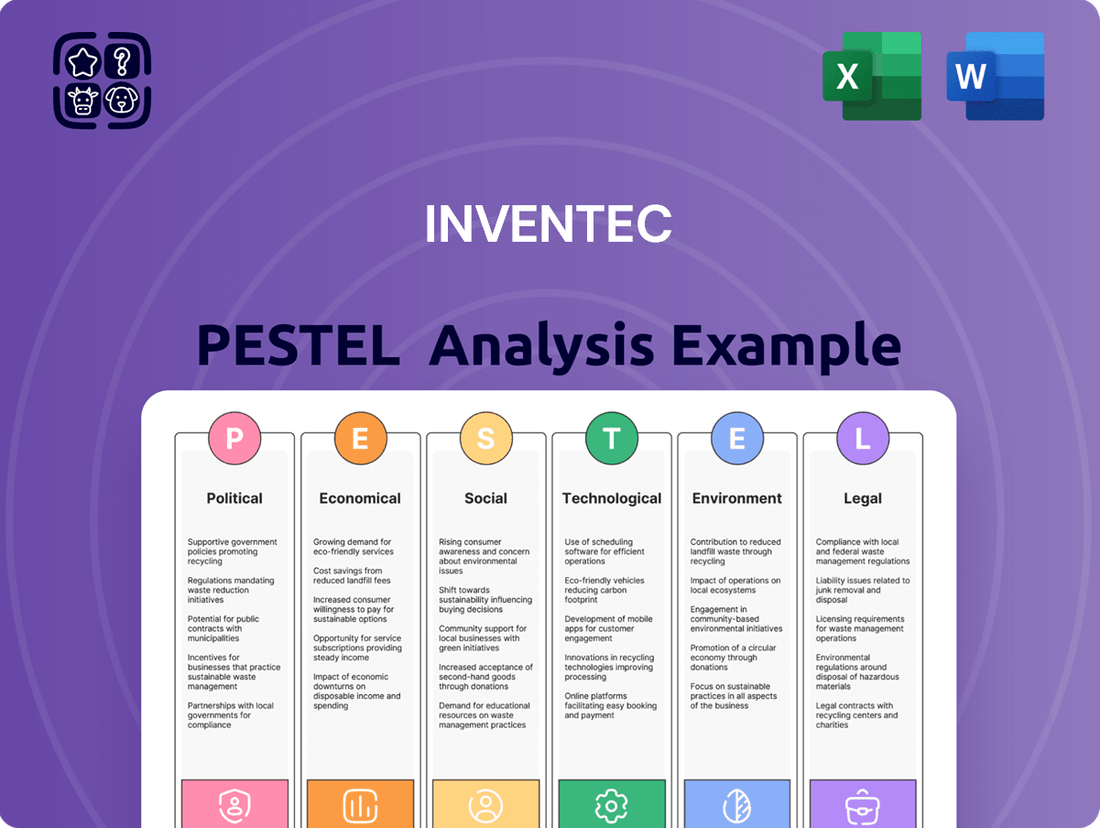

Inventec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inventec Bundle

Uncover the critical external forces shaping Inventec's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting their operations and future growth. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full report now for immediate insights.

Political factors

Inventec, a significant Taiwanese Original Design Manufacturer (ODM), navigates a complex geopolitical landscape. Heightened tensions between the United States and China pose a substantial risk, potentially disrupting global supply chains and limiting market access for its products. For instance, the ongoing trade friction has already led some electronics manufacturers to re-evaluate their reliance on China, with estimates suggesting that by the end of 2024, a notable percentage of companies may have shifted some production capacity.

The dynamic nature of trade disputes and the potential imposition of tariffs directly influence Inventec's manufacturing site selection and overall cost structure. This necessitates strategic diversification of its manufacturing footprint, exploring options in regions beyond mainland China to build resilience against these evolving trade policies and ensure continued market competitiveness.

Governments globally are actively promoting domestic manufacturing through various incentives, while simultaneously tightening regulations on technology products, particularly in areas like cybersecurity and data privacy. Inventec needs to carefully manage these diverse regulatory environments to ensure its broad product portfolio, including IoT devices, remains compliant and accessible in different markets.

For instance, the US CHIPS and Science Act of 2022 provides significant funding to boost domestic semiconductor manufacturing, a sector relevant to Inventec's operations. Failure to adapt to evolving standards, such as the EU's General Data Protection Regulation (GDPR) or emerging cybersecurity mandates for IoT devices, could lead to substantial fines and market exclusion.

