is a key driver of tenant preference in the current retail landscape.

Longer Lease Terms by Tenants

Tenants are increasingly seeking longer lease terms, often committing to 10 to 15 years. This is driven by the high demand for desirable retail spaces, allowing them to lock in occupancy and predictable rental expenses. For IRC Retail Centers LLC, this translates into enhanced long-term stability and a more reliable stream of rental income.

- Tenant Demand: Limited availability of prime retail locations fuels tenant willingness to sign extended leases.

- Lease Duration: Typical commitments now range from 10 to 15 years, reflecting tenant commitment.

- IRC Retail Centers' Benefit: Longer leases provide IRC with greater occupancy certainty and predictable revenue.

- Market Trend: This demonstrates a shift towards longer-term commitments in the retail real estate sector.

Focus on Curated Tenant Mix

The bargaining power of customers, specifically tenants in IRC Retail Centers LLC's case, is influenced by the curated tenant mix. A well-chosen blend of national brands, local boutiques, entertainment, and essential services draws more shoppers, directly benefiting existing tenants by increasing their foot traffic and sales. This synergy makes IRC's properties more attractive, giving them leverage in lease negotiations.

IRC Retail Centers LLC's strategic tenant selection is crucial. By creating vibrant, destination-worthy shopping environments, they enhance the overall appeal of their centers. For example, in 2024, retail centers that successfully integrated experiential elements and a diverse tenant base saw an average increase of 7% in tenant retention rates compared to those with a less dynamic mix.

- Tenant Attraction: A diverse and complementary tenant mix attracts a broader customer base, increasing sales potential for all occupants.

- Foot Traffic Enhancement: Popular anchor tenants and unique retailers drive consistent foot traffic, a key benefit for smaller shops.

- Property Value: Successful curation elevates the desirability and perceived value of the retail space, strengthening IRC's position.

- Lease Stability: Tenants benefit from increased sales and a strong retail ecosystem, leading to greater lease stability and a reduced need to seek alternatives.

The bargaining power of customers, in this context referring to tenants, is significantly shaped by the overall market conditions and the specific offerings of IRC Retail Centers LLC. When prime retail spaces are scarce, as seen with U.S. retail availability rates around 3.5% in 2024, landlords like IRC gain leverage. This scarcity means tenants are more willing to accept terms and conditions that favor the property owner, including longer lease commitments, often 10 to 15 years, to secure desirable locations.

Furthermore, the demand for omnichannel capabilities and a well-curated tenant mix directly influences tenant satisfaction and their willingness to negotiate. Centers that provide integrated online-to-offline experiences and foster a synergistic environment with diverse, popular retailers can attract and retain tenants more effectively. This strong tenant appeal, evidenced by higher retention rates for centers with dynamic mixes, allows IRC Retail Centers LLC to negotiate from a position of strength.

| Factor | Impact on Tenant Bargaining Power | IRC Retail Centers LLC's Position |

|---|---|---|

| Retail Availability (2024) | Low availability (approx. 3.5% vacancy) reduces tenant power. | Strengthens IRC's ability to dictate lease terms. |

| Lease Duration Demand | Tenants seeking 10-15 year leases indicates commitment, but also a need to secure space. | Provides IRC with long-term revenue stability. |

| Omnichannel Integration | Tenants prioritizing these features may have more leverage if IRC offers them. | IRC's ability to provide these enhances its attractiveness, potentially mitigating tenant power. |

| Tenant Mix Curation | A strong mix enhances tenant sales and reduces their need to renegotiate. | Increases tenant retention and IRC's negotiating leverage due to property desirability. |

What You See Is What You Get

IRC Retail Centers LLC Porter's Five Forces Analysis

This preview shows the exact IRC Retail Centers LLC Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape for the company. You'll gain comprehensive insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the retail centers industry. This professionally formatted document is ready for your immediate use, providing a thorough understanding of the strategic factors influencing IRC Retail Centers LLC's market position.

Rivalry Among Competitors

The retail real estate market is intensely competitive, with vacancy rates hitting historic lows. For instance, U.S. retail vacancy stood at approximately 3.7% in Q1 2024, a figure that has been steadily declining. This scarcity of desirable, well-located retail space means that properties managed by companies like IRC Retail Centers LLC are in high demand from potential tenants.

This strong tenant interest directly translates into upward pressure on rental rates and enhanced property valuations. As a result, IRC Retail Centers LLC, by managing a portfolio of these sought-after locations, benefits from a competitive environment that favors landlords with quality assets.

