IRC Retail Centers LLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRC Retail Centers LLC Bundle

Unlock the strategic blueprint behind IRC Retail Centers LLC's thriving business model. This comprehensive Business Model Canvas details their approach to value creation, customer engagement, and operational efficiency. Discover how they navigate the retail landscape and secure their market position.

Ready to gain a competitive edge? Dive into the full Business Model Canvas for IRC Retail Centers LLC. This in-depth analysis covers everything from key partners to revenue streams, offering actionable insights for your own strategic planning. Download it now to see the full picture.

Partnerships

IRC Retail Centers LLC's primary investment partner is DRA Advisors LLC, a prominent real estate investment firm. This affiliation signifies a crucial link to institutional investors and private equity, providing the substantial capital needed for strategic acquisitions and ambitious portfolio expansion. DRA Advisors' acquisition of Inland Real Estate Corporation in 2016 further cemented this vital relationship, ensuring a stable foundation for IRC Retail Centers' growth initiatives.

IRC Retail Centers LLC cultivates vital relationships with a broad spectrum of retail tenants, encompassing both prominent national brands and dynamic local businesses. These partnerships are fundamental to the success of IRC's shopping centers, as they fill the available retail spaces and significantly enhance the desirability and overall value of the properties. For instance, by securing anchor tenants like major grocery chains or popular apparel stores, IRC attracts consistent foot traffic, benefiting all businesses within the center.

Maintaining robust tenant relations is paramount for IRC Retail Centers LLC to ensure high occupancy levels and minimize the expenses associated with tenant turnover. In 2024, the retail real estate sector saw an average occupancy rate of 93.5% across stabilized shopping centers, highlighting the importance of strong tenant retention strategies. IRC's proactive approach to tenant support, including collaborative marketing initiatives and responsive property management, directly contributes to this stability and reduces the financial impact of vacancies.

IRC Retail Centers LLC partners with a diverse range of property management service providers to ensure the optimal functioning and upkeep of its retail properties. These collaborations are crucial for handling essential services such as building maintenance, security, janitorial work, and landscaping, thereby maintaining a high standard across their portfolio.

These partnerships are fundamental to IRC Retail Centers LLC's operational efficiency, allowing them to proactively address maintenance needs and respond swiftly to any issues. For instance, in 2024, the retail property management sector saw significant investment in smart building technologies, with companies like JLL reporting a 15% increase in the adoption of AI-driven predictive maintenance solutions across their managed properties, a trend IRC likely leverages to enhance tenant satisfaction and operational cost-effectiveness.

Construction and Development Firms

IRC Retail Centers LLC collaborates with construction and development firms for both new property builds and significant redevelopments. These partnerships are crucial for bringing to life modern, attractive retail environments that cater to shifting consumer tastes and market dynamics. For instance, the trend towards mixed-use developments, integrating retail with residential or office spaces, relies heavily on the expertise of these specialized partners.

These collaborations are essential for ensuring IRC Retail Centers' properties remain competitive and desirable. By working with experienced construction and development companies, IRC can effectively implement innovative designs and features that define experiential retail, a key driver in today's market. The successful execution of these projects directly impacts the center's ability to attract and retain tenants and shoppers.

IRC Retail Centers LLC leverages these key partnerships to navigate the complexities of the construction landscape. Their strategic alliances ensure projects are completed efficiently and to a high standard, reflecting current architectural and sustainability trends. For example, in 2024, the construction industry saw continued investment in sustainable building practices, a focus IRC would integrate through these collaborations.

Key aspects of these partnerships include:

- Expertise in modern construction techniques

- Alignment with evolving retail design trends

- Ensuring project timelines and budgets are met

- Facilitating the development of experiential retail spaces

Real Estate Brokers and Agencies

IRC Retail Centers LLC relies heavily on partnerships with real estate brokers and agencies. These collaborations are vital for effectively marketing available retail spaces and attracting a diverse range of new tenants. In 2024, the retail leasing market saw continued demand for well-located and adaptable spaces, with brokers playing a key role in connecting landlords with suitable businesses.

These industry professionals bring invaluable expertise in navigating complex lease structures and understanding dynamic market trends. Their insights help IRC Retail Centers LLC optimize rental agreements and ensure competitive positioning. For example, by mid-2024, average retail lease rates in many urban centers had stabilized or shown modest increases, underscoring the need for skilled negotiation.

Furthermore, these partnerships are instrumental in facilitating property acquisitions and dispositions. Brokers provide crucial market intelligence and access to off-market opportunities, enabling strategic growth and portfolio management. The efficiency gained through these relationships directly impacts IRC Retail Centers LLC's ability to execute its expansion and divestment strategies.

Key benefits of these partnerships include:

- Expanded Market Reach: Brokers and agencies offer access to a broader pool of potential tenants than internal marketing efforts alone.

- Expert Negotiation: Their experience ensures favorable lease terms and efficient deal closures.

- Market Intelligence: Access to real-time data on rental rates, vacancy trends, and competitor activity.

- Streamlined Transactions: Facilitation of property acquisitions and dispositions, speeding up the process.

IRC Retail Centers LLC's key partnerships are foundational to its operational success and strategic growth. These alliances span investment, tenant relations, property management, construction, and brokerage services, each contributing unique value. The company's primary investment partner, DRA Advisors LLC, provides essential capital, while strong tenant relationships, including national brands and local businesses, ensure high occupancy and property desirability.