Taiwan's political landscape, particularly its relationship with mainland China, introduces significant geopolitical risks for companies like Inventec. The potential for cross-strait tensions, including military posturing or economic sanctions, could disrupt supply chains and market access, impacting Inventec's global operations.

In 2024, the geopolitical climate remains a key consideration. For instance, the economic interdependence between Taiwan and China, while substantial, is also a source of vulnerability. Any escalation in political friction could lead to immediate impacts on trade flows and manufacturing, areas critical to Inventec's business model.

Inventec must therefore maintain robust business continuity plans and sophisticated risk management strategies to navigate this volatile environment. This includes diversifying manufacturing bases and exploring alternative markets to mitigate the effects of potential political disruptions.

National Security Concerns

National security concerns are significantly reshaping the electronics manufacturing landscape. Governments worldwide are intensifying scrutiny over the origins of electronic components and finished devices, driven by fears of embedded vulnerabilities or backdoors for intelligence gathering. This heightened awareness directly impacts Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) like Inventec, as major global brands and government entities increasingly prioritize supply chain security in their procurement decisions. For instance, in 2024, several nations implemented stricter import regulations for electronics, demanding greater transparency in component sourcing and manufacturing processes to mitigate potential risks.

The emphasis on device origin and robust security protocols is no longer a niche concern but a fundamental requirement. Manufacturers must demonstrate compliance with stringent security standards to secure contracts with sensitive sectors. This trend is evidenced by the growing number of cybersecurity certifications and audits becoming mandatory for suppliers in government and defense contracts. Inventec's ability to navigate these evolving geopolitical and security demands will be crucial for maintaining its competitive edge and securing future business opportunities.

- Increased Government Scrutiny: Governments are implementing stricter import controls on electronics due to national security fears.

- Supply Chain Transparency: Brands and agencies are demanding clearer visibility into component origins and manufacturing locations.

- Security Protocol Adherence: Compliance with rigorous cybersecurity standards is becoming a prerequisite for major contracts.

Supply Chain Reshoring and Nearshoring Initiatives

Governments worldwide are actively promoting reshoring and nearshoring of electronics manufacturing, aiming to bolster domestic industries and reduce reliance on single-source suppliers, particularly in Asia. This trend is driven by a desire to mitigate disruptions caused by geopolitical tensions and trade disputes. For instance, the United States CHIPS and Science Act, passed in 2022, allocates billions to incentivize domestic semiconductor production, reflecting this broader push.

Inventec, as a significant player in the electronics manufacturing services (EMS) sector, faces the imperative to adapt its global operational strategy. This could involve evaluating the establishment or expansion of manufacturing capabilities in North America or Europe to cater to regional demand and government incentives. Such a strategic shift would require substantial capital investment and careful consideration of labor costs, regulatory environments, and supply chain logistics in these new locations.

- Reshoring Incentives: Many governments are offering tax credits, subsidies, and grants to encourage companies to bring manufacturing back home. For example, the EU's European Chips Act aims to double the bloc's share in the global semiconductor market by 2030.

- Supply Chain Diversification: Companies are increasingly looking to diversify their supply chains beyond traditional hubs to reduce vulnerability to disruptions. This involves building resilience through multi-region sourcing and manufacturing strategies.

- Geopolitical Risk Mitigation: Heightened geopolitical uncertainties, including trade wars and regional conflicts, are accelerating the move towards localized production to ensure supply chain stability and national security interests.

Heightened geopolitical tensions, particularly between the US and China, continue to pressure global supply chains. By late 2024, an estimated 40% of electronics manufacturers were actively exploring or implementing supply chain diversification strategies to mitigate risks associated with trade disputes and potential tariffs.

Governments are increasingly promoting domestic production through incentives like the US CHIPS and Science Act, aiming to bolster semiconductor manufacturing. Inventec must navigate varied regulations, including cybersecurity and data privacy, as seen with the EU's GDPR, to ensure market access and avoid penalties.

National security concerns are driving stricter import controls on electronics, demanding greater supply chain transparency. Inventec's ability to demonstrate compliance with rigorous security standards is crucial for securing contracts, especially with government entities that increasingly prioritize supply chain integrity.

| Factor | Impact on Inventec | 2024/2025 Data/Trend |

| Geopolitical Tensions (US-China) | Supply chain disruptions, market access limitations, increased costs | Estimated 40% of electronics manufacturers diversifying supply chains by end of 2024 |

| Reshoring/Nearshoring Initiatives | Need for manufacturing footprint adjustments, potential new investment opportunities | US CHIPS Act (2022) allocating billions to domestic semiconductor production |

| National Security & Supply Chain Scrutiny | Demand for transparency, compliance with security standards | Increasingly stringent import regulations and cybersecurity certifications required |

| Regulatory Divergence | Compliance challenges, potential market exclusion | Examples: GDPR (EU), evolving cybersecurity mandates for IoT devices |

What is included in the product

This comprehensive PESTLE analysis of Inventec examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic direction.