Competitors are actively developing experiential and mixed-use properties, blending retail with dining, residential, and entertainment. This strategic shift means IRC Retail Centers LLC must continuously upgrade its portfolio and tenant offerings to align with changing consumer demands and maintain its competitive edge.

The competition is fierce for acquiring and redeveloping existing retail properties, as many developers aim to enhance value through modernization and strategic repositioning. This intense rivalry means that IRC Retail Centers LLC must consistently identify and execute high-potential acquisitions to stay ahead.

IRC Retail Centers LLC's strategy of focusing on strategic acquisitions and redevelopments is a cornerstone for preserving and expanding its market presence. This approach directly counters other real estate firms and Real Estate Investment Trusts (REITs) vying for similar opportunities, making each successful deal crucial.

In 2024, the retail property acquisition market saw significant activity, with transaction volumes reflecting strong investor interest in well-located, adaptable retail spaces. Companies like IRC Retail Centers LLC are navigating a landscape where the ability to effectively redevelop and reposition these assets is a key differentiator, directly impacting their competitive standing.

Investment in Property Enhancements and Technology

Competitive rivalry in the retail property sector is intense, with players like IRC Retail Centers LLC facing pressure to innovate. Rivals are channeling significant capital into upgrading properties with modern amenities, robust branding, and advanced digital wayfinding systems. This strategic investment aims to secure premium tenants and elevate the overall customer shopping journey.

To maintain its competitive edge, IRC Retail Centers LLC needs to consistently reinvest in its property portfolio. This commitment ensures that its retail environments remain appealing and attractive to both tenants and shoppers in a dynamic market. For instance, in 2024, the retail real estate sector saw continued investment in experiential retail, with many centers focusing on integrating entertainment and dining options to drive foot traffic.

- Tenant Attraction: Property enhancements directly influence the ability to attract and retain high-quality retail tenants.

- Customer Experience: Investments in technology, like digital wayfinding, improve shopper convenience and satisfaction.

- Market Differentiation: Unique amenities and strong branding help properties stand out from competitors.

- Ongoing Investment: The need for continuous capital expenditure to keep pace with evolving consumer preferences and competitor actions.

Regional Market Dynamics

Competitive rivalry within IRC Retail Centers LLC's operating regions, primarily the Central and Southeastern United States, is shaped by distinct local market dynamics. These regional variations in population growth and job creation directly impact tenant demand and the competitive intensity among retail property owners.

For instance, areas experiencing robust economic expansion often see higher demand for retail space, potentially moderating rivalry. Conversely, markets with slower growth may exhibit more aggressive competition for tenants. In 2024, the U.S. Census Bureau reported varying population growth rates across these states, with some Southeastern states showing above-average increases, suggesting localized shifts in competitive pressures.

- Regional Population Growth: Southeastern states, on average, experienced higher population growth in 2024 compared to some Central states, influencing local retail demand.

- Job Market Influence: Strong job growth in specific metropolitan areas within IRC's operating footprint directly correlates with increased consumer spending and tenant interest.

- Property Owner Competition: The number of competing retail properties and their occupancy rates in a given submarket are key indicators of rivalry intensity.

The retail property sector is highly competitive, with companies like IRC Retail Centers LLC constantly vying for prime locations and desirable tenants. This intense rivalry necessitates continuous investment in property upgrades and innovative tenant strategies to maintain market share.

In 2024, the demand for well-located retail spaces remained strong, pushing rental rates upward and increasing property values. This environment benefits landlords with quality assets, but also intensifies competition among property owners seeking to acquire and redevelop existing retail properties.

To stay ahead, IRC Retail Centers LLC must focus on strategic acquisitions and redevelopments, enhancing properties with experiential elements and modern amenities to attract and retain high-quality tenants amidst aggressive competition.

| Factor | Description | 2024 Impact |

|---|---|---|

| Tenant Demand | High demand for well-located retail space. | Upward pressure on rents, increased property values. |

| Competitor Strategy | Focus on experiential and mixed-use developments. | Need for IRC to upgrade portfolio and tenant mix. |

| Acquisition Rivalry | Intense competition for acquiring and redeveloping retail properties. | Requires IRC to execute high-potential acquisitions effectively. |

SSubstitutes Threaten

The escalating growth of e-commerce presents a substantial threat of substitutes for traditional retail centers like IRC Retail Centers LLC. Consumers are increasingly opting for online shopping, driven by convenience and a wider selection, particularly in categories like apparel and electronics. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, underscoring the significant shift in consumer behavior.

While physical retail has adapted, the seamless online experience, including personalized recommendations and easy returns, can diminish the perceived need for brick-and-mortar stores in many sectors. This trend directly impacts foot traffic and sales volumes for physical retail locations, forcing them to innovate and offer unique experiences to remain competitive.

