Inventec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inventec Bundle

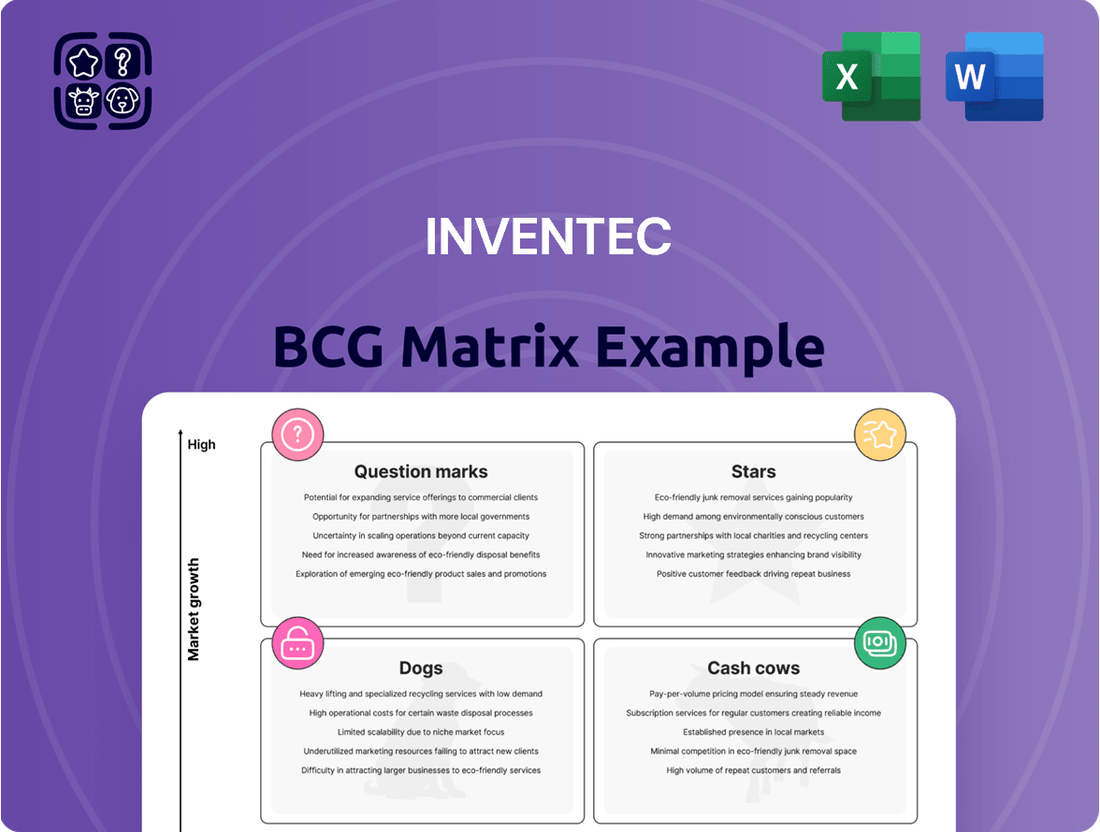

Curious about Inventec's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but to truly understand their strategic positioning, you need the full picture. Discover which products are poised for growth, which are stable earners, and where potential risks lie.

Unlock the complete Inventec BCG Matrix to gain actionable insights into their market share and growth rates. This comprehensive report will empower you to make informed decisions about resource allocation and future investments. Purchase the full version for a detailed breakdown and strategic roadmap.

Stars

Inventec's AI server business is a powerhouse in their portfolio, showing explosive growth. Shipments are set to more than double in 2024, a substantial leap from 2023.

This booming segment is projected to represent a significant double-digit portion of Inventec's total revenue in 2024, a stark increase from the 5-6% seen last year. Looking ahead, the company anticipates over 60% growth in this area for 2025.

The higher average selling price of these AI servers amplifies their impact on revenue, solidifying their role as a critical engine for Inventec's future expansion.