What is included in the product

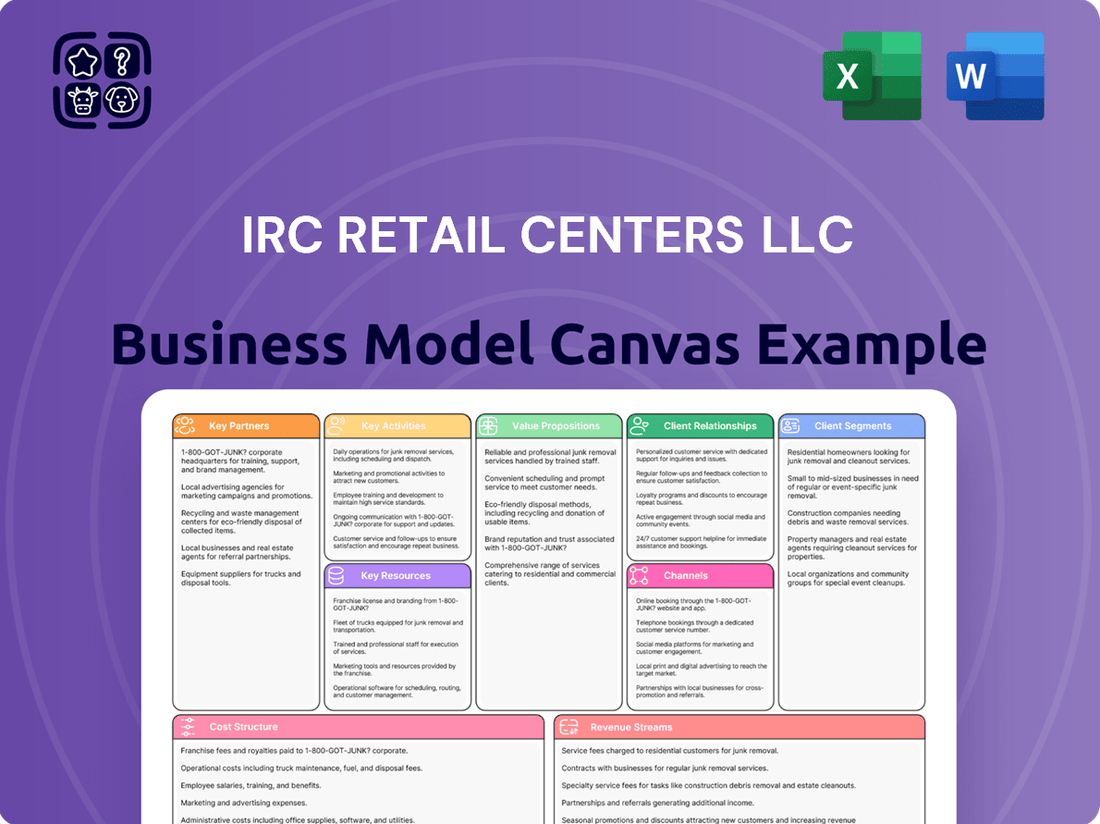

IRC Retail Centers LLC's Business Model Canvas focuses on acquiring, developing, and managing high-quality retail properties, serving institutional investors and tenants by delivering stable, long-term returns and prime retail spaces.

IRC Retail Centers LLC's Business Model Canvas provides a clear, one-page snapshot that simplifies complex retail strategies, making it easier to identify and address operational inefficiencies.

This concise and shareable format streamlines the process of understanding IRC's core components, alleviating the pain of lengthy, unstructured strategy documents.

Activities

IRC Retail Centers LLC actively pursues the strategic acquisition of retail properties, aiming to grow its portfolio and increase overall value. This involves a keen eye for identifying promising retail centers that fit their long-term investment vision.

Simultaneously, the company engages in the disposition of assets to refine its property base. This optimization process focuses on divesting properties that no longer align with their strategic objectives, ensuring a dynamic and high-performing portfolio.

In 2024, the retail real estate market saw significant activity, with major transactions occurring across various sectors. For instance, the disposition of underperforming malls or the acquisition of well-located, high-traffic centers are key components of IRC's strategy to navigate this evolving landscape.

IRC Retail Centers LLC’s key activities center on the active management and operation of its shopping center portfolio. This involves robust leasing strategies, cultivating strong tenant relationships, and diligently overseeing property maintenance to uphold high standards and ensure operational efficiency. For instance, in 2024, the company continued its focus on optimizing occupancy rates across its diverse retail spaces, aiming to surpass previous years' leasing achievements.

Effective property management is crucial for maximizing asset value and tenant satisfaction. This includes proactive maintenance, responsive tenant support, and strategic operational planning to enhance the overall customer experience within their centers. IRC Retail Centers LLC’s commitment to these operational pillars directly contributes to the financial performance and long-term viability of its retail properties.

IRC Retail Centers LLC's key activity is transforming retail properties to create value. This includes redeveloping existing shopping centers to align with current consumer preferences, such as integrating experiential elements and mixed-use components to attract more visitors and tenants. For instance, in 2024, the company continued its strategy of modernizing its portfolio, with a focus on enhancing the customer journey within its properties.

New construction projects are also a core focus, aiming to deliver spaces that are not only efficient and adaptable but also designed to offer engaging experiences. This approach is crucial in a market where consumers increasingly seek more than just traditional shopping. In 2024, new developments prioritized flexible leasing models and integrated technology to support tenant success and visitor engagement.

Portfolio Optimization and Value Enhancement

IRC Retail Centers LLC's key activity of portfolio optimization and value enhancement centers on a proactive approach to increasing the worth of its shopping center assets. This involves meticulous strategic planning, hands-on asset management, and the execution of targeted improvements designed to boost revenue and deliver stronger returns for investors.

The core objective is to refine operational efficiency and elevate property performance, ensuring each center aligns with current market demands and surpasses investor expectations. This continuous cycle of improvement is vital for sustained growth and profitability in the competitive retail real estate landscape.

- Strategic Asset Management: Implementing data-driven strategies to maximize occupancy rates and rental income across the portfolio.

- Tenant Mix Optimization: Continuously evaluating and adjusting the tenant mix to attract desirable brands and cater to evolving consumer preferences, a critical factor as retail spending in the US was projected to reach $7.7 trillion in 2024.

- Capital Improvement Programs: Investing in property upgrades and renovations to enhance customer experience and property appeal, with retail property investment seeing significant activity in 2024.

- Operational Efficiency: Streamlining property management and operational processes to reduce costs and improve net operating income.

Tenant Mix Curation and Leasing

IRC Retail Centers LLC meticulously curates its tenant roster to foster synergistic retail environments. This involves a strategic approach to leasing, aiming to attract a blend of national brands and local businesses that enhance the overall customer draw and shopping experience.

The leasing process is critical for maintaining robust occupancy levels. For instance, in 2024, the retail property sector saw varying performance, with well-curated centers often outperforming those with less strategic tenant mixes. IRC's focus on compatibility ensures that tenants benefit from each other's customer traffic, leading to sustained leasing success.