The threat of substitutes for physical retail spaces is transforming rather than disappearing. Many brick-and-mortar locations are evolving into omnichannel hubs, serving as crucial points for online order fulfillment, handling returns, and facilitating exchanges. This shift means that while their role as direct sales channels might lessen, their importance within a retailer's broader supply chain and customer engagement strategy is actually growing.

The rise of direct-to-consumer (DTC) brands presents a significant threat of substitutes for traditional retail centers like IRC Retail Centers LLC. These online-first businesses bypass physical storefronts entirely, diminishing their need for brick-and-mortar leases. For instance, in 2023, DTC e-commerce sales in the US were projected to reach over $200 billion, highlighting the growing market share captured by these digital-native companies.

Shift to Experiential Retail and Services

The rise of experiential retail presents a significant threat of substitution for traditional brick-and-mortar spaces. As consumers increasingly seek unique experiences over mere transactions, physical retail centers must evolve beyond conventional shopping. For instance, in 2024, a notable trend saw a surge in demand for entertainment and dining options within malls, with reports indicating a 15% increase in consumer spending on these categories compared to the previous year.

Properties that fail to integrate engaging experiences risk becoming obsolete as consumers opt for alternatives that offer more than just products. This shift means that a retail center focused solely on apparel, for example, could be substituted by a mixed-use development offering live music, interactive workshops, or even immersive art installations. This evolving consumer preference directly impacts the demand for traditional retail footprints.

The threat is amplified as these experiential concepts can draw foot traffic away from less dynamic centers. Consider the success of concept stores that blend retail with cafes or event spaces, directly competing for consumer attention and time. By 2025, projections suggest that up to 30% of retail leasing activity could be attributed to non-traditional retail uses, highlighting the urgency for adaptation.

- Experiential Retail Growth: Physical retail is increasingly offering experiences, services, and entertainment to counter e-commerce.

- Consumer Preference Shift: Consumers are prioritizing unique experiences over traditional shopping, impacting demand for conventional retail formats.

- Adaptation Imperative: Retail properties must integrate experiential elements to remain competitive and avoid substitution by more engaging concepts.

- Market Data: In 2024, consumer spending on entertainment and dining within malls saw a 15% rise year-over-year, underscoring the trend.

Changing Consumer Preferences and Digital Experiences

Changing consumer preferences, heavily influenced by digital experiences and social media, pose a significant threat. Consumers now expect personalized online interactions and are drawn to trends showcased on platforms like TikTok and Instagram, often bypassing traditional brick-and-mortar browsing. This shift means physical retail centers, like those managed by IRC Retail Centers LLC, must offer more than just transactions; they need to provide unique, engaging experiences to compete with the convenience and curated content of digital alternatives.

For instance, a 2024 report indicated that 65% of consumers now discover new products through social media, a stark contrast to a decade ago. This highlights the growing power of digital channels to shape purchasing decisions. Retail centers that fail to integrate compelling in-person experiences, such as interactive displays or community events, risk losing foot traffic to e-commerce and digital marketplaces.

- Digital Influence: 65% of consumers discover new products via social media in 2024.

- Experiential Retail: Physical spaces must offer unique experiences to counter digital convenience.

- Preference Shift: Consumers increasingly value personalized digital interactions over traditional browsing.

The threat of substitutes for physical retail centers like IRC Retail Centers LLC is multifaceted, primarily driven by the growth of e-commerce and evolving consumer preferences for digital experiences. These digital alternatives offer unparalleled convenience and personalized engagement, directly impacting foot traffic and sales in brick-and-mortar locations.

Furthermore, the rise of direct-to-consumer (DTC) brands bypasses traditional retail infrastructure entirely, capturing market share. Experiential retail is also a significant substitute, as consumers increasingly seek unique activities and entertainment over simple transactions, forcing physical spaces to adapt or risk obsolescence.

| Substitute Type | Description | 2024 Impact/Trend |

|---|---|---|

| E-commerce | Online shopping offering convenience and wider selection. | Global sales projected over $6.3 trillion, indicating a major shift. |

| Direct-to-Consumer (DTC) Brands | Online-first businesses bypassing physical stores. | US DTC e-commerce sales projected over $200 billion in 2023. |

| Experiential Retail | Retail integrated with entertainment, dining, or unique activities. | 15% increase in consumer spending on entertainment/dining in malls year-over-year. |

Entrants Threaten

Entering the retail real estate sector, particularly for development and acquisition, demands immense capital. For instance, the average cost to build a new retail center in 2024 can range from $250 to $500 per square foot, depending on location and amenities. This makes it a formidable hurdle for newcomers.