Inventec is a significant player in the burgeoning server liquid cooling market, securing the fourth position globally in patent filings and leading Taiwan's charge in this innovative sector. This positions them as a strong contender in a market poised for substantial expansion.

The increasing demand for efficient cooling in next-generation data centers, driven by escalating computational power requirements, makes liquid cooling a critical technology. Inventec's leadership in patents highlights their innovation capabilities in this high-growth area.

Inventec's automotive electronics sector is a star performer, experiencing consistent growth since 2017. This segment is poised for a significant surge in 2024, fueled by anticipated product innovations in 2025 and 2026.

The company projects its automotive revenue to reach NT$100 billion (approximately US$3.2 billion) by 2027. This ambitious target could position automotive as Inventec's third-largest business, underscoring its status as a high-growth area within the company's portfolio.

5G Smart Factory Solutions

Inventec is heavily invested in 5G Smart Factory Solutions, integrating advanced technologies like AIoT and cloud computing. This strategic push aims to revolutionize manufacturing by boosting production efficiency and streamlining operations. The company's commitment to digital supply chains places it as a leader in the burgeoning smart manufacturing sector.

The global smart factory market is projected to reach USD 115.7 billion by 2027, growing at a CAGR of 12.6%, highlighting the significant opportunity Inventec is targeting.

- 5G Integration: Enabling real-time data transfer and low latency for enhanced automation.

- AIoT Capabilities: Leveraging artificial intelligence and the Internet of Things for predictive maintenance and quality control.

- Cloud-Based Platforms: Facilitating seamless data management and operational visibility across the supply chain.

- Efficiency Gains: Aiming for measurable improvements in production throughput and resource utilization.

High-Performance Computing Devices

Inventec's high-performance computing devices are positioned as stars within the BCG matrix. The burgeoning field of generative AI development is a significant tailwind, directly fueling the demand for the specialized hardware Inventec excels at producing. This trend is projected to sustain robust growth in Inventec's server sales through 2025, underscoring its presence in a high-growth market.

Inventec's strategic advantage lies in its proficiency in designing and manufacturing these sophisticated computing solutions. The company's ability to meet the escalating industry requirements for advanced hardware, particularly in the AI sector, solidifies its star status.

- Market Growth: The generative AI boom is expected to drive continued expansion in the high-performance computing sector.

- Inventec's Role: Inventec is well-positioned to capitalize on this growth due to its expertise in specialized hardware design and manufacturing.

- Projected Sales: Inventec anticipates sustained server sales growth through 2025, reflecting its strong market standing.

Inventec's high-performance computing devices, particularly its AI servers, are firmly positioned as Stars in the BCG matrix. The explosive growth in generative AI is a primary driver, directly increasing demand for the specialized hardware Inventec manufactures. This trend is expected to sustain robust server sales growth through 2025, confirming its standing in a high-growth market.

Inventec's expertise in designing and producing these advanced computing solutions gives it a significant market edge. The company's capacity to meet the escalating industry demands for cutting-edge hardware, especially within the AI domain, solidifies its Star classification.

The generative AI boom is a key factor supporting continued expansion in the high-performance computing sector. Inventec is strategically positioned to benefit from this growth due to its specialized hardware capabilities.

Inventec's AI server shipments are projected to more than double in 2024, a substantial increase from the previous year. This segment is expected to contribute a significant double-digit percentage to Inventec's total revenue in 2024, up from 5-6% in 2023, with over 60% growth anticipated for 2025.

| Business Segment | BCG Classification | Key Growth Drivers | 2024 Outlook | 2025 Outlook |

|---|---|---|---|---|

| AI Servers | Star | Generative AI demand, High ASP | Shipments to more than double, Double-digit revenue share | Over 60% growth |

| Automotive Electronics | Star | Product innovation, Market expansion | Significant surge | Continued strong growth |

| Liquid Cooling | Question Mark/Star (Emerging) | Data center efficiency needs, AI hardware | Leading patent filings, Global 4th position | Market expansion |

What is included in the product

The Inventec BCG Matrix offers a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Inventec BCG Matrix provides a clear, one-page overview, instantly clarifying each business unit's position to alleviate strategic uncertainty.