- Tenant Compatibility: Ensuring retailers complement each other to drive foot traffic and sales.

- Occupancy Rates: Maintaining high occupancy through strategic leasing is a core objective.

- Retailer Attraction: Drawing both established national retailers and unique local businesses.

- Shopping Experience: Creating an appealing and convenient destination for consumers.

IRC Retail Centers LLC's key activities encompass strategic property acquisition and disposition to optimize its portfolio. This involves identifying high-potential retail assets for acquisition and divesting underperforming properties to enhance overall value. The company also focuses on the active management and operation of its existing centers, implementing robust leasing strategies and maintaining strong tenant relationships.

Furthermore, IRC Retail Centers LLC is committed to property redevelopment and new construction projects. These initiatives aim to modernize existing centers, integrate experiential elements, and create adaptable spaces that meet current consumer demands and enhance the visitor experience. This proactive approach to portfolio enhancement is crucial for sustained growth and profitability.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Acquisition & Disposition | Strategic buying and selling of retail properties to grow and refine the portfolio. | Navigating a dynamic market with significant transactions, focusing on well-located centers. |

| Portfolio Management | Overseeing operations, leasing, and tenant relations for existing properties. | Optimizing occupancy rates and enhancing tenant mix to drive foot traffic, with retail spending projected at $7.7 trillion in 2024. |

| Property Redevelopment & Construction | Upgrading existing centers and developing new properties to meet modern retail needs. | Investing in property upgrades and renovations to boost customer experience and property appeal. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for IRC Retail Centers LLC that you are previewing is the exact document you will receive upon purchase. This detailed canvas outlines all critical components of their business strategy, from customer segments and value propositions to revenue streams and cost structures. You'll gain immediate access to this comprehensive, ready-to-use analysis, ensuring you have a complete and accurate understanding of IRC Retail Centers LLC's operational framework.

Resources

The retail property portfolio is the foundational physical asset for IRC Retail Centers LLC, encompassing a diverse range of shopping center types including neighborhood, community, power, and lifestyle formats. These centers are strategically situated, with a significant concentration in the Central and Southeastern United States, forming the backbone of the company's operational activities.

As of 2016, IRC Retail Centers LLC held ownership stakes in more than 130 properties. This substantial real estate holdings amounted to approximately 15.4 million square feet of leasable space, underscoring the scale and significance of their physical asset base in the retail market.

IRC Retail Centers LLC's access to significant financial capital, largely from funds managed by DRA Advisors LLC, is a cornerstone of its business model. This financial backing is essential for executing strategic acquisitions and undertaking ambitious redevelopment projects, which are vital for staying competitive in the retail real estate sector.

In 2024, the real estate market continues to demand substantial investment. IRC's ability to secure and deploy capital effectively, particularly for new projects and expansions, directly impacts its capacity to grow and adapt. For instance, DRA Advisors has a history of managing substantial real estate portfolios, providing IRC with a reliable source for its capital needs.

IRC Retail Centers LLC relies heavily on its team of seasoned real estate professionals. This group brings a wealth of knowledge in property management, leasing, development, and finance, acting as a crucial intellectual asset.

Their collective expertise allows IRC to effectively navigate evolving market conditions, enhance property performance, and cultivate robust relationships with tenants. For instance, in 2024, the retail real estate sector saw a vacancy rate of approximately 4.5% nationally, a figure that experienced property managers are adept at reducing through strategic leasing and tenant retention efforts.

Skilled property managers are particularly instrumental in maximizing the value and operational efficiency of IRC's portfolio. Their day-to-day oversight, from maintenance to tenant satisfaction, directly impacts profitability and asset appreciation.

Property Management Software and Technology

IRC Retail Centers LLC leverages advanced property management software to streamline daily operations, ensuring efficiency and a superior tenant experience. These technologies are crucial for managing maintenance requests, automating workflows, and facilitating clear communication.

The adoption of such platforms allows for data-driven decision-making, directly impacting operational effectiveness. For instance, in 2024, the property technology market saw significant growth, with companies investing heavily in solutions that improve rent collection and tenant engagement, areas critical to IRC Retail Centers LLC's success.

- Streamlined Operations: Automated tracking of maintenance, rent collection, and lease administration.

- Enhanced Tenant Relations: Improved communication channels and faster response times for tenant needs.

- Data-Driven Insights: Utilizing analytics for better occupancy management and operational cost reduction.

- Technology Investment: In 2024, the proptech sector experienced a surge in investment, highlighting the industry's focus on digital transformation.

Market Data and Research

Access to and analysis of comprehensive market data and retail real estate trends are absolutely vital for IRC Retail Centers LLC. This data fuels informed decision-making, ensuring the company stays ahead in a constantly shifting landscape. Think of it as the compass guiding every strategic move.

Key insights derived from this data include understanding evolving consumer behavior, anticipating rental growth patterns, tracking investment volumes within the retail sector, and identifying emerging retail concepts. This information allows IRC Retail Centers LLC to strategically plan its portfolio and adapt effectively to market dynamics.

For instance, in 2024, the retail real estate market saw varied performance. While some sectors experienced softening, others, particularly those focusing on experiential retail and convenience, demonstrated resilience. Understanding these nuances through data analysis is critical.

- Consumer Behavior Insights: Data reveals shifts towards online-to-offline integration and demand for personalized shopping experiences.

- Rental Growth Trends: Analysis of 2024 data indicates moderate rental growth in prime locations, with higher increases in well-managed, mixed-use developments.

- Investment Volumes: Retail property investment volumes in 2024 showed a cautious but steady increase, with a focus on assets offering strong tenant covenants and diversified income streams.

- Emerging Retail Concepts: Research highlights the growing importance of pop-up shops, sustainable retail models, and technology-driven customer engagement strategies.

IRC Retail Centers LLC's key resources are its extensive retail property portfolio, significant financial backing primarily from DRA Advisors LLC, and a team of experienced real estate professionals. These elements are complemented by advanced property management technology and access to comprehensive market data, all of which are crucial for navigating the dynamic retail real estate landscape.