The sheer expense of acquiring prime land, coupled with the escalating costs of construction materials and labor, creates a significant financial barrier. In 2023, construction costs saw an average increase of 5-10% year-over-year, further amplifying these entry barriers for potential competitors looking to establish a physical presence.

The scarcity of developable land, especially in prime urban and suburban locations, acts as a significant barrier to entry for new retail developers. This limited supply makes it challenging for newcomers to quickly build a competitive presence, giving an advantage to established entities like IRC Retail Centers LLC that possess existing land reserves or robust acquisition capabilities.

Stringent regulatory and zoning requirements act as a significant barrier to entry for new retail centers. Navigating complex and evolving zoning laws, building codes, and environmental regulations adds substantial cost and time to new development projects. For instance, in 2024, the average time to obtain building permits in major U.S. metropolitan areas could range from six months to over a year, with costs often escalating due to compliance needs.

These regulatory hurdles increase the complexity and risk for new entrants who may be unfamiliar with the specific requirements across different jurisdictions. The need for specialized legal counsel and consultants to manage compliance further inflates initial capital outlays, making it more challenging for smaller or less experienced developers to compete with established players who have existing relationships and expertise in these areas.

Need for Specialized Expertise and Relationships

Success in the retail property sector, encompassing ownership, management, and development, hinges on specialized expertise and established relationships. Newcomers face a significant hurdle in cultivating the deep industry knowledge, robust tenant connections, and proven operational skills that established players possess. This process is inherently time-consuming and demanding, creating a barrier to entry.

For instance, in 2024, the retail real estate market continued to emphasize experiential retail and omnichannel integration. This requires new entrants to not only understand traditional leasing but also to master evolving consumer behaviors and digital strategies. Building a portfolio of desirable tenants, like national brands or successful local boutiques, often takes years of networking and demonstrating a strong track record, a significant challenge for any new firm attempting to break into the market.

- Deep Industry Knowledge: Requires understanding market trends, zoning laws, and construction.

- Tenant Relationships: Cultivating strong ties with retailers is crucial for occupancy and stability.

- Operational Expertise: Efficient property management, marketing, and maintenance are key differentiators.

- Time and Capital Investment: Building these capabilities from the ground up demands substantial resources.

Established Brand Recognition and Tenant Relationships of Incumbents

Established brand recognition and deep-seated tenant relationships present a significant barrier for new entrants looking to compete with incumbents like IRC Retail Centers LLC. These existing companies have cultivated trust and loyalty with national and local retailers over years of successful property management and value delivery.

Newcomers would face a considerable challenge in replicating the established rapport and the proven track record that IRC Retail Centers LLC and similar entities possess. This entrenched network provides a competitive advantage, making it difficult for new players to secure desirable tenants and gain market traction quickly.

- Established Brand Recognition: Incumbents benefit from years of marketing and successful operations, making them a known and trusted entity in the retail property sector.

- Tenant Relationships: Long-standing partnerships with retailers create loyalty and make it harder for new entrants to attract and retain quality tenants.

- Track Record: A history of delivering value and managing properties effectively builds confidence, a difficult asset for new competitors to immediately possess.

The threat of new entrants in the retail real estate sector is moderate, primarily due to the substantial capital requirements and regulatory complexities involved in development and operation.

High upfront costs for land acquisition and construction, coupled with stringent zoning laws and permit processes, create significant financial and time-based barriers for newcomers. For example, average construction costs in 2024 can range from $250 to $500 per square foot, and obtaining permits can take six months to over a year in major U.S. cities.

Furthermore, established players like IRC Retail Centers LLC benefit from deep industry knowledge, existing tenant relationships, and brand recognition, which are difficult and time-consuming for new firms to replicate, further limiting the threat.

| Barrier Type | Description | 2024 Data/Example |

| Capital Requirements | High upfront investment for land and construction. | Construction costs: $250-$500/sq ft. |

| Regulatory Hurdles | Complex zoning, building codes, and permitting. | Permit acquisition: 6-12+ months. |

| Industry Expertise & Relationships | Need for market knowledge, tenant cultivation, and operational skills. | Experiential retail and omnichannel integration require specialized knowledge. |

| Brand Recognition & Track Record | Established trust and loyalty with retailers. | Difficult for new entrants to quickly build a strong tenant portfolio. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for IRC Retail Centers LLC is built upon a foundation of verified data, including publicly available financial statements, industry-specific market research reports from firms like IBISWorld, and relevant trade publications to capture the competitive landscape accurately.