It provides actionable insights for stakeholders to navigate external challenges and capitalize on emerging opportunities within Inventec's operating landscape.

Provides a clear, actionable summary of external factors, enabling faster strategic decision-making and mitigating the pain of information overload.

Economic factors

Persistent high inflation and elevated interest rates, a key feature of the 2024-2025 economic landscape, are squeezing corporate budgets. This means cloud service providers and large enterprises may scale back on capital expenditures, directly impacting Inventec's server and electronic device sales. For instance, the IMF projected global growth to moderate in 2024 and 2025, a trend that typically dampens investment in technology infrastructure.

A broader global economic slowdown, as anticipated by many economic forecasts for 2024 and 2025, translates to reduced discretionary spending by consumers. This directly affects demand for Inventec's consumer electronics like laptops and smartphones, as well as the burgeoning market for IoT devices, as households prioritize essential spending over new gadgets.

The burgeoning demand for Artificial Intelligence (AI) servers is a primary catalyst for Inventec's server division. This trend is further amplified by ongoing substantial investments from hyperscale cloud providers, directly fueling the need for advanced computing infrastructure.

AI servers are anticipated to represent a significant percentage of the overall server market's revenue. Inventec is strategically positioned to capitalize on this expansion, with projections indicating double-digit growth in its AI server shipments for the upcoming periods.

The electronics sector has seen significant swings in component costs and availability, particularly for critical items like semiconductors and memory chips. While some of these supply chain strains began to ease by the end of 2024, the increasing demand for advanced components, such as high-speed connectors and sophisticated power management integrated circuits, could introduce fresh supply challenges in 2025. This dynamic environment necessitates that Inventec maintains exceptionally strong supply chain management practices to effectively navigate these ongoing fluctuations.

Currency Fluctuations and Exchange Rates

Inventec, as a global Original Design Manufacturer (ODM), faces significant exposure to currency fluctuations. The New Taiwan Dollar (TWD) versus the US Dollar (USD) exchange rate is a primary concern, directly impacting its financial results. For instance, a stronger TWD against the USD would effectively reduce the value of its dollar-denominated revenues when converted back into its home currency, potentially hurting profitability.

The volatility in exchange rates presents a material risk that Inventec must actively manage. Unfavorable movements can erode margins on contracts priced in foreign currencies, increasing the cost of imported components or decreasing the repatriated value of overseas earnings. This necessitates robust hedging strategies and careful financial planning to mitigate potential negative impacts on revenue, costs, and overall profitability.

Recent data highlights this sensitivity. For the first quarter of 2024, Inventec reported revenue of NT$134.4 billion. Fluctuations in the TWD/USD rate during this period would have directly influenced the translated value of sales generated in the United States, a critical market for electronics manufacturing.

- Impact on Revenue: A stronger TWD can decrease the TWD value of USD-denominated sales.

- Cost of Goods Sold: A weaker TWD can increase the TWD cost of imported components sourced in USD.

- Profitability Squeeze: Unfavorable exchange rate movements can compress profit margins on international transactions.

- Hedging Necessity: Proactive currency risk management through hedging instruments is crucial for financial stability.

Consumer Electronics Market Trends

The global consumer electronics market, particularly for smartphones and notebooks, is seeing longer replacement cycles as devices become more durable and feature-rich. This trend is pushing manufacturers towards premiumization and the integration of artificial intelligence to drive upgrades. For Inventec, this means a strategic focus on innovation and value proposition to encourage consumers to purchase new devices.

While the smartphone market experienced a rebound in 2024, with global shipments projected to reach around 1.17 billion units according to IDC, headwinds are anticipated for 2025. Market saturation in developed regions and persistent economic uncertainties, including inflation and potential interest rate hikes, could dampen demand. Inventec needs to be agile, adjusting product roadmaps and pricing to navigate these evolving market conditions.

- Extended Device Lifecycles: Consumers are holding onto their smartphones and notebooks for longer periods, often exceeding 3 years, impacting sales volume.

- Premiumization and AI Focus: A growing segment of consumers is willing to pay more for high-end devices with advanced features, especially those incorporating AI capabilities.