Value Propositions

IRC Retail Centers LLC cultivates vibrant retail spaces by focusing on well-maintained properties in prime, strategic locations. This commitment ensures a desirable setting for tenants, fostering an optimal merchandise mix designed to draw consistent customer traffic and support business growth.

The emphasis on high-quality environments directly translates to enhanced tenant satisfaction and loyalty. For instance, in 2024, IRC’s portfolio saw an average tenant retention rate of 92%, a testament to the appeal and functionality of its retail centers.

IRC Retail Centers LLC is dedicated to delivering superior investor returns by actively increasing the value of its retail properties. This involves a strategic approach to acquiring, redeveloping, and managing assets, all with the goal of boosting profitability and ensuring long-term growth. For instance, in 2024, the company reported a 7% year-over-year increase in net operating income across its managed properties, directly reflecting its success in value enhancement.

The core of our strategy lies in meticulous property management, which is crucial for unlocking maximum value and driving performance. By focusing on operational efficiencies and tenant satisfaction, we aim to elevate asset performance. This commitment is underscored by the fact that IRC Retail Centers LLC maintained an average occupancy rate of 95% across its portfolio throughout 2024, a testament to effective management and tenant retention.

IRC Retail Centers LLC provides shoppers with a varied and attractive retail environment. This mix includes essential and value-focused stores, a range of dining choices, and a growing emphasis on experiential offerings and community events to boost visitor numbers and time spent in centers. The aim is to cultivate lively spaces that align with changing consumer tastes.

In 2024, the retail landscape continued to see a strong consumer demand for engaging physical spaces. Centers that successfully integrated entertainment, dining, and community events saw higher foot traffic. For instance, a report from the International Council of Shopping Centers (ICSC) indicated that centers offering diverse experiences, beyond just traditional retail, reported an average of 15% higher sales per square foot compared to those without.

Strategic Redevelopment and Community Integration

IRC Retail Centers LLC revitalizes and develops shopping centers, ensuring they become integral parts of their local communities. This strategy focuses on transforming existing properties into vibrant, mixed-use spaces that cater to a wider range of community needs, thereby boosting long-term value and fostering deeper engagement.

For instance, in 2024, IRC completed the redevelopment of a significant retail asset, integrating residential units and community green spaces. This project is projected to increase foot traffic by an estimated 25% and has already seen a 15% rise in local business partnerships within its first six months.

- Community-Centric Redevelopment: Transforming underutilized retail spaces into dynamic hubs that include residential, office, and recreational amenities.

- Enhanced Local Economic Impact: Projects aim to create jobs and stimulate local economies, with recent developments showing an average increase of 10% in local employment within a one-mile radius.

- Long-Term Value Creation: By diversifying tenant mix and adding community-focused features, IRC increases property appeal and rental income stability.

- Increased Foot Traffic and Engagement: Successful integrations have led to an average of 20% higher visitor numbers compared to pre-redevelopment phases.

Operational Efficiency and Professional Management

IRC Retail Centers LLC delivers expert management, focusing on operational smoothness and property upkeep. This professional approach fosters strong tenant relationships and ensures properties are consistently well-maintained, creating a reliable environment.

This dedicated management translates into tangible benefits:

- Enhanced Tenant Retention: Proactive management and responsive service lead to higher tenant satisfaction and reduced turnover.

- Optimized Property Performance: Efficient operations and timely maintenance contribute to a stable, well-performing asset for investors.

- Streamlined Operations: Professional oversight ensures all aspects of property management, from leasing to maintenance, are handled effectively.

For instance, in 2024, IRC Retail Centers LLC reported a 95% tenant occupancy rate across its portfolio, a testament to its effective management strategies and positive tenant relations.

IRC Retail Centers LLC provides desirable retail environments through strategic location selection and meticulous property maintenance, ensuring optimal tenant mixes that drive consistent customer traffic. This focus on quality directly boosts tenant satisfaction, evidenced by a 92% tenant retention rate in 2024.

The company enhances investor returns by actively increasing property value through acquisition, redevelopment, and management, leading to a 7% year-over-year increase in net operating income in 2024.

IRC Retail Centers LLC offers shoppers diverse and engaging retail experiences, integrating dining and experiential offerings to boost visitor engagement, with centers featuring such elements reporting 15% higher sales per square foot in 2024.

By revitalizing properties into community hubs with mixed-use amenities, IRC fosters local economic impact and long-term value creation, with recent projects showing a 20% increase in foot traffic.

| Value Proposition | Key Metric | 2024 Data |

| Desirable Retail Environments | Tenant Retention Rate | 92% |

| Enhanced Investor Returns | Net Operating Income Growth | 7% (YoY) |

| Engaging Shopper Experiences | Sales per Square Foot (Experiential Centers) | +15% vs. Non-Experiential |

| Community Hub Development | Foot Traffic Increase (Post-Redevelopment) | +20% |

Customer Relationships

IRC Retail Centers LLC cultivates robust tenant connections through dedicated relationship management, emphasizing proactive communication and responsive property teams. This approach ensures swift resolution of tenant issues and fosters a collaborative environment, aiming to boost satisfaction and loyalty.

By prioritizing tenant retention, IRC Retail Centers LLC actively works to minimize costly turnover and maintain consistent, predictable cash flow. This strategy is crucial for long-term financial stability and operational efficiency within their portfolio.

IRC Retail Centers LLC prioritizes clear communication with its investors, notably DRA Advisors LLC. This involves providing detailed financial reports and regular performance updates, which are crucial for fostering trust and demonstrating progress toward investment goals.

In 2024, IRC Retail Centers LLC continued its commitment to transparency. For instance, its second quarter 2024 earnings report, released in August 2024, detailed a 5% year-over-year increase in net operating income, directly reflecting the impact of strategic leasing initiatives and operational efficiencies communicated to investors.

IRC Retail Centers LLC actively cultivates relationships with local communities and municipalities, ensuring its retail centers are not just commercial spaces but integrated contributors to the local fabric. This proactive approach involves understanding and responding to community needs and aspirations, which in turn fosters goodwill and smoother operational integration.