Cash Cows

Notebook computers represent Inventec's primary revenue driver, contributing 54% in 2023. This segment is projected to see a modest single-digit year-on-year increase in 2024, with expectations of double-digit growth in 2025, fueled by a wave of replacement purchases.

Despite moderate growth, the ODM/OEM notebook computer business consistently delivers robust cash flow. This is largely attributed to its significant market share, solidifying its position as a cash cow for Inventec.

Traditional servers, including ODM/OEM models, were a substantial part of Inventec's business, accounting for 40% of its total revenue in 2023. While this segment saw an 8% decline in 2023, the broader server market is projected for significant growth.

Looking ahead to 2024, overall server sales are anticipated to increase by double-digit percentages, largely fueled by the demand for AI servers. This traditional segment remains a reliable source of cash for Inventec, offering steady income even with more modest growth expectations compared to newer, high-demand areas like AI infrastructure.

Inventec's cloud computing infrastructure segment is a prime example of a Cash Cow within its BCG Matrix. As a critical supplier of hardware components, the company fuels the relentless growth of cloud services, a market that experienced significant expansion in 2024. The demand for robust server, storage, and networking hardware remained exceptionally strong as businesses continued their digital transformation journeys and the adoption of AI workloads accelerated.

This mature market provides Inventec with a steady stream of revenue, thanks to its established position and loyal customer base. The consistent, high-volume demand for these essential components translates into predictable and substantial cash flow, allowing Inventec to leverage its market share effectively. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, underscoring the massive scale and ongoing profitability of this sector.

Enterprise Solutions Hardware

Inventec's Enterprise Solutions Hardware segment operates as a Cash Cow within its BCG Matrix. This division focuses on manufacturing and design services for electronic devices crucial to enterprise operations, serving major global brands.

The market for enterprise solutions hardware is characterized by consistent demand and maturity, enabling Inventec to capitalize on its established manufacturing capabilities and operational efficiencies. This stability translates into predictable revenue streams and robust profit margins.

In 2024, the demand for reliable enterprise hardware remained strong, driven by digital transformation initiatives across industries. Inventec’s ability to deliver high-quality, scalable solutions positions it favorably in this segment.

- Stable Market Demand: Enterprise solutions hardware benefits from ongoing business needs for IT infrastructure and specialized devices.

- High Profit Margins: Inventec leverages economies of scale and manufacturing expertise to achieve profitability.

- Steady Cash Flow: The predictable nature of this market segment ensures a reliable source of income for the company.

- Leveraging Expertise: Inventec's long-standing experience in electronics manufacturing is a key advantage.

Existing Production Facilities and Supply Chain Network

Inventec's existing production facilities, strategically located globally including in Mexico, form the bedrock of its cash cow status. This established infrastructure, honed over years, facilitates efficient and cost-effective manufacturing of a wide array of electronic products.

The company's extensive supply chain network complements these facilities, ensuring smooth operations and consistent product delivery. This robust network provides a significant competitive advantage, enabling Inventec to maintain high operational efficiency and reliably generate substantial cash flow from its core manufacturing activities.

- Global Manufacturing Footprint: Inventec operates numerous production sites, including key facilities in Mexico, supporting a diverse product portfolio.

- Supply Chain Efficiency: An integrated and well-managed supply chain network minimizes costs and ensures timely production.

- Cost-Effective Operations: The scale and established nature of its manufacturing infrastructure allow for significant cost efficiencies.

- Consistent Cash Generation: These core operations are a primary source of stable and predictable cash flow for the company.

Inventec's notebook computer segment, a significant revenue contributor, is a prime example of a Cash Cow. Its established market presence and consistent demand, projected for modest growth in 2024, ensure a steady and reliable cash flow for the company.