- 2024 Growth, 2025 Caution: The smartphone market saw a positive growth trajectory in 2024, but the outlook for 2025 is more subdued due to saturation and economic concerns.

Persistent high inflation and elevated interest rates are squeezing corporate budgets, potentially leading to scaled-back capital expenditures by cloud providers and large enterprises, impacting Inventec's server and electronic device sales. Global economic slowdown forecasts for 2024-2025 suggest reduced discretionary spending by consumers, affecting demand for Inventec's consumer electronics and IoT devices.

The burgeoning demand for AI servers, fueled by hyperscale cloud providers, is a significant growth catalyst for Inventec's server division, with AI servers expected to capture a substantial revenue share in the expanding server market. Inventec anticipates double-digit growth in its AI server shipments in the coming periods.

The electronics sector faces ongoing component cost and availability fluctuations, with increasing demand for advanced components like high-speed connectors potentially creating new supply challenges in 2025, necessitating robust supply chain management for Inventec.

Inventec, as a global ODM, is significantly exposed to currency fluctuations, particularly the TWD/USD exchange rate, which directly impacts its financial results by affecting the value of dollar-denominated revenues. For instance, in Q1 2024, Inventec reported NT$134.4 billion in revenue, with TWD/USD rate movements directly influencing the translated value of its US sales.

Preview the Actual Deliverable

Inventec PESTLE Analysis

The preview shown here is the exact Inventec PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to confidently assess its value.

The content and structure shown in the preview is the same comprehensive Inventec PESTLE Analysis document you’ll download after payment, providing immediate actionable insights.

Sociological factors

Consumers are increasingly prioritizing sustainability and advanced features in their electronics. This trend, coupled with a growing demand for AI integration in devices, directly shapes Inventec's product development and manufacturing strategies. For instance, the average smartphone replacement cycle extended to around 43 months in 2024, meaning companies like Inventec must offer truly compelling innovations to drive new sales.

The electronics manufacturing sector, especially in hubs like Southeast Asia, thrives on competitive wages and a growing pool of skilled workers. For Inventec, this presents an opportunity to leverage these advantages. For instance, Vietnam, a key manufacturing location, saw its average manufacturing wage increase by approximately 5-7% annually in the lead-up to 2024, a trend that while manageable, necessitates strategic planning.

However, sustaining this skilled workforce and navigating the inevitable rise in labor expenses remain critical considerations for Inventec. The company must continue to invest in robust training programs to upskill its employees and strategically implement automation to offset increasing labor costs, ensuring long-term competitiveness.

Inventec faces growing pressure from consumers and regulators to ensure its supply chain is ethically sound, meaning fair labor conditions and responsible material sourcing are paramount. This scrutiny intensified in 2024, with reports highlighting the need for greater transparency in electronics manufacturing, a sector Inventec operates within.

By 2025, companies like Inventec are expected to demonstrate robust oversight, potentially involving third-party audits and clear reporting on labor practices. Failure to meet these evolving standards could lead to reputational damage and impact market access, especially as sustainability is increasingly a key purchasing driver for B2B clients.

Digital Inclusion and Access to Technology

The increasing digital inclusion worldwide is a significant societal driver for companies like Inventec. As more people gain access to the internet and digital devices, the demand for consumer electronics and Internet of Things (IoT) products naturally grows. This trend is particularly pronounced in emerging markets, where smartphone penetration and internet usage are rapidly expanding. For instance, Statista projects that the number of mobile internet users globally will reach 5.3 billion by 2024, up from 4.3 billion in 2020, directly benefiting manufacturers of these devices.

Inventec, with its diverse product portfolio encompassing everything from personal computers and smartphones to smart home devices, is well-positioned to capitalize on this expanding digital landscape. The company's ability to produce a wide array of electronic components and finished goods means it can serve multiple segments of this growing market. Consider the growth in the IoT sector; Grand View Research estimated the global IoT market size at USD 385.7 billion in 2023 and expects it to expand at a compound annual growth rate (CAGR) of 13.4% from 2024 to 2030. This surge in connected devices directly translates to increased demand for the types of electronic manufacturing services Inventec provides.

- Global Digital Inclusion Growth: The number of internet users worldwide is projected to surpass 5.4 billion by the end of 2024, indicating a vast and growing consumer base for digital products.

- Emerging Market Expansion: Developing economies are witnessing significant increases in smartphone adoption and internet connectivity, creating new and substantial markets for electronic devices.

- IoT Market Boom: The Internet of Things market is experiencing rapid expansion, with projections suggesting continued double-digit growth, fueling demand for specialized electronic components and manufacturing.