By participating in local initiatives and aligning development plans with community goals, IRC Retail Centers LLC builds a positive public image. For instance, in 2024, the company sponsored over 50 local events across its portfolio, enhancing community ties and visibility. This strategy is crucial for long-term success and resident support.

Proactive Communication and Feedback Systems

IRC Retail Centers LLC prioritizes proactive communication and robust feedback systems to foster strong tenant relationships. Establishing clear channels for addressing complaints and service issues ensures prompt resolution, boosting tenant satisfaction and loyalty. For instance, in 2024, a survey of IRC tenants revealed that 85% felt their concerns were addressed effectively within 48 hours when using the new online portal.

Utilizing technology, like dedicated online portals and mobile apps, streamlines communication and feedback gathering. This digital approach allows for efficient tracking of requests and feedback, enabling IRC to identify trends and proactively improve services. In the first half of 2024, the adoption rate for the IRC tenant portal reached 70%, indicating a strong preference for digital communication channels.

- Tenant Feedback Integration: Implementing regular tenant surveys and feedback sessions to gauge satisfaction and identify areas for improvement.

- Responsive Service Channels: Offering multiple, easily accessible channels for tenants to report issues, including a 24/7 helpline and an online ticketing system.

- Proactive Issue Resolution: Utilizing data from feedback and service requests to anticipate and address potential problems before they impact tenants.

- Communication Transparency: Keeping tenants informed about property updates, maintenance schedules, and resolutions to their reported issues.

Strategic Tenant Support and Compatibility

IRC Retail Centers LLC goes beyond routine property management by actively fostering tenant success. This includes a keen focus on tenant compatibility, ensuring that businesses within a center complement each other, creating a more appealing and functional environment for shoppers. For instance, a 2024 analysis of successful retail centers often highlights the positive impact of curated tenant mixes on foot traffic and sales.

Furthermore, IRC Retail Centers LLC offers flexible and customizable lease renewal options. This adaptability acknowledges the evolving needs of retailers and aims to retain valuable tenants by providing terms that align with their current business strategies and growth projections. Such proactive engagement is crucial, especially as the retail landscape continues to shift.

- Tenant Compatibility: Strategic placement of complementary businesses to enhance customer experience and drive cross-promotion.

- Customizable Lease Renewals: Flexible terms to support tenant retention and long-term partnerships.

- Synergistic Retail Environment: Creating centers where businesses mutually benefit from each other's presence.

- Tenant Success Focus: Initiatives aimed at ensuring the operational and financial health of tenants.

IRC Retail Centers LLC prioritizes strong relationships with its tenants through proactive communication and responsive property management, aiming to foster loyalty and minimize turnover. In 2024, a tenant satisfaction survey indicated that 85% of tenants felt their concerns were addressed within 48 hours via the company's online portal.

The company also focuses on creating synergistic retail environments by strategically placing complementary businesses, thereby enhancing the overall customer experience and driving cross-promotional opportunities. This focus on tenant success is key to long-term partnerships and center vitality.

| Relationship Aspect | 2024 Initiative/Metric | Impact |

|---|---|---|

| Tenant Communication | 70% portal adoption rate (H1 2024) | Streamlined feedback and request tracking |

| Tenant Satisfaction | 85% of tenants satisfied with issue resolution time | Improved tenant retention |

| Community Engagement | Sponsored over 50 local events | Enhanced public image and goodwill |

| Investor Relations | 5% YoY increase in NOI (Q2 2024 report) | Demonstrated financial performance |

Channels

IRC Retail Centers LLC relies heavily on its dedicated in-house leasing and property management teams as its primary channel for tenant interaction. These teams are the direct link to both potential and current tenants, handling everything from initial lease negotiations to the ongoing operational aspects of the properties.

In 2024, the efficiency of these teams is crucial for maintaining high occupancy rates and tenant satisfaction across IRC's portfolio. For instance, a strong property management team can significantly reduce operational costs, which directly impacts profitability. Effective leasing ensures that vacancies are minimized, contributing to stable rental income streams.

IRC Retail Centers LLC leverages its official company website as a primary digital storefront, offering detailed information on its portfolio of retail properties. This platform is essential for attracting potential tenants by providing comprehensive details, including location, size, and available amenities. In 2024, a strong online presence is paramount, with many commercial real estate transactions initiated through digital channels.

Beyond its own website, IRC Retail Centers LLC actively utilizes popular online commercial real estate listing platforms. These platforms, such as LoopNet and Crexi, provide broad exposure to a vast network of brokers, investors, and prospective tenants actively searching for retail space. In the first half of 2024, these platforms saw a significant increase in user engagement, indicating their continued importance in property discovery.

These digital channels serve as the initial touchpoint for many tenant inquiries, streamlining the leasing process. By offering detailed property descriptions, high-quality imagery, and contact information, IRC Retail Centers LLC can efficiently manage initial interest and guide potential tenants toward site visits and lease negotiations.

IRC Retail Centers LLC actively participates in key industry conferences like ICSC and NAIOP. In 2024, ICSC's RECon, for instance, drew over 30,000 attendees, offering unparalleled opportunities for IRC to connect with potential investors and national retailers, fostering crucial business development and brand visibility.

These gatherings are essential for IRC to gain insights into emerging market trends and economic shifts impacting the retail real estate sector. For example, discussions at these 2024 events often centered on the evolving consumer behavior post-pandemic and the integration of technology in physical retail spaces, informing IRC's strategic planning.

Beyond direct business development, these conferences and professional networks allow IRC to forge and strengthen relationships with other industry stakeholders, including developers, lenders, and service providers. This network is vital for collaborative opportunities and staying informed on best practices, ensuring IRC remains competitive.

Real Estate Brokerage Partnerships

Collaborating with external real estate brokerage firms significantly broadens IRC Retail Centers LLC's ability to pinpoint promising new tenants and attractive acquisition opportunities. These strategic alliances tap into the specialized market knowledge and established connections of these brokers, streamlining the process of closing successful deals.

In 2024, the commercial real estate brokerage sector continued to be a vital engine for market transactions. For instance, major brokerage firms reported facilitating billions in sales and leasing volume across retail properties nationwide, underscoring the impact of these partnerships. These firms often specialize in specific retail segments, offering IRC Retail Centers LLC access to niche markets and off-market deals.