Similarly, traditional server products, while facing market shifts, continue to generate substantial and predictable cash. Inventec's established position in this segment allows it to benefit from ongoing, albeit slower, demand, reinforcing its Cash Cow status.

The company's cloud computing infrastructure hardware also functions as a Cash Cow. The massive scale of the cloud market, projected to exceed $1.3 trillion in 2024, combined with Inventec's role as a key hardware supplier, guarantees consistent revenue and strong cash flow generation.

Inventec's Enterprise Solutions Hardware segment is another robust Cash Cow, driven by consistent enterprise demand for IT infrastructure. Its manufacturing expertise and operational efficiencies in this mature market lead to stable revenues and healthy profit margins.

| Segment | 2023 Revenue Contribution | 2024 Growth Projection | Cash Flow Characteristic |

| Notebook Computers | 54% | Single-digit | Stable, High |

| Traditional Servers | 40% | Double-digit | Reliable, Steady |

| Cloud Computing Infrastructure Hardware | N/A (Component Supplier) | Strong Demand | Predictable, Substantial |

| Enterprise Solutions Hardware | N/A (Segment Focus) | Consistent Demand | Robust, Predictable |

Preview = Final Product

Inventec BCG Matrix

The preview you are currently viewing is the exact Inventec BCG Matrix report you will receive upon purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering a clear and actionable analysis of Inventec's product portfolio.

Rest assured, the Inventec BCG Matrix you see is the complete, unwatermarked file you will download after your purchase. It has been meticulously prepared to provide you with a professional-grade tool for assessing Inventec's market position and guiding future business decisions.

What you are previewing is the definitive Inventec BCG Matrix, identical to the file you will receive once the purchase is complete. This analysis-ready report is designed for immediate integration into your strategic planning, ensuring you have the insights needed to navigate Inventec's market landscape effectively.

Dogs

Inventec's older generation smartphones and less popular IoT devices fall into the Dogs category of the BCG Matrix. In 2023, the smart device segment, which includes these items, represented a modest 5-6% of Inventec's total revenue.

While a slight improvement is projected for 2025, this segment's low market share and growth indicate that these products are likely consuming resources without generating substantial returns. Their continued presence may hinder the company's ability to invest in more promising areas.

Inventec, as a major ODM/OEM, likely manufactures numerous electronic components that are essentially commodities. These items often face fierce price wars, resulting in razor-thin profit margins for the company.

If these components aren't strategically positioned in high-growth markets, they could be considered 'cash cows' in a negative sense – tying up capital with very little return. For instance, in 2024, the global market for basic passive components like resistors and capacitors, which Inventec might produce, saw growth of only 2-3%, with average gross margins often below 10%. This suggests these areas might be candidates for reduced investment or even divestment to free up resources for more profitable ventures.

Inventec's legacy peripherals and niche electronics often find themselves in mature or declining markets. These products, if they also possess a low market share and generate minimal profits, would be classified as Dogs in the BCG matrix. For instance, certain older keyboard or mouse models might fall into this category, especially as newer, more advanced alternatives gain traction. In 2024, the global market for traditional PC peripherals saw a slight contraction, with some segments experiencing single-digit declines year-over-year, underscoring the challenges for low-share products in these areas.

General-Purpose Server Shipments (Non-AI)

General-purpose server shipments, excluding those for AI applications, faced headwinds in 2023 due to a challenging macroeconomic environment. These shipments are projected to remain stagnant throughout 2024, indicating a lack of significant growth in this segment.

If Inventec holds a minor market share in this non-AI general-purpose server market, these products could be categorized as 'Dogs' within the BCG Matrix. This classification suggests they may be operating at break-even or even consuming cash without offering substantial growth potential.

For instance, the global server market, while boosted by AI, saw its non-AI segment constrained. IDC reported that worldwide server revenue increased by 10.8% year-over-year in the first quarter of 2024, reaching $24.2 billion. However, this growth was heavily skewed towards AI servers, with the non-AI segment experiencing much slower, if any, expansion.