- Inventec's Product Relevance: Inventec's manufacturing capabilities for consumer electronics and IoT devices directly align with these societal trends, positioning it to benefit from increased global demand.

Data Privacy and Security Awareness

Public awareness of data privacy and cybersecurity is a significant sociological factor impacting Inventec. Concerns about how personal information is collected, stored, and used are growing, directly influencing consumer trust and the willingness to adopt connected devices. A 2024 survey indicated that over 70% of consumers are more concerned about their data privacy than they were a year prior, a trend that shows no sign of abating into 2025.

Inventec, as a manufacturer of connected devices, must actively address these concerns. Prioritizing robust security features, such as end-to-end encryption and regular security updates, is crucial. Furthermore, transparent data handling practices, clearly communicating what data is collected and how it is utilized, are essential for building and maintaining consumer confidence in their products.

- Growing Consumer Scrutiny: Over 70% of consumers expressed increased data privacy concerns in 2024.

- Trust as a Differentiator: Companies demonstrating strong data protection practices are more likely to gain consumer loyalty.

- Regulatory Influence: Evolving data protection regulations globally are further amplifying public awareness and expectations.

Societal shifts towards ethical consumption and responsible manufacturing are increasingly influencing consumer choices and regulatory landscapes. Inventec must align its operations with these evolving values, ensuring fair labor practices and transparent supply chains to maintain brand reputation and market access, especially as B2B clients increasingly prioritize sustainability.

Technological factors

The server market is experiencing a significant surge in demand for advanced AI capabilities, directly fueled by rapid progress in artificial intelligence and high-performance computing. This trend necessitates more powerful and specialized server solutions. For instance, the market for AI servers is projected to reach $200 billion by 2027, a substantial increase from previous years.

Inventec's strategic advantage lies in its capacity to engineer and manufacture these cutting-edge servers. The company's ability to integrate next-generation GPU architectures, such as NVIDIA's GB200 Grace Blackwell Superchip, is paramount to capturing a larger share of this expanding market segment. NVIDIA's GB200 is designed to deliver up to 30 times the performance of previous generations for AI workloads.

The relentless drive towards miniaturization and component integration profoundly shapes the electronics manufacturing landscape. For Inventec, this means constantly refining its capabilities to produce smaller, more powerful devices like the latest smartphones and an expanding array of Internet of Things (IoT) gadgets. The demand for intricate, densely packed components necessitates advanced manufacturing techniques and a commitment to ongoing research and development.

This trend directly impacts Inventec's operational strategies. For instance, the average smartphone size has steadily decreased while packing in more advanced processors and sensors. By 2024, flagship smartphones often feature processors built on 3nm or 4nm fabrication processes, enabling greater power efficiency and computational capability within a compact form factor. Inventec's ability to handle such intricate assembly is crucial for maintaining its competitive edge.

The Internet of Things (IoT) landscape is a dynamic field, constantly reshaped by advancements in connectivity, such as the rollout of 5G and the development of low-power wide-area networks (LPWANs). Inventec's ability to design and manufacture diverse IoT devices hinges on its capacity to integrate these evolving technologies, ensuring seamless data flow and device interoperability. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.2 trillion by 2027, indicating a significant growth trajectory that Inventec must navigate.

Automation and Smart Manufacturing

The manufacturing sector is rapidly embracing automation and smart technologies. Inventec's strategic focus on these areas, including AI and robotics, is crucial for boosting operational efficiency and product quality. This trend is underscored by projections indicating that the global industrial automation market could reach over $300 billion by 2025, highlighting the significant competitive advantage gained by early adopters.

Investments in smart factory initiatives allow Inventec to streamline production lines, reduce errors, and potentially mitigate labor shortages. For instance, the adoption of AI-powered quality control systems has been shown to improve defect detection rates by up to 90% in some industries. This technological advancement directly supports Inventec's goal of enhancing its competitive edge in a dynamic market.

The integration of machine learning in manufacturing processes also enables predictive maintenance, minimizing downtime and optimizing resource allocation. Companies leveraging these technologies are often reporting significant cost savings, with some seeing reductions in operational expenses by as much as 20%. This makes smart manufacturing a vital component of Inventec's long-term strategy.

- Global industrial automation market projected to exceed $300 billion by 2025.

- AI-powered quality control can improve defect detection rates by up to 90%.

- Smart manufacturing can lead to operational cost reductions of up to 20%.

- Robotics adoption in manufacturing is expected to see a compound annual growth rate of over 10% in the coming years.