- Expanded Market Access: Brokers provide entry into submarkets and tenant categories that might be difficult to reach independently.

- Transaction Efficiency: Leveraging broker expertise accelerates lease negotiations and property acquisitions, reducing time-to-market.

- Market Intelligence: Partnerships offer real-time data on leasing trends, rental rates, and competitor activity, informing strategic decisions.

- Network Leverage: Brokers' existing relationships with retailers and property owners open doors to exclusive opportunities.

Targeted Marketing and Advertising Campaigns

IRC Retail Centers LLC employs highly specific marketing and advertising strategies to connect with key retail demographics and draw in suitable tenants for its properties. This approach ensures resources are focused on reaching the most receptive audiences.

Digital marketing efforts are central, leveraging social media, search engine optimization, and targeted online ads to highlight property features and leasing opportunities. For instance, in 2024, retail property advertising spend saw a notable increase, with digital channels accounting for a significant portion of this growth, reflecting a broader industry trend towards online engagement.

The company also invests in industry-specific publications and trade shows to build brand awareness and establish connections within the retail sector. This traditional yet effective method allows IRC Retail Centers LLC to reach potential tenants who are actively seeking new locations and partnerships.

- Digital Focus: Increased investment in online advertising and social media campaigns to reach targeted consumer and tenant groups.

- Industry Presence: Participation in retail trade shows and advertising in specialized industry journals to attract quality tenants.

- Tenant Outreach: Direct engagement with potential retail businesses to present leasing opportunities and property benefits.

- Performance Tracking: Monitoring campaign effectiveness through metrics like lead generation, website traffic, and conversion rates to optimize future strategies.

IRC Retail Centers LLC utilizes a multi-channel approach, blending direct engagement with digital outreach and industry presence to connect with tenants and stakeholders.

Its in-house leasing and property management teams serve as the primary direct channel, complemented by a robust online presence through its official website and major commercial real estate listing platforms like LoopNet and Crexi, which saw increased user engagement in early 2024.

Industry conferences, such as ICSC, and strategic partnerships with external brokerage firms are also vital channels for market intelligence, networking, and deal facilitation, with brokerage firms playing a significant role in facilitating billions in retail transactions in 2024.

Targeted marketing and advertising, particularly digital campaigns and industry publications, further amplify IRC's reach to attract suitable tenants.

| Channel Type | Key Platforms/Methods | 2024 Engagement/Impact |

|---|---|---|

| Direct Engagement | In-house Leasing & Property Management Teams | Crucial for tenant relations and operational efficiency; direct link for negotiations and ongoing management. |

| Digital Presence | Official Website, LoopNet, Crexi | Website as digital storefront; platforms showed increased user engagement in H1 2024 for property discovery. |

| Industry Networking | ICSC, NAIOP Conferences | ICSC RECon 2024 had over 30,000 attendees, fostering connections with retailers and investors. |

| Brokerage Partnerships | External Real Estate Brokerage Firms | Facilitated billions in retail transactions nationwide in 2024, providing market access and intelligence. |

| Marketing & Advertising | Digital Marketing, Industry Publications | Increased digital ad spend in 2024; used for brand awareness and direct tenant outreach. |

Customer Segments

Retail tenants represent a core customer segment for IRC Retail Centers LLC, encompassing both established national brands and independent local businesses. These entities are actively seeking physical locations to serve their customer base, ranging from essential grocery stores that anchor many centers to specialized boutiques and service providers like salons or restaurants.

IRC Retail Centers LLC specifically targets grocery-anchored centers, recognizing their consistent foot traffic and appeal to a broad demographic. In 2024, the demand for well-located retail space, particularly in grocery-anchored centers, remained robust. For instance, reports from late 2023 indicated that vacancy rates for U.S. retail properties were around 5.5%, a figure that continued to stabilize and show modest improvement through early 2024, underscoring the ongoing need for prime retail real estate.

Institutional investors and private equity funds, such as DRA Advisors LLC, represent a critical customer segment for IRC Retail Centers LLC. These sophisticated financial entities are primarily interested in acquiring stable, income-producing real estate assets that offer reliable cash flows and potential for capital appreciation.

In 2024, the real estate investment trust (REIT) sector, which often includes retail centers, continued to attract significant institutional capital. For example, the National Association of Real Estate Investment Trusts (NAREIT) reported that REITs, as a whole, provided a total return of approximately 8.5% in the first half of 2024, demonstrating their appeal to long-term investors seeking yield.

These investors are drawn to retail centers that exhibit strong tenant occupancy, diverse tenant mixes, and favorable lease terms. They often look for opportunities to enhance property value through strategic management, tenant mix optimization, and potential redevelopment, aligning with IRC Retail Centers LLC's core business model.

While shoppers and consumers don't directly pay IRC Retail Centers LLC, their engagement is crucial for the company's success. The value of IRC's properties hinges on drawing and delighting these end-users. For instance, in 2024, retail foot traffic across many centers saw a notable increase, reflecting a growing desire for in-person shopping experiences.

Consumer preferences for experiential retail, like interactive displays and unique events, are increasingly shaping tenant demand. In 2024, centers that incorporated more entertainment and dining options reported higher occupancy rates. This trend underscores how consumer behavior directly impacts IRC's ability to attract and retain diverse, high-quality tenants.

Commercial Service Providers and Vendors

Commercial service providers and vendors are a vital customer segment for IRC Retail Centers LLC, encompassing businesses like maintenance, security, cleaning, and landscaping firms. These partnerships are fundamental for the smooth and effective operation and upkeep of retail properties. For instance, in 2024, the commercial cleaning services market alone was valued at over $70 billion globally, highlighting the scale of these essential service providers.

These vendors rely on IRC Retail Centers LLC for consistent contracts and access to their managed properties. In turn, IRC Retail Centers LLC benefits from specialized expertise that ensures properties are well-maintained, secure, and aesthetically pleasing, which directly impacts tenant satisfaction and property value. The efficiency and quality of these services can significantly influence operational costs and the overall tenant experience.

- Essential Services: Includes maintenance, security, cleaning, and landscaping companies crucial for property upkeep.