- Market Stagnation: General-purpose server shipments are expected to be flat in 2024, contrasting with the robust growth in AI-driven server demand.

- Economic Impact: Poor macroeconomic conditions in 2023 directly impacted the demand for non-AI servers, limiting shipment volumes.

- BCG Matrix Implication: A low market share in this stagnant segment would position these servers as 'Dogs', characterized by low growth and low market share.

Outdated Manufacturing Processes/Technologies

Outdated manufacturing processes and legacy technologies can significantly hinder a company's competitiveness. These are systems that have become inefficient, costly to maintain, or no longer offer a strategic edge in the market. For instance, in 2024, many traditional manufacturing firms are grappling with the high operational costs associated with older machinery compared to newer, automated solutions. The International Federation of Robotics reported that the average robot density in manufacturing globally reached 151 units per 10,000 employees in 2022, a figure that highlights the increasing adoption of advanced automation and the potential disadvantage for those lagging behind.

Continued investment in these areas often results in diminishing returns. The focus for such business units should be on minimizing their negative impact or planning for divestment. Consider the automotive sector, where the shift to electric vehicle production necessitates entirely new manufacturing lines, rendering much of the legacy internal combustion engine production technology obsolete. Companies that fail to adapt face higher production costs and slower output, impacting their ability to compete on price and innovation.

- High operational costs: Legacy systems often consume more energy and require more manual intervention, driving up per-unit production expenses.

- Reduced efficiency and speed: Older technologies typically operate at slower speeds and with lower precision compared to modern alternatives.

- Limited scalability: Outdated processes may struggle to adapt to increased demand or changes in product specifications.

- Increased maintenance burden: Sourcing parts and skilled labor for aging equipment can become increasingly difficult and expensive.

Inventec's older smartphones and less popular IoT devices, representing a small portion of revenue, are considered Dogs. These products, along with commoditized electronic components facing price wars, likely offer low margins and minimal growth. Legacy peripherals and non-AI servers with low market share also fall into this category, potentially tying up capital without significant returns.

Products in the Dogs category, such as older peripherals or commoditized components, are characterized by low market share in slow-growing or declining markets. These items often have low profitability and can drain resources that could be better allocated to high-growth areas. For example, the market for traditional PC peripherals saw slight declines in 2024, making it challenging for low-share products to generate substantial returns.

The implication of having many Dogs in its portfolio is that Inventec might be spreading its resources too thinly across less profitable ventures. In 2024, the global market for basic passive components, which Inventec may produce, grew only 2-3% with margins below 10%, illustrating the low return potential in such segments.

Focusing on reducing investment in or divesting from these Dog categories can free up capital for more promising areas. For instance, while the overall server market grew in early 2024, the non-AI segment remained stagnant, highlighting the need to shift focus away from such areas if market share is low.

Question Marks

Inventec views 2024 as the foundational year for AI PCs, anticipating substantial market expansion between 2025 and 2026. This positions AI PCs as potential 'Stars' in the BCG matrix, representing a high-growth sector. However, as an emerging category, Inventec's current market penetration is likely minimal, classifying them as 'Question Marks' that necessitate considerable investment to achieve significant market share and future growth.

Inventec's smart device business is anticipated to see a slight uptick in performance by 2025, aligning with the broader IoT market's projected robust double-digit growth. This presents an opportunity for new smart devices tailored to emerging IoT segments where Inventec might currently hold a low market share but possesses significant growth potential.

Developing smart devices for these nascent IoT areas, such as advanced healthcare monitoring or sophisticated industrial automation sensors, would necessitate strategic investment. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.2 trillion by 2027, indicating a strong compound annual growth rate (CAGR) of around 19%.

Inventec's venture into advanced cloud services software and enterprise system solutions positions them in a dynamic, highly competitive market. Given the intense rivalry and their current low market share in these areas, these offerings likely fall into the Question Mark category of the BCG matrix. This means they require significant strategic investment to foster growth and establish a stronger market presence.