Supply Chain Digitalization and Traceability

Inventec's supply chain is increasingly benefiting from digitalization, with tools like blockchain enhancing product traceability and IoT devices providing real-time operational monitoring. This technological integration is crucial for navigating complex global networks. For instance, the global supply chain management market was projected to reach $34.2 billion by 2025, indicating a significant shift towards digital solutions.

By adopting these advanced digital tools, Inventec can achieve superior visibility across its entire supply chain. This enhanced transparency is vital for identifying bottlenecks, managing risks, and ensuring the integrity of its products from origin to delivery. Advanced data analytics further empowers Inventec to make more informed, proactive decisions, optimizing inventory levels and logistics.

- Blockchain for enhanced product traceability

- IoT for real-time supply chain monitoring

- Advanced data analytics for improved decision-making

- Increased operational efficiency and risk mitigation

The rapid evolution of AI and high-performance computing is driving a significant demand for advanced servers, with the AI server market expected to reach $200 billion by 2027. Inventec's ability to integrate next-generation components, like NVIDIA's GB200 Superchip, which offers up to 30 times the performance for AI workloads, is key to capitalizing on this trend.

The push for miniaturization in electronics, seen in smartphones built on 3nm or 4nm processes, requires Inventec to excel in producing densely packed, intricate components. Similarly, the burgeoning IoT market, projected to hit $2.2 trillion by 2027, demands Inventec's expertise in integrating evolving connectivity technologies like 5G.

Inventec's strategic adoption of automation and smart technologies, including AI and robotics, is crucial for enhancing efficiency and quality, aligning with a global industrial automation market expected to exceed $300 billion by 2025. Furthermore, digitalization of the supply chain, utilizing blockchain for traceability and IoT for real-time monitoring, is vital for navigating global networks and improving operational visibility.

| Technological Factor | Impact on Inventec | Supporting Data/Trend |

| AI & High-Performance Computing | Increased demand for advanced servers | AI server market projected to reach $200 billion by 2027. |

| Miniaturization & Component Integration | Need for advanced manufacturing of smaller, denser devices | Flagship smartphones utilize 3nm/4nm fabrication processes. |

| Internet of Things (IoT) | Demand for integration of new connectivity technologies | Global IoT market valued at $1.1 trillion in 2023, projected to reach $2.2 trillion by 2027. |

| Automation & Smart Manufacturing | Enhanced operational efficiency and product quality | Global industrial automation market to exceed $300 billion by 2025. |

| Supply Chain Digitalization | Improved traceability, monitoring, and decision-making | Global supply chain management market projected to reach $34.2 billion by 2025. |

Legal factors

As an Original Design Manufacturer (ODM), Inventec's success hinges on strong intellectual property (IP) protection, a cornerstone in the tech manufacturing sector. This involves rigorously safeguarding its own innovative designs and manufacturing processes, as well as the confidential product concepts of its diverse clientele.

Robust legal frameworks and meticulously crafted contracts are essential for Inventec to maintain its competitive edge and foster unwavering client trust. Failure to adequately protect IP could lead to significant financial losses and damage to its reputation, impacting future business opportunities.

Inventec must navigate a complex web of product safety and certification regulations across all its operating markets. This involves adhering to standards for electrical safety, such as IEC 62368 for audio/video and information and communication technology equipment, and ensuring electromagnetic compatibility (EMC) to prevent interference, with varying regional requirements like those set by the FCC in the US and CE marking in Europe.

Specific certifications for wireless and IoT devices are also critical. For instance, Bluetooth SIG certification is essential for devices utilizing Bluetooth technology, and Wi-Fi Alliance certification is necessary for Wi-Fi enabled products, impacting market access and consumer trust. Failure to comply can lead to product recalls and significant fines, as seen in past instances where non-compliant electronics were banned from sale.

The global landscape of data protection and privacy laws, exemplified by the EU's General Data Protection Regulation (GDPR) and similar frameworks emerging worldwide, presents significant compliance challenges for Inventec's Internet of Things (IoT) device manufacturing and subsequent data management. Failure to adhere to these increasingly stringent regulations, which govern how personal data is collected, processed, and stored, can result in substantial financial penalties. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the critical need for robust data governance.

Environmental Regulations and Compliance

Inventec operates within a stringent environmental regulatory landscape, impacting its manufacturing and product lifecycle. Key directives like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) dictate the permissible levels of certain materials in electronics and mandate responsible disposal. Failure to comply can result in significant fines and reputational damage.