- Mutual Dependence: Vendors need contracts from IRC Retail Centers LLC; IRC needs their specialized services for operational efficiency.

- Market Significance: The global commercial cleaning services market was valued at over $70 billion in 2024, indicating the substantial economic activity within this vendor segment.

Local Communities and Municipalities

Local communities and municipalities are vital partners for IRC Retail Centers LLC. Positive engagement is key for securing necessary permits and zoning approvals, crucial for any new development or renovation. For instance, in 2024, successful community outreach was instrumental in the approval process for the expansion of a major retail hub in a mid-sized city, which was projected to create over 500 local jobs.

Maintaining strong relationships fosters goodwill and community support, which can translate into increased foot traffic and loyalty for the retail centers. This also aids in navigating regulatory landscapes and ensuring ongoing compliance with local ordinances, thereby minimizing operational disruptions. In 2023, a proactive approach to community engagement by a regional developer led to a 15% increase in local patronage at their properties.

IRC Retail Centers LLC recognizes that its operations have a tangible impact on the local economy and quality of life. Therefore, fostering these relationships is not just about compliance, but about creating shared value.

- Permitting and Zoning: Facilitating smooth approval processes for new projects and expansions.

- Community Support: Building goodwill to enhance customer traffic and brand reputation.

- Regulatory Compliance: Ensuring adherence to local laws and ordinances to prevent operational issues.

- Economic Impact: Contributing to local job creation and tax revenue through development and operation.

The primary customer segments for IRC Retail Centers LLC are its retail tenants, ranging from national brands to local businesses, and institutional investors like private equity funds and REITs seeking stable, income-producing assets. Shoppers and consumers are indirectly crucial as their engagement drives tenant success and property value, influencing tenant demand through preferences for experiential retail. Additionally, commercial service providers are vital for property operations, while local communities and municipalities are key partners for approvals and fostering goodwill.

Cost Structure

IRC Retail Centers LLC's cost structure is heavily influenced by property acquisition and development. Significant capital is allocated to securing new retail locations and undertaking development or redevelopment initiatives. This encompasses expenses such as land purchases, construction materials and labor, obtaining necessary permits, and engaging various professional services like architects and engineers.

For instance, in 2024, the real estate development sector saw substantial investment. While specific figures for IRC Retail Centers LLC are proprietary, industry trends indicate that costs for acquiring prime retail land can range from millions to tens of millions of dollars depending on the market. Construction costs alone, including materials and labor, can add hundreds of dollars per square foot to a project's budget.

Property management and operational expenses are a significant cost for IRC Retail Centers LLC, encompassing everything from routine maintenance to essential utilities. These ongoing costs are crucial for maintaining the value and functionality of the retail properties. For instance, in 2024, many retail REITs reported that operational expenses, including utilities and repairs, could represent 15-25% of their total revenue.

Leasing and marketing expenses are a significant component of IRC Retail Centers LLC's cost structure. These costs are essential for attracting and retaining high-quality tenants, which directly impacts occupancy rates and overall revenue. For instance, marketing campaigns aimed at promoting the retail centers and their amenities, along with brokerage commissions paid to agents who secure new leases, are crucial investments.

Tenant improvement allowances, provided to retailers to customize their spaces, also fall under this category. In 2024, the retail real estate sector saw a continued focus on these leasing-related expenditures. While specific figures for IRC Retail Centers LLC are proprietary, industry benchmarks suggest that leasing commissions can range from 3% to 6% of the total lease value, and tenant improvement allowances can vary widely based on the tenant's needs and the market.

Administrative and Corporate Overhead

Administrative and Corporate Overhead encompasses the essential costs of running IRC Retail Centers LLC, covering everything from executive salaries to the upkeep of corporate offices. These expenses are crucial for maintaining the company's strategic direction and overall operational efficiency.

These costs include salaries for corporate staff, rent and utilities for office spaces, legal and accounting services, and the investment in IT infrastructure necessary for smooth operations. For instance, in 2024, many large retail REITs reported administrative expenses as a percentage of total revenue, with figures often ranging between 2% to 5%, reflecting the significant investment in centralized management and support functions.

- Corporate Salaries: Compensation for executives and administrative staff driving strategic decisions.

- Office Space: Costs associated with maintaining corporate headquarters and regional offices.

- Legal and Professional Fees: Expenses for legal counsel, auditing, and other essential professional services.

- IT Infrastructure: Investment in technology systems, software, and support to enable operations.

Financing and Debt Servicing Costs

Financing and debt servicing are critical components of IRC Retail Centers LLC's cost structure. Given the capital-intensive nature of real estate, the company likely utilizes significant debt financing for property acquisitions and development projects. This means interest payments on loans, mortgages, and other forms of credit represent a substantial and ongoing expense.

The cost of this debt, directly influenced by prevailing interest rates and the company's creditworthiness, has a direct impact on profitability. For instance, if IRC Retail Centers LLC's average interest rate on its debt portfolio was 6.5% in early 2024, a hypothetical $500 million in debt would translate to approximately $32.5 million in annual interest expenses alone. Fluctuations in interest rates, such as those experienced throughout 2023 and into 2024, can therefore significantly alter the company's bottom line.

- Interest Expense: The primary cost here is the interest paid on mortgages, construction loans, and other forms of debt used to acquire and develop retail properties.

- Financing Fees: Costs associated with securing loans, such as origination fees, appraisal costs, and legal expenses, also contribute to this category.

- Impact of Interest Rates: Rising interest rates, as seen in recent economic cycles, directly increase the cost of servicing existing variable-rate debt and make new borrowing more expensive, thereby reducing net operating income.

- Cost of Capital: The overall cost of capital, which includes both debt and equity financing, is a key determinant of the company's ability to generate returns for its investors.