The global cloud computing market is projected to reach over $1.3 trillion by 2025, highlighting the immense opportunity but also the fierce competition Inventec faces. Developing differentiated software in this landscape demands substantial R&D and marketing expenditure, essential for carving out a niche and achieving scalability.

New Geographic Market Expansions (e.g., US Manufacturing Facility)

Inventec's strategic decision to establish a new AI server-related manufacturing facility in Texas, with a projected investment of up to US$85 million, signifies a bold move into a new geographic market. This expansion, targeting the burgeoning US market, positions the company to capitalize on high growth potential within the AI sector.

Despite the promising market outlook, the new Texas facility, by its very nature, starts with a relatively low market share in this specific production region. This characteristic places it squarely in the 'Question Mark' category of the BCG Matrix. Such ventures demand substantial capital infusion and strategic focus to overcome initial hurdles and achieve profitability.

- Investment: Up to US$85 million allocated for the Texas AI server facility.

- Market Potential: High growth opportunities within the US AI server market.

- BCG Classification: 'Question Mark' due to low initial market share in the new region.

- Strategic Imperative: Requires significant investment and focused strategy for market penetration and profitability.

Niche or Specialized Server Architectures (beyond mainstream AI)

Inventec might be venturing into specialized server architectures, such as those for high-performance computing (HPC) in scientific research or edge computing for real-time data processing. These areas represent nascent markets with potentially high growth but currently low market share for Inventec. For instance, the global HPC market was valued at approximately $39.2 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for specialized solutions.

Developing these niche offerings would require focused R&D and strategic partnerships to build expertise and establish a foothold. This aligns with a BCG matrix approach where these new ventures would initially be considered question marks, demanding careful evaluation of their potential return on investment against the required capital expenditure.

- High-Performance Computing (HPC): Servers optimized for complex simulations and data-intensive scientific workloads.

- Edge Computing Servers: Compact, robust architectures designed for decentralized data processing closer to the source.

- Quantum Computing Infrastructure: Specialized hardware and server components to support emerging quantum computing technologies.

- Specialized Data Analytics Servers: Architectures tailored for specific analytical tasks like genomic sequencing or financial modeling.

Inventec's new ventures, like AI PCs and specialized server solutions, are currently classified as Question Marks. This means they operate in high-growth markets but hold a low market share, requiring significant investment to capture potential. For example, Inventec's AI PC strategy positions them to capitalize on a market expected to see substantial growth, yet their current penetration is minimal.

These Question Mark products demand strategic capital allocation and focused R&D to overcome initial market entry challenges and build competitive advantage. The success of these ventures hinges on Inventec's ability to effectively invest and innovate, transforming them into future Stars or Cash Cows.

The global AI market is projected to grow rapidly, with AI PCs expected to be a significant driver. Inventec's entry into this space, while promising, necessitates careful management of resources to gain traction. Similarly, their investments in advanced cloud services and specialized server architectures face intense competition, placing them in the Question Mark category.

The company's expansion into new geographic markets, such as the US AI server facility, also starts as a Question Mark. This requires substantial investment to establish a presence and build market share in a new territory.

| Business Area | Market Growth | Inventec Market Share | BCG Classification | Investment Need |

|---|---|---|---|---|

| AI PCs | High | Low | Question Mark | High |

| Smart Devices (New IoT Segments) | High (IoT Market ~19% CAGR) | Low | Question Mark | High |

| Advanced Cloud Services | High (Global Cloud Market >$1.3T by 2025) | Low | Question Mark | High |

| Enterprise System Solutions | High | Low | Question Mark | High |

| US AI Server Facility | High | Low (in new region) | Question Mark | High (US$85M investment) |

| Specialized Servers (HPC, Edge) | High (HPC Market ~$39.2B in 2023) | Low | Question Mark | High |

BCG Matrix Data Sources

Our Inventec BCG Matrix is constructed using a blend of internal financial statements, market research reports, and industry growth trend data to provide a comprehensive view of product performance.