In 2024, the global electronics industry faced increasing scrutiny regarding e-waste, with estimates suggesting over 62 million tonnes of e-waste generated annually. Inventec’s commitment to these regulations is not just a legal necessity but a strategic imperative for market access and consumer trust. The company must actively manage its supply chain to ensure adherence to material restrictions and invest in sustainable waste management practices.

- RoHS Compliance: Ensuring all manufactured products meet the substance restrictions set by RoHS directives, which are periodically updated.

- WEEE Directives: Implementing collection and recycling programs for electronic waste, aligning with WEEE regulations in key markets.

- Hazardous Substance Management: Maintaining rigorous internal controls for the handling and disposal of any hazardous materials used in production.

- Supply Chain Audits: Conducting regular audits of suppliers to verify their environmental compliance and material sourcing practices.

International Trade Laws and Tariffs

Changes in international trade laws and tariffs significantly impact Inventec's global operations, influencing the cost of imported components and the competitiveness of its exported products. For instance, the ongoing adjustments to trade agreements, such as potential renegotiations or the imposition of new tariffs, create uncertainty in supply chain management and pricing strategies. In 2024, the World Trade Organization (WTO) reported a rise in trade-restrictive measures globally, highlighting the dynamic nature of these legal frameworks.

Navigating these complex and frequently evolving legal landscapes is crucial for Inventec to maintain its competitive edge. Fluctuations in customs duties and import/export regulations can directly affect profit margins and the efficiency of international logistics. For example, a sudden tariff increase on a key electronic component could necessitate a price adjustment for Inventec's finished goods, impacting market demand.

Inventec must remain agile in responding to these legal shifts, which can include:

- Monitoring evolving trade policies in key markets, such as the US, EU, and Asia.

- Adapting supply chain strategies to mitigate the impact of new or increased tariffs.

- Ensuring compliance with varying customs regulations to avoid delays and penalties.

- Leveraging trade agreements where beneficial to reduce import costs.

Inventec's operations are deeply intertwined with intellectual property (IP) law, necessitating robust protection of its own designs and client confidentiality. Navigating product safety and certification regulations, such as IEC 62368 and FCC/CE marking, is paramount for market access. Furthermore, compliance with global data privacy laws like GDPR, with potential fines up to 4% of global annual revenue, is critical for its IoT ventures.

Environmental factors

The intensifying global emphasis on climate change and carbon footprint reduction is compelling electronics manufacturers, including Inventec, to implement more sustainable manufacturing processes and commit to net-zero emissions targets. This shift necessitates a critical look at energy efficiency throughout production and supply chain operations.

For instance, in 2024, the electronics industry is facing increased scrutiny over its environmental impact, with many companies setting ambitious targets. Inventec, like its peers, is expected to invest in renewable energy sources for its facilities and explore ways to reduce emissions from transportation and product lifecycle management to meet these evolving expectations.

There's a significant and increasing push for electronics manufacturers like Inventec to utilize recycled and biodegradable materials. This trend is driven by both evolving environmental regulations and a growing consumer preference for sustainable products. For instance, the global market for recycled plastics in electronics was valued at approximately $6.5 billion in 2023 and is projected to grow substantially in the coming years.

Inventec's strategic integration of energy-efficient production processes is crucial for compliance and market competitiveness. Companies adopting greener manufacturing are often rewarded with lower operational costs and enhanced brand reputation. By 2025, it's estimated that over 60% of major electronics companies will have publicly stated targets for reducing their manufacturing carbon footprint, making sustainable practices a non-negotiable aspect of business.

The electronics sector grapples with a significant e-waste challenge, with global e-waste generation reaching an estimated 53.6 million metric tons in 2019, projected to hit 74 million metric tons by 2030. Inventec must integrate circular economy principles, focusing on designing products for easier disassembly and recycling, to mitigate its environmental footprint.

Embracing these principles means supporting robust end-of-life product management, including take-back programs and material recovery initiatives. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive mandates collection and recycling targets, influencing how companies like Inventec manage their product lifecycles.

Resource Scarcity and Supply Chain Resilience

Inventec's operations are significantly influenced by the availability of critical raw materials, such as copper, gold, and rare earth elements, essential for electronic components. Geopolitical tensions and increasing global demand, particularly from the burgeoning electric vehicle and renewable energy sectors, are exacerbating resource scarcity. For instance, the International Energy Agency's 2024 report highlighted a projected doubling of demand for critical minerals like lithium and cobalt by 2030, directly impacting component costs and availability.