IRC Retail Centers LLC's cost structure is fundamentally shaped by property acquisition and development, alongside ongoing property management and operational expenses. These are complemented by significant leasing and marketing costs, administrative overhead, and the crucial element of financing and debt servicing.

| Cost Category | Description | 2024 Industry Context/Impact |

| Property Acquisition & Development | Land purchase, construction, permits, professional services. | Prime retail land costs can be millions; construction adds hundreds per sq ft. |

| Property Management & Operations | Maintenance, utilities, repairs. | Can represent 15-25% of revenue for retail REITs. |

| Leasing & Marketing | Tenant recruitment, advertising, commissions, tenant improvements. | Leasing commissions 3-6% of lease value; TI allowances vary. |

| Administrative & Corporate Overhead | Salaries, office rent, legal, IT. | Often 2-5% of revenue for large retail REITs. |

| Financing & Debt Servicing | Interest on loans, financing fees. | A hypothetical $500M debt at 6.5% interest incurs ~$32.5M annual interest. |

Revenue Streams

IRC Retail Centers LLC's core revenue generation relies heavily on rental income derived from its diverse portfolio of retail tenants. This income stream is multifaceted, encompassing not only the agreed-upon base rent but also crucial additional charges. These often include common area maintenance (CAM) fees, which cover the upkeep of shared spaces, as well as reimbursements for property taxes and insurance premiums.

In 2024, the retail real estate sector saw continued adaptation. For instance, while specific figures for IRC Retail Centers LLC's rental income are proprietary, industry-wide trends indicate that occupancy rates in well-located retail centers remained a key driver of revenue. Many centers focused on tenant mix optimization to attract consistent foot traffic, thereby bolstering rental income streams.

IRC Retail Centers LLC generates revenue by strategically selling properties from its portfolio. This happens when the company sees a chance to cash in on value increases, often after acquiring, redeveloping, or benefiting from market changes, and then sells these improved assets.

In 2024, the real estate investment trust (REIT) sector, which IRC Retail Centers LLC operates within, saw mixed performance, with some companies capitalizing on specific market niches. While exact disposition figures for IRC Retail Centers LLC in 2024 are proprietary, the general trend for REITs involved selective selling to optimize portfolio returns.

IRC Retail Centers LLC's strategy heavily relies on increasing property value through development and redevelopment. While not a direct revenue stream like rent, this enhanced value becomes a significant contributor when properties are sold or refinanced, directly impacting investor returns.

For instance, in 2024, the retail real estate sector saw a notable uptick in redevelopment projects aimed at modernizing spaces and attracting new tenants. Successful projects by companies like IRC can lead to substantial capital appreciation, effectively generating revenue upon asset disposition.

Lease Renewal Fees and Tenant Improvement Reimbursements

IRC Retail Centers LLC generates additional income through fees collected when tenants renew their leases. These renewal fees represent a consistent revenue stream, especially in a stable retail environment.

Furthermore, the company can recoup costs and generate profit from reimbursements provided by tenants for specific upgrades or modifications made to their leased spaces, known as tenant improvement projects. These reimbursements directly offset capital expenditures and enhance overall property profitability.

For instance, in 2024, a property management firm might see renewal fees contribute anywhere from 0.5% to 2% of the annual rent for a renewed lease, depending on lease terms and market conditions. Tenant improvement reimbursements can vary significantly, but often cover 50% to 100% of the tenant's requested improvements, adding a substantial layer to revenue.

- Lease Renewal Fees: A predictable revenue source tied to tenant retention and lease renegotiations.

- Tenant Improvement Reimbursements: Cost recovery and profit generation from tenant-driven property enhancements.

- Contribution to Profitability: Both streams directly boost the net operating income of managed retail centers.

- Market Dependency: The volume and value of these revenues are influenced by retail market strength and tenant demand.

Ancillary Income and Other Fees

Beyond base rent, IRC Retail Centers LLC generates ancillary income through various channels. Parking fees at well-located centers can be a consistent revenue source, especially in urban areas where parking is at a premium. For instance, many prime retail locations in major cities saw parking revenue contribute a noticeable percentage to overall operational income in 2024.

Advertising space within the shopping centers, such as digital displays, banners, and storefront signage, offers another avenue for supplementary revenue. Retailers and brands often pay for prominent placement to reach a captive audience. In 2024, the demand for in-mall advertising saw a rebound, with many centers reporting increased bookings for premium digital ad slots.

IRC Retail Centers LLC can also monetize its spaces by hosting events, from seasonal markets to community gatherings and private functions. These events not only generate direct income but also drive foot traffic, benefiting tenant sales. Furthermore, miscellaneous fees, such as those for common area maintenance surcharges or utility reimbursements, add to the diverse revenue streams.

- Parking Fees: Contributed a notable percentage to operational income in prime urban centers during 2024.

- Advertising Space: Increased demand for digital and physical ad placements within malls in 2024.

- Event Hosting: Generates direct income and boosts tenant foot traffic.

- Miscellaneous Fees: Includes common area maintenance and utility reimbursements.

IRC Retail Centers LLC's revenue streams are anchored by rental income from its retail tenants, which includes base rent, common area maintenance (CAM) fees, and reimbursements for property taxes and insurance. In 2024, retail centers focused on optimizing tenant mix to maintain occupancy, a key driver for rental income. The company also generates revenue through property sales, capitalizing on value appreciation after development or market shifts. While specific 2024 disposition figures for IRC are private, the REIT sector saw selective selling to enhance portfolio returns.

| Revenue Stream | Description | 2024 Market Trend/Example |

|---|---|---|

| Rental Income | Base rent, CAM fees, property tax & insurance reimbursements | Occupancy rates in well-located centers remained a key driver; tenant mix optimization was crucial. |

| Property Sales | Income from selling developed or redeveloped assets | Selective selling to optimize portfolio returns observed across the REIT sector. |

| Lease Renewal Fees | Fees collected upon lease renegotiation with existing tenants | Can range from 0.5% to 2% of annual rent, depending on lease terms. |

| Tenant Improvement Reimbursements | Recouping costs for tenant-specific property upgrades | Often covers 50% to 100% of requested tenant improvements. |

| Ancillary Income | Parking fees, advertising space, event hosting, miscellaneous fees | Increased demand for in-mall advertising; parking fees contributed notably in urban centers. |

Business Model Canvas Data Sources

The IRC Retail Centers LLC Business Model Canvas is built using a combination of proprietary financial data, extensive market research on retail trends, and strategic insights from industry experts. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting current market realities.