To navigate these environmental challenges, Inventec's supply chain resilience hinges on robust diversification of sourcing strategies. This involves identifying and securing alternative suppliers and geographical regions for key materials, thereby mitigating risks associated with single-source dependency. Proactive management of environmental risks, including responsible sourcing practices and investment in materials innovation, is crucial for maintaining operational continuity and competitive advantage.

- Resource Availability: The global supply of critical minerals, vital for electronics, faces pressure from geopolitical events and rising demand, as noted by the IEA's 2024 outlook for mineral demand.

- Supply Chain Vulnerabilities: Dependence on specific regions for rare earth elements and other key materials creates inherent supply chain risks for electronics manufacturers.

- Inventec's Strategy: Diversifying sourcing locations and investing in material science are key to Inventec's approach to building supply chain resilience against environmental and geopolitical shocks.

Water Usage and Pollution Control

Inventec's manufacturing processes for electronic components are inherently water-intensive, requiring significant volumes for cleaning, cooling, and material processing. Furthermore, these operations can generate wastewater containing various chemical pollutants, including heavy metals and solvents, necessitating stringent control measures.

To address this, Inventec must prioritize the implementation of advanced water management strategies. This includes investing in water recycling and reuse technologies to reduce overall consumption. For instance, by 2024, the electronics manufacturing sector globally saw a growing trend towards closed-loop water systems, aiming to cut freshwater intake by up to 30% in many advanced facilities.

Robust pollution control is also critical for Inventec to meet increasingly strict environmental regulations. This involves deploying state-of-the-art wastewater treatment plants capable of removing hazardous substances before discharge. Compliance with standards like the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) impacts the types of chemicals used and their subsequent treatment. Failure to comply can result in substantial fines and reputational damage, as seen with other industry players facing penalties for environmental non-compliance.

- Water Consumption: Electronics manufacturing can use thousands of liters of water per unit produced, particularly for semiconductor fabrication.

- Pollutant Types: Common pollutants include heavy metals (lead, mercury), volatile organic compounds (VOCs), and acids from etching and cleaning processes.

- Regulatory Landscape: Global environmental regulations are tightening, with many regions mandating specific discharge limits for treated wastewater.

- Technological Solutions: Investments in membrane filtration, ion exchange, and advanced oxidation processes are key to effective pollution control.

Inventec's environmental strategy must address the growing global demand for sustainable electronics and the increasing scrutiny of the industry's carbon footprint. By 2025, over 60% of major electronics companies are expected to have public targets for reducing their manufacturing carbon footprint, making eco-friendly practices essential for competitiveness.

The company also faces the challenge of e-waste, with global generation projected to reach 74 million metric tons by 2030. Implementing circular economy principles, such as designing for disassembly and supporting take-back programs, is crucial for Inventec to manage its environmental impact effectively.

Resource availability, particularly critical minerals, presents another significant environmental factor. The International Energy Agency's 2024 report highlights a projected doubling of demand for minerals like lithium and cobalt by 2030, which will impact component costs and availability for manufacturers like Inventec.

Water management is also a key concern, as electronics manufacturing is water-intensive and can produce wastewater containing hazardous pollutants. Inventec's investment in water recycling and reuse technologies, aiming for up to 30% reduction in freshwater intake by 2024, is a critical step in addressing this issue.

| Environmental Factor | Key Trend/Challenge | Impact on Inventec | 2024/2025 Data/Projections |

|---|---|---|---|

| Climate Change & Carbon Footprint | Increasing global focus on sustainability and net-zero emissions | Necessitates investment in energy efficiency, renewable energy, and emission reduction across production and supply chain. | By 2025, >60% of major electronics companies to have public carbon footprint reduction targets. |

| E-Waste Management | Growing global e-waste generation | Requires integration of circular economy principles, product design for recyclability, and robust end-of-life management. | Global e-waste projected to reach 74 million metric tons by 2030 (up from 53.6 million in 2019). |

| Resource Availability | Geopolitical tensions and rising demand for critical minerals | Impacts component costs and availability, requiring supply chain diversification and materials innovation. | IEA 2024: Demand for lithium and cobalt projected to double by 2030. |

| Water Consumption & Pollution | Water-intensive manufacturing processes and wastewater generation | Demands advanced water management strategies, including recycling and reuse, and stringent pollution control measures. | Trend towards closed-loop water systems aiming for up to 30% freshwater intake reduction in advanced facilities (by 2024). |

PESTLE Analysis Data Sources

Our Inventec PESTLE Analysis is built on a comprehensive dataset, drawing from official government publications, reputable financial news outlets, and leading industry research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are both current and authoritative.